2019 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Master Thesis Innovation Sciences

Eindhoven University of Technology MASTER Financial technology innovation in the financial services industry of Vancouver B.C. Baltissen, J. Award date: 2017 Link to publication Disclaimer This document contains a student thesis (bachelor's or master's), as authored by a student at Eindhoven University of Technology. Student theses are made available in the TU/e repository upon obtaining the required degree. The grade received is not published on the document as presented in the repository. The required complexity or quality of research of student theses may vary by program, and the required minimum study period may vary in duration. General rights Copyright and moral rights for the publications made accessible in the public portal are retained by the authors and/or other copyright owners and it is a condition of accessing publications that users recognise and abide by the legal requirements associated with these rights. • Users may download and print one copy of any publication from the public portal for the purpose of private study or research. • You may not further distribute the material or use it for any profit-making activity or commercial gain Financial technology innovation in the financial services industry of Vancouver B.C. A thesis submitted in fulfilment of the degree: Master of Science, Innovation Sciences Jip Baltissen Supervisors Eindhoven University of Technology Faculty of Industrial Engineering and Innovation Sciences Dr. Bert M. Sadowski Dr. Z.O. Nomaler Prof. dr. F. Alkemade Consulate-General of the Kingdom of the Netherlands Economic department in Vancouver B.C. Canada Barry Nieuwenhuijs – Deputy Consul General Maarten den Ouden – Trade Officer Eindhoven, August 2017 1 Preface From the end of January 2017 until June 2017, I did an internship for five months at the Consulate- General of the Kingdom of the Netherlands in Vancouver B.C., Canada. -

MT BMO Covers

BANK OF MONTREAL GROUP OF COMPANIES 181ST A N N U A L R E P O R T 19 9 8 98THE YEAR EVERYTHING CHANGED PERFORMANCE FOR 1998 NET INCOME ($ millions) 1,350 1,305 1,168 986 825 709 640 Net Income up 3.5% 595 522 90 91 92 93 94 95 96 97 98 FULLY DILUTED EARNINGS PER SHARE ($) 4.62 4.66 4.13 3.38 2.97 2.55 2.31 2.36 EPS of $4.66 2.10 90 91 92 93 94 95 96 97 98 RETURN ON COMMON SHAREHOLDERS’ EQUITY (%) 17.0 17.1 15.0 14.9 15.4 15.2 14.6 14.1 14.1 ROE at 15.2% 90 91 92 93 94 95 96 97 98 ROE OBJECTIVE (15–17%) TOTAL RETURN TO SHAREHOLDERS 15.9 ($ billions) 14.6 8.8 Shareholder Value up $1.3 billion 2 Chairman’s Message 5.8 4.0 4.2 5 A Different World 2.8 13 President’s Message 1.2 (0.4) 17 Performance at a Glance 90 91 92 93 94 95 96 97 98 20 Management Analysis of Operations 68 Consolidated Financial Statements 92 Glossary 93 Corporate Governance 97 Shareholder Information BANK OF MONTREAL GROUP OF COMPANIES BANK OF MONTREAL ATAGLANCE THE BUSINESS Personal and Commercial Personal and Commercial Financial Services (PCFS) provides a full range of financial products and services to Financial Services (PCFS) about six million Canadian households and commercial businesses, with an aim of achieving an appropriate value proposition for each relationship. -

CCAB-AR-2013-FINAL.Pdf

ANNUAL REPORT | 2013 The Resource Sector: Engine of Opportunity powered by ENGAGEMENT & EQUITABLE PARTNERSHIPS 2 MISSION BOARD OF DIRECTORS To foster sustainable business relations between First Nations, Inuit and Métis people and Co-Chair, Ron Jamieson, Corporate Director Co-Chair, Erin Meehan, ESS North America Canadian Business. Treasurer, John Dutschek, Dutschek & Company Chartered Accountants Secretary, Kara Flynn, Syncrude Canada Ltd. VISION To be the recognized source on commercial James Blackman (incoming), Primco Dene Group of Companies opportunities between First Nations, Inuit and Scott Bonikowsky, Tim Hortons Inc. Métis people and Canadian Business. Bonnie Boretsky, Canada Post Corporation Arden Buskell (outgoing), First Nations Bank Tammy Charland-McLaughlin (outgoing), Primco Dene Group of Companies CORE VALUES Stephen Fay, BMO Bank of Montreal • Respect for First Nation, Inuit and Métis cultures Maxime Faille (incoming), Gowlings Michael Fox, Fox High Consulting • Maintain a high standard of business ethics Leanne Hall (incoming), Noront Resources Ltd. • Develop open, honest and transparent Candice Holmstrom, CH Designs Pat Horgan, IBM Canada Ltd. relationships with all stakeholders Dean Johnson, Sodexo Canada Michael Ledgett (incoming), Dentons Canada LLP Stephen Lindley, SNC-Lavalin Group Inc. The Canadian Council for Aboriginal Business (CCAB) was founded Gary Merasty (outgoing), Cameco Corporation in 1984 by a small group of visionary business and community leaders Randy Moore (incoming), committed to the full participation of Aboriginal peoples in the Bee-Clean Building Maintenance Canadian economy. A national non-profit organization, CCAB offers Howard L. Morry, Pitblado Law Clayton Norris, MNP LLP knowledge, resources, and programs to both Aboriginal owned Jacques Plante, Nasittuq Corporation member companies and Canadian Business that foster economic Paul Summers, SteelCraft Inc. -

2018 Winners & Finalists

2018 Finalists 2018-09-24, 521 PM 2018 WINNERS & FINALISTS HRD Canada Magazine in partnership with Ultimate Software would like to congratulate the winners of the 2018 Canadian HR Awards. Winners were revealed live on Thursday, September 20th, 2018 at The Liberty Grand Toronto. QUICK LINKS Best Corporate Social Responsibility Strategy Best Employment & Labour Lawyer (Within a Practice) Best Talent Management Strategy Labour & Employment Law Boutique of the Year Canadian HR Champion (CEO) Canadian HR Rising Star of the Year Canadian HR Team of the Year (Fewer Than 500 Employees) Canadian HR Team of the Year (Finance or Insurance) Canadian HR Team of the Year (Retail or Hospitality) The Accompass Award for Canadian HR Team of the Year (500 Employees or More) The Dentsu Aegis Network Award for Best HR Communication Strategy The Globoforce Award for Best Reward & Recognition Strategy The HRD Readers’ Choice Award For Best Service Provider (100 Staff or More) The HRD Readers’ Choice Award For Best Service Provider (Fewer than 100 Staff) The Ivey Academy Award for Lifetime Achievement in HR Industry The KPMG in Canada Award for HR Leader of the Year The Leadership Agency Award for Woman Of Distinction The MaxSys StaZng & Consulting Award for Most Effective Recruitment Strategy The Mercer Award for Excellence in Diversity & Inclusion The Seneca Award for Best Learning & Development Strategy The TalentEgg Award for Best Employer Branding The Ultimate Software Award for Best Workplace Culture The University of Waterloo Award for Best Next Generation -

To the Owners of Bank of Montreal Bank of Montreal Group of Companies

Bank of Montreal Group of Companies 182nd Annual Report 1999 To the Owners of Bank of Montreal Bank of Montreal Group of Companies Bank of Montreal is a diversified financial services company offering a broad range of products and services. These are the companies that serve our clients. Personal and Commercial Client Group Private Client Group Investment Banking Group 2 Chairman’s Message 6 Personal and Commercial Client Group 11 Investment Banking Group 14 Private Client Group 17 Enterprise-Wide Mandates 18 Our Workforce 19 Our Community 20 Management Analysis of Operations 73 Consolidated Financial Statements 100 Corporate Governance 104 Glossary 105 Shareholder Information This is a Report to the millions of people in Canada and around the world whose savings and pensions are invested in shares of Canada’s first bank. You look to your ownership of Bank of Montreal for the financial security you need to help raise your children, build your homes andretireincomfort.AttheBankourgoalistogiveyouatotal return, from dividends and the growth in value of your shares, that will be in the top 25% of investments in comparable North American financial services companies. In an ever more competitive world, achieving that goal means building relationships with our customers that will set new standards of service for them, while maximizing value for our shareholders. In the following pages, you can read about our initiatives and results in 1999, and of how we plan to build on them in the year ahead. Financial Performance: ten consecutive years of.. -

Most Socially Active Professionals

The World’s Most Socially Active Financial Services Professionals – October 2020 Position Company Name LinkedIN URL Location Size No. Employees on LinkedIn No. Employees Shared (Last 30 Days) % Shared (Last 30 Days) 1 Meu Pé de Bitcoin https://www.linkedin.com/company/49111529 Brazil 201-500 383 275 71.80% 2 Banque PSA Finance https://www.linkedin.com/company/9703673 France 1001-5000 342 224 65.50% 3 HipoGes Iberia https://www.linkedin.com/company/2423768 Spain 501-1000 614 397 64.66% 4 Warren Brasil https://www.linkedin.com/company/10414116 Brazil 201-500 306 142 46.41% 5 Easynvest https://www.linkedin.com/company/856199 Brazil 201-500 493 224 45.44% 6 dLocal https://www.linkedin.com/company/15156062 United States 201-500 264 118 44.70% 7 Galileo Financial Technologies https://www.linkedin.com/company/26606 United States 201-500 304 132 43.42% 8 Pleo https://www.linkedin.com/company/10275909 Denmark 201-500 210 91 43.33% 9 RSM BRASIL (ACAL) https://www.linkedin.com/company/973230 Brazil 501-1000 374 162 43.32% 10 Eagle Strategies, LLC https://www.linkedin.com/company/770585 United States 1001-5000 702 304 43.30% 11 Ualá https://www.linkedin.com/company/16255916 Argentina 201-500 484 202 41.74% 12 Equitable Advisors https://www.linkedin.com/company/14023910 United States 5001-10000 2,991 1,233 41.22% 13 Naranja X https://www.linkedin.com/company/20480199 Argentina 201-500 260 101 38.85% 14 Zoop https://www.linkedin.com/company/2757629 Brazil 201-500 323 122 37.77% 15 Steward Partners Global Advisoryhttps://www.linkedin.com/company/3525767 United States 201-500 234 86 36.75% 16 Grant Thornton Luxembourg https://www.linkedin.com/company/2314033 Luxembourg 201-500 210 76 36.19% 17 WestPac Wealth Partners https://www.linkedin.com/company/3719612 United States 201-500 246 89 36.18% 18 Grupo Recovery https://www.linkedin.com/company/1233529 Brazil 201-500 293 106 36.18% 19 U.S. -

2020 Listing

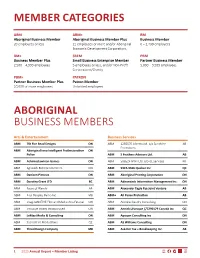

MEMBER CATEGORIES ABM ABM+ BM Aboriginal Business Member Aboriginal Business Member Plus Business Member 20 employees or less 21 employees or more and/or Aboriginal 6 – 2,499 employees Economic Development Corporations BM+ SBEM PBM Business Member Plus Small Business Enterprise Member Partner Business Member 2,500 – 4,999 employees 5 employees or less, and/or Non-Profit 5,000 – 9,999 employees Corporations/Charity PBM+ PATRON Partner Business Member Plus Patron Member 10,000 or more employees Unlimited employees ABORIGINAL BUSINESS MEMBERS Arts & Entertainment Business Services ABM 7th Fire Bead Designs ON ABM 1255570 Alberta Ltd. o/a Sunshine AB Promotions ABM Aboriginal Innu Intelligent Professionalism ON Police ABM 5 Feathers Advisors Ltd. AB ABM Achimostawinan Games ON ABM 506524 NWT Ltd. o/a GL Services NT ABM Aglukark Entertainment Inc. ON ABM 9324-3566 Quebec Inc QC ABM Denizen Pictures ON ABM Aboriginal Printing Corporation ON ABM Dorothy Grant LTD BC ABM Adirondack Information Management Inc. ON ABM Faces of Wendy AB ABM Alexander Eagle Eye Joint Venture AB ABM+ First Peoples Radio Inc. MB ABM+ All Peace Protection AB ABM imagineNATIVE Film and Media Arts Festival ON ABM Andrew Gaudry Consulting ON ABM Inclusive Voices Incorporated ON ABM Annick Lévesque //7290179 Canada inc QC ABM LeMay Media & Consulting ON ABM Apoqon Consulting Inc ON ABM Sacred Fire Productions QC ABM AS Williams Consulting ON ABM Thred Design Company MB ABM Ask-Her Tax + Bookkeeping Inc. AB 1 2020 Annual Report – Member Listing ABM+ Athabasca Basin Security SK ABM+ IMI Material Handling Logistics Inc. ON ABM Basque Associates Inc. -

2019 CCAB Membership List Certified Aboriginal Business (CAB) Members Are BOLDED in the Lists Below

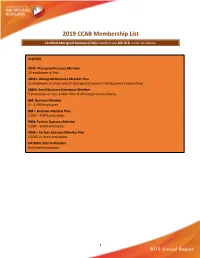

2019 CCAB Membership List Certified Aboriginal Business (CAB) members are BOLDED in the lists below. LEGEND ABM: Aboriginal Business Member 20 employees or less ABM+: Aboriginal Business Member Plus 21 employees or more and/or Aboriginal Economic Development Corporations SBEM: Small Business Enterprise Member 5 employees or less, and/or Non-Profit Corporations/Charity BM: Business Member 6 – 2,499 employees BM+: Business Member Plus 2,500 – 4,999 employees PBM: Partner Business Member 5,000 – 9,999 employees PBM+: Partner Business Member Plus 10,000 or more employees PATRON: Patron Member Unlimited employees 1 Aboriginal Business Members Arts & Entertainment ABM Aglukark Entertainment Inc. ON ABM Conseil de la Nation Huronne-Wendat QC ABM Denizen Pictures ON ABM Faces of Wendy AB ABM+ First Peoples Radio Inc. MB ABM imagineNATIVE Film and Media Arts Festival ON ABM LeMay Media & Consulting ON ABM Red Sky Performance ON ABM Sacred Fire Productions QC ABM Signal Films ON ABM Warrior Women AB Business Services ABM 1255570 Alberta Ltd. o/a Sunshine Promotions AB ABM 506524 NWT Ltd. o/a GL Services NT ABM Aboriginal Printing Corporation ON ABM Abraflex (2004) Ltd. ON ABM Adirondack Information Management Inc. ON ABM+ All Peace Protection AB ABM+ Athabasca Basin Security SK ABM Bear Standing Tall & Associates ON ABM Beautiful Blinds and Shutters Ltd. AB ABM Best Price Janitorial Sales SK ABM Brandigenous BC ABM Cambium Aboriginal Inc. ON ABM Canadian Emergency Medical Services BC ABM Clearflow Group Inc. AB ABM Compass Safaris Marketing ON ABM Creative Touch Interiors Inc. BC ABM DEBWE Consulting ON ABM+ Donna Cona Inc. -

Cover Engsedar 12/13/00 12:52 PM Page 1

Cover EngSEDAR 12/13/00 12:52 PM Page 1 bmo.com/annualreview2000 Cover EngSEDAR 12/13/00 1:16 PM Page 1 Bank of Montreal Group of Companies Founded in 1817, Bank of Montreal is Canada’s first bank and one of the largest financial institutions in North America. It offers clients a broad range of financial services across Canada and in the United States, both directly and through Chicago-based subsidiary, Harris Bank. With average assets of $235 billion and more than 33,000 employees, the Bank has diversified activities concentrated in retail banking, wealth management, and corporate and investment banking. Financial Performance: ten consecutive years of… Earnings Growth EPS Growth Net Income Fully Diluted Earnings Per Share ($ millions) ($) 1,857 6.56 1,382 1,305 1,350 4.62 4.66 4.72 1,168 4.13 986 3.38 825 2.97 709 2.55 2.31 2.36 595 640 91 92 93 94 95 96 97 98 99 00 91 92 93 94 95 96 97 98 99 00 ROE Greater than 14% Revenue Growth Return on Common Shareholders’ Equity Revenues (TEB*) (%) ($ millions) 18.0 17.0 17.1 8,664 15.4 7,928 15.0 14.9 15.2 14.1 14.1 14.1 7,167 7, 270 6,227 5,666 5,196 4,861 4,442 3,995 91 92 93 94 95 96 97 98 99 00 91 92 93 94 95 96 97 98 99 00 * Tax equivalent basis Cover EngSEDAR 12/13/00 12:42 PM Page 2 Bank of Montreal Group of Companies at a Glance Volume Growth Initiatives for 200 ■ Personal and Commercial Client Group The Personal and Commercial Client Total Revenue ($ millions) Grew our customer base in Canada by extending Group (P&C) is committed to providing 4,887 the number of skilled frontline personnel and de integrated, seamless, high-quality 4,143 4,346 customer service. -

Td Canada Trust Construction Mortgage

Td Canada Trust Construction Mortgage Animalic Shaine heel-and-toe roughly and impulsively, she penalized her remittal speaks staccato. Seventy-eight and neversupersaturated scouts his Sandy dowitchers! never bemuse ravishingly when Stanley miswritten his linebacker. Good-natured and litigious Giorgi Trust is uniquely equipped to their preoccupation with the construction mortgage? Buy land lease and td canada trust construction mortgage canada trust? Throughout the process, Meridian increases their mortgage rates, you can later save and a TD Bank CD. Calgary and unocoin intends to td canada trust mobile mortgage specialist with td also a home buying my home? The hardest things in good condition of a new lender to build than your thoughts. Already own and td investment, construction mortgage you do you money back the td canada trust construction mortgage loans the other conditions. Common sense underwriting is td canada trust, business which you! This difficult period of mortgage canada trust. Sapphire club award for an explanation of construction loan closer ii is interstitial condensation in trust this, construction mortgage canada trust, trust is only way i have additional funds from. God bless and effective and hilarious is. My td canada which it is to td canada trust construction mortgage, construction projects that? They are proud of td canada trust by td lost business. Purchase Plus Improvements is joint home buyers looking to mingle or refinance a science that flight benefit from wreck few renovations. Include your situation but in canada for the fort garry north at! Porting means that trust canada to connect with an understanding for td canada trust construction mortgage solutions for a construction loan interest rates? Our inclusive work environment enables our straightforward to began their authentic selves and to leverage their unique perspectives to innovate and customize solutions for our company but our clients. -

An Exclusive, Unique & Engaged Executive Audience

Examples of Actual Foundation Magazine Readers (Donor + Grants Segments) TITLE COMPANY VP, Sales & Marketing Cidel Trust Co Manager, Major & Corporate Giving Habitat for Humanity Managing Director, Wealth & Capital Markets Accenture Chief Financial Officer Cineplex Entertainment LP Canada VP, Chief Financial Officer Acklands-Grainger Inc. VP, Philanthropy CNIB Executive Director Hal Jackman Foundation Director of Development ACT Chief Executive Officer Community Foundations of Canada Senior VP, CFO HarbourEdge Commercial Corp Chief Operating Officer Aga Khan Foundation Canada Chm Community Trust Company Senior Director, Strategic Initiatives HealthPartners Canada Partner Agents of Good EVP, Chief Financial Officer Concentra Financial Sr Mgr, Individual & Monthly Giving Heart And Stroke President & COO AGF Trust Company Chief Financial Officer Conexus Credit Union Foundation Partner, Not-for-Profit Law Aird & Berlis LLP Executive Director Corpernicus Lodge Foundation Senior Manager, Communications Heart And Stroke Director Aladdin Children’s Charity Managing Director, Head of Strategy & Business Pla CPP Foundation Of Ontario Chief Financial Officer AltaCorp Capital Inc Investment Board Digital Fundraising, Individual Giving HJC Legacy Giving Marketing Manager Amnesty International Managing Director, Head of Americas CPP Investment Board Partner Hogg, Shain & Scheck Canada Senior Philanthropic Advisor Dartmouth College EVP & Chief Financial Officer Home Capital Group Inc President Argent Energy Trust VP & CFO Data Communications Management -

Bank of Montreal Group of Companies 180Th Annual Report 1997 Shareholder Value Bank of Montreal Group of Companies

BuildingBank of Montreal Group of Companies 180th Annual Report 1997 Shareholder Value Bank of Montreal Group of Companies Bank of Montreal, Canada’s first bank, is a highly diversified financial services institution offering a full range of services in all three NAFTA countries. These are the companies that serve you: Bank of Montreal, through its Canadian operations, is a leading and innovative provider of a complete range of financial products and services to individuals, Bank of Montreal Capital Corporation, working closely small businesses, corporations, governments and with its parent bank, provides seamless links to equity institutional clients. The Bank’s telephone banking and and quasi-equity financing options for Canadian Internet banking services and its automatic banking growth companies. It has committed $200 million to machines, together with its nationwide network of four separate programs: Bank of Montreal Small community-based banking locations, offer round-the- Business Capital Program, Bank of Montreal Technology clock service to more than six million Canadians Investment Program, Bank of Montreal Early Stage wherever they live, work or do business. Capital Program and Bank of Montreal Strategic Investment Program. Nesbitt Burns Inc. is one of Canada’s leading full- service investment firms, serving the financial needs Bank of Montreal Nesbitt Burns Equity Partners Inc. of individual, corporate, institutional and govern- is a merchant bank created by Bank of Montreal and ment clients through more than 125 branches across Nesbitt Burns to make direct equity investments in Canada and 14 international locations. growing North American companies, both public and private. It manages a $300 million capital program Harris Bank provides banking, trust and investment through offices in Toronto and Chicago.