Company Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

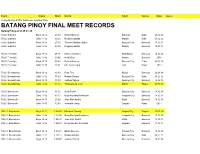

BP 2019 Records

Event Grade Mark Name Team Venue Date Notes Compiled by ATFS Statiscian Andrew Pirie BATANG PINOY FINAL MEET RECORDS Batang Pinoy as of 29.11.16 50 LC Butterfly Boys 11-12 29.40 Rafael Barreto Bulucan Iloilo 05.12.12 50 LC Butterfly Girls 11-12 30.28 Regina Castrillo Manila Iloilo 05.12.12 50 LC Butterfly Boys 13-15 27.58 Terence Mattheu Buico Quezon City Bacolod 13.12.14 50 LC Butterfly Girls 13-15 29.80 Regina Castrillo Manila Bacolod 30.01.14 50 LC Freestyle Boys 11-12 26.35 Marco Austriaco Muntinlupa Bacolod 14.12.14 50 LC Freestyle Girls 11-12 29.06 Heidi Ong Manila Bacolod 2001 50 LC Freestyle Boys 13-15 25.42 Rafael Barreto Quezon City Cebu 29.11.15 50 LC Freestyle Girls 13-15 28.01 Ma. Aresa Lipat Lipa Naga 2011 50 LC Breaststroke Boys 11-12 33.03 Rian Tirol Bohol Bacolod 29.01.14 50 LC Breaststroke Girls 11-12 35.69 Raissa Gavino Quezon City Iloilo 05.12.12 50 LC Breaststroke Boys 13-15 31.88 Joshua Taleon Quezon City Bacolod 12.12.14 50 LC Breaststroke Girls 13-15 35.35 Thanya Dela Cruz MARC Tagum 29.11.16 50 LC Backstroke Boys 11-12 31.12 Seth Martin Quezon City Bacolod 14.12.14 50 LC Backstroke Girls 11-12 33.73 Bhay Maitland Newberry Antipolo City Bacolod 14.12.14 50 LC Backstroke Boys 13-15 29.02 Jose Mari Arcilla Rizal Bacolod 14.12.14 50 LC Backstroke Girls 13-15 32.83 Ariana Herranz Laguna Naga 2011 100 LC Backstroke Boys 11-12 1.08.88 Maenard Batnag Baguio City Tagum 29.11.16 100 LC Backstroke Girls 11-12 1.12.98 Bhay Maitland Newberry Antipolo City Bacolod 13.12.14 100 LC Backstroke Boys 13-15 1.02.72 Jose Mari Arcilla -

SOIL Ph MAP N N a H C Bogo City N O CAMOT ES SEA CA a ( Key Rice Areas ) IL

Sheet 1 of 2 124°0' 124°30' 124°0' R E P U B L I C O F T H E P H I L I P P I N E S Car ig ar a Bay D E PA R T M E N T O F A G R IIC U L T U R E Madridejos BURE AU OF SOILS AND Daanbantayan WAT ER MANAGEMENT Elliptical Roa d Cor. Visa yas Ave., Diliman, Quezon City Bantayan Province of Santa Fe V IS A Y A N S E A Leyte Hagnaya Bay Medellin E L San Remigio SOIL pH MAP N N A H C Bogo City N O CAMOT ES SEA CA A ( Key Rice Areas ) IL 11°0' 11°0' A S Port Bello PROVINCE OF CEBU U N C Orm oc Bay IO N P Tabogon A S S Tabogon Bay SCALE 1:300,000 2 0 2 4 6 8 Borbon Tabuelan Kilom eter s Pilar Projection : Transverse Mercator Datum : PRS 1992 Sogod DISCLAIMER : All political boundaries are not authoritative Tuburan Catmon Province of Negros Occidental San Francisco LOCATION MA P Poro Tudela T I A R T S Agusan Del S ur N Carmen O Dawis Norte Ñ A Asturias T CAMOT ES SEA Leyte Danao City Balamban 11° LU Z O N 15° Negros Compostela Occi denta l U B E Sheet1 C F O Liloan E Toledo City C Consolacion N I V 10° Mandaue City O R 10° P Magellan Bay VIS AYAS CEBU CITY Bohol Lapu-Lapu City Pinamungajan Minglanilla Dumlog Cordova M IN DA NA O 11°30' 11°30' 5° Aloguinsan Talisay 124° 120° 125° ColonNaga T San Isidro I San Fernando A R T S T I L A O R H T O S Barili B N Carcar O Ñ A T Dumanjug Sibonga Ronda 10°0' 10°0' Alcantara Moalboal Cabulao Bay Badian Bay Argao Badian Province of Bohol Cogton Bay T Dalaguete I A R T S Alegria L O H O Alcoy B Legaspi ( ilamlang) Maribojoc Bay Guin dulm an Bay Malabuyoc Boljoon Madridejos Ginatilan Samboan Oslob B O H O L S E A PROVINCE OF CEBU SCALE 1:1,000,000 T 0 2 4 8 12 16 A Ñ T O Kilo m e te r s A N Ñ S O T N Daanbantayan R Santander S A T I Prov. -

Province, City, Municipality Total and Barangay Population AURORA

2010 Census of Population and Housing Aurora Total Population by Province, City, Municipality and Barangay: as of May 1, 2010 Province, City, Municipality Total and Barangay Population AURORA 201,233 BALER (Capital) 36,010 Barangay I (Pob.) 717 Barangay II (Pob.) 374 Barangay III (Pob.) 434 Barangay IV (Pob.) 389 Barangay V (Pob.) 1,662 Buhangin 5,057 Calabuanan 3,221 Obligacion 1,135 Pingit 4,989 Reserva 4,064 Sabang 4,829 Suclayin 5,923 Zabali 3,216 CASIGURAN 23,865 Barangay 1 (Pob.) 799 Barangay 2 (Pob.) 665 Barangay 3 (Pob.) 257 Barangay 4 (Pob.) 302 Barangay 5 (Pob.) 432 Barangay 6 (Pob.) 310 Barangay 7 (Pob.) 278 Barangay 8 (Pob.) 601 Calabgan 496 Calangcuasan 1,099 Calantas 1,799 Culat 630 Dibet 971 Esperanza 458 Lual 1,482 Marikit 609 Tabas 1,007 Tinib 765 National Statistics Office 1 2010 Census of Population and Housing Aurora Total Population by Province, City, Municipality and Barangay: as of May 1, 2010 Province, City, Municipality Total and Barangay Population Bianuan 3,440 Cozo 1,618 Dibacong 2,374 Ditinagyan 587 Esteves 1,786 San Ildefonso 1,100 DILASAG 15,683 Diagyan 2,537 Dicabasan 677 Dilaguidi 1,015 Dimaseset 1,408 Diniog 2,331 Lawang 379 Maligaya (Pob.) 1,801 Manggitahan 1,760 Masagana (Pob.) 1,822 Ura 712 Esperanza 1,241 DINALUNGAN 10,988 Abuleg 1,190 Zone I (Pob.) 1,866 Zone II (Pob.) 1,653 Nipoo (Bulo) 896 Dibaraybay 1,283 Ditawini 686 Mapalad 812 Paleg 971 Simbahan 1,631 DINGALAN 23,554 Aplaya 1,619 Butas Na Bato 813 Cabog (Matawe) 3,090 Caragsacan 2,729 National Statistics Office 2 2010 Census of Population and -

Lrt Line 2 East Extension Project

Roadmap for Transport Infrastructure Development for Metro Manila and Its Surrounding Areas (Region III and Region IV-A) Main Points of the Roadmap Technical Assistance from the Japan International Cooperation Agency (JICA) Roadmap Study Objective Study Period To formulate “Transportation March 2013 – March 2014 Infrastructure Roadmap” for sustainable development of Metro Manila and its surrounding areas Stakeholders Consulted (Region III and IV-A) NEDA DPWH Outputs DOTC MMDA Dream plan towards 2030 Others (donors, private sectors, etc.) Roadmap towards 2016 and 2020 Priority projects 2 Significance of the study area: How to ensure sustainable growth of Metro Manila and surrounding regions. Study Area Nueva Ecija Aurora Tarlac GCR: MManila, Region III, Region IV-A Region III 100km Mega Manila: MManila, Bulacan, Rizal, Laguna, Cavite Metro Manila : 17 cities/municipality Pampanga Metro Manila shares 36% of GDP GCR shares 62% of GDP (Population :37%) Bulacan 50km Popuation Population growth rate (%/year) GRDP Metro (000) (Php billion) Rizal (1) GRDP by sector; growth rate (%/year), Manila 25,000 (2) 4,000 (3) sector share (%) 6.3% 2.0% 20,000 1 18 1.5% 3,000 15,000 Cavite 1.8% 3.1% Laguna 2,000 2.4% 6.1% 10,000 6 2.6% 81 2.1% 32 4.6% 63 17 1,000 Batangas 5,000 17 31 28 41 42 31 51 41 Region IV-A 0 0 MetroMetro Region IIIIII RegionRegion IV-A IV Visayas Mindanao ManilaManila Growth rate of population & GRDP is between 2000 and 2010 3 Rapid growth of Metro Manila, 1980 - 2010 1980 2010 2010/’80 Population (000) 5,923 11,856 2.0 Roads (km) 675 1,032 1.5 GRDP @ 2010 price (Php billion) 1,233 3,226 2.6 GRDP per Capita (Php 000) 208 272 1.3 No. -

SOIL FERTILITY MAP ! Province of ( Key Corn Areas ) ^Bogo Leyte

SHEET 1 124°0' 124°30' INDEX TO ADJOINING SHEET 11°30' 11°30' 124°0' R E P U B L I C O F T H E P H I L I P P I N E S Carigara Bay DEPARTMENT OF AGRICULTURE Madridejos ! Daanbantayan BUREAU OF SOILS AND ! WATER MANAGEMENT Sillon Cabalioa !! ! Elliptical Road Cor. Visayas Ave., Diliman, Quezon City !!! Hamayhumay Bantayan VISAYAN SEA ! Santa Fe Basaan ! !! Medellin ! Hagnaya Bay San Remigio SOIL FERTILITY MAP ! Province of ( Key Corn Areas ) ^Bogo Leyte 11°0' 11°0' PROVINCE OF CEBU Port Bello Tabogon Ormoc Bay ! ° Tabogon Bay CAMOTES SEA SCALE 1:140,000 0 2 4 6 8 10 Borbon Tabuelan ! ! Pilar Kilometers VISAYAN SEA ! Projection : Transverse Mercator Sogod Datum : PRS 1992 ! Tuburan Catmon DISCLAIMER : All political boundaries are not authoritative ! ! Province of Negros Occidental San Francisco Tudela ! Poro ! ! Carmen ! Asturias ! Danao Madridejos Balamban ^ ! ! Compostela ! Sheet1 Liloan ! Toledo Consolacion ^ ! Mandaue Magellan Bay Daanbantayan Cebu ^City Lapu-Lapu ! \ ^ TAÑON STRAIT Pinamungajan ! Cordova MinglanillaTalisay ! ! Aloguinsan ^ ! ^Naga San Fernando ! Barili VISAYAN SEA Carcar ! BOHOL STRAIT Sillon ^ !! Cabalioa ! ! Dumanjug !! Hamayhumay ! Sibonga ! 10°0' 10°0' Alcantara Bantayan ! ! Moalboal Cabulao Bay ! Santa Fe ! Badian Bay Argao Badian ! ! Basaan Province of Bohol !! Cogton Bay Medellin Alegria ! ! Hagnaya Bay San Isidro ! Alcoy ! Maribojoc Bay Guindulman Bay Malabuyoc ! Boljoon ! San Remigio ! Ginatilan ! Panglao Bay Bogo Bay Samboan Oslob ! ! B O H O L S E A PROVINCE OF CEBU Bogo SCALE 1:600,000 ^ 0 3 6 9 12 15 Kilometers -

Stage 1 Stage 1

STAGE 1 STAGE 1 STAGE MAP Quezon City - Palayan City | 157.15 km Sunday | 20 May 2018 Maria Aurora San Jose City COURSE FEATURES TYPE Science City SPRINT Baler of Muñoz START Rizal DRINK START Bongabon FEED ZONE Guimba FINISH Talaberaalavera San Luis GeronaKOM COURSE COURSE PALAYAN CITY NEUTRAL ZONE Cabanatuan Tarlac City City Dingalan 3 Capas Gapan City Mabalacat San Miguel Angeles 2 San Fernando Baliuag General Nakar Malolos 1 City of Balanga Manila Bay QUEZON CITY Manila Makati Parañaque 24 Untitled-1 24 17/05/2018 7:31 PM STAGE 1 STAGE 1 PROFILE Quezon City - Palayan City | 157.15 km Sunday | 20 May 2018 ELEVATION KM 131.42 1 KM 53.13 2 KM 101.65 3 Elevation (m) 1 KM 29.29 King of the Mountain Sprint 0 km RACE ACTIVITIES 5 km 5 km to finish 4:30 a.m. Race facilities crew on site 5:30 a.m. Security on site STAGE PROFILE 6:30 a.m. Race staff on site 6:45 a.m. Public address on 157.15 km 7:00 a.m. Teams arrive 0800H 7:10 a.m. Signing on opens Liwasang Aurora Fountain Quezon City 7:30 a.m. Signing on closes 1230H 7:40 a.m. Riders assemble on start line KM Post 130, 8:00 a.m. Le Tour de Filipinas departs Nueva Ecija-Aurora Road Palayan City, Nueva Ecija 8:30 a.m. Road closure ends 25 Untitled-1 25 17/05/2018 7:31 PM STAGE 1 STAGE 1 SCHEDULE START LOCATION : Liwasang Aurora, Quezon City Memorial Park FINISH LOCATION : Plaza Concepcion, Palayan City, Nueva Ecija NEUTRALIZED ZONE : 9.61 km DEPARTURE : 08:00:00 RACE DESCRIPTION FROM TO FEATURE INSTRUCTION DESCRIPTION ESTIMATED TIME OF ARRIVAL (kph) START FINISH 35 40 45 0.00 9.61 START GANTRY -

52083-002: Malolos-Clark Railway Project (PFR 1)

Environmental Monitoring Report Semi-annual Environmental Monitoring Report No. 1 March 2020 PHI: Malolos-Clark Railway Project – Tranche 1 Volume II September 2019 – March 2020 Prepared by the Project Management Office (PMO) of the Department of Transportation (DOTr) for the Government of the Republic of the Philippines and the Asian Development Bank. CURRENCY EQUIVALENTS (as of 30 March 2020) Currency unit – Philippine Peso (PHP) PHP1.00 = $0.02 $1.00 = PHP50.96 ABBREVIATIONS ADB – Asian Development Bank BMB – Biodiversity Management Bureau Brgy – Barangay CCA – Climate Change Adaptation CCC – Climate Change Commission CDC – Clark Development Corporation CEMP – Contractor’s Environmental Management Plan CENRO – City/Community Environment and Natural Resources Office CIA – Clark International Airport CIAC – Clark International Airport Corporation CLLEx – Central Luzon Link Expressway CLUP – Comprehensive Land Use Plan CMR – Compliance Monitoring Report CMVR – Compliance Monitoring and Validation Report CNO – Certificate of No Objection CPDO – City Planning and Development Office DAO – DENR Administrative Order DD / DED – Detailed Design Stage / Detailed Engineering Design Stage DENR – Department of Environment and Natural Resources DepEd – Department of Education DIA – Direct Impact Area DILG – Department of Interior and Local Government DOH – Department of Health DOST – Department of Science and Technology DOTr – Department of Transportation DPWH – Department of Public Works and Highways DSWD – Department of Social Welfare and Development -

Store Store Business Address Business Center Location Inside

Business Center Location Store Store Business Address inside Robinsons Department Store 1 RDS RP Ermita Robinsons Place, M. Adriatico St., Ermita, Manila 1000 Midtown Wing Level 1 near Ladies Shoes Section RDS Tutuban 2 Tutuban Center, Loop Road West, C.M. Recto, Tondo, Manila 1012 Level 2 beside Luggage Section Center Mall RDS Festival Mall 3 Filinvest Alabang, Muntinlupa City Level 2 beside Snacks and Toys Section Alabang 4 RDS RP Pioneer EDSA corner Pioneer St., Mandaluyong City Level 2 beside Intimate Apparel Section 5 RDS RP Magnolia UG, Level 2 &3, Aurora Boulevard, New Manila, Q.C. Upper Ground Floor Near Men’s Furnishing Section RDS Victoria Mall 6 3rd Floor Galeria Victoria Bldg JP Rizal Balanga City, Bataan Level 3 beside Toys and Infants’ Wear Section Bataan 7 RDS RP Santiago Maharlika Hi-way, Brgy Mabini, Santiago City, Isabela Level 1 beside Luggage section 8 RDS RP Imus Aguinaldo Highway, Imus, Cavite Level 2 near Luggage and Mens Accessories Section RDS RP Level 1 near West Entrance, Gapan-Olangapo Road Brgy. San Jose, San 9 Level 1 near West Entrance Pampanga Fernando Pampanga Robinsons Town Mall, Lopez Avenue, Batong Malake, Los Baños, Laguna 10 RDS RP Los Banos Level 2 beside gift-wrapping section 4030 RDS Nepomall 11 St. Joseph Cor Dona Teresa St Sto Rosario Angeles City, Pampanga Level 2 beside Athletic Shoes Section Angeles 12 RDS RP Lipa Mataas na Lupa, Lipa City Level 1 near Luggage Area and Plasticware Section RDS RP 13 Km 111 Maharlika Highway, Cabanatuan City Level 2 beside Luggage Section Cabanatuan RDS RP Ilocos 14 Brgy. -

Malolos-Clark Railway Project Department SERD/SETC /Division Country Philippines Executing Agency Department of Borrower Republic of the Philippines Transportation 2

Report and Recommendation of the President to the Board of Directors Project Number: 52083-001 April 2019 Proposed Multitranche Financing Facility Republic of the Philippines: Malolos–Clark Railway Project Distribution of this document is restricted until it has been approved by the Board of Directors. Following such approval, ADB will disclose the document to the public in accordance with ADB’s Access to Information Policy. CURRENCY EQUIVALENTS (as of 25 March 2019) Currency unit – Philippine Peso (₱) ₱1.00 = $0.0190 $1.00 = ₱52.56 ABBREVIATIONS ADB – Asian Development Bank ASEAN – Association of Southeast Asian Nations BBB – Build, Build, Build CIA – Clark International Airport CPS – country partnership strategy DOTr – Department of Transportation EIA – environmental impact assessment EMP – environmental management plan FAM – facility administration manual GDP – gross domestic product ha – hectare IPIF – Infrastructure Preparation and Innovation Facility JICA – Japan International Cooperation Agency km – kilometer LRT – Light Rail Transit MFF – multitranche financing facility MRT – Metro Rail Transit NAIA – Ninoy Aquino International Airport NCR – National Capital Region NEDA – National Economic and Development Authority NSCR – North–South Commuter Railway O&M – operation and maintenance PDP – Philippine Development Plan PMO – project management office PNR – Philippine National Railways RAP – resettlement action plan RIPPF – resettlement and indigenous peoples planning framework TA – technical assistance NOTES (i) The fiscal year (FY) -

Uimersity Mcrofihns International

Uimersity Mcrofihns International 1.0 |:B litt 131 2.2 l.l A 1.25 1.4 1.6 MICROCOPY RESOLUTION TEST CHART NATIONAL BUREAU OF STANDARDS STANDARD REFERENCE MATERIAL 1010a (ANSI and ISO TEST CHART No. 2) University Microfilms Inc. 300 N. Zeeb Road, Ann Arbor, MI 48106 INFORMATION TO USERS This reproduction was made from a copy of a manuscript sent to us for publication and microfilming. While the most advanced technology has been used to pho tograph and reproduce this manuscript, the quality of the reproduction Is heavily dependent upon the quality of the material submitted. Pages In any manuscript may have Indistinct print. In all cases the best available copy has been filmed. The following explanation of techniques Is provided to help clarify notations which may appear on this reproduction. 1. Manuscripts may not always be complete. When It Is not possible to obtain missing pages, a note appears to Indicate this. 2. When copyrighted materials are removed from the manuscript, a note ap pears to Indicate this. 3. Oversize materials (maps, drawings, and charts) are photographed by sec tioning the original, beginning at the upper left hand comer and continu ing from left to right In equal sections with small overlaps. Each oversize page Is also filmed as one exposure and Is available, for an additional charge, as a standard 35mm slide or In black and white paper format. * 4. Most photographs reproduce acceptably on positive microfilm or micro fiche but lack clarify on xerographic copies made from the microfilm. For an additional charge, all photographs are available In black and white standard 35mm slide format.* *For more information about black and white slides or enlarged paper reproductions, please contact the Dissertations Customer Services Department. -

List of Licensed Covid-19 Testing Laboratory in the Philippines

LIST OF LICENSED COVID-19 TESTING LABORATORY IN THE PHILIPPINES ( as of November 26, 2020) OWNERSHIP MUNICIPALITY / NAME OF CONTACT LICENSE REGION PROVINCE (PUBLIC / TYPE OF TESTING # CITY FACILITY NUMBER VALIDITY PRIVATE) Amang Rodriguez 1 NCR Metro Manila Marikina City Memorial Medical PUBLIC Cartridge - Based PCR 8948-0595 / 8941-0342 07/18/2020 - 12/31/2020 Center Asian Hospital and 2 NCR Metro Manila Muntilupa City PRIVATE rRT PCR (02) 8771-9000 05/11/2020 - 12/31/2020 Medical Center Chinese General 3 NCR Metro Manila City of Manila PRIVATE rRT PCR (02) 8711-4141 04/15/2020 - 12/31/2020 Hospital Detoxicare Molecular 4 NCR Metro Manila Mandaluyong City PRIVATE rRT PCR (02) 8256-4681 04/11/2020 - 12/31/2020 Diagnostics Laboratory Dr. Jose N. Rodriguez Memorial Hospital and (02) 8294-2571; 8294- 5 NCR Metro Manila Caloocan City PUBLIC Cartridge - Based PCR 08/13/2020 - 12/31/2020 Sanitarium 2572 ; 8294-2573 (GeneXpert)) Lung Center of the 6 NCR Metro Manila Quezon City PUBLIC rRT PCR 8924-6101 03/27/2020 - 12/31/2020 Philippines (LCP) Lung Center of the 7 NCR Metro Manila Quezon City Philippines PUBLIC Cartridge - Based PCR 8924-6101 05/06/2020 - 12/31/2020 (GeneXpert) Makati Medical Center 8 NCR Metro Manila Makati City PRIVATE rRT PCR (02) 8888-8999 04/11/2020 - 12/31/2020 (HB) Marikina Molecular 9 NCR Metro Manila Marikina City PUBLIC rRT PCR 04/30/2020 - 12/31/2020 Diagnostic laboratory Philippine Genome 10 NCR Metro Manila Quezon City Center UP-Diliman PUBLIC rRT PCR 8981-8500 Loc 4713 04/23/2020 - 12/31/2020 (NHB) Philippine Red Cross - (02) 8790-2300 local 11 NCR Metro Manila Mandaluyong City PRIVATE rRT PCR 04/23/2020 - 12/31/2020 National Blood Center 931/932/935 Philippine Red Cross - 12 NCR Metro Manila City of Manila PRIVATE rRT PCR (02) 8527-0861 04/14/2020 - 12/31/2020 Port Area Philippine Red Cross 13 NCR Metro Manila Mandaluyong City Logistics and PRIVATE rRT PCR (02) 8790-2300 31/12/2020 Multipurpose Center Research Institute for (02) 8807-2631; (02) 14 NCR Metro Manila Muntinlupa City Tropical Medicine, Inc. -

A. MINING TENEMENT APPLICATIONS 1. Under Process (Returned Pursuant to the Pertinent Provisions of Section 4 of EO No

ANNEX B Page 1 of 105 MINES AND GEOSCIENCES BUREAU REGIONAL OFFICE NO. VII MINING TENEMENTS STATISTICS REPORT FOR MONTH OF MAY, 2017 ANNEX B - MINERAL PRODUCTION SHARING AGREEMENT (MPSA) TENEMENT HOLDER/ LOCATION line PRESIDENT/ CHAIRMAN OF AREA PREVIOUS TENEMENT NO. ADDRESS/FAX/TEL. NO. DATE FILED COMMODITY REMARKS no. THE BOARD/CONTACT (has.) Barangay/s Mun./City Province HOLDER PERSON A. MINING TENEMENT APPLICATIONS 1. Under Process (Returned pursuant to the pertinent provisions of Section 4 of EO No. 79) 1.1. By the Regional Office 25th Floor, Petron Mega Plaza 358 Sen. Gil Puyat Ave., Makati City Apo Land and Quarry Corporation Cebu Office: Mr. Paul Vincent Arcenas - President Tinaan, Naga, Cebu Contact Person: Atty. Elvira C. Contact Nos.: Bairan Naga City Apo Cement 1 APSA000011VII Oquendo - Corporate Secretary and 06/03/1991 10/02/2009 240.0116 Cebu Limestone Returned on 03/31/2016 (032)273-3300 to 09 Tananas San Fernando Corporation Legal Director FAX No. - (032)273-9372 Mr. Gery L. Rota - Operations Manila Office: Manager (Cebu) (632)849-3754; FAX No. - (632)849- 3580 6th Floor, Quad Alpha Centrum, 125 Pioneer St., Mandaluyong City Tel. Nos. Atlas Consolidated Mining & Cebu Office (Mine Site): 2 APSA000013VII Development Corporation (032) 325-2215/(032) 467-1408 06/14/1991 01/11/2008 287.6172 Camp-8 Minglanilla Cebu Basalt Returned on 03/31/2016 Alfredo C. Ramos - President FAX - (032) 467-1288 Manila Office: (02)635-2387/(02)635-4495 FAX - (02) 635-4495 25th Floor, Petron Mega Plaza 358 Sen. Gil Puyat Ave., Makati City Apo Land and Quarry Corporation Cebu Office: Mr.