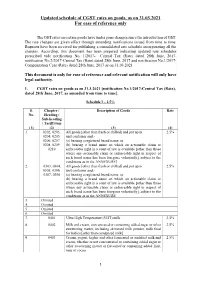

Updated Schedule of CGST Rates on Goods, As on 15.11.2017 for Ease of Reference Only

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Onam Onam-Harvest Festival of Kerala • Onam Is the Biggest and the Most Important Festival of the State of Kerala, India

Onam Onam-Harvest Festival of Kerala • Onam is the biggest and the most important festival of the state of Kerala, India. • It is a harvest festival and is celebrated with joy and enthusiasm by Malayalis (Malayalam speaking people) all over the world. It celebrates rice harvest. • Onam is celebrated in the beginning of the month of Chingam, the first month of Malayalam Calendar (Kollavarsham), which in Gregorian Calendar corresponds to August-September. Chingam 1 is the New Year day for Malayali Hindus. • It celebrates the Vamana (fifth avatar of god Vishnu) avatar of Vishnu (principal deity of Hinduism). • It is celebrated to welcome King Mahabali, whose spirit is said to visit Kerala at the time of Onam. • The festival goes on for ten days. • Onam celebrations include Vallamkali (boat race), Pulikali (tiger dance), Pookkalam (floral carpet), Onathappan (worship), Vadamvali (Tug of War), Thumbi Thullal (women's dance), Kummattikali (mask dance), Onathallu (martial arts), Onavillu (music), Kazhchakkula (plantain offerings), Onapottan (costumes), Atthachamayam (folk songs and dance), and other celebrations. Vallamkali Pulikali Pookkalam Onathappan Vadamvali Thumbi Thullal Onathallu Kummattikali Onavillu Atthachamayam Onapottan Kazhchakkula Significance • King Mahabali was also known as Maveli and Onathappan. Mahabali was the great great grandson of a Brahmin sage named Kashyapa , the great grandson of demonic dictator Hiranyakashipu, and the grandson of Vishnu devotee Prahlada. Prahlada, was born to a demonic Asura father who hated Vishnu. Despite this, Prahlada rebelled against his father's ill-treatment of people and worshipped Vishnu. • Hiranyakashipu tried to kill his son Prahlada, but was slained by Vishnu in his Narasimha avatar, Prahlada was saved. -

GST Notifications (Rate) / Compensation Cess, Updated As On

Updated schedule of CGST rates on goods, as on 31.03.2021 For ease of reference only The GST rates on certain goods have under gone changes since the introduction of GST. The rate changes are given effect through amending notifications issued from time to time. Requests have been received for publishing a consolidated rate schedule incorporating all the changes. According, this document has been prepared indicating updated rate schedules prescribed vide notification No. 1/2017- Central Tax (Rate) dated 28th June, 2017, notification No.2/2017-Central Tax (Rate) dated 28th June, 2017 and notification No.1/2017- Compensation Cess (Rate) dated 28th June, 2017 as on 31.03.2021 This document is only for ease of reference and relevant notification will only have legal authority. 1. CGST rates on goods as on 31.3.2021 [notification No.1/2017-Central Tax (Rate), dated 28th June, 2017, as amended from time to time]. Schedule I – 2.5% S. Chapter / Description of Goods Rate No. Heading / Sub-heading / Tariff item (1) (2) (3) (4) 1. 0202, 0203, All goods [other than fresh or chilled] and put up in 2.5% 0204, 0205, unit container and,- 0206, 0207, (a) bearing a registered brand name; or 0208, 0209, (b) bearing a brand name on which an actionable claim or 0210 enforceable right in a court of law is available [other than those where any actionable claim or enforceable right in respect of such brand name has been foregone voluntarily], subject to the conditions as in the ANNEXURE] 2. 0303, 0304, All goods [other than fresh or chilled] and put up in 2.5% 0305, 0306, unit container and,- 0307, 0308 (a) bearing a registered brand name; or (b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available [other than those where any actionable claim or enforceable right in respect of such brand name has been foregone voluntarily], subject to the conditions as in the ANNEXURE 3. -

Agenda for 21 GST Council Meeting

Confidential Agenda for 21st GST Council Meeting 9 September 2017 Hyderabad, Telangana Page 2 of 173 F.No. 144/21st Meeting/GST Council/2017 GST Council Secretariat Room No.275, North Block, New Delhi Dated: 5 September 2017 Notice for the 21st Meeting of the GST Council on 9 September 2017 The undersigned is directed to refer to the subject cited above and to say that the 21st meeting of the GST Council will be held on 9 September 2017 at Hyderabad International Convention Centre, Novotel Hotel, Madhapur, Hyderabad. The schedule of the meeting is as follows: i. Saturday, 9 September 2017 : 1100 hours onwards 2. In addition, an officers’ meeting will be held at the same venue as per the following schedule: ii. Friday, 8 September 2017 : 1500 hours onwards 3. The agenda items for the 21st GST Council Meeting are attached. 4. Keeping in view the constraints of rooms in the hotel, it is requested that participation from each State may be limited to 2 officers in addition to the Hon’ble Member of the GST Council. 5. Please convey the invitation to the Hon’ble Members of the GST Council to attend the 21st GST Council Meeting. - Sd - (Dr. Hasmukh Adhia) Secretary to the Govt. of India and ex-officio Secretary to the GST Council Tel: 011 23092653 Copy to: 1. PS to the Hon’ble Minister of Finance, Government of India, North Block, New Delhi with the request to brief Hon’ble Minister about the above said meeting. 2. PS to Hon’ble Minister of State (Finance), Government of India, North Block, New Delhi with the request to brief Hon’ble Minister about the above said meeting. -

Annual Report 1990 .. 91

SANGEET NAT~AKADEMI . ANNUAL REPORT 1990 ..91 Emblem; Akademi A wards 1990. Contents Appendices INTRODUCTION 0 2 Appendix I : MEMORANDUM OF ASSOCIATION (EXCERPTS) 0 53 ORGANIZATIONAL SET-UP 05 AKADEMI FELLOWSHIPS/ AWARDS Appendix II : CALENDAR OF 19900 6 EVENTS 0 54 Appendix III : GENERAL COUNCIL, FESTIVALS 0 10 EXECUTIVE BOARD, AND THE ASSISTANCE TO YOUNG THEATRE COMMITTEES OF THE WORKERS 0 28 AKADEMID 55 PROMOTION AND PRESERVATION Appendix IV: NEW AUDIO/ VIDEO OF RARE FORMS OF TRADITIONAL RECORDINGS 0 57 PERFORMING ARTS 0 32 Appendix V : BOOKS IN PRINT 0 63 CULTURAL EXCHANGE Appendix VI : GRANTS TO PROGRAMMES 0 33 INSTITUTIONS 1990-91 064 PUBLICATIONS 0 37 Appendix VII: DISCRETIONARY DOCUMENTATION / GRANTS 1990-91 071 DISSEMINATION 0 38 Appendix VIll : CONSOLIDATED MUSEUM OF MUSICAL BALANCE SHEET 1990-91 0 72 INSTRUMENTS 0 39 Appendix IX : CONSOLIDATED FINANCIAL ASSISTANCE TO SCHEDULE OF FIXED CULTURAL INSTITUTIONS 0 41 ASSETS 1990-91 0 74 LIBRARY AND LISTENING Appendix X : PROVIDENT FUND ROOMD41 BALANCE SHEET 1990-91 078 BUDGET AND ACCOUNTS 0 41 Appendix Xl : CONSOLIDATED INCOME & EXPENDITURE IN MEMORIAM 0 42 ACCOUNT 1990-91 KA THAK KENDRA: DELHI 0 44 (NON-PLAN & PLAN) 0 80 JA WAHARLAL NEHRU MANIPUR Appendix XII : CONSOLIDATED DANCE ACADEMY: IMPHAL 0 50 INCOME & EXPENDITURE ACCOUNT 1990-91 (NON-PLAN) 0 86 Appendix Xlll : CONSOLIDATED INCOME & EXPENDITURE ACCOUNT 1990-91 (PLAN) 0 88 Appendix XIV : CONSOLIDATED RECEIPTS & PAYMENTS ACCOUNT 1990-91 (NON-PLAN & PLAN) 0 94 Appendix XV : CONSOLIDATED RECEIPTS & PAYMENTS ACCOUNT 1990-91 (NON-PLAN) 0 104 Appendix XVI : CONSOLIDATED RECEIPTS & PAYMENTS ACCOUNT 1990-91 (PLAN) 0 110 Introduction Apart from the ongoing schemes and programmes, the Sangeet Natak Akademi-the period was marked by two major National Academy of Music, international festivals presented Dance, and Drama-was founded by the Akademi in association in 1953 for the furtherance of with the Indian Council for the performing arts of India, a Cultural Relations. -

Drum Racks for Ableton Live.Pages

"Masters Of India - Drum Racks For Ableton Live EarthMoments presents - Percussion Masters of India. This pack was recorded with leading industry musicians all over India. All sounds & samples are recorded using A-class pre-amps and microphones while paying attention to the instruments finer "details to capture their bloom in a perfect way. Experience India’s drums as never before. Own an unrivaled, premium quality pack "of live drum recordings that were collected using instruments from all across India. This is a quintessential Earthmoments pack that shows the artist just how much more there is to Indian drumming than just the tabla. Every major Indian drum except the "tabla is included in this pack. Also included is a bonus Earthmoments Sampler, a taster from the essential "boutique sample library.! The drums presented in the pack are the: Bass Dholak, Chellangai, Duki Tharang, Ganjira, Gatham Singarri, Gatham, Khol, Mirudangam, Pakhwaj, Tapatam, Thalam, "Thavil, and the Udukai. For each instrument, EarthMoments has provided 10 pre-made patterns to demonstrate what that instrument is fully capable of. These are not just traditionally Indian patterns either, but include some western styles as a demonstration of the "versatility of these instruments. "Instruments: Bass Dholak - Bass Dholak is a large wooden barrel shaped drum associated with the folk music of Punjab. The drum is hung around the neck and the bass and treble "heads on either side are struck using sticks. Chellangai - The complex movement of Indian dancers is translated into sound with the Chellangai. These bells worn as anklets serve to accentuate the intricate footwork of each dancer, moving in step with accompanying percussion. -

![THE GAZETTE of INDIA : EXTRAORDINARY [PART II—SEC. 3(I)] NOTIFICATION New Delhi, the 22Nd September, 2017 No.28/2017-Union](https://docslib.b-cdn.net/cover/2596/the-gazette-of-india-extraordinary-part-ii-sec-3-i-notification-new-delhi-the-22nd-september-2017-no-28-2017-union-2342596.webp)

THE GAZETTE of INDIA : EXTRAORDINARY [PART II—SEC. 3(I)] NOTIFICATION New Delhi, the 22Nd September, 2017 No.28/2017-Union

66 THE GAZETTE OF INDIA : EXTRAORDINARY [P ART II—SEC . 3(i)] 111. उडुकईi 112. चंडे 113. नागारा - केटलेG स कƙ जोड़ी 114. प बाई - दो बेलनाकार Gम कƙ इकाई 115. पैराित पु, हगी - sेम Gम दो िटϝस के साथ खेला 116. संबल 117. िटक डफ या िटक डफ - लाठी के साथ खेला जाने वाला टġड मĞ डेफ 118. तमक 119. ताशा - केटलेGम का Oकार 120. उƞम 121. जलातरंग िच पēा - पीतल के ƚजगल के साथ आग टĪग 122. चĞिगल - धातु िडक 123. इलाथलम 124. गेजर - Qास पोत 125. घटक और मटकाम (िमŝी के बरतन बतϕन Gम) 126. घुंघĐ 127. खारट या िच पला 128. मनजीरा या झंज या ताल 129. अखरोट - िमŝी के बतϕन 130. संकरजांग - िल थोफोन 131. थाली - धातु लेट 132. थाकुकाजामनाई 133. कंचारांग, कांच के एक Oकार 134. कथाततरंग, एक Oकार का जेलोफ़ोन [फा सं.354/117/2017-टीआरयू-भाग II] मोिहत ितवारी, अवर सिचव Ɨट पणी : Oधान अिधसूचना सं. 2/2017- संघ राϤ यϓेJ कर (दर), तारीख 28 जून, 2017, सा.का.िन. 711 (अ) तारीख 28 जून, 2018 ůारा भारत के राजपJ , असाधारण, भाग II, खंड 3, उपखंड (i) ůारा Oकािशत कƙ गई थी । NOTIFICATION New Delhi, the 22nd September, 2017 No.28/2017-Union Territory Tax (Rate) G.S.R.1196 (E).— In exercise of the powers conferred by sub-section (1) of section 8 of the Union Territory Goods and Services Tax Act, 2017 (14 of 2017), the Central Government, being satisfied that it is necessary in the public interest so to do, on the recommendations of the Council, hereby makes the following amendments in the notification of the Government of India in the Ministry of Finance (Department of Revenue), No.2/2017-Union territory Tax (Rate), dated the 28th June, 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. -

Background Material on Exempted Services Under GST

Background Material on Exempted Services under GST The Institute of Chartered Accountants of India (Set up by an Act of Parliament) New Delhi © The Institute of Chartered Accountants of India All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form, or by any means, electronic, mechanical, photocopying, recording, or otherwise without prior permission, in writing, from the publisher. DISCLAIMER: The views expressed in this book are of the author(s). The Institute of Chartered Accountants of India may not necessarily subscribe to the views expressed by the author(s). The information cited in this book has been drawn from various sources. While every effort has been made to keep the information cited in this book error free, the Institute or any officer of the same does not take the responsibility for any typographical or clerical error which may have crept in while compiling the information provided in this book. First Edition : January, 2018 Committee/Department : Indirect Taxes Committee E-mail : [email protected] Website : www.idtc.icai.org / www.icai.org Published by : The Publication Department on behalf of the Institute of Chartered Accountants of India, ICAI Bhawan, Post Box No. 7100, Indraprastha Marg, New Delhi - 110 002. Foreword In the GST regime, when a supply of goods and/or services falls within the purview of charging Section, such supply is chargeable to GST. However, for determining the liability to pay the tax, one needs to further check whether such supply of goods and/or services are exempt from tax or not. -

The Arunachal Pradesh Gazette EXTRAORDINARY PUBLISHED by AUTHORITY

The Arunachal Pradesh Gazette EXTRAORDINARY PUBLISHED BY AUTHORITY No. 411, Vol. XXIV, Naharlagun, Wednesday, October 4, 2017 Asvina 12, 1939 (Saka) GOVERNMENT OF ARUNACHAL PRADESH DEPARTMENT OF TAX & EXCISE ITANAGAR ————— Notification No. 28/2017-State Tax (Rate) The 26th September, 2017 No. GST/24/2017.— In exercise of the powers conferred by sub-section (1) of Section 11 of the Arunachal Pradesh Goods and Services Tax Act, 2017 (7 of 2017), the State Government, on the recommendations of the Council, hereby makes the following amendments in the notification of the Government of Arunachal Pradesh, Department of Tax & Excise, No.2/2017-State Tax (Rate), dated the 28th June, 2017, published in the Extra ordinary Gazette of Arunachal Pradesh, vide number 192, Vol XXIV, dated the 30th June, 2017, namely:- In the said notification,- (B) in the Schedule,- (i) against serial number 27, in column (3), for the words “other than put up in unit containers and bearing a registered brand name”, the words, brackets and letters “other than those put up in unit container and,- (a) bearing a registered brand name; or (b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available [other than those where any actionable claim or enforceable right in respect of such brand name has been foregone voluntarily, subject to the conditions as in the ANNEXURE I]”, shall be substituted ; (jj) against serial numbers 29 and 45, in column (3), for the words “other than put up in unit container and bearing a registered brand -

Ashtadasha Vadyam's and Temple Arts of Kerala

www.ijcrt.org © 2020 IJCRT | Volume 8, Issue 8 August 2020 | ISSN: 2320-2882 Ashtadasha Vadyam’s and Temple Arts of Kerala Manoj Manikkoth PhD research scholar Vels University Abstract: Kerala – The God’s Own Country – is filled with the presence of music, dance, musical instruments, temple arts and temple rituals. The history of various traditional art forms rests in the soil of Kerala. About eighteen musical instruments are known as ‘Kshetra Vadyam’. It includes ‘Deva vadyam’ and ‘Asura Vadyam’ from which the distinct place for ‘Chenda’ can be acknowledged by observing where it is present. It might be ‘Chenda’s resonance that make the seventeen ‘Ashtadasha Vadyam’s to below the ‘Chenda’. Some of the musical instruments which are being used for Pooja rituals in temples are also being used for some classical dance forms in Kerala. The study of such musical instruments and the classical dance forms associated to it are the foundation of this journal. Some musical instruments are used only outside the temple and some are used inside the temple only. ‘Sopana Sangeetham’ is one of the popular among ‘Kshetra Sangeetham’. Only one musical instrument is used in ‘Sopana Sangeetham’ ie Idakka. Idakka is a musical instrument which is inevitable in ‘Mohiniyattam’ concert. Idakka is only used in ‘Kathakali’ when female role is presented. The ‘Chenda’ is an inevitable musical instrument in ‘Kathakali’. Altogether, five musical instruments in ‘Pakkamaelam” are used when ‘Kathakali’ is staged from which four are ‘Kshetra Vadyam’s, ‘Chenda’, ‘Idakka’, ‘Madhalam’, ‘Chengila’ and the one which is excluded in Kshetra Vadyam’s is ‘Ilathalam’. -

Background Material on GST Acts and Rules

Background Material on GST Acts and Rules The Institute of Chartered Accountants of India (Set up by an Act of Parliament) New Delhi © The Institute of Chartered Accountants of India All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form, or by any means, electronic, mechanical, photocopying, recording, or otherwise without prior permission, in writing, from the publisher. DISCLAIMER: The views expressed in this book are of the author(s). The Institute of Chartered Accountants of India may not necessarily subscribe to the views expressed by the author(s). The information cited in this book has been drawn primarily from the www.cbec.gov.in and other sources. While every effort has been made to keep the information cited in this book error free, the Institute or any office of the same does not take the responsibility for any typographical or clerical error which may have crept in while compiling the information provided in this book. First Edition : May, 2017 Second Edition : September, 2017 Revised Edition : January 2018 Committee/Department : Indirect Taxes Committee E-mail : [email protected] Website : www.icai.org; www.idtc.icai.org Price : e-publication ISBN : 978-81-8441-869-9 Published by : The Publication Department on behalf of the Institute of Chartered Accountants of India, ICAI Bhawan, Post Box No. 7100, Indraprastha Marg, New Delhi - 110 002. Foreword Implementation of Goods and Services Tax (GST) in India is one of the major economic reforms. GST aims to make India a common market with common tax rates and procedures and remove the economic barriers thus, paving the way for an integrated economy at the national level. -

Experiencing Onam of 1960'S

ONAM NG OF CI T N H E E I R 1 9 E 6 P 0 X S E f Onam ty o eau e b on yg At Saigramam b e Enjoy h t d Onam in all its l o h Original glory e B A SOCIAL TOURISM INITIATIVE nam is the state festival of he Malayalam month of Kerala. It is a yearly tribute Chingam heralds Onam. The paid to Lord Mahabali countdown for Onam begins Owhose rule had gifted the land a Ton Atham day of the month. On golden era during time immemorial. Atham day, children start roaming Devas were jealous of the good rule around in groups searching for by Mahabali who belonged to their flowers to make a floral design archrivals, Asuras. Consequently, called Atha Pookalam in front of the magnanimous King was pushed their homes as a mark of welcome down to the nether world by Vamana, for Lord Mahabali. On the first day, an incarnation of Lord Vishnu. the design will be a single circle. The Mahabali was granted a permission number of circles grows to ten on the to emerge from the underworld and tenth day, which is Thiruvonam. The visit his people once in a year. On ninth day is called Uthradam day Thiruvonam, the main Onam day, on which people get into a purchase it is believed that the King Mahabali spree, procuring all gifts and makes an invisible visit to watch the commodities required for adding welfare of his people. In and out of glamor to Thiruvonam. -

I. Pre-GTS Tax Incidence Vis-À-Vis GST Rate for Goods: S. No. Chapter

I. Pre-GTS tax incidence vis-à-vis GST rate for goods: S. Chapter Description of goods Pre-GST GST Rate No. Tax Incidence* Food & Beverage 1. 4 Milk powder 6% 5% 2. 4 Curd, Lassi, Butter milk put up in unit 4% 0% container 3. 4 Unbranded Natural Honey 6% 0% 4. 0401 Ultra High Temperature (UHT) Milk 6% 5% 5. 801 Cashew nut 7% 5% 6. 806 Raisin 6% 5% 7. 9 Spices 6% 5% 8. 9 Tea 6% 0% 9. 10 Wheat 2.5% 0% 10. 10 Rice 2.75% 0% 11. 11 Flour 3.5% 0% 12. 15 Soyabean oil 6% 5% 13. 15 Groundnut oil 6% 5% 14. 15 Palm oil 6% 5% 15. 15 Sunflower oil 6% 5% 16. 15 Coconut oil 6% 5% 17. 15 Mustard Oil 6% 5% 18. 15 Sunflower oil 6% 5% 19. 15 Other vegetable edible oils 6% 5% 20. 17 Sugar 6% 5% 21. 1704 Sugar confectionery 21% 18% 22. 21 Sweetmeats 7% 5% 23. 2103 Ketchup & Sauces 12% 12% 24. 2103 30 00 Mustard Sauce 12% 12% 25. 2103 90 90 Toppings, spreads and sauces 12% 12% 26. 22 Mineral water 27% 18% Household goods of daily use 27. 33 Agarbatti 10% 5% 28. 33 Tooth powder 17% 12% 29. 33 Hair oil 27% 18% 30. 33 Toothpaste 27% 18% 31. 34 Soap 27% 18% 32. 4823 Kites 11% 5% 33. 64 Footwear of RSP upto Rs. 500 per pair 10% 5% 34. 64 Other footwear 21% 18% 35. 73 LPG Stove 21% 18% 36. 76 Aluminium foils 19% 18% 37.