Technology, Media, and Telecommunications Predictions 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Weekly Wireless Report March 25, 2016

Week Ending: Weekly Wireless Report March 25, 2016 This Week’s Stories Facebook To Drop Support For BlackBerry Devices March 23, 2016 Inside This Issue: This Week’s Stories Facebook is moving on from BlackBerry. Facebook To Drop Support For BlackBerry Devices Bad news, BlackBerry users. Not only is Facebook-owned WhatsApp dropping support for BBOS and BlackBerry 10 devices at the end of the year, now Facebook itself will discontinue supporting the iPhone SE Unveiled; Apple platform. That means the Facebook and Messenger apps will no longer work on either platform. Vows To Protect Customer Privacy The announcement was made on the Inside BlackBerry blog last week. Products & Services BBOS runs on older BlackBerry devices, such as the Bold. BlackBerry 10 powers more recent devices Vevo’s Recommendations such as the Passport and Classic. Get More Personalized, Thanks To Integrations With “We are extremely disappointed in their decision as we know so many users love these apps,” reads Spotify, Twitter And the post. The post goes on to urge users to reach out to both companies using the hashtag YouTube “#ILoveBB10Apps” to “let them know how you feel.” Mapstr Adds Directions To Changing Facebook’s mind will require more than a hashtag, however. In February, Gartner reported Its App To Keep Track of BlackBerry’s global market share was a lowly 0.2% in the fourth quarter of 2015. Your Favorite Places There’s very little incentive to support a platform with such a small user base, especially when Emerging Technology BlackBerry itself is moving away from its BlackBerry 10 operating system in favor of Android-powered Apple Pay Reportedly devices, such as the Priv. -

KT Corporation Separate Interim Financial Statements March 31, 2019 and 2018 KT Corporation Index March 31, 2019 and 2018

KT Corporation Separate Interim Financial Statements March 31, 2019 and 2018 KT Corporation Index March 31, 2019 and 2018 Page(s) Report on Review of Interim Financial Statements …….....……….……. 1 – 2 Separate Interim Financial Statements Separate Interim Statements of Financial Position …………………………. 3 – 4 Separate Interim Statements of Profit or Loss ………….…………………… 5 Separate Interim Statements of Comprehensive Income ...………...……… 6 Separate Interim Statements of Changes in Equity ……….……….……….. 7 Separate Interim Statements of Cash Flows ………………………………. 8 Notes to the Separate Interim Financial Statements ……………………… 9 – 54 Report on Review of Interim Financial Statements (English Translation of a Report Originally Issued in Korean) To the Shareholders and Board of Directors of KT Corporation Reviewed Financial Statements We have reviewed the accompanying separate interim financial statements of KT Corporation (the “Company”). These financial statements consist of the separate interim statement of financial position of the Company as at March 31, 2019, and the related separate interim statements of profit or loss, comprehensive income, changes in equity and cash flows for the three-month periods ended March 31, 2019 and 2018, and a summary of significant accounting policies and other explanatory notes, expressed in Korean won. Management’s Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these separate interim financial statements in accordance with International Financial Reporting Standards as adopted by the Republic of Korea (Korean IFRS) 1034 Interim Financial Reporting, and for such internal control as management determines is necessary to enable the preparation of separate interim financial statements that are free from material misstatement, whether due to fraud or error. -

'Appy to Get You There!

‘Appy to Get You There! Travel around town without waiting around. Part of Bolder Adults TechTime, classes geared for adults 50 years & beyond. Learn to use current technology in fun & meaningful ways. Here are some transportation-related applications/apps and websites for your smartphone, tablet, and computer. Android apps are available through the Google Play Store and iOS ones through the Apple App Store. Not all apps are available for, or can work, on all operating systems and devices. These services are always in motion and information may change. This information is for educational purposes and SFPL does not endorse any of these services. Ride-Booking Apps (aka ride-sharing): Uber, On demand ride service, plus bike share and taxi option Lyft, On demand ride service, plus bike share option Flywheel, On Demand taxi service Public Transportation Apps: Transit, Multiple transit agencies, links to Lyft and Uber apps Citymapper, Multiple transit agencies, bike/scooter sharing inventory, links to Lyft and Uber apps, and international options Quicky, Muni times, Google Play Store only Bart Runner, BART times, Google Play Store only Routesy, Multiple transportation agencies, Apple App Store only Moovit, Multiple transit agencies, international options Nextbus, Muni, or call 511 or text 41411 with your stop # to get travel times Map Apps for Navigation: Google Maps, Navigation software for driving, walking, cycling, and public transportation plus Lyft and Uber option, offline version available Google Maps Go, Navigation software -

ECC REPORT 143 Electronic Communications Committee

ECC REPORT 143 Electronic Communications Committee (ECC) within the European Conference of Postal and Telecommunications Administrations (CEPT) PRACTICAL IMPROVEMENTS IN HANDLING 112 EMERGENCY CALLS: CALLER LOCATION INFORMATION Lisbon, April 2010 ECC REPORT 143 Page 2 0 EXECUTIVE SUMMARY Each year in the European Union several millions of citizens dial the emergency call number to access emergency services. Due to increasing penetration of mobile telephony in the society, the share of emergency calls emanating from mobile networks is rapidly outgrowing emergency calls for fixed networks; this causes that an emergency situation mobile callers are increasingly not able to indicate the precise location for an optimum response. Similarly, VoIP services are substituting voice calls over traditional networks, customers increasingly use VoIP for emergency calls and expecting the same reliability and completeness of the emergency calls service. Location information is normally represented by data indicating the geographic position of the terminal equipment of a user. These data vary in range, indicating in a general way where the user is or very precise, pinpointing the user’s whereabouts to within a few meters. Some location data are effectively a subset of signalling data as they are necessary for setting up a telephone connection. In the framework of Enhanced emergency call services, the availability of location information must serve three main goals: Route the calls to the right emergency call centre; Locate the caller and/or the incident site. Dispatch the most appropriate emergency response team(s); The Report identify the most relevant regulatory principles applicable to caller location requirements in the context of emergency calls and analyses the location information standards produced by ETSI as a Standard Development Organization for fixed, mobile and IP communications networks. -

Global Pay TV Operator Forecasts

Global Pay TV Operator Forecasts Table of Contents Published in October 2016, this 190-page electronically-delivered report comes in two parts: A 190-page PDF giving a global executive summary and forecasts. An excel workbook giving comparison tables and country-by-country forecasts in detail for 400 operators with 585 platforms [125 digital cable, 112 analog cable, 208 satellite, 109 IPTV and 31 DTT] across 100 territories for every year from 2010 to 2021. Forecasts (2010-2021) contain the following detail for each country: By country: TV households Digital cable subs Analog cable subs Pay IPTV subscribers Pay digital satellite TV subs Pay DTT homes Total pay TV subscribers Pay TV revenues By operator (and by platform by operator): Pay TV subscribers Share of pay TV subscribers by operator Subscription & VOD revenues Share of pay TV revenues by operator ARPU Countries and operators covered: Country No of ops Operators Algeria 4 beIN, OSN, ART, Algerie Telecom Angola 5 ZAP TV, DStv, Canal Plus, Angola Telecom, TV Cabo Argentina 3 Cablevision; Supercanal; DirecTV Australia 1 Foxtel Austria 3 Telekom Austria; UPC; Sky Bahrain 4 beIN, OSN, ART, Batelco Belarus 2 MTIS, Zala Belgium 5 Belgacom; Numericable; Telenet; VOO; Telesat/TV Vlaanderen Bolivia 3 DirecTV, Tigo, Entel Bosnia 3 Telemach, M:Tel; Total TV Brazil 5 Claro; GVT; Vivo; Sky; Oi Bulgaria 5 Blizoo, Bulsatcom, Vivacom, M:Tel, Mobitel Canada 9 Rogers Cable; Videotron; Cogeco; Shaw Communications; Shaw Direct; Bell TV; Telus TV; MTS; Max TV Chile 6 VTR; Telefonica; Claro; DirecTV; -

Monthly Industry Overview

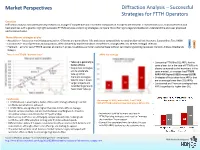

Market Perspectives Diffraction Analysis – Successful Strategies for FTTH Operators Overview Diffraction Analysis conducted primary research on a range of competitive and incumbent companies in Europe to benchmark FTTH/B services so as to analyse trends and best practices with a goal to: highlight successful FTTH/B services and pricing strategies; compare fibre offerings to legacy broadband; understand the end-user proposed and perceived value. Three different strategies at play ARPU • Acquisition – focuses on maximising penetration. Offerings are generally no frills and priced competitively to existing alternatives: Networx; Superonline; Teo; HKBN TAKE • Constrained – mix of premium and acquisition, often dictated by market condition: Rostelecom; Orange; KPN; Izzi; M-Net; Portugal Telecom - UP • Premium – aims for sexy FTTH/B services at premium prices, to address a smaller customer base without cannibalising existing revenues: Verizon; Altibox; Bredbands Bolaget There is no FTTH/B “demand issue” ARPU by strategy • Take-up is generally a • Comparing FTTH/B to DSL ARPU for the factor of time same player (or in the case of FTTH/B only • Acquisition strategies players compared to the incumbent in the aim to accelerate same market), on average has FTTH/B take-up while ARPU 46% higher (US$55 versus US$38) Premium strategies • Strategies of Acquisition have ARPUs that tend to slow it down are on average lower than DSL ARPUs • Larger projects and • Constrained and Premium strategies have incumbents generally ARPUs significantly higher than DSL -

Fritz-Handleiding-Ziggokpn-7490.Pdf

Handleiding: Hoe sluit je de FRITZ!Box aan achter een Ziggo of KPN modem Pagina | 1 Inhoudsopgave Pagina 1 - Voorblad Pagina 2 - Inhoudsopgave Pagina 3 - Voorwoord / Tips Pagina 4 - Instellen van de taal Pagina 5 - Instellen van het land Pagina 6 - Kiezen van de Annex verbinding Pagina 7 - Kiezen van het password Pagina 8 - 9 - Kiezen van de Internet Service Provider Pagina 9 - 10 - Set Up Internet Connection / Instellen snelheid DSL line Pagina 11 - 12 - Opslaan instellingen en testen internet connectie Pagina 13 - Einde van het instellen van de internetverbinding Pagina 14 - Instellen telefonie Ziggo via de FRITZ!Box Pagina 15 - Verbindingstype telefonie kiezen Pagina 16 - Ingeven telefoonnummer / Eind instellen telefonie Pagina 17 - Slotwoord / Tel.nr Helpdesk AVM / FAQ Pagina | 2 Het instellen van de FRITZ!Box als u een Ziggo of KPN modem/router heeft Allereerst bedankt voor de aanschaf van de FRITZ!Box. Wij wensen u er veel plezier mee! Via deze handleiding lopen we stap voor stap met u door wat u moet doen om de FRITZ!Box in de juiste instellingen te krijgen. Dit neemt enkele minuten in beslag. De handleiding is alleen om uw internet en telefonie in te stellen. Aan het TV signaal verandert niets en zal gewoon via uw Ziggo of KPN modem blijven gaan. Het is aan te raden om uw Ziggo of KPN modem in Bridge mode te zetten. Dit houdt in dat de Ziggo of KPN modem geen enkel signaal meer uitzendt wat storing kan geven. Hij geeft alleen nog via de LAN 1 poort internet door naar de FRITZ!Box. -

Transport in the Digital Age Disruptive Trends for Smart Mobility

Transport in the Digital Age Disruptive Trends for Smart Mobility March 2015 Contents Foreword 1 Executive summary 2 Rising demand for transport 3 Trends in digital age transport 4 User centred 6 Integrated and intelligent 8 Pricing and payments 11 Automation and safety 14 Public and private innovation 17 Looking ahead 19 About the authors 20 Endnotes 21 Foreword Change has already arrived in transport. The current wave of digital innovation, which has brought us travel planning on our smartphones and far greater access to customer information, was predicted in our 2012 Deloitte University Press publication and the pace of change is accelerating. In the last three years digital disruption has become more widespread and companies like Uber have grown to become multi-billion dollar global enterprises. It is now timely to update our research and to examine the trends that we believe will be relevant to the future of the metro, rail, road, air and automotive industries. Smart mobility strives to integrate all modes of transport to provide the vision of a seamless end to end journey experience. Technology has a major role to play as the transport sector now stands on the brink of great change, where digital innovation will go further to bring about improvements in operations, asset management and the delivery of capital programmes. As the global population in urban areas reaches four billion, our current research seeks to stimulate debate about the future transport services passengers desire and how digital innovation can support this, and provide a framework for predicting the trends that will shape the transport industry. -

Public Transport Applications for Smartphones

University of Eastern Finland School of Computing Master’s Thesis Public transport applications for smartphones Golam Rabbi 2nd of January 2019 ABSTRACT Public transports and their timetable are inseparable parts of the urban lifestyle. It is essential to know the public transport information to ensure the commute quality and time. This information can be fetched using a mobile phone app, which unfortunately are not available in the market. The popular public transport applications in the market are not satisfying the needs of all kinds of users, which is being reflected in their review comments. The number of cities, where the applications are providing their service is far less than the world’s total city count. We have analyzed different types of public transport applications and identified different types of users to know the reason behind users’ disappointments and the unavailability of service in most of the cities of the world. We proposed a model for public transport application and built a prototype to partially demonstrate the application. We have also described improvements which are neither available in any application in the market nor suggested by any user. Keywords: Public transport application, mobile app, smartphone app, ticketing system I ACKNOWLEDGEMENTS I would like to thank the University of Eastern Finland and the IMPIT program for providing a nice educational environment which helped me a lot during my master’s degree study life. I would like to thank my thesis advisor Professor Pasi Fränti for reviewing my thesis draft scrupulously and giving me a clear suggestion to write it correctly. I am very thankful to Dr. -

Table of Contents

TABLE OF CONTENTS Executive Summary 1 Regional Cable TV & Broadband Operators 57 Regional DTH Satellite Pay-TV Operators 77 Regional IPTV & Broadband Operators 90 Regional Broadcasters 99 Regional Digital & Interactive 126 Regional Fixed Service Satellite 161 Regional Broadcasting & Pay-TV Finance 167 Regional Regulation 187 Australia 195 Cambodia 213 China 217 Hong Kong 241 India 266 Indonesia 326 Japan 365 Korea 389 Malaysia 424 Myanmar 443 New Zealand 448 Pakistan 462 Philippines 472 Singapore 500 Sri Lanka 524 Taiwan 543 Thailand 569 Vietnam 590 TABLE OF CONTENTS Executive Summary 1-56 Methodology & Definitions 2 Overview 3-13 Asia Pacific Net New Pay-TV Subscriber Additions (Selected Years) 3 Asia Pacific Pay-TV Subs - Summary Comparison 4 Asia Pacific Pay-TV Industry Revenue Growth 4 China & India - Net New Pay-TV Subscribers (2013) 5 China & India - Cumulative Net New Pay-TV Subscribers (2013-18) 5 Asia Pacific (Ex-China & India), Net New Subscribers (2013) 6 Asia Pacific Ex-China & India - Cumulative Net New Pay-TV Subscribers (2013-18) 8 Economic Growth in Asia (% Real GDP Growth, 2012-2015) 9 Asia Pacific Blended Pay-TV ARPU Dynamics (US$, Monthly) 10 Asia Pacific Pay-TV Advertising (US$ mil.) 10 Asia Pacific Next Generation DTV Deployment 11 Leading Markets for VAS Services (By Revenue, 2023) 12 Asia Pacific Broadband Deployment 12 Asia Pacific Pay-TV Distribution Market Share (2013) 13 Market Projections (2007-2023) 14-41 Population (000) 14 Total Households (000) 14 TV Homes (000) 14 TV Penetration of Total Households (%) -

Playout Delay of TV Broadcasting

Master Thesis Playout delay of TV broadcasting Wouter Kooij 11/03/2014 University of Twente Faculty of Electrical Engineering, Mathematics and Computer Science Nederlandse Organisatie voor toegepast-natuurwetenschappelijk onderzoek, TNO Supervisors UT Prof. Dr. Ir. Boudewijn R. Haverkort Dr.ir. Pieter-Tjerk de Boer Supervisors TNO Ir. Hans Stokking Ray van Brandenburg, M.Sc. Date of the graduation 13/03/2014 Contents Acknowledgments 3 Nomenclature 5 1. Background 7 1.1. Introduction . .7 1.2. Research questions . .7 1.3. Outline . .8 2. Related Work 11 3. TV content delivery networks 13 3.1. Introduction . 13 3.2. Overview . 13 3.2.1. Analog TV . 14 3.2.2. Terrestrial, Satellite and Cable TV (DVB) . 15 3.2.3. IPTV . 15 3.3. TV Content delivery chain elements . 18 4. Delays in TV content delivery networks 21 4.1. Introduction . 21 4.2. Encoding and decoding . 22 4.2.1. Coding types . 23 4.2.2. Conclusion . 25 4.3. Transmission delays . 25 4.4. IPTV Techniques . 26 4.5. Delays in the KPN Chain . 26 5. Design and development of a playout difference measurement system 29 5.1. Introduction . 29 5.2. Content recognition techniques . 29 5.2.1. Audio fingerprinting . 31 5.3. Overview . 35 5.4. Reference time-source . 38 5.4.1. GPS as time-source . 38 5.4.2. GPS architecture in Android . 39 5.4.3. Obtaining GPS time in Android . 41 i Contents Contents 5.4.4. NTP as time-source . 44 5.4.5. NTP implementation in Android . 45 5.4.6.