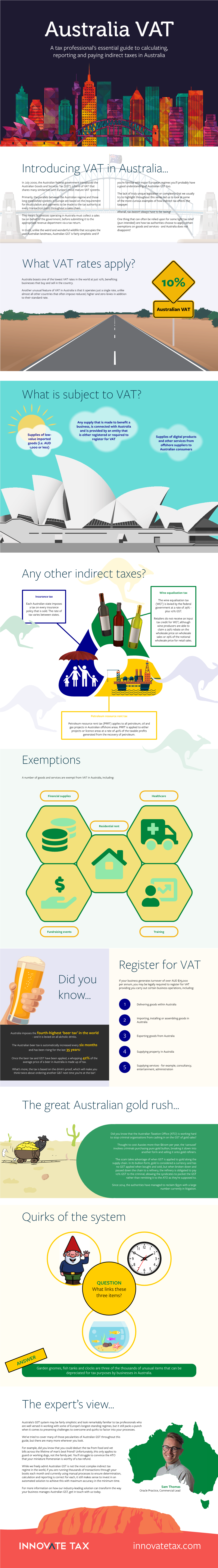

Exemptions Did You Know... Register for VAT Introducing VAT in Australia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

How Australia Got a VAT (C) Tax Analysts 2011

How Australia Got a VAT (C) Tax Analysts 2011. All rights reserved. does not claim copyright in any public domain or third party content. By Susan C. Morse Susan C. Morse is an associate professor at the University of California Hastings College of the Law. This project was supported by a Hackworth Grant from the Markkula Center for Applied Ethics at Santa Clara University. Many thanks to Neil Warren and Richard Eccleston for helpful discussion and review; to participants in the April 2010 Northern California Tax Roundtable and to Chris Evans, Kathryn James, Rick Krever, and Dale Pinto for useful comments and references; and to Erin Phillips and Gadi Zohar for able research assistance. Australians, like Canadians and New Zealanders, call their VAT a goods and services tax, or GST, but their GST fits the VAT mold: it is a credit-invoice method, destination-based consump- tion tax with fairly limited tax base exclusions.1 Although all OECD countries aside from the United States have value-added taxes, external pressures like those resulting from preconditions for European Union membership2 or for financial support from organizations such as the World Bank or International Monetary Fund3 have played a role in many countries’ VAT enactment 1See Liam Ebrill, Michael Keen, Jean-Paul Bodin & Victoria Summers, The Modern VAT 2 (2001) (defining a VAT). This paper uses the term tax base ‘‘exclusion’’ to mean ‘‘a situation in which the rate of tax applied to sales is zero, though credit is still given for taxes paid on inputs’’ which is called ‘‘GST-free’’ in Australia and ‘‘zero-rated’’ elsewhere. -

Taxpack 2010

Instructions for taxpayers TaxPack 2010 To help you complete your tax return 1 July 2009 – 30 June 2010 Lodge online with e-tax You may also need Lodge your tax return – it’s free. the separate publication by 31 October 2010. n Secure and user friendly TaxPack 2010 supplement – see page 2. n Most refunds in 14 days or less n Built-in checks and calculators to help you n Pre-filling service – download your personal tax information from the ATO Go to www.ato.gov.au NAT 0976–6.2010 Commissioner’s foreword TaxPack 2010 is a guide to help you correctly If you have access to the internet, you can prepare complete your 2010 tax return. We have tried and lodge your tax return online using e-tax. It’s fast, to make it easy to use, and for most people it free and easy, and most refunds are issued within will provide all you need to know to fill in your 14 days. It also provides more extensive information tax return. than contained in this guide and allows you to automatically include on your tax return some Be assured that if you do your best to fill in your tax information that we already know about you. return correctly, you will not be subject to any penalties if you get these things wrong. We also have a range of services that can assist you when completing your tax return. The inside back Nevertheless, please take care in ensuring that the cover provides details about how you can access information you provide to us is as complete and these services and how you can contact us. -

Regulation of New South Wales Electricity Distribution Networks

REGULATION OF NEW SOUTH WALES ELECTRICITY DISTRIBUTION NETWORKS Determination and Rules Under the National Electricity Code December 1999 I NDEPENDENT P RICING AND REGULATORY T RIBUNAL OF N EW S OUTH W ALES I NDEPENDENT P RICING AND R EGULATORY T RIBUNAL OF N EW S OUTH W ALES REGULATION OF NEW SOUTH WALES ELECTRICITY DISTRIBUTION NETWORKS Determination and Rules Under the National Electricity Code December 1999 National Electricity Code Determination 99-1 December 1999 2 The Tribunal members for this review are: Dr Thomas G Parry, Chairman Mr James Cox, Full time member This publication comprises two documents: The Tribunal's determination on Regulation of New South Wales Electricity Distribution Networks under the National Electricity Code Rules made by the Tribunal under clause 9.10.1(f) of the National Electricity Code Inquiries regarding this publication should be directed to: Scott Young (02) 9290 8404 [email protected] Anna Brakey (02) 9290 8438 [email protected] Eric Groom (02) 9290 8475 [email protected] Independent Pricing and Regulatory Tribunal of New South Wales Level 2, 44 Market Street Sydney NSW 2000 (02) 9290 8400 Fax (02) 9290 2061 www.ipart.nsw.gov.au All correspondence to: PO Box Q290, QVB Post Office, NSW 1230 Determination Under the National Electricity Code December 1999 I NDEPENDENT P RICING AND REGULATORY T RIBUNAL OF N EW S OUTH W ALES 4 TABLE OF CONTENTS FOREWORD i EXECUTIVE SUMMARY iii SUMMARY OF DETERMINATION vii GLOSSARY OF ACRONYMS AND TERMS xix 1 INTRODUCTION 1 1.1 The -

Alcoa of Australia Ltd Tax Transparency Report

2017 TaxAlcoa Transparency Report of Australia Limited Alcoa of Australia2016 Tax Transparency Report Limited 2017 Tax Transparency Report Page 2017 Tax Transparency Report Contents Message from the Chairman and Managing Director ....................................................... .........................3 About Alcoa of Australia ........................................................................................................................... 4 Approach to tax governance ..................................................................................................................... 5 Tax contribution ........................................................................................................................................ 6 International related party dealings ........................................................................................................... 7 Reconciliations of Australian accounting profit to tax expense and income tax payable ........................... 8 Page 2 2017 Tax Transparency Report Message from the Chairman and Managing Director For 55 years, Alcoa of Australia Limited (Alcoa of Australia) has been an important contributor to Australia’s economy. Our operations across the aluminium value chain provide stable employment for some 4,275 people, predominately in regional Western Australia and Victoria. Our commitment to supporting domestic employment and economic prosperity is further evidenced by our strong local procurement practices. We’re proud that more than 65 per -

302746 ICE Country Guide

International Core of Excellence 2018 ICE Essentials Foreword Local insight into key foreign jurisdictions—International Core of Excellence The impact of the U.S. tax reform will be felt not only in the U.S. but around the world. While it likely will take some time for stakeholders to familiarize themselves fully with the new rules and evaluate their implications and consequences, U.S. businesses soon will have to make real- world decisions that will affect their foreign operations: decisions regarding cash repatriation, adjustments to ownership structures for foreign investments, acquisition financing where multiple jurisdictions are involved, organization of supply chain activities, etc. When that time comes, the focus will no longer be solely on the new U.S. rules. Companies will be looking for practical solutions that best serve the interest of their businesses and those solutions will have to accommodate non-U.S. tax factors—for example, it is important to be aware that steps taken to limit a tax cost in the U.S. may eventuate in a higher tax burden outside the U.S. In this respect, one thing has not changed: U.S. companies will still need to integrate non-U.S. tax considerations into their decision-making. Now more than ever, they will need reliable and timely information—as well as actionable insights—on tax policy, legislation and practices affecting their foreign operations if they are to maintain a competitive edge. We are committed to helping you and your organization navigate the opportunities and challenges of a rapidly evolving global tax environment. The foreign country specialists in the International Core of Excellence (ICE) team have the technical and practical experience to help you identify and address the impact of foreign tax rules on U.S. -

International Visas and Taxation: a Guide for Performing Arts Organisations in Australia and New Zealand

International visas and taxation: a guide for performing arts organisations in Australia and New Zealand August 2010 Contents Acknowledgements 3 Introduction 4 Who is this guide for? 5 Recommended practice 5 A quick checklist 6 Getting started 7 Visas 8 Taxation 9 Withholding tax 10 Withholding tax and expenses 11 Goods and services tax (GST) 12 Tax on royalties and copyright payments 13 Social security 14 Country profiles 15 Australia 16 New Zealand 18 Asia 20 China (People’s Republic of) 21 Hong Kong (Special Administrative Region of the People’s Republic of China) 24 Japan 27 Korea, Republic of (South Korea) 32 Macau (Special Administrative Region of the People’s Republic of China) 36 Singapore (Republic of) 40 Taiwan 43 Europe 45 Austria 46 Belgium 48 Denmark 51 Finland 53 France 55 Germany 59 Ireland (Republic of) 62 Italy 64 Netherlands (the) 64 United Kingdom 69 Latin America 75 Argentina 76 Brazil 78 Chile 81 Colombia 83 Mexico 86 North America 89 Canada 90 United States of America 94 Resources 102 2 Acknowledgements This guide was initiated and developed by the Australia Council for the Arts and Creative New Zealand Toi Aotearoa in response to the needs of the artists and arts organisations they work with. We are very grateful to the artists, companies and producers who anonymously contributed advice and case studies for this resource. Authors: Sophie Travers and Linda Sastradipradja Design: Summa Durie ISBN: 978-1-920784-58-4 Published under Creative Commons Attribution – Noncommercial – NonDerivative Works 2.5 Australia License. -

Taxation and Investment in Australia 2017 Reach, Relevance and Reliability

Taxation and Investment in Australia 2017 Reach, relevance and reliability A publication of Deloitte Touche Tohmatsu Limited Contents 1.0 Investment climate 1.1 Business environment 1.2 Currency 1.3 Banking and financing 1.4 Foreign investment 1.5 Tax incentives 1.6 Exchange controls 2.0 Setting up a business 2.1 Principal forms of business entity 2.2 Regulation of business 2.3 Accounting, filing and auditing requirements 3.0 Business taxation 3.1 Overview 3.2 Residence 3.3 Taxable income and rates 3.4 Capital gains taxation 3.5 Double taxation relief 3.6 Anti-avoidance rules 3.7 Administration 3.8 Other taxes on business 4.0 Withholding taxes 4.1 Dividends 4.2 Interest 4.3 Royalties 4.4 Branch remittance tax 4.5 Wage tax/social security contributions 4.6 Distributions from MITs 5.0 Indirect taxes 5.1 Goods and services tax 5.2 Capital tax 5.3 Real estate tax 5.4 Transfer tax 5.5 Stamp duty 5.6 Customs and excise duties 5.7 Environmental taxes 5.8 Other taxes 6.0 Taxes on individuals 6.1 Residence 6.2 Taxable income and rates 6.3 Inheritance and gift tax 6.4 Net wealth tax 6.5 Real property tax 6.6 Social security contributions 6.7 Compliance 7.0 Labor environment 7.1 Employee rights and remuneration 7.2 Wages and benefits 7.3 Termination of employment 7.4 Employment of foreigners 8.0 Deloitte International Tax Source 9.0 Contact us Australia Taxation and Investment 2017 (Updated December 2016) 1.0 Investment climate 1.1 Business environment Australia is an independent country within the Commonwealth of Nations. -

Australia Australian Dollar (AUD) Foreign Exchange Control No Accounting Principles/Financial Statements Australian Equivalent of IFRS (A-IFRS)

Investment basics Currency Australia Australian Dollar (AUD) Foreign exchange control No Accounting principles/financial statements Australian equivalent of IFRS (A-IFRS). Financial statements must be filed annually. Principal business entities These are the public company (“Limited” or Ltd), private company (“Proprietary Limited” or Jonathan Hill Pty Ltd), partnership, corporate limited partnership, trust, superannuation fund and branch of Partner Tel: +1 718 508 6805 a foreign corporation. [email protected] Corporate taxation Residence A company is resident in Australia if it is incorporated in Australia or, if not incorporated in Australia, it carries on business in Australia and either exercises central management and control there, or has its voting power controlled by shareholders that are residents of Australia. Basis Capital gains Resident companies are taxed on worldwide income. A Assessable income includes any capital gains after offsetting nonresident company generally pays taxes only on income capital losses. Net capital gains derived by companies are derived from Australian sources. The tax rates and treatment taxed at the 30% corporate rate. Australian tax residents are the same for companies and branches of foreign (excluding temporary residents) are liable for tax on companies. However, there are exceptions for special types worldwide capital gains (subject to double tax relief). Where of companies such as cooperative firms, mutual and other a company holds a direct voting interest of 10% or more in life insurance companies and nonprofit organizations, which a foreign company for a certain period, any capital gain or are taxed at slightly different rates. Additionally, from 1 July loss on the sale of the shares in the foreign company may 2015, the tax rate was reduced to 28.5% for companies be reduced (see under “Participation exemption”). -

The Taxation Savings in Australia

TAX AND TRANSFER POLICY INSTITUTE The taxation of savings in Australia Theory, current practice and future policy directions The Tax and Transfer Policy Institute (TTPI) The Tax and Transfer Policy Institute (TTPI) is an independent policy institute that was established in 2013 with an endowment from the federal government. It is supported by the Crawford School of Public Policy of the Australian National University. TTPI contributes to public policy by improving understanding, building the evidence base, and promoting the study, discussion and debate of the economic and social impacts of the tax and transfer system. TTPI Policy Report Series This report series aims to develop a framework for understanding different aspects of taxation to inform and improve future policy design. The evidence presented in the reports is grounded in economic theory and empirical research. It is also tailored to the challenges facing modern Australia. Authorship This report is a Tax and Transfer Institute Policy Report. It was written by Peter Varela, Robert Breunig, and Kristen Sobeck. The report was edited by Ric Curnow and the executive summary was reviewed by David Uren. Media support was provided by James Giggacher. Graphic and typographic design, as well as layout and electronic publication were done by Giraffe. The opinions in this report are those of the authors and do not necessarily represent the views of the Tax and Transfer Policy Institute’s research affiliates, fellows, individual board members, or reviewers. Any remaining errors or omissions are the responsibility of the authors. For further information the Institute’s research, please consult the website: https://taxpolicy.crawford.anu.edu.au Acknowledgements The authors would like to thank the following individuals for their detailed comments on the report: Paul Abbey, Brendan Coates, Graeme Davis, Shane Johnson, Ann Kayis-Kumar, Jason McDonald, Andrew Podger, Victoria Pullen, Mathias Sinning, Ralf Steinhauser, Miranda Stewart, David Tellis, and Hector Thompson. -

FY2021 Annual Report

ANNUAL REPORT 2021 APA GROUP ANNUAL REPORT 2021 CONTENTS 02 Chairman’s Report 04 Managing Director’s Report 06 APA Group Board 07 APA Group Executive Leadership 08 2021 Summary AUSTRALIAN PIPELINE TRUST (ARSN 091 678 778) 10 Directors’ Report 40 Remuneration Report 56 Consolidated Financial Statements APT INVESTMENT TRUST (ARSN 115 585 441) 119 Directors’ Report 123 Consolidated Financial Statements 143 Additional Information 144 Five Year Summary 145 Investor Information We aspire to be world class in everything we do. We are APA: Always Powering Ahead. CHAIRMAN’S REPORT CHAIRMAN’S APA GROUP ANNUAL REPORT 2021 01 MANAGING DIRECTOR’S REPORT DIRECTOR’S MANAGING BOARD & EXECUTIVES & BOARD SUMMARY OUR TRUST PIPELINE AUSTRALIAN VISION To be world class in energy Cover image: Julie Mackenzie has a background in engineering solutions REPORT DIRECTORS’ and works at APA as a Project Manager, in our Western Australian Infrastructure Development Division. Julie has worked at APA for close to ten years and says she is most proud of the gender, age and cultural diversity within her own REPORT REMUNERATION team and across APA. OUR PURPOSE STATEMENTS FINANCIAL To strengthen communities through responsible TRUST INVESTMENT APT energy DIRECTORS’ REPORT DIRECTORS’ FINANCIAL STATEMENTS FINANCIAL This page: Badgingarra Wind OTHER and Solar farms in WA, photo taken by employee S Robinson. 02 APA GROUP ANNUAL REPORT 2021 CHAIRMAN’S REPORT We aspire to be world class in everything we do. Our success over 21-years has been under- pinned by our ability to be nimble in our approach to the ever-changing needs of our customers, Securityholders and stakeholders. -

Tow Au Unit 3 2019 Final.Indd

TOWARDS AN ENTERPRISING I AUSTR ALIA & 4th edition E VCE Industry and Enterprise 3&4 Work Studies, Careers & Pathways Education U n i t s 3 & 4 Michael Carolan SSusanusan BendallBendall DDELIVERELIVER EEducationalducational ConsultingConI&Esu Unitsltin g3&4: Towards an Enterprising Australia (4ed.) i Written by Michael Carolan Copyright © 2019 DELIVER Educational Consulting and its licensors. All rights reserved VIC A en on: VCAL and Applied Learning, Careers, Pathways, 2020 and Work Educa on Co-ordinators and teachers. New edi ons of VCAL Work Related Skills and Personal Development Skills tles for 2020 and beyond. All new releases for 2020 now available, more details on the next page. PDS - Founda on 2ed, PDS Intermediate 4ed, and PDS Senior 3ed. WRS - Founda on 2ed, WRS Intermediate 4ed, and WRS Senior 3ed. PDS Ac vity Planner - Founda on, PDS Ac vity & Project Planner - Intermediate, and PDS Project Planner - Senior. In 2019 new edi ons of VCAL Numeracy and Literacy tles were released. Numeracy - Founda on 2ed, Numeracy Intermediate 2ed (units 1&2), Numeracy Senior 2ed (units 1&2). Literacy - Founda on 2ed, Literacy Intermediate 4ed, Literacy Senior 2ed. In 2019 new edi ons of VCE Industry and Enterprise for 2019 were released. I&E Unit 1: Workplace Par cipa on 4ed, I&E Units 1&2: Towards an Enterprising You 5ed, and I&E Units 3&4: Towards an Enterprising Australia 4ed. Look for more informa on about these new resources, and others, online or through the emails. Note: If you receive this fl yer without receiving an email then you are not on the email list. -

Australia Tax Profile

Australia Tax Profile Produced in conjunction with the KPMG Asia Pacific Tax Centre June 2018 1 Table of Contents 1 Corporate Income Tax 3 1.1 General Information 3 1.2 Determination of Taxable Income and Deductible Expenses 7 1.2.1 Income 7 1.2.2 Expenses 8 1.3 Tax Compliance 10 1.4 Financial Statements/Accounting 12 1.5 Incentives 13 1.6 International Taxation 14 2 Transfer Pricing 18 3 Indirect Tax 21 4 Personal Taxation 22 5 Other Taxes 23 6 Trade & Customs 24 6.1 Customs 24 6.2 Free Trade Agreements (FTA) 24 7 Tax Authority 25 © 2018 KPMG International Cooperative (“KPMG International”). KPMG International provides no client services and is a Swiss entity with which the independent member firms of the KPMG network are affiliated. Australia Tax Profile 2 1 Corporate Income Tax 1.1 General Information Corporate Income Tax Corporate income tax is levied at the federal level only. It applies to the company’s taxable income, which is the total of assessable income minus allowable deductions. Tax Rate 30 percent to all companies that are not eligible for the lower company tax rate. Eligibility for the lower company tax rate depends on whether you are a ‘base rate entity’ from the 2017–18 income year. Special rates apply to life insurance companies, non-profit companies and credit unions. From the 2017–18 income year, companies that are base rate entities will be taxed at the lower company tax rate of 27.5 percent. A base rate entity is a company that is carrying on a business and has an aggregated turnover below the turnover threshold (AUD25 million for the 2017–18 income year).