Yass Valley Council

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sumo Has Landed in Regional NSW! May 2021

Sumo has landed in Regional NSW! May 2021 Sumo has expanded into over a thousand new suburbs! Postcode Suburb Distributor 2580 BANNABY Essential 2580 BANNISTER Essential 2580 BAW BAW Essential 2580 BOXERS CREEK Essential 2580 BRISBANE GROVE Essential 2580 BUNGONIA Essential 2580 CARRICK Essential 2580 CHATSBURY Essential 2580 CURRAWANG Essential 2580 CURRAWEELA Essential 2580 GOLSPIE Essential 2580 GOULBURN Essential 2580 GREENWICH PARK Essential 2580 GUNDARY Essential 2580 JERRONG Essential 2580 KINGSDALE Essential 2580 LAKE BATHURST Essential 2580 LOWER BORO Essential 2580 MAYFIELD Essential 2580 MIDDLE ARM Essential 2580 MOUNT FAIRY Essential 2580 MOUNT WERONG Essential 2580 MUMMEL Essential 2580 MYRTLEVILLE Essential 2580 OALLEN Essential 2580 PALING YARDS Essential 2580 PARKESBOURNE Essential 2580 POMEROY Essential ©2021 ACN Inc. All rights reserved ACN Pacific Pty Ltd ABN 85 108 535 708 www.acn.com PF-1271 13.05.2021 Page 1 of 31 Sumo has landed in Regional NSW! May 2021 2580 QUIALIGO Essential 2580 RICHLANDS Essential 2580 ROSLYN Essential 2580 RUN-O-WATERS Essential 2580 STONEQUARRY Essential 2580 TARAGO Essential 2580 TARALGA Essential 2580 TARLO Essential 2580 TIRRANNAVILLE Essential 2580 TOWRANG Essential 2580 WAYO Essential 2580 WIARBOROUGH Essential 2580 WINDELLAMA Essential 2580 WOLLOGORANG Essential 2580 WOMBEYAN CAVES Essential 2580 WOODHOUSELEE Essential 2580 YALBRAITH Essential 2580 YARRA Essential 2581 BELLMOUNT FOREST Essential 2581 BEVENDALE Essential 2581 BIALA Essential 2581 BLAKNEY CREEK Essential 2581 BREADALBANE Essential 2581 BROADWAY Essential 2581 COLLECTOR Essential 2581 CULLERIN Essential 2581 DALTON Essential 2581 GUNNING Essential 2581 GURRUNDAH Essential 2581 LADE VALE Essential 2581 LAKE GEORGE Essential 2581 LERIDA Essential 2581 MERRILL Essential 2581 OOLONG Essential ©2021 ACN Inc. -

Rural Fringe April 2012

URAL FRINGE Journal of the Hall district VOLUME 19 ISSUE 2 APRIL 2012 NATIONAL SHEEPDOG TRIALS 2012 PROVE POPULAR The 2012 National sheep Dog Trial Championships concluded suc- cessfully with 53 competitors and a total of 278 dogs competing in 3 separate Championship events; the Maiden Championship, the Improver Championship and the Open championship. The winner of the Open becomes the National Champion. Once again Hall village played a prominent role in welcoming the Trial- lers, their wives and their families to the village. The social events put on by the Hall Progress Association for the visitors to make them feel welcome were as always much appreciated and very well attended and Andrew Purdam Photos: © are now very much a part of the Trial itself. Public attendance was very good with total of nearly 1000 people paying to enter on the weekend and a significant numbering attending through the week when entry was free. The National Champion this year is Greg Prince from Dubbo NSW who has now won the title an amazing 14 times which only adds to his legendary status in the sport of sheep dog trialling. To give this achiev- ment some perspective the next highest number of National Champion wins is by both Geoff Jolly and Ross Dodge who each won 6 times. Each of these gentlemen now deceased are deservedly also consid- ered legends in the sport and until Greg’s run of success it was thought that 6 wins would never be exceeded. The main results are as follows: Open championship (and National Champion) 1st Greg Prince NSW, Princes Di 188 points -

Australian Way August 2014

just say Historic hotels, horseback rides, hearty food and fine wine make the Yass Valley in New South Wales an ideal destination in any season. WORDS GARETH MEYER PHOTOGRAPHY DAVID HAHN SEPTEMBER 2014 QANTAS 73 FOOD AND& WINE WINE YASS YASS VALLEY VALLEY IN THE MID-1800S, the Yass Valley was a bustling rest stop for travellers between Sydney abandoned city life to apply their passion to Flint in the Vines, a and Melbourne. The to-and-fro of Cobb & Co coaches, drovers, the superb cellar door-restaurant in Murrumbateman. horsemen of the Murrumbidgee and gold prospectors stoked the Scratch the cultural surface of the area and one finds an eclectic, creative imagination of a local boy by the name of Andrew Barton but equally committed troupe of artists, among them world-renowned “Banjo” Paterson. But since those early days, the region hasn’t really film-score composers, classical musicians and glassblowers. A warranted its own postcard. When neighbouring Canberra became month of artistic activity will be launched this year with YASSarts the nation’s seat of power, the pollies settled to the east and left the Spring (October 3-26), incorporating Sculptures in the Paddock, region to merino sheep and grain farmers. which made its successful debut last year. This month, Yass hosts Even now, a GPS system offers limited help in navigating this the Turning Wave Festival of Irish and Australian music (September McCubbinesque landscape of stringybark and scribbly gums. 19-21, turningwave.org.au), while November brings Classic Yass Fortunately, pioneering locals and passionate ring-ins are putting the (November 1, classicyass.com), a day of classic cars, billycart races valley firmly on the discerning food and wine traveller’s map. -

The Gundaroo Gazette Community | Cohesion | Harmony

The Gundaroo Gazette Community | Cohesion | Harmony www.gundaroo.org Volume 204 Print circulation 600 — Readership keeps growing November 2020 Gundaroo blessed with memorable Spring events Spring has on the whole been very acts to six for a semi-final, and then kind to Gundaroo. four performing in the Grand Final on We have continued to stay free of the 24 October. The McGrath-sponsored virus that has plagued so much of the contest was won by Canberra teenage world. Good rain has meant vigorous singer-songwriter Madi Kate (pictured). growth of pastures and flowers (although some properties have suffered flooding). And we have been treated to some great entertainment – with more to come – and to news of a new prize-winning artist in our midst. been helping local musicians by holding regular music events since re-opening Live music returned to the Colonial Inn in May. (See more on pages 10–11.) and to Tallagandra Hill, playing to And more is to come. (See ad page 12.) COVID-safe sell-out ‘crowds’. As well as enjoying the return of live At the Inn, three heats of the Gundaroo music to our favourite venues, we also Emerging Muso battle (GEM) over had the pleasure of taking part in the three weekends reduced 12 ‘emerging’ the Gundaroo School P&C ‘Silent An evening concert followed, closing Auction’ on Friday 6 November. This In this issue … with Canberra band, Dark Horse was organised as an alternative to the Local News pp 1–4 (pictured, above right). The event was usual rowdy live auction Quiz Night, From ‘The Desk’ p 4 known as the Gundaroo Music Wedge – which is the annual fund-raiser for the Community Noticeboard pp 4–5 an ‘in-between’ event, not a ‘festival’, school. -

Water Bills Could Soar to Pay for Drinkable Water

Page 1 YASS VALLEY TIMES WEDNESDAY May 26, 2021 $2.00 Water Bills could soar to pay for drinkable water Despite holding claim to the second most expensive and comfortably the most complained about water of council areas categorised as 'medium-sized' within NSW, Yass Valley water could be about to become even more expensive. Yass Valley Council will tonight be presented with information stating an increase of $260 per year to Typical Residential Bills will be required to pay for the construction of an upgraded water treatment plant if they fail to receive further government subsidies. Households in Yass Valley paid $3.40 per kL of water used in 2019/20 which is well above the median of $2.22/kL in the medium category of 19 Councils with Walgett holding the cheapest at $0.90 and Tenterfield the most expensive at $3.80. The project cost is estimated now to total $33.2 million, with the Council's water operations still holding an outstanding loan of $11.954 million as of June 2020, due to the raising of the Yass Dam Wall project of 2013, which also received no government subsidy. For those that can recall, the Dam Wall project's repayments were considered hefty at the time at $205.67 per year for each household and was the highest loan repayment in medium category water operations in the state. The financial modelling, requested by Councillors shows upgrading the water treatment plant with no assis- Yass River water loaded with organics triggered a 'Boil Water Alert' in 2020. -

A Taste of Yass Valley

A Taste of Yass Valley Yass Valley is bursting with amazing experiences so we’ve put together a sampler, ‘A Taste of Yass Valley’, for all to enjoy. Most activities can be interchanged, so have fun tailor making your perfect getaway! Please note that this is just a small selection of many amazing experiences on offer in Yass Valley. Please visit www.yassvalley.com.au for plenty more options to make your visit to Yass Valley a memorable one. Saturday Murrumbateman Village Market At the Murrumbateman Village Market you are sure to discover a new favourite among the abundant fresh local produce, local handicrafts, art work and quality goods. From local wines, beautiful jams, delicious sauces, oil, baked goods, great coffee and juices you will be spoilt for choice. Also available are locally grown vegetables and plants, make sure you have lots of room in your boot! Saturday (2nd & 4th of month) 9am – 1pm Recreation Grounds, Barton Highway, Murrumbateman www.mvmarket.com Robyn Rowe Chocolates After filling your bags at the markets, take your wares on a picturesque drive along Murrumbateman road, turning right onto on Nanima Rd, to discover the delights of lovingly hand crafted chocolates made with fresh, natural ingredients at Robyn Rowe’s purpose built chocolate shop. Made with the highest quality imported Belgian Callebaut Fair Trade couverture, Robyn Rowe chocolates are deliciously smooth, glossy and creamy. Take a peek through the two way glass between the shop and the factory and watch the skilled technicians create these moreish delicacies. Enjoy a coffee or hot chocolate while sampling the delights, a perfect start to an indulgent weekend. -

Planning Frameowrk for the ACT and Southern Tablelands

A Planning Framework for Natural Ecosytems of the ACT and NSW Southern Tablelands Prepared by Martin Fallding, Land & Environment Planning for and under the direction of the Joint Regional Biodiversity Working Group. The Joint Regional Biodiversity Working Group consists of representatives of the Housing Industry Association (ACT and Southern NSW Region), NSW National Parks and Wildlife Service, Environment ACT, PlanningNSW, Queanbeyan City Council, Yass Shire Council, the Upper Murrumbidgee Catchment Co-ordinating Committee and the Conservation Council of the South East Region and Canberra Inc. Martin Fallding is principal of Land & Environment Planning, an environmental planning and land management consultancy. He is an environmental planner with qualifications in science and planning specialising in the integration of biodiversity conservation and natural ecosystems with development. He has extensive experience in local government and also operates the Callicoma Hill wilderness eco-retreat www.calli.com.au. First published in 2002 by: NSW National Parks and Wildlife Service 43 Bridge Street (PO Box 1967) Hurstville NSW 2220 Phone (02) 9585 6444 Fax (02) 9585 6555 Website: www.npws.nsw.gov.au © NSW National Parks and Wildlife Service 2002 Information presented in this publication may be reproduced in whole or in part for study or training purposes, subject to inclusion of acknowledgment of the source, and provided no commercial usage or sale of the material occurs. Reproduction for purposes other than those given above requires written permission from the NSW National Parks and Wildlife Service. This document should be cited as Fallding M. (2002), Planning Framework for Natural Ecosystems of the ACT and NSW Southern Tablelands. -

Festival O F Women Makers

FESTIVAL OF WOMEN MAKERS The Makers of Murrumbateman combine to showcase women winemakers, alongside high-profle chefs, musicians, artists and producers of handcrafted products. Supported by f Murrumbateman o Makers Makers 2 | Wine, Women and Song Festival and Song Festival Women Wine, INTRODUCING F E S T I V A L HIGHLIGHTS wine, women and song Blind Tasting featuring captivating Australian actress, Sylvia Keays CANBERRA REGION’S MAY FESTIVAL Trois Femmes Artistiques art Take in the Earth Mother Concert at Tallagandra Hill, featuring the experience rollicking Hatftz and Cara alongside leading Canberra musician, Leadership in the Jess Green, or enjoy a unique dinner in his own ‘Champagne House’ Vines workshop with Mr Bubbles, Greg Gallagher together with his special guests Hitzone, Art in the Vines - a ‘juicy’ dance performance at McKellar Ridge, blind-tasting wine theatre, meet Gaia and Liban Trois Femmes Artistiques at Gundog, chocolate-making classes with Robyn Earth Mother Concert Rowe or beautiful wine and food across all venues all weekend reaching featuring Hatftz and Cara, with Pheno the fnal crescendo with a dozen Mothers’ Day Feasts to choose from. You Champagne House can even learn new leadership skills through a winemaking experience at dinner and concert by Dionysus, or be part of a live soundtrack to wine performance by brilliant Hitzone experimental musician, Natsuko Yonezawa. Juicy dance performance by f Murrumbateman All ages and interests are catered for - from makers’ markets, sip Somebody’s Aunt o and paint classes, art and photography exhibitions and various wine Mother’s Day Feasts experiences from vineyard walks and talks to workshops and all forms at all venues Makers of wine tastings. -

Government Gazette No 123 of Friday 10 November 2017

GOVERNMENT GAZETTE – 10 November 2017 Government Gazette of the State of New South Wales Number 123 Friday, 10 November 2017 The New South Wales Government Gazette is the permanent public record of official notices issued by the New South Wales Government. It also contains local council and other notices and private advertisements. The Gazette is compiled by the Parliamentary Counsel’s Office and published on the NSW legislation website (www.legislation.nsw.gov.au) under the authority of the NSW Government. The website contains a permanent archive of past Gazettes. To submit a notice for gazettal – see Gazette Information. By Authority ISSN 2201-7534 Government Printer 6736 NSW Government Gazette No 123 of 10 November 2017 Government Notices GOVERNMENT NOTICES Miscellaneous Instruments CRIMES (ADMINISTRATION OF SENTENCES) ACT 1999 GOVERNOR I, General The Honourable David Hurley AC DSC (Ret'd), Governor of the State of New South Wales, with the advice of the Executive Council, and pursuant to section 225(1) and 225(3) of the Crimes (Administration of Sentences) Act 1999, do, by this Proclamation, declare the area described hereunder and all buildings erected thereon, to be a correctional centre within the meaning of the Crimes (Administration of Sentences) Act 1999 and I further declare that the correctional centre shall be known as Macquarie Correctional Centre, viz: All that piece or parcel of land situate in the Local Government Area of Dubbo Regional, Parish of Nanima and County of Bligh, being part of lot 1 Deposited Plan 1141897, shown by the shading on Plan Catalogue Number 57461 in the Plan Room of the NSW Department of Finance, Services & Innovation reproduced hereunder and having an area of 5.88 hectares or thereabouts. -

Yass Valley Escapes Guide

Temora Young Woolgarlo Good Hope Burrinjuck Wallaroo Yass Valley Sutton Information Centre Hours: Monday to Sunday 9:30am to 4:30pm (Closed Good Friday and Christmas Day) Email: [email protected] Web: yassvalley.com.au Ph: 1300 886 014 Address: 259 Comur St, Yass NSW 2582 Nature & Outdoors Shopping Heritage & Arts Food & Wine Dinner MERCHANT CAMPBELL Ewe & Me* - Local produce, passionate staff, moreish dishes rich in flavour and technique, on an à la carte menu, complete this dining experience. Thunderbird Motel, Comur Street, Yass Shopping Accommodation Thunderbird Hotel* - Thunderbird Motel offers personalised and professional service combined Follow the yellow path on the map to with warm country hospitality. explore the best of Shopping in Yass Valley. 264 Comur Street, Yass Day 1 Day 2 Morning Morning Markets - Local wines, beautiful jams, delicious Breakfast at Kaffeine - Kaffeine 2582, a trendy sauces, oil, baked goods, great coffee, juices, coffee house and homewares shop, is a stand- locally-grown vegetables and plants. alone attraction, with boutique clothes and Yass Community Markets homeware items for sale. Locally-roasted blends 10am - 1pm Saturday (1st & 3rd of month) of coffee, fresh juices squeezed on request, and a St Augustine’s Hall and grounds, Meehan St, Yass range of exotic teas to enjoy. Homemade cakes, baked goods and all-day breakfasts entice diners. Murrumbateman Village Markets 193 Comur Street, Yass 9am - 1pm Saturday (2nd & 4th of month) Recreation Grounds, Barton Highway, Murrumbateman Hillgrove Pottery* - Visit Hillgrove Pottery’s gallery, showcasing tableware and decorative YASS COMMUNITY Lunch ceramic products that are entirely handmade MARKETS Thyme to Taste - A deli-style café offering on-site at the studio in Murrumbateman, NSW. -

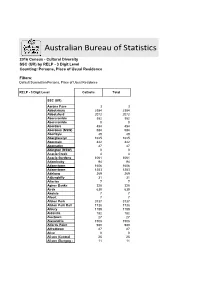

Australian Bureau of Statistics

Australian Bureau of Statistics 2016 Census - Cultural Diversity SSC (UR) by RELP - 3 Digit Level Counting: Persons, Place of Usual Residence Filters: Default Summation Persons, Place of Usual Residence RELP - 3 Digit Level Catholic Total SSC (UR) Aarons Pass 3 3 Abbotsbury 2384 2384 Abbotsford 2072 2072 Abercrombie 382 382 Abercrombie 0 0 Aberdare 454 454 Aberdeen (NSW) 584 584 Aberfoyle 49 49 Aberglasslyn 1625 1625 Abermain 442 442 Abernethy 47 47 Abington (NSW) 0 0 Acacia Creek 4 4 Acacia Gardens 1061 1061 Adaminaby 94 94 Adamstown 1606 1606 Adamstown 1253 1253 Adelong 269 269 Adjungbilly 31 31 Afterlee 7 7 Agnes Banks 328 328 Airds 630 630 Akolele 7 7 Albert 7 7 Albion Park 3737 3737 Albion Park Rail 1738 1738 Albury 1189 1189 Aldavilla 182 182 Alectown 27 27 Alexandria 1508 1508 Alfords Point 990 990 Alfredtown 27 27 Alice 0 0 Alison (Central 25 25 Alison (Dungog - 11 11 Allambie Heights 1970 1970 Allandale (NSW) 20 20 Allawah 971 971 Alleena 3 3 Allgomera 20 20 Allworth 35 35 Allynbrook 5 5 Alma Park 5 5 Alpine 30 30 Alstonvale 116 116 Alstonville 1177 1177 Alumy Creek 24 24 Amaroo (NSW) 15 15 Ambarvale 2105 2105 Amosfield 7 7 Anabranch North 0 0 Anabranch South 7 7 Anambah 4 4 Ando 17 17 Anembo 18 18 Angledale 30 30 Angledool 20 20 Anglers Reach 17 17 Angourie 42 42 Anna Bay 789 789 Annandale (NSW) 1976 1976 Annangrove 541 541 Appin (NSW) 841 841 Apple Tree Flat 11 11 Appleby 16 16 Appletree Flat 0 0 Apsley (NSW) 14 14 Arable 0 0 Arakoon 87 87 Araluen (NSW) 38 38 Aratula (NSW) 0 0 Arcadia (NSW) 403 403 Arcadia Vale 271 271 Ardglen -

Graeme Barrow This Book Was Published by ANU Press Between 1965–1991

Graeme Barrow This book was published by ANU Press between 1965–1991. This republication is part of the digitisation project being carried out by Scholarly Information Services/Library and ANU Press. This project aims to make past scholarly works published by The Australian National University available to a global audience under its open-access policy. Canberra region car tours Graeme Barrow PL£A*£ RETURN TO Australian National University Press Canberra, Australia, London, England and Miami, Fla., USA, 1981 First published in Australia 1981 Australian National University Press, Canberra © Text and photographs, Graeme Barrow 1981 This book is copyright. Apart from any fair dealing for the purpose of private study, research, criticism, or review, as permitted under the Copyright Act, no part may be reproduced by any process without written permission. Inquiries should be made to the publisher. National Library of Australia Cataloguing-in-Publication entry Barrow, Graeme: Canberra region car tours. ISBN 0 7081 1087 8. 1. Historic buildings — Australian Capital Territory — Guide-books. I. Title. 919.47’0463 Library of Congress No. 80-65767 United Kingdom, Europe, Middle East, and Africa: Books Australia, 3 Henrietta St., London WC2E 8LU, England North America: Books Australia, Miami, Fla., USA Southeast Asia: Angus & Robertson (S.E. Asia) Pty Ltd, Singapore Japan: United Publishers Services Ltd, Tokyo Design by ANU Graphic Design Adrian Young Typeset by Australian National University Printed by The Dominion Press, Victoria, Australia To Nora