Form W-2, Wage and Tax Statement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Form IT-399:2020:New York Depreciation Schedule:It399

Department of Taxation and Finance New York State Depreciation Schedule IT-399 Name(s) as shown on return Identifying number as shown on return Mark an X in one box to show the income tax return you are filing and submit this form with that return. IT-201, Resident IT-203, Nonresident and part-year resident IT-204, Partnership IT-205, Fiduciary Part 1 – Depreciation information for property (except for Internal Revenue Code (IRC) section 280F property) placed in service inside or outside New York State in tax years beginning after December 31, 1980, but before January 1, 1985, and if you elect to continue using IRC section 167 depreciation for property placed in service outside New York State in tax years beginning after December 31, 1984, but before January 1, 1994 (see instructions) A B C D E F G Description of property Date placed Depreciable Depr. Life or New York Federal ACRS (submit schedule if needed) in service basis method rate depreciation deduction (mmddyyyy) .00 .00 .00 .00 .00 .00 .00 .00 .00 1 Enter column F and column G totals ................................................................ 1 .00 .00 Transfer the column F total to: Transfer the column G total to: Form IT-225, line 10, Total amount column and enter Form IT-225, line 1, Total amount column and enter subtraction modification S-210 in the Number column. addition modification A-205 in the Number column. Estates and trusts: If the amount computed is attributable to items reflected in the federal distributable net income, transfer the amounts as stated above. If the amount is not reflected in federal distributable net income, see instructions. -

Form W-4, Employee's Withholding Certificate

Employee’s Withholding Certificate OMB No. 1545-0074 Form W-4 ▶ (Rev. December 2020) Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. ▶ Department of the Treasury Give Form W-4 to your employer. 2021 Internal Revenue Service ▶ Your withholding is subject to review by the IRS. Step 1: (a) First name and middle initial Last name (b) Social security number Enter Address ▶ Does your name match the Personal name on your social security card? If not, to ensure you get Information City or town, state, and ZIP code credit for your earnings, contact SSA at 800-772-1213 or go to www.ssa.gov. (c) Single or Married filing separately Married filing jointly or Qualifying widow(er) Head of household (Check only if you’re unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.) Complete Steps 2–4 ONLY if they apply to you; otherwise, skip to Step 5. See page 2 for more information on each step, who can claim exemption from withholding, when to use the estimator at www.irs.gov/W4App, and privacy. Step 2: Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse Multiple Jobs also works. The correct amount of withholding depends on income earned from all of these jobs. or Spouse Do only one of the following. Works (a) Use the estimator at www.irs.gov/W4App for most accurate withholding for this step (and Steps 3–4); or (b) Use the Multiple Jobs Worksheet on page 3 and enter the result in Step 4(c) below for roughly accurate withholding; or (c) If there are only two jobs total, you may check this box. -

Form 309 Instructions

Arizona Form 2018 Credit for Taxes Paid to Another State or Country 309 For information or help, call one of the numbers listed: those taxes that qualify for a credit under Internal Phoenix (602) 255-3381 Revenue Code (IRC) §§ 901 and 903. From area codes 520 and 928, toll-free (800) 352-4090 NOTE: To claim a credit for taxes paid to a foreign country, Tax forms, instructions, and other tax information you must complete Form 309. You must complete Form 309 If you need tax forms, instructions, and other tax information, even if you did not have to complete federal Form 1116 to go to the department’s website at www.azdor.gov. claim a credit on your federal return. Income Tax Procedures and Rulings You may not claim this credit for the following: These instructions may refer to the department’s income tax • income taxes paid to any city or county, and procedures and rulings for more information. To view or print • interest or penalties paid to another state or country. these, go to our website and click on Reports and Legal NOTE: If you file an amended return after you claim this Research then click on Legal Research and select a document and category type from the drop down menus. credit, be sure to recalculate the credit, if required. Publications Application of Credit To view or print the department’s publications, go to our Claim this credit only if the income was subject to tax in both website and click on Reports and Legal Research then click Arizona and the other state or country in the same tax year. -

Income Tax Basics

International Student Taxes Information compiled by International Student Services International Student Taxes • The Basics • Specific Tax Scenarios • What You Can Do Now • Resolving Tax Issues • Top Ten Tax Myths • Tax Resources THE BASICS Tax Basics • Taxes – What are they? – A financial charge imposed by a governing body upon a taxpayer in order to collect funds – Collected funds are used to carry out a variety of functions – There are many types of taxes • Income Tax – A financial charge imposed on income earned by an individual or business – Income can be taxed at the local, state and federal (i.e. national) level. – This session primarily focuses on Federal Income Taxes • Internal Revenue Service (IRS) – The unit of the U.S. federal government responsible for administering and enforcing tax laws – www.irs.gov • Tax Year – January 1 – December 31 • Why should you care about taxes? – Paying income taxes and filing the appropriate paperwork with the IRS is required by law in the U.S. – Failure to comply can result in serious immigration, financial, and legal consequences Income Tax Basics • How are Income Taxes paid? – It is the taxpayer’s (i.e. YOUR) responsibility to pay tax obligation to IRS – Most common process: 1. Portion of your income is withheld from each paycheck throughout the year by your employer 2. Employer pays the withheld income to IRS on your behalf during the year 3. Each year, you file tax return to summarize tax obligations and payments for the prior tax year • What is a tax return? – A report that YOU file with the IRS to… 1. -

The Alternative Minimum Tax

Updated December 4, 2017 Tax Reform: The Alternative Minimum Tax The U.S. federal income tax has both a personal and a Individual AMT corporate alternative minimum tax (AMT). Both the The modern individual AMT originated with the Revenue corporate and individual AMTs operate alongside the Act of 1978 (P.L. 95-600) and operated in tandem with an regular income tax. They require taxpayers to calculate existing add-on minimum tax prior to its repeal in 1982. their liability twice—once under the rules for the regular Table 2 details selected key individual AMT parameters. income tax and once under the AMT rules—and then pay the higher amount. Minimum taxes increase tax payments Table 2. Selected Individual AMT Parameters, 2017 from taxpayers who, under the rules of the regular tax system, pay too little tax relative to a standard measure of Single/ Married their income. Head of Filing Married Filing Household Jointly Separately Corporate AMT Exemption $54,300 $84,500 $42,250 The corporate AMT originated with the Tax Reform Act of 1986 (P.L. 99-514), which eliminated an “add-on” 28% bracket 187,800 187,800 93,900 minimum tax imposed on corporations previously. The threshold corporate AMT is a flat 20% tax imposed on a Source: Internal Revenue Code. corporation’s alternative minimum taxable income less an exemption amount. A corporation’s alternative minimum The individual AMT tax base is broader than the regular taxable income is the corporation’s taxable income income tax base and starts with regular taxable income and determined with certain adjustments (primarily related to adds back various deductions, including personal depreciation) and increased by the disallowance of a exemptions and the deduction for state and local taxes. -

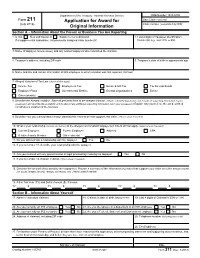

Form 211, Application for Award for Original Information

Department of the Treasury - Internal Revenue Service OMB Number 1545-0409 Form 211 Application for Award for Date Claim received (July 2018) Claim number (completed by IRS) Original Information Section A – Information About the Person or Business You Are Reporting 1. Is this New submission or Supplemental submission 2. Last 4 digits of Taxpayer Identification If a supplemental submission, list previously assigned claim number(s) Number(s) (e.g., SSN, ITIN, or EIN) 3. Name of taxpayer (include aliases) and any related taxpayers who committed the violation 4. Taxpayer's address, including ZIP code 5. Taxpayer's date of birth or approximate age 6. Name and title and contact information of IRS employee to whom violation was first reported, if known 7. Alleged Violation of Tax Law (check all that apply) Income Tax Employment Tax Estate & Gift Tax Tax Exempt Bonds Employee Plans Governmental Entities Exempt Organizations Excise Other (identify) 8. Describe the Alleged Violation. State all pertinent facts to the alleged violation. (Attach a detailed explanation and include all supporting information in your possession and describe the availability and location of any additional supporting information not in your possession.) Explain why you believe the act described constitutes a violation of the tax laws 9. Describe how you learned about and/or obtained the information that supports this claim. (Attach sheet if needed) 10. What is your relationship (current and former) to the alleged noncompliant taxpayer(s)? Check all that apply. (Attach sheet if needed) Current Employee Former Employee Attorney CPA Relative/Family Member Other (describe) 11. Do you still maintain a relationship with the taxpayer Yes No 12. -

State Individual Income Tax Federal Starting Points

STATE PERSONAL INCOME TAXES: FEDERAL STARTING POINTS (as of January 1, 2021) Federal Tax Base Used as Relation to Federal Starting Point to Calculate STATE Internal Revenue Code State Taxable Income ALABAMA --- --- ALASKA no state income tax --- ARIZONA 1/1/20 adjusted gross income ARKANSAS --- --- CALIFORNIA 1/1/15 adjusted gross income COLORADO Current taxable income CONNECTICUT Current adjusted gross income DELAWARE Current adjusted gross income FLORIDA no state income tax --- GEORGIA 3/27/20 adjusted gross income HAWAII 3/27/20 adjusted gross income IDAHO 1/1/20 taxable income ILLINOIS Current adjusted gross income INDIANA 1/1/20 adjusted gross income IOWA Current adjusted gross income KANSAS Current adjusted gross income KENTUCKY 12/31/18 adjusted gross income LOUISIANA Current adjusted gross income MAINE 12/31/19 adjusted gross income MARYLAND Current adjusted gross income MASSACHUSETTS 1/1/05 adjusted gross income MICHIGAN Current (a) adjusted gross income MINNESOTA 12/31/18 adjusted gross income MISSISSIPPI --- --- MISSOURI Current adjusted gross income MONTANA Current adjusted gross income NEBRASKA Current adjusted gross income NEVADA no state income tax --- NEW HAMPSHIRE on interest & dividends only --- NEW JERSEY --- --- NEW MEXICO Current adjusted gross income NEW YORK Current adjusted gross income NORTH CAROLINA 5/1/20 adjusted gross income NORTH DAKOTA Current taxable income OHIO 3/27/20 adjusted gross income OKLAHOMA Current adjusted gross income OREGON 12/31/18 taxable income PENNSYLVANIA --- --- RHODE ISLAND Current adjusted gross income SOUTH CAROLINA 12/31/19 taxable income SOUTH DAKOTA no state income tax --- TENNESSEE on interest & dividends only --- TEXAS no state income tax --- UTAH Current adjusted gross income VERMONT 12/31/19 adjusted gross income VIRGINIA 12/31/19 adjusted gross income WASHINGTON no state income tax --- WEST VIRGINIA 12/31/19 adjusted gross income WISCONSIN 12/31/17 adjusted gross income WYOMING no state income tax --- DIST. -

2021 Instructions for Form 6251

Note: The draft you are looking for begins on the next page. Caution: DRAFT—NOT FOR FILING This is an early release draft of an IRS tax form, instructions, or publication, which the IRS is providing for your information. Do not file draft forms and do not rely on draft forms, instructions, and publications for filing. We do not release draft forms until we believe we have incorporated all changes (except when explicitly stated on this coversheet). However, unexpected issues occasionally arise, or legislation is passed—in this case, we will post a new draft of the form to alert users that changes were made to the previously posted draft. Thus, there are never any changes to the last posted draft of a form and the final revision of the form. Forms and instructions generally are subject to OMB approval before they can be officially released, so we post only drafts of them until they are approved. Drafts of instructions and publications usually have some changes before their final release. Early release drafts are at IRS.gov/DraftForms and remain there after the final release is posted at IRS.gov/LatestForms. All information about all forms, instructions, and pubs is at IRS.gov/Forms. Almost every form and publication has a page on IRS.gov with a friendly shortcut. For example, the Form 1040 page is at IRS.gov/Form1040; the Pub. 501 page is at IRS.gov/Pub501; the Form W-4 page is at IRS.gov/W4; and the Schedule A (Form 1040/SR) page is at IRS.gov/ScheduleA. -

IRS Publication 4128, Tax Impact of Job Loss

Publication 4128 Tax Impact of Job Loss The Life Cycle Series A series of informational publications designed to educate taxpayers about the tax impact of significant life events. Publication 4128 (Rev. 5-2020) Catalog Number 35359Q Department of the Treasury Internal Revenue Service www.irs.gov Facts JOB LOSS CREATES TAX ISSUES References The Internal Revenue Service (IRS) recognizes that the loss of a job may • Publication 17, Your create new tax issues. The IRS provides the following information to Federal Income Tax (For assist displaced workers. Individuals) • Severance pay and unemployment compensation are taxable. • Publication 575, Payments for any accumulated vacation or sick time are also Pension and Annuity taxable. You should ensure that enough taxes are withheld from Income these payments or make estimated payments. See IRS Publication 17, Your Federal Income Tax, for more information. • Publication 334, Tax Guide for Small • Generally, withdrawals from your pension plan are taxable unless Businesses they are transferred to a qualified plan (such as an IRA). If you are under age 59 1⁄2, an additional tax may apply to the taxable portion of your pension. See IRS Publication 575, Pension and Annuity Income, for more information. • Job hunting and moving expenses are no longer deductible. • Some displaced workers may decide to start their own business. The IRS provides information and classes for new business owners. See IRS Publication 334, Tax Guide for Small Businesses, for more information. If you are unable to attend small business tax workshops, meetings or seminars near you, consider taking Small Business Taxes: The Virtual Workshop online as an alternative option. -

Tax Policy State and Local Individual Income Tax

TAX POLICY CENTER BRIEFING BOOK The State of State (and Local) Tax Policy SPECIFIC STATE AND LOCAL TAXES How do state and local individual income taxes work? 1/9 Q. How do state and local individual income taxes work? A. Forty-one states and the District of Columbia levy broad-based taxes on individual income. New Hampshire and Tennessee tax only individual income from dividends and interest. Seven states do not tax individual income of any kind. Local governments in 13 states levy some type of tax on income in addition to the state income tax. State governments collected $344 billion from individual income taxes in 2016, or 27 percent of state own-source general revenue (table 1). “Own-source” revenue excludes intergovernmental transfers. Local governments—mostly concentrated in Maryland, New York, Ohio, and Pennsylvania—collected just $33 billion from individual income taxes, or 3 percent of their own-source general revenue. (Census includes the District of Columbia’s revenue in the local total.) TABLE 1 State and Local Individual Income Tax Revenue 2016 Revenue (billions) Percentage of own-source general revenue State and local $376 16% State $344 27% Local $33 3% Source: Urban-Brookings Tax Policy Center, “State and Local Finance Initiative Data Query System.” Note: Own-source general revenue does not include intergovernmental transfers. Forty-one states and the District of Columbia levy a broad-based individual income tax. New Hampshire taxes only interest and dividends, and Tennessee taxes only bond interest and stock dividends. (Tennessee is phasing its tax out and will completely eliminate it in 2022.) Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming do not have a state individual income tax. -

FACT SHEET Creating a Graduated Income

70 East Lake Street, Suite 1700 Chicago, IL • 60601 www.ctbaonline.org FACT SHEET Creating a Graduated Income Tax March 2012 What is a Graduated Income Tax? A flat income tax structure assesses one tax rate for all taxpayers, regardless of income. Unlike a flat tax, a graduated income tax structure assesses greater tax rates on greater levels of income. A graduated rate structure allows an income tax to adjust its burden in accordance with ability to pay. Thus, it helps create a fair tax system, by imposing a greater tax burden on affluent, than on low and middle income families, when tax burden is measured as a percentage of income. Why does Illinois need a Graduated Income Tax Structure? . The answer is simple, the lack of a graduated income tax rate structure makes the state’s tax system unfair and unsustainable, while hurting the Illinois economy. Creating a graduated income tax structure would help remedy both the unfairness and unsustainability of Illinois’ tax structure. Consider fairness first: o Of all the different ways to tax (sales, property, excise, etc.), the income tax is the fairest because it is the only tax which increases or decreases automatically in accordance with ability to pay. If a taxpayer receives a raise, his or her income tax liability will increase. If on the other hand a taxpayer loses his or her job, income tax liability will decrease. The current Illinois tax system is the opposite of fair, because it places the greatest burden on low and middle income families. Indeed Illinois presently has the third highest tax burden for low income families of all 50 states.1 Consequently, as shown in Figure A, the tax burden of the lowest 20percent of income earners is more than double that of the top 1 percent. -

Section 5 Explanation of Terms

Section 5 Explanation of Terms he Explanation of Terms section is designed to clarify Additional Standard Deduction the statistical content of this report and should not be (line 39a, and included in line 40, Form 1040) T construed as an interpretation of the Internal Revenue See “Standard Deduction.” Code, related regulations, procedures, or policies. Explanation of Terms relates to column or row titles used Additional Taxes in one or more tables in this report. It provides the background (line 44b, Form 1040) or limitations necessary to interpret the related statistical Taxes calculated on Form 4972, Tax on Lump-Sum tables. For each title, the line number of the tax form on which Distributions, were reported here. it is reported appears after the title. Definitions marked with the symbol ∆ have been revised for 2015 to reflect changes in Adjusted Gross Income Less Deficit the law. (line 37, Form 1040) Adjusted gross income (AGI) is defined as total income Additional Child Tax Credit (line 22, Form 1040) minus statutory adjustments (line 36, (line 67, Form 1040) Form 1040). Total income included: See “Child Tax Credit.” • Compensation for services, including wages, salaries, fees, commissions, tips, taxable fringe benefits, and Additional Medicare Tax similar items; (line 62a, Form 1040) Starting in 2013, a 0.9 percent Additional Medicare Tax • Taxable interest received; was applied to Medicare wages, railroad retirement com- • Ordinary dividends and capital gain distributions; pensation, and self-employment income that were more than $200,000 for single, head of household, or qualifying • Taxable refunds of State and local income taxes; widow(er) ($250,000 for married filing jointly, or $125,000 • Alimony and separate maintenance payments; for married filing separately).