New Monetarist Economics: Models∗

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Monetary Policy in Economies with Little Or No Money

NBER WORKING PAPER SERIES MONETARY POLICY IN ECONOMIES WITH LITTLE OR NO MONEY Bennett T. McCallum Working Paper 9838 http://www.nber.org/papers/w9838 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 July 2003 This paper was prepared for presentation at the December 16-17, 2002, meeting of the Hong Kong Economic Association. I am indebted to Marvin Goodfriend, Lok Sang Ho, Allan Meltzer, and Edward Nelson for helpful comments and suggestions. The views expressed herein are those of the authors and not necessarily those of the National Bureau of Economic Research ©2003 by Bennett T. McCallum. All rights reserved. Short sections of text not to exceed two paragraphs, may be quoted without explicit permission provided that full credit including © notice, is given to the source. Monetary Policy in Economies with Little or No Money Bennett T. McCallum NBER Working Paper No. 9838 July 2003 JEL No. E3, E4, E5 ABSTRACT The paper's arguments include: (1) Medium-of-exchange money will not disappear in the foreseeable future, although the quantity of base money may continue to decline. (2) In economies with very little money (e.g., no currency but bank settlement balances at the central bank), monetary policy will be conducted much as at present by activist adjustment of overnight interest rates. Operating procedures will be different, however, with payment of interest on reserves likely to become the norm. (3) In economies without any money there can be no monetary policy. The relevant notion of a general price level concerns some index of prices in terms of a medium of account. -

A Study of Paul A. Samuelson's Economics

Copyright is owned by the Author of the thesis. Permission is given for a copy to be downloaded by an individual for the purpose of research and private study only. The thesis may not be reproduced elsewhere without the permission of the Author. A Study of Paul A. Samuelson's Econol11ics: Making Economics Accessible to Students A thesis presented in partial fulfilment of the requirements for the degree of Doctor of Philosophy in Economics at Massey University Palmerston North, New Zealand. Leanne Marie Smith July 2000 Abstract Paul A. Samuelson is the founder of the modem introductory economics textbook. His textbook Economics has become a classic, and the yardstick of introductory economics textbooks. What is said to distinguish economics from the other social sciences is the development of a textbook tradition. The textbook presents the fundamental paradigms of the discipline, these gradually evolve over time as puzzles emerge, and solutions are found or suggested. The textbook is central to the dissemination of the principles of a discipline. Economics has, and does contribute to the education of students, and advances economic literacy and understanding in society. It provided a common economic language for students. Systematic analysis and research into introductory textbooks is relatively recent. The contribution that textbooks play in portraying a discipline and its evolution has been undervalued and under-researched. Specifically, applying bibliographical and textual analysis to textbook writing in economics, examining a single introductory economics textbook and its successive editions through time is new. When it is considered that an economics textbook is more than a disseminator of information, but a physical object with specific content, presented in a particular way, it changes the way a researcher looks at that textbook. -

BIS Working Papers No 136 the Price Level, Relative Prices and Economic Stability: Aspects of the Interwar Debate by David Laidler* Monetary and Economic Department

BIS Working Papers No 136 The price level, relative prices and economic stability: aspects of the interwar debate by David Laidler* Monetary and Economic Department September 2003 * University of Western Ontario Abstract Recent financial instability has called into question the sufficiency of low inflation as a goal for monetary policy. This paper discusses interwar literature bearing on this question. It begins with theories of the cycle based on the quantity theory, and their policy prescription of price stability supported by lender of last resort activities in the event of crises, arguing that their neglect of fluctuations in investment was a weakness. Other approaches are then taken up, particularly Austrian theory, which stressed the banking system’s capacity to generate relative price distortions and forced saving. This theory was discredited by its association with nihilistic policy prescriptions during the Great Depression. Nevertheless, its core insights were worthwhile, and also played an important part in Robertson’s more eclectic account of the cycle. The latter, however, yielded activist policy prescriptions of a sort that were discredited in the postwar period. Whether these now need re-examination, or whether a low-inflation regime, in which the authorities stand ready to resort to vigorous monetary expansion in the aftermath of asset market problems, is adequate to maintain economic stability is still an open question. BIS Working Papers are written by members of the Monetary and Economic Department of the Bank for International Settlements, and from time to time by other economists, and are published by the Bank. The views expressed in them are those of their authors and not necessarily the views of the BIS. -

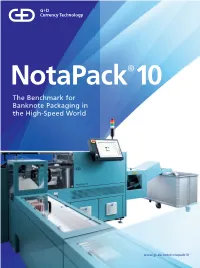

The Benchmark for Banknote Packaging in the High-Speed World

NotaPack®10 The Benchmark for Banknote Packaging in the High-Speed World www.gi-de.com/notapack10 2 NotaPack® 10 3 Concentrated packaging power NotaPack 10 is the leading banknote PHENOMENAL SECURITY MODULAR, COMPACT, FLEXIBLE FULLY AUTOMATIC – INCREASED PRODUCTIVITY – packaging system worldwide for cash Three main factors drive a high level With a high level of product modularity FULLY INTEGRATED INCREASED EFFICIENCY of security: First, intelligent features and optimum flexibility as a result of The G+D High-Speed World is character- NotaPack 10 packages up to 10 bundles centers and banknote printing works, that safeguard the unpackaged bank- over 30 different modules, NotaPack 10 ized by the perfect integration of every of 500 or 1,000 banknotes per minute – engineered in particular for the de- note bundle right up until it is fully can fulfill all key customer requirements. single element, so it is no surprise that quickly, reliably, and to a consistently manding requirements of the industry. shrink-wrapped. These include optical It also offers integration of up to five NotaPack 10 is designed for perfect high level of quality. The system’s energy It is the flawless packaging solution bundle inspection and advanced access BPS systems, and an extremely compact alignment and compatibility with BPS consumption is very low in comparison protection facilitated by continuous design that is suitable for very confined systems and G+D software. Thus, the to other systems. These considerations for the BPS M3, M5, M7, and X9 conveyor covers with locks and log file spaces (taking up floor space of just ideally alligned end-to-end process make the NotaPack 10 a highly efficient, High-Speed Systems, simultaneously writing (p. -

A Structural Model of the Unemployment Insurance Take-Up

A Structural Model of the Unemployment Insurance Take-up Sylvie Blasco∗ Fran¸coisFontainey GAINS, University of Aarhus, BETA-CNRS, CREST and IZA LMDG and IZA. January 2012 - IN PROGRESSz Abstract A large fraction of the eligible workers do not claim the unemployment insurance when they are unemployed. This paper provides a structural framework to identify clearly, through the esti- mates, the economic mechanisms behind take-up. It incorporates take-up in a job search model and accounts for the determinants of claiming, especially the level of the unemployment benefits and the practical difficulties to make a claim. It provides a simple way to model selection into participation and sheds new light on the link between the job search and the claiming efforts. We estimate our model using a unique administrative dataset that matches a linked employer - employee data and the records of the national employment agency. Keywords: Unemployment Insurance Take-up, Job Search JEL Classification numbers: J64, J65, C41 ∗Address : Universit´e du Maine, Av. Olivier Messiaen, 72085 Le Mans Cedex 9, France ; Email: [email protected] yUniversity of Nancy 2, Email: [email protected]. zWe thank Jesper Bagger, Sebastian Buhai, Sam Kortum, David Margolis, Dale Mortensen, Fabien Postel-Vinay, Jean-Marc Robin, Chris Taber and participants at the Tinbergen Institute internal seminar, CREST-INSEE, Nancy and Royal Holloway seminars, the ESEM conference, the AFSE, IZA-Labor Market Policy Evalation, LMDG, T2M workshops for comments and discussions. This is a preliminary version of the paper, the readers are invited to check on the authors' websites for newer versions. -

Capitalist Crisis and the Rise of Monetarism

CAPITALIST CRISIS AND THE RISE OF MONETARISM Simon Clarke What is the significance of 'monetarism' for an understanding of the relationship between the economy and the capitalist state? Before we can address the question we have to try to define 'monetarism'. In the strictest sense 'monetarism' refers to the advocacy of the quantity theory of money and a policy preoccupation with the growth of the money supply. In this sense monetarism expresses a pre-Keynesian ortho- doxy, that has been perpetuated by a few cranks and that inexplicably grabbed the hearts and minds of economists and politicians for the best part of a decade, between 1975 and 1985. This is the view that has tended to be taken by economists who remain committed to a Keynesian analysis. For these economists monetarism was a combination of huckstering and collective madness that led to mistaken economic policies. The response to monetarism was to keep faith and wait until normal sanity was resumed. Such a view has apparently now been vindicated by the almost universal abandonment of this kind of monetarist orthodoxy, although elements of its rhetoric remain. This is to take much too narrow a view of monetarism. Although this narrow monetarism has been utterly discredited, and the money supply no longer has the fetishistic significance that it briefly enjoyed, the broader contours of the politics and ideology of monetarism remain with us, and have been assimilated by many of those of a Keynesian persuasion. This politics and ideology relates not so much to the narrow technical issues of monetary policy and the control of the money supply as to the broader questions of the relations between the state and the economy. -

Frequently Asked Questions Coins and Notes July 2020

Frequently Asked Questions Coins and Notes July 2020 A. Currency Issuance 1. Under what authority does the Bangko Sentral ng Pilipinas (BSP) issue currency? The BSP is the sole government institution mandated by law to issue notes and coins for circulation in the Philippines. In Particular, Section 50 of Republic Act (R.A) No. 7653, otherwise known as The New Central Bank Act, as amended by Republic Act No. 11211, stipulates that the BSP shall have the sole power and authority to issue currency within the territory of the Philippines. It also issues legal tender commemorative notes and coins. 2. How does the BSP determine the volume/value of notes and coins to be issued annually? The annual volume/value of currency to be issue is projected based on currency demand that is estimated from a set of economic indicators which generally measure the country’s economic activity. Other variables considered in estimating currency order include: required currency reserves, unfit notes for replacement, and beginning inventory balance. The total amount of banknotes and coins that the BSP may issue should not exceed the total assets of the BSP. 3. How is currency issued to the public? Based on forecast of currency demand, denominational order of banknotes and coins is submitted to the Currency Production Sub-Sector (CPSS) for production of banknotes and coins. The CPSS delivers new BSP banknotes and coins to the Cash Department (CD) and the Regional Operations Sub-Sector (ROSS). In turn, CD services withdrawals of notes and coins of banks in the regions through its 22 Regional Offices/Branches. -

How Goldsmiths Created Money Page 1 of 2

Money: Banking, Spending, Saving, and Investing The Creation of Money How Goldsmiths Created Money Page 1 of 2 If you want to understand money, you have got to start with its history, and that means gold. Have you ever wondered why gold is so valuable? I mean, it is a really weak metal that does not have a lot of really practical uses. Maybe it is because it reminded people of the sun, which was worshipped in ancient times, that everyone decided they wanted it. Once everyone wants it, it is capable as serving as a medium of exchange. That is, gold can be used as money, and it is an ideal commodity to serve as a medium of exchange because it’s portable, it’s durable, it’s divisible, and it’s standardizable. Everybody recognizes what they want, it can be broken into little pieces, carried around, it doesn’t rot, and it is a great thing to serve as money. So, before long, gold is circulating in the form of coins. When gold circulates as coins, it is called commodity money, that is, money that has intrinsic value made out of something people want. Now, once gold coins begin to circulate as the medium of exchange, we have got another problem. That problem is security. Imagine that you are in the ancient world, lugging around bags and bags of gold. You are going to be pretty vulnerable to bandits. So what you want to do is make sure that there is a safe place to store your gold because you can store all of your wealth in the form of this valuable commodity, but you do not want it all lying around somewhere that it is easy for somebody else to pick off. -

Competitive Supply of Money in a New Monetarist Model

Munich Personal RePEc Archive Competitive Supply of Money in a New Monetarist Model Waknis, Parag 11 September 2017 Online at https://mpra.ub.uni-muenchen.de/75401/ MPRA Paper No. 75401, posted 23 Sep 2017 10:12 UTC Competitive Supply of Money in a New Monetarist Model Parag Waknis∗ September 11, 2017 Abstract Whether currency can be efficiently provided by private competitive money suppliers is arguably one of the fundamental questions in monetary theory. It is also one with practical relevance because of the emergence of multiple competing financial assets as well as competing cryptocurrencies as means of payments in certain class of transactions. In this paper, a dual currency version of Lagos and Wright (2005) money search model is used to explore the answer to this question. The centralized market sub-period is modeled as infinitely repeated game between two long lived players (money suppliers) and a short lived player (a continuum of agents), where longetivity of the players refers to the ability to influence aggregate outcomes. There are multiple equilibria, however we show that equilibrium featuring lowest inflation tax is weakly renegotiation proof, suggesting that better inflation outcome is possible in an environment with currency competition. JEL Codes: E52, E61. Keywords: currency competition, repeated games, long lived- short lived players, inflation tax, money search, weakly renegotiation proof. ∗The paper is based on my PhD dissertation completed at the University of Connecticut (UConn). I thank Christian Zimmermann (Major Advisor, St.Louis Fed), Ricardo Lagos (Associate Advisor, NYU) and Vicki Knoblauch (Associate Advisor, UConn) for their guidance and support. I thank participants at various conferences and the anonymous refer- ees at Economic Inquiry for their helpful comments and suggestions. -

Reducing Income Inequality While Boosting Economic Growth: Can It Be Done?

Economic Policy Reforms 2012 Going for Growth © OECD 2012 PART II Chapter 5 Reducing income inequality while boosting economic growth: Can it be done? This chapter identifies inequality patterns across OECD countries and provides new analysis of their policy and non-policy drivers. One key finding is that education and anti-discrimination policies, well-designed labour market institutions and large and/or progressive tax and transfer systems can all reduce income inequality. On this basis, the chapter identifies several policy reforms that could yield a double dividend in terms of boosting GDP per capita and reducing income inequality, and also flags other policy areas where reforms would entail a trade-off between both objectives. 181 II.5. REDUCING INCOME INEQUALITY WHILE BOOSTING ECONOMIC GROWTH: CAN IT BE DONE? Summary and conclusions In many OECD countries, income inequality has increased in past decades. In some countries, top earners have captured a large share of the overall income gains, while for others income has risen only a little. There is growing consensus that assessments of economic performance should not focus solely on overall income growth, but also take into account income distribution. Some see poverty as the relevant concern while others are concerned with income inequality more generally. A key question is whether the type of growth-enhancing policy reforms advocated for each OECD country and the BRIICS in Going for Growth might have positive or negative side effects on income inequality. More broadly, in pursuing growth and redistribution strategies simultaneously, policy makers need to be aware of possible complementarities or trade-offs between the two objectives. -

Cryptocurrency: the Economics of Money and Selected Policy Issues

Cryptocurrency: The Economics of Money and Selected Policy Issues Updated April 9, 2020 Congressional Research Service https://crsreports.congress.gov R45427 SUMMARY R45427 Cryptocurrency: The Economics of Money and April 9, 2020 Selected Policy Issues David W. Perkins Cryptocurrencies are digital money in electronic payment systems that generally do not require Specialist in government backing or the involvement of an intermediary, such as a bank. Instead, users of the Macroeconomic Policy system validate payments using certain protocols. Since the 2008 invention of the first cryptocurrency, Bitcoin, cryptocurrencies have proliferated. In recent years, they experienced a rapid increase and subsequent decrease in value. One estimate found that, as of March 2020, there were more than 5,100 different cryptocurrencies worth about $231 billion. Given this rapid growth and volatility, cryptocurrencies have drawn the attention of the public and policymakers. A particularly notable feature of cryptocurrencies is their potential to act as an alternative form of money. Historically, money has either had intrinsic value or derived value from government decree. Using money electronically generally has involved using the private ledgers and systems of at least one trusted intermediary. Cryptocurrencies, by contrast, generally employ user agreement, a network of users, and cryptographic protocols to achieve valid transfers of value. Cryptocurrency users typically use a pseudonymous address to identify each other and a passcode or private key to make changes to a public ledger in order to transfer value between accounts. Other computers in the network validate these transfers. Through this use of blockchain technology, cryptocurrency systems protect their public ledgers of accounts against manipulation, so that users can only send cryptocurrency to which they have access, thus allowing users to make valid transfers without a centralized, trusted intermediary. -

New Monetarist Economics: Methods∗

Federal Reserve Bank of Minneapolis Research Department Staff Report 442 April 2010 New Monetarist Economics: Methods∗ Stephen Williamson Washington University in St. Louis and Federal Reserve Banks of Richmond and St. Louis Randall Wright University of Wisconsin — Madison and Federal Reserve Banks of Minneapolis and Philadelphia ABSTRACT This essay articulates the principles and practices of New Monetarism, our label for a recent body of work on money, banking, payments, and asset markets. We first discuss methodological issues distinguishing our approach from others: New Monetarism has something in common with Old Monetarism, but there are also important differences; it has little in common with Keynesianism. We describe the principles of these schools and contrast them with our approach. To show how it works, in practice, we build a benchmark New Monetarist model, and use it to study several issues, including the cost of inflation, liquidity and asset trading. We also develop a new model of banking. ∗We thank many friends and colleagues for useful discussions and comments, including Neil Wallace, Fernando Alvarez, Robert Lucas, Guillaume Rocheteau, and Lucy Liu. We thank the NSF for financial support. Wright also thanks for support the Ray Zemon Chair in Liquid Assets at the Wisconsin Business School. The views expressed herein are those of the authors and not necessarily those of the Federal Reserve Banks of Richmond, St. Louis, Philadelphia, and Minneapolis, or the Federal Reserve System. 1Introduction The purpose of this essay is to articulate the principles and practices of a school of thought we call New Monetarist Economics. It is a companion piece to Williamson and Wright (2010), which provides more of a survey of the models used in this literature, and focuses on technical issues to the neglect of methodology or history of thought.