July-September

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vocalink Blank

LINK Scheme Public - Redacted Copy Network Members Council Minutes of a Meeting of the Network Members Council Held at Cedar Court Hotel, Park Parade, Harrogate, HG1 5AH at 11.00 on Thursday 18th June 2015 Present: Dr Ken Andrew Independent Chairman Sarah Comley American Express Adrian Roberts Bank of Ireland Tim Allen Barclays Jonathan Simpson-Dent Cardtronics UK Craig Dye Co-operative Bank Lyndsay James Cumberland Building Society Bill Hoyne G4S Cash Solutions Glyn Warren HSBC Bank Mike Bullough Lloyds Bank Sue Bentley National Australia Group Anne Dalgleish Nationwide Building Society Kevin McMullan Northern Bank Nigel Constable NoteMachine Tim Watkin-Rees PayPoint Adam Bailey Royal Bank of Scotland Iain Gibson Sainsbury's Bank Helen Matthews Santander Anne Robertson Tesco Personal Finance Mark Akers TSB Bank Janice Aitken Yorkshire Building Society Jenny Campbell YourCash In Attendance: John Howells LINK Sue Wallace LINK Alex Leckenby LINK Graham Mott LINK Mary Buffee LINK Mandy Mahon LINK Deborah Thackwray LINK Sarah Chalmers LINK Katie Hinchley LINK Natalie Dix LINK Mike Newhouse LINK In Attendance for Item 7 only: Alistair Darling Giles Peel DAC Beachcroft LLP In Attendance for Item 9 only: Simon Walker KPMG Michelle Plevey KPMG 1. APOLOGIES FOR ABSENCE Michael Coffey (AIB Group), Billy McCall (Airdrie Savings Bank), Paul Meehan (Change Group ATMs), Mick Willets (Citibank Savings), Neil Lover (Coventry Building Society), Gordon Rennison (Creation), Jean-Luc Dubois (Credit Mutuel), Tim Wilder (DC Payments UK), Nigel Emery (Metro Bank), Alan Chambers (Moneycorp), Beth Williams (Raphaels), Grant Wells (Travelex), and Dave Walker (Virgin Money). 18th June 2015 1 LINK Scheme Public - Redacted Copy Network Members Council The Independent Chairman welcomed to their first meeting of the NMC: Lyndsay James (Cumberland Building Society), Kevin McMullan (Northern Bank), and Mike Newhouse (LINK Scheme). -

Simplified Access to the UK's Payments Systems Takes Another

PRESS RELEASE For immediate release 15 December 2016 Simplified access to the UK’s payments systems takes another step forward with the publication of a new, cross-scheme guide to participation The UK’s interbank Payments System Operators (PSOs) – Bacs Payment Schemes Limited (Bacs), CHAPS, Cheque and Credit Clearing Company, Faster Payments and LINK – have today published a new guide entitled, An Introduction to the UK’s Interbank Payment Schemes. Available on each of the PSOs’ websites, the guide is intended for use by payments service providers (PSPs) that are considering joining, or thinking of extending more payments services to their customers. The document provides an overview of the UK’s payment schemes, what each one offers, and how they can be accessed by PSPs. It has been developed collaboratively by the schemes, capturing input from the Payments Strategy Forum, a number of challenger banks and FinTechs. This is another important step forward in the journey to open up the UK’s payments systems. This year has already seen broadening access to the schemes, with Raphaels and Metro Bank joining Faster Payments, and Societe Generale and Northern Trust joining CHAPS. In 2017, the interbank schemes are expecting growth in direct participation to continue to accelerate. Hannah Nixon, Managing Director of the Payment Systems Regulator, said: “Simple, clear and fair requirements will help make it easier to gain access to the UK’s Interbank Payment Systems. As the economic regulator for the £75 trillion UK payment systems industry, we welcome the work that has been undertaken to produce this guide – which should help introduce organisations to the different access options available to them in each of the payment systems. -

The Ritz London, 16Th November 2016 by Invitation Only Confidential – Not for Distribution

® The Ritz London, 16th November 2016 By Invitation Only The AI Finance Summit is the world’s first and only high-level conference exploring the impact of Artificial Intelligence on the financial services industry. The invitation-only event, brings together CxOs from the world’s leading banks, insurance companies, asset management organisations, brokers. The event takes place at London’s most prestigious address, The Ritz, on the 16th of November and features world-class speakers presenting exclusive case studies shedding light into how the 4th industrial revolution will affect specifically affect the financial services industry. DRAFT AGENDA 16tH November 2016, The Ritz London 08:30 Registration, Breakfast refreshments & Networking 09:15 A welcome unlike any other… and Chair’s Opening Remarks 09:20 State of Play opening keynote: the 4th industrial revolution in financial services Where are financial services currently at with artificial intelligence, what technologies in particular are being used, how quickly is it being adopted, and what areas are leading the adoption of new intelligent technologies? These are are some of the pivotal questions answered in the scene-setting opening keynote to the AI Finance Summit. 09:45 Introducing a new era of risk management in investment banking The use of artificial intelligence within the world of investment banking is a phenomenon which is going to propel the industry in more ways than one. This talk will discuss how the advent of AI technologies, focusing on machine learning and cognitive computing, will drastically enhance risk management processes and achieve levels of accuracy previously unseen in the industry 10:10 Customer Experience/ Relations Management through AI platforms AI is revolutionizing customer service across every industry, with financial services already a pioneer in adoption. -

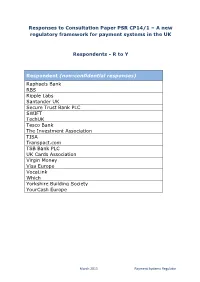

Responses to Consultation Paper PSR CP14/1 – a New Regulatory Framework for Payment Systems in the UK

Responses to Consultation Paper PSR CP14/1 – A new regulatory framework for payment systems in the UK Respondents - R to Y Respondent (non-confidential responses) Raphaels Bank RBS Ripple Labs Santander UK Secure Trust Bank PLC SWIFT TechUK Tesco Bank The Investment Association TISA Transpact.com TSB Bank PLC UK Cards Association Virgin Money Visa Europe VocaLink Which Yorkshire Building Society YourCash Europe March 2015 Payment Systems Regulator RAPHAELS BANK RAPHAELS BANK RAPHAELS BANK Page 2 of 10 Question in relation to our proposed regulatory approach (see Part B of our Consultation Paper and Supporting Paper 1: The PSR and UK payments industry for more details) SP1-Q1: Do you agree with our regulatory approach? If you disagree with our proposed approach, please give your reasons. We broadly support your approach but we are concerned that regulation needs to be joined up between yourselves, the PRA, FCA, CMA and BoE. We have heard and read that this will be the case, however, we have seen major disruption through withdrawal of banking support in the market for payments providers in the past two years which appears to be continuing without any apparent regulatory intervention. You have rightly identified access to payment systems as an important area for your involvement, however, if indirect access is to work, there has to be a range of sponsoring banks providing such services. This market is limited and apparently contracting, exacerbated by the closure and non-availability of bank accounts from clearing banks to the sector. Some sponsoring banks have made significant moves to close bank accounts on policy grounds to UK payments providers and this is continuing today partly, we believe, in response to increased regulation. -

Banking Automation Bulletin | Media Pack 2021

Banking Automation BULLETIN Media Pack 2021 Reaching and staying in touch with your commercial targets is more important than ever Curated news, opinions and intelligence on Editorial overview banking and cash automation, self-service and digital banking, cards and payments since 1979 Banking Automation Bulletin is a subscription newsletter Independent and authoritative insights from focused on key issues in banking and cash automation, industry experts, including proprietary global self-service and digital banking, cards and payments. research by RBR The Bulletin is published monthly by RBR and draws 4,000 named subscribers of digital and printed extensively on the firm’s proprietary industry research. editions with total, monthly readership of 12,000 The Bulletin is valued by its readership for providing independent and insightful news, opinions and 88% of readership are senior decision makers information on issues of core interest. representing more than 1,000 banks across 106 countries worldwide Regular topics covered by the Bulletin include: Strong social media presence through focused LinkedIn discussion group with 8,500+ members • Artificial intelligence and machine learning and Twitter @RBRLondon • Biometric authentication 12 issues per year with bonus distribution at key • Blockchain and cryptocurrency industry events around the world • Branch and digital transformation Unique opportunity to reach high-quality • Cash usage and automation readership via impactful adverts and advertorials • Deposit automation and recycling • Digital banking and payments Who should advertise? • Financial inclusion and accessibility • Fintech innovation Banking Automation Bulletin is a unique and powerful • IP video and behavioural analytics advertising medium for organisations providing • Logical, cyber and physical bank security solutions to retail banks. -

Divide and Rule As Mexico and the US Face Off, Can Payments Take the Strain?

April 2017 Issue 358 www.electronicpaymentsinternational.com Divide and rule As Mexico and the US face off, can payments take the strain? •Airwallex looks to China •First Data looks to the future •New UK pound coin- is it worth it? •Country Surveys: The Philippines, Cambodia, Estonia EPI 358.indd 1 11/04/2017 11:45:13 Simple, secure and effortless digital solutions for fi nancial services organisations To fi nd out more please visit: www.intelligentenvironments.com @IntelEnviro Intelligent Environments is an international provider of innovative mobile and online solutions for fi nancial services providers. Our mission is to enable our clients to deliver a simple, secure and effortless digital experience to their own customers. We do this through Interact®, our single software platform, which enables secure customer acquisition, engagement, transactions and servicing across any mobile and online channel and device. Today these are predominantly focused on smartphones, PCs and tablets. However Interact® will support other devices, if and when they become mainstream. We provide a more viable option to internally developed technology, enabling our clients with a fast route to market whilst providing the expertise to manage the complexity of multiple channels, devices and operating systems. Interact® is a continuously evolving technology that ensures our clients keep pace with the fast moving digital landscape. We are immensely proud of our achievements, in relation to our innovation, our thought leadership, our industrywide recognition, our demonstrable product differentiation, the diversity of our client base, and the calibre of our partners. For many years we have been the digital heart of a diverse range of fi nancial services providers including Atom Bank, Generali Wealth Management, HRG, Ikano Retail Finance, Lloyds Banking Group, MotoNovo Finance, Think Money Group and Toyota Financial Services. -

ASSET FINANCE 50 March 2016

ASSET FINANCE 50 March 2016 Sponsored by Published by CHP CONSULTING CHP Consulting has been delivering systems and user interface, easy deployment and transactional consultancy services to the global asset finance industry transparency. currently serving since 1990. We know that no one project is like another. Gaining a 5 of the top 10 Our best practice methodologies and specialised knowledge competitive advantage in the modern marketplace demands of asset finance mean that we deliver the largest system fresh innovation every time. We work to understand in the AF50 implementations and most complex business change your business completely, then align our implementation projects. With an excellent delivery history over our 26 years methodology with your business practices. We work with you in the industry, CHP’s track record is unrivalled. to shape the solution that fills all the gaps. ALFA Systems, our class-leading software solution, is Our people are only the most talented graduates and used by many of the world’s top equipment finance and professionals. All our consultants operate in all areas of the automotive finance companies for full-lifecycle management business, from preliminary client contact and requirements of portfolios, ranging from the most complex structured definition right through to manning the support desk. This loans to high-volume flow transactions. ALFA is a fully ensures all our staff develop and maintain excellent all-round scalable, enterprise-wide solution that provides end-to-end expertise. integration and workflow automation. Setting the standard With over 40 clients in 18 countries, CHP has offices in for operational excellence, ALFA makes next-generation London, Paris, Detroit, and Sydney. -

Private Cloud Leasing

March 2016 Vol 22 No 270 www.leasinglife.com Private cloud leasing NEWS: Polish and Estonian leasing market figures SPECIAL REPORT: Germany y www.leasinglife.comPLUS: IAA-Advisory & Leasing Foundation research March 2016 1 LL270March 1 final version.indd 1 01/03/2016 15:19:04 Headline Sponsor Leasing Life Conference & Awards 2016 Paris, France EARLY BIRD RATE AVAILABLE NOW Leasing Life Conference & Awards 2016 brings together asset Why Attend? finance professionals and industry disruptors in an active • Hear from senior industry figures on current challenges and discussion of the key issues facing the leasing industry: benchmark your success • Reinventing leasing to meet customer needs • Network and share best practise with your peers in the asset finance community • Exploring alternative sources of funding • Discover high level content and case studies delivered over four • Increasing digital across your company comprehensive sessions • Managing risk and industry disruptors • Celebrate at our black tie awards dinner recognising those at the • Pioneering young talent and diversity top of their game Top industry movers and shakers will meet to debate the importance of new strategies, business practices and partnerships in the industry. We invite you to become an active voice in this discussion to shape the future of asset finance. For more details please contact Victoria Pennell on [email protected] or call +44 (0) 20 3096 2634. Event supported by Gold Sponsor Silver Sponsors Badge and Lanyard Sponsor LL270March 1 final version.indd 2 01/03/2016 15:19:05 Headline Sponsor CONTENTS LEASING LIFE n Cover Story n News 5 Rabobank considers 21-21 PRIVATE CLOUD LEASING €4.5bn DLL sale. -

INTRODUCTION to the LINK SCHEME 2017 the LINK Scheme

INTRODUCTION TO THE LINK SCHEME 2017 The LINK Scheme is a network which connects the UK’s cash machines and provides consumers with universal access to their cash. Link Scheme Holdings Ltd "LINK" is the operator of the LINK system as set out in the Financial Services (Banking Reform) Act 2013. It works with the Payments Systems Regulator "PSR" to achieve its core objectives of promoting innovation and competition in LINK and furthering the interests of people and businesses that use LINK. LINK is Recognised as an inter-bank payment system under section 184 of the Banking Act 2009, bringing LINK into the scope of the Bank of England's supervisory regime. This is because of the crucial role that LINK plays in the UK economy as the main facilitator of free-to-use cash withdrawals. Link Scheme Holdings Ltd Registered Office: RSM, 2 Whitehall Quay, Leeds, LS1 4HG. Registered in England and Wales. Company Number 10535808. Access to cash and cash machines is vital for the UK economy: • Cash is still the most significant payment method in the UK in terms of volume. There were 17.2 billion cash payments in 2015, accounting for 50% of all consumer payments1 and 57% of spontaneous payments. • Consumers make around 2.1bn LINK cash withdrawals in 2016 amounting to £129bn and ATMs account for 88% of all cash withdrawals2. 89% of consumers withdrew cash from ATMs at least once a month3. • Low income groups and older consumers rely strongly on cash for their payments. 40% of consumers who rely on cash have a total household income of less than £10,000 and almost 62% of those aged 65+ rely on cash for day-to-day payments. -

Access and Governance Report 2017

Factsheet www.psr.org.uk Access and governance repor t 2017 No.17/1 We’ve published our second report on access to payment systems, and the governance of those systems. This factsheet summarises our key findings. What is access and why is it important? Payment service providers (PSPs) like banks and building societies need access to payment systems to be able to transfer funds for their customers. We want PSPs to be able to get access on a fair, open and transparent basis, and to be able to choose the form of access that suits them best. Opening up access to more PSPs is essential to help create greater competition in payments. This can have a positive effect on the quality and range of services that consumers receive. Our findings: what’s gone well? • There has been a significant improvement in the choice of access options available to payment service providers (PSPs). Direct participation in the interbank systems1 is rising and looks set to increase considerably in 2017, and there are now more indirect access providers (IAPs). • Payment system operators have improved their processes for new PSPs joining as direct participants, reducing the time and complexity of joining. The recommendations of the Payments Strategy Forum on simplifying access will improve this further. • The cost of getting direct access appears to be reducing. The new IAPs entering the market should further increase competition and help drive down prices for indirect access. Access and governance • For PSPs who choose indirect access, there have been report on payment systems: update on progress and areas improvements in the quality and availability of for ongoing focus technical access to Faster Payments Scheme (FPS). -

LINK Scheme Public Redacted Copy Network Members Council 26Th

LINK Scheme Public Redacted copy Network Members Council Minutes of a Meeting of the Network Members Council Held at Level 33, 25 Canada Square, Canary Wharf, London, E14 5LB, in the Toronto and Montreal Rooms 26th January 2017 Present: Dr Ken Andrew Independent Chairman Sarah Comley American Express Phil Briley Bank of Ireland Tim Allen Barclays Bank Alastair Mayne Cardtronics UK Justin Latter Change Group Sue Bentley Clydesdale Clare Hodgson Coventry Building Society Helene Soulages Handelsbanken David Thrift HSBC Bank James Frost Lloyds Banking Group Alan Chambers Moneycorp Scott Manson Nationwide Building Society Garth Graham Northern Bank Nigel Constable NoteMachine Tim Watkin-Rees PayPoint Beth Williams Raphaels Adam Bailey Royal Bank of Scotland Iain Gibson Sainsbury's Bank Martin Bischoff Santander Douglas Gowan Tesco Jenny Campbell YourCash In Attendance: John Howells LINK Sue Wallace LINK Alex Leckenby LINK Graham Mott LINK Mary Buffee LINK Suzanne Davidson LINK Mandy Myers LINK 1. APOLOGIES FOR ABSENCE Michael Coffey (AIB), Mick Willets (Citibank), Shell Tyson (Co-Operative Bank), Lyndsay James (Cumberland Building Society), Tim Wilder (DC Payments UK), Gerry Langdale (G4S), Simon Watts (Metro Bank), Duncan Letham (Travelex), Judy Rose (Triodos), Martin Southgate (TSB), Dave Walker (Virgin Money) and David Judson (Yorkshire Building Society). 26th January 2017 1 LINK Scheme Public Redacted copy Network Members Council The Scheme Executive confirmed that they were placing votes received on behalf of Michael Coffey (AIB), Lindsay James (Cumberland Building Society), Martin Southgate (TSB). Shell Tyson (Co-Operative Bank), Tim Wilder (DC Payments UK), Simon Watts (Metro Bank). Judy Rose (Triodos), Dave Walker (Virgin Money), David Judson (YBS). -

An Exploratory Spatial Analysis of Access to Physical and Digital Retail Banking Channels1*

AN EXPLORATORY SPATIAL ANALYSIS OF 1 ACCESS TO PHYSICAL AND DIGITAL RETAIL BANKING CHANNELS * TECHNICAL REPORT Andra Sonea, Weisi Guo, Stephen Jarvis† ‡ October, 2019 Abstract In this study, we measured the distance from the centroids of 42148 small statistical areas of the UK to the first and the second closest point of access to physical banking channels (ATM, Post Office, branch). Secondly, access to digital banking was approximated from geographic customer segmentation based on the distances to the nearest mobile base station and local telephone exchanges. Exploratory spatial data analysis at both UK and regional level showed strong spatial patterns; significant rural/urban clusters could be identified as well as a North/South divide which we need to explore further. No significant association was found between distance metrics and income and employment. Despite data limitations, the indicators used in this study can be used to identify “the void” areas, as well as areas vulnerable to the closure of the last points of access. We learned that the majority of the infrastructure for access is no longer operated by banks. In this context, it becomes even more critical to maintain and monitor a dynamic map of access and therefore we recommend more transparency on location, capability and capacity of the points of access from all players, as well as on broadband availability and quality from telecom providers. Retail banking access should be treated as a joined-up system so that territorial coverage can be ensured, such that entire communities are not accidentally excluded from participation in the economy. Keywords: Retail Banking, Infrastructure, Access, Exploratory Spatial Data Analysis (ESDA), Financial Exclusion, UK.