FTSE Factsheet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COVID-19 Proxy Governance Update

COVID-19 Proxy Governance Update 2020 AGM mid-season review FROM EQUINITI 01 Looking back and planning ahead It is incredible to note that it has been over 12 weeks since the official announcement on 23 March of the UK Government’s Stay at Home Measures, and nearly seven months since the severity of the pandemic became apparent in China. Over the said period, PLC boards, company secretaries and investor relations officers have kept their corporate calendars going thanks to rapid adoption of modified regulatory guidelines and inventive modes of engagement with investors. With annual general meetings being an obvious highlight in the corporate calendar, we take stock of the progress made so far over the 2020 AGM season, as well as using what we learned to plan ahead. Now that we are over the first ‘hump’ with the busy period of May AGMs out of the way, we are readying for the second ‘peak’ of June and July AGMs, and then an ‘easing’ until the second ‘mini’ season in the early autumn. As such, in this update, we look at: • 2020 AGM season statistics…so far • Proxy adviser engagement and ISS recommendations review • High-level assumptions for Q3 and Q4 • Relevant updates from the regulators, industry bodies and proxy advisers • Communications in the COVID-19 world – special commentary by leading financial PR firm,Camarco • How has COVID-19 impacted activism – special commentary by international law firm,White & Case 02 2020 AGM Season Statistics…so far Scope of data To assess progress and forecast what is to come, we look at the key statistics for the UK AGM season 2020 thus far. -

Taylor Woodrow Plc Report and Accounts 2006 Our Aim Is to Be the Homebuilder of Choice

Taylor Woodrow plc Report and Accounts 2006 Our aim is to be the homebuilder of choice. Our primary business is the development of sustainable communities of high-quality homes in selected markets in the UK, North America, Spain and Gibraltar. We seek to add shareholder value through the achievement of profitable growth and effective capital management. Contents 01 Group Financial Highlights 54 Consolidated Cash Flow 02 Chairman’s Statement Statement 05 Chief Executive’s Review 55 Notes to the Consolidated 28 Board of Directors Financial Statements 30 Report of the Directors 79 Independent Auditors’ Report 33 Corporate Governance Statement 80 Accounting Policies 37 Directors’ Remuneration Report 81 Company Balance Sheet 46 Directors’ Responsibilities 82 Notes to the Company Financial Statement Statements 47 Independent Auditors’ Report 87 Particulars of Principal Subsidiary 48 Accounting Policies Undertakings 51 Consolidated Income Statement 88 Five Year Review 52 Consolidated Statement of 90 Shareholder Facilities Recognised Income and Expense 92 Principal Taylor Woodrow Offices 53 Consolidated Balance Sheet Group Financial Highlights • Group revenues £3.68bn (2005: £3.56bn) • Housing profit from operations* £469m (2005: £456m) • Profit before tax £406m (2005: £411m) • Basic earnings per share 50.5 pence (2005: 50.6 pence) • Full year dividend 14.75 pence (2005: 13.4 pence) • Net gearing 18.6 per cent (2005: 23.7 per cent) • Equity shareholders’ funds per share 364.7 pence (2005: 338.4 pence) Profit before tax £m 2006 405.6 2005 411.0 2004 403.9 Full year dividend pence (Represents interim dividends declared and paid and final dividend for the year as declared by the Board) 2006 14.75 2005 13.4 2004 11.1 Equity shareholders’ funds per share pence 2006 364.7 2005 338.4 2004 303.8 * Profit from operations is before joint ventures’ interest and tax (see Note 3, page 56). -

Disclaimer Strictly Not to Be Forwarded to Any

DISCLAIMER STRICTLY NOT TO BE FORWARDED TO ANY OTHER PERSONS IMPORTANT: You must read the following disclaimer before reading, accessing or making any other use of the attached document relating to SEGRO plc (the “Company”) dated 10 March 2017. In accessing the attached document, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. You acknowledge that this electronic transmission and the delivery of the attached document is confidential and intended for you only and you agree you will not forward, reproduce, copy, download or publish this electronic transmission or the attached document (electronically or otherwise) to any other person. The attached document has been prepared solely in connection with the proposed rights issue and offering of nil paid rights, fully paid rights and new ordinary shares (the “Securities”) of the Company (the “Transaction”). The Prospectus has been published in connection with the admission of the Securities to the Official List of the UK Financial Conduct Authority (the ‘‘Financial Conduct Authority’’) and to trading on the London Stock Exchange plc’s main market for listed securities (together, ‘‘Admission’’). The Prospectus has been approved by the Financial Conduct Authority as a prospectus prepared in accordance with the Prospectus Rules made under section 73A of the Financial Services and Markets Act 2000, as amended. NOTHING IN THIS ELECTRONIC TRANSMISSION AND THE ATTACHED DOCUMENT CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. -

The Taylor Wimpey Difference

Annual Report and Accounts 2019 Difference The Taylor Wimpey Taylor Wimpey plc Annual Report and Accounts 2019 www.taylorwimpey.co.uk Taylor Wimpey plc is a customer-focused residential developer building and delivering homes and communities across the UK and in Spain. Our Company purpose is to deliver new homes within thriving communities, in a safe and environmentally responsible manner, with customers at the heart of our decision making and consideration of the potential impact on wider stakeholders. Contents Strategic report Financial statements Connect with us 1 The Taylor Wimpey difference 140 Independent auditor’s report There are several ways you can get in 12 Investment case 148 Consolidated income statement touch with us or follow our news. 14 Chair’s statement 149 Consolidated statement of www.taylorwimpey.co.uk/corporate 17 Group Management Team Q&A comprehensive income 18 UK market review 150 Consolidated balance sheet www.twitter.com/taylorwimpeyplc 22 Chief Executive’s letter 151 Consolidated statement of changes in equity 24 Our strategy and www.linkedin.com/company/taylor-wimpey key performance indicators 152 Consolidated cash flow statement 30 Our business model 153 Notes to the consolidated financial statements 32 Making a difference for our stakeholders Navigating this report 183 Company balance sheet 44 Non-financial information statement The icons below help to signpost where you 184 Company statement of changes 45 Our approach to identifying and can find more information. in equity managing risk 185 Notes to the -

Consultation Statement

Maidstone Borough Council Affordable and Local Needs Housing Supplementary Planning Document Consultation Statement 21st August 2019 1 Maidstone Borough Council - Consultation Statement 1.1 Maidstone Borough Council (MBC) has recently adopted its Local Plan (October 2017) and this includes a commitment to produce an Affordable and Local Needs Housing Supplementary Planning Document (the SPD). 1.2 Adams Integra have been instructed to compile an SPD which is intended to facilitate negotiations and provide certainty for landowners, lenders, housebuilders and Registered Providers regarding MBC’s expectations for affordable and local needs housing provision in specific schemes. 1.3 The purpose of this Supplementary Planning Document (SPD) is to provide advice on how the Council’s Local Plan housing policies are to be implemented. 1.4 In order to facilitate the preparation of the SPD we (Adams Integra) consulted with the following persons and organisations: David Banfield Redrow Homes Barry Chamberlain Wealden Homes Tim Daniels Millwood Designer Homes Paul Dawson Fernham Homes Rosa Etherington Countryside Properties PLC Chris Lilley Redrow Homes Chris Loughead Crest Nicholson Iain McPherson Countryside Properties PLC Stuart Mitchell Chartway Group Chris Moore Bellway Guy Osborne Country House Developments Kathy Putnam Chartway Group James Stevens Home Builders Federation Julian Wilkinson BDW Homes Kerry Kyriacou Optivo Adetokunbo Adeyeloja Golding Homes Sarah Paxton Maidstone Housing Trust Joe Scullion Gravesend Churches Housing Association Gareth Crawford Homes Group Mike Finch Hyde HA Russell Drury Moat HA Keiran O'Leary Orbit HA Chris Cheesman Clarion Housing Micheal Neeh Sanctuary HA Colin Lissenden Town and Country West Kent HA Guy Osbourne Country House Homes Katherine Putnam Chartway Group Annabel McKie Golding Homes Councillors at Maidstone Maidstone Borough Council Borough Council 2 Maidstone Borough Council - Consultation Statement 1.5 We sent out separate questionnaires to Housing Associations and Developers which have been appended to this statement. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

2016 Annual Report

bovishomesgroup.co.uk Bovis Homes Group PLC Annual report and accounts Bovis Homes Group PLC, The Manor House, North Ash Road, New Ash Green, Longfield, Kent DA3 8HQ. www.bovishomesgroup.co.uk 2016 Designed and produced by the Bovis Homes Graphic Design Department. Printed by Tewkesbury Printing Company Limited accredited with ISO 14001 Environmental Certification. Printed using bio inks formulated from sustainable raw materials. Printed on Cocoon 50:50 silk a recycled paper containing 50% recycled waste and 50% virgin fibre and manufactured at a mill certified with ISO 14001 environmental management standard. The pulp used in this product is bleached using an Elemental Chlorine Free process (ECF). When you have finished with this pack please recycle it. Annual report and accounts 2016 Bovis Homes Group PLC When you have finished with this pack please recycle it. Annual report and accounts Strategic report Business overview 4 2 2016 highlights Chairman’s statement A review of our business 4 Chairman’s statement model, strategy and Ian Tyler discusses how the 6 What we do summary financial and Group is well placed for 7 Reasons to invest operational performance the future 10 Housing market overview Our business and strategy 12 Interim Chief Executive’s report 18 Our business model 20 Strategic priorities 26 Principal risks and uncertainties 30 Risk management 12 Corporate social responsibility Interim Chief Executive’s report 32 Our CSR priorities Earl Sibley provides an overview of the year and Our financial performance discusses the -

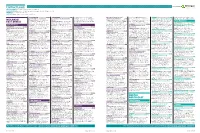

Contract Leads Powered by EARLY PLANNING Projects in Planning up to Detailed Plans Submitted

Contract Leads Powered by EARLY PLANNING Projects in planning up to detailed plans submitted. PLANS APPROVED Projects where the detailed plans have been approved but are still at pre-tender stage. TENDERS Projects that are at the tender stage CONTRACTS Approved projects at main contract awarded stage. NORTHAMPTON £3.7M CHESTERFIELD £1M Detail Plans Granted for 2 luxury houses The Coppice Primary School, 50 County Council Agent: A A Design Ltd, GRIMSBY £1M Studios, Trafalgar Street, Newcastle-Upon- Land Off, Alibone Close Moulton Recreation Ground, North Side New Client: Michael Howard Homes Developer: Shawhurst Lane Hollywood £1.7m Aizlewood Road, Sheffield, South Yorkshire, Grimsby Leisure Centre, Cromwell Road Tyne, Tyne & Wear, NE1 2LA Tel: 0191 2611258 MIDLANDS/ Planning authority: Daventry Job: Outline Tupton Bullworthy Shallish LLP, 3 Quayside Place, Planning authority: Bromsgrove Job: Detail S8 0YX Contractor: William Davis Ltd, Forest Planning authority: North East Lincolnshire Plans Granted for 16 elderly person Planning authority: North East Derbyshire Quayside, Woodbridge, Suffolk, IP12 1FA Tel: Plans Granted for school (extension) Client: Field, Forest Road, Loughborough, Job: Detailed Plans Submitted for leisure Plans Approved EAST ANGLIA bungalows Client: Gayton Retirement Fund Job: Detail Plans Granted for 4 changing 01394 384 736 The Coppice Primary School Agent: PR Leicestershire, LE11 3NS Tel: 01509 231181 centre Client: North East Lincolnshire BILLINGHAM £0.57M & Beechwood Trusteeship & Administration rooms pavilion -

Building Excellence

Barratt Developments PLC Building excellence Annual Report and Accounts 2017 Annual Report and Accounts 2017 Inside this report 1 45 113 175 Strategic Report Governance Financial Statements Other Information 1 Key highlights 46 The Board 114 Independent Auditor’s Report 175 KPI definitions and why we measure 2 A snapshot of our business 48 Corporate governance report 119 Consolidated Income Statement 176 Glossary 4 Our performance and financial highlights 60 Nomination Committee report 119 Statement of Comprehensive Income 177 Other Information 6 How we create and preserve value 65 Audit Committee report 120 Statement of Changes in 8 Chairman’s statement 74 Safety, Health and Environment Shareholders’ Equity – Group 10 Key aspects of our market Committee report 121 Statement of Changes in 76 Remuneration report Shareholders’ Equity – Company 12 Chief Executive’s statement Notice regarding limitations on Directors’ liability under 106 Other statutory disclosures 122 Balance Sheets English law 17 Our Strategic priorities Under the Companies Act 2006, a safe harbour limits the 112 Statement of Directors’ 123 Cash Flow Statements liability of Directors in respect of statements in, and omissions from, the Strategic Report contained on pages 1 to 44 and the Our principles Responsibilities 124 Notes to the Financial Statements Directors’ Report contained on pages 45 to 112. Under English Law the Directors would be liable to the Company (but not to 34 Keeping people safe any third party) if the Strategic Report and/or the Directors’ Report contains errors as a result of recklessness or knowing 35 Being a trusted partner misstatement or dishonest concealment of a material fact, 36 Building strong but would not otherwise be liable. -

49 P51 AO1 Hot Noms.Qxp 04/12/2007 17:23 Page 51

49 p51 AO1 Hot noms.qxp 04/12/2007 17:23 Page 51 www.propertyweek.com Analysis + opinion – Hot 100 51 07.12.07 ROLL OF HONOUR The following 527 rising stars were all nominated by readers, but did not receive enough votes to make it on to the Hot 100 list. However, we have decided to publish all of their names to recognise and reward their individual achievements Ab Shome, RBS Caroline McDade, Drivers Jonas Douglas Higgins Ian Webster, Colliers CRE Adam Buchler, Buchler Barnett Celine Donnet, Cohen & Steers Duncan Walker, Helical Bar Ian Webster, Savills Adam Oliver, Coleman Bennett Charles Archer, Colliers CRE Edward Offenbach, DTZ James Abrahms, Allsop Adam Poyner, Colliers CRE Charles Bull, DTZ Corporate Finance Edward Siddall-Jones, Nattrass Giles James Ackroyd, Colliers CRE Adam Robson, Drivers Jonas Charles Ferguson Davie, Moorfield Group Edward Towers James Bain, Mollison Adam Varley, Lambert Smith Hampton Charles Kearney, Gerry O’Connor Elizabeth Higgins, Drivers Jonas James Baker, Nice Investments Adam Winton, Kaupthing Estate Agents Elliot Robertson, Manorlane James Cobbold, Colliers CRE Agnes Peters, Drivers Jonas Charlie Archer, Colliers CRE Emilia Keladitis, DTZ Corporate Finance James Ebel, Harper Dennis Hobbs Akhtar Alibhai, Colliers CRE Charlie Barke, Cushman & Wakefield Emma Crowley, Jones Lang LaSalle James Feilden, GVA Grimley Alan Gardener, Jones Lang LaSalle Charlie Bezzant, Reed Smith Richards Butler Emma Wilson, Urban Splash James Goymour, Edward Symmons Alan Hegarty, Bennett Property Charlote Fourmont, Drivers Jonas -

Driving Sustainability in New Homes: a Resource for Local Authorities VERSION 1.1: July 2018

Driving sustainability in new homes: a resource for local authorities VERSION 1.1: July 2018 (Version 1.0 originally published March 2018) An output from the UKGBC Cities Programme, sponsored by: 1 Acknowledgements This resource is the output of a UKGBC project in association with The intention is that key stakeholders feel ‘co-ownership’ of this Core Cities UK. It has been produced through a combination of resource, and we are grateful to the organisations below for their workshops, meetings, written consultation and individual feedback. endorsement. We invite others to do likewise. A large number of organisations have taken time to feed into the For any queries in relation to this resource, contact process. A full list can be found on the following slide. However, John Alker, Director of Policy & Places, UKGBC: we are particularly grateful for the extensive time provided by [email protected] Charlene Clear, BRE and Duncan Price, BuroHappold. 2 Acknowledgements The following organisations provided input and/or review during the original process. This acknowledgement does not imply endorsement. Barratt Developments GLA Newcastle City Council Berkeley Group Greater Manchester Combined Authority PassivHaus Trust Bioregional Hoare Lea PRP BRE HTA Rockwool BuroHappold Hurstwyn Associates Saint Gobain Cambridge City Council Igloo Regeneration St Albans & District Council Clarion Housing Group JLL Sustainable Homes Climate KIC Lendlease UK100 Core Cities UK Levitt Bernstein Useful Projects Currie Brown Linkcity WSP Eastleigh Borough Council -

Marten & Co / Quoted Data Word Template

Monthly roundup | Real estate October 2019 Winners and losers in September Best performing companies in price terms in Sept Worst performing companies in price terms in Sept (%) (%) Capital & Regional 37.9 Countrywide (11.7) Hammerson 24.9 Town Centre Securities (7.2) NewRiver REIT 19.1 Aseana Properties (5.1) Inland Homes 15.8 Harworth Group (4.3) Capital & Counties Properties 14.8 Ediston Property Investment Company (4.0) British Land 14.7 GRIT Real Estate Income Group (3.7) Workspace Group 13.2 Daejan Holdings (3.5) Countryside Properties 12.3 Primary Health Properties (2.9) Triple Point Social Housing REIT 11.7 Big Yellow Group (2.9) U and I Group 11.1 Conygar Investment Company (2.6) Source: Bloomberg, Marten & Co Source: Bloomberg, Marten & Co Capital & Regional share price YTD The month of Countrywide share price YTD On the flip side, the September was a UK’s biggest estate 40 12 bumper month for agent group, 30 many property 8 Countrywide, which 20 companies’ share also owns a 4 10 price, dominated by commercial real 0 retail focused 0 estate consultancy, Jan FebMar Apr May Jun Jul Aug Sep Jan FebMar Apr May Jun Jul Aug Sep companies, who in was the worst Source: Bloomberg, Marten & Co general have taken a Source: Bloomberg, Marten & Co performing in hammering over the September. It is the past 18 months or so. Top of the list was Capital & Regional. second month in a row that it has been in the bottom 10 and Shares in the shopping centre landlord bounced after it in the year to date it is beaten only by Intu Properties as the announced it was in talks with South African REIT worst performing listed property company, losing 53.5%.