CLIMATE ACTION PLAN Websites

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Plan Employers

Plan Employers 18th Street Community Care Society 211 British Columbia Services Society 28th Avenue Homes Ltd 4347 Investments Ltd. dba Point Grey Private Hospital 484017 BC Ltd (dba Kimbelee Place) 577681 BC Ltd. dba Lakeshore Care Centre A Abilities Community Services Acacia Ty Mawr Holdings Ltd Access Human Resources Inc Active Care Youth and Adult Services Ltd Active Support Against Poverty Housing Society Active Support Against Poverty Society Age Care Investment (BC) Ltd AIDS Vancouver Society AiMHi—Prince George Association for Community Living Alberni Community and Women’s Services Society Alberni-Clayoquot Continuing Care Society Alberni-Clayoquot Regional District Alouette Addiction Services Society Amata Transition House Society Ambulance Paramedics of British Columbia CUPE Local 873 Ann Davis Transition Society Archway Community Services Society Archway Society for Domestic Peace Arcus Community Resources Ltd Updated September 30, 2021 Plan Employers Argyll Lodge Ltd Armstrong/ Spallumcheen Parks & Recreation Arrow and Slocan Lakes Community Services Arrowsmith Health Care 2011 Society Art Gallery of Greater Victoria Arvand Investment Corporation (Britannia Lodge) ASK Wellness Society Association of Neighbourhood Houses of British Columbia AVI Health & Community Services Society Avonlea Care Centre Ltd AWAC—An Association Advocating for Women and Children AXIS Family Resources Ltd AXR Operating (BC) LP Azimuth Health Program Management Ltd (Barberry Lodge) B BC Council for Families BC Family Hearing Resource Society BC Institute -

Unconventional Gas and Oil in North America Page 1 of 24

Unconventional gas and oil in North America This publication aims to provide insight into the impacts of the North American 'shale revolution' on US energy markets and global energy flows. The main economic, environmental and climate impacts are highlighted. Although the North American experience can serve as a model for shale gas and tight oil development elsewhere, the document does not explicitly address the potential of other regions. Manuscript completed in June 2014. Disclaimer and copyright This publication does not necessarily represent the views of the author or the European Parliament. Reproduction and translation of this document for non-commercial purposes are authorised, provided the source is acknowledged and the publisher is given prior notice and sent a copy. © European Union, 2014. Photo credits: © Trueffelpix / Fotolia (cover page), © bilderzwerg / Fotolia (figure 2) [email protected] http://www.eprs.ep.parl.union.eu (intranet) http://www.europarl.europa.eu/thinktank (internet) http://epthinktank.eu (blog) Unconventional gas and oil in North America Page 1 of 24 EXECUTIVE SUMMARY The 'shale revolution' Over the past decade, the United States and Canada have experienced spectacular growth in the production of unconventional fossil fuels, notably shale gas and tight oil, thanks to technological innovations such as horizontal drilling and hydraulic fracturing (fracking). Economic impacts This new supply of energy has led to falling gas prices and a reduction of energy imports. Low gas prices have benefitted households and industry, especially steel production, fertilisers, plastics and basic petrochemicals. The production of tight oil is costly, so that a high oil price is required to make it economically viable. -

Zone 12 - Northern Interior and Prince George

AFFORDABLE HOUSING Choices for Seniors and Adults with Disabilities Zone 12 - Northern Interior and Prince George The Housing Listings is a resource directory of affordable housing in British Columbia and divides British Columbia into 12 zones. Zone 12 identifies affordable housing in the Northern Interior and Prince George. The attached listings are divided into two sections. Section #1: Apply to The Housing Registry Section 1 - Lists developments that The Housing Registry accepts applications for. These developments are either managed by BC Housing, Non-Profit societies, or Co- Operatives. To apply for these developments, please complete an application form which is available from any BC Housing office, or download the form from www.bchousing.org/housing- assistance/rental-housing/subsidized-housing. Section #2: Apply directly to Non-Profit Societies and Housing Co-ops Section 2 - Lists developments managed by non-profit societies or co-operatives which maintain and fill vacancies from their own applicant lists. To apply for these developments, please contact the society or co-op using the information provided under "To Apply". Please note, some non-profits and co-ops close their applicant list if they reach a maximum number of applicants. In order to increase your chances of obtaining housing it is recommended that you apply for several locations at once. Housing for Seniors and Adults with Disabilities, Zone 12 - Northern Interior and Prince George August 2020 AFFORDABLE HOUSING SectionSection 1:1: ApplyApply toto TheThe HousingHousing RegistryRegistry forfor developmentsdevelopments inin thisthis section.section. Apply by calling 250-562-9251 or, from outside Prince George, 1-800-667-1235. -

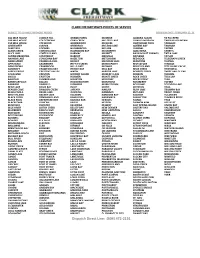

Points of Service

CLARK FREIGHTWAYS POINTS OF SERVICE SUBJECT TO CHANGE WITHOUT NOTICE REVISION DATE: FEBRUARY 12, 21 100 MILE HOUSE COBBLE HILL GRAND FORKS MCBRIDE QUADRA ISLAND TA TA CREEK 108 MILE HOUSE COLDSTREAM GRAY CREEK MCLEESE LAKE QUALICUM BEACH TABOUR MOUNTAIN 150 MILE HOUSE COLWOOD GREENWOOD MCGUIRE QUATHIASKI COVE TADANAC AINSWORTH COMOX GRINDROD MCLEOD LAKE QUEENS BAY TAGHUM ALERT BAY COOMBS HAGENSBORG MCLURE QUESNEL TAPPEN ALEXIS CREEK CORDOVA BAY HALFMOON BAY MCMURPHY QUILCHENA TARRY'S ALICE LAKE CORTES ISLAND HARMAC MERRITT RADIUM HOT SPRINGS TATLA LAKE ALPINE MEADOWS COURTENAY HARROP MERVILLE RAYLEIGH TAYLOR ANAHIM LAKE COWICHAN BAY HAZELTON METCHOSIN RED ROCK TELEGRAPH CREEK ANGELMONT CRAIGELLA CHIE HEDLEY MEZIADIN LAKE REDSTONE TELKWA APPLEDALE CRANBERRY HEFFLEY CREEK MIDDLEPOINT REVELSTOKE TERRACE ARMSTRONG CRANBROOK HELLS GATE MIDWAY RIDLEY ISLAND TETE JAUNE CACHE ASHCROFT CRAWFORD BAY HERIOT BAY MILL BAY RISKE CREEK THORNHILL ASPEN GROVE CRESCENT VALLEY HIXON MIRROR LAKE ROBERTS CREEK THREE VALLEY GAP ATHALMER CRESTON HORNBY ISLAND MOBERLY LAKE ROBSON THRUMS AVOLA CROFTON HOSMER MONTE CREEK ROCK CREEK TILLICUM BALFOUR CUMBERLAND HOUSTON MONTNEY ROCKY POINT TLELL BARNHARTVALE DALLAS HUDSONS HOPE MONTROSE ROSEBERRY TOFINO BARRIERE DARFIELD IVERMERE MORICETOWN ROSSLAND TOTOGGA LAKE BEAR LAKE DAVIS BAY ISKUT MOYIE ROYSTON TRAIL BEAVER COVE DAWSON CREEK JAFFARY NAKUSP RUBY LAKE TRIUMPH BAY BELLA COOLA DEASE LAKE JUSKATLA NANAIMO RUTLAND TROUT CREEK BIRCH ISLAND DECKER LAKE KALEDEN NANOOSE BAY SAANICH TULAMEEN BLACK CREEK DENMAN ISLAND -

Assessment of Contaminants Associated with Coal Bed Methane

Contaminant Report Number: R6/721C/05 U.S. FISH & WILDLIFE SERVICE REGION 6 CONTAMINANTS PROGRAM Assessment of Contaminants Associated with Coal Bed Methane-Produced Water and Its Suitability for Wetland Creation or Enhancement Projects USFWS - Region 6 - EC Report - R6/721C/05 ABSTRACT Extraction of methane gas from coal seams has become a significant energy source in the Powder River Basin of northeastern Wyoming. In Wyoming, coalbed methane (CBM) gas is extracted by drilling wells into coal seams and removing water to release the gas. Each CBM well produces an average of 10 gallons per minute (gpm) of water and a maximum of 100 gpm. Disposal of CBM produced water is accomplished by direct discharge to surface drainages, and also by a variety of other treatment and disposal methods. Untreated CBM produced water discharged to surface drainages is the primary method of disposal provided that the CBM produced water meets Wyoming water quality standards. Water failing to meet water quality standards cannot legally be discharged into surface drainages and is alternately discharged into closed containment ponds for soil-ground water infiltration and evaporation. In 2000 and 2001, we collected and analyzed water from CBM discharges and receiving waters and sediment and biota from CBM produced water impoundments. In 2002, we collected and analyzed water from CBM closed containment impoundments. All the samples were analyzed for trace elements. The biota included pondweed (Potamogeton vaginatus), aquatic invertebrates, fish, and tiger salamanders (Ambystoma tigrinum). One CBM produced water discharge exceeded the chronic criterion for iron and several CBM produced water discharges exceeded the acute criterion for copper. -

Pages 16 & 17 Kaslo City Hall National Historic Site Re-Opens

August 9, 2018 The Valley Voice 1 CHRISTINA HARDER Your Local Real Estate Professional Volume 27, Number 16 August 9, 2018 Delivered to every home between Edgewood, Kaslo & South Slocan. Office 250-226-7007 Published bi-weekly. Cell 250-777-3888 Your independently owned regional community newspaper serving the Arrow Lakes, Slocan & North Kootenay Lake Valleys Kaslo City Hall National Historic Site re-opens by Jan McMurray The stone work around the foundation CAO Neil Smith points out Also, it will be one of the properties Canada, BC Heritage Legacy Fund, Kaslo’s 1898 City Hall building was repointed, the wood siding boards that the offices have also been to benefit from the sewer collection Community Works Funds and other re-opened July 23 after being closed were refurbished or replaced, the modernized for the 21st century, with system expansion. programs. for restoration and renovations for circular entrance stairway and the telecommunications fibre broadband The Village accessed considerable Kaslo City Hall is one of only almost nine years. The makeover was south side stairway were rebuilt, and and VOIP services telephone made funding support for the project three municipal buildings in BC that well worth the wait – this National a wheelchair ramp was added. possible by the Kaslo infoNet Society. from Columbia Basin Trust, Parks are National Historic Sites. Historic Site is looking very good indeed. “It’s a happy coincidence that 2018 is both the community’s 125th anniversary and a new chapter in the life of City Hall,” said Chief Administrative Officer Neil Smith. The “happy coincidence” doesn’t stop at the year, though. -

Order in Council 1096/1937

1096 Approved and ordered this 18th day of September , A.D. 19 37 At the Executive Council Chamber, Victoria, LleutenantGovernor. PRESENT: The Honourable in the Chair. Mn Hart Mr. Weir Mn Pearson Mr. Wismer Mr. Gray Mn Mr. Mr. To His Honour The Lieutenant-Governor in Council: The undersigned has the honour to recommend that, under the provisions of section 12..of the " Provincial Elections Act," the persons whose names appear hereunder be appointed, without salary, Provincial Elections Commissioners for the purposes of the said section tifor the Electoral Districts in which they reside respectively, as follows :— ELECTORAL DISTRICT. NAME. ADDRESS. Mackenzie Robertson, Robert Spear Ocean Falls The Islands MacCreesh, John Campbell James Island Black, Edward Hamilton Downey Rd.,Deep Cove via Sidney Skinner, William John Fifth St., Sidney Butler, Frank McTavish Rd., Sidney Omineca Brown, Andrew Robertson Burns Lake Ruddy, Anthony Martin Burns Lake Taylor, Thomas Edward Burns Lake Meyers, Allen Colleymount Osborne, Earl Colleymount Meidal, Haakon Decker Lake Saul, Louis Grindley Decker Lake Caldwell, Matthew Charles Endako Ross, John Samuel Endako Kells, Lawrence Hoyden Engen Simard, Amede Joseph Engen Clarke, Frederick Fort Fraser Makins, Frederick Waite Fort Fraser Wars, Julian Philip Fort Fraser Dickinson, William Henry, Jr. Fort St. James Hoy, David Henry Fort St. James Henkel, Jacob William Francois Lake Foote, Henry Hollis Bentley Fraser Lake Steele, Robert Swan Fraser Lake Telford, Ralph Fraser Lake Bickle, William Grassy Plains Durban, Hubert Astlett Grassy Plains Madigan, Frank Houston Silverthorne, Harold Herbert Houston Broadbent, Tom Wesley LeJac Corcoran, Patrick Joseph LeJec Steele, William Beattie Manson Creek, via Fort St. -

In This Issue COVID-19 Overdose Prevention and Response Other Organizational News Wellness and More

July 13, 2021 In this issue COVID-19 Overdose prevention and response Other organizational news Wellness and more COVID-19 NH’s COVID-19 resources • On the NH physician website: • COVID-19 information and resources • On OurNH: • COVID-19 (Coronavirus) • Pandemic Recovery Toolkit COVID-19 case counts and statements Visit the new COVID-19 surveillance dashboard from the BCCDC, to see graphs, maps, and data showing COVID-19 case rates, test positivity and vaccination coverage by local health area (LHA) and community health service area (CHSA). As of July 12, 7,803 cases have been reported in the NH region since the beginning of the pandemic. • Cases currently active: 30 • New cases: 0 • Currently in hospital: 1 o Currently in ICU level care in hospital: 2 • Deaths in the NH region since the beginning of the pandemic: 157 For the latest provincial numbers, see the BC COVID-19 dashboard, which is updated Monday-Friday. The dashboard may not work in all browsers; Chrome is suggested. Page 1 of 6 Medical Staff Digest July 13, 2021 As well, for a visual comparison of COVID-19 cases in BC by HSDA to other Canadian and global jurisdictions, see the COVID-19 Epidemiology app. It’s updated on Mondays, Wednesdays, and Fridays. • Joint statement on Province of B.C.'s COVID-19 response – July 2, 2021 • BCCDC Situation Report – July 7, 2021 Northern Health Virtual Clinic: Data on patient visits The Northern Health Virtual Clinic supports after hours access to COVID-19 and primary care services for those who cannot easily access these services in their communities. -

200 LNG-Powered Vessels Planned in Chongqing by 2020

Number #110 April 2016 2016, APRIL 1 Asian NGV Communications is a publication of AltFuels Communications Group. China: 200 LNG-powered vessels planned in Chongqing by 2020 India Emirates 15,000 vehicles MAN showcases converted to CNG natural gas buses in Delhi this year in Dubai 2 ASIAN NGV COMMUNICATIONS 2016, APRIL 3 Summary April 2016 #110 COPIES DISTRIBUTION We print and mail to 24 Asian countries around 4,000 hard copies addressed to conversion pag 04 China: 200 LNG-powered vessels planned in Chongqing by 2020 centres, Oil & Gas companies, OEM NGVs, governmental related offices, filling station 11. MAN showcases natural owners, equipment suppliers, gas buses in Dubai related associations and industries. In addition, the 12. New collaboration electronic version of the magazine is sent to more than boosts LNG use as 15,000 global NGV contacts in marine fuel in Middle 94 countries. East pag 06 New LNG terminal project begins commercial This e-version is also available 13. Pioneer dual fuel engine for free download to all visitors operations in Beihai of www.ngvjournal.com. demonstrated in Korea Below is the list of hard copy 14. Korean scientists develop receivers. Armenia, Australia, engine operating with Azerbaijan, Bangladesh, China, Egyp, India, Indonesia, Iran, hydrogen and CNG Israel, Japan, Kazakhstan, Korea, Malaysia, Myanmar (Burma), 15. Japan: first hydrogen New Zealand, Pakistan, The refuelling station will Philippines, Russia, Singapore, open in Tohoku Taiwan, Thailand, Turkey, United pag 08 India: 15,000 vehicles Arab Emirates, Vietnam, If your 16. New venture will NGV business is in Asia, the converted to CNG in Delhi Pacific, and the Middle East, promote hydrogen fuel since January advertise with us! cell technologies in Japan Asian NGV Communications 1400 - PMB 174, 300-5, Changchon –Ri, Namsan- 17. -

Clark Freightways Service Schedule and Points of Service

CLARK FREIGHTWAYS SERVICE SCHEDULE AND POINTS OF SERVICE SUBJECT TO CHANGE WITHOUT NOTICE REVISION DATE: JULY 14, 21 DESTINATION BRANCH SHIPPING DAYS DESTINATION BRANCH SHIPPING DAYS 100 MILE HOUSE 100 MILE HOUSE M, W, F BOUCHIE LAKE PRINCE GEORGE 108 MILE HOUSE 100 MILE HOUSE M, W, F BOWSER CAMPBELL RIVER DAILY 150 MILE HOUSE WILLIAMS LAKE M, W, F BRACKENDALE SQUAMISH DAILY 70 MILE HOUSE 100 MILE HOUSE BRALORNE KAMLOOPS T, TH AHOUSAT NANAIMO BRENTWOOD BAY VICTORIA DAILY AINSWORTH CASTLEGAR M, W, F BRIDESVILLE CASTLEGAR AIYANISH TERRACE BRIDGE LAKE 100 MILE HOUSE ALERT BAY CAMPBELL RIVER M, W, F BRITANNIA BEACH SQUAMISH DAILY ALEXIS CREEK WILLIAMS LAKE TUESDAY BRILLIANT CASTLEGAR DAILY ALICE LAKE SQUAMISH DAILY BROOKMERE KAMLOOPS ALKALI LAKE WILLIAMS LAKE BROOKS BAY CAMPBELL RIVER ALLISON CREEK PRINCETON BUCKLEY BAY CAMPBELL RIVER DAILY ALPINE MEADOWS SQUAMISH DAILY BUFFALO CREEK 100 MILE HOUSE ANAHIM LAKE WILLIAMS LAKE TUESDAY BULL RIVER CRANBROOK M, T, W ANGELMONT KAMLOOPS WEDNESDAY BURNS LAKE BURNS LAKE M, T, W, F APEX MINE SITE PENTICTON BURTON VERNON M, W, F APEX MOUNTAIN PENTICTON BUTTLE LAKE CAMPBELL RIVER APPLEDALE CASTLEGAR TH, F CACHE CREEK * CACHE CREEK M, W, TH, F APPLEGROVE VERNON CALL INLET CAMPBELL RIVER AGRENTA CASTLEGAR CAMPBELL RIVER CAMPBELL RIVER DAILY ARMSTRONG VERNON DAILY CANAL FLATS * CRANBROOK M, T, W ASHCROFT * CACHE CREEK M, W, TH, F CANIM LAKE 100 MILE HOUSE W ASPEN GROVE KAMLOOPS M, W, F CANOE KAMLOOPS M, W, F ASPEN PARK KAMLOOPS CANYON CRESTON M, T, W ATHALMER CRANBROOK M, T, W CANYON CITY TERRACE AVOLA KAMLOOPS -

Chapter L—Coal-Bed Methane Gas-In-Place Resource Estimates

Chapter L National Coal Resource Coal-Bed Methane Gas-In-Place Resource Assessment Estimates Using Sorption Isotherms and Burial History Reconstruction: An Example from the Ferron Sandstone Member Click here to return to Disc 1 Volume Table of Contents of the Mancos Shale, Utah By Todd A. Dallegge1 and Charles E. Barker1 Chapter L of Geologic Assessment of Coal in the Colorado Plateau: Arizona, Colorado, New Mexico, and Utah Edited by M.A. Kirschbaum, L.N.R. Roberts, and L.R.H. Biewick U.S. Geological Survey Professional Paper 1625–B* 1 U.S. Geological Survey, Denver, Colorado 80225 * This report, although in the USGS Professional Paper series, is available only on CD-ROM and is not available separately U.S. Department of the Interior U.S. Geological Survey Contents Overview ...................................................................................................................................................... L1 What Is Coal-Bed Methane? ...................................................................................................................... 2 Importance of Coal-Bed Methane Production ........................................................................................ 2 How Much Coal-Bed Methane is Available?........................................................................................... 3 How Do Coal Beds Generate and Store Methane? ................................................................................ 4 Details About Coal Cleat.................................................................................................................... -

Coal Mine Methane Recovery: a Primer

Coal Mine Methane Recovery: A Primer U.S. Environmental Protection Agency July 2019 EPA-430-R-09-013 ACKNOWLEDGEMENTS This report was originally prepared under Task Orders No. 13 and 18 of U.S. Environmental Protection Agency (USEPA) Contract EP-W-05-067 by Advanced Resources, Arlington, USA and updated under Contract EP-BPA-18-0010. This report is a technical document meant for information dissemination and is a compilation and update of five reports previously written for the USEPA. DISCLAIMER This report was prepared for the U.S. Environmental Protection Agency (USEPA). USEPA does not: (a) make any warranty or representation, expressed or implied, with respect to the accuracy, completeness, or usefulness of the information contained in this report, or that the use of any apparatus, method, or process disclosed in this report may not infringe upon privately owned rights; (b) assume any liability with respect to the use of, or damages resulting from the use of, any information, apparatus, method, or process disclosed in this report; or (c) imply endorsement of any technology supplier, product, or process mentioned in this report. ABSTRACT This Coal Mine Methane (CMM) Recovery Primer is an update of the 2009 CMM Primer, which reviewed the major methods of CMM recovery from gassy mines. [USEPA 1999b, 2000, 2001a,b,c] The intended audiences for this Primer are potential investors in CMM projects and project developers seeking an overview of the basic technical details of CMM drainage methods and projects. The report reviews the main pre-mining and post-mining CMM drainage methods with associated costs, water disposal options and in-mine and surface gas collection systems.