Marten & Co / Quoted Data Word Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

![Aberdeen Standard OEIC ASI UK Real Estate Share (Class a Acc [GBP])](https://docslib.b-cdn.net/cover/3695/aberdeen-standard-oeic-asi-uk-real-estate-share-class-a-acc-gbp-13695.webp)

Aberdeen Standard OEIC ASI UK Real Estate Share (Class a Acc [GBP])

Aberdeen Standard OEIC ASI UK Real Estate Share (Class A Acc [GBP]) Benchmark Aims Benchmark FTSE 350 Real Estate To generate income and some growth over the long term (5 years or more) by investing in UK property-related equities (company shares) including listed closed ended real estate investment trusts (“REITs”). Performance IA sector Property Target: To achieve the return of the FTSE 350 Real Estate Index plus 3% per annum (before charges) over rolling three year periods. The Performance Target is the level of performance that the management team hopes to Identification Codes achieve for the fund. There is however no certainty or promise that they will achieve the Performance Target. The ACD believes this is an appropriate target for the fund based on the investment policy of the fund and the Sedol code B0XWNM5 constituents of the index. Mex code AFPRSA ISIN code GB00B0XWNM59 Performance Fund Overview Price Bid 178.69p Offer 178.69p (24/09/2021) Historic yield 1.11% Fund size £468.6m Number of holdings 32 Concentration Coefficient* 23 Charges Discounted initial charge 0.000% Net discounted AMC 0.750% Initial charge 4.25% Annual Management Charge 1.50% Exit charge None Performance fees No Cumulative Performance (%) 3m 6m 1Yr 3Yr 5Yr Fund Background Fund 7.72% 19.32% 35.73% 44.71% 70.86% Valuation point Daily 12:00 Sector 2.76% 13.07% 22.94% 20.79% 31.89% Fund type OEIC Rank 3/26 4/26 2/24 1/20 1/20 Launch date 29/10/1990 Quartile 1 1 1 1 1 Launch price £0.50 Discrete Performance (%) - to last month end Fund currency Pound Sterling -

REAL ESTATE July 2020

LISTED MARKETS – REAL ESTATE July 2020 Leo Zielinski Partner Tel. +44 (0)7980 809031 [email protected] John Rodgers Partner Tel. +44 (0)7810 307422 [email protected] Will Strachan Partner Tel. +44 (0)7929 885859 [email protected] Lloyd Davies We track the share price movement and regulatory announcements Partner of 57 real estate owning listed entities (“Gerald Eve tracked index”). Tel. +44 (0)7767 311254 A summary of the Gerald Eve tracked index in terms of GAV, NAV, [email protected] LTV, Dividend, Share Price, Market Cap, Discount/Premium to NAV and their respective weekly movement is attached. Lorenzo Solazzo Data Analyst We provide a comparison to share price data from 3 February 2020 Tel. +44 (0)783 309 5582 [email protected] (pre-Covid-19 level) to present day to demonstrate the impact across certain entities as a direct result of Covid-19. James Brown Surveyor As at 30 of June, the Gerald Eve tracked index is currently down 30% to pre- Tel. +44 (0)7464 656563 Covid-19 level, under-performing the FTSE350 which is slowly recovering and is [email protected] now down 16%. The tracked listed REITs share price decreased on average 3% since 1 June 2020 (March: -25%, April: +6%, May: -3%). To provide context around the share price movement, the average discount to NAV is currently 31% against 3% pre-Covid-19. It is unsurprising to note that specialist sector entities across Industrial, Healthcare and Supermarkets have out-performed the REIT universe relative to other strategies within the Gerald Eve tracked index. -

Consultation Statement

Maidstone Borough Council Affordable and Local Needs Housing Supplementary Planning Document Consultation Statement 21st August 2019 1 Maidstone Borough Council - Consultation Statement 1.1 Maidstone Borough Council (MBC) has recently adopted its Local Plan (October 2017) and this includes a commitment to produce an Affordable and Local Needs Housing Supplementary Planning Document (the SPD). 1.2 Adams Integra have been instructed to compile an SPD which is intended to facilitate negotiations and provide certainty for landowners, lenders, housebuilders and Registered Providers regarding MBC’s expectations for affordable and local needs housing provision in specific schemes. 1.3 The purpose of this Supplementary Planning Document (SPD) is to provide advice on how the Council’s Local Plan housing policies are to be implemented. 1.4 In order to facilitate the preparation of the SPD we (Adams Integra) consulted with the following persons and organisations: David Banfield Redrow Homes Barry Chamberlain Wealden Homes Tim Daniels Millwood Designer Homes Paul Dawson Fernham Homes Rosa Etherington Countryside Properties PLC Chris Lilley Redrow Homes Chris Loughead Crest Nicholson Iain McPherson Countryside Properties PLC Stuart Mitchell Chartway Group Chris Moore Bellway Guy Osborne Country House Developments Kathy Putnam Chartway Group James Stevens Home Builders Federation Julian Wilkinson BDW Homes Kerry Kyriacou Optivo Adetokunbo Adeyeloja Golding Homes Sarah Paxton Maidstone Housing Trust Joe Scullion Gravesend Churches Housing Association Gareth Crawford Homes Group Mike Finch Hyde HA Russell Drury Moat HA Keiran O'Leary Orbit HA Chris Cheesman Clarion Housing Micheal Neeh Sanctuary HA Colin Lissenden Town and Country West Kent HA Guy Osbourne Country House Homes Katherine Putnam Chartway Group Annabel McKie Golding Homes Councillors at Maidstone Maidstone Borough Council Borough Council 2 Maidstone Borough Council - Consultation Statement 1.5 We sent out separate questionnaires to Housing Associations and Developers which have been appended to this statement. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

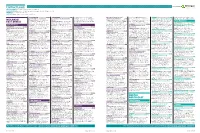

Contract Leads Powered by EARLY PLANNING Projects in Planning up to Detailed Plans Submitted

Contract Leads Powered by EARLY PLANNING Projects in planning up to detailed plans submitted. PLANS APPROVED Projects where the detailed plans have been approved but are still at pre-tender stage. TENDERS Projects that are at the tender stage CONTRACTS Approved projects at main contract awarded stage. NORTHAMPTON £3.7M CHESTERFIELD £1M Detail Plans Granted for 2 luxury houses The Coppice Primary School, 50 County Council Agent: A A Design Ltd, GRIMSBY £1M Studios, Trafalgar Street, Newcastle-Upon- Land Off, Alibone Close Moulton Recreation Ground, North Side New Client: Michael Howard Homes Developer: Shawhurst Lane Hollywood £1.7m Aizlewood Road, Sheffield, South Yorkshire, Grimsby Leisure Centre, Cromwell Road Tyne, Tyne & Wear, NE1 2LA Tel: 0191 2611258 MIDLANDS/ Planning authority: Daventry Job: Outline Tupton Bullworthy Shallish LLP, 3 Quayside Place, Planning authority: Bromsgrove Job: Detail S8 0YX Contractor: William Davis Ltd, Forest Planning authority: North East Lincolnshire Plans Granted for 16 elderly person Planning authority: North East Derbyshire Quayside, Woodbridge, Suffolk, IP12 1FA Tel: Plans Granted for school (extension) Client: Field, Forest Road, Loughborough, Job: Detailed Plans Submitted for leisure Plans Approved EAST ANGLIA bungalows Client: Gayton Retirement Fund Job: Detail Plans Granted for 4 changing 01394 384 736 The Coppice Primary School Agent: PR Leicestershire, LE11 3NS Tel: 01509 231181 centre Client: North East Lincolnshire BILLINGHAM £0.57M & Beechwood Trusteeship & Administration rooms pavilion -

XINT F UK Real Estate P GBP Index

As of December 30, 2020 XINT F UK Real Estate P GBP Index DE000A13PXZ5 GBP The XINT F UK Real Estate P GBP Index is a free-float adjusted index, designed to track the performance of real estate companies and REITS listed on the London Stock Exchange. INDEX PERFORMANCE - PRICE RETURN 120 115 110 105 100 95 90 85 80 75 70 Jun-19 Sep-19 Dec-19 Mar-20 Jun-20 Sep-20 Returns (p.a) Standard Deviation (p.a) Maximum Drawdown 3M 69.43% 3M 23.80% From 14.02.2020 6M 21.90% 6M 21.90% To 19.03.2020 1Y -17.08% 1Y -17.08% Return -38.63% Index Intelligence GmbH - Grosser Hirschgraben 15 - 60311 Frankfurt am Main Tel.: +49 69 247 5583 50 - [email protected] www.index-int.com Top 10 Constituents FFMV (GBPm) Weight % Industry Sector Segro PLC 11,298 19.84 Real Estate Land Securities Group PLC 4,910 8.62 Real Estate British Land Company PLC 4,630 8.13 Real Estate Unite Group PLC 3,341 5.87 Real Estate Derwent London PLC 3,136 5.51 Real Estate Tritax Big Box REIT Plc 2,866 5.03 Real Estate LondonMetric Property PLC 2,059 3.61 Real Estate Assura PLC 2,021 3.55 Real Estate Primary Health Properties PLC 1,989 3.49 Real Estate Grainger PLC 1,900 3.34 Real Estate Total 38,151 66.99 This information has been prepared by Index Intelligence GmbH (“IIG”). All information is provided "as is" and IIG makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to any data included herein. -

Recommended Cash and Share Offer for A&J Mucklow Group

172591 Proof 2 Thursday, May 23, 2019 03:22 NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION. THIS ANNOUNCEMENT IS DEEMED BY LONDONMETRIC AND MUCKLOW TO CONTAIN INSIDE INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION NO 596/2014. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN. THIS ANNOUNCEMENT IS AN ADVERTISEMENT AND NOT A PROSPECTUS OR PROSPECTUS EQUIVALENT DOCUMENT AND INVESTORS SHOULD NOT MAKE ANY INVESTMENT DECISION IN RELATION TO THE NEW LONDONMETRIC SHARES EXCEPT ON THE BASIS OF INFORMATION IN THE SCHEME DOCUMENT AND THE COMBINED CIRCULAR AND PROSPECTUS WHICH ARE PROPOSED TO BE PUBLISHED IN DUE COURSE. 23 May 2019 FOR IMMEDIATE RELEASE RECOMMENDED CASH AND SHARE OFFER FOR A&J MUCKLOW GROUP PLC (“MUCKLOW”) BY LONDONMETRIC PROPERTY PLC (“LONDONMETRIC”) to be effected by means of a Scheme of Arrangement under Part 26 of the Companies Act 2006 Summary The boards of directors of LondonMetric and Mucklow are pleased to announce that they have reached agreement on the terms of a recommended offer pursuant to which LondonMetric will acquire the entire issued and to be issued ordinary share capital of Mucklow (the “Combination” forming the “Combined Group”). The Combination is to be effected by means of a scheme of arrangement under Part 26 of the Companies Act. Under the terms of the Combination, for each Mucklow Ordinary Share, Mucklow Shareholders will be entitled to receive: 2.19 New LondonMetric Shares and 204.5 pence in cash On the basis of the Closing Price per LondonMetric Ordinary Share of 205.8 pence on 22 May 2019, the Combination values each Mucklow Ordinary Share at 655.2 pence and the entire issued and to be issued ordinary share capital of Mucklow at approximately £414.7 million. -

49 P51 AO1 Hot Noms.Qxp 04/12/2007 17:23 Page 51

49 p51 AO1 Hot noms.qxp 04/12/2007 17:23 Page 51 www.propertyweek.com Analysis + opinion – Hot 100 51 07.12.07 ROLL OF HONOUR The following 527 rising stars were all nominated by readers, but did not receive enough votes to make it on to the Hot 100 list. However, we have decided to publish all of their names to recognise and reward their individual achievements Ab Shome, RBS Caroline McDade, Drivers Jonas Douglas Higgins Ian Webster, Colliers CRE Adam Buchler, Buchler Barnett Celine Donnet, Cohen & Steers Duncan Walker, Helical Bar Ian Webster, Savills Adam Oliver, Coleman Bennett Charles Archer, Colliers CRE Edward Offenbach, DTZ James Abrahms, Allsop Adam Poyner, Colliers CRE Charles Bull, DTZ Corporate Finance Edward Siddall-Jones, Nattrass Giles James Ackroyd, Colliers CRE Adam Robson, Drivers Jonas Charles Ferguson Davie, Moorfield Group Edward Towers James Bain, Mollison Adam Varley, Lambert Smith Hampton Charles Kearney, Gerry O’Connor Elizabeth Higgins, Drivers Jonas James Baker, Nice Investments Adam Winton, Kaupthing Estate Agents Elliot Robertson, Manorlane James Cobbold, Colliers CRE Agnes Peters, Drivers Jonas Charlie Archer, Colliers CRE Emilia Keladitis, DTZ Corporate Finance James Ebel, Harper Dennis Hobbs Akhtar Alibhai, Colliers CRE Charlie Barke, Cushman & Wakefield Emma Crowley, Jones Lang LaSalle James Feilden, GVA Grimley Alan Gardener, Jones Lang LaSalle Charlie Bezzant, Reed Smith Richards Butler Emma Wilson, Urban Splash James Goymour, Edward Symmons Alan Hegarty, Bennett Property Charlote Fourmont, Drivers Jonas -

Distressing Debt Seek out Shares in the Lowest Quality Companies; Verdad Compared Equity Performance with Credit the Worst-Of-The-Worst, If You Like

TIPS IDEAS FARM want to play the ‘dash for trash’ should simply the issue price. A similar story was found when Distressing debt seek out shares in the lowest quality companies; Verdad compared equity performance with credit the worst-of-the-worst, if you like. However, quality based on the scores of rating agencies. ALGY HALL ignoring ‘quality’ when it comes to buying Here the research found share performance t’s been a tough time for short sellers lately. beaten-up stocks (the kind of shares found on started to deteriorate when ratings fell below a IThe ‘dash for trash’ that I wrote about in this these pages in our tables of shorts, downgrades high single B rating. The annualised equity return column last week, has been indiscriminate. and 52-week lows) is rarely wise. from stocks in the least creditworthy category Even real no-hoper shares have benefited. The Intrigued by the price movement of bankrupt- (CC and below) was a negative 34 per cent. most headline-grabbing example of investors’ company stocks, Verdad – a US investment firm This research holds an important lesson for willingness to overlook all fundamentals in their that specialises in investing in the shares of investors targeting the grubbier end of this recov- hunt for ‘trash’ has been the strong performance cheap, indebted, smaller companies – trawled its ery. Rather than buying the worst-of-the-worst, of shares in US companies that have already database. It looked for the long-term relationship it’s the best-of-the-worst that should provide the declared bankruptcy or are about to (Hertz, JC between share price performance and the level optimal trade-off between risk and reward. -

COVERAGE LIST GEO Group, Inc

UNITED STATES: REIT/REOC cont’d. UNITED STATES: REIT/REOC cont’d. UNITED STATES: NON-TRADED REITS cont’d. COVERAGE LIST GEO Group, Inc. GEO Sabra Health Care REIT, Inc. SBRA KBS Strategic Opportunity REIT, Inc. Getty Realty Corp. GTY Saul Centers, Inc. BFS Landmark Apartment Trust, Inc. Gladstone Commercial Corporation GOOD Select Income REIT SIR Lightstone Value Plus Real Estate Investment Trust II, Inc. Gladstone Land Corporation LAND Senior Housing Properties Trust SNH Lightstone Value Plus Real Estate Investment Trust III, Inc. WINTER 2015/2016 • DEVELOPED & EMERGING MARKETS Global Healthcare REIT, Inc. GBCS Seritage Growth Properties SRG Lightstone Value Plus Real Estate Investment Trust, Inc. Global Net Lease, Inc. GNL Silver Bay Realty Trust Corp. SBY Moody National REIT I, Inc. Government Properties Income Trust GOV Simon Property Group, Inc. SPG Moody National REIT II, Inc. EUROPE | AFRICA | ASIA-PACIFIC | MIDDLE EAST | SOUTH AMERICA | NORTH AMERICA Gramercy Property Trust Inc. GPT SL Green Realty Corp. SLG MVP REIT, Inc. Gyrodyne, LLC GYRO SoTHERLY Hotels Inc. SOHO NetREIT, Inc. HCP, Inc. HCP Sovran Self Storage, Inc. SSS NorthStar Healthcare Income, Inc. UNITED KINGDOM cont’d. Healthcare Realty Trust Incorporated HR Spirit Realty Capital, Inc. SRC O’Donnell Strategic Industrial REIT, Inc. EUROPE Healthcare Trust of America, Inc. HTA St. Joe Company JOE Phillips Edison Grocery Center REIT I, Inc. GREECE: Athens Stock Exchange (ATH) AFI Development Plc AFRB Hersha Hospitality Trust HT STAG Industrial, Inc. STAG Phillips Edison Grocery Center REIT II, Inc. AUSTRIA: Vienna Stock Exchange (WBO) Babis Vovos International Construction S.A. VOVOS Alpha Pyrenees Trust Limited ALPH Highwoods Properties, Inc. -

Marten & Co / Quoted Data Word Template

Monthly roundup | Real estate October 2019 Winners and losers in September Best performing companies in price terms in Sept Worst performing companies in price terms in Sept (%) (%) Capital & Regional 37.9 Countrywide (11.7) Hammerson 24.9 Town Centre Securities (7.2) NewRiver REIT 19.1 Aseana Properties (5.1) Inland Homes 15.8 Harworth Group (4.3) Capital & Counties Properties 14.8 Ediston Property Investment Company (4.0) British Land 14.7 GRIT Real Estate Income Group (3.7) Workspace Group 13.2 Daejan Holdings (3.5) Countryside Properties 12.3 Primary Health Properties (2.9) Triple Point Social Housing REIT 11.7 Big Yellow Group (2.9) U and I Group 11.1 Conygar Investment Company (2.6) Source: Bloomberg, Marten & Co Source: Bloomberg, Marten & Co Capital & Regional share price YTD The month of Countrywide share price YTD On the flip side, the September was a UK’s biggest estate 40 12 bumper month for agent group, 30 many property 8 Countrywide, which 20 companies’ share also owns a 4 10 price, dominated by commercial real 0 retail focused 0 estate consultancy, Jan FebMar Apr May Jun Jul Aug Sep Jan FebMar Apr May Jun Jul Aug Sep companies, who in was the worst Source: Bloomberg, Marten & Co general have taken a Source: Bloomberg, Marten & Co performing in hammering over the September. It is the past 18 months or so. Top of the list was Capital & Regional. second month in a row that it has been in the bottom 10 and Shares in the shopping centre landlord bounced after it in the year to date it is beaten only by Intu Properties as the announced it was in talks with South African REIT worst performing listed property company, losing 53.5%.