USACE Civil Works Program Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sandies, Hybrids Hot Bites

Hunting Texas Special section inside * August 8, 2008 Texas’ Premier Outdoor Newspaper Volume 4, Issue 24 * Hunting Annual 2008 www.lonestaroutdoornews.com INSIDE HUNTING Sandies, hybrids hot bites Schools keep anglers in class The Texas Animal Health Commission approved new BY CRAIG NYHUS rules permitting the transport of male hogs to Summer means hot white bass and hybrid striped authorized game ranches bass action at many Texas lakes, and North Texas without requiring blood lakes like Lake Ray Hubbard, Ray Roberts, Lewisville tests for swine disease. and Richland Chambers lead the way for many. Page 6 Gary Goldsmith, a retired principal, fished Lewisville Lake with Art Kenney and Michael The U.S. Fish and Wildlife Anderson. “We caught and released more than 100 Service approved liberal sand bass reaching the 2-pound mark,” Goldsmith waterfowl limits for the said. “With 30 minutes of daylight left we went to an 2008-2009 season. area called Queen’s Point for hybrids. As soon as we Page 7 started the bite was on — we caught 20 more fish at that spot.” FISHING The group was fishing Lead Babies Slabs in 18 feet of water. “It’s best to keep them as close to the bottom as possible when fishing for hybrids,” Goldsmith said. East Texas lakes find crappie fishermen switching gears to chase sandies when the crappie bite slows. West Texas reservoirs see the whites hitting on top. And in the Hill Country, the Highland Lakes often get hot. “All of the fish are on the main lakes,” said Joe Bray, who guides on several Hill Country lakes. -

Consumer Plannlng Section Comprehensive Plannlng Branch

Consumer Plannlng Section Comprehensive Plannlng Branch, Parks Division Texas Parks and Wildlife Department Austin, Texas Texans Outdoors: An Analysis of 1985 Participation in Outdoor Recreation Activities By Kathryn N. Nichols and Andrew P. Goldbloom Under the Direction of James A. Deloney November, 1989 Comprehensive Planning Branch, Parks Division Texas Parks and Wildlife Department 4200 Smith School Road, Austin, Texas 78744 (512) 389-4900 ACKNOWLEDGMENTS Conducting a mail survey requires accuracy and timeliness in every single task. Each individualized survey had to be accounted for, both going out and coming back. Each mailing had to meet a strict deadline. The authors are indebted to all the people who worked on this project. The staff of the Comprehensive Planning Branch, Parks Division, deserve special thanks. This dedicated crew signed letters, mailed, remailed, coded, and entered the data of a twenty-page questionnaire that was sent to over twenty-five thousand Texans with over twelve thousand returned completed. Many other Parks Division staff outside the branch volunteered to assist with stuffing and labeling thousands of envelopes as deadlines drew near. We thank the staff of the Information Services Section for their cooperation in providing individualized letters and labels for survey mailings. We also appreciate the dedication of the staff in the mailroom for processing up wards of seventy-five thousand pieces of mail. Lastly, we thank the staff in the print shop for their courteous assistance in reproducing the various documents. Although the above are gratefully acknowledged, they are absolved from any responsibility for any errors or omissions that may have occurred. ii TEXANS OUTDOORS: AN ANALYSIS OF 1985 PARTICIPATION IN OUTDOOR RECREATION ACTIVITIES TABLE OF CONTENTS Introduction ........................................................................................................... -

Oklahoma, Kansas, and Texas Draft Joint EIS/BLM RMP and BIA Integrated RMP

Poster 1 Richardson County Lovewell Washington State Surface Ownership and BLM- Wildlife Lovewell Fishing Lake And Falls City Reservoir Wildlife Area St. Francis Keith Area Brown State Wildlife Sebelius Lake Norton Phillips Brown State Fishing Lake And Area Cheyenne (Norton Lake) Wildlife Area Washington Marshall County Smith County Nemaha Fishing Lake Wildlife Area County Lovewell State £77 County Administered Federal Minerals Rawlins State Park ¤ Wildlife Sabetha ¤£36 Decatur Norton Fishing Lake Area County Republic County Norton County Marysville ¤£75 36 36 Brown County ¤£ £36 County ¤£ Washington Phillipsburg ¤ Jewell County Nemaha County Doniphan County St. 283 ¤£ Atchison State County Joseph Kirwin National Glen Elder BLM-administered federal mineral estate Reservoir Jamestown Tuttle Fishing Lake Wildlife Refuge Sherman (Waconda Lake) Wildlife Area Creek Atchison State Fishing Webster Lake 83 State Glen Elder Lake And Wildlife Area County ¤£ Sheridan Nicodemus Tuttle Pottawatomie State Thomas County Park Webster Lake Wildlife Area Concordia State National Creek State Fishing Lake No. Atchison Bureau of Indian Affairs-managed surface Fishing Lake Historic Site Rooks County Parks 1 And Wildlife ¤£159 Fort Colby Cloud County Atchison Leavenworth Goodland 24 Beloit Clay County Holton 70 ¤£ Sheridan Osborne Riley County §¨¦ 24 County Glen Elder ¤£ Jackson 73 County Graham County Rooks State County ¤£ lands State Park Mitchell Clay Center Pottawatomie County Sherman State Fishing Lake And ¤£59 Leavenworth Wildlife Area County County Fishing -

Greetings Fellow Naturalists! I Do Hope You All Had a Happy, Healthy, and Rejuvenating 2018 New Year's Celebration. and What

Photo by Diane Humes Galveston Bay Area Chapter - Texas Master Naturalists February 2018 Table of Contents President’s Corner by George Kyame, President 2018 Wetland Wanderings 2 Greetings fellow naturalists! Prairie Ponderings 3 Beach Patrol 4 I do hope you all had a happy, healthy, and rejuvenating 2018 New Year's celebration. Heritage Book Study - 4 And what a wintry entrance to the New Year we have had here. Hope your flora fared Review better than my bananas! Ocelot: Little Texas 5 I am still excited about the excellent 2017 that our chapter had. Here are some (mostly Cat complete) numbers for your general information and Galveston Bay Area Chapter Treasures of the Bay 6 pride. As of December 31st, we collectively have submitted over 42,150 volunteer Award Recipients service hours which is a new record for the chapter! Also reported are over 3,840 2017 advanced training hours. And lastly, I would like to share our Education Outreach Map Out a New Year 7 numbers. With more than 2,450 volunteer hours, over 18,500 people have been of Travel Adventures enlightened by our programs, over half of whom were children. Our numbers are even Let’s talk about 9 more amazing when you figure the time lost to Hurricane Harvey. Congratulations to Raptors everyone for their hard work and participation! Guppies From Julie 10 In other chapter news, the Texas Master Naturalist program will be celebrating its 20th 2018 Board of 10 anniversary this year. In honor of this, we and other chapters will be submitting Chapter Directors histories, stories, and even some video interviews! As wonderful as this sounds, a lot of work is required, but our team is on it. -

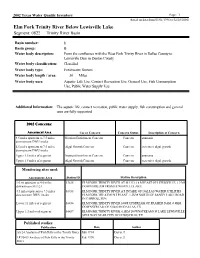

Elm Fork Trinity River Below Lewisville Lake Segment: 0822 Trinity River Basin

2002 Texas Water Quality Inventory Page : 1 (based on data from 03/01/1996 to 02/28/2001) Elm Fork Trinity River Below Lewisville Lake Segment: 0822 Trinity River Basin Basin number: 8 Basin group: B Water body description: From the confluence with the West Fork Trinity River in Dallas County to Lewisville Dam in Denton County Water body classification: Classified Water body type: Freshwater Stream Water body length / area: 30 Miles Water body uses: Aquatic Life Use, Contact Recreation Use, General Use, Fish Consumption Use, Public Water Supply Use Additional Information: The aquatic life, contact recreation, public water supply, fish consumption and general uses are fully supported. 2002 Concerns: Assessment Area Use or Concern Concern Status Description of Concern 4.5 miles upstream to 7.5 miles Nutrient Enrichment Concern Concern ammonia downstream DWU intake 4.5 miles upstream to 7.5 miles Algal Growth Concern Concern excessive algal growth downstream DWU intake Upper 1.5 miles of segment Nutrient Enrichment Concern Concern ammonia Upper 1.5 miles of segment Algal Growth Concern Concern excessive algal growth Monitoring sites used: Assessment Area Station ID Station Description 1.0 mi upstream to 4.5 miles 13615 ELM FORK TRINITY RIVER AT SH 121 1.8 MI EAST OF LEWISVILLE, 1.9 MI downstream SH 121 DOWNSTREAM FROM LEWISVILLE LAKE 4.5 miles upstream to 7.5 miles 16438 ELM FORK TRINITY RIVER AT INTAKE OF DALLAS WATER UTILITIES downstream DWU intake ELM FORK TREATMENT PLANT, 1.2KM NORTH OF SANDY LAKE ROAD IN CARROLLTON Lower 11 miles of segment 16436 ELM FORK TRINITY RIVER 100M UPSTREAM OF FRASIER DAM, 0.8KM DOWNSTREAM OF SH482 IN DALLAS, TX Upper 1.5 miles of segment 16437 ELM FORK TRINITY RIVER, 0.5KM DOWNSTREAM OF LAKE LEWISVILLE SPILLWAY NEAR CITY OF LEWISVILLE, TX Published studies: Publication Date Author AS 24 Analysis of Fish Kills in the Trinity River July 1994 Davis, J. -

Annual Proceedings of the Texas Chapter American Fisheries Society

ANNUAL PROCEEDINGS of the TEXAS CHAPTER AMERICAN FISHERIES SOCIETY Pottsboro, Texas 13-15 February 2014 Volume 36 TEXAS CHAPTER AMERICAN FISHERIES SOCIETY The Texas Chapter of the American Fisheries Society was organized in 1975. Its objectives are those of the parent Society – conservation, development and wise use of recreational and commercial fisheries, promotion of all branches of fisheries science and practice, and exchange and dissemination of knowledge about fishes, fisheries, and related subjects. A principal goal is to encourage the exchange of information among members of the Society residing within Texas. The Chapter holds at least one meeting annually at a time and place designated by the Executive Committee. MEMBERSHIP Persons interested in the Texas Chapter and its objectives are eligible for membership and should apply to: Texas Chapter, American Fisheries Society Secretary-Treasurer Texas Parks and Wildlife Department 4200 Smith School Road Austin, Texas 78744 Annual membership dues are $12 for Active Members and $5 for Student Members. ANNUAL PROCEEDINGS OF THE TEXAS CHAPTER AMERICAN FISHERIES SOCIETY Annual Meeting 13-15 February 2014 Pottsboro, Texas 2014-2015 Officers Richard Ott, President Texas Parks and Wildlife Department Bruce Hysmith, President-Elect Texas Parks and Wildlife Department Greg Southard, Secretary-Treasurer Texas Parks and Wildlife Department Editorial Committee: Dan Daugherty and Allison Pease, Co-Chairs 2014 Published by: Texas Chapter, American Fisheries Society c/o Texas Parks & Wildlife Department -

Nutrient Loading to Lewisville Lake, North-Central Texas, 1984-87

NUTRIENT LOADING TO LEWISVILLE LAKE, NORTH-CENTRAL TEXAS, 1984-87 By W. Scott Gain and Stanley Baldys III U.S. GEOLOGICAL SURVEY Water-Resources Investigations Report 95-4076 Prepared in cooperation with the CITY OF DALLAS Austin, Texas 1995 U.S. DEPARTMENT OF THE INTERIOR BRUCE BABBITT, Secretary U.S. GEOLOGICAL SURVEY Gordon P. Eaton, Director Any use of trade, product, or firm names is for descriptive purposes only and does not imply endorsement by the U.S. Government. For additional information write to: Copies of this report can be purchased from: U.S. Geological Survey Earth Science Information Center District Chief Open-File Reports Section U.S. Geological Survey Box 25286, Mail Stop 517 8011 Cameron Rd. Denver Federal Center Austin, TX 78754-3898 Denver, CO 80225-0046 CONTENTS Abstract ................... ..........................................................................................................................................^ 1 Introduction ......................................................................... 1 Purpose and Scope .................................................................................................................................................... 3 Description of the Study Area .................................................................................................................................. 3 Sampling .................................................................................................................................................................. -

2014 Texas Surface Water Quality Standards

Presented below are water quality standards that are in effect for Clean Water Act purposes. EPA is posting these standards as a convenience to users and has made a reasonable effort to assure their accuracy. Additionally, EPA has made a reasonable effort to identify parts of the standards that are not approved, disapproved, or are otherwise not in effect for Clean Water Act purposes. 2014 Texas Surface Water Quality Standards (updated September 23, 2014) EPA has not approved the definition of “surface water in the state” in the TX WQS, which includes an area out 10.36 miles into the Gulf of Mexico by reference to §26.001 of the Texas Water Code. Under the CWA, Texas does not have jurisdiction to establish water quality standards more than three nautical miles from the coast, but does not extend past that point. Beyond three miles, EPA retains authority for CWA purposes. EPA’s approval also does not include the application the TX WQS for the portions of the Red River and Lake Texoma that are located within the state of Oklahoma. Finally, EPA is not approving the TX WQS for those waters or portions of waters located in Indian Country, as defined in 18 U.S.C. 1151. The following sections in the 2014 Texas WQS have been approved by EPA and are therefore effective for CWA purposes: • §307.1. General Policy Statement • §307.2. Description of Standards • §307.5. Antidegradation • §307.6. Toxic Materials (see “No Action” section) • §307.8. Application of Standards (see “No Action” section) • Appendix B – Sole-source Surface Drinking Water Supplies • Appendix E – Site-specific Toxic Criteria • Appendix F – Site-specific Nutrient Criteria for Selected Reservoirs (see “No Action” section) The following sections in the 2014 Texas WQS have been approved by EPA, except for specific items as noted: • §307.3. -

Volumetric and Sedimentation Survey of LEWISVILLE LAKE

Volumetric and Sedimentation Survey of LEWISVILLE LAKE September 2007 Survey Prepared by: The Texas Water Development Board December 2008 Texas Water Development Board J. Kevin Ward, Executive Administrator Texas Water Development Board James E. Herring, Chairman Jack Hunt, Vice Chairman Lewis H. McMahan, Member Thomas Weir Labatt III, Member Edward G. Vaughan, Member Joe M. Crutcher, Member Prepared for: Dallas Water Utilities With Support Provided by: U.S. Army Corps of Engineers, Fort Worth District Authorization for use or reproduction of any original material contained in this publication, i.e. not obtained from other sources, is freely granted. The Board would appreciate acknowledgment. This report was prepared by staff of the Surface Water Resources Division: Barney Austin, Ph.D., P.E. Jordan Furnans, Ph.D., P.E. Jason Kemp, Team Lead Tony Connell Holly Weyant Tyler McEwen Nathan Brock Published and Distributed by the Texas Water Development Board P.O. Box 13231 Austin, TX 78711-3231 Executive Summary In April of 2007, the Texas Water Development Board entered into agreement with the U.S. Army Corps of Engineers, Fort Worth District, for the purpose of performing a volumetric and sedimentation survey of Lewisville Lake. The U.S. Army Corps of Engineers, Fort Worth District, contributed 50% of the funding for this survey through their Planning Assistance to States Program, while Dallas Water Utilities contributed the remaining 50%. This survey was performed using a multi-frequency (200 kHz, 50 kHz, and 24 kHz) sub-bottom profiling depth sounder. In addition, sediment core samples were collected in selected locations and were used in interpreting the multi-frequency depth sounder signal returns to derive sediment accumulation estimates. -

Figure: 30 TAC §307.10(1) Appendix A

Figure: 30 TAC §307.10(1) Appendix A - Site-specific Uses and Criteria for Classified Segments The following tables identify the water uses and supporting numerical criteria for each of the state's classified segments. The tables are ordered by basin with the segment number and segment name given for each classified segment. Marine segments are those that are specifically titled as "tidal" in the segment name, plus all bays, estuaries and the Gulf of Mexico. The following descriptions denote how each numerical criterion is used subject to the provisions in §307.7 of this title (relating to Site-Specific Uses and Criteria), §307.8 of this title (relating to Application of Standards), and §307.9 of this title (relating to Determination of Standards Attainment). Segments that include reaches that are dominated by springflow are footnoted in this appendix and have critical low-flows calculated according to §307.8(a)(2) of this title. These critical low-flows apply at or downstream of the spring(s) providing the flows. Critical low-flows upstream of these springs may be considerably smaller. Critical low-flows used in conjunction with the Texas Commission on Environmental Quality regulatory actions (such as discharge permits) may be adjusted based on the relative location of a discharge to a gauging station. -1 -2 The criteria for Cl (chloride), SO4 (sulfate), and TDS (total dissolved solids) are listed in this appendix as maximum annual averages for the segment. Dissolved oxygen criteria are listed as minimum 24-hour means at any site within the segment. Absolute minima and seasonal criteria are listed in §307.7 of this title unless otherwise specified in this appendix. -

Lake Lewisville Watershed, Texas City of Denton Watershed Protection Program

Watershed-Based Permitting Case Study Lake Lewisville Watershed, Texas City of Denton Watershed Protection Program Permitting Authority: Pollutants of Concern in Watershed: Texas Commission on Environmental Quality Nutrients, ammonia, pesticides/herbicides, and sediment Permittee Point of Contact: Ken Banks (940) 349-7165 [email protected] Permit Types: Individual and general permits to publicly owned Permit Issued: Various dates treatment works to control discharges of industrial process wastewater and industrial, municipal, and construction storm water Permit Information: www.cityofdenton.com/pages/mygovenvironmentalwater319demo.cfm www.cityofdenton.com/pages/utilswaterwatershed.cfm Overview The Lake Lewisville watershed has been experiencing Watershed: Lake Lewisville, Texas significant development pressures, so in 2001 the city of Key Water Quality Concerns: Denton, Texas, the largest city in the watershed, devel- Nutrients, ammonia, oped several watershed-based programs to address water pesticides and herbicides, and total quality concerns and storm water permitting require- suspended solids ments. While Lake Lewisville is not currently listed as Stakeholder Involvement Techniques: impaired under the state’s Clean Water Act (CWA) section • Watershed monitoring database used by 303(d) list, the city has taken some proactive measures communities to protect the water quality of the lake. The city has lever- • Integrated land use & monitoring data to educate aged multiple funding sources for this. Specifically, Den- public about threats to water quality ton has implemented a water quality monitoring program, • ” Find Your Watershed ” web page for citizens as education/resource tool employed land use planning and management tools, and disseminated critical information to the public aimed at Case Study Issues of Interest changing residential land use practices. -

CITY of LAKE DALLAS REQUEST for QUALIFICATIONS PARKS MASTER PLAN and OPEN SPACE/TRAILS UPDATE DECEMBER 7, 2020 E N I L C E N Y a L

CITY OF LAKE DALLAS REQUEST FOR QUALIFICATIONS PARKS MASTER PLAN AND OPEN SPACE/TRAILS UPDATE DECEMBER 7, 2020 e n i l C e n y a L : t n e d n e t n i r e p u S s k r o W c i l b u P Request for Statement of Qualifications For Parks Master Plan and Open Space/Trails Update IMPORTANT DATES: SOQ Issue Date: Monday December 7, 2020 SOQ Publication Dates: Monday December 14, 2020 Questions Deadline: Wednesday, January 20, 2021 @ 4:00 PM CST Submittal Due Date and Time: Monday, February 1, 2021 @ 4:00 PM CST Submittal Opening: Wednesday, February 3, 2021 @ 2:00 PM CST Interview Week: February 8-February 12, 2021 Expected Contract Date: Monday, March 1, 2021 Statements of Qualifications (SOQ) for the services specified will be received by the City of Lake Dallas until the date and time as indicated above. Please submit one (1) original SOQ, one (1) digital SOQ and seven (7) copies of the SOQ in hard copy only. Delivery and Mailing Address: Proposal Contact: City of Lake Dallas Layne Cline Attn.: Public Works Department Public Works Superintendent 212 Main Street [email protected] Lake Dallas, Texas 75065 Late submissions will not be considered. Statements of Qualifications must be submitted with the SOQ number and the respondent’s name and address clearly indicated on the front of the envelope. Additional instructions for preparing a Statement of Qualifications are provided within. The City appreciates your time and effort in preparing a response. The City does not accept oral, telephone, faxed or electronic proposal.