Vodafoneziggo 2016 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Planning Application

Planning Application In respect of a Residential and Commercial Development at Lands at Scholarstown Road, Dublin 16 Submitted on Behalf of Ardstone Homes Limited November 2019 1.0 INTRODUCTION 1.1 Multi-Disciplinary Team 2.0 DESCRIPTION OF THE DEVELOPMENT 2.1 Development Description 2.2 What is Build-to-Rent? 3.0 SITE LOCATION AND DESCRIPTION 3.1 Site Location 3.2 Site Description 3.3 Site Context 3.4 Accessibility 3.4.1 Available Bus Services 3.4.2 Improvement of Public Transport in the Area 3.4.3 Employment Locations Available by Public Transport 3.4.4 Greater Dublin Area Cycle Network Plan (2013) 3.4.5 Services and Facilities Available in Close Proximity to the Subject Site 4.0 NATIONAL POLICY 4.1 Project Ireland 2040: The National Development Plan 2018-2027 4.2 Project Ireland 2040: National Planning Framework 4.2.1 Introduction 4.2.2 National Strategic Outcomes and Objectives 4.2.3 Population Growth and Employment 4.2.4 Current Trends in Tenure and Household Formation in Ireland 4.2.5 Sustainable Modes of Transport 4.2.6 Scale, Massing and Design 4.2.7 Waste and Environmental Issues 4.2.8 Implementing the National Planning Framework 4.3 National Spatial Strategy 2002-2020 4.4 Action Plan for Housing and Homelessness, Rebuilding Ireland 4.5 Urban Development and Building Heights – Guidelines for Planning Authorities (December 2018) 4.6 Sustainable Urban Housing: Design Standards for New Apartments – Guidelines for Planning Authorities, 2018 4.7 Urban Design Manual – A Best Practice Guide (2009); 4.8 Design Manual for Urban Roads -

Case Study M7 Group Zenterio OS Chosen As Preferred Middleware by M7 Group

Case Study M7 Group Zenterio OS chosen as preferred middleware by M7 Group M7 Group SA was established in October 2009 in the Grand- Duchy of Luxembourg and is the European provider of satellite and IP-based services for consumers and business customers. 2 | Zenterio Case Study | M7 Group Case Study M7 Group SA Zenterio OS chosen as preferred middleware by M7 Group Today M7 Group SA provides more than 3 million viewers with hundreds of radio and television channels in digital and HD quality. Since 2011 M7 Group SA also provides Internet and VOIP services to their customers in the Netherlands and Belgium. Challenge ing and encoding. Fortunately for us ment process there are always a lot of chal- Zenterio has also worked with a lot of these lenges. Together you want to solve these “Our main challenge was to launch our companies before and have a good rela- challenges and Zenterio helped us a lot. IPTV solution within a limited time frame, tionship with them. Together with the strong Not only by providing good documentation and to do this in a way that would allow and well-documented API’s, especially the for their products (like the different APIs) broad support for different chipsets. Our JS API, we were therefore able to achieve a but also by giving us great support. solution is built for different hybrid projects fast and agile development process for this like DVB-T/S/C, OTT and IPTV. That means project”, continues, Leon Thoolen, CTO All of this also means that we have a solu- that we are dealing with a variety of hard- and co-founder Stream Group and EVP at tion that we can easily implement in other ware and legacy devices from a number of M7 Group. -

Lcd Tv / Led Lcd Tv

ENGLISH OWNER’S MANUAL LCD TV / LED LCD TV Please read this manual carefully before operating your set and retain it for future reference. www.lg.com Separate purchase Wall Mounting Bracket Optional extras can be changed or LSW200B or LSW400B or modified for quality improvement LSW100B or LSW400BG or without any notification. LSW200BG LSW100BG DSW400B or Contact your dealer for buying these DSW400BG items. This device only works with compatible LG LED LCD TV or LCD TV. (19/22/26/32LD3***, (37/42/47LD4***, 32LD4***, 32LD5***, 42/46LD5***, Wireless Media Box 19/22/26/32LE3***, 37/42LE4***, 32LE4***, 22/26LE5***, 37/42/47LE5***) (52/60LD5***, 32LE5***) 55LE5***) (32/42/46/52/60LD5***, 32LE3***, 32/37/42LE4***, 32/37/42/47/55LE5***) HDMI, the HDMI logo and High-Definition Multimedia Interface are trademarks or regis- tered trademarks of HDMI Licensing LLC. CONTENTS Product/service information...............................39 PREPARATION Simple Manual ..................................................40 Selecting the Programme List ...........................41 LCD TV Models : 19/22/26/32LD35**, Input List ............................................................43 19/22/26/32LD34 CONTENTS ** ..........................................A-1 Input Label ........................................................44 LCD TV Models : 32/37/42/47LD4 , 26/32LD32 *** ** Data Service ......................................................45 26/32LD33** ...........................................................A-14 SIMPLINK ..........................................................46 -

TV Channel Distribution in Europe: Table of Contents

TV Channel Distribution in Europe: Table of Contents This report covers 238 international channels/networks across 152 major operators in 34 EMEA countries. From the total, 67 channels (28%) transmit in high definition (HD). The report shows the reader which international channels are carried by which operator – and which tier or package the channel appears on. The report allows for easy comparison between operators, revealing the gaps and showing the different tiers on different operators that a channel appears on. Published in September 2012, this 168-page electronically-delivered report comes in two parts: A 128-page PDF giving an executive summary, comparison tables and country-by-country detail. A 40-page excel workbook allowing you to manipulate the data between countries and by channel. Countries and operators covered: Country Operator Albania Digitalb DTT; Digitalb Satellite; Tring TV DTT; Tring TV Satellite Austria A1/Telekom Austria; Austriasat; Liwest; Salzburg; UPC; Sky Belgium Belgacom; Numericable; Telenet; VOO; Telesat; TV Vlaanderen Bulgaria Blizoo; Bulsatcom; Satellite BG; Vivacom Croatia Bnet Cable; Bnet Satellite Total TV; Digi TV; Max TV/T-HT Czech Rep CS Link; Digi TV; freeSAT (formerly UPC Direct); O2; Skylink; UPC Cable Denmark Boxer; Canal Digital; Stofa; TDC; Viasat; You See Estonia Elion nutitv; Starman; ZUUMtv; Viasat Finland Canal Digital; DNA Welho; Elisa; Plus TV; Sonera; Viasat Satellite France Bouygues Telecom; CanalSat; Numericable; Orange DSL & fiber; SFR; TNT Sat Germany Deutsche Telekom; HD+; Kabel -

Opportunities for Sports in Interactive Entertainment

6 HOURS OF MEXICO CITY TV DISTRIBUTION LIST - EUROPE Approximate Coverage/ Broadcaster Territory Pay/FTA Live/HLs potential reach Schedule Eurosport 1 Pan-Europe Pay 243’000’000 Delayed Delayed 4/9 09.30 – 10.45h, CET Eurosport 1 Germany/DACH FTA 30’000’000+ homes Delayed Delayed 4/9 09.30 – 10.45h, CET Motors TV Pan-Europe Pay TBC Live/HL’s Full race live, 7 x HLs shows from 4/9 – 11/9 Motors TV France Pay TBC Live/HL’s Full race live, 9 x HLs shows from 4/9 – 11/9 Motors TV UK Pay TBC Live/HL’s Full race live, 5 x HLs shows from 4/9 – 11/9 Full race live 3/9 23.50 – 4/9 6.20h ORF Sport ORF Austria FTA 3’500’000 Live plus, CET RTBF Belgium FTA 5’000’000 News News edits w/c 5/9 Live 19.30/20 – 23h, 1h – podium LMP1 L’Equipe 21 France FTA 4’400’000 Live/HL’s HLs 7/9 12.15h, CET 6 HOURS OF MEXICO CITY TV DISTRIBUTION LIST - EUROPE Approximate Coverage/ Broadcaster Territory Pay/FTA Live/HLs potential reach Schedule Sky Deutschland Germany Pay 4’400’000 Live news edits News edits RTL DACH FTA 55’000’000 HL’s 10” HL’s on 4/9 during F1 RTL 7 Netherlands FTA 13’000’000 HL’s HL’s on 18/9 14.30h, 24/9 14.30h CET Ziggo Sport Netherlands Pay 500’000 HL’s HL’s on 7/9 15.50h, 18h, 9/9 12h SRG/SSR Switzerland FTA 5’000’000 HL’s News edits within Sportpanorama on SRF 2 Full race live 19.30h (BT Sport 3), BST, QF tbc; BT Sport UK Pay 5’500’000 Live/HL’s HLs 7/9 19h (BTS1), 8/9 07h (BTS2) , 15h & 24h (BTS1); 9/9 07h & 15h (BTS3) Quest UK FTA 29’000’000 homes HL’s HL’s w/c 5/9 Sky Sports News UK Pay 5’500’000 News News Channel 4 UK FTA 29’000’000 homes -

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, D.C

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, D.C. In the Matter of EDGE CABLE HOLDINGS USA, LLC, File No. SCL-LIC-2020-____________ AQUA COMMS (AMERICAS) INC., AQUA COMMS (IRELAND) LIMITED, CABLE & WIRELESS AMERICAS SYSTEMS, INC., AND MICROSOFT INFRASTRUCTURE GROUP, LLC, Application for a License to Land and Operate a Private Fiber-Optic Submarine Cable System Connecting the United States, the United Kingdom, and France, to Be Known as THE AMITIÉ CABLE SYSTEM JOINT APPLICATION FOR CABLE LANDING LICENSE— STREAMLINED PROCESSING REQUESTED Pursuant to 47 U.S.C. § 34, Executive Order No. 10,530, and 47 C.F.R. § 1.767, Edge Cable Holdings USA, LLC (“Edge USA”), Aqua Comms (Americas) Inc. (“Aqua Comms Americas”), Aqua Comms (Ireland) Limited (“Aqua Comms Ireland,” together with Aqua Comms Americas, “Aqua Comms”), Cable & Wireless Americas Systems, Inc. (“CWAS”), and Microsoft Infrastructure Group, LLC (“Microsoft Infrastructure”) (collectively, the “Applicants”) hereby apply for a license to land and operate within U.S. territory the Amitié system, a private fiber-optic submarine cable network connecting the United States, the United Kingdom, and France. The Applicants and their affiliates will operate the Amitié system on a non-common-carrier basis, either by providing bulk capacity to wholesale and enterprise customers on particularized terms and conditions pursuant to individualized negotiations or by using the Amitié cable system to serve their own internal business connectivity needs. The existence of robust competition on U.S.-U.K., U.S.-France, and (more broadly) U.S.-Western Europe routes obviates any need for common-carrier regulation of the system on public-interest grounds. -

Global Pay TV Operator Forecasts

Global Pay TV Operator Forecasts Table of Contents Published in October 2016, this 190-page electronically-delivered report comes in two parts: A 190-page PDF giving a global executive summary and forecasts. An excel workbook giving comparison tables and country-by-country forecasts in detail for 400 operators with 585 platforms [125 digital cable, 112 analog cable, 208 satellite, 109 IPTV and 31 DTT] across 100 territories for every year from 2010 to 2021. Forecasts (2010-2021) contain the following detail for each country: By country: TV households Digital cable subs Analog cable subs Pay IPTV subscribers Pay digital satellite TV subs Pay DTT homes Total pay TV subscribers Pay TV revenues By operator (and by platform by operator): Pay TV subscribers Share of pay TV subscribers by operator Subscription & VOD revenues Share of pay TV revenues by operator ARPU Countries and operators covered: Country No of ops Operators Algeria 4 beIN, OSN, ART, Algerie Telecom Angola 5 ZAP TV, DStv, Canal Plus, Angola Telecom, TV Cabo Argentina 3 Cablevision; Supercanal; DirecTV Australia 1 Foxtel Austria 3 Telekom Austria; UPC; Sky Bahrain 4 beIN, OSN, ART, Batelco Belarus 2 MTIS, Zala Belgium 5 Belgacom; Numericable; Telenet; VOO; Telesat/TV Vlaanderen Bolivia 3 DirecTV, Tigo, Entel Bosnia 3 Telemach, M:Tel; Total TV Brazil 5 Claro; GVT; Vivo; Sky; Oi Bulgaria 5 Blizoo, Bulsatcom, Vivacom, M:Tel, Mobitel Canada 9 Rogers Cable; Videotron; Cogeco; Shaw Communications; Shaw Direct; Bell TV; Telus TV; MTS; Max TV Chile 6 VTR; Telefonica; Claro; DirecTV; -

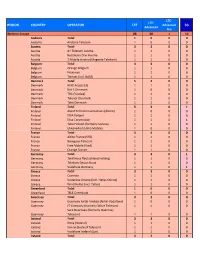

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced 5G Advanced Pro Western Europe 88 68 1 10 Andorra Total 10 0 0 Andorra Andorra Telecom 10 0 0 Austria Total 33 0 0 Austria A1 Telekom Austria 11 0 0 Austria Hutchison Drei Austria 11 0 0 Austria T‐Mobile Austria (Magenta Telekom) 11 0 0 Belgium Total 33 0 0 Belgium Orange Belgium 11 0 0 Belgium Proximus 11 0 0 Belgium Telenet (incl. BASE) 11 0 0 Denmark Total 54 0 0 Denmark Hi3G Access (3) 11 0 0 Denmark Net 1 Denmark 10 0 0 Denmark TDC (YouSee) 11 0 0 Denmark Telenor Denmark 11 0 0 Denmark Telia Denmark 11 0 0 Finland Total 53 0 1 Finland Aland Telecommunications (Alcom) 10 0 0 Finland DNA Finland 11 0 0 Finland Elisa Corporation 11 0 1 Finland Telia Finland (formerly Sonera) 11 0 0 Finland Ukkoverkot (Ukko Mobile) 10 0 0 France Total 44 0 0 France Altice France (SFR) 11 0 0 France Bouygues Telecom 11 0 0 France Free Mobile (Iliad) 11 0 0 France Orange France 11 0 0 Germany Total 33 0 1 Germany Telefonica Deutschland Holding 11 0 0 Germany Telekom Deutschland 11 0 0 Germany Vodafone Germany 11 0 1 Greece Total 33 0 0 Greece Cosmote 11 0 0 Greece Vodafone Greece (incl. Hellas Online) 11 0 0 Greece Wind Hellas (incl. Tellas) 11 0 0 Greenland Total 10 0 0 Greenland TELE Greenland 10 0 0 Guernsey Total 32 0 0 Guernsey Guernsey Airtel Limited (Airtel‐Vodafone) 10 0 0 Guernsey JT Guernsey (formerly Wave Telecom) 11 0 0 Sure Guernsey (formerly Guernsey Guernsey Telecom) 11 0 0 Iceland Total 33 0 0 Iceland Nova (Iceland) 11 0 0 Iceland Siminn (Iceland Telecom) 11 0 0 Iceland Vodafone Iceland (Syn) -

Indicatieve Procentuele Zenderverdeling

Indicatieve Zenderverdeling Top Time Pakket (februari) Ziggo Sport National RTL 4 RTL 5 RTL 7 RTL 8 RTL Z History Ziggo Sport XITE Discovery Eurosport ID TLC 24Kitchen FOX ESPN ESPN 2 ESPN 3 Comedy Central MTV Spike Select Geographic 25 t/m 39 47,4% 16,6% 9,9% 7,6% 2,3% - 2,4% 0,6% - - - - - - - 1,6% 0,8% 0,3% - 5,3% 1,9% 3,2% 25 t/m 54 45,9% 13,7% 12,0% 8,4% 3,0% - 2,4% 0,6% - 2,6% - - 2,3% - 2,5% - - - 1,6% 5,0% - - 25 t/m 59 48,9% 13,9% 13,3% 9,6% 3,2% - - - - 4,1% 2,2% 1,9% 2,7% - - - - - - - - - 35 t/m 54 49,2% 13,3% 13,3% 9,7% 3,5% - - - - 3,3% 1,6% 1,6% - - 2,8% - - - 1,7% - - - 35 t/m 64 50,0% 12,1% 13,4% 10,4% 3,0% - - - - 4,4% 2,2% 1,9% 2,5% - - - - - - - - - 50+ 49,6% 9,6% 13,5% 11,1% 2,2% - 2,4% 0,6% - - 2,9% 1,4% 1,5% - - 3,1% 1,6% 0,5% - - - - 50 t/m 64 49,4% 10,7% 13,5% 9,8% 2,5% 3,0% - - - - 2,3% 1,5% 1,9% - - 3,1% 1,6% 0,5% - - - - 60+ 50,6% 8,6% 13,1% 12,1% 1,7% - 2,4% 0,6% - - 3,6% 1,5% - - - 3,5% 1,8% 0,6% - - - - AB1 25 t/m 54 49,3% 15,1% 11,2% 7,3% 3,0% - 2,4% 0,6% - - 1,3% - - - - - - - - 4,8% 1,3% 3,6% AB1 25 t/m 59 49,3% 14,5% 11,5% 7,6% 3,1% - 2,4% 0,6% - - 1,6% - - - - - - - - 4,5% 1,3% 3,6% AB1 35 t/m 54 50,2% 13,2% 11,6% 7,8% 3,3% - 2,4% 0,6% - - 1,2% 1,0% - 0,8% 1,7% - - - - 3,3% - 3,0% AB1 M 35 t/m 54 46,8% 13,0% 16,7% 5,2% 4,3% - 2,4% 0,6% - 2,3% 1,4% - - - - 2,3% 1,2% 0,4% - - - 3,5% AB1 V 25 t/m 54 52,9% 15,7% 7,9% 9,1% 2,4% - - - - - 1,1% 1,4% 2,6% 1,1% - - - - - 4,1% 1,6% - BDS 25 t/m 54 46,4% 14,3% 10,6% 9,1% 2,6% - 2,4% 0,6% - 2,4% - - 2,7% 1,0% 2,6% - - - - 5,2% - - BDS + kind 50,8% 13,9% 11,5% 10,1% -

Internal Memorandum

Non-confidential version text which has been removed from the confidential version is marked [business secrets] or [XXX] as the case may be Case handlers: Tormod S. Johansen, Brussels, 11 July 2007 Runa Monstad Tel: (+32)(0)2 286 1841/1842 Case No: 13114 e-mail: [email protected] Event No: 436086 By fax (+47 22 83 07 95) and courier Viasat AS Care of: BA-HR Advokatfirma Att: Mr. Helge Stemshaug Postboks 1524 Vika N-0117 Oslo Norway Dear Mr. Stemshaug, Case COM 13114 (former case COM 020.0173) - Viasat/TV2/Canal Digital Norge (please quote this reference in all correspondence) I refer to the application of Viasat AS dated 30 July 2001, pursuant to Article 3 of Chapter II of Protocol 41 to the Agreement between the EFTA States on the Establishment of a Surveillance Authority and a Court of Justice (hereinafter “Surveillance and Court Agreement”), regarding alleged infringements of Articles 53 and 54 of the Agreement on the European Economic Area (hereinafter “EEA Agreement” or “EEA”) by TV2 Gruppen AS and Canal Digital Norge AS. By this letter I inform you that, pursuant to Article 7(1) of Chapter III of Protocol 4 to the Surveillance and Court Agreement,2 the Authority considers that, for the reasons set out below and on the basis of the information in its possession, there are insufficient grounds for acting on your complaint. 1 As applicable before the entry into force of the Agreement amending Protocol 4 of 24 September 2004 (e.i.f. 20.5.2005). 2 As applicable after the entry into force of the Agreement amending Protocol 4 of 3 December 2004 (e.i.f. -

Liste Complète Des Chaînes

Liste complète des chaînes Mise à jour: 2 juin 2020 Retrouvez ci-dessous l'ensemble des chaînes disponibles dans nos différents abonnements ainsi que les chaînes disponibles gratuitement (Free to Air) via la télévision numérique par satellite. Important: les chaînes positionnées sur 23,5 et 28,2 (POS) nécessitent une tête LNB spécifique non disponible dans nos packs. Chaînes disponibles dans notre abonnement Live TV. Options Restart & Replay disponibles pour cette chaîne. NR CHAÎNE ABONNEMENT POS FREQ POL SYMB FEC 1 La Une HD Basic Light Basic Basic+ 13.0 10930 H 30000 2/3 2 La Deux Basic Light Basic Basic+ 13.0 10930 H 30000 2/3 3 RTL-TVI HD Basic Light Basic Basic+ 13.0 10930 H 30000 2/3 4 Club RTL / Kidz RTL Basic Light Basic Basic+ 13.0 10930 H 30000 2/3 5 Plug RTL Basic Light Basic Basic+ 13.0 10930 H 30000 2/3 6 La Trois Basic Light Basic Basic+ 13.0 10930 H 30000 2/3 7 AB3 Basic Light Basic Basic+ 19.2 12515 H 22000 5/6 8 C8 HD Basic Light Basic Basic+ 19.2 12207 V 29700 2/3 9 Infosport+ Basic Light Basic Basic+ 19.2 12207 V 29700 2/3 10 TF 1 HD Basic Light Basic Basic+ 13.0 11681 H 27500 3/4 11 France 2 HD Basic Light Basic Basic+ 13.0 11681 H 27500 3/4 12 France 3 Basic Light Basic Basic+ 13.0 11681 H 27500 3/4 13 France 4 Basic Light Basic Basic+ 13.0 11681 H 27500 3/4 14 France 5 Basic Light Basic Basic+ 13.0 11681 H 27500 3/4 15 France Ô Basic Basic+ 13.0 12692 H 27500 3/4 18 TV Breizh HD Basic Basic+ 19.2 12402 V 29700 2/3 19 Comédie+ HD Basic+ 19.2 12441 V 29700 2/3 24 MCM Basic+ 19.2 12402 V 29700 2/3 25 TMC Basic Basic+ -

Pay-TV Und Paid-Vod in Deutschland 2020/2021

PAY-TV & PAID-VOD IN DEUTSCHLAND 2020/2021 Aktualisierter Marktüberblick 2020/2021 zum Pressegespräch des VAUNET-Arbeitskreises Pay-TV am 27. Juli 2021 Pay-TV und Paid-VoD in Deutschland 2020/2021 Pay-TV und Paid-VoD in Deutschland 2020/2021 2 | VAU.NET Pay-TV und Paid-VoD in Deutschland 2020/2021 Pay-TV und Paid-VoD in Deutschland 2020/2021 Inhalt Methodik .................................................................................................................................. 4 Haftungsausschluss ................................................................................................................ 4 Editorial ................................................................................................................................... 5 Executive Summary .................................................................................... 6 Programmangebot ..................................................................................... 7 Pay-TV-Programme ................................................................................................................. 7 Übersicht aller Pay-TV-Programme nach Genres .................................................................... 8 Plattformen ................................................................................................ 9 Pay-TV-Plattformen ................................................................................................................ 9 Paid-Video-on-Demand-Plattformen ....................................................................................