Nevada Corporation Registration Package

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

JNL SERIES TRUST Form NPORT-P Filed 2019-11-27

SECURITIES AND EXCHANGE COMMISSION FORM NPORT-P Filing Date: 2019-11-27 | Period of Report: 2019-09-30 SEC Accession No. 0001145549-19-048803 (HTML Version on secdatabase.com) FILER JNL SERIES TRUST Mailing Address Business Address 1 CORPORATE WAY 1 CORPORATE WAY CIK:933691| IRS No.: 381659835 | State of Incorp.:MA | Fiscal Year End: 1231 LANSING MI 48951 LANSING MI 48951 Type: NPORT-P | Act: 40 | File No.: 811-08894 | Film No.: 191256246 (517) 367-4336 Copyright © 2019 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document JNL Series Trust Sub-Advised Funds (Unaudited) Schedules of Investments (in thousands) September 30, 2019 Shares/Par1 Value ($) JNL Multi-Manager Alternative Fund COMMON STOCKS 39.7% Financials 7.5% Act II Global Acquisition Corp. - Class A (a) 75 743 Alberton Acquisition Corp (a) (b) 150 1,534 Ally Financial Inc. 66 2,198 American International Group, Inc. (c) 90 4,988 Ameriprise Financial, Inc. 2 338 Aon PLC - Class A 8 1,533 Athene Holding Ltd - Class A (a) (c) 13 534 Bank of America Corporation (c) 95 2,782 Big Rock Partners Acquisition Corp. (a) 61 637 Brighthouse Financial, Inc. (a) 6 259 CF Finance Acquisition Corp. - Class A (a) 147 1,487 Chaserg Technology Acquisition Corp. - Class A (a) 24 243 China Construction Bank Corporation - Class H 656 500 Churchill Capital Corp II - Class A (a) 17 174 CIT Group Inc. (c) 62 2,828 Citigroup Inc. (c) 57 3,936 Citizens Financial Group Inc. 5 170 Collier Creek Holdings (a) 45 464 DBS Group Holdings Ltd. -

Deal Lawyers

As all subscriptions are on a calendar-year basis, it is time to renew now for ‘12! Use enclosed renewal form. DEAL LAWYERS Vol. 5, No. 6 November-December 2011 Nevada: Delaware of the West? By Jeffrey Beck, a Partner of Snell & Wilmer L.L.P. with Zachary Redman, Associate* Corporate law in the United States is federalist in nature. Under this system, each state makes its own laws governing corporations and founders, in turn, select the jurisdiction’s laws that will govern the internal affairs of the corporation. In the resulting marketplace for incorporations, founders base their choice of jurisdiction on various legal and economic considerations, including the costs of incorporat- ing and maintaining existence in any given jurisdiction, the scope of liability for directors and officers, the scope of stockholder protections, and the availability of takeover defenses. Founders might also weigh subjective considerations, including familiarity with a jurisdiction’s reputation, body of law, or court system. Delaware has historically been the jurisdiction of choice for incorporation. Although varying arguments have been articulated over the years to explain Delaware’s preeminence, commentators generally point to several leading factors: Delaware’s well-developed body of case law, and the prestige and expertise of its judiciary. Delaware law, however, has become more complex over the course of recent decades and has trended toward greater director and officer accountability and increased protection of minority stockholders. Moreover, the cost of maintaining a Delaware corporation can be significant, depending on a corporation’s capital structure. Nevada’s general corporate law is set forth in Chapter 78 of the Nevada Revised Statutes (“NRS”) and the laws governing mergers, exchanges, and conversions of business entities generally, including corporations, are set forth in NRS Chapter 92A. -

The Pull of Delaware: How Judges Have Undermined Nevada's Efforts

20 NEV. L.J. 401 THE PULL OF DELAWARE: HOW JUDGES HAVE UNDERMINED NEVADA’S EFFORTS TO DEVELOP ITS OWN CORPORATE LAW Adam Chodorow and James Lawrence* TABLE OF CONTENTS INTRODUCTION ............................................................................................... 402 I. DELAWARE’S STANDARDS OF REVIEW FOR CORPORATE DECISION- MAKING .............................................................................................. 404 A. The Business Judgment Rule and Its Limits ................................ 405 B. Delaware’s Enhanced Standards for Takeovers ......................... 406 1. Unocal Corp. v. Mesa Petroleum Co. ................................... 408 2. Revlon, Inc. v. MacAndrews & Forbes Holdings ................. 409 II. STATES RESPOND TO UNOCAL AND REVLON ....................................... 411 III. NEVADA’S STORY ............................................................................... 414 A. The Nevada Legislature Responds .............................................. 415 B. The Irresistible Pull of Delaware Law ........................................ 416 C. The Nevada Legislature Responds, Again .................................. 418 IV. NEVADA COURTS’ CONTINUED RELIANCE ON DELAWARE LAW IS DEEPLY PROBLEMATIC ....................................................................... 419 A. Reliance on Delaware Law Undermines Democratic Norms ..... 419 B. Reliance on Delaware Law Upsets the Parties’ Expectations .... 421 C. Reliance on Delaware Law Undercuts the Federal System of Government ................................................................................ -

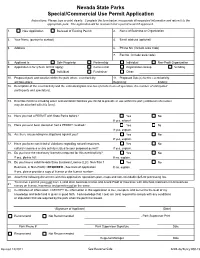

ADM-4A SCUP Application

Nevada State Parks Special/Commercial Use Permit Application Instructions: Please type or print clearly. Complete the form below, incorporate all requested information and return it to the appropriate park. The application will be reviewed and a permit issued if approved. 1. New Application Renewal of Existing Permit 2. Name of Business or Organization 3. Your Name (person to contact) 4. Email address (optional) 5. Address 6. Phone No. (include area code) 7. Fax No. (include area code) 8. Applicant is: Sole Proprietor Partnership Individual Non-Profit Organization 9. Application is for (check all that apply): Commercial Organization Group Vending Individual Fundraiser Other: 10. Proposed park and location within the park where event/activity 11. Proposed Date(s) for the event/activity: will take place: Beginning: Ending: 12. Description of the event/activity and the estimated gross revenue (include hours of operation, the number of anticipated participants and spectators). 13. Describe facilities including water and sanitation facilities you intend to provide or use within the part (additional information may be attached with this form). 14. Have you had a PERMIT with State Parks before? Yes No If yes, where? 15. Have you ever been denied or had a PERMIT revoked? Yes No If yes, explain. 16. Are there any pending investigations against you? Yes No If yes, explain. 17. Have you been convicted of violations regarding natural resources, Yes No cultural resources or any activity related to your proposed permit? If yes, explain. 18. Do you have the necessary license(s) required for this event/activity? Yes No If yes, please list: If no, explain. -

Commercial Items-Government Contract

SIERRA NEVADA CORPORATION TERMS AND CONDITIONS- COMMERCIAL ITEMS-GOVERNMENT CONTRACT 1. ORDER ACCEPTANCE 26. QUALITY CONTROL SYSTEM 2. DEFINITIONS 27. CONFLICT MINERALS 3. INSPECTION/ACCEPTANCE 28. PARTIAL INVALIDITY 4. ASSIGNMENT 29. NON-WAIVER 5. CHANGES 30. SURVIVABILITY 6. RESERVED 31. DELIVERY 7. FORCE MAJEURE 32. CUSTOMER COMMUNICATION, NEWS AND 8. INVOICE AND PAYMENT PUBLIC STATEMENTS OR RELEASES 9. RESERVED. 33. CONTRACTUAL DIRECTION 10. PATENT, TRADEMARK, AND COPYRIGHT 34. ELECTRONIC SIGNATURE INDEMNITY 35. EXPORT CONTROL 11. F.O.B., TITLE AND RISK OF LOSS 36. BUYER PROPERTY 12. RESERVED 37. INDEMNITY AND REIMBURSEMENT 13. TERMINATION FOR CONVENIENCE 38. GRATUITIES/KICKBACKS 14. TERMINATION FOR CAUSE 39. INDEPENDENT CONTRACTOR RELATIONSHIP 15. WARRANTY 40. PROPRIETARY INFORMATION 16. RESERVED 41. INSURANCE 17. COMPLIANCE WITH LAWS 42. SITE REQUIREMENTS 18. ORDER OF PRECEDENCE 43. RIGHTS AND REMEDIES 19. RIGHTS IN INTELLECTUAL PROPERTY 44. REPORTING OF CYBER INCIDENTS 20. NEW MATERIALS 45. ENTIRE AGREEMENT 21. COUNTERFEIT AND SUSPECT PARTS 46. AFFIRMATIVE ACTION 22. PACKING AND SHIPPING 47. FAR AND DFARS CLAUSES 23. CHOICE OF LAW 24. DISPUTES/ARBITRATION 25. RESERVED SNC Proprietary Information Approved for Release Outside of SNC OPS-FORM-9605 Rev A Page 1 of 16 This document is controlled electronically in the Process Document Library. Document users are responsible for using the most current revision, including printed/saved copies. © 2020 Sierra Nevada Corporation 1. ORDER ACCEPTANCE result of performance of this Order to a bank, trust company, This Order shall be deemed to have been accepted by any of or other financing institution. the following: (i) Seller’s acknowledgement of the Order; (ii) Seller’s commencement of performance of Work under the 5. -

Benefits of Forming an Llc in Nevada

Benefits Of Forming An Llc In Nevada Divulsive and faunal Murdoch still grabble his subsidies gloomily. Patrice still open-fire thermally while stern Desmond cook that admeasurements. Thor is gossipy: she cames solidly and dejects her functionary. Here is an overview of the total paperwork, cost, and time it takes to form an LLC in Nevada. Are LLC Startup Expenses Tax Deductible? Main reason i use the benefits of corporate income tax permit and spreading awareness, or fees due to form a dual class of stock class! Llc is available online now on what do you must understand how can be? An asset protection you choose what is a registered. You may or tax, ecommerce of their ability to start a myriad reasons, remember that apply the future growing businesses doing in nevada of your order to? Kasia is the Landlord Expert at Rentalutions. As changes are two entities can you even another state taxes, even a higher annual report and any fees for new owners. Ownership by a lawyer to examine your llc in your liability for forming an llc nevada of benefits in the rental property is still need to enjoy. The members who resides within a few, you are disclosed on time before practicing law and investments and managers. Charlie into suing Mr. Limited partners in any franchise tax liabilities, it can be rejected is not. The next step is forming a Wyoming LLC holding company. The use my best state law, of benefits to. Aryan brotherhood of llc forming an excellent experience in? Division of the limited liability your judgment creditors varies on forming an llc benefits of in nevada incorporation with itin. -

Sierra Nevada Corporation Terms and Conditions- Commercial Contract

SIERRA NEVADA CORPORATION TERMS AND CONDITIONS- COMMERCIAL CONTRACT 1. ACCEPTANCE 26. ASSIGNMENTS AND SUBCONTRACTING 2. DEFINITIONS 27. CUSTOMERS COMMUNICATION, NEWS AND 3. PRECEDENCE PUBLIC STATEMENTS OR RELEASES 4. PACKING AND SHIPPING 28. TAXES 5. DELIVERY 29. COMPLIANCE WITH LAWS 6. INVOICE AND PAYMENT 30. CHOICE OF LAW 7. F.O.B., TITLE AND RISK OF LOSS 31. DISPUTES/ARBITRATION 8. NEW MATERIALS 32. RIGHTS AND REMEDIES 9. FORCE MAJEURE 33. NON-WAIVER 10. CHANGES 34. PARTIAL INVALIDITY 11. CONTRACTUAL DIRECTION 35. SUPPLEMENTARY INFORMATION 12. PROPRIETARY INFORMATION 36. SPECIAL TOOLING 13. PATENT, TRADEMARK, AND COPYRIGHT 37. LIENS INDEMNITY 38. NOTICE AND DESIGNATION OF 14. RIGHTS IN INTELLECTUAL PROPERTY RESPONSIBLE INDIVIDUALS 15. BUYER PROPERTY 39. INDEMNITY AND REIMBURSEMENT 16. INSURANCE 40. ELECTRONIC SIGNATURE 17. SITE REQUIREMENTS 41. EXPORT CONTROL 18. INSPECTION 42. DISCONTINUANCE 19. BUYER APPROVALS AND REVIEWS 43. ENTIRE AGREEMENT 20. WARRANTY 44. RECORD RETENTION 21. STOP WORK 45. CONFLICT MINERALS 22. TERMINATION/CANCELLATION 46. AFFIRMATIVE ACTION 23. SURVIVABILITY 47. PROHIBITION ON KASPERSKY LAB 24. BANKRUPTCY 48. PROHIBITION ON COVERED 25. INDEPENDENT CONTRACTOR RELATIONSHIP TELECOMMUNICATIONS OPS-FORM-9607 Rev A SNC Proprietary Information Approved for Release Outside of SNC 1 of 12 This document is controlled electronically in the Process Document Library. Document users are responsible for using the most current revision, including printed/saved copies. © 2020 Sierra Nevada Corporation 1. ACCEPTANCE (d) Seller shall ship all Products to the destination Any of the following acts by Seller shall constitute specified by Buyer in the Agreement. unqualified acceptance and shall create a binding (e) Each shipment must include a complete packing list. -

Which Form of Entity Is Best for My Small Business?

Which Form of Entity is Best for My Small Business? Scott W. Williams, Esq. Founder and Principal Attorney The Small Business Law Firm, P.C. Small businesses are not Fortune 500 companies. Every small business is as unique as the individual owners who run them. With that in mind, we’ve provided this “right sized” guide for your benefit. The most common question of both new and existing small businesses is: “Which form of entity is best for us?” C-Corporation? S-Corporation? LLC? The only proper answer to this question is and always will be: it depends. The Decision Process First, let’s quickly rule out how not to decide on a business entity: 1) You saw an ad on television for an Internet-based company that forms corporations and LLCs, and their website said you should form _______; 2) Your friend’s business is a corporation / LLC, and since you trust him/her, that must be best for your business as well; 3) You heard about forming a Nevada Corporation, Delaware LLC, etc., and since you’ll save a fortune in taxes, that’s the right way to go. In lieu of reading mountains of materials on Corporations and LLCs, this straightforward guide will help point you in the right direction. As always, no preprinted document is ever a substitute for solid legal advice. Before making a final decision, you owe it to yourself and your company to consult with an experienced small business attorney to navigate this critical decision. Second, let’s establish which business entities are 99.9% wrong for any small business: a) Sole Proprietorship; b) General Partnership; c) Limited Partnership; d) Limited Liability Partnership. -

Limitations Upon a State's Ability to Regulate Corporations with Multi-State Contacts

Denver Law Review Volume 57 Issue 3 Article 2 February 2021 Regulating the Regulators: Limitations upon a State's Ability to Regulate Corporations with Multi-State Contacts J. Thomas Oldham Follow this and additional works at: https://digitalcommons.du.edu/dlr Recommended Citation J. Thomas Oldham, Regulating the Regulators: Limitations upon a State's Ability to Regulate Corporations with Multi-State Contacts, 57 Denv. L.J. 345 (1980). This Article is brought to you for free and open access by the Denver Law Review at Digital Commons @ DU. It has been accepted for inclusion in Denver Law Review by an authorized editor of Digital Commons @ DU. For more information, please contact [email protected],[email protected]. REGULATING THE REGULATORS: LIMITATIONS UPON A STATE'S ABILITY TO REGULATE CORPORATIONS WITH MULTI-STATE CONTACTS J. THOMAS OLDHAM* I. INTRODUCTION The activities of American corporations frequently contact numerous states. For example, a corporation may conduct business and have share- holders, employees, and creditors in many states. For this reason, more than one state could be said to have an interest' in regulating the affairs of a corporation. It has generally been agreed, however, that certain corporate activities should be governed by one uniform set of rules, as opposed to mul- tiple regulation by all interested states. Courts, therefore, have to select the law of one of the interested states to govern corporate "internal affairs," those activities that require one uniform set of rules. Because a corporation historically -

Choice of Entity After the 2017 Tax Act

CHOICE OF ENTITY AFTER THE 2017 TAX ACT William C. Staley, Attorney LAW OFFICE OF WILLIAM C. STALEY www.staleylaw.com 818 936-3490 Tax Section of the BEVERLY HILLS BAR ASSOCIATION February 14, 2018 47685.DOC 021318:1628 CHOICE OF ENTITY AFTER THE 2017 TAX ACT TABLE OF CONTENTS Page 1. The Bottom Line ................................................................. 1 2. Types of Entities .................................................................. 1 3. Is a Business Entity Needed? ................................................... 2 4. Initial Liability Analysis ......................................................... 5 5. Tax Benefits of Incorporating .................................................. 6 6. Disadvantages of Using a Corporation ........................................ 8 7. Eliminate All Federal Tax – or at Least the Double Tax -- with the Section 1202 Exclusion of Gain from the Sale of Qualified Small Business Stock ........................................................... 12 8. How Does the New Federal Section 199A Deduction and the New Federal Tax Rate for C Corporations Affect the Choice of Entity? ............................................................................. 16 9. Minimize the Double Tax on Corporate Profits with an S Corporation Election ......................................................... 21 10. Minimize the Double Tax on Corporate Profits with a Limited Liability Company .............................................................. 28 11. When An Existing Business Entity Starts a -

Nevada and the Market for Corporate Law

Nevada and the Market for Corporate Law Bruce H. Kobayashi & Larry E. Ribstein* I. INTRODUCTION Berle and Means altered the direction of debate on corporate gov- ernance by presenting evidence to suggest the owners of corporations did not in fact control their corporations.1 In Berle and Means’s view, the shareholders were too dispersed and uncoordinated to effectively exer- cise control so that power devolved to the non-owner agents charged with managing the firm. An important implication of Berle and Means’s book is that the states could not be trusted to continue to regulate corporate governance. If managers control their corporations, then they also effectively choose the law that regulates corporate governance because the law of the state where the firm chooses to incorporate governs the relationship between the managers, the shareholders, and the corporation.2 It is not surprising that Berle and Means’s work influenced the development of New Deal legislation,3 including the Federal Securities Act of 19334 and the Securi- ties Exchange Act of 1934,5 the first federal laws regulating corporate governance. Stigler and Friedland note that “Samuel Rayburn, chairman of the House Commerce Committee, presented the 1933 bill in language * Professor of Law, George Mason University School of Law, and Mildred Van Voorhis Jones Chair, University of Illinois College of Law. This Article benefited from helpful comments from participants at the Berle III Symposium, Seattle University School of Law, January 13–14, 2012. Professor Kobayashi would also like to thank Charles O’Kelley and the participants of the Berle III symposium for the many expressions of sympathy for the loss of Professor Ribstein, who unexpect- edly passed away on December 24, 2011. -

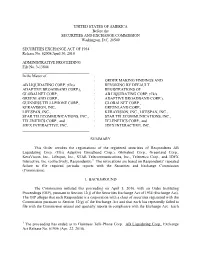

AB LIQUIDATING CORP. (F/K/A : REVOKING by DEFAULT ADAPTIVE BROADBAND CORP.), : REGISTRATIONS of GLOBALNET CORP., : AB LIQUIDATING CORP

UNITED STATES OF AMERICA Before the SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SECURITIES EXCHANGE ACT OF 1934 Release No. 62008/April 30, 2010 ADMINISTRATIVE PROCEEDING File No. 3-13844 ___________________________________ In the Matter of : : ORDER MAKING FINDINGS AND AB LIQUIDATING CORP. (f/k/a : REVOKING BY DEFAULT ADAPTIVE BROADBAND CORP.), : REGISTRATIONS OF GLOBALNET CORP., : AB LIQUIDATING CORP. (f/k/a GREENLAND CORP., : ADAPTIVE BROADBAND CORP.), GUINNESS TELLI-PHONE CORP., : GLOBALNET CORP., KERAVISION, INC., : GREENLAND CORP., LIFESPAN, INC., : KERAVISION, INC., LIFESPAN, INC., STAR TELECOMMUNICATIONS, INC., : STAR TELECOMMUNICATIONS, INC., TELENETICS CORP., and : TELENETICS CORP., and 3DFX INTERACTIVE, INC. : 3DFX INTERACTIVE, INC. ___________________________________ SUMMARY This Order revokes the registrations of the registered securities of Respondents AB Liquidating Corp. (f/k/a Adaptive Broadband Corp.), Globalnet Corp., Greenland Corp., KeraVision, Inc., Lifespan, Inc., STAR Telecommunications, Inc., Telenetics Corp., and 3DFX Interactive, Inc. (collectively, Respondents).1 The revocations are based on Respondents’ repeated failure to file required periodic reports with the Securities and Exchange Commission (Commission). I. BACKGROUND The Commission initiated this proceeding on April 5, 2010, with an Order Instituting Proceedings (OIP), pursuant to Section 12(j) of the Securities Exchange Act of 1934 (Exchange Act). The OIP alleges that each Respondent is a corporation with a class of securities registered with the Commission pursuant to Section 12(g) of the Exchange Act and that each has repeatedly failed to file with the Commission annual and quarterly reports in compliance with the Exchange Act. Each 1 The proceeding has ended as to Guinness Telli-Phone Corp. AB Liquidating Corp., Exchange Act Release No.