June Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Islamic Finance Pakistan the Islamic Finance Industry Newsletter

Islamic Finance Pakistan The Islamic Finance Industry Newsletter VOLUME 1 ISSUE 5 | NOVEMBER 2010 Editorial……………………………….………………………………………………… 2 O ye who believe! Guard Remembering Dr. Mehmood Ahmed Ghazi………….………………… 3 e your duty to Allah, and u Messages on sad demise of Dr. Ghazi…………………..……………….. 4 s s Moves and Promotion……………………………………………………………. 4 i speak words straight to 5 ﺣﺎﻓﻆ ڈاﮐﭩﺮﻣﺤﻤﻮداﺣﻤﺪ ﻏﺎزی ﻣﺮﺣﻮم s the point. i h Ask Us ……………………………………………………………….………………….. 6 t News Bulletin ………………………………………………………………………… 8 n Al – Quran , 33:70 I Spotlight………………………………………………………………………………… 10 Upcoming Event…………………………………………………………………….. 12 Dr. Mahmood Ahmed Ghazi… A man of true letters By Anwar Ahmed Meenai The sad news of Dr. Mahmood scholar, free of any prejudices on the Ahmed Ghazi’s death was received basis of caste or creed or association on 26th September 2010. It has with a particular school of thought. He caused immense grief and sorrow to always discussed issues in a scholarly everyone who knew him. manner, stating his viewpoint in a Dr. Ghazi belonged to a learned polite way as has been the practice of family which hailed from U.P., India. all true scholars in past generations. He received traditional religious Not only would he respect the works education at Jamiatul-Ulam-e- of scholars of the past generations, he Islamia, Binnori Town, Karachi and also admired his contemporaries and pursued further study, obtaining a acknowledged their works with an Besides recognition of his capabilities and works in Pakistan, Dr. Ghazi was Ph.D. Beside Arabic and Persian, he open mind. a scholar of international fame also knew English, German and Beside recognition of his capabilities scholar. -

Financial Statements 10 Company Information

FOR THE THREE Financial (3) MONTHS ENDED Statements SEPTEMBER 30, 2020 (UNAUDITED) Dadex Eternit Limited Contents Company Information 2 Directors' Review 4 Condensed Interim Statement of Financial position 5 Condensed Interim Statement of Profit or Loss 6 Condensed Interim Comprehensive Income 7 Condensed Interim Cash Flow Statement 8 Condensed Interim Statement of Changes in Equity 9 Notes to the Condensed Interim Financial Statements 10 Company Information Board of Directors Sikander Dada - Chairman (Non - Executive Director) Abu Talib H.K. Dada (Non - Executive Director) Maqbool H.H. Rahimtoola (Non - Executive Director) Shahzad M. Husain (Non - Executive Director) Syed Shahid Ali Bukhari (Independent Director) Amber Ahmed Motiwala (Independent Director) Ayesha Allawala (Independent Director) Chief Executive Officer Qazi Sajid Ali Chief Financial Officer Muhammad Yousuf Company Secretary/ Umar Rasheed Head of Internal Audit Board Audit Committee Syed Shahid Ali Bukhari - Chairman Shahzad M. Husain Maqbool H.H. Rahimtoola Amber Ahmed Motiwala Human Resource and Ayesha Allawala – Chairperson Remuneration Committee Maqbool H.H. Rahimtoola Abu Talib H.K. Dada Management Team Qazi Sajid Ali - Chief Executive Officer Danish Dada - CEO (International Division) Tanveer Saleem - Chief Operating Officer (Technical & Operations) Syed Wasim Ahmed - Director Finance & Corporate Affairs Muhammad Yousuf - Chief Financial Officer Lt. Cdr. (Retd.) Saeed Ahmed Khan - General Manager Admin & HR Syed Shahrukh Mehdi - General Manager Sales 2 Quarterly Report September 2020 Auditors BDO Ebrahim & Co., Chartered Accountants Bankers National Bank of Pakistan Bank Islami Pakistan Limited Habib Metropolitan Bank Limited MCB Bank Limited Sindh Bank Limited The Bank of Punjab United Bank Limited (UBL Ameen) Standard Chartered Bank (Pakistan) Limited Faysal Bank Limited Habib Bank Limited Askari Bank Limited Al-Baraka Bank (Pakistan) Limited Meezan Bank Limited Dubai Islamic Bank Pakistan Limited Legal Advisor Abrar Hasan & Co. -

Snapshot of Results of Banks in Pakistan Snapshot of Results of Banks in Pakistan Six Months Period Ended 30 June 2016

KPMG Taseer Hadi & Co. Chartered Accountants Snapshot of results of Banks in Pakistan Snapshot of results of banks in Pakistan Six months period ended 30 June 2016 This snapshot has been prepared by KPMG Taseer Hadi & Co. and summarizes the performance of selected banks in Pakistan for the 6 months period ended 30 June 2016. The information contained in this snapshot has been obtained from the published consolidated financial statements of the banks and where consolidated financial statements were not available, standalone financials have been used. Reference should be made to the published financial statements of the banks to enhance the understanding of ratios and analysis of performance of a particular bank. We have tried to provide relevant financial analysis of the banks which we thought would be useful for benchmarking and comparison. However, we welcome any comments, which would facilitate in improving the contents of this document. The comments may be sent on [email protected] Dated: 23 September 2016 Karachi © 2016 KPMG Taseer Hadi & Co., a Partnership firm registered in Pakistan and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. 2 Document Classification: KPMG Public HBL NBP UBL MCB ABL BAF 2016 2015 2016 2015 2016 2015 2016 2015 2016 2015 2016 2015 Ranking By total assets 1 1 2 2 3 3 4 4 5 5 6 6 By net assets 1 1 2 2 3 3 4 4 5 5 7 7 By profit before tax 1 1 4 4 2 3 3 2 5 5 7 8 Profit before tax * 28,298 -

NBP Active Allocation Riba Free Savings Fund 2020.FH11

NBP ACTIVE ALLOCATION RIBA FREE SAVINGS FUND ANNUAL REPORT JUNE 2020 NBP ACTIVE ALLOCATION RIBA FREE SAVINGS FUND MISSION STATEMENT To rank in the top quartile in performance of NBP FUNDS relative to the competition, and to consistently offer Superior risk-adjusted returns to investors. 01 NBP ACTIVE ALLOCATION RIBA FREE SAVINGS FUND FUND'S INFORMATION 03 DIRECTORS' REPORT 07 TRUSTEE REPORT TO THE UNIT HOLDERS 13 FUND MANAGER REPORT 14 STATEMENT OF COMPLIANCE WITH THE SHARIAH PRINCIPLES 21 Contents REPORT OF THE SHARIAH SUPERVISORY BOARD 21 INDEPENDENT AUDITORS' REPORT TO THE UNIT HOLDERS 18 STATEMENT OF ASSETS AND LIABILITIES 21 INCOME STATEMENT 22 STATEMENT OF COMPREHENSIVE INCOME 23 STATEMENT OF MOVEMENT IN UNIT HOLDERS' FUND 24 CASH FLOW STATEMENT 25 NOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTS 26 PERFORMANCE TABLE 45 02 NBP ACTIVE ALLOCATION RIBA FREE SAVINGS FUND FUNDS INFORMATION Management Company NBP Fund Management Limited - Management Company Board of Directors of Management Company Shaikh Muhammad Abdul Wahid Sethi Chairman Dr. Amjad Waheed Chief Executive Officer Mr. Saad ur Rahman Khan Director Syed Hasan Irtiza Kazmi Director Mr. Ali Saigol Director Mr. Imran Zaffar Director Mr. Khalid Mansoor Director Mr. Humayun Bashir Director Mr. Saad Amanullah Khan Director Company Secretary & COO Mr. Muhammad Murtaza Ali Chief Financial Officer Mr. Khalid Mehmood Audit & Risk Committee Mr. Saad Amanullah Khan Chairman Syed Hasan Irtiza Kazmi Member Mr. Imran Zaffar Member Mr. Humayun Bashir Member Human Resource Committee Mr. Khalid Mansoor Chairman Shaikh Muhammad Abdul Wahid Sethi Member Mr. Ali Saigol Member Mr. Humayun Bashir Member Strategy & Business Planning Committee Mr. -

Mr. Farooq Rahmatullah Khan

Mr. Farooq Rahmatullah Khan Farooq Rahmatullah Khan is a Law graduate. He joined Burma Shell Oil & Distribution Company in 1968 and worked in different roles in Chemicals, Human Resources, Marketing, Supply, Distribution, Retail, etc. He was transferred to Shell International London in 1994 as a Manager in the Business Strategy Division and was involved in various portfolios covering over 140 countries. On his return in 1998, he was appointed as Head of Operations of Shell Pakistan and was looking after Middle East and South Asia (MESA). In 2001, he was appointed as Chairman of Shell Companies in Pakistan and Managing Director of Shell Pakistan Limited. He is currently leading an Expert Energy group which has developed a 25-year Integrated Energy Plan (first time ever in the history of energy planning) for the country. This plan has been in principle accepted by the Government, Pakistan Business Council, international agencies and some other stakeholders. The Expert Energy group continues to work in updating and revising the energy plan on an annual basis and engaging political leadership and other stakeholders. Key Positions Held Chairman of Shell Companies in Pakistan and Managing Director of Shell Pakistan Limited Founding Member of PAPCO (Pak Arab Pipeline Company Limited) Director General of Civil Aviation Authority of Pakistan Chairman of Oil and Gas Development Company Limited Chairman of LEADS Pakistan Chairman of Pakistan Refinery Limited Founding Member of Pakistan Human Development Fund Member of the Economic Advisory Council, Ministry of Finance, Government of Pakistan Member of National Commission of Government Reforms Director on the Boards of PCB, PIA and Pakistan Stone Development Company He is serving on the Boards of Directors of Faysal Bank Limited Society for Sustainable Development Resource Development Committee of Aga Khan University Hospital Pakistan Refinery Ltd.-Director and Chairman of the Board Hascol Oil Company He is also a Trustee of Legends Trust (Formed by the Government of Sindh) Address: House No. -

An Analysis of Mission Statement of Pakistani Commercial (Scheduled) Banks Using a Nine Points Scale Approach of Fred R. David

ijcrb.webs.com JUNE 2012 INTERDISCIPLINARY JOURNAL OF CONTEMPORARY RESEARCH IN BUSINESS VOL 4, NO 2 An Analysis of Mission Statement of Pakistani Commercial (Scheduled) banks Using A Nine Points Scale approach of Fred R. David Muhammad Farrukh Moin 1, Ahsan Ali 2, Ali Nawaz Khan 3 M.S. Students, Department of Business Administration, Federal Urdu University of Arts, Science, and Technology, Islamabad Campus, Pakistan. Abstract = Objective The objective of this study was to make a comparative analysis of the mission statement of all the scheduled banks operating in Pakistan, in order to visualize the quality of its mission statement using a Nine Point Scale model given by Fred R. David. Methodology Publication of Sate Bank of Pakistan (SBP) (December, 2011) informs that 44 scheduled banks were operating in Pakistan till the closing of December 2011, out of them 22 were domestic private Pakistani banks, that means (50%) of the population. A number of 21 domestic private Pakistani banks were used as a convenient sample to make analysis in this study. Data needed to make comparative analysis of mission statement were collected from annual reports of (2010 and 2011) and websites of these private banks. Limitation This study was limited to the local private banks operating in Pakistan. Thus, it may lack high Generalisability. Researchers may expand the spectrum of study by investigating other types of banks operating in Pakistan. Findings Overall, the score card of mission statement of (scheduled) banking setups in Pakistan were found above the average score card of mission statement. Banks were more focused on customers and concern for survival, growth and profitability rather market, technology, employees and self concept. -

Third Quarter Report March 31, 2021

QUARTERLY REPORT 2020-21 Contents Corporate Information 2 Directors’ Report 3 Condensed Interim Balance Sheet 7 Condensed Interim Profit and Loss Account (unaudited) 8 Condensed Interim Statement of Comprehensive Income (unaudited) 9 Condensed Interim Cash Flow Statement (unaudited) 10 Condensed Interim Statement of Changes In Equity (unaudited) 11 Notes To The Condensed Interim Financial Statements (unaudited) 12 HabibMetro 1 Modaraba Management QUARTERLY REPORT 2020-21 Corporate Information BOARD OF DIRECTORS Syed Rasheed Akhtar - Chairman (Non-Executive Independent Director) Mr. Muhammad Shoaib Ibrahim - Chief Executive Officer Mr. Usman Nurul Abedin - Non-Executive Director Mr. Saeed Uddin Khan - Non-Executive Independent Director Mr. Mohammad Shams Izhar - Non-Executive Director Dr. Irum Saba - Non-Executive Director LEGAL ADVISOR BANKERS Mohsin Tayebaly & Company Habib Metropolitan Bank Limited (Islamic Banking) Ahmed & Qazi Advocates & Legal Consultants Meezan Bank Limited Al Baraka Bank Pakistan Limited AUDIT COMMITTEE Bankislami Pakistan Limited Mr. Saeed Uddin Khan - Chairman Dubai Islamic Bank Pakistan Limited Syed Rasheed Akhtar - Member Soneri Bank Limited (Islamic Banking) Mr. Mohammad Shams Izhar - Member - Secretary Mr. Anas Majid REGISTERED OFFICE HUMAN RESOURCE COMMITTEE 6th Floor, HBZ Plaza (Hirani Centre) Syed Rasheed Akhtar - Chairman I.I. Chundrigar Road, Karachi. Mr. Saeed Uddin Khan - Member Tel : 021-32635949-51 Mr. Mohammad Shams Izhar - Member Fax : 021-32627373 Mr. Tehsin Abbas - Secretary UAN : 111-346-346 Web : www.habibmodaraba.com SHARES REGISTRAR Email : [email protected] CDC Share Registrar Services Limited GEOGRAPHICAL PRESENCE - BRANCH OFFICES Share Registrar Department CDC House, 99-B, Block “B”, Karachi Branch: S.M.C.H.S 3rd Floor, Al-Manzoor Building, Main Shahrah-e-Faisal, Dr. -

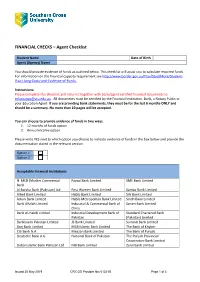

FINANCIAL CHECKS – Agent Checklist

FINANCIAL CHECKS – Agent Checklist Student Name Date of Birth Agent (Agency) Name You should provide evidence of funds as outlined below. This checklist will assist you to calculate required funds. For information on the financial capacity requirement see http://www.border.gov.au/Trav/Stud/More/Student- Visa-Living-Costs-and-Evidence-of-Funds. Instructions: Please complete this checklist and return it together with bank/agent certified financial documents to [email protected] . All documents must be certified by the Financial Institution, Bank, a Notary Public or your Education Agent. If you are providing bank statements, they must be for the last 6 months ONLY and should be a summary. No more than 10 pages will be accepted. You can choose to provide evidence of funds in two ways. 1. 12 months of funds option 2. Annual income option Please write YES next to which option you choose to indicate evidence of funds in the box below and provide the documentation stated in the relevant section. Option 1 Option 2 Acceptable Financial Institutions N MCB (Muslim Commercial Faysal Bank Limited SME Bank Limited Bank Al Baraka Bank (Pakistan) Ltd First Women Bank Limited Samba Bank Limited Allied Bank Limited Habib Bank Limited Silk Bank Limited Askari Bank Limited Habib Metropolitan Bank Limited Sindh Bank Limited Bank Alfalah Limited Industrial & Commercial Bank of Soneri Bank Limited China Bank Al-Habib Limited Industrial Development Bank of Standard Chartered Bank Pakistan (Pakistan) Limited BankIslami Pakistan Limited JS Bank Limited Summit -

Habib Metro Modaraba Prospectus English

ADVICE FOR INVESTORS INVESTORS ARE STRONGLY ADVISED IN THEIR OWN INTEREST TO CAREFULLY READ THE CONTENTS OF THIS PROSPECTUS, ESPECIALLY THE RISK FACTORS GIVEN AT PARA 5.9 BEFORE MAKING ANY INVESTMENT DECISION. SUBMISSION OF FALSE AND FICTICIOUS APPLICATIONS IS PROHIBITED AND SUCH APPLICATIONS’ MONEY MAY BE FORFEITED UNDER SECTION 87(8) OF THE SECURITIES ACT, 2015 (THE SECURITIES ACT) HABIB METRO MODARABA PROSPECTUS (An Islamic Financial Institution) Habib Metro Modaraba MANAGED BY: HABIB METROPOLITAN MODARABA MANAGEMEN T COMPANY (PRIVATE) LIMITED This Public Issue consists of 9,000,000 Modaraba Certificates (30% of the Total Paid up Fund) of Rs. 10/- each at face value out of the Total Paid up Fund of 30,000,000 Modaraba Certificates As per regulation 3(11) of the PO Regulations read with regulation 5.2.2. of PSX’s Listing of Companies and Securities Regulations, the Draft Prospectus was placed on the websites of PSX, Habib Metro Modaraba and the Consultant to the Issue for seeking public comments for seven working days starting from July 20, 2017 to July 28, 2017. No comments were received from the general public during this period. THE SUBSCRIPTION LIST WILL OPEN AT THE COMMENCEMENT OF BANKING HOURS ON 19/09/2017 AND WILL CLOSE ON 20/09/ 2017 AT THE CLOSE OF BANKIN G HOURS CONSULTANT TO THE ISSUE IECnet Consulting (Private) Limited BANKERS TO THE PRESENT ISSUE Al Baraka Bank (Pakistan) Limited Bank AL Habib Limited Bank AlFalah Limited * Bank Islami Pakistan Limited Dubai Islamic Bank Pakistan Limited Habib Bank Limited Meezan Bank Limited MCB Bank Limited Allied Bank Limited United Bank Limited * Habib Metropolitan Bank Limited Summit Bank Limited* *In order to facilitate investors, United Bank Limited (“UBL”), Bank Alfalah Limited (“BAFL”) and Summit Bank (SMBL) are offering electronic submission of application (e-IPO) to their account holders. -

Supreme Court of Pakistan and Prime Minister of Pakistan's Diamer Bhasha and Mohmand Dam Fund Account List of Donor for 28 Nov-1

SUPREME COURT OF PAKISTAN AND PRIME MINISTER OF PAKISTAN'S DIAMER BHASHA AND MOHMAND DAM FUND ACCOUNT LIST OF DONOR FOR 28 NOV-18 RECEIPT Bank Depositor Name Amount AL BARAKA BANK (PAKISTAN) LTD AL MAJAZI WELFARE 135,000 AL BARAKA BANK (PAKISTAN) LTD LABARD 56,856 AL BARAKA BANK (PAKISTAN) LTD SHAHID BALOCH 24,200 AL BARAKA BANK (PAKISTAN) LTD RAMZAN ALI 3,120 AL BARAKA BANK (PAKISTAN) LTD SABIR AZEEM 1,086 AL BARAKA BANK (PAKISTAN) LTD KHALID IQBAL 1,000 AL BARAKA BANK (PAKISTAN) LTD FAISAL QURESHI 1,000 AL BARAKA BANK (PAKISTAN) LTD ISLAM SHAH 400 AL BARAKA BANK (PAKISTAN) LTD KHAN AFSAR 200 AL BARAKA BANK (PAKISTAN) LTD SHER ZAMAN 100 AL BARAKA BANK (PAKISTAN) LTD JAFAR KHAN 50 AL BARAKA BANK (PAKISTAN) LTD Total 223,012 IMRAN AKRAM SUPREME COURT OF PAKISTAN Allied Bank Limited DIAMER BHASHA AND MOHMAND DAMS FUND 200,000 ZAFAR SUPREME COURT OF PAKISTAN DIAMER Allied Bank Limited BHASHA AND MOHMAND DAMS FUND 200,000 MUSSADIQ SUPREME COURT OF PAKISTAN Allied Bank Limited DIAMER BHASHA AND MOHMAND DAMS FUND 100,000 MUHAMMAD TARIQ SUPREME COURT OF PAKISTAN DIAMER BHASHA AND MOHMAND Allied Bank Limited DAMS FUND 100,000 NOMAN AZHAR SUPREME COURT OF PAKISTAN Allied Bank Limited DIAMER BHASHA AND MOHMAND DAMS FUND 99,000 malik muhammad aslam SUPREME COURT OF PAKISTAN DIAMER BHASHA AND MOHMAND Allied Bank Limited DAMS FUND 90,000 ZIA UL HAQ SUPREME COURT OF PAKISTAN Allied Bank Limited DIAMER BHASHA AND MOHMAND DAMS FUND 50,000 RASHIDA BEGUM SUPREME COURT OF PAKISTAN Allied Bank Limited DIAMER BHASHA AND MOHMAND DAMS FUND 50,000 MIRZA USMAN -

Partner with Us

The World’s Leading Islamic Finance News Provider (All Cap) 1100 Malaysia Pakistan levels Islamic banks Islamic 1,039.58 1050 fi ghting the playing fi eld cashing in on banks 1000 1,040.92 hard to keep for Islamic fi nance mobile payments unlikely 950 0.12% its Islamic sector with new as the UAE goes to return 900 fi nance tax neutrality cashless...7 to double- W T F S S M T title...6 for Sukuk digit asset Powered by: IdealRatings® transactions...7 growth...10 COVER STORY 7th September 2016 (Volume 13 Issue 36) Financial technology: Force for the future or ϐlash in the pan? Fintech is on the rise — on that much, but what do we actually mean by it? advice and investment management). everyone is agreed. But what does it Before we can evaluate a trend, we need Up-and-coming new trends include actually mean for the Islamic market to classify what it truly entails — which authentication and biometrics, — what is happening, what advantages can sometimes get lost in the crowd. blockchain, cloud computing and big will it bring and why should we get data. excited? It’s easy to start a trend, but In essence, the term fi ntech refers to we need to see real progress before a widely promoted and potentially Islamic advancements we believe it can actually change disruptive alternative to the technology So where does Islamic fi nance fi t in, the world. LAUREN MCAUGHTRY and solutions off ered by traditional and what are the opportunities for a talks to the movers and shakers in the large-scale, highly regulated fi nancial specifi cally Shariah compliant sector? Islamic fi ntech space to ask whether institutions: transforming the In recent months, we’ve seen plenty of these big promises will ever be more fi nancial industry through mobility development in the Islamic arena, and than just the latest buzzword.. -

IBFT- Guidelines

MCB Bank Limited IBFT- Guidelines 1. Al Baraka Bank (Pakistan) Limited Please enter Bank Al-Baraka total digits of account Number: Total Digits of Account Number: 13 Digits Format Example: AAAAAAAAAAAAA Note: A = Account Number 2. Allied Bank Limited Please enter Allied Bank Account Number by following the layout below: Total Digits of Account Number: 13 or 20 Digits Format Example: BBBBAAAAAAAAA or BBBBAAAAAAAAAAAAAAAA Note: B = Branch Code, A = Account Number 3. APNA Microfinance Bank Please enter APNA Microfinance Bank Account Number by following the layout below: Total Digits of Account Number: 16 Digits Format Example: BBBBAAAAAAAAAAAA Note: B = Branch Code, A = Account Number 4. Askari Bank Limited Please enter Askari Bank Account Number by following the layout below: For Branch Banking: Total Digits of Bank Account Number: 14 Digits Format Example: BBBBAAAAAAAAAA Note: B = Branch Code, A = Account Number For Branchless Banking: Total Digits of Bank Account Number: 11 Digits Format Example: 03XXXXXXXXX 5. Bank Al-Habib Limited Please enter Bank Al-Habib Account Number by following the layout below: Total Digits of Account Number: 17 Digits Format Example: BBBBTTTTBBBBBBRRC Note: B = Branch Code, A = Account Number, T = Account Type, BBBB= Base Number, RR = Digit Running Number, C = Check Digit 111 000 622 mcb.com.pk /MCBBankPk Over 1350 Branches & ATMs 6. Bank Al-Falah Limited Please enter Bank Al-Falah Account Number by following the layout below: For Conventional Banking: Total Digits of Account Number: 14 Digits Format Example: BBBBAAAAAAAAAA Note: B = Branch Code, A = Account Number For Islamic Banking: Total Digits of Account Number: 18 Digits Format Example: BBBBAAAAAAAAAAAAAA Note: B = Branch Code, A = Account Number For Branchless Banking: Total Digits of Account Number: 11 Digits Format Example: 03XXXXXXXXX 7.