Uol Group 3Q2020 Business Update 11 November 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Strata Management's Portfolio

Knight Frank Property Asset Management – Strata Management’s Portfolio As of 1 May 2021, Knight Frank Property Asset Management (Strata Management) manages the following projects: Residential Properties No MCST Estate Name No. of Units 1 2761 38 Draycott Drive 30 2 2201 7 Claymore 76 3 4480 8M Residences 68 4 2171 9 Holland Hill 24 5 2991 Amaninda 70 6 TOP Amber 45 139 7 3548 Angullia Park Residences @ Orchard 46 8 3583 Ardmore II 118 9 2645 Ardmore Park 330 10 4203 Ardmore Three 84 11 2532 Aspen Heights 609 12 4693 Botanique at Bartley 797 13 4192 Boulevard Vue 28 14 3007 Cairnhill Crest 248 15 1862 Casa Esperanza 90 16 2414 Chestervale 396 17 4064 Coralis 127 18 3316 D'Lotus 83 19 4596 d'Nest 912 20 3174 De Royale 204 21 2653 Dunman Place 69 22 1075 Eastern Lagoon II 220 23 4705 Elite Residences 8 24 3970 Floridian 336 25 TOP Forest Woods 519 26 2549 Glendale Park 448 27 3728 Grange Infinite 68 28 4649 Greenwood Mews 62 29 4638 Highline Residences 500 30 3555 Hillcrest Villa 163 31 4737 Hundred Palms Residences 531 32 3559 Illoura 30 33 4547 J Gateway 738 34 TOP Kandis Residence 130 35 4701 Lake Grande 710 Knight Frank Property Asset Management Pte Ltd 160 Paya Lebar Road #05-05 Orion@Paya Lebar Singapore 409022 Tel: +65 6848 5678 Fax: +65 6848 5600 Reg.No: 200007671Z CEA Licence No: L3009602I KnightFrank.com.sg Other Offices: Knight Frank Pte Ltd 10 Collyer Quay #08-01 Ocean Financial Centre Singapore 049315 KF Property Network Pte Ltd 10 Collyer Quay #08-01 Ocean Financial Centre Singapore 049315 36 4556 Lakeville 699 37 3670 Lumiere -

A Review of the Singapore Office Market

Singapore Q1/Q2 2019 Published 1st March 2019 Singapore | Hong Kong The Office A review of the Singapore office market Index P2 Building Rental Table (Islandwide) P3 Leasing Options – New Downtown & Economy Range P4 Demand – who is moving where P5 Featured New Development – 9 Penang Road P6 Special Feature – Co-working space P7 Leasing Options – Raffles Place & Tanjong Pagar P8 Supply / Rentals / Forecast Corporate Locations (S) Pte Ltd License No. L3010044A Marina One T +65 6320 8355 / [email protected] / www.corporatelocations.com.sg RENTAL GUIDE 1st March 2019 Summary of Asking Rates Raffles Place / New Downtown Bangkok Bank Building TBA City Hall / Marina Centre / Beach Rd Chinatown / River Valley Road BEA Building $7.50 18 Robinson $12.00 Capital Tower $10.00 11 Beach Road Full Central Mall $7.00 20 Collyer Quay $11.00-$13.00 Cecil Court $5.80 30 Hill Street Full CES Centre $5.50+ 55 Market Street $7.00 China Square Central $8.50 Beach Centre $7.80 Chinatown Point $6.50 6 Battery Road $14.00 City House $7.80+ Bugis Junction Towers $7.80 Great World City $7.00 Asia Square T1 & T2 $14.00 Far East Finance Bldg $7.00 Centennial Tower $14.80 Kings Centre $7.00 Bank of China Building Full Far Eastern Bank Bildg Full Duo Tower $10.50 The Central $9.80 Bank of Singapore Centre $9.50 GB Building $6.00+ Funan $9.00 UE Square $8.00 Bharat Building $6.50 Keck Seng Tower $6.00 Manulife Centre $10.00+ Valley Point $7.00 CapitaGreen $13.50 Manulife Tower $9.50 Millenia Tower $14.80 Capital Square Full MYP Plaza $7.00 Odeon Tower -

Justco Unveils Its First Smart Centre, Partners with the World's First On-Demand Workspace Platform, Switch, and Spatial Analy

JustCo Unveils its First Smart Centre, Partners with the World’s First On-demand Workspace Platform, Switch, and Spatial Analytics Technology Company, SixSense at The Centrepoint Spanning three levels, members at JustCo at The Centrepoint will enjoy smart workspace technologies such as facial recognition, card-free access with Bluetooth capability, on- demand space usage, social distance detection technology and a robot barista café [For immediate release] Singapore, 19 NOVEMBER 2020 JustCo, the leading co-working company in Asia Pacific, continues to revolutionize the future of work. This time, it has notched up a holistic work solution by launching its first technology- enabled workspace. With support from one of its strategic partners, Frasers Property, JustCo has introduced its total work solutions platform at The Centrepoint in Singapore’s iconic retail district, Orchard Road. JustCo at The Centrepoint is set to inject vibrancy and fun into the neighbourhood, while making work better and smarter for businesses and individuals in the heart of town. Piloting at The Centrepoint, JustCo has partnered with workspace on-demand platform Switch to offer users fuss-free access to conducive workspaces as and when they need, and pay for exactly what they use. In addition, this centre will feature other workspace technologies such as facial recognition card-free access via Bluetooth capability and a fully-automated, in-house café by day and cocktail bar by night. Powered by robotics and artificial intelligence, RATIO offers custom-crafted coffee and cocktails, made to a high level of precision. As an added safety feature, the facial recognition turnstiles are designed to detect if members are wearing their face masks, in order to permit them entry. -

Annual Report 2019 01

UOL GROUP LIMITED Contents About Us 01 Building On Our Strengths 02 Sustaining Long-Term Value 04 Extending Our Horizons 06 Financial Highlights 08 Two-Year Financial Highlights 10 Corporate Information 11 Highlights 12 Chairman’s Statement 14 Board Of Directors 16 Key Management Executives 22 Listing Of Senior Management 23 Awards & Accolades 24 Operation Highlights 26 Corporate Governance Report 40 Investor Relations 60 Sustainability 62 Geographical Presence 66 Property Summary 68 Simplified Group Financial Position76 Five-Year Financial Summary 77 Segmental Performance Analysis 79 Value-Added Statement 81 Alex Residences S20009 size:W210mm x H297mm 1st Page 01 ANNUAL REPORT 2019 01 About Us UOL Group Limited (UOL) is one of Singapore’s leading UOL, through hotel subsidiary Pan Pacific Hotels public-listed property companies with total assets of Group Limited (PPHG), owns three acclaimed brands about $20 billion. We have a diversied portfolio of namely “Pan Pacic”, PARKROYAL COLLECTION and development and investment properties, hotels and PARKROYAL. PPHG currently owns and/or manages serviced suites in Asia, Oceania, Europe and North over 30 hotels in Asia, Oceania and North America America. with over 10,000 rooms. Our Singapore-listed property subsidiary, United Industrial Corporation Limited (UIC), With a track record of over 50 years, UOL strongly owns an extensive portfolio of prime commercial assets believes in delivering product excellence and quality and hotels in Singapore. service in all its business ventures. Our unwavering commitment to architectural and quality excellence is UOL values and recognises our people as the leading reected in all our developments, winning us prestigious asset. -

Independent Market Overview by CBRE Pte Ltd

45 Annual Report 2017/18 Independent Market Overview By CBRE Pte Ltd 1. THE SINGAPORE ECONOMY Chart 1: Singapore GDP Growth Rate at 2010 Prices 1.1 Economic Overview 6.0% According to the Ministry of Trade & Industry (“MTI”), 5.1% Singapore’s economy expanded by 3.6% in 2017, an 5.0% 3.9% 3.6% improvement from the 2.4% growth achieved in 2016. Growth 4.0% was driven primarily by robust expansion in the manufacturing 2.4% 3.0% 2.2% sector, which grew by 10.1%. It was led by the precision engineering and electronics clusters amidst a decline in output 2.0% within the biomedical manufacturing, transport engineering 1.0% and general manufacturing clusters. The services sector also saw an overall expansion of 2.8% in 2017 which was supported 2013 2014 2015 2016 2017 by the wholesale & retail trade, transportation & storage and Sources: MTI and CBRE finance & insurance sectors. Conversely, the construction sector 2. THE OFFICE MARKET contracted by 8.4% on the back of weaknesses in private sector 2.1 Existing Office Supply construction activities. The total office stock in Singapore stood at 59.5 million sf in 1Q 2018, representing a 3.9% year-on-year increase. This is According to the MAS, headline inflation for 2017 came in at due largely to the completion of new developments such as 0.6%. Meanwhile, core inflation averaged 1.5% for the year. MAS UIC Building (277,540 sf) and Marina One East & West Tower expects core inflation to stay in the range of 1-2% in 2018. -

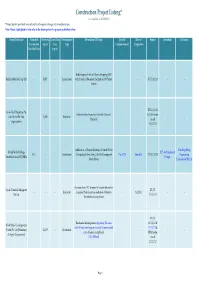

Construction Project Listing* (Last Updated on 20/12/2013) *Project Details Provided May Subject to Subsequent Changes by Owner/Developer

Construction Project Listing* (Last Updated on 20/12/2013) *Project details provided may subject to subsequent changes by owner/developer. Note: Words highlighted in blue refer to the latest updates for projects published before. Owner/Developer Estimated Site Area Gross Floor Development Description Of Project Date Of Date of Source Consultant Contractor Construction (sq m) Area Type Commencement Completion Cost ($million) (sq m) Redevelopment into a 6 Storey Shopping Mall Raffles Medical Group Ltd - 5,827 - Institutional with 2 levels of Basement Carpark at 100 Taman - - ST 17/12/13 - - Warna BT 11/12/13 Grow-Tech Properties Pte Industrial development at Gambas Crescent & URA tender Ltd (Part of Far East - 14,302 - Industrial -- -- (Parcel 3) result Organization) 13/12/13 Addition of a 5 Storey Building to United World Kim Seng Heng United World College BLT Architecture & 42.5 - - Institutional College South East Asia (UWCSEA) campus at Dec-2013 Aug-2015 BT 13/12/13 Engineering South East Asia (UWCSEA) Design Dover Road Construction Pte Ltd Erection of an LPG Terminal to import alternative Vopak Terminals Singapore BT/ST - - - Industrial Liquefied Petroleum Gas feedstock at Banyan - 1Q 2016 -- Pte Ltd 11/12/13 Terminal in Jurong Island BT/ST Residential development comprising 281 units 16/11/12 & World Class Developments with 24 hour concierge service and 18 commercial 11/12/13 & (North) Pte Ltd [Subsidiary - 10,170 - Residential -- -- units at Jalan Jurong Kechil URA tender of Aspial Corporation] (The Hillford) result 22/11/12 Page 1 Construction Project Listing* (Last Updated on 20/12/2013) *Project details provided may subject to subsequent changes by owner/developer. -

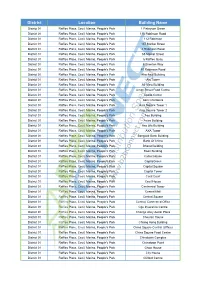

District Location Building Name

District Location Building Name District 01 Raffles Place, Cecil, Marina, People's Park 1 Finlayson Green District 01 Raffles Place, Cecil, Marina, People's Park 110 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 112 Robinson District 01 Raffles Place, Cecil, Marina, People's Park 137 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 4 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park 55 Market Street District 01 Raffles Place, Cecil, Marina, People's Park 6 Raffles Quay District 01 Raffles Place, Cecil, Marina, People's Park 6 Shenton Way District 01 Raffles Place, Cecil, Marina, People's Park 80 Robinson Road District 01 Raffles Place, Cecil, Marina, People's Park Afro-Asia Building District 01 Raffles Place, Cecil, Marina, People's Park Aia Tower District 01 Raffles Place, Cecil, Marina, People's Park Air View Building District 01 Raffles Place, Cecil, Marina, People's Park Amoy Street Food Centre District 01 Raffles Place, Cecil, Marina, People's Park Apollo Center District 01 Raffles Place, Cecil, Marina, People's Park Asia Chambers District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 1 District 01 Raffles Place, Cecil, Marina, People's Park Asia Square Tower 2 District 01 Raffles Place, Cecil, Marina, People's Park Aso Building District 01 Raffles Place, Cecil, Marina, People's Park Aviva Building District 01 Raffles Place, Cecil, Marina, People's Park Axa Life Building District 01 Raffles Place, Cecil, Marina, People's Park AXA Tower District 01 -

Uol Group 1H2021 Results 12 August 2021 Disclaimer

UOL GROUP 1H2021 RESULTS 12 AUGUST 2021 DISCLAIMER This presentation may contain forward-looking statements or financial information. Such forward-looking statements and financial information may involve known and unknown risks, uncertainties, assumptions and other factors which may cause the actual results, performance or achievements of UOL Group Limited, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements and financial information. Such forward-looking statements and financial information are based on assumptions including (without limitation) UOL Group Limited’s present and future business strategies, general industry and economic conditions, interest rate trends, cost of capital and capital availability, availability of real estate properties, competition from other companies, shifts in customer demands, customers and partners, changes in operating expenses (including employee wages, benefits and training), governmental and public policy changes and the continued availability of financing in the amounts and the terms necessary to support future business activities. You are advised not to place undue reliance on these forward-looking statements and financial information, which are based on UOL Group Limited’s current views concerning future events. UOL Group Limited expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements or financial information contained in this presentation to reflect any change in UOL Group Limited’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement or information is based, subject to compliance with all applicable laws and regulations and/or the rules of the SGX-ST and/or any other regulatory or supervisory body. -

V on Shenton Condo in Singapore

RaRely does a Residence encapsulate so many expeRiences in one Realm. a multitude of exquisite amenities and activities that offeR an exceptional expeRience foR those endowed to acquiRe this extRaoRdinaRy addRess – fi e shenton way. enthRalling. intRiguing. exciting. welcome to on shenton. THE GRANDEUR OF THE PAST Known famously as singapore’s wall street, shenton way proudly holds the financial and trading history of singapore. it was not until the 1960’s that the first buildings appeared along shenton way. the first being the conference hall and trade union house (1965), later becoming the singapore conference hall, and the icB Building (1968) and shing Kwan house which is now the sgx centre. also of significance to the area in the 1970s were Robina house, shenton house and of course, uic Building. standing at 152m tall, and 39 storeys high, uic Building at fi e shenton way was the tallest of the ‘three sisters’ on the south side of shenton way. Robina house and shenton house make up the other two. A Breath OF FRESH AIR ON SINGAPORE’S WALL STREET an address with a glorious legacy, the former uic Building located at fi e shenton way dominated the city skyline as singapore’s tallest building for many years since its completion in 1973. today, the area is undergoing rejuvenation and transformation with the completion of several notable projects including one Raffles quay, marina Bay financial centre and asia square. fi e shenton way will once again be positioned in the new financial heart of singapore. a spectacular twin tower comprising a 23-storey office building and a 54-storey residential tower, on shenton, will rise from the monolithic sheen of the central business district. -

Singapore Office Market Review

December 2020 Singapore Office Market Review ISLANDWIDE RENTAL GUIDE Pg 2 SUPPLY / NEW DEVELOPMENTS Pg 4 Latest asking rates for 200+ office buildings Current vacancy rate in the CBD at 5% Photo by Tsuyuri Hara on Unsplash MARKET OVERVIEW / FORECAST Looking for office space? • Market will be dominated by short-term renewals Our detailed reports will give you all the information • Tech firms to lead demand: Alibaba, ByteDance, you need, including our guide on the lowest possible Twitter, Rackspace are all expanding, making Singapore effective rates to target their regional base See page 9 • Demand for co-working space to continue • Rates to soften by 7% – 9% across the board Celebrating 21 years in Singapore • Very few new office developments coming on stream 1999 – 2020 in the CBD in 2021 • Companies will continue to ‘right-size’ Corporate Locations (S) Pte Ltd Licence No. L3010044A Disclaimer T +65 6391 5212 The information in this publication should be regarded as a general guide only. Whilst every care is [email protected] taken in it preparation, no representation is made or responsibility accepted for its accuracy or completeness. The rentals mentioned are neither asking rentals nor rentals agreed by property owners, www.corporatelocations.com.sg but only represent the writers views on estimated rentals and is intended as reference only. Office Rental Guide MYP Plaza $6.50 Singapore Pools Building Full OUE Downtown 1 & 2 $9.00 Sunshine Plaza $6.50 Official Asking Rates PIL Building $6.50 Tanglin Shopping Centre $6.00 -

Office Rental Guide Official Asking Rates

Office Rental Guide MYP Plaza $6.50 Singapore Pools Building Full OUE Downtown 1 & 2 $9.00 Sunshine Plaza $6.50 Official Asking Rates PIL Building $6.50 Tanglin Shopping Centre Full Robinson 77 $9.00 The Bencoolen $5.50 S$ per sq ft per month – Robinson 112 $6.80 The Heeren $10.50 inclusive of service charge Robinson Centre $10.50 Thong Teck Building $7.00-$8.00 Robinson Point $8.00-$8.50 Tong Building $9.00 1 July 2020 SBF Centre $8.50+ TripleOne Somerset $8.50-$8.80 SGX Centre 1 & 2 $9.50 Visioncrest Commercial $9.00 Raffles Place/New Downtown Shenton House TBC Wheelock Place $11.50 6 Battery Road $14.00 SIF Building Full Wilkie Edge $9.00 6 Raffles Quay $7.00+ The Globe $7.00 Winsland House I & II $9.50 18 Robinson $12.00 The Octagon $5.80 Wisma Atria $9.80-$11.00 20 Collyer Quay $9.00-$13.00 Tokio Marine Centre Full 30 Raffles Place $11.00 Tong Eng Building $5.60+ Chinatown/River Valley Road 55 Market Street $10.50 UIC Building Full Central Mall $7.00 AIA Tower Full CES Centre $5.80 Asia Square Tower 1 $14.00+ Tanjong Pagar Chinatown Point $6.20-$8.00 Asia Square Tower 2 $13.50 78 Shenton Way Tower 1 $7.00-$8.20 Great World City $7.50 ASO Building $6.20 79 Shenton Way Tower 2 $9.20 Havelock II $7.50 Bank of China Building Full 79 Anson Road $8.50 King’s Centre $6.50 Bank of Singapore Centre $11.00 100AM $7.30-$8.30 The Central $8.80+ Bharat Building $6.30 ABI Plaza Full UE Square $8.50 CapitaGreen $13.50 Anson Centre $4.50 Valley Point $6.50 CapitaSpring TBC Anson House $9.00 Capital Square $11.50 AXA Tower $8.80 Edge of CBD Clifford -

Fire Rated Duct System British Standard 476 Part 24:1987 Ventilation Duct Smoke Extract Duct Kitchen Exhaust Duct

100% Asbestos Free FIRE RATED DUCT SYSTEM BRITISH STANDARD 476 PART 24:1987 VENTILATION DUCT SMOKE EXTRACT DUCT KITCHEN EXHAUST DUCT FSB/PSB/001/00: ENCLOSURE TO SPRINKLER WET & DRY RISERS HYDRANT PIPES ETC BRITISH STANDARD 476 PART 20: ENCLOSURE TO GENERAL BUILDING SERVICES: CABLES, SANITARY PIPE CHILLED WATER PIPE AND ETC Ng Teng Hong Changi Airport Terminal 4 Downtown Line 3 Singapore Sports Hub General Hospital Fire Resistance Test Standard Fire resistance test standard on ventilation ducts are carried out (INTEGRITY) and the thermal transmittance (INSULATION) in accordance with BS 476: Part 24 (ISO 6944). This standard functions can be judged. The standard temperature/time fire Lafire Asia Pte Ltd, understand specifies a method of vertical and horizontal ventilation ducts exposure specified in BS 476: Part 20 is representative of only one under standardized fire conditions. The general purpose of the test possible fire exposure condition at the fully developed fire stage. the importance of fire protection is to measure the ability of a representative duct or duct assembly The method of test does not quantify the behavior of a duct for systems in a building. Besides saving to resist the spread of fire from one compartment to another. a precise period of time in a real fire situation but can be used The test is conducted without the involvement of fire dampers. directly to show compliance with fire resistance requirements in lives in the event of fire outbreak, It is applicable to vertical and horizontal ducts, with or without regulations or other safety specifications, enables comparisons to INGEBORG® also reduces the rising branches, taking into account of joints, air supply and exhaust be made between constructions.