Our Identification Requirements I.D

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lender Panel List December 2019

Threemo - Available Lender Panels (16/12/2019) Accord (YBS) Amber Homeloans (Skipton) Atom Bank of Ireland (Bristol & West) Bank of Scotland (Lloyds) Barclays Barnsley Building Society (YBS) Bath Building Society Beverley Building Society Birmingham Midshires (Lloyds Banking Group) Bristol & West (Bank of Ireland) Britannia (Co-op) Buckinghamshire Building Society Capital Home Loans Catholic Building Society (Chelsea) (YBS) Chelsea Building Society (YBS) Cheltenham and Gloucester Building Society (Lloyds) Chesham Building Society (Skipton) Cheshire Building Society (Nationwide) Clydesdale Bank part of Yorkshire Bank Co-operative Bank Derbyshire BS (Nationwide) Dunfermline Building Society (Nationwide) Earl Shilton Building Society Ecology Building Society First Direct (HSBC) First Trust Bank (Allied Irish Banks) Furness Building Society Giraffe (Bristol & West then Bank of Ireland UK ) Halifax (Lloyds) Handelsbanken Hanley Building Society Harpenden Building Society Holmesdale Building Society (Skipton) HSBC ING Direct (Barclays) Intelligent Finance (Lloyds) Ipswich Building Society Lambeth Building Society (Portman then Nationwide) Lloyds Bank Loughborough BS Manchester Building Society Mansfield Building Society Mars Capital Masthaven Bank Monmouthshire Building Society Mortgage Works (Nationwide BS) Nationwide Building Society NatWest Newbury Building Society Newcastle Building Society Norwich and Peterborough Building Society (YBS) Optimum Credit Ltd Penrith Building Society Platform (Co-op) Post Office (Bank of Ireland UK Ltd) Principality -

Lenders Who Have Signed up to the Agreement

Lenders who have signed up to the agreement A list of the lenders who have committed to the voluntary agreement can be found below. This list includes parent and related brands within each group. It excludes lifetime and pure buy-to-let providers. We expect more lenders to commit over the coming months. 1. Accord Mortgage 43. Newcastle Building Society 2. Aldermore 44. Nottingham Building Society 3. Bank of Ireland UK PLC 45. Norwich & Peterborough BS 4. Bank of Scotland 46. One Savings Bank Plc 5. Barclays UK plc 47. Penrith Building Society 6. Barnsley Building Society 48. Platform 7. Bath BS 49. Principality Building Society 8. Beverley Building Society 50. Progressive Building Society 9. Britannia 51. RBS plc 10. Buckinghamshire BS 52. Saffron Building Society 11. Cambridge Building Society 53. Santander UK Plc 12. Chelsea Building Society 54. Scottish Building Society 13. Chorley Building Society 55. Scottish Widows Bank 14. Clydesdale Bank 56. Skipton Building Society 15. The Co-operative Bank plc 57. Stafford Railway Building Society 16. Coventry Building Society 58. Teachers Building Society 17. Cumberland BS 59. Tesco Bank 18. Danske Bank 60. Tipton & Coseley Building Society 19. Darlington Building Society 61. Trustee Savings Bank 20. Direct Line 62. Ulster Bank 21. Dudley Building Society 63. Vernon Building Society 22. Earl Shilton Building Society 64. Virgin Money Holdings (UK) plc 23. Family Building Society 65. West Bromwich Building Society 24. First Direct 66. Yorkshire Bank 25. Furness Building Society 67. Yorkshire Building Society 26. Halifax 27. Hanley Economic Building Society 28. Hinckley & Rugby Building Society 29. HSBC plc 30. -

Basic Information About the Protection of Your Eligible Deposits

Basic information about the protection of your eligible deposits Eligible deposits in the Vernon Building Society The Financial Services Compensation Scheme are protected by (“FSCS”) 1 £85,000 per depositor per bank / building Limit of protection: society / credit union2 All your eligible deposits at the same bank / If you have more eligible deposits at the same bank building society / credit union are “aggregated” / building society / credit union: and the total is subject to the limit of £85,0002 The limit of £85,000 applies to each If you have a joint account with other person(s): depositor separately3 Reimbursement period in case of bank, 10 working days4 building society or credit union’s failure: Pound sterling (GBP, £) or for branches of UK Currency of reimbursement: banks operating in other EEA Member States, the currency of that State. To contact the Vernon Building Society for Vernon Building Society, enquiries relating to your account: 19 St Petersgate Stockport Cheshire SK1 1HF Tel: 0161 429 6262 To contact the FSCS for further Financial Services Compensation Scheme, information on compensation: 10th Floor Beaufort House 15 St Botolph Street London EC3A 7QU Tel: 0800 678 1100 or 0207 741 4100 Email: [email protected] More information: http://www.fscs.org.uk Additional Information (all or some of the below) 1 Scheme responsible for the protection of your eligible deposit Your eligible deposit is covered by a statutory Deposit Guarantee Scheme. If insolvency of your bank, building society or credit union should occur, your eligible deposits would be repaid up to £85,000 by the Deposit Guarantee Scheme. -

Name in Bold Capitals

ANDREW TOWNSLEY Located – South Yorkshire (Mobile) 07944 446655 E mail: [email protected] An experienced Director with a strong commitment to mutual organisations, and a proven track record of growing financial services business. I also have a good understanding of corporate governance, strategy, credit and risk management and following retirement in 2016, want to utilise the skills and knowledge acquired to help other organisations in a Non-Executive Director capacity. In addition to my Kingston Unity main Board role I was a member of the Society’s Risk, Nominations and Investment sub committees and also attended Audit and Remuneration sub committee meetings. CAREER: Board – Non Executive Oct 2016 STOCKPORT CREDIT UNiON Chairman from March 2017 Non Executive Director – • Leading the Board to meet its commitment to financial inclusion for members, sustainability and the Credit Unions regulatory obligations with a personal focus on Business Planning and strategy development. 2010 – 2013 ASSOCIATION OF FINANCIAL MUTUALS Non Executive Director • Member of the Board of the trade body representing Mutual and not for profit Insurers, Friendly Societies and other Financial Mutuals. Formed following a merger of the Association of Friendly Societies (AFS) and the Association of Mutual Insurers (AMI) the trade body represents 48 members who have 30 million customers with Annual Premium Income of £15.9 billion and its role is to provide services to Members, input to Government and Regulatory policy development and promote good corporate governance within the sector. 2004 – 2010 ASSOCIATION OF FRIENDLY SOCIETIES Non Executive Director • Similar role and objectives to those of the AFM but at the time representing over 50 Friendly Societies with 4.5 million members and £15 billion of assets. -

171122 Financial References Guidancev2 FINAL

Mortgage lenders and financial references Guidance as at 22/11/2017 • Scope of guidance and general considerations • Charging for references • Lenders which will accept financial references from CIOT and ATT members • HMRC agreement with the Council of Mortgage Lenders re SA302s • Example financial reference letter Scope of guidance and general considerations for references Members are often asked to provide a form of financial reference on behalf of their clients and may wish to assist. The scope of this guidance is limited to references that can be provided from factual information in a member’s possession, not additional assurance work (e.g. a form of limited scope audit procedures) that some members may be qualified to perform by virtue of their membership of bodies other than the CIOT or ATT. The purpose of this guidance is to alert members to some practical issues and risks associated with giving references, and to provide specific guidance on references requested by the leading mortgage lenders. This guidance does not consider Statements of Net Worth for consumer credit purposes under the Financial Services and Markets Act 2000 (Regulated Activities) Order 2001 (formerly the Consumer Credit (Exempt Agreements) Order), which must be signed by members of ICAEW, ICAS, ICAI, ACCA, CIMA, CIPFA or a comparable overseas professional body of accountants. CIOT and ATT members who are not also members of the above professional bodies of accountants are not permitted signatories. As a general matter, members should recognise the possible risks of providing references, even where they take the opportunity to disclaim liability to the person to whom the reference is provided, as in the suggested template letter given below. -

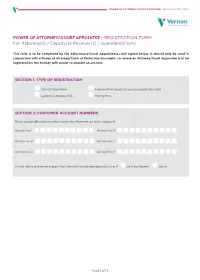

Power of Attorney Application Form

POWER OF ATTORNEY/COURT APPOINTEE - REGISTRATION FORM POWER OF ATTORNEY/COURT APPOINTEE - REGISTRATION FORM For Attorney(s) / Deputy(s) Receiver(s) / Guardian(s) only This form is to be completed by the Attorney(s)/Court Appointee(s) and signed below. It should only be used in conjunction with a Power of Attorney/Court of Protection document, i.e. where an Attorney/Court Appointee is to be registered by the Society with power to operate an account. SECTION 1: TYPE OF REGISTRATION Court of protection Enduring PoA registered and stamped by the court Lasting/Continuing PoA General PoA SECTION 2: CUSTOMER ACCOUNT NUMBERS Please provide all account numbers where the Attorneys are to be registered. ACCOuNT NO . 1 ACCOuNT NO . 4 ACCOuNT NO . 2 ACCOuNT NO . 5 ACCOuNT NO . 3 ACCOuNT NO . 6 If more than one attorney is appointed, how are the attorneys appointed to act ? Joint and Several Jointly PAGE 1 OF 8 POWER OF ATTORNEY/COURT APPOINTEE - REGISTRATION FORM SECTION 3: ATTORNEY DETAILS ATTORNEY 1 ATTORNEY 2 TITLE (MR, MRS, MS, MISS, OThER) TITLE (MR, MRS, MS, MISS, OThER) FIRST NAME FIRST NAME MIDDLE NAME(S) MIDDLE NAME(S) SuRNAME SuRNAME DATE OF bIRTh DATE OF bIRTh DD MM YYYY DD MM YYYY TELEPhONE NuMbER TELEPhONE NuMbER EMAIL ADDRESS EMAIL ADDRESS EMPLOYMENT STATuS EMPLOYMENT STATuS Employed unemployed Self-employed Retired Employed unemployed Self-employed Retired ADDRESS ADDRESS POSTCODE POSTCODE how long have you lived at this address? how long have you lived at this address? YYYY MM YYYY MM If less than 1 year please provide your previous address:- If less than 1 year please provide your previous address:- POSTCODE POSTCODE how long have you lived at this address? how long have you lived at this address? YYYY MM YYYY MM PAGE 2 OF 8 POWER OF ATTORNEY/COURT APPOINTEE - REGISTRATION FORM SECTION 4: TAX DETAILS It is mandatory to complete this section for each Attorney named on this form. -

Vernon 20Pg Review 2015 5Th Draft Layout 1 16/03/2016 15:59 Page 2

Vernon 20pg Review 2015 5th draft_Layout 1 16/03/2016 15:59 Page 2 ANNUAL REVIEW2015 Expert writer Poynton focus Rio Games 2016 Annie Shaw is a financial Thriving branch at the Stockport wheelchair racers journalist and a Vernon heart of change in a new hope to be winning medals customer. Read her story. look village. for Team GB. Page 3 Page 6 Page 16 Great personal service, not just a number“ processed “ by a computer. Thank you for all your help. Ms W, Cheadle Hulme Mortgages in retirement Find out out how Spencer and Linda Kahan benefit. Page 4 As individual as you are Vernon 20pg Review 2015 5th draft_Layout 1 17/03/2016 09:02 Page 3 AnnualReview 2015 Welcome to our Contents 2015 Annual Review 03 Financial journalist Annie Shaw gives her view on the Vernon experience 04 We meet Spencer and Linda Kahan At this time of year we reflect as they tell us more about the background to their retirement on the last 12 months, mortgage reporting back on the financial performance of the Society. 05 Your questions answered on the Personal Savings Allowance We also get an opportunity to focus on interesting stories about our customers, the 06 Poynton branch helping to secure Vernon’s people, our products and services the future for the village and its as well as our community giving customers programme, some of which is inspired by an Olympic year. We hope you enjoy the read. 08 Key performance indicators During 2015 we have succeeded in improving levels of profitability 09-11 Summary Financial Statement with a keen eye on building for the future. -

The Rechabite Friendly Society Limited Trading As Healthy Investment

The Rechabite Friendly Society Limited trading as Healthy Investment Notice of Annual General Meeting Annual Review Vote Summary Financial Statements Online See inside Wednesday 26 June 2019 at 10:00am for details Bury Town Hall, Knowsley Street, Bury BL9 0SW Welcome Notice of Annual General Meeting This is your invitation to Healthy Investment’s Annual General Meeting. Notice is hereby given that the Annual General Meeting of The Rechabite Friendly Society Limited is to be held on Wednesday 26 June 2019 at Bury Town Hall, Knowsley Street, Bury BL9 0SW. As a mutual friendly society we are owned by and run for the sole benefit of you the member. There The meeting will commence at 10:00am for the purpose of carrying out the following business: are no shareholders to benefit from your investment in the Society or to influence the way we are managed, which is why your vote is important. Every member has a similar responsibility to those of shareholders in a proprietary company to vote on resolutions including the appointment of Directors, as well as having the ability to challenge the Agenda Board on the way that they are running the Society. All adult members are entitled to vote and I do hope that you will. We have made it as simple as Resolution 1 - To receive the Directors’ Report and Consolidated Accounts for the year ended possible for all members to vote in person, online, or by using the enclosed pre-paid voting card. 31 December 2018. This year we are returning to the Town Hall in Bury for our AGM. -

Rpt MFI-EU Hard Copy Annual Publication

MFI ID NAME ADDRESS POSTAL CITY HEAD OFFICE RES* UNITED KINGDOM Central Banks GB0425 Bank of England Threadneedle Street EC2R 8AH London No Total number of Central Banks : 1 Credit Institutions GB0005 3i Group plc 91 Waterloo Road SE1 8XP London No GB0015 Abbey National plc Abbey National House, 2 Triton NW1 3AN London No Square, Regents Place GB0020 Abbey National Treasury Services plc Abbey National House, 2 Triton NW1 3AN London No Square, Regents Place GB0025 ABC International Bank 1-5 Moorgate EC2R 6AB London No GB0030 ABN Amro Bank NV 10th Floor, 250 Bishopsgate EC2M 4AA London NL ABN AMRO Bank N.V. No GB0032 ABN AMRO Mellon Global Securities Services Princess House, 1 Suffolk Lane EC4R 0AN London No BV GB0035 ABSA Bank Ltd 75 King William Street EC4N 7AB London No GB0040 Adam & Company plc 22 Charlotte Square EH2 4DF Edinburgh No GB2620 Ahli United Bank (UK) Ltd 7 Baker Street W1M 1AB London No GB0050 Airdrie Savings Bank 56 Stirling Street ML6 OAW Airdrie No GB1260 Alliance & Leicester Commercial Bank plc Building One, Narborough LE9 5XX Leicester No GB0060 Alliance and Leicester plc Building One, Floor 2, Carlton Park, LE10 0AL Leicester No Narborough GB0065 Alliance Trust Savings Ltd Meadow House, 64 Reform Street DD1 1TJ Dundee No GB0075 Allied Bank Philippines (UK) plc 114 Rochester Row SW1P 1JQ London No GB0087 Allied Irish Bank (GB) / First Trust Bank - AIB 51 Belmont Road, Uxbridge UB8 1SA Middlesex No Group (UK) plc GB0080 Allied Irish Banks plc 12 Old Jewry EC2R 8DP London IE Allied Irish Banks plc No GB0095 Alpha Bank AE 66 Cannon Street EC4N 6AE London GR Alpha Bank, S.A. -

Reinvigorating Communities

REINVIGORATING COMMUNITIES Reinvigorating communities Building societies’ social purpose in action May 2019 www.bsa.org.uk @BSABuildingSocs 1 REINVIGORATING COMMUNITIES The Building Societies Association (BSA) represents all 43 UK building societies, as well as 5 credit unions. Building societies have total assets of over £400 billion and, together with their subsidiaries, hold residential mortgages of over £320 billion, 23% of the total outstanding in the UK. They hold over £280 billion of retail deposits, accounting for 19% of all such deposits in the UK. 1 www.bsa.org.uk @BSABuildingSocs REINVIGORATING COMMUNITIES Contents Foreword 4 Executive summary 5 Introduction 7 The importance of communities 8 High streets & town centres 18 The changing role of branches 23 Networked society 31 Investments in the community 35 Regional employment & skills 39 The world around us 43 Conclusions 46 www.bsa.org.uk @BSABuildingSocs 2 REINVIGORATING COMMUNITIES 3 www.bsa.org.uk @BSABuildingSocs REINVIGORATING COMMUNITIES Foreword Community and social purpose are the bedrock of building societies and mutuality. The first building societies were created not by financiers or landowners, but by communities who understood that the difficulties that each person faced individually in buying a home of their own could be overcome by acting together. Today’s world would be unrecognisable to the founders of the first building societies, with technological and economic advancements, changes in consumer expectation and shifts in attitudes and public policy transforming the landscape in which we operate. But the ethos of putting customers first, personal connection and community remain central to the way building societies have continued to operate. -

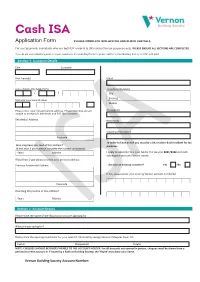

Application Form PLEASE COMPLETE in BLACK INK and BLOCK CAPITALS

Application Form PLEASE COMPLETE IN BLACK INK AND BLOCK CAPITALS For use by private individuals who are both UK resident & UK resident for tax purposes only. PLEASE ENSURE ALL SECTIONS ARE COMPLETED. If you do not understand any point or require assistance in completing this form, please call the Vernon Building Society on 0161 429 6262 Section 1: Customer Details Title Surname First Name(s) Email Date of Birth (DD/MM/YYYY) Telephone Numbers / / Day Evening National Insurance Number Mobile Please enter your full permanent address. Please note that we are Occupation unable to accept c/o addresses and P.O. Box numbers. Residential Address Nationality Country of Residence Postcode In order to have an ISA you must be a UK resident & UK resident for tax How long have you lived at this address? purposes. (if less than 3 years please complete the number of months) Years Months I apply to subscribe to a Cash ISA for the tax year 2021/2022 and each subsequent year until further notice. If less than 1 year please provide your previous address Previous Residential Address Are you an existing customer? Yes No If Yes, please enter your existing Vernon account number(s) Postcode How long did you live at this address? Years Months Section 2: Account Details Please state the name of the ISA product you are applying for What are you saving for? Please state the opening investment for your new ISA OR monthly savings amount if Regular Saver ISA Cash £ Cheque(s) £ Total £ NOTE: CHEQUES SHOULD BE MADE PAYABLE TO THE ACCOUNT HOLDER. -

Our Identification Requirements

I.D. REQUIREMENTS Our Identification Requirements Why do we need identification ? • Council tax demand letter or statement * All financial service providers are required by law • Tax credit * to verify their customers’ identity. This is so that we • DWP state pension document * can meet UK money laundering regulations to • Utility bill ** help stop criminals from using financial products • Current original bank statement ** or services for their own benefit. We will only ask for enough information to allow us to open your • Current original credit/debit card account. statement ** • Mortgage statement * How do we verify your identification? * These documents must be dated in the past 12 months ** These documents must be dated in the past 6 months. We will carry out an electronic search against records held by a credit reference agency to verify your name and address. To support this If you are under 21 or opening an electronic search we will require you to provide account on behalf of someone one identity document from the Acceptable under 21 Identity Documents list below. We will require two documents. One from the Acceptable Identity Documents list and one from This check is only used to check your name and the following – ‘Additional document list for address and does not affect your credit rating. under 21s’ list. If we are unable to verify you through this search These will be used to verify identity without an we may ask you to provide a further identity electronic identification search. document. Where an adult opens an account in respect of All identity documents must contain your full somebody under 21, the adult's ID is required to name and either: be verified as above, and in addition one of the • your residential address or following must be seen in the name of the person under 21: • your date of birth.