Complete Quarterly Bulletin 4/2012

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Stefan Kollmuss

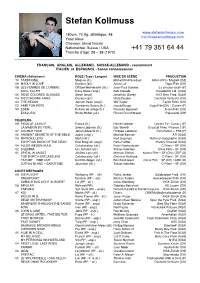

Stefan Kollmuss www.stefankollmuss.com 180cm, 70 Kg, athlétique, 48 [email protected] Yeux bleus Cheveux: blond foncés Nationalitée: Suisse / USA +41 79 351 64 44 Tranche d’âge: 28 – 38 (1972) Spielalter: 25 – 38 FRANÇAIS, ANGLAIS, ALLEMAND, SUISSE-ALLEMAND - couramment ITALIEN et ESPAGNOL - bonne connaissances CINÉMA (Séléctions) RÔLE (Type / Langue) MISE EN SCÈNE PRODUCTION ‘10 TAXIPHONE Magnus (fr.) Mohammed Soudani Amka (CH) / Magreb (DZ) ‘09 MADLY IN LOVE Docteur (all.) Anna Luif Topic Film (CH) ‘08 LES FEMMES DE L’OMBRE Offizier Wehrmacht (all.) Jean-Paul Salomé La chauve souris (F) SOUL KILLER Dany Shaw (angl.) Bob Canode Canodefilm Ltd. (USA) ‘06 ROSE COLORED GLASSES Steve (angl.) Jonathan Garrity 1012 films Prod. (USA) ‘05 RICCORDARE ANNA Docteur (all.) Walo Deuber Dschoint Ventschr (CH) ‘04 THE NEXUS Janson Dean (angl.) Will Taylor Taylor Films (CH) ‘02 AIME TON PÈRE Gendarme Suisse (fr.) Jacob Berger Vega Film(CH) / Canal+ (F) ‘99 EDEN Policier de village (fr.) Rccardo Signorell Arsen Film (CH) EXKLUSIV Bruno Huber (all.) Florian Froschmayer Paparazzi (CH) TÉLÉFILMS ’09 PIGALLE, LA NUIT Patrick (fr.) Hervé Hadmar Lincoln TV / Canal + (F) LA MAISON DU PÉRIL Simon Liebman (fr.) Eric Woreth Escazal Films / France 2 (F) ‘07 DOUBLE FACE Johan Albrecht (fr.) Philippe Lefebvre PLG Fiction – FR3 (F) ‘06 ANCIENT SECRETS OF THE BIBLE Judas (angl.) Michael Bouson ATI (USA) ‘05 MIKROKILLERS Martin (fr.) Kurt Sayenga National Geographic (USA) EGYPTIAN BOOK OF THE DEAD Emil Brugsch (angl.) Petra Haffter History Channel (USA) ‘04 ALLES -

Press Documentation

presents a production A FILM BY CIHAN INAN A FILM BY CIHAN INAN www.180-film.com PRESS DOCUMENTATION PRAESENS-FILM AG Münchhaldenstrasse 10 P.O.Box 919 CH-8034 Zurich Phone +41 44 422 38 33, Fax +41 44 422 37 93 E-Mail: [email protected] www.praesens.com CONTENT 1. SYNOPSIS 2. CAST 3. CREW 4. THE DIRECTOR 5. PRODUCER’S NOTES 6. FACTS AND FIGURES 7. PRODUCTION COMPANY C-FILMS AG 8. PRODUCTION PARTNERS 9. GENERAL CONTACTS 93’ 35mm - Anamorphic - 2:35.1 Dolby Digital 5.1 Original version: German, Swiss German, Turkish Subtitles: English, German © 2009 - C-Films AG Switzerland PRESS DOCUMENTATION „180°“ - Page 2 of 15 1. SYNOPSIS SHORT SYNOPSIS Early evening – a big city. Two teenagers shyly flirt with each other, a housewife sits down to watch her daily soap, nurses in a hospital gossip before the nightshift starts, a trendy couple drives through rush hour, so excited they can hardly wait to get home – a man with a rifle enters a building seeking revenge. In the blink of an eye seemingly unrelated events turn upside down what were once secure, happy, ‘normal’ lives. Behind fear, beyond the unexpected, there is love and hope. PRESS DOCUMENTATION „180°“ - Page 3 of 15 2. CAST CHRISTOPHER BUCHHOLZ SOPHIE ROIS MICHAEL NEUENSCHWANDER „HE“ "MARION" "MANFRED" ASLI BAYRAM SIIR ELOGLU GÜVEN KIRAC "ÖZLEM" "ÜLKER" "AHMED" MEHMET ATESCI FIRAT KAPLAN UMUT YILDERIM "CEM" "SINAN" "KEMAL" PRESS DOCUMENTATION „180°“ - Page 4 of 15 LEONARDO NIGRO SABINE TIMOTEO LORENZ NUFER "MARIO" "PETRA" "DANIEL" BENJAMIN GRUETTER CARLA JURI MIRIAM STEIN "PETER" "ESTHER" "SILVIA" NURIT HIRSCHFELD GERD HEINZ KAMIL KREJCI "SABINE BERGER" "PATHOLOGE" "STEINMANN" In further roles: Christoph Betulius, Viviana Borner, Arniko Dross, Juri Elmer, Seher Gökyazan, Barbara Grimm, Susannah Haberfeld, Eva Helmy, Jürgen Holdorf, Phil Malbec, Alessandro Neri, Oriana Schrage, Nicolas Steiner, Rolf Strub, Fabrice Tchato, Anja Tobler, Kaspar Weiss, Martin Willi, Verena Zimmermann a.o. -

Professional Credits

Professional Credits Filme als Chef Maske & Haare / movie head of make-up & hair Das Missen Massaker Michael Steiner / Kontra Produktion CH / Red Balloon 2012 co.Ltd Thailand Bon Appétit David Pinillos / Morena Films / Egoli tossell / Zodiac 2008/ Pictures / Spanien, Deutschland, Schweiz 2009 The Ring Thing Marc Schippert / Condor Pictures AG, Elevator Group AG 2004 Filme erster teil 2. maske zweiter teil als Chef Maske & Haare / movie 1. part 2.Key make-up 2.part head of make-up & hair Amen Saleikum / Jetzt Marc Hollenstein / Kataline Gödrös / Hugofilm 2019 erst Recht Seitentriebe Marc Hollenstein / Güzin Kar / Cosima Frei / Langfilm AG 2018 Filme als 2.Maske & Haare / movie key make-up and hair Tatort Zürich 2 Marc Hollenstein / Viviane Andereggen / Zodiac Pictures 2020 Tatort Zürich 1 Marc Hollenstein / Viviane Andereggen / Zodiac Pictures 2019 Frieden Marc Hollenstein / Michael Schaerer / Zodiac Pictures 2019 3.M&H Statisten Seitentriebe Marc Hollenstein / Güzin Kar / Markus Welter / Langfilm 2017 AG Tatort zwei Leben Marc Hollenstein / Walter Weber / Turnuns Film 2016 Papa Moll Marc Hollenstein / Manuel Flurin Hendry / Zodiac 2016 Pictures Tatort Kriegssplitter Marc Hollenstein / Tobias Ineichen / Hugofilm 2016 Charlotte Marc Hollenstein / Kataline Gödrös / Turnus Film 2016 Tatort Freitod Marc Hollenstein / Sabine Boss / C-Films / Turnus Film 2015 Tatort Kleine Prinzen Marc Hollenstein / Markus Welter / Hugofilm 2015 Schellen-Ursli Marc Hollenstein / Xavier Koller / C-Films 2014/ 2015 Tatort - Sniper Marc Hollenstein / Florian Froschmayer -

Albert Hofmann's Own Description of the Perceptual and Emotional Changes That He Experienced As a Result

THE SUBSTANCE: ALBERT HOFMANN’S LSD An Icarus Films Release Directed by Martin Witz 2011 / English / 90 minutes / Switzerland-Germany For press materials: http://icarusfilms.com/pressroom.html Username: icarus Password: press (718) 488-8900 www.IcarusFilms.com SHORT SYNOPSIS In 1943, Swiss chemist Albert Hofmann made a sensational discovery: a powerful molecule with the power to alter both the scientific world and human perception itself. But did its benefits outweigh its dangers? The Substance: Albert Hofmann’s LSD investigates the discovery and history of LSD in a fascinating historical, scientific and cinematic trip. LONG SYNOPSIS In the spring of 1943, the year the first A-bomb was built, Swiss chemist Albert Hofmann discovered a powerful substance that would become an A-bomb of the mind: lysergic acid diethylamide or LSD. The Substance: Albert Hofmann’s LSD, directed by Martin Witz, is an informative and entertaining investigation into the history of a drug so potent that mere fractions of a milligram can turn a subject’s perception of time and space upside down. Never-before seen archival material and new interviews with principal historical witnesses—including Hofmann himself, interviewed before his death—are used to chart the drug’s discovery from a Basel chemistry laboratory to Hofmann’s first experiments on himself. Viewers learn how the 1950’s brought Cold War experiments by the American military and the CIA, who saw LSD as a potential weapon. Meanwhile, international psychiatrists and consciousness researchers tried unlock the drug’s medicinal possibilities, wondering whether it might be an effective tool for contemporary psychiatry or neuroscience. -

ICT Schweizermeisterschaft 2014

ICT Schweizermeisterschaft 2014 Beruf InformatikerIn EFZ - Trade 9 : IT Solutions for Business OdA ICT Berufsbildung Schweiz Max 102.5 Punkte Rang Kanton Name Vorname Jahrgang Ausbildungsbetrieb Punkte % erreicht 1 SG Tönz Lars 1996 Verwaltungsrechenzentrum AG 97.5 95.1% 2 SH Roost Dano 1995 UBS AG 81.5 79.5% 3 SG Allenspach Manuel 1996 Bühler AG 79.5 77.6% 4 BE Djurdjevic Boris 1994 Post CH AG 72.5 70.7% 5 BE Béguin Cédric 1997 Bundesamt für Informatik und Telekommunikation BIT 70.5 68.8% 6 BE Nöthiger Mike 1994 Post CH AG 69.5 67.8% 7 BE Reho Michele 1997 Die Mobiliar 69 67.3% 8 BE Ritz Luca 1994 RUAG Aviation 67.5 65.9% 8 BE Bigler Julian 1994 SBB Informatik/login AG 67.5 65.9% 10 SG Scheiwiller Christoph 1995 Verwaltungsrechenzentrum AG 67 65.4% 11 AG Paonessa Claudio 1996 Libs 62.5 61.0% 12 LU / VFI Ulmi Cyrille 1995 bbv Software Services AG, Blumenrain 10, 6006 Luzern 60.5 59.0% 13 BE Walther Markus 1997 Hewlett Packard 57 55.6% 13 SG Scherrer Robin 1995 Bühler AG 57 55.6% 15 VD Delafontaine Ludovic 1994 ETML 53 51.7% 16 ZH Widtmann Brian 1995 Sevitec AG 52.5 51.2% 17 BE Seglias Lukas 1994 Glue Software Engineering AG 52 50.7% 17 SG Christel Lukas 1996 EGELI Informatik AG 52 50.7% 19 AG Matter Naemi 1992 Libs 51.5 50.2% 20 SG Hehli Justin 1995 GemDat Informatik AG 51 49.8% 21 LU / VFI Hecht Lukas 1995 BISON Schweiz AG, Allee 1A, 6210 Sursee 50 48.8% 22 BE Stolz Jan 1996 Bundesamt für Informatik und Telekommunikation BIT 48.5 47.3% 23 BL Gasser Daniel 1994 Coop Genossenschaft 48 46.8% 24 VD Reka Mentor 1994 CPNV 47 45.9% 25 LU / VFI -

PDF 04/2012 – Business Cycle Trends: SNB Regional Network 13.04.2016

Business cycle trends SNB regional network Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of December 2012 Fourth quarter of 2012 The Swiss National Bank’s delegates for regional economic relations are constantly in touch with companies from the different economic sectors and industries. Their reports, which contain evaluations by these companies, are a valuable source of information for assessing the economic situation. The following pages contain a summary of the most important results of the talks held in October and November 2012 with 244 representatives of various industries on the current and future situation of their companies and the economy in general. The selection of companies is made according to a model that reflects Switzerland’s industrial structure. The reference parameter is GDP excluding agriculture and public services. The companies selected differ from one quarter to the next. Region Delegate Central Switzerland Walter Näf Eastern Switzerland JeanPierre Jetzer Geneva Marco Föllmi JeanMarc Falter Italianspeaking Switzerland Fabio Bossi Mittelland Martin Wyss Northwestern Switzerland Daniel Hanimann VaudValais Aline Chabloz Zurich Markus Zimmerli SNB 30 Quarterly Bulletin 4/2012 Summary The outlook for real growth in turnover over the next few months remains cautiously optimistic In the fourth quarter of 2012, the survey indi in all industries. Demand for staff is likely to cated that economic activity was once again stable continue to stagnate. Respondents in manufacturing at the level of the previous quarter. There was evi and services considered the average utilisation of dence of a very slight improvement in business technical production capacity and infrastructure to activity in the services sector, whereas business be normal, whereas in the construction sector, it stagnated in manufacturing and construction. -

Heinrich Fueter (1911-1979) 68 Brauerei Hürlimann (Vergriffen) Z Schweizer Pioniere Der Wirtschaft Und Technik I

Umschlag_Band95_Fueter_312345_Umschlag_82 255423 30.01.12 16:24 Seite 1 45 Johann Georg Bodmer (vergriffen) Verein für wirtschaftshistorische Studien 46 6 Schweizer Flugpioniere (vergriffen) ISBN 978-3-909059-56-0 95 Gegründet 1950 47 Welti-Furrer (vergriffen) Vorstand: 48 Drei Generationen Saurer (vergriffen) k Dr. Kurt Moser, Präsident 49 Ernst Göhner (vergriffen) i n Christian Boesch 50 Prof. Dr. Eduard Imhof (vergriffen) h c Dr. Hans Bollmann 51 Jakob Heusser-Staub e Prof. Dr. Joseph Jung T 52 Johann Sebastian Clais (vergriffen) Anna-Marie Kappeler 53 Drei Schweizer Wasserbauer d n Christian Rogenmoser 54 Friedrich von Martini u t Dr. Gerhard Schwarz 55 Brown und Boveri, 2. Auflage f a Prof. Dr. Klaus Urner 56 Philippe Suchard, 3. Ausgabe h 57 Brauerei Haldengut (vergriffen) c Geschäftsführer: s 58 Jakob und Alfred Amsler t Dr. Bernhard Ruetz r 59 Franz und August Burckhardt (vergriffen) i W Wissenschaftliche Mitarbeiterin: 60 Arnold Bürkli (vergriffen) r lic. phil. Susanna Ruf 61 Von Schmidheiny zu Schmidheiny (vergriffen) e d 62 Rieter (Band 1 Geschichte, Band 2 Technik) Adresse/Kontakt: e 63 Schweizer Flugtechniker und Ballonpioniere r Verein für wirtschaftshistorische Studien e 64 Geilinger Winterthur (vergriffen) i Vogelsangstrasse 52 | CH-8006 Zürich n 65 Die Zisterzienser im Mittelalter (vergriffen) o Tel. +41 (0)43 343 18 40 | Fax +41 (0)43 343 18 41 i 66 Ludwig von Tetmajer Przerwa P www.pioniere.ch, [email protected] 67 Schweizer Wegbereiter des Luftverkehrs r e Heinrich Fueter (1911-1979) 68 Brauerei Hürlimann (vergriffen) z Schweizer Pioniere der Wirtschaft und Technik i 69 Sechs Alpenbahningenieure (vergriffen) e 1 Philippe Suchard (vergriffen) 70 Zeller AG w 2 J. -

Cluster Data 2016

Canton of Zurich Department for Economic Affairs Office for Economy and Labour Cluster Data 2016 Facts, Figures and Players Published by Department for Economic Affairs of the Canton of Zurich Office for Economy and Labour Division of Business and Economic Development Project team Anita Martinecz Fehér Beat Rhyner Danielle Spichiger Eva May Layout komunikat GmbH, Zurich Production Cantonal Central Office for Printed Matter and Material (kdmz), Zurich, printed on Munken Polar (FSC) Circulation 800 copies PDF version and order at www.standort.zh.ch [email protected] Copyright This publication may be cited with due reference to the source. The data preparation for this publication was kindly supported by the Statistical Office Canton of Zurich. October 2016 — CONTENT — CLUSTER FIGURES AT A GLANCE — 2 ICT — 11 FINANCE — 27 LIFE SCIENCES — 37 CLEANTECH — 47 AEROSPACE — 57 CREATIVE INDUSTRIES — 63 TOURISM — 79 CONTACTS AND ADDITIONAL INFORMATION — 81 ADDITIONAL BACKGROUND INFORMATION IS AVAILABLE IN THE PUBLICATION “CLUSTER REPORT 2011–2013: INDUSTRIAL DIVERSITY AND POTENTIAL IN ZURICH” 1 OVERVIEW INCL. SUB-SEGMENTS Canton of Zurich and Switzerland 2013 Full-time Gross value added (GVA) Workplaces Share Zurich CH total of Jobs Share Zurich CH total of equivalents (FTE) Share Zurich CH total of in million CHF Share Zurich CH total of Sectors and industries % % % % OVERALL ECONOMY* Total overall economy 112 434 654 806 17.2 978 455 4 962 608 19.7 766 769 3 901 740 19.7 132 312 613 973 21.9 Hardware 192 1 001 19.2 3 744 27 591 13.6 3 477 25 733 -

Ina Luders. 1St Assistant Director

020 8747 1203 | [email protected] | www.chapterspeople.co.uk INA LUDERS. 1ST ASSISTANT DIRECTOR SKILLS Fluent in English, Spanish, German, French, working knowledge of Italian, scheduling in EP/ mms. * Full Credit List available Completed First Option: Managing COVID-19 Risks on Production Course (June 2020) Passed the APA COVID-19 Shooting Guidelines Assessment Test (June 2020) YEAR PRODUCTION COMPANY COMMERCIALS DIRECTOR 2020 STERNTAG, Hamburg Kaufland - Christmas Campaign Jeroen Annokkee 2020 LUCKY STRIKE, London Opel Kim Jacobsen 2019 TANGENT MIND, Saint Louis, London/Paris Purina Campaign Jon Michael Ryan 2019 ANGELIC FILMS, London Lenovo Amy Coop 2019 BWGTBLD Berlin, Digital Spirit, Bucharest VW United Campaign James F Coton 2019 ABOUT YOU Hamburg, Digital Spirit Bucharest About You - Romania Launch Daniel Wardh 2019 ABOUT YOU, Hamburg Adidas Antoine Bal 2019 ABOUT YOU, Hamburg, Flatpack Film, Budapest About You – Hungary Launch Klabautermann 2019 AHOC, Toronto, DoP: Bob Richardson CIBC Chris Sargent 2019 OUTSIDER, London/Sterntag, Hamburg Edeka Jim Gilchrist 2019 ABOUT YOU, Hamburg/Das Rund, Vienna About You, SVK Launch Klabautermann 2019 ROCK HOUND @SMOKE & MIRRORS, London Merck -Bio Reliance Katie Swain 2019 SOAP FILMS, BERLIN, CRÈME FRAICHE, Bratislava Lidl - Alpine Ski Felix Urbauer 2019 PINK BANANA STUDIOS, London Cineworld Liam & Grant 2018 MT MELVILL, LA, SOUP FILM Berlin Toyota Chris Sargent 2018 SOUP FILM BERLIN, DIGITAL SPIRIT, Bucharest Audi Vincent Haycock 2018 QUAD, PARIS/MARKENFILM, Hamburg Samsung Jan Wentz -

LE CINÉMA EN SUISSE Facts & Figures Content

L’OFFICE FÉDÉRAL DE LA CULTURE PRÉSENTE LE CINÉMA EN SUISSE Facts & Figures Content 01 BOX OFFICE 08 Eingangsbemerkungen zum Film in der Schweiz Remarques liminaires sur le cinéma en Suisse 10 Der Schweizer Film in der Schweiz / Le cinéma suisse en Suisse FÖRDERUNG DER FILMPRODUKTION 02 ENCOURAGEMENT À LA PRODUCTION 14 Einige Beobachtungen zur selektiven Filmförderung Quelques observations sur l’aide sélective 16 Einige Beobachtungen zur erfolgsabhängigen Filmförderung Quelques observations sur l’aide automatique 18 Produktionsfirmen in der Schweiz / Les boîtes de productions suisse 20 Koproduzieren mit dem Ausland / Coproduire avec l’étranger 22 Weitere Tendenzen im Bereich Produktion Quelques tendances dans le domaine de la production FÖRDERUNG DER FILMDISTRIBUTION 03 ENCOURAGEMENT À LA DISTRIBUTION 28 Unterstützung des Filmverleihs in der Schweiz / Soutenir la distribution en Suisse 30 Kinosäle in der Schweiz / Les salles de cinéma en Suisse 32 Schweizer Filme im Ausland / Les films suisses à l’étranger FILMKULTUR 04 CULTURE CINÉMATOGRAPHIQUE 36 Filmfestivals / Festivals de cinéma ANHANG ANNEXE DER FREUND von / de Micha Lewinsky 05 Vorwort / Préface Liebe Filmschaffende, Chers cinéastes, Liebe Filmfreunde, Chers amis du cinéma, Liebe Leserinnen und Leser, Chers lectrices et lecteurs, Filmpolitik kommt auf verschiedenen Wegen zum Aus- La politique culturelle cinématographique peut s’ex- druck: Selbstverständlich über die Aussagen der Film- primer sous plusieurs formes : à travers les mots des ci- schaffenden, aber auch in Gesetzestexten, Reden, parla- néastes, bien évidemment, mais aussi dans les textes de mentarischen Debatten und durch die unumgänglichen loi, dans les discours, au sein des débats parlementaires Zahlen, Statistiken und Fördergelder. et – cela est incontournable – à travers des montants et des chiffres. -

Speaker Book As of November 2014 Table of Contents

Speaker Book as of November 2014 Table of Contents Draft Program 5-6 Overview of NOAH Conference 2013 10 Overview of NOAH Advisors 11 Speaker Profiles - Main Stage, Page 1 (All speaker profiles based on public information) Accel Partners (USA) - Sonali De Rycker (Partner) 12 Access Industries (UK) - Jörg Mohaupt (Partner) 13 AdTelligence (Germany) - Michael Altendorf (Founder & CEO) 14 Adyen (Netherlands) - Pieter van der Does (CEO) 15 Akanoo (Germany) - Jan-Paul Lüdtke Founder & CEO 16 Angel’s Den (UK) - Bill Morrow (Founder & CEO) 17 Appcard (USA) - Yair Goldfinger (Founder & CEO) 18 AppLift (Germany) - Kaya Taner (Co-Founder and CEO) 19 Au10tix (Cyprus) - Ron Atzmon (Managing Director) 20 Avito (Russia) - Filip Engelbert (Co-Founder) 21 Axel Springer (Germany) - Dr. Mathias Döpfner (CEO) 22 badoo (UK) - Michelle Kennedy (Member of Executive Board) 23 Bitpay (USA) - Moe Levin (Director European Business Development) 24 BlaBlaCar (France) - Nicolas Brusson (Co-Founder and COO) 25 B2x (Germany) - Thomas Berlemann (CEO) 26 Bettenriese (Germany) - Alexander Stelmaszyk (Co-Founder & MD) 27 BI Science - Kfir Moyal (CEO) 28 Cashboard (Germany) - Robert Henker (Founder & CEO) 29 Catcha Group (Malaysia) - Patrick Grove (Founder & CEO) 30 CAV Investment Holdings (UK) - Simon Baker (Online Classifieds Business Investor) 31 Chrono24 (Germany) - Tim Stracke (Founder & CEO) 32 Cloudlynx (Switzerland) - Serge Meyer (CEO) 33 Credit Suisse (Switzerland) - Omar Sheikh (Music Analyst) 34 Criteo (France) - Robert Lang (MD Fast Growing Markets) 35 Cybits -

Kundenreferenzliste (Jährlich Wiederkehrende Projekte Werden Nur Einmal Aufgeführt, Es Sei Denn, Es Handelt Sich Um Neue Staffeln)

Acoustic Advertising Badenerstrasse 281 8003 Zürich Tel: 044/450 38 58 Fax: 044/450 38 59 [email protected] Kundenreferenzliste (jährlich wiederkehrende Projekte werden nur einmal aufgeführt, es sei denn, es handelt sich um neue Staffeln) Agentur/Produzent resp. Projekt (Titel, Jahr Kunde Auftragsart (Job-Beschreib) Auftraggeber Beschreibung) Aktion für Lizenzeinkauf, Tonstudio 1992 "Pro Familia" Tages-Anzeiger H,S,G + L, 8702 Zollikon Inserentenkundschaft (Sprecher), MC-Replikation Komposition/Produktion der 1993 Tages-Anzeiger direkt Code-Videomagazin Titelmelodie 1993 Aidshilfe Schweiz Stop Aids Kampagne TV-Spot "Hot Rubber" Rechtsabklärung für Lizenz Kremlin Cup (Chairman: Boris ITP (Int. Tournament Tonstudio (Mastering), CD- 1994 Tennisturnier (Marketing) Jelzin) Promotions Ltd.), 6304 Zug Pressung Radiospot Ugly-House I Komposition, Tonstudio 1994 Ugly-Club Richterswil Instanz AG, 8125 Zollikerberg und Ugly-House II (Sprecher) PPM Filmproduktions AG, 8004 1994 Sprotplausch Widder TV-Spot Komposition Zürich 1994 Theater Casino Zug direkt CD-Produktion CDRs Original-Aussenaufnahmen, Hörspiel "interio zum 1994 Interio, 8600 Dübendorf direkt Tonstudio (Sprecher und hören gern" Geräusche), CD-Pressung Komposition, Tonstudio 1995 KPT/CPT Krankenversicherung Twin Productions, 2501 Biel TV-Spot (Sprecheraufnahmen d,f,i) Kremlin-Cup Moskau, ATP- Tennisturnier, VIP- 1995 L'altro / SALT, 8048 Zürich Vinyl-Schallplatten-Pressung Turnier Giveaway Event am Europatag (6. ZH Komitee "Geboren am 7. div. Kompositionen und 1995 direkt Mai 1995) zur Eidg. Dezember" - Ja zu Europa Musikarrangements Volksinitiative Prod./Post (Beta SP), Credit Suisse, Abt. VI (Institut. Burnett Group Europe, 8001 1996 Imagefilm Tonstudio (Komp. und Anl.) Zürich Sprecher) 1996 Kammer-Sprech-Chor Zürich direkt CD-Produktion Tonstudio, CD-Pressung Tonstudio (Editing, 1996 Sony Musik (Schweiz) AG direkt Radiospots Sprecheraufnahmen d,f) 1996 ABB Turbo Systems AG Urs Emmenegger Prod.