Annual Report 2018 2 Annual Report 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

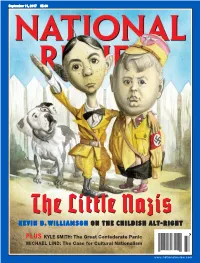

The Little Nazis KE V I N D

20170828 subscribers_cover61404-postal.qxd 8/22/2017 3:17 PM Page 1 September 11, 2017 $5.99 TheThe Little Nazis KE V I N D . W I L L I A M S O N O N T H E C HI L D I S H A L T- R I G H T $5.99 37 PLUS KYLE SMITH: The Great Confederate Panic MICHAEL LIND: The Case for Cultural Nationalism 0 73361 08155 1 www.nationalreview.com base_new_milliken-mar 22.qxd 1/3/2017 5:38 PM Page 1 !!!!!!!! ! !! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! !! "e Reagan Ranch Center ! 217 State Street National Headquarters ! 11480 Commerce Park Drive, Santa Barbara, California 93101 ! 888-USA-1776 Sixth Floor ! Reston, Virginia 20191 ! 800-USA-1776 TOC-FINAL_QXP-1127940144.qxp 8/23/2017 2:41 PM Page 1 Contents SEPTEMBER 11, 2017 | VOLUME LXIX, NO. 17 | www.nationalreview.com ON THE COVER Page 22 Lucy Caldwell on Jeff Flake The ‘N’ Word p. 15 Everybody is ten feet tall on the BOOKS, ARTS Internet, and that is why the & MANNERS Internet is where the alt-right really lives, one big online 35 THE DEATH OF FREUD E. Fuller Torrey reviews Freud: group-therapy session The Making of an Illusion, masquerading as a political by Frederick Crews. movement. Kevin D. Williamson 37 ILLUMINATIONS Michael Brendan Dougherty reviews Why Buddhism Is True: The COVER: ROMAN GENN Science and Philosophy of Meditation and Enlightenment, ARTICLES by Robert Wright. DIVIDED THEY STAND (OR FALL) by Ramesh Ponnuru 38 UNJUST PROSECUTION 12 David Bahnsen reviews The Anti-Trump Republicans are not facing their challenges. -

Point of Sale Newsletter

September 2017 April 2019 POINT OF SALE Updates from Benesch’s Retail, Hospitality & Consumer Products Industry Group Media Transparency: An Update on the Status of the FBI/DOJ Investigation, Recovery Efforts and Best Practices Going Forward The number of issues and areas of inquiry resulting from the revelations set forth in the ANA/K2 Report continue to mount. As originally detailed in the Fall of last year, the FBI is actively investigating certain media buying agencies for alleged non-transparent practices and looking to the advertisers potentially defrauded to assist with its investigation. Just last week, AdAge published an article noting that the FBI has an “unredacted version” of the K2 report including names of all 41 previously unidentified sources. Moreover, certain agencies are affirmatively The evidence shows media trying to cover their tracks and/or to revise their existing contracts to either permit the questionable conduct going forward or to limit the audit rights of their advertiser clients. suppliers paying undisclosed Benesch attorneys are working closely with the forensic investigators at K2 Intelligence and auditors rebates to media buying at FirmDecisions to assist clients with investigating possible wrongdoing by their (current or former) agencies in amounts ranging media buying agencies. These efforts range from helping clients navigate the potential pitfalls involved from 1.67% to 20% of in cooperating with the active FBI investigation and ensuring that they fulfill their duties to shareholders, to securing recoveries from the agencies where appropriate. Given that non-transparent conduct can aggregate media spending. often amount to a substantial percentage of a company’s overall media spend, these claims can easily stretch in to the seven- and eight-figure range. -

N R a T E N Tum (

£ V M kE y Mawfl< • i' \_ . n r a t e n CO't",ChI H!-, mo«-. vai,.,N.-.i - m /Idaho's Largest EviJening iSewspaper Even l•.1^ Inr 72nd Year., TWIN FALLS. IDAHO, MOONDA\.MAY24.1976 1 5 ' tOt(,er. do),.ery iT M \ T T k • ---------- l ^ w t u m (o u t s <e e n ' e y DAVE HORSMAN' Tho remainder ol the delegates of the three Tlmes-News writer parties will l>e sele.•lected al p a rty conventions TWIN FALLS - Tw in F a lls Coui■'ounly (.’lerk next m onth, Harold Unneasterex|Kvl.sa bigtiirrioiinoiil Tuesday Church's biggestit lest T uestlay will com c In d B S | | ^ " In- Idaho's first presidcnllal preferentialpn the Oregon primaryry. He has campaigned hard ' pi‘iniar>’oloclioi). for Jhe .slaJe'.s .->4 Dernocr.-itici: dclegales, - buf "If reglstrallon is any criteria, we’llwc' h av e a tra ils In reecnl polls,is, bitbig lurnoul. We’re prepariil for it." UiiiciisterI The Oregonian, tillIJie sta te 's la rg e sl new spaper, s;iid loday. published a poll Mayay lfl w hich show ed th e Idaho THICK CLOUD of smoke pours from a Voter registration for Ihc eleclionon was’ al an senator l>ehlnd Cartirter. Mlnncsola Sen. Hubert hijacked PliUlpplnee AAir Lines jetliner, above, all-lime high in Twin Falls Counly,• wwi hen l>ooks H um phrey a n d Mas.sjichu.setsMi Sen, Edward H m H a fte r s U M oslem youtlouths se t off g ren a d es Inside were closcd lasl week, Olher Mag,Iagie Valley Ivejinedylnpopulariiirity. -

Viacom Boosts Direct-To-Consumer Pitch with $340 Million Acquisition

Publication date: 24 Jan 2019 Author: Kia Ling Teoh Senior Research Analyst, Advertising and Television Media Viacom boosts direct- to-consumer pitch with $340 million acquisition of Pluto TV Brought to you by Informa Tech Viacom boosts direct-to-consumer pitch with 1 $340 million acquisition of Pluto TV Viacom has revealed its intentions to go direct-to-consumer via the acquisition of ad-supported streaming service Pluto TV. The deal is worth a reported $340m and will see Pluto TV operate as an independent subsidiary of Viacom. The transaction is expected to close in the first quarter of 2019. Viacom is the owner of MTV, Comedy Central, Nickelodeon and Paramount Pictures. In 2017, it reported annual revenues of $13 billion from media networks and filmed entertainment businesses. Pluto TV was founded in 2013 and had received several rounds of funding from investors including broadcasters ProsiebenSat.1 and Scripps Networks in 2016. Our analysis The acquisition came at a time when Viacom’s media networks advertising revenues were under pressure. Nearly half of its media networks revenues are advertising and in the first nine months of 2018, advertising revenues dropped 3.5% year-on-year from $3.57 billion to $3.44 billion, largely due to lower linear impressions. The ad-supported streaming market is becoming intensely competitive, with each player trying to counter the influence of global giants Google and Facebook as advertising budgets continue to focus more on cross- border growth. Alongside Awesomeness TV, the youth-targeted video service Viacom acquired in July 2018, Pluto TV will complement Viacom’s advertising strategy. -

Music on PBS: a History of Music Programming at a Community Radio Station

Music on PBS: A History of Music Programming at a Community Radio Station Rochelle Lade (BArts Monash, MArts RMIT) A thesis submitted for the degree of Doctor of Philosophy January 2021 Abstract This historical case study explores the programs broadcast by Melbourne community radio station PBS from 1979 to 2019 and the way programming decisions were made. PBS has always been an unplaylisted, specialist music station. Decisions about what music is played are made by individual program announcers according to their own tastes, not through algorithms or by applying audience research, music sales rankings or other formal quantitative methods. These decisions are also shaped by the station’s status as a licenced community radio broadcaster. This licence category requires community access and participation in the station’s operations. Data was gathered from archives, in‐depth interviews and a quantitative analysis of programs broadcast over the four decades since PBS was founded in 1976. Based on a Bourdieusian approach to the field, a range of cultural intermediaries are identified. These are people who made and influenced programming decisions, including announcers, program managers, station managers, Board members and the programming committee. Being progressive requires change. This research has found an inherent tension between the station’s values of cooperative decision‐making and the broadcasting of progressive music. Knowledge in the fields of community radio and music is advanced by exploring how cultural intermediaries at PBS made decisions to realise eth station’s goals of community access and participation. ii Acknowledgements To my supervisors, Jock Given and Ellie Rennie, and in the early phase of this research Aneta Podkalicka, I am extremely grateful to have been given your knowledge, wisdom and support. -

Dhspring2014 DH Program

Oren Katzeff, Head of Programming, Tastemade Digital Hollywood Spring David Karp, EVP, Business Development, SnagFilms, Inc. The Digital Future has Arrived! Jason Berger, founder & Executive Producer, Kids at Play 1 May 5th - 8th, 2014 Elizabeth Brooks, Head of Marketing, Live Nation Labs The Ritz Carlton Hotel, Marina del Rey, California Sang H. Cho, President and CEO, Mnet Ann Greenberg, Founder & Chief Tinkerer, Sceneplay, The Strategic Sessions - Let's Get Started! Moderator Monday, May 5th Track II: Poolside Tent I (FINANCE) 10:00 AM - 11:15 AM Valuing and Financing Entertainment Content: Track I:Ballroom Terrace (BrandPower) (ADVERT) Movies, Television and Online Video, From VC Native Advertising: Digital Advertising & Equity to Crowdfunding Industry Gets Serious About Better Advertising Join a group of influential players in the media, entertainment Matt Palmer, SVP and GM, Demand Media and tech finance worlds for an enlightening look at emerging Andrew Budkofsky, EVP, Sales and Partnerships, Digital growth areas in our industry. They reveal where the value and Trends opportunities are, who's investing and whether we're headed for Greg Portell, Partner, A.T. Kearney a bubble or sustained hypergrowth in the convergence space. Mike Kisseberth, Chief Revenue Officer, TechMedia Network Mike LaSalle, Partner, Shamrock Capital Advisors Roger Camp, Partner & Chief Creative Officer, CAMP + KING Marti Frucci, Managing Director, Digital Capital Advisors Aron Levitz, SVP, Wattpad René Bourdages, CEO, Elevado Media, Inc. Shawn Gold, Advisor -

AT&T Investor Relations

AT&T 4Q20 Highlights Following are certain 4Q20 highlights. The full set of earnings materials with all reported results and non-GAAP reconciliations is posted here, including trend schedules. Consolidated Results 4Q20 EPS Reported ($1.95) 4Q20 adj. EPS down ($0.14); including ($0.08) of estimated EPS Adjusted $0.75 COVID impacts Revenues $45.7 billion Down ($1.1B) YOY; sequential growth of $3.4B ~($2.5B) estimated YOY impact from COVID partially offset by higher Mobility revenue +$1.4B Adj. EBITDA $12.9 billion Down ($1.5); including ($0.7B) estimated impact from COVID 2020 free cash flow of $27.5B Free Cash Flow $7.7 billion Total dividend payout ratio of ~55% for full year; Capex $2.4 billion Expect 2021 free cash flow in $26B range and gross capital Gross Cap Investment $4.3 billion investment in the $21B range $147.5B net debt; ~$10B cash on hand at end of 4Q20 Net Debt to Adj. EBITDA 2.70x Reduced ~$33B in net debt since closing of TWX transaction Restructured ’21-’25 debt maturities in 2020 Revenues ($M) 4Q20 4Q19 % Change $ Change COVID impact (estimated) Mobility 20,119 18,700 7.6% 1,419 (250) Wireless service revenue 14,022 13,948 0.5% 74 (250) Video1 7,168 8,075 -11.2% (907) (210) Broadband1 3,116 3,161 -1.4% (45) 0 Business Wireline1 6,319 6,586 -4.1% (267) (100) WarnerMedia2 8,554 9,453 -9.5% (899) (1,550) Latin America 1,498 1,758 -14.8% (260) (350) Other2,3,4 (1,083) (912) - (171) (20) Total Revenues 45,691 46,821 -2.4% (1,130) (2,480) Adj. -

AT&T U-Verse

AT&T U-verse® TV y AT&T Phone Guía legal Medio Oeste Guardar como referencia Términos del servicio Política de privacidad Tarifas normales de AT&T U-verse® TV Aceptación del servicio 911 Normas del servicio al cliente de Illinois Resolución de disputas de Michigan Obtenga respuestas a toda hora en att.com/uversesupport o llame al 800.288.2020 Términos generales de los servicios AT&T U-verse® TV y AT&T Phone........................................3 Política de privacidad de AT&T......................................................................................................................18 Tarifas normales de AT&T U-verse TV........................................................................................................31 Aceptación del servicio 911……………………….............................................................................................35 Normas del servicio al cliente de Illinois.....................................................................................................35 Resolución de disputas de Michigan..............................................................................................................39 AT&T U-VERSE® TV Y AT&T PHONE TÉRMINOS GENERALES DEL SERVICIO Con entrada en vigor en enero de 2019 1. CONTRATO GENERAL Los siguientes Términos del servicio, inclusive sus anexos y los términos incorporados aquí por referencia (denominados “TOS” o “Acuerdo”), constituyen un contrato entre el cliente y una de las siguientes compañías de AT&T, dependiendo de la dirección de servicio del cliente: -

AT&T U-Verse® TV

AT&T U-verse ® TV Legal Guide West Please retain for your records Customer Service Standards Terms of Service Privacy Policy U-verse® TV Standard Rates Municipal Contact List Get answers 24/7 att.com/support or talk live 800.288.2020 AT&T U-verse ® TV Legal Guide Table of Contents West Customer Service Standards..................................................................................................3 AT&T U-verse® TV General Terms of Service.........................................................5 Privacy Policy .......................................................................................................................................16 U-verse TV Standard Rates...................................................................................................26 Municipal Contact List................................................................................................................30 U-verse ® TV Customer Service Standards October 2019 We’ve established general U-verse TV customer service standards designed to exceed your expectations. Here are some of the general customer service standards we intend to meet. • We can help you with your questions. Contact us online at att.com/support or call us at 800.288.2020. For technical support or to report a problem, call 24 hours a day, 7 days a week. • For ordering, billing, and other inquiries, call us Monday through Friday, from 8 a.m. to 7 p.m. Pacific Time and Saturdays from 8 a.m. to 5 p.m. Pacific Time. Aer hours, an automated response system will answer your call . Important customer service standards: AT&T employees and representatives will carry identification. U-verse TV employees and representatives carry an ID card showing their name and photo. Appointment hours for installations and service calls with respect for your time The appointment window for installations, service calls, and other installation activities will be, at most, a 4-hour time block during normal business hours. -

Annual Report 2017 Iab Annual Report 2017

ANNUAL REPORT 2017 IAB ANNUAL REPORT 2017 dynamic creative powerhouses apply their storytelling expertise to build marketers’ brands. Similarly, the 2017 IAB Leadership Dialogues were a first-ever Building 21st Century Brands: series of discussions with transformative leaders in business, politics, economics, and technology to gain The Race to the New Economy insights from and debate critical industry, political, and economic issues with each other. A cross-screen economy requires new standards and ife in America in 2017 was lived inside a series a time. These direct brands—as well as the incumbents guidelines to grow the marketplace, and IAB and the of paradoxes, all of them balanced on one side that join their club—are the growth engine of the new L IAB Tech Lab introduced the completely revamped by the ongoing economic boom, characterized by brand economy. IAB Standard Ad Unit Portfolio, featuring dynamic a bull market now in its 10th year. We had political more than 14,800 digital media professionals Adapting to this new landscape is not optional either: ads that allow for flexible creative on a multitude turmoil … and economic boom. Populist revolt … have advanced through the IAB Certification Two-thirds of consumers now expect direct brand of screen sizes and resolution capabilities and that and economic boom. Immigration mania … and Programs and Professional Development initiatives. connectivity. puts user experience front and center. Another major economic boom. Media disruption … and economic accelerator for growth is a trustworthy supply chain. An emerging economy and fast-changing media boom. Retail apocalypse … and economic boom. THE WORLD HAS SHIFTED FROM AN A major initiative for the Tech Lab in this area was INDIRECT BRAND ECONOMY TO A landscape also requires an active eye on policy, and In the digital media and marketing industries, we DIRECT BRAND ECONOMY. -

Rhythmone Plc Announces Audited Full Year Financial Year 2017 Results

RHYTHMONE PLC ANNOUNCES AUDITED FULL YEAR FINANCIAL YEAR 2017 RESULTS Company Returns to Full-Year Underlying Profitability led by 28% Growth of “Core” Revenues London, England and San Francisco, CA – 15 May 2017 – RhythmOne plc (LSE AIM: RTHM, “Company” or “Group”), today reports audited results for the year ending 31 March 2017 (“FY2017” or “the Period”). The Company’s FY2017 conference call will be webcast live at https://investor.rhythmone.com at 9:30AM BST; 4:30AM EST; 1:30AM PST. Financial Highlights (Audited) Year ended Year ended 31 March 31 March 2017 2016 (audited) (audited) Change $000 $000 % or $ Operating Metrics: Total Revenue1 175,381 166,716 5% Core Revenue2 149,025 116,058 28% Non-Core Revenue3 26,356 50,658 (48%) Adjusted EBITDA4 1,386 (10,475) $11,861 Cash and Cash Equivalents, and Marketable Securities 75,204 78,486 (4%) Statutory Metrics: Revenue 149,025 116,058 28% Loss from Continuing Operations (14,029) (75,527) $61,499 Loss from Discontinued Operations net of Tax (4,761) (16,726) $11,965 Loss for the year (18,790) (92,253) $73,463 Loss per share attributed to RhythmOne Cents Cents Cents Basic (4.45) (22.88) 18.43 Loss per share from Continuing Operations Basic (3.32) (18.73) 15.41 1 Completed transformational shift to Core mobile, video and programmatic products, resulting in a return to revenue growth and profitability5; Significant growth of Core mobile, video and programmatic products that has driven financial performance across key metrics: – Total revenues1 of $175.4M, 85% from Core products (FY2016: $166.7M, -

Rhythmone Plc Announces Unaudited First Half Financial Year 2018 Results

RHYTHMONE PLC ANNOUNCES UNAUDITED FIRST HALF FINANCIAL YEAR 2018 RESULTS Unified Programmatic Platform Continues to Lead Company Growth London, England and San Francisco, CA – 4 December 2017 – RhythmOne plc (LSE AIM: RTHM, “Company” or “Group”), today reports unaudited results for the six months ended 30 September 2017 (“H12018” or “the Period”). The Company’s H12018 conference call will be webcast live at https://investor.rhythmone.com on 4 December 2017 at 9:30AM GMT; 4:30AM EST; 1:30AM PST. Financial Highlights (Unaudited) Six months to Six months to 30-Sep 30-Sep 2017 2016 (restated2) (unaudited) (unaudited) Change $000 $000 % or $ Revenue from Continuing Operations 114,528 66,771 72% Loss from Continuing Operations (8,238) (10,700) 2,462 Loss from Discontinued Operations net of Tax - (197) 197 Loss for the Period (8,238) (10,897) 2,659 Adjusted EBITDA1 3,057 (2,597) 5,654 Cash and Cash Equivalents, and Marketable Securities 39,325 75,204* (48%) (restated2) Loss per share attributed to RhythmOne plc Cents Cents Cents Basic (16.63) (26.91) 10.28 Loss per share from Continuing Operations Basic (16.63) (26.43) 9.80 *FY2017 Ending Balance Maintained focus on strategic revenue growth and returned to profitability on an Adjusted EBITDA1 basis; H12018 performance in line with management expectations across key metrics, as follows: – Total revenues from Continuing Operations of $114.5M (H12017: $66.8M), up 72% year-on-year – Adjusted EBITDA1 of $3.1M, an improvement of $5.7M (H12017: $2.6M Loss) – RhythmOne on-platform revenues of $44.4M (H12017: $35.5M), up 25% year-on- year Announced definitive agreement to acquire YuMe, Inc., a publicly-traded company listed on the New York Stock Exchange; 1 Invested approximately $2.1M in product development and capital expenditures to strengthen and improve growth product lines; Ended the Period with approximately $39.3M in cash and cash equivalents.