Download the Full GTC ONE Minute Brief

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

On the Shoulders of Struggle, Memoirs of a Political Insider by Dr

On the Shoulders of Struggle: Memoirs of a Political Insider On the Shoulders of Struggle: Memoirs of a Political Insider Dr. Obert M. Mpofu Dip,BComm,MPS,PhD Contents Preface vi Foreword viii Commendations xii Abbreviations xiv Introduction: Obert Mpofu and Self-Writing in Zimbabwe xvii 1. The Mind and Pilgrimage of Struggle 1 2. Childhood and Initiation into Struggle 15 3. Involvement in the Armed Struggle 21 4. A Scholar Combatant 47 5. The Logic of Being ZANU PF 55 6. Professional Career, Business Empire and Marriage 71 7. Gukurahundi: 38 Years On 83 8. Gukurahundi and Selective Amnesia 97 9. The Genealogy of the Zimbabwean Crisis 109 10. The Land Question and the Struggle for Economic Liberation 123 11. The Post-Independence Democracy Enigma 141 12. Joshua Nkomo and the Liberation Footpath 161 13. Serving under Mugabe 177 14. Power Struggles and the Military in Zimbabwe 205 15. Operation Restore Legacy the Exit of Mugabe from Power 223 List of Appendices 249 Preface Ordinarily, people live to either make history or to immortalise it. Dr Obert Moses Mpofu has achieved both dimensions. With wanton disregard for the boundaries of a “single story”, Mpofu’s submission represents a construction of the struggle for Zimbabwe with the immediacy and novelty of a participant. Added to this, Dr Mpofu’s academic approach, and the Leaders for Africa Network Readers’ (LAN) interest, the synergy was inevitable. Mpofu’s contribution, which philosophically situates Zimbabwe’s contemporary politics and socio-economic landscape, embodies LAN Readers’ dedication to knowledge generation and, by extension, scientific growth. -

Anc Today Voice of the African National Congress

ANC TODAY VOICE OF THE AFRICAN NATIONAL CONGRESS 14 – 20 May 2021 Conversations with the President South Africa waging a struggle that puts global solidarity to the test n By President Cyril Ramaphosa WENTY years ago, South In response, representatives of massive opposition by govern- Africa was the site of vic- the pharmaceutical industry sued ment and civil society. tory in a lawsuit that pitted our government, arguing that such public good against private a move violated the Trade-Relat- As a country, we stood on princi- Tprofit. ed Aspects of Intellectual Property ple, arguing that access to life-sav- Rights (TRIPS). This is a compre- ing medication was fundamental- At the time, we were in the grip hensive multilateral agreement on ly a matter of human rights. The of the HIV/Aids pandemic, and intellectual property. case affirmed the power of trans- sought to enforce a law allowing national social solidarity. Sev- us to import and manufacture The case, dubbed ‘Big Pharma eral developing countries soon affordable generic antiretroviral vs Mandela’, drew widespread followed our lead. This included medication to treat people with international attention. The law- implementing an interpretation of HIV and save lives. suit was dropped in 2001 after the World Trade Organization’s Closing remarks by We are embracing Dear Mr President ANC President to the the future! Beware of the 12 NEC meeting wedge-driver: 4 10 Unite for Duma Nokwe 2 ANC Today CONVERSATIONS WITH THE PRESIDENT (WTO) Agreement on Trade-Re- ernment announced its support should be viewed as a global pub- lated Aspects of Intellectual Prop- for the proposal, which will give lic good. -

Education and Training, Health and Science and Technology

1 ANC Today VOTE ANC 33 VOICE OF THE AFRICAN NATIONAL CONGRESS DAYS LEFT 05 -11 April 2019 Conversations with the President Guest Feature: Cde Naledi Pandor Minister of Higher Education Education and Training, Health and Science and Technology e ready ourselves to celebrate available to our government and country. and commemorate many It provides details of how we will further fallen heroes, heroines and Throughout this manifesto improve the lives of South Africans with your stalwarts of our movement. full support and mandate. We extoll several leaders we have emphasised that When the President of the African National who fell in April. Their Congress, Comrade Cyril Ramaphosa, launched memory and contribution are imprinted on our ours is your plan. It is by the 2019 ANC National Election Manifesto movement’sW history. They are and will always at the Moses Mabhida Stadium in eThekwini be leaders of the African National Congress on Saturday, 12 January, he described the and we shall mark their undying contribution all of us and about all of manifesto as A People’s Plan for a Better throughout the month of April. Life for All! We recall Comrade Oliver Reginald Tambo, us, South Africans, Black We are here today to speak to you and to the Cde Chris Hani, Cde Mama Charlotte Maxeke, nation about this People’s Plan with special Comrade Winne Mandela, Cde Braam Fisher, and White, young and old, focus on Basic Education, Higher Education Cde Molefi Sefularo and many others. and Training, Health Science and Technology. The election manifesto of the ANC makes the rural and urban. -

Report of the 54Th National Conference Report of the 54Th National Conference

REPORT OF THE 54TH NATIONAL CONFERENCE REPORT OF THE 54TH NATIONAL CONFERENCE CONTENTS 1. Introduction by the Secretary General 1 2. Credentials Report 2 3. National Executive Committee 9 a. Officials b. NEC 4. Declaration of the 54th National Conference 11 5. Resolutions a. Organisational Renewal 13 b. Communications and the Battle of Ideas 23 c. Economic Transformation 30 d. Education, Health and Science & Technology 35 e. Legislature and Governance 42 f. International Relations 53 g. Social Transformation 63 h. Peace and Stability 70 i. Finance and Fundraising 77 6. Closing Address by the President 80 REPORT OF THE 54TH NATIONAL CONFERENCE 1 INTRODUCTION BY THE SECRETARY GENERAL COMRADE ACE MAGASHULE The 54th National Conference was convened under improves economic growth and meaningfully addresses the theme of “Remember Tambo: Towards inequality and unemployment. Unity, Renewal and Radical Socio-economic Transformation” and presented cadres of Conference reaffirmed the ANC’s commitment to our movement with a concrete opportunity for nation-building and directed all ANC structures to introspection, self-criticism and renewal. develop specific programmmes to build non-racialism and non-sexism. It further directed that every ANC The ANC can unequivocally and proudly say that we cadre must become activists in their communities and emerged from this conference invigorated and renewed drive programmes against the abuse of drugs and to continue serving the people of South Africa. alcohol, gender based violence and other social ills. Fundamentally, Conference directed every ANC We took fundamental resolutions aimed at radically member to work tirelessly for the renewal of our transforming the lives of the people for the better and organisation and to build unity across all structures. -

Zuma's Cabinet Reshuffles

Zuma's cabinet reshuffles... The Star - 14 Feb 2018 Switch View: Text | Image | PDF Zuma's cabinet reshuffles... Musical chairs reach a climax with midnight shakeup LOYISO SIDIMBA [email protected] HIS FIRST CABINET OCTOBER 2010 Communications minister Siphiwe Nyanda replaced by Roy Padayachie. His deputy would be Obed Bapela. Public works minister Geoff Doidge replaced by Gwen MahlanguNkabinde. Women, children and people with disabilities minister Noluthando MayendeSibiya replaced by Lulu Xingwana. Labour minister Membathisi Mdladlana replaced by Mildred Oliphant. Water and environmental affairs minister Buyelwa Sonjica replaced by Edna Molewa. Public service and administration minister Richard Baloyi replaced by Ayanda Dlodlo. Public enterprises minister Barbara Hogan replaced by Malusi Gigaba. His deputy became Ben Martins. Sport and recreation minister Makhenkesi Stofile replaced by Fikile Mbalula. Arts and culture minister Lulu Xingwana replaced by Paul Mashatile. Social development minister Edna Molewa replaced by Bathabile Dlamini. OCTOBER 2011 Public works minister Gwen MahlanguNkabinde and her cooperative governance and traditional affairs counterpart Sicelo Shiceka are axed while national police commissioner Bheki Cele is suspended. JUNE 2012 Sbu Ndebele and Jeremy Cronin are moved from their portfolios as minister and deputy minister of transport respectively Deputy higher education and training minister Hlengiwe Mkhize becomes deputy economic development minister, replacing Enoch Godongwana. Defence minister Lindiwe Sisulu moves to the Public Service and Administration Department, replacing the late Roy Padayachie, while Nosiviwe MapisaNqakula moves to defence. Sindisiwe Chikunga appointed deputy transport minister, with Mduduzi Manana becoming deputy higher education and training minister. JULY 2013 Communications minister Dina Pule is fired and replaced with former cooperative government and traditional affairs deputy minister Yunus Carrim. -

Official Newspaper of the Parliament of the Republic of South Africa Vol 03

Vol 03 Official newspaper of the Parliament of the Republic of South Africa Issue 01 PARLIAMENT OF THE REPUBLIC OF SOUTH AFRICA www.parliament.gov.za parliamentofrsa 2 INSESSION NEWS independent property owners Parliament commits to Freedom Day – we must without male representation continue making South Africa and allows former residents a better country to live in for of apartheid homelands to all. Freedom was attained be free from poverty, benefit equally, like all South through bloodshed and great Africans, from land ownership sacrifices, and we must make conversions. it count for all South Africans. unemployment, racism Our task is to ensure that On this day, through the all our people enjoy their & sexism instruments at our disposal freedom with dignity. under the Constitution, The Presiding Officers (POs) of Parliament, the Speaker of the National Assembly (NA) Ms Thandi Modise and the Chairperson of the National Council of Province (NCOP) Mr Amos Masondo, joined South Africans in commemorating Freedom Day in April. Mr Nelson Mandela, Former President of South Africa Ms Thandi Modise, Speaker of the NA & Mr Amos Masondo, NCOP Chairperson “NEVER, NEVER AND NEVER AGAIN SHALL IT BE THAT THIS On 27 April in 1994, 27 years faster than ever before. BEAUTIFUL LAND WILL AGAIN ago, millions of South Africans Freedom and security of the cast their votes in the first Parliament will continuously person, freedom of religion, EXPERIENCE THE OPPRESSION OF democratic elections as equals sharpen its constitutional belief and opinion, freedom ONE BY ANOTHER.” to select the government of oversight role in fighting of expression, and freedom their choice. -

Campaign to Force out Mugabe Escalates in Zimbabwe

Campaign to Force Out Mugabe Escalates in Zimbabwe By Chris Marsden Region: sub-Saharan Africa Global Research, November 19, 2017 Theme: History World Socialist Web Site 18 November 2017 Zimbabwe’s war veterans’ association is staging a march today through the capital, Harare, demanding the resignation of President Robert Mugabe. Tens of thousands are expected to take part after all ten of the country’s provincial Zimbabwe African National Union–Patriotic Front (ZANU-PF) branches passed motions of no confidence in Mugabe. Mugabe refused to step down yesterday and was briefly released from house arrest to make his first public appearance since the army staged a palace coup early Wednesday. His appearance in the role of chancellor of the Open University at a graduation ceremony in Harare was designed to lend an appearance of normalcy to an enforced transition of power to the faction of the ruling ZANU-PF led by its former vice president, Emmanuel Mnangagwa. The president’s wife, Grace Mugabe, was not present at the ceremony. Mugabe, now 93, sacked Mnangagwa last week to pave the way for Grace Mugabe, 52, to assume power. She heads the G40 faction of younger bourgeois layers in the ruling elite. The army, under the leadership of the Zimbabwe Defence Forces commander,General Constantino Chiwenga, moved to back Mnangagwa and call a halt to efforts by Mugabe to sideline or remove from office members of the old guard tied to the military. The military issued statements via Zimbabwe state media stressing their respect for Mugabe and citing progress in talks “with the Commander-in-Chief President Robert Mugabe on the way forward.” But the talks are being held at gunpoint and a senior member of ZANU-PF warned, “If he becomes stubborn, we will arrange for him to be fired on Sunday… When that is done, it’s impeachment on Tuesday.” The chairman of the war veterans’ association, Chris Mutsvangwa, a key ally of Mnangagwa, has been at the forefront of demands for Mugabe to go, and go quickly. -

Unrevised Hansard National Assembly Tuesday, 27

UNREVISED HANSARD NATIONAL ASSEMBLY TUESDAY, 27 OCTOBER 2020 Page: 1 TUESDAY, 27 OCTOBER 2020 ____ PROCEEDINGS OF THE NATIONAL ASSEMBLY ____ The House met at 14:00. The House Chairperson, Ms M G Boroto, took the Chair and requested members to observe a moment of silence for prayer or meditation. CONSIDERATION OF REPORT OF AD HOC COMMITTEE ON APPOINTMENT OF AUDITOR-GENERAL OF SOUTH AFRICA The HOUSE CHAIRPERSON (Ms M G Boroto): Hon members, in the interest of safety for all in the Chamber, please keep your mask on and sit at your designated areas. Already I can see some who are not sitting at their designated areas. Please try to ... Sepedi: Mokone! O batametše kudu. Agaa, Mokone nke o šute gannyane. English: UNREVISED HANSARD NATIONAL ASSEMBLY TUESDAY, 27 OCTOBER 2020 Page: 2 The second issue is that we request every member to sign the attendance slips. Can somebody assist Mokone where to sit? Thank you. Ms N G TOLASHE: Hon House Chair, it is an honour for me to stand before this House to table the report of the Ad hoc Committee on the Appointment of the Auditor-General of SA. As you will recall, some few months ago this House resolved to establish an Ad hoc Committee on the Appointment of the Auditor-General of SA. The committee was then mandated to nominate a person in terms of section 193 of the Constitution for the appointment of the Auditor-General. It was further mandated to report to the House on the nomination of such a person. It was not easy to execute such a unique and momentous task amidst the risk of a pandemic that is still ravaging our country. -

Week Group a 1. Dr Mathole Motshekga 2. Ms Dibolelo Mahlatsi

2 March 2020 Week Group A Group B 1. Dr Mathole Motshekga 1. Adv. Bongani Bongo 2. Ms Dibolelo Mahlatsi 2. Ms Regina Lesoma 3. Inkosi ZMD Mandela 3. Mr Sibusiso Gumede 4. Ms Nolitha Ntobongwana 4. Mr PR Moroatshehla 5. Dr Mimmy Gondwe 5. Ms Thandeka Mbabama 6. Mr Julius Malema 6. Mr Floyd Shivambu 7. Inkosi EM Buthelezi 8. Mr Wayne Thring Province Venue Province Venue North-West KwaZulu-Natal Group a departs on 5 March and Group B departs on 4 March 5 March Mtubatuba Inkosi Mzondeni Civic Centre 14:00 6 March Schweizer Reneke Extension 5 Ipelegeng Community Vryheid Cecil Emmett Hall 14:00 Hall. 7 March Mahikeng/Mafikeng Civic Centre Winterton Khethani Community Hall 11:00 8 March Potchefstroom Mandela Banquet Hall Kokstad Kokstad Town Hall 11:00 Gauteng Eastern Cape Both groups depart on 11 March 12 March Pretoria Venue to be confirmed Tsolo Tsolo Town Hall 14:00 13 March Westonaria Westonaria Banquet Hall Engcobo Indoor Sports centre 14:00 14 March Vereeniging Vereeniging City Hall King William’ s War Memorial 11:00 Town 15 March Ekurhuleni Germiston City Hall PE (Motherwell) Raymond Mhlaba Hall 11:00 (17-19 March) Western Cape Parliament Parliament No hearings on weekend due to Human Rights Day Limpopo Northern Cape Group A departs on 25 March. Group B on 25 March 26 March Vhembe Thohoyandou Main Hall 14:00 27 March Capricorn Westenburg Community Hall Kimberley Venue to be confirmed 14:00 28 March Mopani Relela Community Hall Upington Venue to be confirmed 11:00 29 March Sekhukhune Jane Furse Comprehensive Hall Springbok Venue to be confirmed 11:00 Western Cape 3 April Khayelitsha Venue to be confirmed Khayelitsha Venue to be confirmed 4 April Mossel Bay Venue to be confirmed Saldanha Venue to be confirmed 5 April Worcester Worcester Town Hall Citrusdal Venue to be confirmed . -

Unrevised Hansard

UNREVISED HANSARD JOINT SITTING MONDAY, 19 FEBRUARY 2018 Page: 1 MONDAY, 19 FEBRUARY 2018 ____ PROCEEDINGS AT JOINT SITTING ____ Members of the National Assembly and the National Council of Provinces assembled in the Chamber of the National Assembly at 10:06. The Speaker took the Chair and requested members to observe a moment of silence for prayers or meditation. PASSING ON OF MEMBERS OF PARLIAMENT (Announcement) The SPEAKER: Hon members, during the recess period we learnt of the passing on of Mr Laloo Chiba, a former Member of Parliament, MP. We convey our condolences to the Chiba family. UNREVISED HANSARD JOINT SITTING MONDAY, 19 FEBRUARY 2018 Page: 2 We have also learnt with shock of the passing on last night of Ms Beatrice Ngcobo, a serving MP in the National Assembly since 2005. She did not recover after undergoing an operation in early February. We will now request hon members to stand and observe a moment of silence in memory of our former members. Thank you. Please be seated. Condolence motions in respect of our former colleagues will be considered at the appropriate time. We have also learnt of the passing on, after a short illness, of Mrs Connie Bapela, the wife of Deputy Minister Obed Bapela. We convey our condolences to the Bapela family. MASEKELA FAMILY MESSAGE OF THANKS (Announcement) The SPEAKER: Hon Members, I have received a copy of the President’s address delivered at the Joint Sitting on UNREVISED HANSARD JOINT SITTING MONDAY, 19 FEBRUARY 2018 Page: 3 16 February 2018. The speech has been printed in the minutes of the Joint Sitting. -

Joe Mcgluwa Response to Home Affairs Budget

Department of Home Affairs riddled by mismanagement has spent millions in legal fees By Joe McGluwa MP – DA Shadow Minister of Home Affairs Speaker, The Constitutional Court, like all South Africans, has instructed the State and, in this case, the Department of Home Affairs (DHA), to uphold the dignity of South African citizens and their families. The former Minister of State Security, Honourable Bongani Bongo, should therefore not have been allowed to participate in this budget speech here today because of all the numerous allegations of corruption and bribery against him. Last week, the Court gave the Department two years to amend foreign spousal visa laws which require foreign spouses or children of South African citizens to leave the country to renew their visas. Though this is a significant victory. The challenge will, however, remain if the Department takes its own time to fix legislation that could result in the separation of foreign spouses from their families, and once again making refugees and asylum seekers the scapegoats of the Department of Home Affairs’ failures The corruption, bribery, wrongful and unnecessary rejections, and the delaying tactics on the part of officials at Home Affairs have resulted in several frivolous court cases, Honourable Bongo. The Deputy Minister Njabulo Nzuza, has been tasked with overseeing and driving three “distinct” areas of operation within the Department namely Refugee and Asylum Seekers Management, the Moetapele improvement campaign, and Legal Services. When it comes to Legal Services, however, the Constitutional Court on many occasions described your Department’s litigation as obstructive, floppy, shocking with no conscious towards refugees and asylum seekers, Honourable Deputy Minister. -

State Capture Shadow Looms Large in Parliament

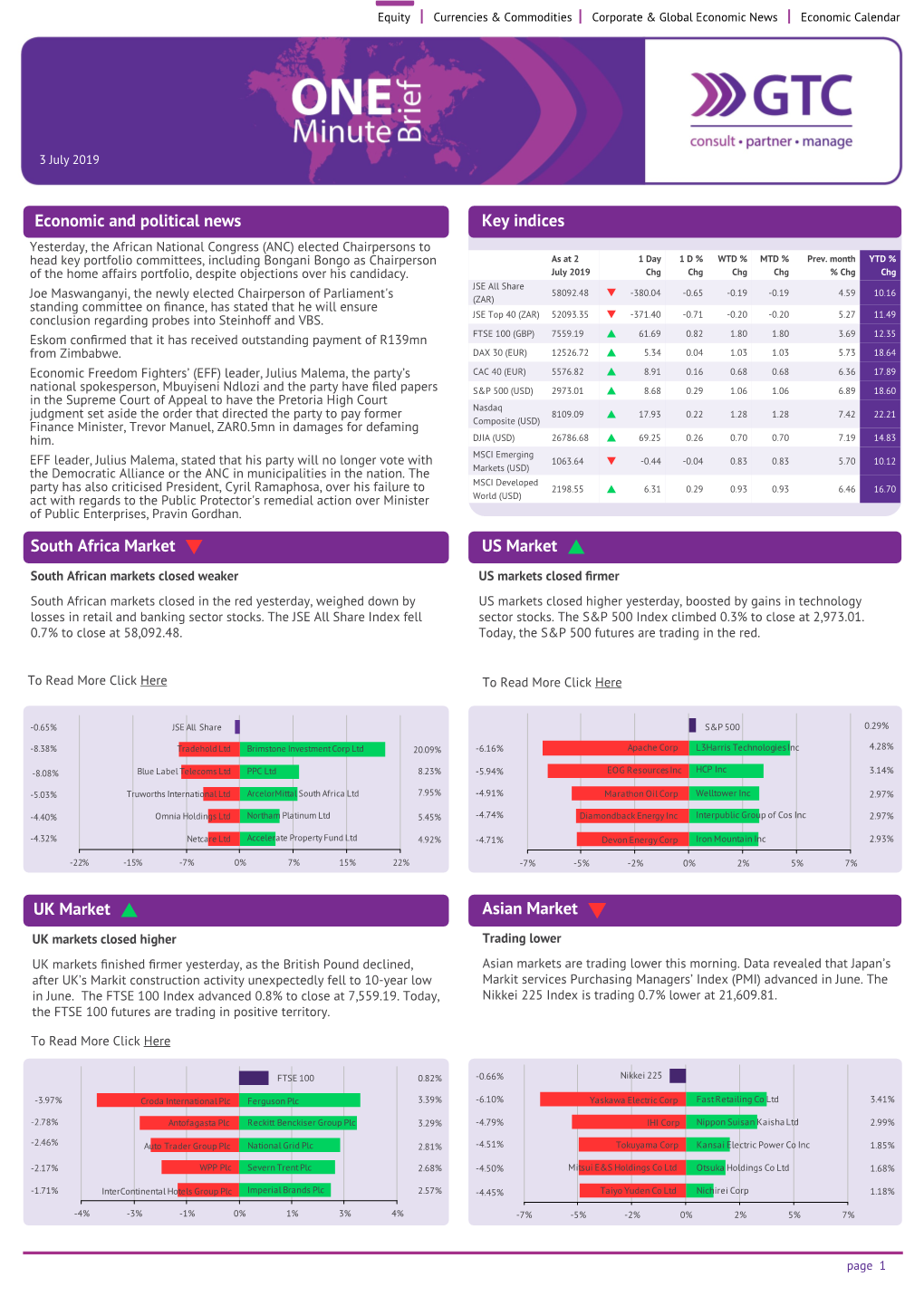

Legalbrief | your legal news hub Thursday 30 September 2021 State capture shadow looms large in Parliament The shadow of former President Jacob Zuma looms large in the sixth SA Parliament following yesterday’s delayed announcement of the ANC choices to head various committees, notes Legalbrief. Several former Zuma Cabinet Ministers and others implicated in state capture, either at the Zondo Commission or through the Gupta leaks e-mails, have the backing of the party, raising questions about the seriousness of the promised ‘new dawn’ by President Cyril Ramaphosa. ANC Chief Whip Pemmy Majodina and secretary-general Ace Magashule denied the list of nominations for committee chairpersons – the full list is published in a News24 report online – is the outcome of a factional balancing act. The nominations were announced yesterday after an ANC caucus meeting. MPs and former Ministers during Zuma's administration, who are seemingly resistant to rooting out state capture, will chair some committees. ‘When we approach deployment, we don't approach deployment in a factional manner,’ Majodina said. ‘Because deployed here are members of the ANC who came out of the process of the list conference,’ she added. Zuma stalwarts who will head National Assembly committees include former Communications Minister Faith Muthambi as chairperson designate for the Committee on Co-operative Governance & Traditional Affairs; Mosebenzi Zwane, the former Mineral Resources Minister, who will chair the Transport Committee; former Energy Minister Tina Joemat-Pettersson, who is set to chair the Police Committee; Bongani Bongo, as Home Affairs Committee chairperson; Sifiso Buthelezi, who will head the Appropriations Committee; Joe Maswanganyi (Standing Committee on Finance); and Supra Mahumapelo, (Tourism Committee).