Background Material on GST Acts and Rules

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Safeguarding the Intangible Cultural Heritage and Diverse Cultural Traditions of India”

Scheme for “Safeguarding the Intangible Cultural Heritage and Diverse Cultural Traditions of India” Form for National Inventory Register of Intangible Cultural Heritage of India A. Name of the State WEST BENGAL B. Name of the Element/Cultural Tradition (in English) BENA B.1. Name of the element in the language and script of the community Concerned, if applicable 뇍যানা (Bengali) C. Name of the communities, groups or, if applicable, individuals concerned (Identify clearly either of these concerned with the practice of the said element/cultural tradition) The Bena is traditionally used by two communities - the Rajbongshis and the Meities of Manipur. The Rajbongshis are spread across North Bengal, western Assam, Meghalaya and eastern parts of Bihar and the neighbouring countries of Bangladesh and Nepal. The Meiteis of Manipur have a similar instrument which they call the Pena and it plays a very important role in their culture - accompanying many of their rituals and their folk music. It continues to play a much larger role in their lives than the Bena does among the Rajbongshis. D. Geographical location and range of the element/cultural tradition (Please write about the other states in which the said element/tradition is present ) The Bena is to be found in the northern districts of Cooch Behar and Jalpaiguri (which has recently been bifurcated into Jalpaiguri and Alipurduar districts) in West Bengal, Assam, Meghalaya, Bihar and also neighbouring countries like Bangladesh and Nepal. The Bena is traditionally an integral part of a Rajbongshi folk theatre called Kushan. However the Kushan tradition prevails only in North Bengal, Bangladesh and Assam. -

Categorization of Stringed Instruments with Multifractal Detrended Fluctuation Analysis

CATEGORIZATION OF STRINGED INSTRUMENTS WITH MULTIFRACTAL DETRENDED FLUCTUATION ANALYSIS Archi Banerjee*, Shankha Sanyal, Tarit Guhathakurata, Ranjan Sengupta and Dipak Ghosh Sir C.V. Raman Centre for Physics and Music Jadavpur University, Kolkata: 700032 *[email protected] * Corresponding Author ABSTRACT Categorization is crucial for content description in archiving of music signals. On many occasions, human brain fails to classify the instruments properly just by listening to their sounds which is evident from the human response data collected during our experiment. Some previous attempts to categorize several musical instruments using various linear analysis methods required a number of parameters to be determined. In this work, we attempted to categorize a number of string instruments according to their mode of playing using latest-state-of-the-art robust non-linear methods. For this, 30 second sound signals of 26 different string instruments from all over the world were analyzed with the help of non linear multifractal analysis (MFDFA) technique. The spectral width obtained from the MFDFA method gives an estimate of the complexity of the signal. From the variation of spectral width, we observed distinct clustering among the string instruments according to their mode of playing. Also there is an indication that similarity in the structural configuration of the instruments is playing a major role in the clustering of their spectral width. The observations and implications are discussed in detail. Keywords: String Instruments, Categorization, Fractal Analysis, MFDFA, Spectral Width INTRODUCTION Classification is one of the processes involved in audio content description. Audio signals can be classified according to miscellaneous criteria viz. speech, music, sound effects (or noises). -

Music from the Beginning

Review Article iMedPub Journals 2015 Insights in Blood Pressure http://journals.imedpub.com Vol. 1 No. 1:2 ISSN 2471-9897 Music and its Effect on Body, Brain/Mind: Archi Banerjee, Shankha A Study on Indian Perspective by Neuro- Sanyal, Ranjan Sengupta, Dipak Ghosh physical Approach Sir CV Raman Centre for Physics and Music, Jadavpur University, Kolkata Keywords: Music Cognition, Music Therapy, Diabetes, Blood Pressure, Neurocognitive Benefits Corresponding author: Archi Banerjee Received: Sep 20, 2015, Accepted: Sep 22, 2015, Submitted:Sep 29, 2015 [email protected] Music from the Beginning Sir CV Raman Centre for Physics and Music, The singing of the birds, the sounds of the endless waves of the Jadavpur University, Kolkata 700032. sea, the magical sounds of drops of rain falling on a tin roof, the murmur of trees, songs, the beautiful sounds produced by Tel: +919038569341 strumming the strings of musical instruments–these are all music. Some are produced by nature while others are produced by man. Natural sounds existed before human beings appeared Citation: Banerjee A, Sanyal S, Sengupta R, on earth. Was it music then or was it just mere sounds? Without et al. Music and its Effect on Body, Brain/ an appreciative mind, these sounds are meaningless. So music Mind: A Study on Indian Perspective by has meaning and music needs a mind to appreciate it. Neuro-physical Approach. Insights Blood Press 2015, 1:1. Music therefore may be defined as a form of auditory communication between the producer and the receiver. There are other forms of auditory communication, like speech, but the past and Raman, Kar followed by Rossing and Sundberg later on, difference is that music is more universal and evokes emotion. -

Onam Onam-Harvest Festival of Kerala • Onam Is the Biggest and the Most Important Festival of the State of Kerala, India

Onam Onam-Harvest Festival of Kerala • Onam is the biggest and the most important festival of the state of Kerala, India. • It is a harvest festival and is celebrated with joy and enthusiasm by Malayalis (Malayalam speaking people) all over the world. It celebrates rice harvest. • Onam is celebrated in the beginning of the month of Chingam, the first month of Malayalam Calendar (Kollavarsham), which in Gregorian Calendar corresponds to August-September. Chingam 1 is the New Year day for Malayali Hindus. • It celebrates the Vamana (fifth avatar of god Vishnu) avatar of Vishnu (principal deity of Hinduism). • It is celebrated to welcome King Mahabali, whose spirit is said to visit Kerala at the time of Onam. • The festival goes on for ten days. • Onam celebrations include Vallamkali (boat race), Pulikali (tiger dance), Pookkalam (floral carpet), Onathappan (worship), Vadamvali (Tug of War), Thumbi Thullal (women's dance), Kummattikali (mask dance), Onathallu (martial arts), Onavillu (music), Kazhchakkula (plantain offerings), Onapottan (costumes), Atthachamayam (folk songs and dance), and other celebrations. Vallamkali Pulikali Pookkalam Onathappan Vadamvali Thumbi Thullal Onathallu Kummattikali Onavillu Atthachamayam Onapottan Kazhchakkula Significance • King Mahabali was also known as Maveli and Onathappan. Mahabali was the great great grandson of a Brahmin sage named Kashyapa , the great grandson of demonic dictator Hiranyakashipu, and the grandson of Vishnu devotee Prahlada. Prahlada, was born to a demonic Asura father who hated Vishnu. Despite this, Prahlada rebelled against his father's ill-treatment of people and worshipped Vishnu. • Hiranyakashipu tried to kill his son Prahlada, but was slained by Vishnu in his Narasimha avatar, Prahlada was saved. -

(Published in the Journal of Sangeet Natak Akademi, New Delhi, 133-134 (1999) Pages 16-24

(Published in the Journal of Sangeet Natak Akademi, New Delhi, 133-134 (1999) pages 16-24. ) Synthesizing Carnatic Music with a Computer M.Subramanian 1. Introduction. The term Computer Music is generally applied to producing music from notation or data, using a Computer Sound Card installed in a Computer or a Synthesizer. It thus implies that the music is synthesized or created artificially approximating as closely as possible the tones of musical instruments. Although the advent of multimedia (simultaneous use of text, pictures and sound on a computer) has led to publication of large number of CD Titles relating to music, these mostly have music recorded from a performer (though occasionally there may be some synthetic music in such titles) and are not considered as generating 'Computer Music'. Again artificial music produced using analog devices are not considered as Computer Music, the essential requirement being that the music is generated from digital data. This article describes the present situation in synthesizing Carnatic Music with the computer, the problems and possible solutions. 1.1. Western musicians and composers have been extensively using the computer in the field of music for the past decade or so. The synthesizer in the computer, similar to the synthesizer of electronic keyboard instruments can play simultaneously more than one 'voice' i.e. more than one instrument (melodic or percussion) playing its own notes. Computer Music greatly assists composers of Western Music with its emphasis on orchestration and harmony. A composer can immediately listen to his ideas without waiting for it to be played by an orchestra. -

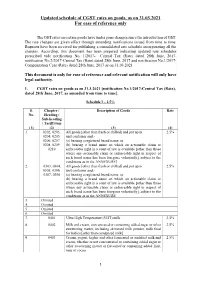

GST Notifications (Rate) / Compensation Cess, Updated As On

Updated schedule of CGST rates on goods, as on 31.03.2021 For ease of reference only The GST rates on certain goods have under gone changes since the introduction of GST. The rate changes are given effect through amending notifications issued from time to time. Requests have been received for publishing a consolidated rate schedule incorporating all the changes. According, this document has been prepared indicating updated rate schedules prescribed vide notification No. 1/2017- Central Tax (Rate) dated 28th June, 2017, notification No.2/2017-Central Tax (Rate) dated 28th June, 2017 and notification No.1/2017- Compensation Cess (Rate) dated 28th June, 2017 as on 31.03.2021 This document is only for ease of reference and relevant notification will only have legal authority. 1. CGST rates on goods as on 31.3.2021 [notification No.1/2017-Central Tax (Rate), dated 28th June, 2017, as amended from time to time]. Schedule I – 2.5% S. Chapter / Description of Goods Rate No. Heading / Sub-heading / Tariff item (1) (2) (3) (4) 1. 0202, 0203, All goods [other than fresh or chilled] and put up in 2.5% 0204, 0205, unit container and,- 0206, 0207, (a) bearing a registered brand name; or 0208, 0209, (b) bearing a brand name on which an actionable claim or 0210 enforceable right in a court of law is available [other than those where any actionable claim or enforceable right in respect of such brand name has been foregone voluntarily], subject to the conditions as in the ANNEXURE] 2. 0303, 0304, All goods [other than fresh or chilled] and put up in 2.5% 0305, 0306, unit container and,- 0307, 0308 (a) bearing a registered brand name; or (b) bearing a brand name on which an actionable claim or enforceable right in a court of law is available [other than those where any actionable claim or enforceable right in respect of such brand name has been foregone voluntarily], subject to the conditions as in the ANNEXURE 3. -

KRAKAUER-DISSERTATION-2014.Pdf (10.23Mb)

Copyright by Benjamin Samuel Krakauer 2014 The Dissertation Committee for Benjamin Samuel Krakauer Certifies that this is the approved version of the following dissertation: Negotiations of Modernity, Spirituality, and Bengali Identity in Contemporary Bāul-Fakir Music Committee: Stephen Slawek, Supervisor Charles Capwell Kaushik Ghosh Kathryn Hansen Robin Moore Sonia Seeman Negotiations of Modernity, Spirituality, and Bengali Identity in Contemporary Bāul-Fakir Music by Benjamin Samuel Krakauer, B.A.Music; M.A. Dissertation Presented to the Faculty of the Graduate School of The University of Texas at Austin in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy The University of Texas at Austin May 2014 Dedication This work is dedicated to all of the Bāul-Fakir musicians who were so kind, hospitable, and encouraging to me during my time in West Bengal. Without their friendship and generosity this work would not have been possible. জয় 巁쇁! Acknowledgements I am grateful to many friends, family members, and colleagues for their support, encouragement, and valuable input. Thanks to my parents, Henry and Sarah Krakauer for proofreading my chapter drafts, and for encouraging me to pursue my academic and artistic interests; to Laura Ogburn for her help and suggestions on innumerable proposals, abstracts, and drafts, and for cheering me up during difficult times; to Mark and Ilana Krakauer for being such supportive siblings; to Stephen Slawek for his valuable input and advice throughout my time at UT; to Kathryn Hansen -

Folk Instruments of Punjab

Folk Instruments of Punjab By Inderpreet Kaur Folk Instruments of Punjab Algoza Gharha Bugchu Kato Chimta Sapp Dilruba Gagar Dhadd Ektara Dhol Tumbi Khartal Sarangi Alghoza is a pair of woodwind instruments adopted by Punjabi, Sindhi, Kutchi, Rajasthani and Baloch folk musicians. It is also called Mattiyan ,Jōrhi, Pāwā Jōrhī, Do Nālī, Donāl, Girāw, Satārā or Nagōze. Bugchu (Punjabi: ਬੁਘਚੂ) is a traditional musical instrument native to the Punjab region. It is used in various cultural activities like folk music and folk dances such as bhangra, Malwai Giddha etc. It is a simple but unique instrument made of wood. Its shape is much similar to damru, an Indian musical instrument. Chimta (Punjabi: ਚਚਮਟਾ This instrument is often used in popular Punjabi folk songs, Bhangra music and the Sikh religious music known as Gurbani Kirtan. Dilruba (Punjabi: ਚਿਲਰੱਬਾ; It is a relatively young instrument, being only about 300 years old. The Dilruba (translated as robber of the heart) is found in North India, primarily Punjab, where it is used in Gurmat Sangeet and Hindustani classical music and in West Bengal. Dhadd (Punjabi: ਢੱਡ), also spelled as Dhad or Dhadh is an hourglass-shaped traditional musical instrument native to Punjab that is mainly used by the Dhadi singers. It is also used by other folk singers of the region Dhol (Hindi: ढोल, Punjabi: ਢੋਲ, can refer to any one of a number of similar types of double-headed drum widely used, with regional variations, throughout the Indian subcontinent. Its range of distribution in India, Bangladesh and Pakistan primarily includes northern areas such as the Punjab, Haryana, Delhi, Kashmir, Sindh, Assam Valley Gagar (Punjabi: ਗਾਗਰ, pronounced: gāger), a metal pitcher used to store water in earlier days, is also used as a musical instrument in number of Punjabi folk songs and dances. -

GCSE Music Revision Booklet

GCSE Music Revision Booklet Dr T Pankhurst Preparing for the exam You need over the next month to develop your listening skills and learn various technical terms and facts about the Areas of Study. The listening skills is what I will concentrate on in class, leaving you to do most of the fact-bashing at home. I will run revision sessions to help with understanding technical vocabulary and the finer points of the Areas of Study topics Revision sessions In addition to lessons in class the following revision sessions will definitely run from 3-4 (I may add a few others if I can): Wednesday 16th May, Friday 20th May, Tuesday 24th May, Tuesday 7th June and Wednesday 8th June. Please email me on [email protected]. MAD TSHIRT It is vital that you use the MAD TSHIRT Melody mnemonic to help prompt you to talk Articulation about relevant and sufficiently technical Dynamics aspects of the music. Texture Structure Harmony Instrumentation Rhythm Time Signature Contents 1. Mad T-Shirt Page 2 2. AoS 2 Page 11 3. AoS 3 Page 18 4. AoS 4 Page 24 5. Chords and Keys Page 26 6. Music periods Online Where there are red {LISTEN} signs you can go to www.alevelmusic.com and follow the GCSE link to find the relevant example. Listen to orchestral instruments: http://www.dsokids.com/listen/by-instrument/.aspx Listen to and practice basics of intervals etc: http://www.auralworkshop.com/index.htm GCSE revision materials: http://www.bbc.co.uk/schools/gcsebitesize/music/ OCR specific materials: http://www.musicalcontexts.co.uk/index_files/page0007.htm In the AoS notes there is suggested listening that you should search for on Youtube. -

MUSIC Hindustani

The Maharaja Sayajirao University of Baroda, Vadodara Ph. D Entrance Tet (PET) SYLLABUS Subject: MUSIC PET ExamCode : 21 Hindustani (Vocal, Instrumental & Musicology), Karnataka, Percussion and Rabindra Sangeet Note:- Unit-I, II, III & IV are common to all in music Unit-V to X are subject specific in music -1- Unit-I Technical Terms: Sangeet, Nada: ahata & anahata , Shruti & its five jaties, Seven Vedic Swaras, Seven Swaras used in Gandharva, Suddha & Vikrit Swara, Vadi- Samvadi, Anuvadi-Vivadi, Saptak, Aroha, Avaroha, Pakad / vishesa sanchara, Purvanga, Uttaranga, Audava, Shadava, Sampoorna, Varna, Alankara, Alapa, Tana, Gamaka, Alpatva-Bahutva, Graha, Ansha, Nyasa, Apanyas, Avirbhav,Tirobhava, Geeta; Gandharva, Gana, Marga Sangeeta, Deshi Sangeeta, Kutapa, Vrinda, Vaggeyakara Mela, Thata, Raga, Upanga ,Bhashanga ,Meend, Khatka, Murki, Soot, Gat, Jod, Jhala, Ghaseet, Baj, Harmony and Melody, Tala, laya and different layakari, common talas in Hindustani music, Sapta Talas and 35 Talas, Taladasa pranas, Yati, Theka, Matra, Vibhag, Tali, Khali, Quida, Peshkar, Uthaan, Gat, Paran, Rela, Tihai, Chakradar, Laggi, Ladi, Marga-Deshi Tala, Avartana, Sama, Vishama, Atita, Anagata, Dasvidha Gamakas, Panchdasa Gamakas ,Katapayadi scheme, Names of 12 Chakras, Twelve Swarasthanas, Niraval, Sangati, Mudra, Shadangas , Alapana, Tanam, Kaku, Akarmatrik notations. Unit-II Folk Music Origin, evolution and classification of Indian folk song / music. Characteristics of folk music. Detailed study of folk music, folk instruments and performers of various regions in India. Ragas and Talas used in folk music Folk fairs & festivals in India. -2- Unit-III Rasa and Aesthetics: Rasa, Principles of Rasa according to Bharata and others. Rasa nishpatti and its application to Indian Classical Music. Bhava and Rasa Rasa in relation to swara, laya, tala, chhanda and lyrics. -

Agenda for 21 GST Council Meeting

Confidential Agenda for 21st GST Council Meeting 9 September 2017 Hyderabad, Telangana Page 2 of 173 F.No. 144/21st Meeting/GST Council/2017 GST Council Secretariat Room No.275, North Block, New Delhi Dated: 5 September 2017 Notice for the 21st Meeting of the GST Council on 9 September 2017 The undersigned is directed to refer to the subject cited above and to say that the 21st meeting of the GST Council will be held on 9 September 2017 at Hyderabad International Convention Centre, Novotel Hotel, Madhapur, Hyderabad. The schedule of the meeting is as follows: i. Saturday, 9 September 2017 : 1100 hours onwards 2. In addition, an officers’ meeting will be held at the same venue as per the following schedule: ii. Friday, 8 September 2017 : 1500 hours onwards 3. The agenda items for the 21st GST Council Meeting are attached. 4. Keeping in view the constraints of rooms in the hotel, it is requested that participation from each State may be limited to 2 officers in addition to the Hon’ble Member of the GST Council. 5. Please convey the invitation to the Hon’ble Members of the GST Council to attend the 21st GST Council Meeting. - Sd - (Dr. Hasmukh Adhia) Secretary to the Govt. of India and ex-officio Secretary to the GST Council Tel: 011 23092653 Copy to: 1. PS to the Hon’ble Minister of Finance, Government of India, North Block, New Delhi with the request to brief Hon’ble Minister about the above said meeting. 2. PS to Hon’ble Minister of State (Finance), Government of India, North Block, New Delhi with the request to brief Hon’ble Minister about the above said meeting. -

Evolution and Assessment of South Asian Folk Music: a Study of Social and Religious Perspective

British Journal of Arts and Humanities, 2(3), 60-72, 2020 Publisher homepage: www.universepg.com, ISSN: 2663-7782 (Online) & 2663-7774 (Print) https://doi.org/10.34104/bjah.020060072 British Journal of Arts and Humanities Journal homepage: www.universepg.com/journal/bjah Evolution and Assessment of South Asian Folk Music: A Study of Social and Religious Perspective Ruksana Karim* Department of Music, Faculty of Arts, Jagannath University, Dhaka, Bangladesh. *Correspondence: [email protected] (Ruksana Karim, Lecturer, Department of Music, Jagannath University, Dhaka, Bangladesh) ABSTRACT This paper describes how South Asian folk music figured out from the ancient era and people discovered its individual form after ages. South Asia has too many colorful nations and they owned different culture from the very beginning. Folk music is like a treasure of South Asian culture. According to history, South Asian people established themselves here as a nation (Arya) before five thousand years from today and started to live with native people. So a perfect mixture of two ancient nations and their culture produced a new South Asia. This paper explores the massive changes that happened to South Asian folk music which creates several ways to correspond to their root and how they are different from each other. After many natural disasters and political changes, South Asian people faced many socio-economic conditions but there was the only way to share their feelings. They articulated their sorrows, happiness, wishes, prayers, and love with music, celebrated social and religious festivals all the way through music. As a result, bunches of folk music are being created with different lyric and tune in every corner of South Asia.