Texas America's Leader in Wind Energy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Exhibits and Financial Statement Schedules 149

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K [ X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011 OR [ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 1-16417 NUSTAR ENERGY L.P. (Exact name of registrant as specified in its charter) Delaware 74-2956831 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 2330 North Loop 1604 West 78248 San Antonio, Texas (Zip Code) (Address of principal executive offices) Registrant’s telephone number, including area code (210) 918-2000 Securities registered pursuant to Section 12(b) of the Act: Common units representing partnership interests listed on the New York Stock Exchange. Securities registered pursuant to 12(g) of the Act: None. Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ] Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X] Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Valero Port Arthur Refinery Presents $750000 to Local Children's Charities

FOR IMMEDIATE RELEASE: VALERO PORT ARTHUR REFINERY PRESENTS $750,000 TO LOCAL CHILDREN’S CHARITIES Despite tournament’s cancellation, community support endures PORT ARTHUR, Texas, October 9, 2020 — The COVID-19 pandemic canceled the Valero Texas Open, like it did so many prominent events across the country, but it didn’t stop the tournament’s legacy of giving back. Business partners, sponsors and individual donors of the tournament and related events including the Valero Benefit for Children still contributed more than $14 million in net proceeds for charitable organizations across the United States, including those in the Port Arthur area. The Valero Port Arthur Refinery will distribute $750,000 to local charities with funds raised through the Valero Energy Foundation and the 2020 Valero Texas Open and Benefit for Children. “This is really positive news for our local nonprofit organizations, many of whom are facing challenges as a result of the pandemic,” said Mark Skobel, Vice President and General Manager of the Valero Port Arthur Refinery. “We know how important it is to continue supporting these agencies and the work they do for the children in our community.” The 2020 Valero Benefit for Children local recipients are: • Port Arthur Independent School District • Gulf Coast Health Center • YMCA of Southeast Texas • Communities in Schools of Southeast Texas • CASA of Southeast Texas • Southeast Texas Food Bank • Garth House, Mickey Mehaffy Children’s Advocacy Program • Richard Shorkey Education and Rehabilitation Center “We are blessed by our long-standing relationships with our tournament and Benefit for Children top sponsors,” said Joe Gorder, Valero Chairman and Chief Executive Officer. -

Suncor Energy – Annual Report 2005

Suncor05ARcvr 3/8/06 1:33 PM Page 1 SUNCOR ENERGY INC. 2005 ANNUAL REPORT > growing strategically Suncor’s large resource base, growing production capacity and access to the North American energy market are the foundation of an integrated strategy aimed at driving profitable growth, a solid return on capital investment and strong returns for our shareholders. A staged approach to increasing our crude oil production capacity allows Suncor to better manage capital costs and incorporate new ideas and new technologies into our facilities. production 50,000 bpd 110,000 bpd (capacity) resources Third party bitumen 225,000 bpd Mining 260,000 bpd 350,000 bpd 500,000 bpd In-situ 500,000 – 550,000 bpd OUR PLANS TO GROW TO HALF A MILLION BARRELS PER DAY IN 2010 TO 2012* x Tower Natural gas Vacuum 1967 – Upgrader 1 1998 – Expand Upgrader 1, Vacuum Tower Future downstream integrat 2001 – Upgrader 2 Other customers 2005 – Expand Upgrader 2, 2008 – Further Expansion of Upgrader 2 2010-2012 – Upgrader 3 Denver refinery ion Sarnia refinery markets To provide greater North American markets reliability and flexibility to our feedstock supplies, we produce bitumen through our own mining and in-situ recovery technologies, and supplement that supply through innovative third-party agreements. Suncor takes an active role in connecting supply to consumer demand with a diverse portfolio of products, downstream assets and markets. Box 38, 112 – 4th Avenue S.W., Calgary, Alberta, Canada T2P 2V5 We produce conventional natural Our investments in renewable wind tel: (403) 269-8100 fax: (403) 269-6217 [email protected] www.suncor.com gas as a price hedge against the energy are a key part of Suncor’s cost of energy consumption. -

Renewable Energy: Wind and Solar

Renewable Energy: Chapter | 19 Wind and Solar ❖ Can Texans harness the wind and sun and even the jobs that go with these energy sources? 600-turbine development across 336,000 Introduction acres of West Texas. Financed by Chinese In late 2009, German utility giant E.ON banks, the development will feature new constructed the world’s largest wind farm in turbines made in China and will bring the tiny West Texas town of Roscoe. The 300 temporary construction jobs and 30 Roscoe wind farm has the capacity to produce permanent jobs to the area. Renewable 781.5 megawatts — enough electricity for energy in Texas is new — and it has already every home in Plano, McKinney and the been globalized. rest of the 265,000 households in Collin These giant wind projects illustrate County. The $1 billion project in Roscoe two key trends: Texas is emerging as took 21 months to complete and employed the capital of renewable energy, and 500 construction workers, who built 627 wind foreign companies are moving fast to take turbines on the fields of 300 property owners advantage. “People in Texas think it has — land that once pumped oil. got to be conventional energy or renewable The wind turbines of West Texas spin at energy. It’s not. It’s both,” said Michael 7 miles per hour. And one turbine produces Webber, an engineering professor at the about as much electricity as 350 households University of Texas at Austin and associate consume in a year. These economics are director of the Center for International attracting more wind turbines to the state, Energy and Environmental Policy. -

Renewable Energy Potential in Texas and Business Opportunities for the Netherlands

Renewable energy potential in Texas and business opportunities for the Netherlands Commissioned by the ministry of Foreign Affairs 2016-2017 Renewable energy potential in Texas and business opportunities for the Netherlands Elène Lenders Wageningen University Environmental Economics and Natural Resources Group, Wageningen, The Netherlands The Netherlands Business Support Office, Houston, Texas, United States of America September 2016 – February 2017 Content 1. Introduction ........................................................................................................................................... 4 1.1. Research Question ........................................................................................................................ 4 1.2. Method .......................................................................................................................................... 4 1.3. Definition of renewable energy ..................................................................................................... 5 1.4. Units .............................................................................................................................................. 5 2. The current market situation for energy in Texas ................................................................................. 6 2.1. An independent electricity grid ..................................................................................................... 6 2.2. The main fuel types supplied ....................................................................................................... -

Chevron Unocal Analysis

ANALYSIS OF PROPOSED CONSENT ORDER TO AID PUBLIC COMMENT IN THE MATTER OF CHEVRON CORPORATION AND UNOCAL CORPORATION, FILE NO. 051-0125 I. Introduction The Federal Trade Commission (“Commission” or “FTC”) has issued a complaint (“Complaint”) alleging that the proposed merger of Chevron Corporation (“Chevron,” formerly ChevronTexaco Corporation) and Unocal Corporation (“Unocal”) (collectively “Respondents”) would violate Section 7 of the Clayton Act, as amended, 15 U.S.C. § 18, and Section 5 of the Federal Trade Commission Act, as amended, 15 U.S.C. § 45, and has entered into an agreement containing consent order (“Agreement Containing Consent Order”) pursuant to which Respondents agree to be bound by a proposed consent order (“Proposed Consent Order”). The Proposed Consent Order remedies the likely anticompetitive effects arising from Respondents’ proposed merger, as alleged in the Complaint. II. Description of the Parties and the Transaction A. Chevron Chevron is a major international energy firm with operations in North America and about 180 foreign countries in Europe, Africa, South America, Central America, Indonesia, and the Asia-Pacific region. Its petroleum operations consist of exploring for, developing and producing crude oil and natural gas; refining crude oil into finished petroleum products; marketing crude oil, natural gas, and various finished products derived from petroleum; and transporting crude oil, natural gas, and finished petroleum products by pipeline, marine vessels, and other means. The company operates light petroleum refineries for products such as gasoline, jet fuel, kerosene and fuel oil at Pascagoula, Mississippi; El Segundo, California; Richmond, California; Salt Lake City, Utah; and Kapolei, Hawaii. Chevron is a major refiner and marketer of gasoline that meets the requirements of the California Air Resources Board (“CARB”). -

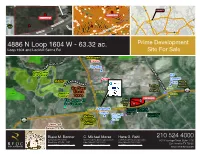

10 4886 N Loop 1604 W

1 02 2 4 9 1 2 0 26 8 10 0 24 4 1 1 0 024 22 1 1024 9 8 6 Hope Center Church 1 9 022 8 1 8 1 0 L 0 2 1 2 L Budget Blinds, Lush Rooftop, Amore Cafe, 1 0 0 L 0 E 8 L Rodrigo Pinheiro BJJ, Pure Fun, Picks Bar, E M 1 M 1022 0 U 0 The Brazilian Capoeira Academy: San Antonio 4 2 9 9 U 4 9 O 2 10 9 2 O L 4 1 L 0 2 10 1 0 00 1 1 2 0 0 4 1 Æþ281 10 022 1 10 00 10 2 06 1020 1 1 8 0 1 06 0 0 0 0 1 1 0 1100 4 !$" 2 # 16 SUBJECT 10 1014 BBQ 2 012 00 1 1 1 0 0 08 Outfitters 4 10 B 2 9 9 2 1000 Not100 Available B Ridge Shopping 99 8 990 Center 996 9 994 9 Not Available 2 9 1604 86 UV 9 1 8 1 4 0 1 0 3355 4 0 !$" 2 # 2 1 4 3 4 0 1 4 0 6 4 0 3 1 0 2 D 8 9 8 1604 R 4 82 9 S 3 UV S 0 E 1 CC UV53 0 A 3 1 0 0 W 1 0 90 4 2 98 9 2 6 0 98 0 8 2 992 Teralta 6 2 10 281 1 0 994 Æþ P V 1 6 218 O 84 8 UV 9 16 O I 80 9 UV L A 9 88 4 Corporate N 9 82 4 9 96 98 1100 98 00 9 #$!" S 10 98 A 32 A D 9 H 10 R Park A S S 02 V CE 10 1604 AC 04 AN 10 UV O W 1008 6 v 4 0 60 10 978 537 1 1 1 UV 0 0 0 OP 10 8 0 O 0 6 6 L 2 1 9 97 W 10 N 01 7 4 10 1 8 1604 60 1 1 0 UV W 6 OP 3 04 98 441100 LO 6 P 16 #$!" N LOO 6 L 4 12 101 N 9 97 L 10 O 76 014 O 1 1 C 0 345 C 3 K UV 8 1604 980 K UV H 0 v 102 1018 H H.E.B Federal IL 9 8 2 8 I 102 2 L 2 441100 02 7 L 1 - 9 #$!" 368 1020 S 9 UV L 8 Credit Union E 0 - 4 S 4 102 L 4 3355 University Oaks 102 26 8 9 $!" 10 30 # E 10 6 M 4 8 L 2 A 9 9 10 0 8 M 32 1 6 Camp Bullis Church of Christ R 9 A 1034 D 9 8 8 8 R 8 Subject D 103 K 421 1 8 1036 A UV 04 K 0 8 O A 2 Y 2 Ft Elevation Lines 4 0 O T 9 7 1 I 7 9 Y 1 BACON RD S 8 0 BACON RD T 4 R 100 Year FEMA Floodplain I 2 E S 1 1 Prime Development V 0 I R 0 1604 4 N 6 1100 E 2 97 151 " 4 UV #$! 6 U 9 UV 8 [email protected] PPIVG Paints 990 0 N Apria CBD 4886 N LoopU 1604 W - 63.32 ac. -

Who Is Most Impacted by the New Lease Accounting Standards?

Who is Most Impacted by the New Lease Accounting Standards? An Analysis of the Fortune 500’s Leasing Obligations What Do Corporations Lease? Many companies lease (rather than buy) much of the equipment and real estate they use to run their business. Many of the office buildings, warehouses, retail stores or manufacturing plants companies run their operations from are leased. Many of the forklifts, trucks, computers and data center equipment companies use to run their business is leased. Leasing has many benefits. Cash flow is one. Instead of outlaying $300,000 to buy five trucks today you can make a series of payments over the next four years to lease them. You can then deploy the cash you saved towards other investments that appreciate in value. Also, regular replacement of older technology with the latest and greatest technology increases productivity and profitability. Instead of buying a server to use in your data center for five years, you can lease the machines and get a new replacement every three years. If you can return the equipment on time, you are effectively outsourcing the monetization of the residual value in the equipment to an expert third-party, the leasing company. Another benefit of leasing is the accounting, specifically the way the leases are reported on financial statements such as annual reports (10-Ks). Today, under the current ASC 840 standard, leases are classified as capital leases or operating leases. Capital leases are reported on the balance sheet. Operating leases are disclosed in the footnotes of your financial statements as “off balance sheet” operating expenses and excluded from important financial ratios such as Return on Assets that investors use to judge a company’s performance. -

Texas Wind Industry's Rapid Growth Creates New Challenges

BU S I NES SEX R E V I E W A TBureau of Business Research • IC2 institute •The University of Texas at AustinSFebruary 2010 In the past decade, Texas began to harness in carbon emissions and other harmful by- Texas Wind some of its abundant wind potential and, in products associated with some conventional the process, became an international wind forms of power, decreased dependence on Industry's energy leader. The state currently accounts for foreign oil, and economic revitalization of more than 25 percent of installed wind energy rural areas, to name but a few. As compelling Rapid capacity in the United States (see Table 1). as the arguments for wind energy may be, the But while 2009 brought a new pro-renewable growth of wind energy in Texas hinges upon Growth energy administration in Washington, the industry’s ability to address issues that may increased public awareness and interest in limit future development. green technology, and an ever-expanding Creates New demand for energy, the growth of the state’s For example, although wind energy has been new installed capacity fell below 40 percent touted as a green alternative to traditional Challenges for the first time since 2006 (see Table 2, p. generation, there is growing concern about 2). While the recession-induced credit crunch the environmental impact of development by and falling natural gas prices were two obvious on certain key species. And on the political culprits, Texas faces a host of other challenges as front, while the wind industry successfully Will Furgeson avoided any major setbacks during the 81st Development Manager, it seeks to retain its position atop the domestic Invenergy wind energy market and attract the capital and Legislative Session in 2009, the industry must new jobs that the booming renewable energy navigate through another session in 2011. -

The Economic Value of Renewable Energy in Texas

The Economic Value of Renewable Energy in Texas Wind Solar Alliance (WSA) American Wind Energy Association Fall 2018 Prepared by & TXP, Inc. 1310 South 1st Street, Suite 105 Austin, Texas 78704 www.txp.com Commissioned by: Wind Solar Alliance (WSA) American Wind Energy Association (AWEA) Solar Energy Industries Association (SEIA) Table of Contents Executive Summary ................................................................................................................... 1 Background: Renewables in the Texas Energy Market ............................................................ 3 Renewable Energy in Texas: Providing Revenue to Local Governments ................................. 7 Renewable Energy in Texas: Providing Revenue to Landowners .......................................... 11 Renewable Energy in Texas: Reducing Energy Costs for Customers ..................................... 13 The Model ............................................................................................................................. 13 Model Results: Impact on the Wholesale Electricity Costs .................................................. 14 Renewable Energy in Texas: Providing Well-Paying Jobs ...................................................... 17 Industry-Related Employment.............................................................................................. 17 Backward & Forward Linkages/Supply Chain ....................................................................... 17 Renewable Energy in Texas: Stimulating Economic -

Willingness to Pay for Electricity with a $40 Carbon

Research Team Principal Investigators Gail Buttorff, Co-Director, Survey Research Institute and Assistant Instructional Professor, Hobby School of Public Affairs Francisco Cantú, Co-Director, Survey Research Institute and Associate Professor, Department of Political Science Ramanan Krishnamoorti, Chief Energy Officer, UH Energy and Professor of Chemical and Biomolecular Engineering, Petroleum Engineering, and Chemistry Pablo M. Pinto, Director, Center for Public Policy and Associate Professor, Hobby School of Public Affairs Researchers Aparajita Datta, Graduate Assistant, UH Energy, and PhD Student, Department of Political Science Yewande O. Olapade, Post-Doctoral Fellow, Hobby School of Public Affairs Acknowledgements The research team would like to thank our colleagues at the Hobby School of Public Affairs, UH Energy, UH Marketing and Communications, and the Center for Carbon Management in Energy for supporting and actively engaging in the study. Their valuable contributions and feedback are greatly appreciated. i Executive Summary The US energy industry is in the early stages of an energy transition with a focus on decarbonization. Despite these efforts, the immense scale of decarbonization required, while providing society with more, affordable, and sustainable energy, necessitates all stakeholders to contribute to the energy transition. Governments, producers, and consumers must collaborate to advance technology, policy, and regulatory shifts, invest in low-carbon technologies, and incentivize carbon man- agement. These efforts can gain firm anchorage from public support and consumer willingness to partially cover the costs of the energy transition. At a time when climate, social, and economic concerns need urgent prioritization, public opinion will be a powerful driver of the US response on carbon management, climate change, and the future of sustainable energy. -

PBF Energy Inc. 2017 Annual Report 2017 At-A-Glance

PBF Energy Inc. 2017 Annual Report 2017 At-A-Glance PBF Energy (“PBF”) is a growth-oriented independent petroleum refiner and supplier of unbranded petroleum products. We are committed to the safe, reliable and environmentally responsible operations of our five domestic oil refineries, and related assets, with a combined processing capacity of approximately 900,000 barrels per day (bpd) and a weighted-average Nelson Complexity Index of 12.2. PBF Energy also owns approximately 44% of PBF Logistics LP (NYSE: PBFX). PBF Logistics LP, headquartered in Parsippany, New Jersey, is a fee-based, growth-oriented master limited partnership formed by PBF Energy to own or lease, operate, develop and acquire crude oil and refined petroleum products, terminals, pipelines, storage facilities and similar logistics assets. Nelson Complexity Chalmette Refinery The Chalmette Refinery, in Louisiana, is a 189,000 bpd, dual-train coking refinery with a Nelson Complexity Index of 12.7 and is capable of processing both light and heavy crude oil. The facility is strategically positioned on the Gulf Coast with strong logistics connectivity that offers flexible raw material sourcing and product distribution opportunities, including the potential to export products. 12.7 Nelson Complexity Delaware City Refinery The Delaware City refinery has a throughput capacity of 190,000 bpd and a Nelson Complexity Index of 11.3. As a result of its configuration and petroleum refinery processing units, Delaware City has the capability to process a diverse heavy slate of crudes with a high concentration of high sulfur crudes making it one of the largest and most complex refineries on the East Coast.