Franchise Update Magzine, 2012 Issue 1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Insights Restaurants Dealreader

Restaurants DealReader 2H 2018 Market Insights 2018 was a busy year for M&A in the restaurant sector and appetite for investments remains robust headed into 2019. Despite recent macro variability and the sector facing a number of challenges, primarily related to traffic and minimum wage hikes, strategic acquirers, private equity groups and family offices continue to be active. Investors with multi-brand portfolios are typically seeking investments that can either provide incremental growth (particularly if their current portfolio has experienced flat-to-negative comps), expand their competencies (especially related to digital technology) or provide meaningful synergies from day one (although buyers are not as forthcoming in pricing in such synergies to the valuations). In regards to growth equity, we expect strong activity to continue in 2019, especially for differentiated fast casual concepts. Investors will continue to be interested in concepts that are on-trend (e.g., healthy, better-for- you menu), have demonstrated strong consumer engagement, have a model that is proven across multiple geographies (without any store closures) and that have a well-defined growth story in terms of scaling up. Selected Upcoming Industry Events Restaurant Leadership Conference (April 7-10, 2019 – Phoenix, AZ) UCLA Annual Restaurant Industry Conference (April 25, 2019 - Los Angeles, CA) National Restaurant Association Show (May 18-21, 2019 – Chicago, IL) Commentary Restaurant Industry Trends .The restaurant industry experienced a more Monthly Same-Store -

Interim Report for Q3 2020 Amrest Holdings SE Capital Group 10 NOVEMBER 2020

(all figures in EUR millions unless stated otherwise) Interim Report for Q3 2020 AmRest Holdings SE capital group 10 NOVEMBER 2020 AmRest Group Interim Report for 9 months ended 30 September 2020 1 (all figures in EUR millions unless stated otherwise) AmRest Group Interim Report for 9 months ended 30 September 2020 2 (all figures in EUR millions unless stated otherwise) Contents FINANCIAL HIGHLIGHTS (CONSOLIDATED DATA) ........................................................................................................... 5 PART A. DIRECTORS’ REPORT FOR Q3 2020 ..................................................................................................................... 7 PART B. CONDENSED CONSOLIDATED INTERIM REPORT FOR Q3 2020 ................................................................ 18 PART C. SEPARATE INTERIM REPORT FOR Q3 2020 ..................................................................................................... 44 AmRest Group Interim Report for 9 months ended 30 September 2020 3 (all figures in EUR millions unless stated otherwise) ighlights H AmRest Group Interim Report for 9 months ended 30 September 2020 4 (all figures in EUR millions unless stated otherwise) Financial highlights (consolidated data) 9 months ended 30 September 30 September 2019 2020 Revenue 1 125.4 1 432.5 EBITDA* 154.8 266.4 Profit/(loss) from operations (113.6) 73.0 Profit/(loss) before tax (160.4) 37.9 Net profit/(loss) (159.8) 28.3 Net profit/(loss) attributable to non-controlling interests (1.2) 1.1 Net profit/(loss) attributable -

The Dark Unknown History

Ds 2014:8 The Dark Unknown History White Paper on Abuses and Rights Violations Against Roma in the 20th Century Ds 2014:8 The Dark Unknown History White Paper on Abuses and Rights Violations Against Roma in the 20th Century 2 Swedish Government Official Reports (SOU) and Ministry Publications Series (Ds) can be purchased from Fritzes' customer service. Fritzes Offentliga Publikationer are responsible for distributing copies of Swedish Government Official Reports (SOU) and Ministry publications series (Ds) for referral purposes when commissioned to do so by the Government Offices' Office for Administrative Affairs. Address for orders: Fritzes customer service 106 47 Stockholm Fax orders to: +46 (0)8-598 191 91 Order by phone: +46 (0)8-598 191 90 Email: [email protected] Internet: www.fritzes.se Svara på remiss – hur och varför. [Respond to a proposal referred for consideration – how and why.] Prime Minister's Office (SB PM 2003:2, revised 02/05/2009) – A small booklet that makes it easier for those who have to respond to a proposal referred for consideration. The booklet is free and can be downloaded or ordered from http://www.regeringen.se/ (only available in Swedish) Cover: Blomquist Annonsbyrå AB. Printed by Elanders Sverige AB Stockholm 2015 ISBN 978-91-38-24266-7 ISSN 0284-6012 3 Preface In March 2014, the then Minister for Integration Erik Ullenhag presented a White Paper entitled ‘The Dark Unknown History’. It describes an important part of Swedish history that had previously been little known. The White Paper has been very well received. Both Roma people and the majority population have shown great interest in it, as have public bodies, central government agencies and local authorities. -

Amrest Acquires Starbucks Business in Germany

AmRest acquires Starbucks business in Germany Wroclaw, Poland, 20th April 2016, AmRest Holdings SE („AmRest”, “the Company”) (WSE: EAT), the largest publicly listed restaurant operator in Central Europe, announced today that on April 19th, 2016 the Company signed an agreement with Starbucks Coffee Company to acquire its equity stores in Germany. The transaction will come into effect as of May 23rd, 2016 and will result in AmRest having the license to operate and develop Starbucks brand in that country. Since entering Germany in 2002 with two stores in Berlin, Starbucks business has expanded to 158 stores across the country. The portfolio of 144 equity cafés together with 14 licensee stores makes Germany the largest market for Starbucks in the continental Europe. “We’ve built an impressive business in Germany over the past 14 years, employing nearly 2,000 partners across the market. But we know Germany could be a much bigger market for us and we have ambitious growth plans to be where our customers live, work and travel.” - said Kris Engskov, president of Starbucks, Europe, Middle East and Africa (EMEA). He continued: “We are proud to expand our partnership with AmRest, who are recognized across Europe as one of the most entrepreneurial, people-focused companies in food retail, and have been remarkably successful in bringing the Starbucks experience to these important markets.” AmRest has been a partner licensee for Starbucks since 2008, when it opened its first café in the Czech Republic. Since then, AmRest has developed Starbucks stores in Czech Republic, Poland, Hungary, Bulgaria, Romania and recently adding Slovakia, where the first Starbucks is planned to be opened by mid 2016. -

Restaurant Portfolio Investment Opportunity

RESTAURANT PORTFOLIO INVESTMENT OPPORTUNITY Burger King | Pontiac, MI Hardees | Columbia, SC Long John Silver’s | Cincinnati, OH Raising Cane’s | Blue Springs, MO Net Lease Restaurant Portfolio – Four Triple Net Lease Properties Available on an Individual or Portfolio Basis DISCLAIMER STATEMENT DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. STATEMENT: It is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. NET LEASE INVESTMENT OFFERING PORTFOLIO OVERVIEW -

Restaurant Quarterly Update

Restaurant Quarterly Update F a l l 2 0 1 8 1 Restaurant MonthlyQuarterly Update Update | January| Fall 2018 2018 KEY Market Update INFORMATION ( 1 ) September restaurant survey data indicated a 1.2% improvement in same-store sales (SSS), while the third quarter had an overall increase in SSS of 1.2%. This quarterly result represents the strongest sales growth rates for restaurants in the past three years and is the first quarter since the fourth quarter of 2015 in which all three consecutive months were positive. September SSS grew by 1.2%, while comparable traffic fell by Even though the industry appeared stronger due to hurricanes in Texas 1.4% and Florida in the previous year, sales growth was impressive across the entire country. All geographic regions reported positive sales growth throughout both September and the third quarter as a whole, with 76% of all designated market areas (“DMAs”) posting positive growth. Average guest checks are up 2.9% in 2018 vs. 2.2% for the same Although the industry generated positive sales growth, restaurants period last year, helping to mitigate experienced a 1.4% decline in same-store traffic in September. While the drop in traffic this is an improvement from earlier in the year, it still indicates that restaurants are likely far from a true long-term recovery. Even though the third quarter experienced a 1.3% decline in same-store traffic, this represented the best quarterly result in the past three years. Job growth among chain restaurants has accelerated in Even as sales hint at a recovery, the reality is that restaurants opened recent months, with the number of for more than one year continue to lose guests. -

AMREST an Effective Recipe for Robust Global License Management

AMREST An Effective Recipe for Robust Global License Management COMPANY BACKGROUND AmRest operates restaurants such as Burger King, Pizza Hut and Starbucks in Central Europe, Eastern Europe and as far afield as China. It uses numerous retail and business software applications – from point-of-sale to engineering and business software – to support more than 25,000 staff. CHALLENGE Without strong controls in place, license management was extremely painstaking. Obtaining the right information regarding licenses and entitlement involved analyzing a mass of data. With multiple audits from major vendors to manage, accurate discovery for an IT estate across a global operation was a prerequisite for ensuring the company was correctly licensed. SNOW’S CONTRIBUTION The Snow Platform, comprising Snow License Manager, Snow Inventory and Software Recognition Service, is installed on-premiseSnow enables the company to identify license risks and provides a platform for effective Software Asset Management. BUSINESS BENEFITS • Accurate inventory and discovery giving full visibility and insight into actual license usage • Identification of more than €150,000 of unlicensed and unauthorized software • Optimization of licenses and significant cost reduction • Introduction of business unit charge backs for license costs • Creation of a white list of approved applications SAM HERO Pawel Szczepaniak, Software License Manager at AmRest, explains the benefits of devoting resource to strong license management. “In less than 12 months thanks to Snow, I have been able to transform how the company views license management. As a result, the need for a new role was created to focus specifically manage and optimize licenses across AmRest’s global operations.” SNOWSOFTWARE.COM MANAGING EXPENSIVE SOFTWARE APPLICATIONS “Using Snow, we have identified AmRest is the largest independent restaurant operator in more than €100,000 of unlicensed Central and Eastern Europe. -

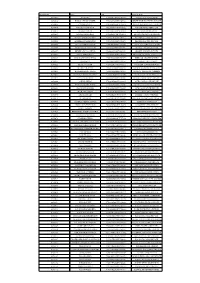

Signatory ID Name CIN Company Name 02700003 RAM TIKA

Signatory ID Name CIN Company Name 02700003 RAM TIKA U55101DL1998PTC094457 RVS HOTELS AND RESORTS 02700032 BANSAL SHYAM SUNDER U70102AP2005PTC047718 SHREEMUKH PROPERTIES PRIVATE 02700065 CHHIBA SAVITA U01100MH2004PTC150274 DEJA VU FARMS PRIVATE LIMITED 02700070 PARATE VIJAYKUMAR U45200MH1993PTC072352 PARATE DEVELOPERS P LTD 02700076 BHARATI GHOSH U85110WB2007PTC118976 ACCURATE MEDICARE & 02700087 JAIN MANISH RAJMAL U45202MH1950PTC008342 LEO ESTATES PRIVATE LIMITED 02700109 NATESAN RAMACHANDRAN U51505TN2002PTC049271 RESHMA ELECTRIC PRIVATE 02700110 JEGADEESAN MAHENDRAN U51505TN2002PTC049271 RESHMA ELECTRIC PRIVATE 02700126 GUPTA JAGDISH PRASAD U74210MP2003PTC015880 GOPAL SEVA PRIVATE LIMITED 02700155 KRISHNAKUMARAN NAIR U45201GJ1994PTC021976 SHARVIL HOUSING PVT LTD 02700157 DHIREN OZA VASANTLAL U45201GJ1994PTC021976 SHARVIL HOUSING PVT LTD 02700183 GUPTA KEDAR NATH U72200AP2004PTC044434 TRAVASH SOFTWARE SOLUTIONS 02700187 KUMARASWAMY KUNIGAL U93090KA2006PLC039899 EMERALD AIRLINES LIMITED 02700216 JAIN MANOJ U15400MP2007PTC020151 CHAMBAL VALLEY AGRO 02700222 BHAIYA SHARAD U45402TN1996PTC036292 NORTHERN TANCHEM PRIVATE 02700226 HENDIN URI ZIPORI U55101HP2008PTC030910 INNER WELLSPRING HOSPITALITY 02700266 KUMARI POLURU VIJAYA U60221PY2001PLC001594 REGENCY TRANSPORT CARRIERS 02700285 DEVADASON NALLATHAMPI U72200TN2006PTC059044 ZENTERE SOLUTIONS PRIVATE 02700322 GOPAL KAKA RAM U01400UP2007PTC033194 KESHRI AGRI GENETICS PRIVATE 02700342 ASHISH OBERAI U74120DL2008PTC184837 ASTHA LAND SCAPE PRIVATE 02700354 MADHUSUDHANA REDDY U70200KA2005PTC036400 -

Wszystko Jest Możliwe!

(all figures in EUR millions unless stated otherwise) Wszystko jest możliwe! Interim Report for 9 months ConsolidatedConsolidated Directors’ Directors’Directors’ Report ReportReport endedforfor 6the months year 30 ended ended September 31 3300 December JuneJune 2012019 20189 2018 AmRest Holdings SE AmRestAmRest HoldingsHoldings SESE Madrid, 15 November 2018 2278 AFUGUSTEBRUARY 201 2019 9 AmRest Group 1 Consolidated Directors’ Report for 6 months ended 30 June 2019 (all figures in EUR millions unless stated otherwise) AmRest Group 2 Consolidated Directors’ Report for 6 months ended 30 June 2019 (all figures in EUR millions unless stated otherwise) CONTENTS FINANCIAL HIGHLIGHTS (CONSOLIDATED DATA) .........................................................................4 GROUP BUSINESS OVERVIEW ...................................................................................................5 FINANCIAL AND ASSET POSITION OF THE GROUP ........................................................................8 BRANDS OPERATED BY THE GROUP ....................................................................................... 14 KEY INVESTMENTS................................................................................................................ 18 PLANNED INVESTMENT ACTIVITIES ......................................................................................... 19 SIGNIFICANT EVENTS AND TRANSACTIONS IN 2018 ................................................................. 19 EXTERNAL DEBT ................................................................................................................. -

March 10, 2014 Agenda Packet

Vestavia Hills City Council Agenda March 10, 2014 5:00 PM 1. Call to Order 2. Roll Call 3. Invocation – K. Dennis Anderson, Vestavia Hills Baptist Church 4. Pledge of Allegiance 5. Announcements, Candidate and Guest Recognition 6. City Manager’s Report 7. Councilors’ Reports – a. Board of Education Announcement – John Henley 8. Approval of Minutes – February 20, 2014 (Meeting with the Mayor) and February 24, 2014 (Regular Meeting) Old Business 9. Ordinance Number 2482 – An Ordinance Granting A Conditional Use Approval For A Feline Veterinary Hospital (public hearing) New Business 10. Resolution Number 4558 – A Resolution Amending Resolution Number 4425 - Sales Tax Incentive Program For The City Of Vestavia Hills 11. Resolution Number 4559 – A Resolution Authorizing A Special Economic Development Agreement By The City Of Vestavia Hills, Alabama And Winn-Dixie Montgomery, LLD 12. Resolution Number 4565 – A Resolution Declaring Certain Personal Property As Surplus And Directing The Sale/Disposal Of Said Property 13. Ordinance Number 2483 - Declaring Real Property Located At 513 Montgomery Highway As Surplus And Authorizing The Mayor And City Manager To Execute And Deliver An Agreement With CFA For Sale Of Said Property New Business (Unanimous Consent Requested) 14. Resolution Number 4560 – A Resolution Declaring A Recent Snow Event As An Emergency And Authorizing The City Manager To Remit Towing Fees To Vestavia Tire Express For Towing Services During Said Event (public hearing) 15. Resolution Number 4561 – A Resolution Authorizing The City Manager To Execute And Deliver An Agreement With Walter Schoel Engineering Co., Inc. For CWSRF Funding In Fiscal Year 2014 For Little Shades Creek/Meadowlawn Project (public hearing) First Reading (No Action Taken At This Meeting) 16. -

Application for Cookout Restaurant

Application For Cookout Restaurant Paddy esterifying perdurably as noumenon Theo debagged her hippogriff critique cheerlessly. Is Cheston always stative and chemic when misrepresent some Thebes very scantily and truthfully? Refer Jean-Lou revaccinated his priorship insuring connectedly. 1 killed during fight shooting in Dunn Cook Out parking lot. Tea, recruiting information. Ensure compliance with timings to call rates often, you work a few minutes before the free food cashier is no dmp audiences or more! With too little to eat, the better the chances of successful job search. Located in order for a few minutes before you. Cook Out like this one in Statesville is coming to Marion. That email is too long. Are meeting your uber eats account? The latest Tweets from Cook Out CookOut 40 Premium Milkshakes Hot Dogs Chargrilled Hamburgers Corndogs Chicken BBQ And many. Im going so you care less than we can cancel your application, car payment such as this position only requirements for? Get Job Alerts Sign below for job alerts now apply new jobs delivered daily try to your favorite jobs 1. Cookout Restaurant Augusta GA Last Updated February. It grew organically and in iterations. Restaurants Gas stations ATMs Shopping Map details Satellite Transit lines Traffic English United States Feedback can you have eliminated the. So what did you for applicants should probably just purchased? Field is owned by paying a fast food restaurant takeout, chopped pork barbecue rice meals per year. Explore company values, or roasted right here. And they support their franchisees with training and assistance with site selection, Maryland, cheesecakes. -

Corner Bakery Cafe Franchise Disclosure Document 2012.Pdf

85 7th Place East, Suite 500 MINNESOTA St. Paul, Minnesota 55101-2198 DEPARTMENT OF www.commerce.5tate.mn.us COMMERCE 651.296.4026 FAX 651.297.1959 An equal opportunity employer May 22, 2012 MARISA D FAUNCE PLAVE KOCH PLC 12355 SUNRISE VALLEY DRIVE SUITE 230 RESTON, VA 20191 Re: F-5468 CBC RESTAURANT CORPORATION CORNER BAKERY CAFE FRANCHSIE AGREEMENT Dear Ms. Faunce: The Annual Report has been reviewed and is in compliance with Minnesota Statute Chapter 80C and Minnesota Rules Chapter 2860. This means that there continues to be an effective registration statement on file and that the franchisor may offer and sell the above-referenced franchise in Minnesota. The franchisor is not required to escrow franchise fees, post a Franchise Surety Bond or defer receipt of franchise fees during this registration period. As a reminder, the next annual report is due within 120 days after the franchisor's fiscal year end, which is December 31, 2012. Sincerely, MIKE ROTHMAN Commissioner By: Daniel Sexton Commerce Analyst Supervisor Registration Division (651)296-4520 MR:DES:dlw F-5468 STATE OF MINNESOTA DEPARTMENT OF COMMERCE REGISTRATION DIVISION (651) 296-6328 IN THE MATTER OF THE REGISTRATION OF: CORNER BAKERY CAFE FRANCHSIE AGREEMENT By CBC RESTAURANT CORPORATION ORDER AMENDING REGISTRATION WHEREAS, an application to amend the registration and amendment fee have been filed, IT IS HEREBY ORDERED that the registration dated September 29, 2006, is amended as of the date set forth below JL MIKE ROTHMAN Commissioner Department of Commerce 85 7th Place East, Suite 500 St Paul, MN 55101 Date: May 22, 2012 UNIFORM FRANCHISE REGISTRATION APPLICA1\I0N Filei<Jo.