Capitaland Group Presentation Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Clinics in Downtown Core Open on Friday 24 Jan 2020

LIST OF CLINICS IN DOWNTOWN CORE OPEN ON FRIDAY 24 JAN 2020 POSTAL S/N NAME OF CLINIC BLOCK STREET NAME LEVEL UNIT BUILDING TEL OPENING HOURS CODE 1 ACUMED MEDICAL GROUP 16 COLLYER QUAY 02 03 INCOME AT RAFFLES 049318 65327766 8.30AM-12.30PM 2 AQUILA MEDICAL 160 ROBINSON ROAD 05 01 SINGAPORE BUSINESS FEDERATION CENTER 068914 69572826 11.00AM- 8.00PM 3 AYE METTA CLINIC PTE. LTD. 111 NORTH BRIDGE ROAD 04 36A PENINSULA PLAZA 179098 63370504 2.30PM-7.00PM 4 CAPITAL MEDICAL CENTRE 111 NORTH BRIDGE ROAD 05 18 PENINSULA PLAZA 179098 63335144 4.00PM-6.30PM 5 CITYHEALTH CLINIC & SURGERY 152 BEACH ROAD 03 08 GATEWAY EAST 189721 62995398 8.30AM-12.00PM 6 CITYMED HEALTH ASSOCIATES PTE LTD 19 KEPPEL RD 01 01 JIT POH BUILDING 089058 62262636 9.00AM-12.30PM 7 CLIFFORD DISPENSARY PTE LTD 77 ROBINSON ROAD 06 02 ROBINSON 77 068896 65350371 9.00AM-1.00PM 8 DA CLINIC @ ANSON 10 ANSON ROAD 01 12 INTERNATIONAL PLAZA 079903 65918668 9.00AM-12.00PM 9 DRS SINGH & PARTNERS, RAFFLES CITY MEDICAL CENTRE 252 NORTH BRIDGE RD 02 16 RAFFLES CITY SHOPPING CENTRE 179103 63388883 9.00AM-12.30PM 10 DRS THOMPSON & THOMSON RADLINK MEDICARE 24 RAFFLES PLACE 02 08 CLIFFORD CENTRE 048621 65325376 8.30AM-12.30PM 11 DRS. BAIN + PARTNERS 1 RAFFLES QUAY 09 03 ONE RAFFLES QUAY - NORTH TOWER 048583 65325522 9.00AM-11.00AM 12 DTAP @ DUO MEDICAL CLINIC 7 FRASER STREET B3 17/18 DUO GALLERIA 189356 69261678 9.00AM-3.00PM 13 DTAP @ RAFFLES PLACE 20 CECIL STREET 02 01 PLUS 049705 69261678 8.00AM-3.00PM 14 FULLERTON HEALTH @ OFC 10 COLLYER QUAY 03 08/09 OCEAN FINANCIAL CENTRE 049315 63333636 -

For Immediate Release NEWS RELEASE

For immediate release NEWS RELEASE CapitaLand celebrates milestone in sustainability journey with official opening of CapitaGreen One of Singapore CBD’s greenest office developments wins widespread support from tenants and community Singapore, 9 September 2015 – CapitaGreen, the landmark premium office development in Singapore’s Central Business District (CBD) was officially opened today. Through the use of innovative construction technologies, ‘design-and-build’ methods and streamlined work processes, CapitaGreen was completed in 36 months, compared to the industry average of 40-42 months it would take to complete a building of this scale. With its striking green façade and rooftop wind scoop which contributes to cooling the building naturally, CapitaGreen’s sustainable design makes it one of the greenest office buildings in the CBD. Today, CapitaGreen is already home to about 30 multinational companies from diverse industry sectors including insurance, energy and commodities, technology and e-commerce, and financial services. They include Bordier & Cie, Cargill, Catlin Asia Pacific, China Life Insurance, Fitness First, Jardine Lloyd Thompson, Jones Day, Lloyds Banking Group, Rakuten, Schroders Investment Management and South32. To-date, aggregate committed occupancy stands at approximately 83% or 583,200 square feet of total net lettable area. Many tenants were attracted to CapitaGreen because of its sustainable design principles, which are aligned with their own corporate values and business focus. A number of tenants including Lloyds Banking Group, Schroders Investment Management and South32 have embarked on the process of being certified under the BCA Green Mark Office Interior scheme. Mr Lim Ming Yan, President and Group Chief Executive Officer of CapitaLand Limited said, “CapitaLand strongly believes that our buildings must have lasting impact – because when we build buildings, we are also creating communities where people can live, grow and fulfill their dreams. -

Strata Management's Portfolio

Knight Frank Property Asset Management – Strata Management’s Portfolio As of 1 May 2021, Knight Frank Property Asset Management (Strata Management) manages the following projects: Residential Properties No MCST Estate Name No. of Units 1 2761 38 Draycott Drive 30 2 2201 7 Claymore 76 3 4480 8M Residences 68 4 2171 9 Holland Hill 24 5 2991 Amaninda 70 6 TOP Amber 45 139 7 3548 Angullia Park Residences @ Orchard 46 8 3583 Ardmore II 118 9 2645 Ardmore Park 330 10 4203 Ardmore Three 84 11 2532 Aspen Heights 609 12 4693 Botanique at Bartley 797 13 4192 Boulevard Vue 28 14 3007 Cairnhill Crest 248 15 1862 Casa Esperanza 90 16 2414 Chestervale 396 17 4064 Coralis 127 18 3316 D'Lotus 83 19 4596 d'Nest 912 20 3174 De Royale 204 21 2653 Dunman Place 69 22 1075 Eastern Lagoon II 220 23 4705 Elite Residences 8 24 3970 Floridian 336 25 TOP Forest Woods 519 26 2549 Glendale Park 448 27 3728 Grange Infinite 68 28 4649 Greenwood Mews 62 29 4638 Highline Residences 500 30 3555 Hillcrest Villa 163 31 4737 Hundred Palms Residences 531 32 3559 Illoura 30 33 4547 J Gateway 738 34 TOP Kandis Residence 130 35 4701 Lake Grande 710 Knight Frank Property Asset Management Pte Ltd 160 Paya Lebar Road #05-05 Orion@Paya Lebar Singapore 409022 Tel: +65 6848 5678 Fax: +65 6848 5600 Reg.No: 200007671Z CEA Licence No: L3009602I KnightFrank.com.sg Other Offices: Knight Frank Pte Ltd 10 Collyer Quay #08-01 Ocean Financial Centre Singapore 049315 KF Property Network Pte Ltd 10 Collyer Quay #08-01 Ocean Financial Centre Singapore 049315 36 4556 Lakeville 699 37 3670 Lumiere -

POISED for a GRADUAL RECOVERY Senior Associate Director | Research | Singapore +65 6531 8567 [email protected]

COLLIERS QUARTERLY OFFICE | SINGAPORE | RESEARCH | Q4 2020 | 14 JANUARY 2021 Shirley Wong POISED FOR A GRADUAL RECOVERY Senior Associate Director | Research | Singapore +65 6531 8567 [email protected] Tricia Song 2021–25 Director and Head | Research | Insights & Q4 2020 Full Year 2021 Annual Average Singapore > CBD Grade A office showed resilience with +65 6531 8536 Recommendations [email protected] 336,900 sq ft net absorption in 2020 despite CBD Grade A rents declined 2.1% GDP contraction of 5.8%, driven by previous QOQ in Q4 2020 and 5.4%* for Demand flexible workspace commitments. In 2021, -59,600 sq ft 787,900 sq ft 894,000 sq ft the full year to SGD9.57 (USD7.24) we expect technology to drive demand. per sq foot, on weak global > We expect relatively muted CBD Grade A economic conditions. We forecast supply in 2021-2022, with annual expansion rents to grow 5.5% by the end of averaging 2.6% of stock versus 4.7% for the 0 sq ft 783,900 sq ft 883,000 sq ft 2021, on an eventual economic Supply last five years. 2023 should see higher supply rebound and benign supply. at 4.5% of stock. We forecast new demand in 2021 Annual Average to be driven by the technology QOQ / YOY / Growth 2021–25 / End Q4 End 2021 End 2025 sector. Meanwhile, Q4 2020 CBD > CBD Grade A rents declined 2.1% in Q4 2020 Grade A vacancy of 5.2% (+1.8pp 1.0pp-2.1%* +3.7% and 5.4%* for the full year to SGD9.57 5.5% YOY) could tighten over the next (USD7.24) per sq foot. -

A Review of the Singapore Office Market

Singapore Q1/Q2 2019 Published 1st March 2019 Singapore | Hong Kong The Office A review of the Singapore office market Index P2 Building Rental Table (Islandwide) P3 Leasing Options – New Downtown & Economy Range P4 Demand – who is moving where P5 Featured New Development – 9 Penang Road P6 Special Feature – Co-working space P7 Leasing Options – Raffles Place & Tanjong Pagar P8 Supply / Rentals / Forecast Corporate Locations (S) Pte Ltd License No. L3010044A Marina One T +65 6320 8355 / [email protected] / www.corporatelocations.com.sg RENTAL GUIDE 1st March 2019 Summary of Asking Rates Raffles Place / New Downtown Bangkok Bank Building TBA City Hall / Marina Centre / Beach Rd Chinatown / River Valley Road BEA Building $7.50 18 Robinson $12.00 Capital Tower $10.00 11 Beach Road Full Central Mall $7.00 20 Collyer Quay $11.00-$13.00 Cecil Court $5.80 30 Hill Street Full CES Centre $5.50+ 55 Market Street $7.00 China Square Central $8.50 Beach Centre $7.80 Chinatown Point $6.50 6 Battery Road $14.00 City House $7.80+ Bugis Junction Towers $7.80 Great World City $7.00 Asia Square T1 & T2 $14.00 Far East Finance Bldg $7.00 Centennial Tower $14.80 Kings Centre $7.00 Bank of China Building Full Far Eastern Bank Bildg Full Duo Tower $10.50 The Central $9.80 Bank of Singapore Centre $9.50 GB Building $6.00+ Funan $9.00 UE Square $8.00 Bharat Building $6.50 Keck Seng Tower $6.00 Manulife Centre $10.00+ Valley Point $7.00 CapitaGreen $13.50 Manulife Tower $9.50 Millenia Tower $14.80 Capital Square Full MYP Plaza $7.00 Odeon Tower -

Justco Unveils Its First Smart Centre, Partners with the World's First On-Demand Workspace Platform, Switch, and Spatial Analy

JustCo Unveils its First Smart Centre, Partners with the World’s First On-demand Workspace Platform, Switch, and Spatial Analytics Technology Company, SixSense at The Centrepoint Spanning three levels, members at JustCo at The Centrepoint will enjoy smart workspace technologies such as facial recognition, card-free access with Bluetooth capability, on- demand space usage, social distance detection technology and a robot barista café [For immediate release] Singapore, 19 NOVEMBER 2020 JustCo, the leading co-working company in Asia Pacific, continues to revolutionize the future of work. This time, it has notched up a holistic work solution by launching its first technology- enabled workspace. With support from one of its strategic partners, Frasers Property, JustCo has introduced its total work solutions platform at The Centrepoint in Singapore’s iconic retail district, Orchard Road. JustCo at The Centrepoint is set to inject vibrancy and fun into the neighbourhood, while making work better and smarter for businesses and individuals in the heart of town. Piloting at The Centrepoint, JustCo has partnered with workspace on-demand platform Switch to offer users fuss-free access to conducive workspaces as and when they need, and pay for exactly what they use. In addition, this centre will feature other workspace technologies such as facial recognition card-free access via Bluetooth capability and a fully-automated, in-house café by day and cocktail bar by night. Powered by robotics and artificial intelligence, RATIO offers custom-crafted coffee and cocktails, made to a high level of precision. As an added safety feature, the facial recognition turnstiles are designed to detect if members are wearing their face masks, in order to permit them entry. -

Singapore REIT Sector Research Analysts SECTOR REVIEW

26 October 2015 Asia Pacific/Singapore Equity Research REITs (REITs SG (Asia)) Singapore REIT Sector Research Analysts SECTOR REVIEW Nicholas Teh 603 2723 2085 [email protected] URA 3Q15: Continued softening in rents Daniel Lim 65 6212 3011 Figure 1: URA 3Q15 data summary [email protected] Price index Rental index Vacancy (%) 3Q15 2Q15 % chg 3Q15 2Q15 % chg 3Q15 2Q15 pp chg Office^ 138.8 139.0 -0.1 180.6 186.0 -2.9 10.3 10.5 -0.2 Retail^ 129.7 130.1 -0.3 115.0 117.4 -2.0 7.9 8.2 -0.3 Industrial 106.6 106.9 -0.3 101.7 102.5 -0.8 n.a. n.a. n.a. - Biz parks^ n.a. n.a. n.a. n.a. n.a. n.a. 15.7 13.9 1.8 Private home 142.3 144.2 -1.3 110.3 111.0 -0.6 7.8 7.9 -0.1 HDB resale 134.6 135.0 -0.3 n.a. n.a. n.a. n.a. n.a. n.a. ^ Vacancy for private space. Source: URA ■ Retail rents decline, but retail REIT reversions remain positive. Central region's retail rents dipped 2% QoQ with median rents on Orchard falling 0.9% QoQ, while the rest of the city area and suburban rents declined by -2% and -2.1%, respectively. Retail REIT reversions slowed but still remained positive despite the lower industry rents. We believe the divergence is attributed to the superior quality and location of the malls under the REITs. -

A Review of the Singapore Office Market

September 2018 Singapore | Hong Kong The Office A review of the Singapore office market Demand / Supply / Rentals / Forecast P2 Four Best Premium Leasing Options P3 Common Myths You Need to Know P3 Six Best Value For Money Opportunities P4 Eight Most Competitive Leasing Options P5 Summary of New Developments 2018 P6 Frequently Asked Questions P6 Complete Rental Table (Islandwide) P7 Four Most Expensive Office Buildings P8 Future Developments P8 Finding Office Space For You, With You Corporate Locations (S) Pte Ltd License No. L3010044A Marina One T +65 6320 8355 / [email protected] / www.corporatelocations.com.sg Demand Rentals A healthy take-up of space in 2018 Top premium asking rates are now around $14.00+ per sq ft The office leasing market has continued its momentum from 2017 and The top premium asking rates are now around $14.00+ per sq ft, with there has indeed been a healthy take-up of space in 2018. Many of the less room to negotiate than before but effective rates are still averaging preferred locations have been busy, whilst some other locations not around $11.50 - $12.00 per sq ft for prime space. As in any strong so active. Last year the talk of the town was all about the new tenants leasing market, the gap between the upper end and lower end tends to relocating to the brand new schemes such as Marina One and UIC stretch, which is exactly what is happening right now. Building. The story this year so far, has been all the new tenants that have committed to Frasers Tower and Duo Tower. -

1 CAPITALAND COMMERCIAL TRUST ANNOUNCEMENT ASSET VALUATION Pursuant to Rule 703 of the Singapore Exchange Securities Trading

CAPITALAND COMMERCIAL TRUST (Constituted in the Republic of Singapore pursuant to a Trust Deed dated 6 February 2004 (as amended)) ANNOUNCEMENT ASSET VALUATION Pursuant to Rule 703 of the Singapore Exchange Securities Trading Limited (“SGX-ST”) Listing Manual, CapitaLand Commercial Trust Management Limited (the “Manager”), as manager of CapitaLand Commercial Trust (“CCT”), wishes to announce that independent valuations as at 30 June 2019, have been obtained for the properties owned/ jointly owned by CCT. The value of CCT’s Singapore properties comprising Asia Square Tower 2, CapitaGreen, Capital Tower, Six Battery Road and 21 Collyer Quay (HSBC Building) was S$7,112.2 million in aggregate as at 30 June 2019. This figure of S$7,112.2 million excludes CCT’s 60.0% interest in Raffles City Singapore held through RCS Trust, 50.0% interest in One George Street held through One George Street LLP and 45.0% interest in CapitaSpring held through Glory Office Trust and Glory SR Trust. The value of Raffles City Singapore as at 30 June 2019 was S$3,340.0 million. CCT’s 60.0% interest in Raffles City Singapore held through RCS Trust was S$2,004.0 million. The value of One George Street was S$1,141.0 million as at 30 June 2019. CCT’s 50.0% interest in One George Street held through One George Street LLP was S$570.5 million. The value of CapitaSpring, based on the residual land value approach, was S$1,062.0 million. CCT’s 45.0% interest in CapitaSpring held through Glory Office Trust and Glory SR Trust amounts to S$477.9 million. -

Annual Report 2019 01

UOL GROUP LIMITED Contents About Us 01 Building On Our Strengths 02 Sustaining Long-Term Value 04 Extending Our Horizons 06 Financial Highlights 08 Two-Year Financial Highlights 10 Corporate Information 11 Highlights 12 Chairman’s Statement 14 Board Of Directors 16 Key Management Executives 22 Listing Of Senior Management 23 Awards & Accolades 24 Operation Highlights 26 Corporate Governance Report 40 Investor Relations 60 Sustainability 62 Geographical Presence 66 Property Summary 68 Simplified Group Financial Position76 Five-Year Financial Summary 77 Segmental Performance Analysis 79 Value-Added Statement 81 Alex Residences S20009 size:W210mm x H297mm 1st Page 01 ANNUAL REPORT 2019 01 About Us UOL Group Limited (UOL) is one of Singapore’s leading UOL, through hotel subsidiary Pan Pacific Hotels public-listed property companies with total assets of Group Limited (PPHG), owns three acclaimed brands about $20 billion. We have a diversied portfolio of namely “Pan Pacic”, PARKROYAL COLLECTION and development and investment properties, hotels and PARKROYAL. PPHG currently owns and/or manages serviced suites in Asia, Oceania, Europe and North over 30 hotels in Asia, Oceania and North America America. with over 10,000 rooms. Our Singapore-listed property subsidiary, United Industrial Corporation Limited (UIC), With a track record of over 50 years, UOL strongly owns an extensive portfolio of prime commercial assets believes in delivering product excellence and quality and hotels in Singapore. service in all its business ventures. Our unwavering commitment to architectural and quality excellence is UOL values and recognises our people as the leading reected in all our developments, winning us prestigious asset. -

Independent Market Overview by CBRE Pte Ltd

45 Annual Report 2017/18 Independent Market Overview By CBRE Pte Ltd 1. THE SINGAPORE ECONOMY Chart 1: Singapore GDP Growth Rate at 2010 Prices 1.1 Economic Overview 6.0% According to the Ministry of Trade & Industry (“MTI”), 5.1% Singapore’s economy expanded by 3.6% in 2017, an 5.0% 3.9% 3.6% improvement from the 2.4% growth achieved in 2016. Growth 4.0% was driven primarily by robust expansion in the manufacturing 2.4% 3.0% 2.2% sector, which grew by 10.1%. It was led by the precision engineering and electronics clusters amidst a decline in output 2.0% within the biomedical manufacturing, transport engineering 1.0% and general manufacturing clusters. The services sector also saw an overall expansion of 2.8% in 2017 which was supported 2013 2014 2015 2016 2017 by the wholesale & retail trade, transportation & storage and Sources: MTI and CBRE finance & insurance sectors. Conversely, the construction sector 2. THE OFFICE MARKET contracted by 8.4% on the back of weaknesses in private sector 2.1 Existing Office Supply construction activities. The total office stock in Singapore stood at 59.5 million sf in 1Q 2018, representing a 3.9% year-on-year increase. This is According to the MAS, headline inflation for 2017 came in at due largely to the completion of new developments such as 0.6%. Meanwhile, core inflation averaged 1.5% for the year. MAS UIC Building (277,540 sf) and Marina One East & West Tower expects core inflation to stay in the range of 1-2% in 2018. -

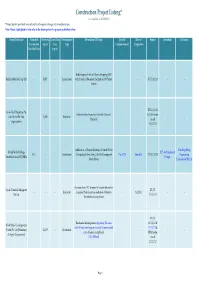

Construction Project Listing* (Last Updated on 20/12/2013) *Project Details Provided May Subject to Subsequent Changes by Owner/Developer

Construction Project Listing* (Last Updated on 20/12/2013) *Project details provided may subject to subsequent changes by owner/developer. Note: Words highlighted in blue refer to the latest updates for projects published before. Owner/Developer Estimated Site Area Gross Floor Development Description Of Project Date Of Date of Source Consultant Contractor Construction (sq m) Area Type Commencement Completion Cost ($million) (sq m) Redevelopment into a 6 Storey Shopping Mall Raffles Medical Group Ltd - 5,827 - Institutional with 2 levels of Basement Carpark at 100 Taman - - ST 17/12/13 - - Warna BT 11/12/13 Grow-Tech Properties Pte Industrial development at Gambas Crescent & URA tender Ltd (Part of Far East - 14,302 - Industrial -- -- (Parcel 3) result Organization) 13/12/13 Addition of a 5 Storey Building to United World Kim Seng Heng United World College BLT Architecture & 42.5 - - Institutional College South East Asia (UWCSEA) campus at Dec-2013 Aug-2015 BT 13/12/13 Engineering South East Asia (UWCSEA) Design Dover Road Construction Pte Ltd Erection of an LPG Terminal to import alternative Vopak Terminals Singapore BT/ST - - - Industrial Liquefied Petroleum Gas feedstock at Banyan - 1Q 2016 -- Pte Ltd 11/12/13 Terminal in Jurong Island BT/ST Residential development comprising 281 units 16/11/12 & World Class Developments with 24 hour concierge service and 18 commercial 11/12/13 & (North) Pte Ltd [Subsidiary - 10,170 - Residential -- -- units at Jalan Jurong Kechil URA tender of Aspial Corporation] (The Hillford) result 22/11/12 Page 1 Construction Project Listing* (Last Updated on 20/12/2013) *Project details provided may subject to subsequent changes by owner/developer.