Polymetal: H1 2020 Results Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Ftse4good UK 50

2 FTSE Russell Publications 19 August 2021 FTSE4Good UK 50 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.81 UNITED GlaxoSmithKline 5.08 UNITED Rentokil Initial 0.67 UNITED KINGDOM KINGDOM KINGDOM Anglo American 2.56 UNITED Halma 0.74 UNITED Rio Tinto 4.68 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.36 UNITED HSBC Hldgs 6.17 UNITED Royal Dutch Shell A 4.3 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.56 UNITED InterContinental Hotels Group 0.64 UNITED Royal Dutch Shell B 3.75 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 8.25 UNITED International Consolidated Airlines 0.47 UNITED Schroders 0.28 UNITED KINGDOM Group KINGDOM KINGDOM Aviva 1.15 UNITED Intertek Group 0.65 UNITED Segro 0.95 UNITED KINGDOM KINGDOM KINGDOM Barclays 2.1 UNITED Legal & General Group 1.1 UNITED Smith & Nephew 0.99 UNITED KINGDOM KINGDOM KINGDOM BHP Group Plc 3.2 UNITED Lloyds Banking Group 2.39 UNITED Smurfit Kappa Group 0.74 UNITED KINGDOM KINGDOM KINGDOM BT Group 1.23 UNITED London Stock Exchange Group 2.09 UNITED Spirax-Sarco Engineering 0.72 UNITED KINGDOM KINGDOM KINGDOM Burberry Group 0.6 UNITED Mondi 0.67 UNITED SSE 1.13 UNITED KINGDOM KINGDOM KINGDOM Coca-Cola HBC AG 0.37 UNITED National Grid 2.37 UNITED Standard Chartered 0.85 UNITED KINGDOM KINGDOM KINGDOM Compass Group 1.96 UNITED Natwest Group 0.77 UNITED Tesco 1.23 UNITED KINGDOM KINGDOM KINGDOM CRH 2.08 UNITED Next 0.72 UNITED Unilever 7.99 UNITED KINGDOM KINGDOM -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

The R&CO Risk-Based UK Index Provides an Alternative to Market

The R&CO Risk-Based UK Index provides an alternative to market-cap weighting with a risk-based approach to index construction. The strategy seeks to equalize risk contribution of index constituents and to maximize risk diversification while avoiding excessive turnover and portfolio concentration. The approach seeks to provide lower volatility, reduced maximum drawdown and higher Sharpe ratio compared with market capitalization indices over the long-term. Rothschild & Co Risk-Based UK TR GBP (Total) 6,871.0 Rothschild & Co Risk-Based UK NR GBP (Total) 6,857.9 MSCI United Kingdom GR LCL (Total) 2,016.9 24.54 24.49 16.45 21.38 27.6621.38 9,000 -9.25 -9.28 -8.76 -22.15 -22.15 -28.46 7,000 13.57 13.55 11.79 5.86 5.86 6.57 4.99 4.95 19.24 5,000 25.62 25.62 14.62 11.83 11.82 -2.16 23.25 23.25 20.09 3,000 2.38 2.37 0.54 22.86 22.86 11.49 1,000 26.58 26.58 18.47 17.96 17.95 10.24 26.70 26.70 18.76 -1,000 4.32 -1.794.30 -7.08 -7.08 -23.37 2002 2004 2006 2008 2010 2012 2014 2016 2018 17.30 12.2217.29 2.27 2.27 -11.78 Risk-Based UK TR GBP 3,217.01 -7.52 -5.20 -8.83 5.06 3.99 5.17 9.76 10.05 Risk-Based UK NR GBP 3,210.90 -7.53 -5.21 -8.84 5.01 3.95 5.14 9.74 10.04 MSCI United Kingdom GR LCL 14,679.63 -9.10 -9.77 -12.11 -3.48 0.57 2.79 5.88 3.55 Risk-Based UK TR GBP 10.83 10.06 9.96 -0.06 0.24 0.01 0.84 0.87 0.86 78.38 74.41 74.33 68.28 69.49 70.67 Risk-Based UK NR GBP 10.83 10.06 9.96 -0.06 0.24 0.01 0.84 0.87 0.86 78.40 74.43 74.35 68.23 69.46 70.66 MSCI United Kingdom GR LCL 13.87 11.57 11.25 -0.33 -0.05 0.20 1.00 1.00 1.00 100.00 100.00 100.00 100.00 -

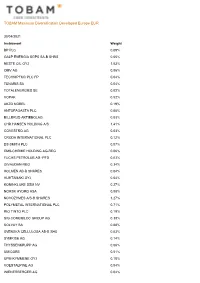

TOBAM Maximum Diversification Developed Europe EUR

TOBAM Maximum Diversification Developed Europe EUR 30/04/2021 Instrument Weight BP PLC 0.09% GALP ENERGIA SGPS SA-B SHRS 0.05% NESTE OIL OYJ 1.03% OMV AG 0.06% TECHNIPFMC PLC FP 0.04% TENARIS SA 0.04% TOTALENERGIES SE 0.02% VOPAK 0.52% AKZO NOBEL 0.19% ANTOFAGASTA PLC 0.05% BILLERUD AKTIEBOLAG 0.03% CHR HANSEN HOLDING A/S 1.41% COVESTRO AG 0.03% CRODA INTERNATIONAL PLC 0.12% DS SMITH PLC 0.07% EMS-CHEMIE HOLDING AG-REG 0.06% FUCHS PETROLUB AG -PFD 0.03% GIVAUDAN-REG 0.34% HOLMEN AB-B SHARES 0.04% HUHTAMAKI OYJ 0.04% KONINKLIJKE DSM NV 0.27% NORSK HYDRO ASA 0.08% NOVOZYMES A/S-B SHARES 1.27% POLYMETAL INTERNATIONAL PLC 0.71% RIO TINTO PLC 0.19% SIG COMBIBLOC GROUP AG 0.38% SOLVAY SA 0.08% SVENSKA CELLULOSA AB-B SHS 0.03% SYMRISE AG 0.14% THYSSENKRUPP AG 0.06% UMICORE 0.51% UPM-KYMMENE OYJ 0.18% VOESTALPINE AG 0.04% WIENERBERGER AG 0.04% TOBAM Maximum Diversification Developed Europe EUR 30/04/2021 Instrument Weight YARA INTERNATIONAL ASA 0.08% A P MOLLER - MAERSK A/S - A 0.06% A P MOLLER - MAERSK A/S - B 0.08% ACS ACTIVIDADES CONS Y SERV 0.07% ADDTECH AB-B SHARES 0.03% ADP 0.04% AENA SA 0.11% ALSTOM 0.17% ANDRITZ AG 0.03% ATLANTIA SPA 0.08% BELIMO HOLDING AG-REG 0.04% BUCHER INDUSTRIES AG-REG 0.04% BUNZL PLC 0.10% DEUTSCHE LUFTHANSA-REG 0.05% DIPLOMA PLC 0.04% DSV PANALPINA A/S 0.45% EASYJET PLC 0.20% ELIS SA 0.03% EPIROC AB-A 0.10% EPIROC AB-B 0.06% FERROVIAL SA 0.05% FLUGHAFEN ZURICH AG-REG 0.03% GEA GROUP AG 0.06% GEBERIT AG-REG 0.21% HAYS PLC 0.03% HOMESERVE PLC 0.04% HOWDEN JOINERY GROUP PLC 0.06% IMCD GROUP NV 0.07% IMI PLC 0.05% -

FTSE Publications

2 FTSE Russell Publications FTSE 100 Semi Annual Equally 19 August 2021 Weighted Net Tax Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.95 UNITED Fresnillo 0.86 UNITED Prudential 0.92 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 1.06 UNITED GlaxoSmithKline 1.08 UNITED Reckitt Benckiser Group 1.02 UNITED KINGDOM KINGDOM KINGDOM Anglo American 0.91 UNITED Glencore 0.94 UNITED RELX 1.05 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.91 UNITED Halma 1.05 UNITED Rentokil Initial 1.04 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.04 UNITED Hargreaves Lansdown 0.98 UNITED Rightmove 1.09 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.96 UNITED Hikma Pharmaceuticals 1.03 UNITED Rio Tinto 0.96 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 1.11 UNITED HSBC Hldgs 0.94 UNITED Rolls-Royce Holdings 0.9 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 1.15 UNITED Imperial Brands 0.98 UNITED Royal Dutch Shell A 0.56 UNITED KINGDOM KINGDOM KINGDOM Avast 1.07 UNITED Informa 0.94 UNITED Royal Dutch Shell B 0.49 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 1.08 UNITED InterContinental Hotels Group 0.97 UNITED Royal Mail 0.99 UNITED KINGDOM KINGDOM KINGDOM Aviva 1 UNITED Intermediate Capital Group 0.99 UNITED Sage Group 1.06 UNITED KINGDOM KINGDOM KINGDOM B&M European Value Retail 1.04 UNITED International Consolidated Airlines 0.85 UNITED Sainsbury (J) 1.03 UNITED KINGDOM Group KINGDOM KINGDOM BAE Systems 1 UNITED Intertek -

20 Years of Sustainable Development

20 YEARS OF SUSTAINABLE DEVELOPMENT Polymetal International plc Sustainability Report 2017 THE GROUP CEO’S STATEMENT OVERVIEW Action expresses priorities OVERVIEW HEALTH AND SAFETY Welcome to our Sustainability Report, which marks Polymetal’s 20th year of conducting business responsibly: Welcome to our At a glance 06 Safety risks management 48 two decades in which we have achieved tremendous Where we operate 08 Safety performance 50 success. We currently employ around 12,000 people at eight Sustainability Business model 10 operations covering three countries and seven time zones. Our approach 12 COMMUNITIES Of our employees, 20% are under 30, and more than 500 come from families who have worked at Polymetal for years. Report 2017 How we manage sustainability 14 Community engagement 55 Materiality 17 Social investment 56 Altogether we have produced almost 16.6 Moz of gold, and over 350 Moz of silver. We have discovered 20 mineral ENVIRONMENT Stakeholder engagement 18 Impact assessment 58 deposits, performed 2,200 km of exploration drilling, and Sustainable development goals 20 developed over 550 km underground. Our current licensed Our performance 21 ECONOMIC area is the size of 1,000,000 football pitches. We were the first company in the former Soviet Union to use pressure Financial assistance 63 ENVIRONMENT oxidation technology (POX) for extracting gold from refractory Local employment 63 concentrates, and the first in post-Soviet states to establish Water 26 Supply chain 63 When our environment and society an in-house engineering and design centre. Waste 27 R&D 64 ABOUT THIS REPORT flourish, our business can flourish. Our achievements spread beyond Polymetal to the benefit Polymetal International’s Sustainability Report 2017 covers Energy and carbon 29 Markets served 64 of the wider community. -

Expiry Notice

Expiry Notice 17 February 2017 London Stock Exchange Derivatives Expiration prices for UK Single Stock Products Please find below expiration prices for UK Single Stock Products expiring on Friday 17 February 2017: Underlying Code Underlying Name Expiration Price ADN ABERDEEN ASSET MANAGEMENT PLC 264.70 AGK AGGREKO PLC 1012.00 AAL ANGLO AMERICAN PLC 1345.00 ANTO ANTOFAGASTA PLC 837.00 AHT ASHTEAD GROUP PLC 1704.00 ABF ASSOCIATED BRITISH FOODS PLC 2609.00 AZN ASTRA ZENECA PLC 4595.00 AV AVIVA PLC 498.40 BA BAE SYSTEMS PLC 606.50 BARC BARCLAYS PLC 237.00 BLT BHP BILLITON PLC 1394.50 BP BP PLC 446.00 BATS BRITISH AMERICAN TOBACCO PLC 5004.00 BTA BT GROUP PLC 316.10 CPI CAPITA PLC 522.00 CCL CARNIVAL PLC 4303.00 CNA CENTRICA PLC 232.60 CPG COMPASS GROUP PLC 1473.00 DGE DIAGEO PLC 2273.00 EVR EVRAZ PLC 245.00 FRES FRESNILLO PLC 1523.00 GFS G4S PLC 260.20 GSK GLAXOSMITHKLINE PLC 1639.50 GLEN GLENCORE PLC 319.45 HSBA HSBC HOLDINGS PLC 707.50 IMB IMPERIAL BRANDS PLC 3781.00 1 IHG INTERCONTINENTAL HOTELS GROUP PLC 3889.00 IAG INTERNATIONAL CONSOLIDATED AIRLINES 513.00 ITV ITV PLC 205.50 KAZ KAZ MINERALS PLC 559.50 KGF KINGFISHER PLC 327.10 LCL LADBROKES CORAL GROUP 120.60 LAND LAND SECURITIES GROUP PLC 1054.00 LGEN LEGAL & GENERAL GROUP PLC 244.00 LLOY LLOYDS BANKING GROUP PLC 66.86 LMI LONMIN PLC 133.25 EMG MAN GROUP PLC 141.80 MKS MARKS & SPENCER GROUP PLC 325.50 MRW MORRISON (WM) SUPERMARKETS PLC 248.90 NG NATIONAL GRID PLC 961.20 NXT NEXT PLC 3852.00 PSON PEARSON PLC 668.50 PFC PETROFAC PLC 869.50 POLY POLYMETAL INTERNATIONAL PLC 979.00 PRU -

Morningstar® UK Dividend Yield Focus Indexsm 18 June 2021

Morningstar Indexes | Reconstitution Report Page 1 of 3 Morningstar® UK Dividend Yield Focus IndexSM 18 June 2021 The Morningstar® UK Dividend Yield Focus IndexSM is part of the Morningstar® Global Dividend Yield Focus Index Family. The index tracks the For More Information: performance of a portfolio of high-quality, dividend-paying securities. The constituents of the index are a subset of the Morningstar® UK Index http://indexes.morningstar.com (benchmark), a broad market index representing 97% of UK's equity market capitalization. US: +1 312 384-3735 Europe: +44 20 3194 1082 Reconstituted Holdings Name Ticker Country Sector Yield(%) Weight(%) Unilever ULVR United Kingdom Consumer Defensive 3.53 10.00 Royal Dutch Shell PLC RDSA United Kingdom Energy 3.63 9.37 Reckitt Benckiser Group PLC RKT United Kingdom Consumer Defensive 2.74 9.09 RELX Plc REL United Kingdom Communication Services 2.56 8.99 Mondi Plc MNDI United Kingdom Basic Materials 4.23 8.79 3I Group III United Kingdom Financial Services 2.82 7.58 Severn Trent SVT United Kingdom Utilities 4.14 5.82 Polymetal International PLC POLY United Kingdom Basic Materials 5.56 5.71 IG Group Holdings IGG United Kingdom Financial Services 5.04 3.66 Pearson PSON United Kingdom Communication Services 2.38 3.52 Schroders Plc SDR United Kingdom Financial Services 3.20 3.29 Renewables Infrastructure Group TRIG United Kingdom Financial Services 5.26 3.27 Man Group EMG United Kingdom Financial Services 4.38 2.92 Plus500 Ltd PLUS United Kingdom Financial Services 7.32 2.52 Hargreaves Lansdown Plc HL. -

2016 Annual Report

ANNUAL REPORT 2016 IMPLEMENTING A COMPELLING GROWTH STRATEGY ABOUT US CONTENTS STRATEGIC REPORT POLYMETAL IS A PRECIOUS METALS Chairman’s statement 02 MINING GROUP WITH A STRONG TRACK Group Chief Executive’s review 04 RECORD OF CONSISTENT OPERATING At a glance 06 Business model 08 PERFORMANCE AND DELIVERING Market overview 10 ON NEW PROJECTS. Our strategy 11 Performance highlights 20 Operating review 22 OUR ROBUST OPERATING AND Sustainability 42 Financial review 52 FINANCIAL RESULTS REFLECT THE Risks and risk management 64 SUCCESS OF OUR STRATEGY FOCUSED GOVERNANCE ON GROWTH AND DELIVERING VALUE Board of Directors 70 TO OUR STAKEHOLDERS. Senior management 71 Corporate governance 72 Audit and Risk Committee report 78 Remuneration report 83 Directors’ report 100 Directors’ responsibility statement 103 FRONT COVER IMAGE FINANCIAL STATEMENTS Kyzyl, Kazakhstan Independent auditor’s report 104 We have made considerable progress at Kyzyl, our flagship project, which is on track to go into production in late 2018, Consolidated income statement 109 ramping up to full capacity in 2019. One of the highest Consolidated statement grade and largest untapped gold deposits in the Former of comprehensive income 110 Soviet Union, with a long mine life and low-capital intensity, Consolidated balance sheet 111 it is set to become the main source of medium-term Consolidated statement of cash flows 112 growth for Polymetal and will create significant returns for our shareholders. Consolidated statement of changes in equity 113 Notes to the consolidated FIND OUT MORE ON OUR WEBSITE financial statements 114 www.polymetalinternational.com APPENDICES Operational statistics 158 Reserves and Resources 165 SEE OUR SUSTAINABILITY REPORT Glossary 176 Shareholder information 179 www.polymetalinternational.com/sustainable-development POLYMETAL INTERNATIONAL PLC ANNUAL REPORT & ACCOUNTS 2016 01 CHAIRMAN’S STATEMENT Dear fellow stakeholders ATTRACTIVE INVESTMENT OPPORTUNITY I am pleased to report on Polymetal’s robust financial performance and consistent operational delivery throughout the year. -

FTSE Publications

2 FTSE Russell Publications FTSE All-Share ex Investment 19 August 2021 Trusts ESG Climate Select Index Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country 3i Group 0.65 UNITED KINGDOM Informa 0.72 UNITED KINGDOM Royal Mail 1.18 UNITED KINGDOM Antofagasta 0.44 UNITED KINGDOM Intermediate Capital Group 0.12 UNITED KINGDOM Sage Group 0.56 UNITED KINGDOM Associated British Foods 0.06 UNITED KINGDOM Intertek Group 1.08 UNITED KINGDOM Segro 0.19 UNITED KINGDOM AstraZeneca 5.28 UNITED KINGDOM Investec 0.05 UNITED KINGDOM Severn Trent 1.11 UNITED KINGDOM Auto Trader Group 1.12 UNITED KINGDOM ITV 0.9 UNITED KINGDOM Smith & Nephew 0.18 UNITED KINGDOM Aviva 2.62 UNITED KINGDOM Johnson Matthey 1.3 UNITED KINGDOM Smith (DS) 0.65 UNITED KINGDOM Barclays 2.94 UNITED KINGDOM Jupiter Fund Management 0.08 UNITED KINGDOM Smiths Group 0.19 UNITED KINGDOM Barratt Developments 0.24 UNITED KINGDOM Just Eat Takeaway.com 0.12 UNITED KINGDOM Smurfit Kappa Group 0.98 UNITED KINGDOM BHP Group Plc 1.01 UNITED KINGDOM Kingfisher 1.7 UNITED KINGDOM Spectris 0.15 UNITED KINGDOM BP 2.38 UNITED KINGDOM Land Securities Group 0.12 UNITED KINGDOM Spirax-Sarco Engineering 1.22 UNITED KINGDOM British Land Co 0.56 UNITED KINGDOM Legal & General Group 0.62 UNITED KINGDOM Spirent Communications 0.07 UNITED KINGDOM Britvic 0.08 UNITED KINGDOM Lloyds Banking Group 2.5 UNITED KINGDOM SSE 0.37 UNITED KINGDOM BT Group 1.03 UNITED KINGDOM London Stock Exchange Group 2.36 UNITED KINGDOM St.