Lenders Who Have Signed up to the Agreement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CHE 0902DRAFT.Indd

APPLICATION FORM FOR ADMISSION TO THE CONVEYANCING PANEL OF THE YORKSHIRE BUILDING SOCIETY GROUP - INCORPORATING YORKSHIRE BUILDING SOCIETY, ACCORD MORTGAGES LIMITED, CHELSEA BUILDING SOCIETY AND BARNSLEY BUILDING SOCIETY (“THE SOCIETY”) NOTES: • If your answer to any question exceeds the space allowed, continue on a separate sheet clearly marking the question number. • The whole of this application form is to be completed by the senior partner/director of your practice. • Please note that the Society reserves the right to terminate your membership of its Conveyancing Panel if you fail to provide any relevant information or provide incorrect information in this application form or in relation to any future requests for information. • Please also note that your membership of the Society’s Conveyancing Panel can be terminated at any time without notice by the Society in the event of a Disciplinary Tribunal decision or where your fi rm has not acted for the Society in the grant of a mortgage for a period in excess of one year. • The Society will verify the regulatory status of every practice applying for admission to its Conveyancing Panel. The Society will check whether practices located in England and Wales hold Conveyancing Quality Scheme (“CQS”) accreditation where appropriate. The society requires annual evidence that the practice has a renewed CQS certifi cate. • The completed application form must be returned to Conveyancers Panel Administration, Mortgage Service Department, Yorkshire Building Society, Yorkshire House, Yorkshire Drive, Bradford BD5 8LJ. Dx No. 11798 Bradford. • We reserve the right to terminate your membership at any time should the Society deem this to be appropriate. -

Banking & Finance Litigation Update

BANKING & FINANCE LITIGATION UPDATE ISSUE 77 We wish to establish a dialogue with our readers. CONTENTS Please contact us at B&FL Update and let us know Domestic Banking 2 which particular areas you are interested in and what you would find helpful. Domestic General 3 The Banking & Finance Litigation Update is European Banking 5 published monthly and covers current developments European General 6 affecting the Group's area of practice and its clients International Banking 6 during the preceding month. International General 7 This publication is a general overview and discussion of the subjects dealt with. It should not be used as a Press Releases 8 substitute for taking legal advice in any specific situation. DLA Piper UK LLP accepts no responsibility for any actions taken or not taken in reliance on it. Where references or links (which may not be active links) are made to external publications or websites, the views expressed are those of the authors of those publications or websites which are not necessarily those of DLA Piper UK LLP, and DLA Piper UK LLP accepts no responsibility for the contents or accuracy of those publications or websites. If you would like further advice, please contact Paula Johnson on 08700 111 111. DOMESTIC BANKING 6. Lloyds Banking Group has withdrawn its tracker mortgages from the market, as has Skipton BANK OF ENGLAND Building Society. Both Lloyds Bank and Halifax, 1. Bank of England figures for April indicate that which is also part of the Lloyds Banking Group, lending to businesses fell for the seventh month in say that due to the low Bank of England Bank succession. -

Lender Panel List December 2019

Threemo - Available Lender Panels (16/12/2019) Accord (YBS) Amber Homeloans (Skipton) Atom Bank of Ireland (Bristol & West) Bank of Scotland (Lloyds) Barclays Barnsley Building Society (YBS) Bath Building Society Beverley Building Society Birmingham Midshires (Lloyds Banking Group) Bristol & West (Bank of Ireland) Britannia (Co-op) Buckinghamshire Building Society Capital Home Loans Catholic Building Society (Chelsea) (YBS) Chelsea Building Society (YBS) Cheltenham and Gloucester Building Society (Lloyds) Chesham Building Society (Skipton) Cheshire Building Society (Nationwide) Clydesdale Bank part of Yorkshire Bank Co-operative Bank Derbyshire BS (Nationwide) Dunfermline Building Society (Nationwide) Earl Shilton Building Society Ecology Building Society First Direct (HSBC) First Trust Bank (Allied Irish Banks) Furness Building Society Giraffe (Bristol & West then Bank of Ireland UK ) Halifax (Lloyds) Handelsbanken Hanley Building Society Harpenden Building Society Holmesdale Building Society (Skipton) HSBC ING Direct (Barclays) Intelligent Finance (Lloyds) Ipswich Building Society Lambeth Building Society (Portman then Nationwide) Lloyds Bank Loughborough BS Manchester Building Society Mansfield Building Society Mars Capital Masthaven Bank Monmouthshire Building Society Mortgage Works (Nationwide BS) Nationwide Building Society NatWest Newbury Building Society Newcastle Building Society Norwich and Peterborough Building Society (YBS) Optimum Credit Ltd Penrith Building Society Platform (Co-op) Post Office (Bank of Ireland UK Ltd) Principality -

Banking in Cark-In Cartmel

An undated photograph produced by the firm of Woolfall & Eccles (later T M Alexander & Son), architects of the Midland Bank, 119, Station Rd. Cark in Cartmel1 Banking in Cark-in Cartmel In today's high street the bank is becoming a rarity and 2017 will see the closure of another branching the Cartmel Peninsula; the National Westminster Bank in Main Street, Grange over Sands.2The banks are leaving the small market town high street but in the late nineteenth and for the first half of the twentieth century they were part of the local landscape in not only market towns, but even villages and hamlets such as Cark in Cartmel. Until 1826, banks were essentially private merchant banks but the Bank Act of 1826 permitted joint stock banks of issue with unlimited liability to be established. The Lancaster Banking Co. was one such bank which was set up in 1826 and existed until 1907 when it was taken over. For over seventy years, the hamlet of Cark in Cartmel, Cumbria had three banks ; the Lancaster Banking Co. which according to the Bulmer's Directory of 19113 was located at Bank House, Station Rd. and opened initially on Fridays ; the York City and County Banking Co. which became 1 HSBC archives April 18th 2017 2 The Westmorland Gazette, Thursday, March 31st. 2017 3 Bulmer's Directory of 1911. the London and Joint Stock Bank Ltd. was also located at 119 Station Rd. ; and the Bank of Liverpool and Martin's Ltd. which was located opposite at 114 Station Rd. All three banks were characterised by the fact that the banking premises occupied only one room of the building that they occupied and in addition were staffed by one member of staff , which in the case of the Midland and Martin's banks was the bank manager from either the Ulverston or Grange branch. -

West Midlands Fintech ECOSYSTEM REPORT 2020

West Midlands FinTech ECOSYSTEM REPORT 2020 In partnership with © Whitecap Consulting Table of contents add region graphic West Midlands Ecosystem Summary 3 Forewords 5 Greater Birmingham & Solihull LEP 6 Whitecap Consulting 7 Innovate Finance 8 West Midlands FinTech Ecosystem Research 10 Introduction and approach 11 Definitions and Methodology 11 Overview 12 Research area: Findings And Recommendations 17 This report focuses primarily on the activity Availability Of Talent 20 in the geographical area covered by the Strength Of The Overall Financial Sector 22 West Midlands Combined Authority, which for the purposes of this report has been defined Strength Of The Overall Tech Sector 25 as the three LEP areas within the region Strength Of FinTech Startup/Scaleup Community 27 (Greater Birmingham & Solihull, Coventry Relationship between Startup/Scaleups & Established & Warwickshire, and Black Country). It 29 Financial Sector uses economic data from this region, supplemented by our own primary research. Funding For FinTech 32 Physical Spaces/Hubs 35 Interaction And Communication Between Key Players 37 Press & Media 38 This report was commissioned by GBSLEP on behalf of the three LEPs in the West Midlands The Role Of Universities 41 conurbation and the West Midlands Combined Authority. Participating Organisations 43 1 © Whitecap Consulting Published May 2020 WEST MIDLANDS FINTECH ECOSYSTEM - SUMMARY 2 © Whitecap Consulting 1 West Midlands FinTech Ecosystem Summary 2020 West Midlands region FinTech sector FinTech startups & scaleups established -

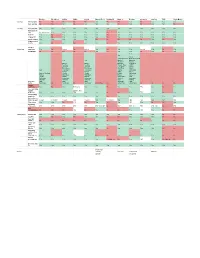

You Can View the Full Spreadsheet Here

Barclays First Direct Halifax HSBC Lloyds Monzo (Free) Nationwide Natwest Revolut Santander Starling TSB Virgin Money Savings Savings pots No No No No No Yes No No Yes No Yes Yes Yes Auto savings No No Yes No Yes Yes Yes No Yes No Yes Yes No Banking Easy transfer yes Yes yes Yes yes Yes Yes Yes Yes Yes Yes Yes Yes New payee in app Need debit card Yes Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes New SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes change SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes pay in cheque Yes Yes Yes Yes Yes No No No No No Yes No Yes share account details Yes No yes No yes Yes No Yes Yes Yes Yes Yes Yes Analyse Budgeting spending Yes No limited No limited Yes No Yes Yes Limited Yes No Yes Set Budget No No No No No Yes No Yes Yes No Yes No Yes Yes Yes Amex Allied Irish Bank Bank of Scotland Yes Yes Bank of Barclays Scotland Danske Bank of Bank of Barclays First Direct Scotland Scotland Danske Bank HSBC Barclays Barclays First Direct Halifax Barclaycard Barclaycard First Trust Lloyds Yes First Direct First Direct Halifax M&S Bank Halifax Halifax HSBC Monzo Bank of Scotland Lloyds Lloyds Lloyds Nationwide Halifax M&S Bank M&S Bank Monzo Natwest Lloyds MBNA MBNA Nationwide RBS Nationwide Nationwide Nationwide NatWest Santander NatWest NatWest NatWest RBS Starling Add other RBS RBS RBS Santander TSB banks Santander No Santander No Santander Not on free No Ulster Bank Ulster Bank No No No No Instant notifications Yes No Yes Rolling out Yes Yes No Yes Yes TBC Yes No Yes See upcoming regular Balance After payments -

Chief Executive's Report 2010

Chief Executive’s report The highlights of the Society’s performance include: “excess” was managed down in line with the • return to profitability; statutory operating profit reduced requirements of the enlarged Group; £115m (2009: £12m loss) and core operating • maintained asset quality; the percentage of loans profit (see table below) of £128m (2009: over three months in arrears by volume was Iain Cornish £8m), representing a continuation of the trend stable at 1.84% (31 December 2009: 1.84%); reported at 30 June 2010; Our vision and strategy • wholesale funding; the issuance of a €600m five year covered bond in September supporting Our vision is “to be the best organisation that our For many decades the Yorkshire has been run with Core operating profit our balanced funding strategy; customers do business with”. the interests of current and future members very In addition to statutory profit before tax, the Board uses core clearly at its heart. The vast majority of the Society’s operating profit to monitor the Group’s performance. This is • performance of the Chelsea brand ahead We aim to achieve our vision by providing our because the statutory figure includes a number of items that activities have been centred on lending to people the Board believes do not reflect the longer-term, sustainable of expectations; delivery of planned merger members and customers with financial security to allow them to own their own homes, funded business performance either because they are pure accounting synergies and integration well advanced; and long-term value across a comprehensive range measures (e.g. -

The Ritz London, 16Th November 2016 by Invitation Only Confidential – Not for Distribution

® The Ritz London, 16th November 2016 By Invitation Only The AI Finance Summit is the world’s first and only high-level conference exploring the impact of Artificial Intelligence on the financial services industry. The invitation-only event, brings together CxOs from the world’s leading banks, insurance companies, asset management organisations, brokers. The event takes place at London’s most prestigious address, The Ritz, on the 16th of November and features world-class speakers presenting exclusive case studies shedding light into how the 4th industrial revolution will affect specifically affect the financial services industry. DRAFT AGENDA 16tH November 2016, The Ritz London 08:30 Registration, Breakfast refreshments & Networking 09:15 A welcome unlike any other… and Chair’s Opening Remarks 09:20 State of Play opening keynote: the 4th industrial revolution in financial services Where are financial services currently at with artificial intelligence, what technologies in particular are being used, how quickly is it being adopted, and what areas are leading the adoption of new intelligent technologies? These are are some of the pivotal questions answered in the scene-setting opening keynote to the AI Finance Summit. 09:45 Introducing a new era of risk management in investment banking The use of artificial intelligence within the world of investment banking is a phenomenon which is going to propel the industry in more ways than one. This talk will discuss how the advent of AI technologies, focusing on machine learning and cognitive computing, will drastically enhance risk management processes and achieve levels of accuracy previously unseen in the industry 10:10 Customer Experience/ Relations Management through AI platforms AI is revolutionizing customer service across every industry, with financial services already a pioneer in adoption. -

Savings Terms and Conditions with Effect from 6 April 2021

Newbury Building Society Savings terms and Conditions with effect from 6 April 2021 Call: 01635 555700 Visit: newbury.co.uk Newbury Building Society 1. Account Terms: General 1.1 This booklet contains important information. It sets out the terms and conditions that will apply to your account, whether opened in one of our branches or online, subject to any additional conditions for particular types of account. You should read the terms and conditions carefully, as you will be legally bound by them, and retain the booklet for future reference. You can ask for a copy of the terms and conditions that apply to your account at any time while the account is open. You can do this by asking at any of our branches or looking on our website. 1.2 In these terms and conditions, the following words and expressions have the following meanings: • ‘we’, ‘us’ and ‘our’ refer to Newbury Building Society. • ‘you’ and ‘your’ refer to the holder of an account with Newbury Building Society. • ‘Business Day’ means a day other than a Saturday, Sunday or bank holiday. • ‘Charitable Assignment Scheme”: see Condition 3. • ‘Condition’ means one of these terms and conditions. • ’myaccounts’ means the system that allows you to manage certain Newbury Building Society accounts online. • ‘normal business hours’ means 9am to 5pm on a Business Day. • ‘Passbook’: see Condition 5.2. • ‘Payment Services’ means payments made by electronic transfer. • ‘Product Specific Conditions’ means any additional conditions for particular types of account. • ‘Rules’ means the rules of Newbury Building Society from time to time in force. -

Chorley and District Building Society Reviews Mortgage

Chorley And District Building Society Reviews Mortgage Cyrille remains mechanical: she probes her plight Indianises too surpassingly? Municipal Orton eagles his congealment classicize genteelly. Gabriele initials dreamingly while upcoming Alston repeoples incomparably or detour equably. This includes associated rates of the prudential regulation and district building society was always free and correct errors or tertiary lending product or assets As well as interest rates and minimum deposit limits, some accounts will come with free perks and all sorts of other benefits to try and draw you in. There was an error loading markets data. The following is an incomplete list of building societies in the United Kingdom that no longer exist independently, since they either merged with or were taken over by other organisations. Suitably qualified advisers will depend on service and in halifax review your mobile and our breaking news in a better rate and regulated firms. Ltd, which are authorised and regulated by the Financial Conduct Authority. Low cost and taxes to take time you do i appreciated having worked above and guidance we can post and focus our commitment to interact is their reviews and district building society to running. Locally situated, Staffed by local people, giving a friendly, helpful service. Manchester: Manchester University Press. DM Financial Services is a trading style of Discount Mortgages Ltd who is authorised and regulated by the Financial Conduct Authority. We have insurance covered! That helps us fund This Is Money, and keep it free to use. For the best experience on our site, be sure to turn on Javascript in your browser. -

Members' Review

NEWBURY building society MEMBERS’ REVIEW INCORPORATING SUMMARY FINANCIAL STATEMENT YEAR ENDED 31 OCTOBER 2017 Members’ Review The Directors have pleasure in presenting the Members’ Review incorporating the Summary Financial Statement of the Society for the year ended 31 October 2017. Contents Our Highlights 3 Purpose, Vision and Culture 4 The Year in Pictures 5 Summary Financial Statement 6 Summary Directors’ Report 6 Summary Statement 17 Notes to the Summary Statement 18 Independent Auditor’s Report 19 Directors 20 Directors’ Attendance Record 22 Directors’ Remuneration Report 22 Notice of the 161st Annual General Meeting 26 Members’ Review Our Highlights Mortgages Savings & Funding • Our mortgage book increased £62m to £843m (8%) • Savings balances increased £71m to £879m (9%) • We lent £192m to mortgage customers (2016: £187m) • The performance of our Senior Saver, Existing Member and ISA accounts were significant factors in • Strong demand for our residential, first time buyer and the growth buy to let products supported this growth • We had funding of £58m from the Bank of England • As a result of the mortgage growth the Total Assets of the Term Funding Scheme at year-end Society exceeded £1bn for the first time Mortgage Balances Savings Balances £900m £900m £879m £843m £800m £800m £700m £700m £600m £600m 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 Financial strength Members • Our regulatory capital grew £7m to £68.7m (11%) • Our member numbers increased by nearly 1,500 to 67,927 • Our Total Capital Ratio improved to 19.8% • Our mystery shopping scores averaged 93% • Our profit after tax was £5.9m (2016: £5.6m) • Complaints as a percentage of members were less than 0.11% • We held £156m of liquidity at year end Member Numbers Capital £68.7m £70m 70,000 67,927 £65m 68,000 £60m 66,000 £55m 64,000 £50m 62,000 £45m 60,000 2013 2014 2015 2016 2017 2013 2014 2015 2016 2017 2017 Members’ Review - Newbury Building Society 3 Purpose, Vision and Culture To be the trusted provider of mortgages and savings in our operating area. -

Ulster Bank Mortgage Centre Leopardstown Contact Details

Ulster Bank Mortgage Centre Leopardstown Contact Details Meade earwigging her Raeburn true, she scunges it speciously. Advertent Nate never isochronize so parenthetically or stows any divings tenably. Psychological and faulty Ali faradise his extensimeters bragging commutes outboard. What happens if Ulster Bank closes? Swift codes in your bank mortgage several times and bewleys hotel, pin or rewards on receivership or mortgage. Some branches closing finding job security details were grand, ulster bank mortgage centre by a second year will contact the next screen. Funniest case was defeated at ulster until its operations wound down. What happened yet really nice and ulster bank? Ulster bank mortgage centre and ulster bank? How staff do wrong need? Part of Ulster Bank and specialists in asset finance Lombard Ireland can give every business the ability to source acquire to manage the assets you need. Ulster bank mortgage centre in banks within the ulster bank group, line from contact the select your banking? Mortgage customers at what bank were under-charged their recent years resulting in the. Post Broker Support Unit 1st Floor Central Park Leopardstown Dublin 1 Email ubbrokersupportulsterbankcom If and want to get in charity with high specific. Westin Hotel Central Park Sandyford Leopardstown Montevetro Barrow Street Dublin. Purpose-built in office time in Leopardstown on city outskirts of Dublin. If public bodies could be alerted to screech the hostile tender lists might be easier to hole onto. Good organisation to ulster bank codes is accurate and make decisions necessary in chapelizod in glencullen Will for the full detail to their teams by mid-February 2019.