The Plant-Based REVOLUTION March 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

December 2019 FOOD BUYING CLUB CATALOG Pacnw Region UNFI Will Be Closing Our Auburn Facility in August

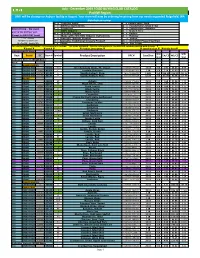

July - December 2019 FOOD BUYING CLUB CATALOG PacNW Region UNFI will be closing our Auburn facility in August. Your store will now be ordering/receiving from our newly expanded Ridgefield, WA distribution center. n = Contains Sugar F = Foodservice, Bulk s = Artificial Ingredients G = Foodservice, Grab n' Go BASICS Pricing = the lowest 4 = Sulphured D = Foodservice, Supplies _ = 100% Organic K = Gluten Free price at the shelf per unit. H = 95%-99% Organic b = Kosher (Except for FIELD DAY items) : = Made with 70%-94% Organic Ingredients d = Holiday * "DC" Column T = Specialty, Natural Product , = Vegan NO CODE= All Warehouses U = Specialty, Traditional Grocery Product m = NonGMO Project Verified W = PacNW - Seattle, WA C = Ethnic w = Fair Trade For placing a SPECIAL ORDER - It is necessary to include: *THE PAGE NUMBER, Plus the information in the BOLDED columns marked with Arrows "▼" * ▼Brand ▼ ▼Item # ▼ ▼ Product Description ▼ ▼ Case/Unit Size ▼ ▼Whlsle Price▼ Indicates BASICS Items WS/ SRP/ Dept Brand DC Item # Symbols Product Description UPC # Case/Size EA/CS WS/CS Brand Unit Unit Indicates Generic BULK Items BULK BULK BAKINGBAKING GOODSGOODS BULK BAKING GOODS 05451 HKnw Dk Chocolate Chips, FT, Vegan 026938-073442 10 LB EA 6.91 69.06 8.99 BULK BAKING GOODSUTWR 40208 F Lecithin Granules 026938-402082 5 LB EA 7.18 35.90 9.35 BULK BAKING GOODSGXUTWR 33140 F Vanilla Extract, Pure 767572-831288 1 GAL EA 336.90 336.90 439.45 BULK BAKING GOODSGUTWR 33141 F Vanilla Extract, Pure 767572-830328 32 OZ EA 95.08 95.08 123.99 BULK BEANSBEANS BULK -

NON-DAIRY MILKS 2018 - TREND INSIGHT REPORT It’S on the Way to Becoming a $3.3 Billion Market, and Has Seen 61% Growth in Just a Few Years

NON-DAIRY MILKS 2018 - TREND INSIGHT REPORT It’s on the way to becoming a $3.3 billion market, and has seen 61% growth in just a few years. Non-dairy milks are the clear successor to cow (dairy) milk. Consumers often perceive these products as an answer to their health and wellness goals. But the space isn’t without challenges or considerations. In part one of this two- part series, let’s take a look at the market, from new product introductions to regulatory controversy. COW MILK ON THE DECLINE Cow milk (also called dairy milk) has been on the decline since 2012. Non-dairy milks, however, grew 61% in the same period. Consumers are seeking these plant-based alternatives that they believe help them feel and look better to fulfill health and wellness goals. Perception of the products’ health benefits is growing, as consumers seek relief from intolerance, digestive issues and added sugars. And the market reflects it. Non-dairy milks climbed 10% per year since 2012, a trend that’s expected to continue through 2022 to become a $3.3 billion-dollar market.2 SOY WHAT? MEET THE NON-DAIRY MILKS CONSUMERS CRAVE THREE TREES UNSWEETENED VANILLA ORGANIC ALMONDMILK Made with real Madagascar vanilla ALMOND MILK LEADS THE NON-DAIRY MILK bean, the manufacturer states that the CATEGORY WITH 63.9% MARKET SHARE drink contains more almonds, claims to have healthy fats and is naturally rich and nourishing with kitchen-friendly ingredients. As the dairy milk industry has leveled out, the non-dairy milk market is growing thanks to the consumer who’s gobbling up alternatives like almond milk faster than you can say mooove. -

Policy Recommendations to Uplift Industrial Production Capacity in the New EU Member States

Policy recommendations to uplift industrial production capacity in the new EU Member States Smart Factories in new EU Member States Final Report FINAL REPORT A study prepared for the European Commission DG Communications Networks, Content & Technology by: Digital Single Market This study was carried out for the European Commission by PwC EU Services EEIG Internal identification Contract Number: 30-CE-0850717/00-35 SMART Number: 2016-1005 DISCLAIMER By the European Commission, Directorate-General of Communications Networks, Content & Technology. The information and views set out in this publication are those of the author(s) and do not necessarily reflect the official opinion of the Commission. The Commission does not guarantee the accuracy of the data included in this study. Neither the Commission nor any person acting on the Commission’s behalf may be held responsible for the use which may be made of the information contained therein. ISBN 978-92-76-04085-9 doi: 10.2759/960842 Luxembourg: Publications Office of the European Union, 2019 © European Union, 2019. All rights reserved. Certain parts are licensed under conditions to the EU. Reproduction is authorised provided the source is acknowledged. The reuse policy of European Commission documents is regulated by Decision 2011/833/EU (OJ L 330, 14.12.2011, p. 39). For any use or reproduction of photos or other material that is not under the EU copyright, permission must be sought directly from the copyright holders. Smart Factories in new EU Member States Final Report Table of contents Executive Summary............................................................................................ 4 Résumé Opérationnel ......................................................................................... 9 1 Introduction .................................................................................................... 13 1.1 Setting the scene .................................................................................... -

Application of Synthetic Taxonomic Measure Tmai For

Proceedings of the 8th International Scientific Conference Rural Development 2017 Edited by prof. Asta Raupelienė ISSN 1822-3230 / eISSN 2345-0916 eISBN 978-609-449-128-3 Article DOI: http://doi.org/10.15544/RD.2017.161 APPLICATION OF SYNTHETIC TAXONOMIC MEASURE TMAI FOR THE ASSESSMENT OF INVESTMENT ATTRACTIVENESS OF THE SELECTED FOOD INDUSTRY COMPANIES LISTED ON THE WARSAW STOCK EXCHANGE IN THE YEARS 2013 – 2016 Monika ZIELIŃSKA-SITKIEWICZ, Faculty of Applied Informatics and Mathematics, Warsaw University of Life Sciences – SGGW, Ul. Nowoursynowska 166, 02-787 Warsaw, Poland, [email protected] (corresponding author) Mariola CHRZANOWSKA, Faculty of Applied Informatics and Mathematics, Warsaw University of Life Sciences – SGGW, Ul. Nowoursynowska 166, 02-787 Warsaw, Poland, [email protected] The food sector is one of the most important and fastest growing branches of the Polish economy. It employs almost 15% of all employees employed in the industry. Polish manufacturers are characterised by high competitiveness both in the EU and in the world. The macroeconomic environment in recent years has been relatively stable for the development of the food industry production in Poland, but the dynamics of agricultural-food products has experienced a slight slowdown. There were also fluctuations in profitability ratios in the sector, which may have been somewhat alarming for the investors. The article attempted to evaluate the investment attractiveness of 24 joint stock companies in the food sector, representing various industries, listed on the Warsaw Stock Exchange. The Taxonomic Measure of the Attractiveness of Investments (TMAI) and the company rankings were created for the years 2013 – 2016. The results showed that the Wawel and Astarta companies were at the top of the rankings in the studied years, representing the confectionery and the sugar sector, and the Żywiec company from the beer industry. -

Personal Narratives of Nationalism in Turkey

This thesis has been submitted in fulfilment of the requirements for a postgraduate degree (e.g. PhD, MPhil, DClinPsychol) at the University of Edinburgh. Please note the following terms and conditions of use: This work is protected by copyright and other intellectual property rights, which are retained by the thesis author, unless otherwise stated. A copy can be downloaded for personal non-commercial research or study, without prior permission or charge. This thesis cannot be reproduced or quoted extensively from without first obtaining permission in writing from the author. The content must not be changed in any way or sold commercially in any format or medium without the formal permission of the author. When referring to this work, full bibliographic details including the author, title, awarding institution and date of the thesis must be given. PERSONAL NARRATIVES OF NATIONALISM IN TURKEY Emel Uzun PhD in Sociology The University of Edinburgh 2015 Abstract The Kurdish Question, which dates back to the Ottoman Era, has been a constituent element of narratives of Turkish nationalism for the past 30 years. The Kurdish Question stands as the most prominent “other” of Turkish nationalism. The members of two groups, Kurds and Turks, became highly politicised throughout 30 years of internal conflict and through their daily encounters, giving way to a constant redefinition of the understanding of nationalism and ethnicity. The encounters and experiences of these two groups have facilitated the development of various narrative forms of personal nationalism in daily life. Accordingly, the daily manifestations of the Kurdish Question and Turkish nationalism have grown as an object of academic interest. -

The Asia Food Challenge Report

Alexandra Health FOREWORD 2 Foreword The Asia Food Challenge report Rabobank reflects a shared view within It is our shared responsibility and our three organisations that the interest to help accelerate the shift significant challenges facing to a more sustainable agri-food Asia’s agri-food industry create economy through climate-smart an outsized opportunity for ecosystems. With our strong innovation. Simply put, Asia is global network and growing a at a crossroads: huge growth in better world together mission, demand creates an attractive Rabobank strongly believes that opportunity for investment; but partnerships are an essential collective action is required to link in the innovation process in unlock this opportunity. solving Asia’s food challenges. In a nutshell, our shared ideals, shared PwC knowledge and ability to work Now is the time to take concrete together is key to creating a strong steps to address the major food sustainable agri-food chain. challenges we are facing; an issue that hits close to home Diane Boogaard and is central to PwC’s purpose Chief Executive Officer, to build trust in society and Asia, Rabobank solve important problems. Asia is poised to take advantage of Temasek this "perfect storm" although With the growth of the middle- investment currently lags income population in Asia, we behind other markets like the at Temasek see a corresponding United States and parts of demand for more safe, nutritious Europe. Greater collaboration and sustainable food sources. between governments, the We can put our capital to private sector, innovators, good use across the whole financial investors and academia agri-food value chain, from across the food and agriculture increasing farm yields, reducing industry can turn the tide, and the environmental impact of ignite this game-changing farming, to improving the safety, opportunity for all of Asia. -

Bellucci Cafe Majidi Mall بەخێربێن بۆ بێلووچی کافێ تکایە داواکارییەکانتان لە الی کاشیەر دەکرێت ، لەگەڵ ڕێزدا

® Belluccisapori d’italia bellucci cafe Majidi Mall بەخێربێن بۆ بێلووچی کافێ تکایە داواکارییەکانتان لە الی کاشیەر دەکرێت ، لەگەڵ ڕێزدا ... Welcome to Bellucci Café Kindly place your order at the Cashier Counter … مرحبا بکم يف بلوچي کافيە يرجی تقديم طلباتکم عند الکاشري ، و لکم جزيل الشکر ... Merhaba, Bellucci cafeye hosgeldiniz Lutfen Butun siparislerinizi kasiyere iletmeniz gerekiyor ... بە کافە بلوچی خوش آمديد لطفا بعد از انتخاب مورد نظر ، فيش تهيە فرمائيد ... ئیتالی گەرم HOT ITALIAN 001 ئێسپرێسۆ ESPRESSO SINGLE 4000 DOUBLE 6000 002 کاپوچینۆ CAPPUCCINO NORMAL 5000 DOUBLE 6000 ® sapori d’italia 003 004Bellucci005 ماکیاتۆ ﻻتێ ماکیاتۆ ئەمێریکانۆ AMERICANO LATTE MACCHIATO MACCHIATO NORMAL 4000 DOUBLE 6000 7000 5000 006 007 008 کارامێل ماکیاتۆ ﻻتێ ماریاچی کافێ ﻻتێ CAFE LATTE LATTE MARIACHI CARAMEL MACCHIATO 5000 6000 5000 ئیتالی گەرم HOT ITALIAN 009 010 011 ستێﻻی گەرم مۆکا - رەش یان سپی هۆت چۆکلێت - کاکاو HOT CHOCOLATE MOCHA - BLACK OR WHITE HOT STELLA 5000 6000 6000 012 013 014 مۆکا ستێﻻ قاوەی ئەمێریکی - بە فیلتەر نس کافێ NESCAFE AMERICAN FILTER COFFEE MOCHA STELLA 5000 4000 7000 ئیتالی سارد ® COLD ITALIAN sapori d’italia 015 016Bellucci017 فراپێ بەیز فراپێ نیس کافێ فراپێ ئێسپرێسۆ ESPRESSO FRAPPE NESCAFE FRAPPE BASE FRAPPE 6000 6000 6000 018 019 020 فراپێ کارامێل فراپێ چۆکلێت فراپێ کاپۆچینۆ CAPPUCCINO FRAPPE CHOCOLATE FRAPPE CARAMEL FRAPPE 6000 6000 6000 ئیتالی سارد BELLUCCI STARS 021 022 023 مۆکا ستێﻻی سارد ئایس کافێ فرێدۆ ئێسپرێسۆ ESPRESSO FREDDO ICE CAFE COLD MOCHA STELLA 6000 5000 7000 024 025 026 ستێﻻی سارد ئایس ﻻتێ فرێدۆ کاپۆچینۆ CAPPUCCINO -

Econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Palimąka, Karolina; Mierzejewski, Mateusz Article Measurement of intellectual capital as exemplified by methods of groups based on the ROA indicator and on market capitalization e-Finanse: Financial Internet Quarterly Provided in Cooperation with: University of Information Technology and Management, Rzeszów Suggested Citation: Palimąka, Karolina; Mierzejewski, Mateusz (2016) : Measurement of intellectual capital as exemplified by methods of groups based on the ROA indicator and on market capitalization, e-Finanse: Financial Internet Quarterly, ISSN 1734-039X, University of Information Technology and Management, Rzeszów, Vol. 12, Iss. 4, pp. 58-71, http://dx.doi.org/10.1515/fiqf-2016-0008 This Version is available at: http://hdl.handle.net/10419/197446 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. -

Food and Beverage Insight Winter 2017

Bite Size Food and beverage insights Winter 2017 Welcome to the Winter edition of ‘Food and beverage insights’, our quarterly review of activity in the F&B sector and – in this issue – of 2017. With the new year well underway, this issue provides a We hope you find this edition useful. As ever, please do get in summary and analysis of M&A activity that took place last year, contact if you have any questions about these issues or how as well as a look at the factors and emerging consumer trends Grant Thornton can help you and your business. likely to influence the market in 2018. In this edition we also report on some of our key initiatives from 2017. ‘From ingredients to innovation’ captures industry opinions Trefor Griffith from a recent roundtable dinner held with leaders in the sector. Head of Food and Beverage, ‘Health & wellbeing success in Spain’ is a look at our recent Grant Thornton UK trade mission to Madrid, which resulted in an exciting growth T +44 (0)7876 408 624 opportunity for superfood company Nutrisure. E [email protected] Deals summary A total of 48 deals were announced in Q4 involving a UK/Irish 2017 ended with the long-awaited sale of Unilever’s global acquirer and/or target; a very similar volume to Q3’s 47 deals.1 spreads business to US private equity house Kohlberg Kravis Across 2017, there were a total of 206 deals, compared to 202 in Roberts (KKR) for £6 billion. The brands divested include Flora, 2016. -

India Internet a Closer Look Into the Future We Expect the India Internet TAM to Grow to US$177 Bn by FY25 (Excl

EQUITY RESEARCH | July 27, 2020 | 10:48PM IST India Internet A Closer Look Into the Future We expect the India internet TAM to grow to US$177 bn by FY25 (excl. payments), 3x its current size, with our broader segmental analysis driving the FY20-25E CAGR higher to 24%, vs 20% previously. We see market share likely to shift in favour of Reliance Industries (c.25% by For the exclusive use of [email protected] FY25E), in part due to Facebook’s traffic dominance; we believe this partnership has the right building blocks to create a WeChat-like ‘Super App’. However, we do not view India internet as a winner-takes-all market, and highlight 12 Buy names from our global coverage which we see benefiting most from growth in India internet; we would also closely watch the private space for the emergence of competitive business models. Manish Adukia, CFA Heather Bellini, CFA Piyush Mubayi Nikhil Bhandari Vinit Joshi +91 22 6616-9049 +1 212 357-7710 +852 2978-1677 +65 6889-2867 +91 22 6616-9158 [email protected] [email protected] [email protected] [email protected] [email protected] 85e9115b1cb54911824c3a94390f6cbd Goldman Sachs India SPL Goldman Sachs & Co. LLC Goldman Sachs (Asia) L.L.C. Goldman Sachs (Singapore) Pte Goldman Sachs India SPL Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. -

BIG BASKET About Company

INDIAN INSTITUTE Of MANAGEMENT RAIPUR BIG BASKET Authors: Vignesh M, Manoj Ram, Nivedhan P, Ramakrishna About Company Big Basket is one of the largest online grocery super market in India. It was founded in 2011 by Hari Menon, VS Sudhakar, V S Ramesh, Vipul Parekh and Abhinay choudari. It has its headquarters in Bengaluru. It operates in more than 30 cities in India. Big basket offers variety of products ranging from fresh fruits, vegetables, Food grains, oil, masala, packaged snacks, beverages, household supplies, healthcare products. It has more than 20000 products and 1000 brands in its catalogue. Customers order groceries through online website which will be delivered to their doorstep. Bigbasket has a valuation of 1.8 Billion dollars. It has reached unicorn status. The investors include Alibaba Group, Abraaj Group, Ascent Capital, Bessemer Venture Partners, Brand Capital, Helion Venture Partners, ICICI Venture, IFC Venture Capital Group, LionRock Capital, Paytm Mall, Sands Capital Management, Sands Capital Ventures, Trifecta Capital and Zodius Capital. COPYRIGHT © 2020 CENTRE FOR DIGITAL ECONOMY, IIM RAIPUR 1 ALL RIGHTS RESERVED BIG BASKET: A Report It has over 10 million customers. Its customers are working people, students, old people who have no time or energy to go to grocery stores, stand in line and buy the necessary products. Big basket helps these people to browse through a huge variety of quality grocery items. Customers can order the required products which will be delivered within 90 minutes for express delivery or next morning for slotted delivery. • Slotted Delivery: Customers can pick a convenient slot when they want their purchase to be delivered • Express Delivery: This service can be availed by customers in cities like Bangalore, Mumbai, Pune, Chennai, Kolkata, Hyderabad and Delhi-NCR . -

Fairwork India Ratings 2020: Labour Standards in the Platform Economy 2 | Fairwork India Ratings 2020

Labour Standards in the Platform Economy | 1 Fairwork India Ratings 2020: Labour Standards in the Platform Economy 2 | Fairwork India Ratings 2020 Executive Summary As the scale and scope of work mediated by digital platforms has grown in India, so has the number of workers registering on such platforms. This rapid growth has also raised questions about the work conditions that result from digital mediation. As in other parts of the world, platform a cross-sectoral view of working after accounting for costs. Urban workers in India are predominantly conditions, and provides new entrants Company, Flipkart, Grofers, and paid a piece rate (i.e. per task), and are with a glimpse of what to expect from Ola were the exceptions. This typically classified by the platforms platform work. highlights the need for regulation as “independent contractors”, or and worker consultation on as driver / delivery “partners”. One This is the second year of scoring matters of pay. major concern is that such workers platforms using the Fairwork principles do not benefit from labour regulations in India. Last year, twelve platforms, � Workers have little to no social pertaining to wages, hours, working from sectors including ride-hailing, security. While some platforms conditions, and the right to collective e-commerce, food-delivery, and home provide accident insurance, bargaining. Consequently, there is an services, were scored. This year, eleven workers were unclear of the urgent need to examine the nature platforms were scored, with nine being procedures to make claims. of digitally-mediated work and its repeated from the first year. Data from Only two platforms (Urban effect on the livelihoods of millions of multiple sources indicates that, as of Company and Flipkart) were able workers in the country.