Pierre Swart Director Pierre Swart Is a Director in Our Finance & Banking Practice

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Absa Bank Limited Absa Bank Limited Annual Report for the Year Ended 31 December 2010

Absa Bank Limited Absa Bank Limited Annual report for the year ended 31 December 2010 Annual report for the year ended 31 December 2010 www.absa.co.za Introduction Introduction JSE-listed South African companies are required to produce an annual report, including annual financial statements, to shareholders. At the Absa Group annual general meeting (AGM) held on 21 April 2011, shareholders approved the special resolutions to change the Group’s articles of association with regard to the distribution to shareholders of summarised financial statements in printed format, while publishing the full set of financials on the Absa Group website. We believe this change will enable us to distribute more relevant information to all our stakeholders. Scope and boundary of the 2010 annual report Absa Bank is a wholly owned subsidiary of Absa Group and, as such, the majority of the disclosures in the Absa Group Annual Report 2010 are applicable to Absa Bank. The focus of this report is on the annual financial statements and corporate governance disclosures specific to Absa Bank. Readers are referred the Absa Group Annual Report 2010 website http://absair.co.za for additional information including the Group strategy, the sustainability review, the Chairman’s statement, Chief Executive’s review, the Group Executive Committee, business operations and the remuneration and compliance reports. This report covers Absa’s South African operations and our African entities in the majority of the disclosures. As Absa’s South African operations constitute the majority of the Bank’s earnings, certain sections have a bias towards these. The report covers the period from 1 January to 31 December 2010. -

Standard Chartered Bank

Joint Media Statement Absa Bank Limited US$ 500,000,000 Term Loan Facility 28th June 2019 Absa Bank Limited (the “Borrower” or “Absa” or the “Bank”), Bank of America Merrill Lynch and Standard Chartered Bank (together the “Bookrunners” and “Coordinators”) are pleased to announce the signing and successful closing of a US$ 500,000,000 Term Loan facility (the “Facility”). The Facility has an initial tenor of two years, subject to an extension option available at the Borrower’s discretion to extend the maturity by a further one-year at the end of the initial two-year tenor. The Facility pays a margin of 1.05% per annum. The proceeds of the Facility will be used for general corporate purposes including, but not limited to trade related finance. The Facility launched on 29th May 2019 to select financial institutions, at a launch amount of US$ 300,000,000 (subject to increase). Absa subsequently elected to upsize the transaction to US$ 500,000,000, in light of the significant commitments received. The response from the market was extremely strong, with more than 192% oversubscription achieved versus the original launch amount with the final lender group consisting of 19 geographically diverse banks. This significant over-subscription necessitated the scaling back of total commitments, even after upsizing the facility to US$ 500,000,000. The positive market response is a reflection of Absa’s strong appeal to international investors, as well as the Borrower’s robust credit profile. “This is the first syndicated loan Absa Bank has concluded in more than a decade and we are pleased with the result. -

Absa Bank Botswana Limited 2020 Annual Report

Introduction Reviewed and re-shaped our Delivering possibilities Annual Financial strategy throughout 2020, and shared value Statements responding to the changing landscape. Absa Bank Botswana Limited 2020 Annual Report Absa Bank Botswana Limited 2020 Annual Report i Introduction Reviewed and re-shaped our Delivering possibilities Annual Financial Introduction Reviewed and re-shaped our Delivering possibilities Annual Financial strategy throughout 2020, and shared value Statements strategy throughout 2020, and shared value Statements responding to the changing responding to the changing landscape. landscape. Contents Absa at a glance Absa Bank Botswana Limited is listed on the Botswana Stock Exchange and is one of Botswana’s leading financial institutions. Leadership reviews 33 branches Board Chairman’s statement 2 P20.6 billion balance Managing Directors report 6 sheet size (2019: P18.8 billion) 113 ATMs Our leadership Country Management Committee 12 deposits Board of Directors 34 P15.9 billion employees due to customers 1 089 (2019: P14.4 billion) Reviews Separation journey 10 Capital Adequacy Ratio 4 147 point-of-sale Finance Director’s report 18 18.2% (2019: 19.2%) Corporate and Investment Banking 24 (PoS) devices Retail Banking 25 Business Banking 26 Treasury and Balance Sheet Management 27 Risk review 29 People Function report 30 Our purpose Citizenship report 32 Digital Journey We believe in Best Investment Chat Banking Governance We are proud to introduce a first to market, our friendly Chatbot Bank powered by artificial intelligence (AI), Abby. bringing Corporate Governance 36 in Botswana possibilities 2020 African Annual financial statements SkyBranch Directors’ responsibilities and approval 50 Banking to life. We launched SkyBranch, our virtual branch where customers can access Independent auditor’s report 54 Awards - EMEA a banker at the call centre for enquires, transactions and accessing Statement of comprehensive income 62 Finance facilities. -

The National Payment System Framework and Strategy Vision 2025

The National Payment System Framework and Strategy Vision 2025 © South African Reserve Bank All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without fully acknowledging The National Payment System Framework and Strategy: Vision 2025 of the South African Reserve Bank as the source. The contents of this publication are intended for general information only and do not serve as financial or other advice. While every precaution is taken to ensure the accuracy of information, the South African Reserve Bank shall not be liable to any person for inaccurate information and/ or the opinions contained in this publication. Comments and enquiries relating to this publication should be addressed to: Head: National Payment System Department South African Reserve Bank P O Box 427 Pretoria 0001 Tel. no.: +27 12 313 3442 Email: [email protected] ISBN (print): 978-1-920556-19-8 http://www.resbank.co.za ISBN (online): 978-1-920556-20-4 National Payment System Framework and Strategy • Vision 2025 Contents Foreword by the Governor ................................................................................. 1 Introduction ....................................................................................................... 2 Overarching vision ............................................................................................. 3 Goals and strategies: achieving Vision 2025 ..................................................... -

ABSA GROUP LIMITED (Formerly Known As Barclays Africa Group Limited) (Incorporated with Limited Liability in South Africa Under

ABSA GROUP LIMITED (formerly known as Barclays Africa Group Limited) (Incorporated with limited liability in South Africa under registration number 1986/003934/06) Bond Issuer Code: ABGI (“ABSA Group” or “ABGI”) ABSA BANK LIMITED (Incorporated with limited liability in South Africa under registration number 1986/004794/06) Bond Issuer Code: BIABS ("“Absa”) TRADING STATEMENT FOR THE YEAR ENDED 31 DECEMBER 2020 In accordance with section 3.4(b) of the JSE Listings Requirements, and updating Absa Group’s trading statement published on 19 November 2020, shareholders are advised that there is more certainty regarding our financial results for the year ended 31 December 2020 and we are able to provide a narrower earnings range. Moreover, the trends set out in our previous trading statement remain relevant. Absa Group’s IFRS headline earnings per share (HEPS) and earnings per share for the year ended 31 December 2020 are expected to decline by 55% to 60% from the 2019 comparatives of 1750.1 cents and 1717.6 cents, respectively. Normalised HEPS for the period is expected to decrease by 50% to 55% from the 1926.0 cents in 2019. The Group expects to release its financial results for the year ended 31 December 2020 on 15 March 2021. Johannesburg 19 February 2021 Enquiries: Alan Hartdegen (+27 72) 576-2713 E-mail: [email protected] Editor’s Note: Normalised reporting Given the process of separating from Barclays PLC, Absa Group continues to report IFRS- compliant financial results and a normalised view. The latter adjusts for the consequences of the separation and better reflects its underlying performance. -

Absa Group Limited Shareholder Report 2008 Reportshareholder Limited Group Absa Limited

Absa Group Absa Group Limited shareholder report 2008 Limited Shareholder report For the year ended 31 December 2008 Contents Introduction 1 Absa in 2008 2 Salient features 4 Share performance 5 Group structure Commentary 8 Chairperson’s statement 11 Group Chief Executive’s review 17 Financial analysis Corporate governance 36 Corporate governance statement 54 Compliance report 58 Group remuneration report 74 The Group board 86 The Group Executive Committee Financial statements 94 Directors’ approval 95 Company Secretary’s certificate to the members of Absa Group Limited 95 Independent auditors’ report to the members of Absa Group Llimited 96 Directors’ report 104 Absa Group Limited and its subsidiaries 287 Absa Group Limited Shareholder and administrative information 300 Shareholders’ information 302 Administration 306 Glossary ibc Other contact information Note Information pertaining to the annual general meeting can be found in a separate document enclosed with this shareholder report. Absa in 2008 Our business Since it was established early in 1991, the Absa Group has grown its asset base almost tenfold to R773,8 billion at 31 December 2008. As a large financial services group in southern Africa, Absa remains at the forefront of the retail banking industry, with over 10 million customers. In keeping with its strategy of diversification through Absa Corporate and Business Bank (ACBB) and Absa Capital, the Group also provides services to the corporate, commercial and investment markets in South Africa and in selected markets on the African continent. Absa has established itself as a leading corporate citizen in South Africa, addressing the needs of all its stakeholders, with the objective of being relevant to the needs and challenges of our country. -

Project Details

Early Warning System MIGA-14391 Absa Group Central Bank Mandatory Reserves Coverage Early Warning System MIGA-14391 Absa Group Central Bank Mandatory Reserves Coverage Quick Facts Countries Mauritius Financial Institutions Multilateral Investment Guarantee Agency (MIGA) Status Approved Bank Risk Rating FI Voting Date 2019-06-14 Borrower Absa Group Limited Sectors Finance Investment Type(s) Guarantee Investment Amount (USD) $ 90.00 million Early Warning System https://ews.rightsindevelopment.org/ [email protected] Early Warning System MIGA-14391 Absa Group Central Bank Mandatory Reserves Coverage Project Description According to bank documents, this summary describes equity investments by Absa Group Limited in its subsidiary in Mauritius, Barclays Bank Mauritius Limited. The investor has applied for MIGA guarantees of up to US$90 million in mandatory reserves cover for a period of up to 15 years. Absa Group, South Africa-based, is one of the largest pan-African financial institutions in terms of total assets with operations in ten countries in Sub Saharan Africa. Its subsidiary banks outside of South Africa are required to maintain reserves at the central banks in their respective jurisdictions, based on the volume of customer deposits that these subsidiaries have. Mandatory reserves contribute to Absa Group's overall risk-weighted assets (RWA) at the consolidated level, resulting in less headroom for other assets at a given level of capital. Early Warning System https://ews.rightsindevelopment.org/ [email protected] Early Warning System MIGA-14391 Absa Group Central Bank Mandatory Reserves Coverage Investment Description Multilateral Investment Guarantee Agency (MIGA) Financial Intermediary Financial Intermediary: A commercial bank or financial institution that receives funds from a development bank. -

Absa Group Limited

Information supplied on CD Questionnaire Governance and accountability Risk and capital management report Absa Group Limited Sustainability review Question form for the annual general meeting (AGM) of ordinary shareholders to be held in the P W Sceales Auditorium, Key performance indicators Absa Towers, 160 Main Street, Johannesburg on Wednesday, 21 April 2010, at 11:00 and feedback form in respect of the annual report. Customer relations Note: Should you wish to pose a question at the AGM, kindly complete this form and fax it to the office of the Group Human resources Secretary at: 011 350 4009, for the attention of: Hendré van Zyl ([email protected]), before Wednesday, 14 April Corporate Social Investment 2010. Kindly keep the questions short and relevant to the matters set out in the notice of AGM. We will endeavour to Absa Group Limited Annual report 2009 Absa address the more frequently raised questions during the course of the AGM. If time does not permit us to address all Absa Group sponsorships questions at the AGM we will prepare responses and make these available on our website. Environmental sustainability Group Limited Financial performance Name of shareholder: Annual report Value-added statement Address: Eight-year summary for the year ended 31 December 2009 Telephone number: GRI Index Fax number: Email address: Questions: Kindly provide us with your feedback on the Absa Group 2009 annual report: Amount of information: Very poor/Poor/Average/Good/Excellent Layout of information: Very poor/Poor/Average/Good/Excellent Ease of finding information: Very poor/Poor/Average/Good/Excellent Readability: Very poor/Poor/Average/Good/Excellent Ease of comprehension: Very poor/Poor/Average/Good/Excellent Visual appearance: Very poor/Poor/Average/Good/Excellent How can Absa’s annual report be improved? I, (Name: ), hereby request the Company not to send me a printed annual report in future, but rather to email the electronic version or the link to the online annual report to the following address: (Email: ). -

![Absa Bank Limited Annual Report Letter from the Chairman and Chief Executive [ 31 December 2006 ] 1](https://docslib.b-cdn.net/cover/4711/absa-bank-limited-annual-report-letter-from-the-chairman-and-chief-executive-31-december-2006-1-2354711.webp)

Absa Bank Limited Annual Report Letter from the Chairman and Chief Executive [ 31 December 2006 ] 1

Absa Bank Limited For the twelve months endedAnnual 31 December report 2006 Contents Letter from the chairman and chief executive 1 Salient features 3 Structure 5 Corporate governance • Corporate governance statement 6 • Bank board 17 Operational review 26 Consolidated financial statements 29 Shareholders’ information and administration 182 Absa Bank Limited Annual report Letter from the chairman and chief executive [ 31 December 2006 ] 1 D C Cronjé: Ch airman S F Booysen: Chi ef ex ecutive Dear Shareholder The annual financial results of Absa Bank Limited (Absa Bank or the Bank) for the twelve months ended 31 December 2006 are contained in this report. As a result of the change in the year-end from March to December, the previous audited financial results were for the nine months ended 31 December 2005. Absa Bank Limited Annual report 2 [ 31 December 2006 ] Letter from the chairman and chief executive Key financial highlights For the year under review, Absa Bank maintained its earnings momentum, as was evident from the achievement of headline earnings of R5 861 million and headline earnings per share of 1 742,5 cents for the twelve months ended 31 December 2006. The Bank delivered a return on equity of 25,1% (nine months ended 31 December 2005: 22,8%). All of the business areas delivered strong growth in attributable earnings. The retail, business, corporate and investment banking segments benefited from a buoyant operating environment and the earnings uplift was assisted by the Absa-Barclays integration benefits. The operating environment The favourable trading conditions of the past few years persisted for the twelve months under review. -

06) ISIN CODE: GB0031348658 JSE Share Code: ASA ISIN: ZAE000067237 (“Absa Group”)

Release date: 6 December 2012 Absa Group Limited Barclays Bank PLC Barclays PLC (Incorporated in the Republic of South (Registered in England) (Registered in England) Africa) (Registration number: 1026167) (Registration number: 0048839) (Registration number: (“Barclays”) LSE CODE: BARC 1986/003934/06) ISIN CODE: GB0031348658 JSE Share Code: ASA ISIN: ZAE000067237 (“Absa Group”) DETAILED ANNOUNCEMENT IN RELATION TO THE PROPOSED STRATEGIC COMBINATION OF BARCLAYS AFRICAN OPERATIONS WITH ABSA GROUP LIMITED, THE PROPOSED CHANGE OF NAME OF “ABSA GROUP LIMITED” TO “BARCLAYS AFRICA GROUP LIMITED” AND WITHDRAWAL OF CAUTIONARY ANNOUNCEMENT Key features of the proposed transaction combining the Barclays African operations with Absa Group Limited (“Absa Group”): Combination of the majority of Barclays African operations with Absa Group, in line with our "One Bank in Africa" strategy An important step in realising our shared goal of becoming the “Go-To” bank in Africa. Unlocks access to sub-Saharan African growth for Absa Group shareholders through a well- established, leading African banking franchise operating across eight African countries Scope of the proposed transaction includes Barclays interests in Botswana, Ghana, Kenya, Mauritius, Seychelles, Tanzania, Uganda and Zambia and the Barclays Africa Regional Office in South Africa Absa Group to issue 129,540,636 ordinary shares to Barclays representing a value of R18.3 billion for Barclays interests in its African operations. Barclays stake in Absa Group to increase to 62.3% from 55.5% Absa Group will be renamed "Barclays Africa Group Limited" to reflect its greater portfolio of African business It is Barclays intention that Barclays Africa Group Limited will be the platform for the management and growth of its business in Africa Requires Absa Group shareholders, excluding Barclays, to approve the proposed transaction by ordinary resolution Independent directors of the board of Absa Group have unanimously approved the proposed transaction and a fairness opinion has been obtained 1. -

Absa Bank Limited Johannesburg, South Africa

FRB Order No. 2019-14 October 1, 2019 FEDERAL RESERVE SYSTEM Absa Bank Limited Johannesburg, South Africa Order Approving the Establishment of a Representative Office Absa Bank Limited (“Absa Bank”), Johannesburg, South Africa, a foreign bank within the meaning of the International Banking Act of 1978 (“IBA”), has applied under section 10(a) of the IBA1 to establish a representative office in New York, New York (the “New York Representative Office”). The IBA provides that a foreign bank must obtain the approval of the Board to establish a representative office in the United States. Notice of the application, affording interested persons an opportunity to comment, has been published in a newspaper of general circulation in New York, New York (New York Daily News, May 17, 2019). The time for submitting comments has expired, and the Board has considered all comments received. Absa Bank, with total assets of approximately $81.8 billion, is the third largest bank in South Africa by asset size.2 Absa Bank provides retail, business, corporate and investment banking, and wealth management products and services. The bank also has subsidiaries that engage in various activities, including information technology, automotive fleet management, and property development and investing. Foreign operations of the bank include representative offices located in Nigeria and Namibia. 1 12 U.S.C. § 3107(a). 2 Asset data is as of June 30, 2019. Ranking data is as of December 31, 2018. - 2 - Absa Bank is a wholly-owned subsidiary of Absa Group Limited (“AGL” – consolidated assets of $97.5 billion), Johannesburg, South Africa, a diversified financial services provider. -

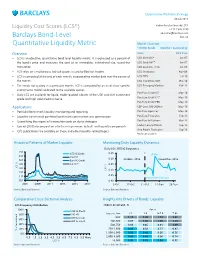

Liquidity Cost Scores (LCS®) Vadim Konstantinovsky, CFA +1 212 526 8290 [email protected] Barclays Bond-Level BCI, US

Quantitative Portfolio Strategy 26 July 2017 Liquidity Cost Scores (LCS®) Vadim Konstantinovsky, CFA +1 212 526 8290 [email protected] Barclays Bond-Level BCI, US Market Coverage Quantitative Liquidity Metric ~20,000 bonds USD45trn outstanding Overview Index Data from • LCS is an objective, quantitative bond-level liquidity metric. It is expressed as a percent of USD Credit IG* Jan-07 the bond’s price and measures the cost of an immediate, institutional-size, round-trip USD Credit HY* Jan-07 transaction USD Credit IG 144A Jan-07 • LCS relies on simultaneous bid-ask quotes issued by Barclays traders USD Treasuries Nov-09 • LCS is computed at the end of each month, incorporating market data over the course of USD TIPS Jul-10 the month USD Fixed Rate MBS Mar-10 • For bonds not quoted in a particular month, LCS is computed by an asset class-specific USD Emerging Markets Feb-12 econometric model calibrated to the available quotes Pan Euro Credit IG* May-10 • Daily LCS are available for liquid, trader-quoted subsets of the USD and EUR investment Pan Euro Credit HY* May-10 grade and high yield credit universe Pan Euro Credit FRN May-10 Applications GBP Corp 100-200mn May-10 • Portfolio/benchmark liquidity monitoring and reporting Pan Euro Agencies May-10 • Liquidity-constrained portfolio/benchmark construction and optimization Pan Euro Treasuries Feb-11 Pan Euro Infl Linkers Mar-11 • Quantifying the impact of transaction costs on alpha strategies Global Covered Bonds Sep-12 • Spread (OAS) decomposition into the risk premium, default, and