Half-Year Financial Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Consolidated Financial Statements As of December 31, 2018

Consolidated Financial Statements as of December 31, 2018 We hereby present to you the annual financial report for the fiscal year ended on December 31, 2018, prepared in accordance with the provisions of Articles L. 451-1-2 III of the French Monetary and Financial Code and 222- 4 et seq. of the General Regulations of the French Financial Markets Regulator (AMF). This report shall be shared in accordance with the provisions of Article 221-3 of the General Regulations of the AMF. In particular, it shall be available on the website of our company, www.mediawan.com. Contents 1. Consolidated Income Statement ................................................................................................... 4 2. Consolidated Statement of Comprehensive Income...................................................................... 5 3. Consolidated Financial Position .................................................................................................... 6 4. Table of Consolidated Cash Flow ................................................................................................... 7 5. Consolidated Variation of Equity................................................................................................... 8 6. Mediawan Group .......................................................................................................................... 9 6.1. Activities of the Group ........................................................................................................................ 9 6.2. Significant -

Strong Organic Growth of +29% in H1 2019 Confirmation of 2019 Prospects Significant Increase in Production Volume

STRONG ORGANIC GROWTH OF +29% IN H1 2019 CONFIRMATION OF 2019 PROSPECTS SIGNIFICANT INCREASE IN PRODUCTION VOLUME o Sales of €189 million in H1 2019 with a +29% increase at constant scope (like- for-like basis). o EBITDA of €26 million in keeping with the budget and annual targets. o Positive trends in the second half of the year, especially for Mediawan Rights, which has already confirmed significant sales. o Confirmation of short- and medium-term prospects: organic growth above 10% and an increase in EBITDA. Paris, Monday, 30 September 2019, 5.45 CEST - Mediawan (ticker MDW – ISIN: FR0013247137) announces its results for the first half of 2019, approved by the Management Board on 26 September and subject to a limited review by the statutory auditors. Key reported financial indicators H1 2018 H1 2018 % change like In €m H1 2019 1 reported proforma for like Mediawan Originals 68.0 42.3 56.0 +21% Mediawan Animation 49.5 - 15.6 +218% Mediawan Rights 17.2 23.2 20.8 -17% Mediawan Thematics 54.0 54.4 54.4 -1% Total Revenues 188.7 120.4 146.8 +28.6% EBITDA 2 25.9 30.1 Adjusted net income – Group share 15.0 17.8 In €m 06/30/19 12/31/18 Net financial debt 3 142.5 120.9 Shareholders equity 225.8 220.0 1 IFRS 16 – leases has been applied as of January 2019 1st, without restating prior-period comparative information 2 After amortization of audiovisual rights (other than recognized through business combinations) 3 Financial debt excluding loans related to productions. -

550Ccc5465f35683157a0f091d3

1 2 SUMMARY 4K p.05 CURRENT AFFAIRS & INVESTIGATION p.09 INVESTIGATION & SPORT p.13 FOOD INDUSTRY p.15 SCIENCE & KNOWLEDGE p.19 ARCHAEOLOGY & HISTORY p.27 SOCIAL ISSUES & HUMAN INTEREST p.37 WILDLIFE p.42 NATURE & ENVIRONMENT p.47 TRAVEL & DISCOVERY p.57 DOCU DRAMA & EDUCATIONAL p.69 DOCU SOAP p.71 LIFESTYLE p.73 FILLERS & AERIAL VIEW p.76 PEOPLE & PLACES: AROUND THE SEA p.81 3 4 5 Ultra HD programs LENGTH: MY EVERYDAY PANIC 90’ DIRECTOR: Planète en danger Sameh Estefanos How and to what extent Egypt & other developing countries have PRODUCER: been affected by Climate changes, since it was transformed to be Shot by Shot fact as the population of the weak areas in north of Egyptian Delta COPYRIGHT: are suffering by the rapid raising of Mediterranean sea level, a farm- 2021 ers lost their agricultural land and fishermen were forced to stop LANGUAGE sailing in addition to those who are planning for illegal immigration VERSION AVAILABLE: which makes global fear! English Watch the video UPCOMING JUNE 2021 LOOKING FOR INTERNATIONAL PRESALES LENGTH: 52’ XIANJU, THE WAY OF BALANCE DIRECTOR: Xianju, la voie de l’équilibre Patrice Desenne 200 miles south of Shanghai lies the Xianju National Park. PRODUCER: It is a pocket of great plant and animal biodiversity that also Grand Angle Productions holds a treasure of ancestral culture and artisanal and ag- COPYRIGHT: ricultural traditions. It shows a now rare image of China. 2020 How can it be protected and developed without disfiguring it? LANGUAGE Some strategies are emerging with the help of international partners. -

Thomas Anargyros Appointed CEO of Mediawan Studio, a New Entity Gathering Mediawan’S French Drama Production Companies

Thomas Anargyros appointed CEO of Mediawan Studio, a new entity gathering Mediawan’s French drama production companies Paris, July 15th, 2020 – Mediawan announces today that Thomas Anargyros (until now CEO of Storia Television, a Mediawan Group company) has been appointed as CEO of Mediawan Studio, a new entity within its Mediawan Originals unit which will bring together the Group’s French drama production companies. He will supervise and coordinate the activities of the Mediawan Studio companies and develop their international coproduction projects, so as to implement an ambitious development strategy of drama production for all broadcasters and SVOD platforms. He will be supported by two COOs: Dominik Schmelck, currently Managing Director of Makever (another Mediawan Group company) and Matthieu Thollin, currently COO of Storia Television. “I am very happy to be able to count on Thomas’ renowned talent and experience to develop and coordinate the activities of our French drama production companies, and lead the Group’s ambition on that segment,” declared Pierre-Antoine Capton, Chairman of the Board of Mediawan. Thanks to an ambitious portfolio of franchises (like “The Red Bracelets”, “Call My Agent”, “The Crimson Rivers”, “Alice Nevers” or “Savages”), Mediawan has been leading the ranking of French prime-time drama producers (published by Ecran Total magazine) since 2017. Thomas Anargyros Thomas Anargyros is CEO of Storia Television which for many years has been developing an ambitious production strategy in terms of French and international prime time drama. Before that, Thomas Anargyros was Chairman of Cipango then of Europacorp Television France and USA where he produced many series including large international projects like “XIII” (with Val Kilmer and Stephen Dorff) for Canal+, M6 and NBC, distributed on over 160 territories, or the 26 episodes of the US series “Taken”, in coproduction with Universal for NBC. -

2020 Selection

APOLLO 11: BACK ON THE MOON CODED BIAS KILLING PATIENT ZERO PICTURE A SCIENTIST APOLLO 11 : RETOUR SUR LA LUNE Written and directed by Shalini Kantayya Written and directed by Laurie Lynd Written and directed by Ian Cheney and Sharon Shattuck Directed by Charles-Antoine de Rouvre 85 min - US - 2020 100 min - Canada - 2019 Written by Sophie Bocquillon and Charles-Antoine de © 7th Empire Media © Fadoo Productions 97 min - US - 2020 Rouvre French Premiere In association with Fine Point Films © Uprising LLC In association with The Wonder Collaborative 96 min - France - 2019 French Premiere French Premiere © Grand Angle Productions - Groupe EDM Modern society sits at the intersection of two In association with Mediawan Thematics, Sveriges Scapegoated as “Patient Zero” at the center of Television, Al Arabya Channel, RSI, HRT Croatia, crucial questions: what does it mean when Picture A Scientist chronicles the groundswell TVP Poland, RTVS, SRF, Czech Television and artificial intelligence increasingly governs our the AIDS epidemic, Gaëtan Dugas was the France Télévisions liberties? And what are the consequences for handsome, openly gay French-Canadian flight of researchers who are writing a new chapter French broadcast: France 2, Toute l'Histoire the people AI is biased against? When MIT attendant characterized as singlehandedly for women scientists. Biologist Nancy Hopkins, Media Lab researcher Joy Buolamwini spreading AIDS to North America. In this chemist Raychelle Burks, and geologist Jane Willenbring lead viewers on a journey deep 16 July 1969. A rocket, carrying Apollo 11, sits discovers that most facial-recognition software riveting documentary, director Laurie Lynd sets into their own experiences in the sciences, on the launch pad at Cape Canaveral awaiting does not accurately identify darker-skinned out to dismantle this myth. -

Documentaries Catalogue 2021

1 2 SUMMARY 4K p.05 CURRENT AFFAIRS & INVESTIGATION p.09 INVESTIGATION & SPORT p.14 FOOD INDUSTRY p.16 SCIENCE & KNOWLEDGE p.20 BIOGRAPHY p.29 ARCHAEOLOGY & HISTORY p.31 SOCIAL ISSUES & HUMAN INTEREST p.42 WILDLIFE p.47 NATURE & ENVIRONMENT p.52 TRAVEL & DISCOVERY p.59 DOCU DRAMA & EDUCATIONAL p.71 DOCU SOAP p.73 LIFESTYLE p.75 FILLERS & AERIAL VIEW p.78 PEOPLE & PLACES: AROUND THE SEA p.83 3 4 5 Ultra HD programs LENGTH: MY EVERYDAY PANIC 90’ DIRECTOR: Planète en danger Sameh Estefanos How and to what extent Egypt & other developing countries have PRODUCER: been affected by Climate changes, since it was transformed to be Shot by Shot fact as the population of the weak areas in north of Egyptian Delta COPYRIGHT: are suffering by the rapid raising of Mediterranean sea level, a farm- 2021 ers lost their agricultural land and fishermen were forced to stop LANGUAGE sailing in addition to those who are planning for illegal immigration VERSION AVAILABLE: which makes global fear! English Watch the video UPCOMING JUNE 2021 LOOKING FOR INTERNATIONAL PRESALES LENGTH: 52’ XIANJU, THE WAY OF BALANCE DIRECTOR: Xianju, la voie de l’équilibre Patrice Desenne 200 miles south of Shanghai lies the Xianju National Park. PRODUCER: It is a pocket of great plant and animal biodiversity that also Grand Angle Productions holds a treasure of ancestral culture and artisanal and ag- COPYRIGHT: ricultural traditions. It shows a now rare image of China. 2021 How can it be protected and developed without disfiguring it? LANGUAGE Some strategies are emerging with the help of international partners. -

Confirmed 2021 Buyers / Commissioners

As of April 13th Doc & Drama Kids Non‐Scripted COUNTRY COMPANY NAME JOB TITLE Factual Scripted formats content formats ALBANIA TVKLAN SH.A Head of Programming & Acq. X ARGENTINA AMERICA VIDEO FILMS SA CEO XX ARGENTINA AMERICA VIDEO FILMS SA Acquisition ARGENTINA QUBIT TV Acquisition & Content Manager ARGENTINA AMERICA VIDEO FILMS SA Advisor X SPECIAL BROADCASTING SERVICE AUSTRALIA International Content Consultant X CORPORATION Director of Television and Video‐on‐ AUSTRALIA ABC COMMERCIAL XX Demand SAMSUNG ELECTRONICS AUSTRALIA Head of Business Development XXXX AUSTRALIA SPECIAL BROADCASTING SERVICE AUSTRALIA Acquisitions Manager (Unscripted) X CORPORATION SPECIAL BROADCASTING SERVICE Head of Network Programming, TV & AUSTRALIA X CORPORATION Online Content AUSTRALIA ABC COMMERCIAL Senior Acquisitions Manager Fiction X AUSTRALIA MADMAN ENTERTAINMENT Film Label Manager XX AUSTRIA ORF ENTERPRISE GMBH & CO KG content buyer for Dok1 X Program Development & Quality AUSTRIA ORF ENTERPRISE GMBH & CO KG XX Management AUSTRIA A1 TELEKOM AUSTRIA GROUP Media & Content X AUSTRIA RED BULL ORIGINALS Executive Producer X AUSTRIA ORF ENTERPRISE GMBH & CO KG Com. Editor Head of Documentaries / Arts & AUSTRIA OSTERREICHISCHER RUNDFUNK X Culture RTBF RADIO TELEVISION BELGE BELGIUM Head of Documentary Department X COMMUNAUTE FRANCAISE BELGIUM BE TV deputy Head of Programs XX Product & Solutions Team Manager BELGIUM PROXIMUS X Content Acquisition RTBF RADIO TELEVISION BELGE BELGIUM Content Acquisition Officer X COMMUNAUTE FRANCAISE BELGIUM VIEWCOM Managing -

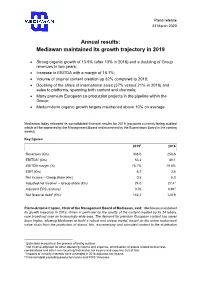

Annual Results: Mediawan Maintained Its Growth Trajectory in 2019

Press release 23 March 2020 Annual results: Mediawan maintained its growth trajectory in 2019 • Strong organic growth of 13.9% (after 13% in 2018) and a doubling of Group revenues in two years; • Increase in EBITDA with a margin of 15.7%; • Volume of original content creation up 32% compared to 2018; • Doubling of the share of international sales (37% versus 21% in 2018) and sales to platforms, spanning both content and channels; • Many premium European co-production projects in the pipeline within the Group; • Medium-term organic growth targets maintained above 10% on average. Mediawan today released its consolidated financial results for 2019 (accounts currently being audited which will be approved by the Management Board and examined by the Supervisory Board in the coming weeks). Key figures 20191 2018 Revenues (€m) 338.0 258.6 EBITDA1 (€m) 53.2 49.1 EBITDA margin (%) 15.7% 19.0% EBIT (€m) 6,7 3,6 Net income – Group share (€m) 0,5 5,0 Adjusted net income2 – Group share (€m) 24.0 27.43 Adjusted EPS (€/share) 0.76 0.943 Net financial debt4 (€m) 142.2 120.9 Pierre-Antoine Capton, Chair of the Management Board of Mediawan, said: “Mediawan maintained its growth trajectory in 2019, driven in particular by the quality of the content created by its 24 labels, now broadcast over an increasingly wide area. The demand for premium European content has never been higher, allowing Mediawan to build a robust and unique model, based on the entire audiovisual value chain from the production of drama, film, documentary and animated content to the distribution 1 Estimated accounts in the process of being audited 2 Net income adjusted for other operating income and expense, amortisation of assets related to business combinations and other non-recurring financial or tax income and expense (net of tax). -

Observe Measure Analyse a Leader in Media Research, We Observe, Measure and Analyse the Behaviour of the Audience and the Trends in the Market

Observe Measure Analyse A leader in media research, we observe, measure and analyse the behaviour of the audience and the trends in the market. Our reliability, our ability to innovate and the commitment of our teams contribute to unite our customers and make Médiamétrie the benchmark and trusted third party in the interest of the media ecosystem. Leader of media and reference studies in audience measurement, Médiamétrie anticipates market developments and is fostering the creation of a data media reference in France. Methodological and technological innovations are at the heart of Médiamétrie’s work, drawing upon the expertise of its teams and a two-fold open innovation process that combines academic and start-up approaches. The company exports its know-how internationally. Significant benchmarks Over 6.5 French people 37.5 screens per household and listen to the radio 44 million Internet an average of daily media and users connect every 42% multimedia contacts day on mobile of households «4 screens» 2h47m per person phones equipped (TV, computer, everyday smartphone and tablet) Nearly 27 million French 60% people have of French people watch 2h48m 44.3 of TV daily viewing million daily watched at a programme on their time worldwide Internet users least one SVoD TV at least 4 nights a week programme in the last 12 months 3 At the Heart of Digital Transformation Track the changes in the media ecosystem Home Devices Media in Life NoTa Audiovisual and digital Contacts with media New TV & Web programmes media equipment in and multimedia in -

Participating Companies at Mip Junior - 06/12/2019

PARTICIPATING COMPANIES AT MIP JUNIOR - 06/12/2019 ARGENTINA BELGIUM EL REINO INFANTIL / LEADER ENTERTAINMENT MACKY INSTITUTO NACIONAL DE CINE Y ARTES AUDIOVISUALES RTBF RADIO TELEVISION BELGE COMMUNAUTE FRANCAISE THE WALT DISNEY COMPANY VRT VIS (VIACOM INTERNATIONAL STUDIOS) BOSNIA AND HERZEGOVINA AUSTRALIA AEON ABC COMMERCIAL BOTSWANA AUSTRALIAN BROADCASTING CORPORATION CAMP BOTSWANA AUSTRALIAN CHILDRENS TELEVISION FOUNDATION TOP POWER PICTURES CASTLEMAN BRAZIL ESCAPADE MEDIA PTY LTD 2DLAB HIPSTER WHALE PTY LTD BOUTIQUE FILMES E PRODUES LTDA IMAGINE IF... BRAZILIAN CONTENT KOMIXX ENTERTAINMENT PTY LTD BROMELIA PRODUCOES LTDA MOOSE TOYS CABONG STUDIOS OZPIX ENTERTAINMENT PTY LTD CHATRONE LATIN AMERICA POP FAMILY ENTERTAINMENT COPA STUDIO PRODUTORA AUDIOVISUAL LTDA. SCREEN AUSTRALIA DRUZINA CONTENT (SUPER8PROD) THE MORFS GLAZ ENTRETENIMENTO SA. WINDMILL PICTURES GLOBOSAT BANGLADESH GLOBOSAT PROGRAMADORA LTDA ROBI AXIATA LIMITED LIGHTSTAR STUDIOS BELARUS MARISOL SA TELEVISION AND RADIO COMPANY VITEBSK MOVILE / PLAY KIDS BELGIUM PAULA TABORDA AGENCE BRUXELLOISE POUR L'ACCOMPAGNEMENT DE PETIT FABRIK L'ENTREPRISE PUSHSTART CONTENTINUUM RIO2C CREATIVE CONSPIRACY N.V. SPIRIT ENTRETENIMENTO LTDA EPP DPG MEDIA SPLIT STUDIO ER PRODUCTIONS STORY PRODUCTIONS BRAZIL FABRIQUE FANTASTIQUE TELECINE PROGRAMACAO DE FILMES LTDA. FLANDERS AUDIOVISUAL FUND - VAF TV PINGUIM IMPS TV SBT CANAL 4 DE SAO PAULO S/A KIWIWIHO PRODUCTIONS BULGARIA LUMIERE PUBLISHING ASSOCIATION OF COPYRIGHT CONTENT CREATORS BULGARIA CANADA CHASE A CLOUD HG DISTRIBUTION FOX NETWORKS GROUP BULGARIA EOOD HOUSE OF COOL CANADA IMAGE-ICC 108 MEDIA JERRYCO ANIMATION 10TH AVE PRODUCTIONS JUST FOR LAUGHS DISTRIBUTION 9 STORY MEDIA GROUP K6 MEDIA GROUP ALLIANCE DES PRODUCTEURS FRANCOPHONES DU CANADA KNOWLEDGE NETWORK KOTV ANTHEM ENTERTAINMENT LP L'ATELIER ANIMATION APARTMENT 11 PRODUCTIONS INC. LANDSLIDE ENTERTAINMENT ARCADIA CONTENT MAINFRAME STUDIOS ATOMIC CARTOONS MOLOT ANIMATION INC. -

8Afdf78ac1020455f3b3db3d584

1 2 SUMMARY 4K p.05 CURRENT AFFAIRS & INVESTIGATION p.08 FOOD INDUSTRY p.13 SCIENCE & KNOWLEDGE p.16 ARCHAEOLOGY & HISTORY p.23 SOCIAL ISSUES & HUMAN INTEREST p.35 WILDLIFE p.41 NATURE & ENVIRONMENT p.46 TRAVEL & DISCOVERY p.52 BIOGRAPHY p.63 DOCU DRAMA & EDUCATIONAL p.65 DOCU SOAP p.67 LIFESTYLE p.69 FILLERS & AERIAL VIEW p.72 PEOPLE & PLACES: AROUND THE SEA p.78 3 4 5 Ultra HD programs LENGTH: 4x52’ MOO! THE EPIC HORNS Meuh ! Les grands bovidés DIRECTOR: Xavier Lefebvre At the dawn of time, their hoof prints mingle with those of Humans. PRODUCER: Step after step, century after century, the great bovine family has Grand Angle Productions accompanied humankind. As essential partners on our greatest ter- COPRODUCERS: ritorial conquests, they continue to change the world at our side even ARTE, TV5 Monde, RSI, today. Ushuaia COPYRIGHT: In the beginning, 18 million years ago, there lived a tiny, shy, forest- 2020 dwelling horned mammal. All alone, through the laws of evolution, LANGUAGE this small antelope becomes the ancestor of the Aurochs, now ex- VERSION AVAILABLE: tinct, which turned humans from the status of hunter-gatherers to French, English that of breeders. Then the ox, yak, buffalo and zebu followed. These descendants are now pivotal elements in many cultures across the world. And against a background of species disappearing from the Earth, they are becoming the biggest land mammals. From their wild forms to the multiple domestic breeds they produced, via the selective hand of humans, the bovines have thus gone side by side with our civilizations throughout our History. -

Mediawan Exchange

PMP MEDIAWAN 100% Vidéo - Mediawan Exchange FÉVRIER 2019 | REGISPUB.COM | MEDIAWAN THEMATICS Mediawan Nos abonnés Expérience Publicitaire mesurer programmatique 270M 250 13000 17 +600 CA H E U R E S D E H E U R E S D E CHAÎNES SALARIÉS PRODUCTION PROGRAMMES THÉMATIQUES P A R A N 3 Mediawan Nos abonnés Expérience Publicitaire mesurer programmatique MEDIAWAN THEMATICS Du contenu vidéo 100% AFFINITAIRE Thématiques affinitaires Grand Public > Mediawan Thematics met à disposition un catalogue affinitaire 100% vidéo. > Documentaires, évènements sportifs, dessins animés, émissions auto, généraliste. > IPTV, Youtube La Jeunesse Chaînes belges 3 NOS ABONNés 100% THÉMATIQUES www.regispub.com Mediawan Nos abonnés Expérience Publicitaire mesurer programmatique NOS chaînes de contenus affinitaires Nous développons des communautés d’intentionnistes , passionnés de vidéos sur les supports préférés de vos cibles. • IPTV – Freebox, Bbox • Chaînes de contenus Youtube Nos Chaînes 1M Abonnés replay Youtube Bénéfice client 2M 33M mois mois Nous développons des liens forts. Vidéos vues Vidéos vues Basés sur : Basé sur statistique free Chaînes thématiques Bouygues + sfr (en cours) (grizzy et les leemings…) - Des licences et contenus forts Streams IPTV, OTT Streams Youtube Report interne digital . Stats Free, facebook et Youtube, novembre 2018 5 Mediawan Nos abonnés Expérience Publicitaire mesurer programmatique NoS abonnés visionnent 35M de contenus tous les mois Des audiences toutes affinitaires Divertissements Kids & school Sports CSP+ 27M 1,2M 800 000 6,5M Vidéos vues Vidéos vues Vidéos vues Vidéos vues Grizzy et les leemings AUTOMOTO, Sciences & Vie, RTL9, Tobot Trek, Toute l’histoire, AB1, Teamkids Golf Channel Golf Channel Channel Youtube Mangas Catch Off Report interne digital .