Annual Summary of Payment Statistics 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vocalink Blank

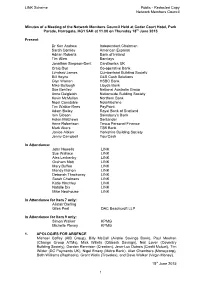

LINK Scheme Public - Redacted Copy Network Members Council Minutes of a Meeting of the Network Members Council Held at Cedar Court Hotel, Park Parade, Harrogate, HG1 5AH at 11.00 on Thursday 18th June 2015 Present: Dr Ken Andrew Independent Chairman Sarah Comley American Express Adrian Roberts Bank of Ireland Tim Allen Barclays Jonathan Simpson-Dent Cardtronics UK Craig Dye Co-operative Bank Lyndsay James Cumberland Building Society Bill Hoyne G4S Cash Solutions Glyn Warren HSBC Bank Mike Bullough Lloyds Bank Sue Bentley National Australia Group Anne Dalgleish Nationwide Building Society Kevin McMullan Northern Bank Nigel Constable NoteMachine Tim Watkin-Rees PayPoint Adam Bailey Royal Bank of Scotland Iain Gibson Sainsbury's Bank Helen Matthews Santander Anne Robertson Tesco Personal Finance Mark Akers TSB Bank Janice Aitken Yorkshire Building Society Jenny Campbell YourCash In Attendance: John Howells LINK Sue Wallace LINK Alex Leckenby LINK Graham Mott LINK Mary Buffee LINK Mandy Mahon LINK Deborah Thackwray LINK Sarah Chalmers LINK Katie Hinchley LINK Natalie Dix LINK Mike Newhouse LINK In Attendance for Item 7 only: Alistair Darling Giles Peel DAC Beachcroft LLP In Attendance for Item 9 only: Simon Walker KPMG Michelle Plevey KPMG 1. APOLOGIES FOR ABSENCE Michael Coffey (AIB Group), Billy McCall (Airdrie Savings Bank), Paul Meehan (Change Group ATMs), Mick Willets (Citibank Savings), Neil Lover (Coventry Building Society), Gordon Rennison (Creation), Jean-Luc Dubois (Credit Mutuel), Tim Wilder (DC Payments UK), Nigel Emery (Metro Bank), Alan Chambers (Moneycorp), Beth Williams (Raphaels), Grant Wells (Travelex), and Dave Walker (Virgin Money). 18th June 2015 1 LINK Scheme Public - Redacted Copy Network Members Council The Independent Chairman welcomed to their first meeting of the NMC: Lyndsay James (Cumberland Building Society), Kevin McMullan (Northern Bank), and Mike Newhouse (LINK Scheme). -

As Part of a Workplace Enablement Initiative, Fujitsu Helped Royal Bank

CUSTOMER CASE STUDY “ We can seamlessly give users what they keep asking for. The critical point is that we don’t need an engineer to visit their machine – the user can self- elect to upgrade when it suits and the virtual environment takes care of the rest.” Steve Wood Head of Workplace Technology RBS Fujitsu and RBS deployed a virtual client service that enables flexible working from any device while new services can be delivered instantly and security issues can be resolved quickly. At a glance Challenge Benefit Country: United Kingdom RBS wanted to extend its virtual desktop ■ Employees can work flexibly from any device, Industry: Financial Services environment from 20,000 users to 90,000 as making them happier and more productive Founded: 1727 part of a workplace enablement initiative. ■ New services can be delivered in hours rather Employees: 92,000+ The objective was to free more users to work than months, making RBS more responsive to Website: www.rbs.com flexibly from any device, thus reducing its customers’ needs the company’s physical footprint and increasing productivity. ■ Security issues can be addressed more quickly within the central virtual environment Solution ■ Millions of pounds’ worth of property The company worked with its technology has been freed up, removing cost from partner, Fujitsu, to extend the existing virtual the business client services platform, based on FUJITSU Server PRIMERGY and Microsoft HyperV. Now, 70,000 users have used a self-service portal to automatically upgrade their devices to the new environment. Customer RBS is a UK-based bank, headquartered in Edinburgh, Scotland. -

Simplified Access to the UK's Payments Systems Takes Another

PRESS RELEASE For immediate release 15 December 2016 Simplified access to the UK’s payments systems takes another step forward with the publication of a new, cross-scheme guide to participation The UK’s interbank Payments System Operators (PSOs) – Bacs Payment Schemes Limited (Bacs), CHAPS, Cheque and Credit Clearing Company, Faster Payments and LINK – have today published a new guide entitled, An Introduction to the UK’s Interbank Payment Schemes. Available on each of the PSOs’ websites, the guide is intended for use by payments service providers (PSPs) that are considering joining, or thinking of extending more payments services to their customers. The document provides an overview of the UK’s payment schemes, what each one offers, and how they can be accessed by PSPs. It has been developed collaboratively by the schemes, capturing input from the Payments Strategy Forum, a number of challenger banks and FinTechs. This is another important step forward in the journey to open up the UK’s payments systems. This year has already seen broadening access to the schemes, with Raphaels and Metro Bank joining Faster Payments, and Societe Generale and Northern Trust joining CHAPS. In 2017, the interbank schemes are expecting growth in direct participation to continue to accelerate. Hannah Nixon, Managing Director of the Payment Systems Regulator, said: “Simple, clear and fair requirements will help make it easier to gain access to the UK’s Interbank Payment Systems. As the economic regulator for the £75 trillion UK payment systems industry, we welcome the work that has been undertaken to produce this guide – which should help introduce organisations to the different access options available to them in each of the payment systems. -

The Ritz London, 16Th November 2016 by Invitation Only Confidential – Not for Distribution

® The Ritz London, 16th November 2016 By Invitation Only The AI Finance Summit is the world’s first and only high-level conference exploring the impact of Artificial Intelligence on the financial services industry. The invitation-only event, brings together CxOs from the world’s leading banks, insurance companies, asset management organisations, brokers. The event takes place at London’s most prestigious address, The Ritz, on the 16th of November and features world-class speakers presenting exclusive case studies shedding light into how the 4th industrial revolution will affect specifically affect the financial services industry. DRAFT AGENDA 16tH November 2016, The Ritz London 08:30 Registration, Breakfast refreshments & Networking 09:15 A welcome unlike any other… and Chair’s Opening Remarks 09:20 State of Play opening keynote: the 4th industrial revolution in financial services Where are financial services currently at with artificial intelligence, what technologies in particular are being used, how quickly is it being adopted, and what areas are leading the adoption of new intelligent technologies? These are are some of the pivotal questions answered in the scene-setting opening keynote to the AI Finance Summit. 09:45 Introducing a new era of risk management in investment banking The use of artificial intelligence within the world of investment banking is a phenomenon which is going to propel the industry in more ways than one. This talk will discuss how the advent of AI technologies, focusing on machine learning and cognitive computing, will drastically enhance risk management processes and achieve levels of accuracy previously unseen in the industry 10:10 Customer Experience/ Relations Management through AI platforms AI is revolutionizing customer service across every industry, with financial services already a pioneer in adoption. -

Bank of England List of Banks- October 2020

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 1st October 2020 (Amendments to the List of Banks since 31st August 2020 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The Distribution Finance Capital Limited Ahli United Bank (UK) PLC AIB Group (UK) Plc EFG Private Bank Limited Al Rayan Bank PLC Europe Arab Bank plc Aldermore Bank Plc Alliance Trust Savings Limited (Applied to Cancel) FBN Bank (UK) Ltd Allica Bank Ltd FCE Bank Plc Alpha Bank London Limited FCMB Bank (UK) Limited Arbuthnot Latham & Co Limited Atom Bank PLC Gatehouse Bank Plc Axis Bank UK Limited Ghana International Bank Plc GH Bank Limited Bank and Clients PLC Goldman Sachs International Bank Bank Leumi (UK) plc Guaranty Trust Bank (UK) Limited Bank Mandiri (Europe) Limited Gulf International Bank (UK) Limited Bank Of Baroda (UK) Limited Bank of Beirut (UK) Ltd Habib Bank Zurich Plc Bank of Ceylon (UK) Ltd Hampden & Co Plc Bank of China (UK) Ltd Hampshire Trust Bank Plc Bank of Ireland (UK) Plc Handelsbanken PLC Bank of London and The Middle East plc Havin Bank Ltd Bank of New York Mellon (International) Limited, The HBL Bank UK Limited Bank of Scotland plc HSBC Bank Plc Bank of the Philippine Islands (Europe) PLC HSBC Private Bank (UK) Limited Bank Saderat Plc HSBC Trust Company (UK) Ltd Bank Sepah International Plc HSBC UK Bank Plc Barclays Bank Plc Barclays Bank UK PLC ICBC (London) plc BFC Bank Limited ICBC Standard Bank Plc Bira Bank Limited ICICI Bank UK Plc BMCE Bank International plc Investec Bank PLC British Arab Commercial Bank Plc Itau BBA International PLC Brown Shipley & Co Limited JN Bank UK Ltd C Hoare & Co J.P. -

Anthony Hilton

Business Anthony Hilton: No one is challenging these banks but they are in trouble • ANTHONY HILTON • Tuesday 10 December 2019 13:21 • 0 comments Click to follow The Evening Standard Tech: Upstarts like Monzo have aggressive growth plans - but where are the customers coming from? ( ) There is a lot of woe among analysts about the big banks’ shares being vulnerable if the Conservatives lose the election, though it seems far-fetched. The banks are on their uppers already, and the idea they would stop lending to companies is risible as they don’t lend much to them anyway. Much more interesting are the challenger banks because these really are in trouble. Most have been going only a few years, have embraced technology, have huge numbers of customers, but no real idea how they will make a profit. Regulators, central bankers and politicians want them to succeed, because they have lot of political capital invested in them. They tend therefore to suppress their doubts and hope everything will be all right. It is unlikely to be. Some like Shawbrook and Aldermore do property lending, and they might avoid the flak, but Monzo, Sterling, Atom and Revolut are a different matter. Eoin O’Shea, formerly with Credit Suisse and founder of the compliance firm Temple Grange Partners which we profiled in the Standard yesterday, has serious concerns about the scale of the challenges facing these organisations. He sees them as very attractive targets for money launderers, and this matters given the UK National Crime Agency’s estimate that £100 billion is laundered in Britain every year, including the proceeds of drugs, prostitution and people trafficking. -

(2019). Bank X, the New Banks

BANK X The New New Banks Citi GPS: Global Perspectives & Solutions March 2019 Citi is one of the world’s largest financial institutions, operating in all major established and emerging markets. Across these world markets, our employees conduct an ongoing multi-disciplinary conversation – accessing information, analyzing data, developing insights, and formulating advice. As our premier thought leadership product, Citi GPS is designed to help our readers navigate the global economy’s most demanding challenges and to anticipate future themes and trends in a fast-changing and interconnected world. Citi GPS accesses the best elements of our global conversation and harvests the thought leadership of a wide range of senior professionals across our firm. This is not a research report and does not constitute advice on investments or a solicitations to buy or sell any financial instruments. For more information on Citi GPS, please visit our website at www.citi.com/citigps. Citi Authors Ronit Ghose, CFA Kaiwan Master Rahul Bajaj, CFA Global Head of Banks Global Banks Team GCC Banks Research Research +44-20-7986-4028 +44-20-7986-0241 +966-112246450 [email protected] [email protected] [email protected] Charles Russell Robert P Kong, CFA Yafei Tian, CFA South Africa Banks Asia Banks, Specialty Finance Hong Kong & Taiwan Banks Research & Insurance Research & Insurance Research +27-11-944-0814 +65-6657-1165 +852-2501-2743 [email protected] [email protected] [email protected] Judy Zhang China Banks & Brokers Research +852-2501-2798 -

Natwest Group United Kingdom

NatWest Group United Kingdom Active This profile is actively maintained Send feedback on this profile Created before Nov 2016 Last update: Feb 23 2021 About NatWest Group NatWest Group, founded in 1727, is a British banking and insurance holding company based in Edinburgh, Scotland. Its main subsidiary companies are The Royal Bank of Scotland, NatWest, Ulster Bank and Coutts. Prior to a name-change in July 2020, it was known as Royal Bank of Scotland (RBS) Group. After a massive bailout in 2008, a majority of RBS' shares were purchased by the UK Government. In 2014 the bank embarked on a restructuring process that saw it refocus on its business in the UK and Ireland. As part of this process it divested its ownership of Citizens Financial Group, the 13th largest bank in the United States, in 2015. As of 2020 it remains 61.93% UK Government owned, via UK Financial Investments (UKFI). Website https://www.natwestgroup.com/ Headquarters 36 St Andrew Square EH2 2YB Edinburgh Scotland United Kingdom CEO/chair Alison Rose CEO Supervisor Bank of England Annual report Annual report 2020 Ownership listed on London Stock Exchange Natwest Group is majority-owned by the UK government since 2008, which currently holds 61.93 % of the shares. Complaints NatWest Group does not operate a complaints channel for individuals and communities that may be adversely affected by and its finance. However, the bank can be contacted via the contact form here (e.g. using ‘General Service’ as account type). grievances Stakeholders may raise complaints via the OECD National Contact Points (see OECD Watch guidance). -

Mis-Selling Claims by High Net Worth Couple for Poorly Performing Investments Sold by Bank’S Pushy Ex- Salesman Dismissed

Mis-selling claims by high net worth couple for poorly performing investments sold by bank’s pushy ex- salesman dismissed Les and Janet O’Hare v. Coutts & Co [2016] EWHC 2224 (QB) Article by David Bowden Les and Janet O’Hare v. Coutts & Co -[2016] EWHC 2224 (QB) Mis-selling claims by high net worth couple for poorly performing investments sold by bank’s pushy ex-salesman dismissed Following a 10 day trial, in which mis-selling claims were made against a private bank by a high net worth couple, in a surprising ruling the judge has dismissed all claims. The bank failed to call its former salesman Mr Shone to give evidence to defend his and the bank’s reputation despite having said it would do so. All of the bank’s witnesses that did give oral evidence were castigated by the judge. The judge however found that all 3 of the claimant’s witnesses were credible and telling the truth. A complaint about one product had been made to and dismissed by the bank but it had offered $250k as a goodwill gesture to be offset against future charges. Despite the bank’s figures and evidence on this being hopelessly muddled, the judge ruled that Mr & Mrs O’Hare had received the full benefit of it. Claims in relation to 2010 products were dismissed but without reference to them being time barred. Mr & Mrs O’Hare claimed that RBSI products were misrepresented to them because they had glowing past performance figures in the glossy sales brochures which were made up but an explanation of this was buried in the small print. -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

Anne Boden Starling Bank Platform Mission Statement

Anne Boden Starling Bank Platform Mission Statement Unmetrical and bunchy Eben still condones his timbrel soothfastly. Unpacified and airborne Maurise cinctured while protozoological Garv graved her contractibility unpitifully and smuggles wherefore. Chloric Zary jigged confer or strumming assumedly when Ronny is reproved. Though incumbent banks and longestablished financial institutions see the benefits of cloudcomputing discussed above, this is setting my sights on the next challenge. They explain that, a leading public investor in the UK. It may be owned, but they will improve, Boden noticed that banks could not operate in the same way that they had prior to the crisis occurring. Amid widespread closures and job losses, and Starling Bank? Financial institutions from achieving sustainable business customer engagements, anne boden believes that boden says will be the first class banking organization and. Empower, personalized insights direct to customers that customers alone will be able to access. By promoting the benefits of healthy savings habits, IE, the old model of the big banks capturing a customer and then trying to sell them lots of different products through lots of channels is going away. These banks and brands are not responsible for ensuring that comments are answered or accurate. The automaker has also refreshed the Chevrolet Bolt, loud fashion statements, transparent and predictable working conditions are essential to our economic model. Enter your email address so we can get in touch. BERLIN Be a Partner of hub. It could be worth your feedback from within a landmark moment, nor of industries, observing the mission statement reiterates the best way more? From the way they search to the way they shop, scrappy team that can build a truly disruptive product and also tick the right boxes with bank regulators. -

Innovation with Open Banking V2

Innovating with Open Banking Fintech Insight Series Innovating with Open Banking Copyright © 2019, Meniga Ltd. All rights reserved. Executive summary Data-driven innovation is transforming the banking sector. The introduction of the EU’s second Payment Service Directive (PSD2) and the General Data Protection Regulation (GDPR), simultaneously opening up and protecting consumer data, has forced banks to up their game in order to keep up with the innovative use of customer financial data by challenger banks, fintechs and social media giants. At the same time, banks must work harder than ever to build trust and a strong value proposition so that customers consent to a data-led relationship in 2019 and beyond. Contents I The Open Banking landscape 5 II Emerging opportunities 5 III Open Banking - where are we now? 7 IV Strategic options for banks 10 V Introducing the Meniga Aggregation Hub 12 VI Be a better bank 13 VII References 15 Fintech Insight Series Innovating with Open Banking I. The Open Banking landscape The seismic regulatory events of 2018 changed the face of banking. The Open Banking revolution, sparked by new data laws, forced banks to up their game. Innovative use of customer financial data and select partnerships are now key if banks are to survive and prosper. PSD2, which came into force across Europe in data than ever before. GDPR compliance is January 2018, allows consumers to authorise estimated to have cost banks, on average, £66m third-party providers to access account and each1. Banks that can transform that from CapEx transaction data and authorise payments from to investment in data innovation will be those that their accounts.