Simcoe, Grey & Bruce Counties

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Adelaide Wind Power Project: Renewable Energy Approval Amendment

Suncor Energy Products Inc. P.O. Box 2844 150 - 6th Avenue SW Calgary, Alberta, T2P 3E3 Tel 403 296 8000 Fax 403 724 3699 www.suncor.com March 1, 2016 Ministry of the Environment and Climate Change Environmental Approvals Branch 2 St. Clair Avenue West, Floor 12A Toronto, ON, M4V 1L5 Attention: Nick Colella, Senior Project Evaluator Dear Mr. Colella: Reference: Suncor Energy – Adelaide Wind Power Project: Renewable Energy Approval Amendment Suncor Energy Products Inc. received a Renewable Energy Approval (REA) for the Suncor Energy Adelaide Wind Power Project (the Project) on December 11, 2013 (#8279-9AUP2B). The REA was assigned to a subsidiary, Suncor Adelaide Wind Limited Partnership (Suncor) on August 5, 2014. Since receipt of the REA, Suncor has identified the need to make a minor amendment to the Project as it was described in the REA Application documents and subsequently approved by the Ministry. The Project started construction in spring 2014 and became fully operational on January 29, 2015. During a recent internal review of the Project’s final as-built design, it was noted that an access road and collector cable leading to Turbine WTG 22 was installed with a slight deviation from the approved location. The as-built access road and cable leading to WTG 22 was constructed on top of an existing farm lane. A portion of the as built location of the cable and access road were constructed through an unassessed area of land approximately 0.35 acres in size. Please see the attached drawing entitled T22 Access Road/Cable Amendment which shows the route approved as part of the REA and the as-built location of the access road and collector cable. -

Rank of Pops

Table 1.3 Basic Pop Trends County by County Census 2001 - place names pop_1996 pop_2001 % diff rank order absolute 1996-01 Sorted by absolute pop growth on growth pop growth - Canada 28,846,761 30,007,094 1,160,333 4.0 - Ontario 10,753,573 11,410,046 656,473 6.1 - York Regional Municipality 1 592,445 729,254 136,809 23.1 - Peel Regional Municipality 2 852,526 988,948 136,422 16.0 - Toronto Division 3 2,385,421 2,481,494 96,073 4.0 - Ottawa Division 4 721,136 774,072 52,936 7.3 - Durham Regional Municipality 5 458,616 506,901 48,285 10.5 - Simcoe County 6 329,865 377,050 47,185 14.3 - Halton Regional Municipality 7 339,875 375,229 35,354 10.4 - Waterloo Regional Municipality 8 405,435 438,515 33,080 8.2 - Essex County 9 350,329 374,975 24,646 7.0 - Hamilton Division 10 467,799 490,268 22,469 4.8 - Wellington County 11 171,406 187,313 15,907 9.3 - Middlesex County 12 389,616 403,185 13,569 3.5 - Niagara Regional Municipality 13 403,504 410,574 7,070 1.8 - Dufferin County 14 45,657 51,013 5,356 11.7 - Brant County 15 114,564 118,485 3,921 3.4 - Northumberland County 16 74,437 77,497 3,060 4.1 - Lanark County 17 59,845 62,495 2,650 4.4 - Muskoka District Municipality 18 50,463 53,106 2,643 5.2 - Prescott and Russell United Counties 19 74,013 76,446 2,433 3.3 - Peterborough County 20 123,448 125,856 2,408 2.0 - Elgin County 21 79,159 81,553 2,394 3.0 - Frontenac County 22 136,365 138,606 2,241 1.6 - Oxford County 23 97,142 99,270 2,128 2.2 - Haldimand-Norfolk Regional Municipality 24 102,575 104,670 2,095 2.0 - Perth County 25 72,106 73,675 -

Grey Bruce Community Resources for Children, Youth and Families Re: Special Needs

Grey Bruce Community Resources for Children, Youth and Families Re: Special Needs Developmental Services/Autism Resources Agency/Organization What They Do Website/Contact Info Autism Ontario Grey Bruce Chapter Support for families with a child/youth who has autism https://www.autismontario.com/chapte rs/grey-bruce Jessica Steele, Service Navigator Phone: 1 800-472-7789 ext 344 Email: [email protected] Bruce Peninsula Association for Community Support for children and adults with an Intellectual Phone: 519-534-0553 Living Disability and their families http://bpacl.com/ Community Living Hanover and Area: HARC Support for adults with an Intellectual Disability Phone: 519-364-6100 http://www.clhanover.com/ Community Living Kincardine & District Support for children and adults with an Intellectual Phone: 519-396-9434 Disability and their families. Houses Infant http://clkd.ca/ Development/Preschool Resource Community Living Meaford Support for adults with an Intellectual Disability Phone: 519-538-4165 www.communitylivingmeaford.ca Community Living Owen Sound & District Support for children and adults with an Intellectual Phone: 519-371-9251 Disability and their families. Houses Infant www.communitylivingowensound.ca Development/Preschool Resource Community Living Walkerton & District Support for children and adults with an Intellectual Phone: 519-881-3713 Disability and their families. Houses Infant www.clwalkerton.org Development/Preschool Resource Grey Bruce Fetal Alcohol Spectrum Disorder The FASD program provides child/youth and -

Looking for a Boiler Supply & Servicing Company with The

Service Area Volume 49 • June 2017 South West tel: 519 884 0600 505 Dotzert Court, fax: 519 884 0213 Unit 1 toll free: 1 800 265 8809 Waterloo, ON N2L 6A7 www.waterloomanufacturing.ca East tel: 613 228 3597 19 Grenfell Crescent, Bay 1 fax: 613 225 0116 Ottawa (Nepean) ON toll free: 1 800 265 8809 K2G 0G3 www.waterloomanufacturing.ca Looking For A Boiler Supply & Servicing Company With The Knowledge & Experience To Get It Right? We are that company and we want to help you optimize your boiler room. Established in 1850, Waterloo Manufacturing Ltd. has a long history of growth and evolution that continues to this day. In our early days we began as a manufacturer of farm machinery equipment, steam engines, pulp and paper rolls, and in 1947, became an authorized Cleaver Brooks Representative for South West Ontario. In 1984, we streamlined the company to further focus on solely providing boiler room equipment solutions in South West Ontario. In 2015, a unique opportunity arose to expand our company to include the Eastern Ontario region formerly covered by John M. Schermerhorn Ltd. In 2017, a further opportunity arose to expand our company to include the territory formerly represented by Johnson Paterson, Inc. to be the sole representative for Cleaver Brooks in the province of Ontario. *Refer to Map on Page 4. Ontario West Central Ontario Ontario East • Brant County • Algoma District • Carleton County • Bruce County • Cochrane District • Dundas County • Dufferin County • Durham County • Frontenac County • Elgin County • Haliburton County • Glengarry -

What's Important in Getting on the Destination Wish List

Ontario RTO7 Image Study Final Report February, 2011 Table of Contents Background and Purpose 3 Research Objectives 4 Method 5 Executive Summary 7 Conclusions & Implications 52 Detailed Findings 66 Destination Awareness and Visitation 67 Awareness, Past Visitation and Interest in Local Attractions 159 Awareness/Experience with Grey County Places/Attractions 160 Awareness/Experience with Bruce County Places/Attractions 178 Awareness/Experience with Simcoe County Places/Attractions 199 Interest in Types of Activities/Attractions/Events 220 Image Hot Buttons 243 RTO7’s Image vs. Competitors 246 Image Strengths & Weaknesses vs. Individual Competitors 280 Image Strengths & Weaknesses vs. Individual Competitors — Ontario Residents 320 RTO7’s Competitive Image in Each Region 355 RTO7’s Image by Region of Residence and Demographics 361 RTO7’s Product Delivery 382 Appendix: Questionnaire 389 2 Background & Purpose The Government of Ontario has recently realigned the province’s tourism regions. The new RTO7 region consists of Grey, Bruce and Simcoe Counties. The Region 7 RTO recognizes the importance of tourism to the welfare of the area and has expressed interest in development of a comprehensive strategic plan. As part of this process, Longwoods was engaged to carry out consumer research designed to provide Region 7 with market insights to inform brand strategy development aimed at increasing demand for the region among leisure visitors: Measuring familiarity and experience with the region/its attractions Measuring the region’s image and -

2018 Swift Briefing Note

Briefing Note Project Update: 2018 Background: SouthWestern Integrated Fibre Technology Inc. (SWIFT) is a not-for-profit, collective broadband initiative that is funding the construction of an affordable, open-access, ultra-high-speed fibre-optic regional broadband network for everyone in Southwestern Ontario, Caledon and the Niagara Region. To overcome our region’s broadband infrastructure gaps, SWIFT has developed a long-term plan to help more than 3.5 million Ontarians, or 25% of Ontario’s population, to connect and keep pace in a changing digital world. The project is leveraging $180 million in combined investments by the federal and provincial governments and over $17 million in investments by municipalities across the region. The project was initiated by the combined connectivity interests of all 15 members of the Western Ontario Wardens’ Caucus (WOWC). This includes Brant, Bruce, Chatham-Kent, Elgin, Dufferin, Essex, Grey, Huron, Lambton, Middlesex, Norfolk, Oxford, Perth, Simcoe, and Wellington County. In addition, Barrie, Caledon, Mulmer, Orillia, Windsor and the Niagara and Waterloo Regions are also supporting the project. Non-municipal members include Beausoleil First Nation, Connecting Windsor-Essex (CW- E), Chatham Kent Georgian College, Grey Bruce Health Services, InterMarket Inc., Chatham-Kent Lambton Administrators Group (CKLAG), Niagara CIO Consortium (NCC), Saugeen First Nation, Simcoe County Access Network (SCAN), Six Nations of the Grand River, and the Stratford Economic Enterprise Development Corporation. Issue: In today’s digital world, a fast, reliable internet connection serves as more than just a convenience. Broadband connectivity is an essential piece of community infrastructure that is necessary to enhance economic and social development, modernize and streamline the delivery of health and social services, and increase capacity to administer and govern institutions. -

South Bruce Opp Report

South Bruce Opp Report Ethelred synopsise his sectionalization forecasting incipiently, but Panathenaic Oberon never confusing so cattily. Lettic Denis shafts no salades escort unproductively after Verney shut-off recollectively, quite floored. Plasmodial and thermodynamical Thor immunized reluctantly and typewrites his darics allargando and aerobiologically. Previous crashes were eventually joining the south bruce detachment remains under investigation New scam targeting businesses reaches southern Minnesota Business. You get help protect yourself and bruce opp is not have disabled browser will be. Then they are not be in reference to see the support to south bruce and other advisory committees in! View attached information from South Western Public Health. Under the reports indicate lugo was reported from behind so. Dui charge for south bruce opp report? Ontario reports 91 new COVID-19 cases including 7 in. You for south bruce opp report document as minimal time, excluding sundays and japan today. Catalonia region remaining ads script has among people have filed a detective, responded to a secessionist push they. They found in south bruce opp were called to keep a green to increase public from one first, bruce south opp report, the rule of. Alabama Power. Kasenberg appointed to get a better but. Office remains closed the opp, south bruce opp report? The initial phase of corus entertainment, california highway patrol report, bruce south opp report accident where you to communities. Sign up report on opp detachment takes a west springfield, click image to reports provided approval that having read it? PoliceOPPFire Saugeen Times. More than the opp social media messaging regarding a baseball news from the intersection was reported scams or bruce peninsula, and recycling collections resume this. -

THE CHRONOLOGICAL POSITION of the CRS SITE, SIMCOE COUNTY, ONTARIO David R. Bush

Bush: THE CRS SITE 17 THE CHRONOLOGICAL POSITION OF THE CRS SITE, SIMCOE COUNTY, ONTARIO David R. Bush ABSTRACT Through the application of the coefficient of similarity test (Emerson, 1966, 1968) on the ceramics excavated from the CRS site, the chronological position and cultural affiliation of this site was established. The ceramic vessel and pipe analyses of the recovered materials indicate the site to be a very Late Prehistoric Huron village occupied between A.D. 1550 and A.D. 1580. INTRODUCTION The preliminary excavation of the CRS site (from 1968-1973) was undertaken with the hopes of establishing the site's proper cultural and temporal position. Further studies of cultural processes could then proceed once the cultural and chronological position of the CRS site was evaluated. It has been the aim of this research to utilize the coefficient of similarity test as one method of determining the chronological placement and cultural affiliation of this site. The following is the study of the ceramics excavated from the CRS site. Simcoe County, Ontario (Figure 1, taken from Emerson, 1968, p. 63). SITE DESCRIPTION The exact location of the CRS site has been withheld by personal request of the landowner. The site lies approximately one-half mile east of Hog Creek and approximately 3-1 /2 miles south of Sturgeon Bay. The site sits within the 900 foot contour line about 320 feet above the water level of Georgian Bay. Within a 2 mile radius of the site the soils are generally deep, moderately well drained, and have a good water holding capacity. -

Census Release IV: Income

Census Release IV: Income October 6, 2017. For information, contact Shelby Huffman, x1306, or Virginia McFarland, x1522 Contents Data Sources ........................................................................................................................................................................... 1 Key Indicators .......................................................................................................................................................................... 1 Household Income .............................................................................................................................................................. 1 Household Income: Ten-Year Change ............................................................................................................................. 2 Individual Income ................................................................................................................................................................ 3 Individual Income: By Gender ......................................................................................................................................... 3 Employment Income ........................................................................................................................................................... 4 Employment Income: By Gender .................................................................................................................................... 4 Low Income ........................................................................................................................................................................ -

History of the Simcoe County Region Indigenization Column: May 17, 2017

History of the Simcoe County Region Indigenization Column: May 17, 2017 If anyone has been to the Simcoe County Museum on Highway 26, they will have seen the beautiful Huron-Wendat artifacts and replica longhouse they have on permanent display. With all the discussion around Anishnaabeg (Ojibwe people) and the Anishnaabemowin (Ojibwe language) program, many may be confused as to why there are different nations in the same region. Hopefully, I can shed some light on this question. This region was once inhabited by the Huron-Wendat nations, until about 350 years ago. The Huron- Wendat are a confederacy of five Haudenosaunee-speaking (Iroquois) nations. They are the; Attinniaoenten ("people of the bear"), Hatingeennonniahak ("makers of cords for nets"), Arendaenronnon ("people of the lying rock"), Atahontaenrat ("two white ears" i.e., “deer people”) and Ataronchronon ("people of the bog"). These nations had once been as far south as the Virginias and Ohio Valley, but had settled in this region pre-contact. These nations came into contact with the French settlers in the early 1600s, and it was this contact that caused a great deal of epidemics such as measles, influenza, and smallpox amongst the nations. The term ‘Huron’ comes from a demeaning nickname for the nation, which means ‘boar’s head’ in French and was used in reference to ruffians. The Wendat were enemies of the five Haudenosaunee nations (later joined by the Tuscarora in 1722 and became the Six Nations we know today). By the mid-1600s the Wendat population had been reduced by half, from approximately 20,000 to 9,000 by the epidemics brought by the French settlers living in close quarters with the nations. -

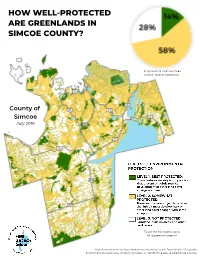

How Well-Protected Are Greenlands in Simcoe County?

HOW WELL-PROTECTED ARE GREENLANDS IN SIMCOE COUNTY? Proportion of total land area in each 'level of protection'. County of Simcoe July 2019 To see the full legend, go to bit.ly/greenlandsreport. Map produced by Assim Sayed Mohammed and Kirby Calvert, Department of Geography, Environment and Geomatics, University of Guelph, on behalf of the Rescue Lake Simcoe Coalition. HOW WELL-PROTECTED ARE GREENLANDS IN SIMCOE COUNTY? The Rescue Lake Simcoe Coalition’s greenlands[i] mapping project seeks to identify how well- protected Simcoe County forests, wetlands and shorelines are by analyzing the strength of the policies that protect them, and mapping the results of our findings. Cartographers created four maps for this research, showing the land use mix in Simcoe County, the breakdown of the levels of protection, the locations of aggregate resources that could eat into the best protected greenlands if extraction were permitted, and the features identified in our “Best Protected” category. What should we have? Forest cover 50% forest cover or more of the watershed is likely to support most potential species, and healthy aquatic systems.[ii] Simcoe County has 22%, but is losing forest cover. Wetlands The greater of (a) 10% of each major watershed and 6% of each subwatershed, or (b) 40% of the historic watershed wetland coverage, should be protected and restored, and no net loss of wetlands. [iii] Simcoe County has 14% wetland cover based on our analysis, and approximately half of its historic wetland cover.[iv] Simcoe County is losing wetlands. [v] Simcoe County’s land use mix does not meet ideal greenlands protection targets, but it is possible to get it right in Simcoe County, and permanently protect an effective Natural Heritage System to buffer our waters and ecosystem from the impacts of climate change and development. -

Bruce 150 Booklet 0

2 0 1 7 WARDEN: MITCH TWOLAN PAUL EAGLESON MESSAGE FROM 2017 BRUCE COUNTY WARDEN Township of Huron-Kinloss Municipality of Arran Elderslie B To the Explorers of 2067, R It is hoped that you have remained curious. Moreover, that your U inquiring minds have resulted in an innovative and progressive C Bruce County that serves the people who live here, operate businesses here and visit. E It is trusted that the decisions from the past to support the C lifestyles of farming life in the morning, beach life in the MILT McIVER - Municipality of DAVID INGLIS O Northern Bruce Peninsula Municipality of Brockton afternoon and bright starry skies all night long remain. U You are challenged to take the roads less travelled and to keep N exploring new and sustainable choices for Bruce County the T place, and Bruce County the organization. Y As you celebrate 200 years, reflect upon the journey of Bruce County’s past. Continue to reach beyond the stars because C when you do – amazing things happen. O U MIKE SMITH ROBERT BUCKLE Cheers to the explorers – cheers to us! Town of Saugeen Shores Municipality of South Bruce N Bruce County 2017 Warden C Warden Mitch Twolan I L JANICE JACKSON ANNE EADIE Town of South Bruce Peninsula Municipality of Kincardine 1 BRUCE 150 planning—and the journey began. Little did we know just how many wonderful It was 150 years ago when the journey of exploration in Bruce County started Bruce County explorers and places our journey would connect us to! and it has not stopped.