Singapore REIT Sector Research Analysts SECTOR REVIEW

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of Clinics in Downtown Core Open on Friday 24 Jan 2020

LIST OF CLINICS IN DOWNTOWN CORE OPEN ON FRIDAY 24 JAN 2020 POSTAL S/N NAME OF CLINIC BLOCK STREET NAME LEVEL UNIT BUILDING TEL OPENING HOURS CODE 1 ACUMED MEDICAL GROUP 16 COLLYER QUAY 02 03 INCOME AT RAFFLES 049318 65327766 8.30AM-12.30PM 2 AQUILA MEDICAL 160 ROBINSON ROAD 05 01 SINGAPORE BUSINESS FEDERATION CENTER 068914 69572826 11.00AM- 8.00PM 3 AYE METTA CLINIC PTE. LTD. 111 NORTH BRIDGE ROAD 04 36A PENINSULA PLAZA 179098 63370504 2.30PM-7.00PM 4 CAPITAL MEDICAL CENTRE 111 NORTH BRIDGE ROAD 05 18 PENINSULA PLAZA 179098 63335144 4.00PM-6.30PM 5 CITYHEALTH CLINIC & SURGERY 152 BEACH ROAD 03 08 GATEWAY EAST 189721 62995398 8.30AM-12.00PM 6 CITYMED HEALTH ASSOCIATES PTE LTD 19 KEPPEL RD 01 01 JIT POH BUILDING 089058 62262636 9.00AM-12.30PM 7 CLIFFORD DISPENSARY PTE LTD 77 ROBINSON ROAD 06 02 ROBINSON 77 068896 65350371 9.00AM-1.00PM 8 DA CLINIC @ ANSON 10 ANSON ROAD 01 12 INTERNATIONAL PLAZA 079903 65918668 9.00AM-12.00PM 9 DRS SINGH & PARTNERS, RAFFLES CITY MEDICAL CENTRE 252 NORTH BRIDGE RD 02 16 RAFFLES CITY SHOPPING CENTRE 179103 63388883 9.00AM-12.30PM 10 DRS THOMPSON & THOMSON RADLINK MEDICARE 24 RAFFLES PLACE 02 08 CLIFFORD CENTRE 048621 65325376 8.30AM-12.30PM 11 DRS. BAIN + PARTNERS 1 RAFFLES QUAY 09 03 ONE RAFFLES QUAY - NORTH TOWER 048583 65325522 9.00AM-11.00AM 12 DTAP @ DUO MEDICAL CLINIC 7 FRASER STREET B3 17/18 DUO GALLERIA 189356 69261678 9.00AM-3.00PM 13 DTAP @ RAFFLES PLACE 20 CECIL STREET 02 01 PLUS 049705 69261678 8.00AM-3.00PM 14 FULLERTON HEALTH @ OFC 10 COLLYER QUAY 03 08/09 OCEAN FINANCIAL CENTRE 049315 63333636 -

For Immediate Release NEWS RELEASE

For immediate release NEWS RELEASE CapitaLand celebrates milestone in sustainability journey with official opening of CapitaGreen One of Singapore CBD’s greenest office developments wins widespread support from tenants and community Singapore, 9 September 2015 – CapitaGreen, the landmark premium office development in Singapore’s Central Business District (CBD) was officially opened today. Through the use of innovative construction technologies, ‘design-and-build’ methods and streamlined work processes, CapitaGreen was completed in 36 months, compared to the industry average of 40-42 months it would take to complete a building of this scale. With its striking green façade and rooftop wind scoop which contributes to cooling the building naturally, CapitaGreen’s sustainable design makes it one of the greenest office buildings in the CBD. Today, CapitaGreen is already home to about 30 multinational companies from diverse industry sectors including insurance, energy and commodities, technology and e-commerce, and financial services. They include Bordier & Cie, Cargill, Catlin Asia Pacific, China Life Insurance, Fitness First, Jardine Lloyd Thompson, Jones Day, Lloyds Banking Group, Rakuten, Schroders Investment Management and South32. To-date, aggregate committed occupancy stands at approximately 83% or 583,200 square feet of total net lettable area. Many tenants were attracted to CapitaGreen because of its sustainable design principles, which are aligned with their own corporate values and business focus. A number of tenants including Lloyds Banking Group, Schroders Investment Management and South32 have embarked on the process of being certified under the BCA Green Mark Office Interior scheme. Mr Lim Ming Yan, President and Group Chief Executive Officer of CapitaLand Limited said, “CapitaLand strongly believes that our buildings must have lasting impact – because when we build buildings, we are also creating communities where people can live, grow and fulfill their dreams. -

POISED for a GRADUAL RECOVERY Senior Associate Director | Research | Singapore +65 6531 8567 [email protected]

COLLIERS QUARTERLY OFFICE | SINGAPORE | RESEARCH | Q4 2020 | 14 JANUARY 2021 Shirley Wong POISED FOR A GRADUAL RECOVERY Senior Associate Director | Research | Singapore +65 6531 8567 [email protected] Tricia Song 2021–25 Director and Head | Research | Insights & Q4 2020 Full Year 2021 Annual Average Singapore > CBD Grade A office showed resilience with +65 6531 8536 Recommendations [email protected] 336,900 sq ft net absorption in 2020 despite CBD Grade A rents declined 2.1% GDP contraction of 5.8%, driven by previous QOQ in Q4 2020 and 5.4%* for Demand flexible workspace commitments. In 2021, -59,600 sq ft 787,900 sq ft 894,000 sq ft the full year to SGD9.57 (USD7.24) we expect technology to drive demand. per sq foot, on weak global > We expect relatively muted CBD Grade A economic conditions. We forecast supply in 2021-2022, with annual expansion rents to grow 5.5% by the end of averaging 2.6% of stock versus 4.7% for the 0 sq ft 783,900 sq ft 883,000 sq ft 2021, on an eventual economic Supply last five years. 2023 should see higher supply rebound and benign supply. at 4.5% of stock. We forecast new demand in 2021 Annual Average to be driven by the technology QOQ / YOY / Growth 2021–25 / End Q4 End 2021 End 2025 sector. Meanwhile, Q4 2020 CBD > CBD Grade A rents declined 2.1% in Q4 2020 Grade A vacancy of 5.2% (+1.8pp 1.0pp-2.1%* +3.7% and 5.4%* for the full year to SGD9.57 5.5% YOY) could tighten over the next (USD7.24) per sq foot. -

A Review of the Singapore Office Market

September 2018 Singapore | Hong Kong The Office A review of the Singapore office market Demand / Supply / Rentals / Forecast P2 Four Best Premium Leasing Options P3 Common Myths You Need to Know P3 Six Best Value For Money Opportunities P4 Eight Most Competitive Leasing Options P5 Summary of New Developments 2018 P6 Frequently Asked Questions P6 Complete Rental Table (Islandwide) P7 Four Most Expensive Office Buildings P8 Future Developments P8 Finding Office Space For You, With You Corporate Locations (S) Pte Ltd License No. L3010044A Marina One T +65 6320 8355 / [email protected] / www.corporatelocations.com.sg Demand Rentals A healthy take-up of space in 2018 Top premium asking rates are now around $14.00+ per sq ft The office leasing market has continued its momentum from 2017 and The top premium asking rates are now around $14.00+ per sq ft, with there has indeed been a healthy take-up of space in 2018. Many of the less room to negotiate than before but effective rates are still averaging preferred locations have been busy, whilst some other locations not around $11.50 - $12.00 per sq ft for prime space. As in any strong so active. Last year the talk of the town was all about the new tenants leasing market, the gap between the upper end and lower end tends to relocating to the brand new schemes such as Marina One and UIC stretch, which is exactly what is happening right now. Building. The story this year so far, has been all the new tenants that have committed to Frasers Tower and Duo Tower. -

1 CAPITALAND COMMERCIAL TRUST ANNOUNCEMENT ASSET VALUATION Pursuant to Rule 703 of the Singapore Exchange Securities Trading

CAPITALAND COMMERCIAL TRUST (Constituted in the Republic of Singapore pursuant to a Trust Deed dated 6 February 2004 (as amended)) ANNOUNCEMENT ASSET VALUATION Pursuant to Rule 703 of the Singapore Exchange Securities Trading Limited (“SGX-ST”) Listing Manual, CapitaLand Commercial Trust Management Limited (the “Manager”), as manager of CapitaLand Commercial Trust (“CCT”), wishes to announce that independent valuations as at 30 June 2019, have been obtained for the properties owned/ jointly owned by CCT. The value of CCT’s Singapore properties comprising Asia Square Tower 2, CapitaGreen, Capital Tower, Six Battery Road and 21 Collyer Quay (HSBC Building) was S$7,112.2 million in aggregate as at 30 June 2019. This figure of S$7,112.2 million excludes CCT’s 60.0% interest in Raffles City Singapore held through RCS Trust, 50.0% interest in One George Street held through One George Street LLP and 45.0% interest in CapitaSpring held through Glory Office Trust and Glory SR Trust. The value of Raffles City Singapore as at 30 June 2019 was S$3,340.0 million. CCT’s 60.0% interest in Raffles City Singapore held through RCS Trust was S$2,004.0 million. The value of One George Street was S$1,141.0 million as at 30 June 2019. CCT’s 50.0% interest in One George Street held through One George Street LLP was S$570.5 million. The value of CapitaSpring, based on the residual land value approach, was S$1,062.0 million. CCT’s 45.0% interest in CapitaSpring held through Glory Office Trust and Glory SR Trust amounts to S$477.9 million. -

AEW Asia Research Perspective Q215 in Progress .Indd

GENERAL ECONOMIC OVERVIEW Globally the economy is expanding at a moderate pace and key commodity prices AEW Asia Research Perspective Q2 2015 are much lower than they were at the beginning of the year. Growth expectations for 2016 and 2017 were broadly unchanged over the quarter while near-term global growth is expected to be slightly lower than initially anticipated. The Asian Development Bank is projecting growth of 2.8% in 2015 increasing to about 3.2% per annum over the following two years. Looking forward, global activity should be supported by continued low commodity prices and generally still-benign fi nancing conditions, notwithstanding the expected modest tightening in U.S. monetary policy. In the second half of 2015, it is likely that we will see a divergence in central bank policy in the major economies. In the U.S. it is widely expected the Federal Reserve will raise the Federal Funds Rate before the end of the year, perhaps as early as their September meeting. This is an important event for global capital markets as it will mark the Federal Reserve’s fi rst rate increase since 2006, and the fi rst increase since the policy rate hit zero at the end of 2008. Meanwhile, we anticipate that other central banks, such as the Bank of Japan and European Central Bank, will continue their highly accommodative monetary policies until at least the end of the year. In line with this central banks in the Fund’s target markets are also easing. Most notably the Bank of Korea reduced its policy rate to 1.5%, a record low, while the Peoples Bank of China (PBOC) is loosening its policy stance with lower benchmark interest rates and lower reserve requirement ratios. -

Building Owner / Carpark Operator Address Postal Code

NETS TOP UP MACHINES Building Owner / Carpark Operator Address Postal Code ZHAOLIM PTE LTD 115 EUNOS AVENUE 3 EUNOS INDUSTRIAL ESTATE SINGAPORE 409839 YESIKEN PTE LTD 970 GEYLANG ROAD TRISTAR COMPLEX SINGAPORE 423492 WINSLAND INVESTMENT PTE LTD 163 PENANG RD WINSLAND HOUSE II SINGAPORE 238463 WILSON PARKING (S) PTE LTD 461 CLEMENTI ROAD P121-SIM SINGAPORE 599491 WILSON PARKING (S) PTE LTD 118 ALJUNIED AVENUE 2 P204_2-GEM SINGAPORE 380118 WILSON PARKING (S) PTE LTD 30 ORANGE GROVE ROAD P203-REL RELC BUILDING SINGAPORE 258352 WILSON PARKING (S) PTE LTD 461 CLEMENTI ROAD P121-SIM SINGAPORE 599491 WILSON PARKING (S) PTE LTD 461 CLEMENTI ROAD P121-SIM SINGAPORE 599491 WILSON PARKING (S) PTE LTD 5 TAMPINES CENTRAL 6 TELEPARK SINGAPORE 529482 WILSON PARKING (S) PTE LTD 49 JALAN PEMIMPIN APS IND BLDG CARPARK SINGAPORE 577203 WILSON PARKING (S) PTE LTD SGH CAR PARK BOOTH NEAR EXIT OF CARPARK C SINGAPORE 169608 WILSON PARKING (S) PTE LTD 587 BT TIMAH RD CORONATION S/C CARPARK SINGAPORE 269707 WILSON PARKING (S) PTE LTD 280 WOODLANDS INDUSTRIAL HARVEST @ WOODLANDS 757322 WILSON PARKING (S) PTE LTD 15 SCIENCE CENTRE ROAD SCI SINGAPORE SCIENCE CEN SINGAPORE 609081 WILSON PARKING (S) PTE LTD 56 CASSIA CRESCENT KM1 SINGAPORE 391056 WILSON PARKING (S) PTE LTD 19 TANGLIN ROAD TANGLIN SHOPPING CENTRE SINGAPORE 247909 WILSON PARKING (S) PTE LTD 115 ALJUNIED AVENUE 2 GE1B SINGAPORE 380115 WILSON PARKING (S) PTE LTD 89 MARINE PARADE CENTRAL MP19 SINGAPORE 440089 WILSON PARKING (S) PTE LTD 32 CASSIA CRESCENT K10 SINGAPORE 390032 WILSON PARKING (S) PTE LTD -

Capitaland Commercial Trust

CAPITALAND COMMERCIAL TRUST FY 2019 Financial Results – Additional Information 22 January 2020 FY 2019 Gross Revenue higher by 4.7% YoY Higher gross revenue mainly from Gallileo, Main Airport Center, Asia Square Tower 2 and 21 Collyer Quay S$ million FY 2018 FY 2019 110.3 105.0 91.1 91.4 71.4 73.1 68.9 67.2 Divested on 29 Aug 2018 25.3 27.2 20.4 12.8 12.5 11.8 10.1 7.7 - - (1) (2) Asia Square CapitaGreen Capital Tower Six Battery Road 21 Collyer Quay Gallileo Main Airport Bugis Village Twenty Anson Tower 2 Center (MAC) (1) Notes: (1) CCT owns 94.9% of Gallileo and MAC which contributed revenue and income from 19 June 2018 and 18 September 2019 respectively. The reported figure is on 100.0% basis. (2) Bugis Village returned to the State on 1 April 2019. 2 CapitaLand Commercial Trust Presentation Jan 2020 FY 2019 Net Property Income higher by 2.1% YoY Net property income lifted mainly by Asia Square Tower 2, Gallileo, 21 Collyer Quay S$ million FY 2018 FY 2019 83.4 80.0 73.3 72.0 54.8 56.3 55.1 52.8 Divested on 29 Aug 2018 24.7 22.5 20.3 12.3 9.3 9.4 5.0 4.5 - - Asia Square CapitaGreen Capital Tower Six Battery Road 21 Collyer Quay Gallileo (1) Main Airport Bugis Village(2) Twenty Anson Tower 2 Center (MAC)(1) Notes: (1) CCT owns 94.9% of Gallileo and MAC which contributed revenue and income from 19 June 2018 and 18 September 2019 respectively. -

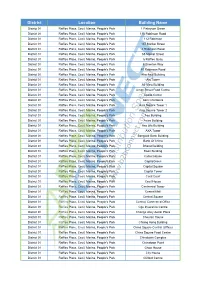

District Location Building Name

District Location Building Name District 01 Raffles Place, Cecil, Marina, People's Park 1 Finlayson Green District 01 Raffles Place, Cecil, Marina, People's Park 110 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 112 Robinson District 01 Raffles Place, Cecil, Marina, People's Park 137 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 4 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 55 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 6 Raffles Quay District 01 Raffles Place, Cecil, Marina, People's Park 6 Shenton Way District 01 Raffles Place, Cecil, Marina, People's Park 80 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park Afro-Asia Building District 01 Raffles Place, Cecil, Marina, People's Park Aia Tower District 01 Raffles Place, Cecil, Marina, People's Park Air View Building District 01 Raffles Place, Cecil, Marina, People's Park Amoy Street Food Centre District 01 Raffles Place, Cecil, Marina, People's Park Apollo Center District 01 Raffles Place, Cecil, Marina, People's Park Asia Chambers District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 1 District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 2 District 01 Raffles Place, Cecil, Marina, People's Park Aso Building District 01 Raffles Place, Cecil, Marina, People's Park Aviva Building District 01 Raffles Place, Cecil, Marina, People's Park Axa Life Building District 01 Raffles Place, Cecil, Marina, People's Park AXA Tower District 01 -

2020 MICE Directory

2020 MICE Directory EMPOWERING COMMERCE, CAPABILTIES, COMMUNITY CONTENTS MESSAGES 5 Message from SACEOS President 6 Message from Singapore Tourism Board EVENT CALENDARS 28 Calendar of Conferences 2020 31 Calendar of Exhibitions 2020 36 Calendar of Conferences 2021 38 Calendar of Exhibitions 2021 VENUE 44 Auditorium, Conventions & Exhibitions Centres 57 Hotels 69 Unique Venues DIRECTORY LISTING 81 SACEOS Members Listings 116 General Listings 209 Singapore Statutory Boards & Government Agencies 217 Advertiser’s Index SACEOS DIRECTORY 2020 Message from SACEOS President I Message from Singapore Tourism Board MR ALOYSIUS ARLANDO MS MELISSA OW President Singapore Association of Deputy Chief Executive Convention & Exhibition Singapore Tourism Board Organisers & Suppliers (SACEOS) Welcome to the 2020 edition of MICE e-directory – the industry’s go-to guide. SACEOS is a community-based association of the MICE industry whose members contribute to a rich history of successful corporate events, business meetings and conventions and exhibitions in Singapore. 2019 was another exciting year for Singapore’s business events landscape. The city maintains its momentum as a leading global business events hub, This year in 2020, SACEOS rang in the new decade with a big bang - by unveiling our brand playing host to a vibrant array of business events across various industry PRESIDENT new visual identity, a symbol of transformation, and a timely reflection that represents a hallmark clusters, and keeping its position as Asia Pacific’s leading city in the 2018 for the next phase of our growth, our hope, our unified future. global ranking by the International Congress and Convention Association MESSAGE (ICCA), and top international meeting country since 2013 in the Union of Singapore is a key player in the ASEAN region and the rest of the world. -

Capitaland Commercial Trust

CapitaLand Commercial Trust Singapore’s First Commercial REIT Extraordinary General Meeting Proposed Acquisition of 50.0% of the units in MSO Trust which holds CapitaGreen Wednesday, 13 th July 2016 1 Disclaimer The past performance of CCT is not indicative of the future performance of CCT. Similarly, the past performance of CapitaLand Commercial Trust Management Limited, the manager of CCT, is not indicative of the future performance of the Manager. The value of units in CCT (CCT Units) and the income derived from them may fall as well as rise. The CCT Units are not obligations of, deposits in, or guaranteed by, the CCT Manager. An investment in the CCT Units is subject to investment risks, including the possible loss of the principal amount invested. Investors have no right to request the CCT Manager to redeem or purchase their CCT Units for so long as the CCT Units are listed on Singapore Exchange Securities Trading Limited (SGX-ST). It is intended that holders of the CCT Units may only deal in their CCT Units through trading on the SGX-ST. Listing of the CCT Units on the SGX-ST does not guarantee a liquid market for the CCT Units. This presentation may contain forward-looking statements that involve assumptions, risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward- looking statements as a result of a number of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, competition from other developments or companies, shifts in expected levels of occupancy rate, property rental income, charge out collections, changes in operating expenses (including employee wages, benefits and training costs), governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business. -

Ministry of Health List of Approved Providers for Antigen Rapid Testing for COVID-19 at Offsite Premises List Updated As at 6 Aug 2021

Ministry of Health List of Approved Providers for Antigen Rapid Testing for COVID-19 at Offsite Premises List updated as at 6 Aug 2021. S/N Service Provider Site of Event Testing Address of Site Date of Event Contact No. 1 OCBC Square 1 Stadium Place #01-K1/K2, Wave - Mall, Singapore 397628 57 Medical Clinic (Geylang Visitor Centre of Singapore Sports Hub 8 Stadium Walk, Singapore 397699 - 66947078 Bahru) Suntec Singapore Convention and Exhibition 1 Raffles Boulevard Singapore 039593 - Centre 2 57 Medical Clinic (Yishun) Holiday Inn Singapore Atrium 317 Outram Road, Singapore 169075 - 62353490 3 Asiamedic Wellness Asiamedic Astique The Aesthetic Clinic Pte. 350 Orchard Road #10-00 Shaw House - 67898888 Assessment Centre Ltd. Singapore 238868 4 Former Siglap Secondary School 10 Pasir Ris Drive 10, Singapore Acumen Diagnostics Pte. Ltd. - 69800080 519385 5 9 Dec 2020 13 and 14 Jan 2021 10 Bayfront Avenue, Singapore 24 and 25 Jan 2021 Sands Expo and Convention Centre 018956 4 Feb 2021 24 and 25 Mar 2021 19 Apr 2021 PUB Office 40 Scotts Road, #22-01 Environment - Building, Singapore 228231 The Istana 35 Orchard Road, Singapore 238823 3 and 4 Feb 2021 Ally Health 67173737 11 Feb 2021 One Marina Boulevard 1 Marina Boulevard, Singapore 018989 11 Feb 2021 Rasa Sentosa Singapore 101 Siloso Road, Singapore 098970 Shangri-La Hotel Singapore 22 Orange Grove Road, Singapore 22 Apr 2021 258350 D'Marquee@Downtown East 1 Pasir Ris Close, Singapore 519599 - Intercontinental Hotel 80 Middle Road, Singapore 188966 - Palfinger Asia Pacific Pte Ltd 4 Tuas Loop, Singapore 637342 - Page 1 of 148 ST ENGINEERING MARINE LTD.