Reliance Industries

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Reliance Mart Is One Such Subsidiary

CHAPTER 1 INTRODUCTION The Reliance Group founded by Dhirubhai H.Ambani (1932-2002), is India’s largest private sector enterprise, with businesses in the energy and materials value chain. The company Reliance Industries Limited was co-founded by Dhirubhai Ambani and his brother Champaklal Damani as Reliance Commercial Corporation. In 1965 the partnership was ended and DhiruBhai continued. Reliance was established as a textile concerns in the year 1966. This company followed a diversified a diversification strategy since its inception. It vertically integrated. This resulted in formation of many subsidiaries. Reliance Mart is one such subsidiary. Reliance Mart is a part of the Reliance Industries is actually the largest conglomerate in India. Reliance mart is the subsidiary company of Reliance Industries. Founded in 2006 and based in Mumbai, It is the largest retailer in India in terms of revenue. Its retail outlets offer foods, groceries, apparel and footwear, lifestyle and home improvement products, electronic goods and farm implements and inputs. The company’s outlets also provide vegetables, fruits and flower. It focuses on consumer goods, consumer durables, travel services, energy, entertainment and leisure, and health and well being products, as well as on educational products and services. Backward vertical integration has been the cornerstone of the evolution and growth of Reliance. Starting with textiles in the late seventies, Reliance pursued a strategy of backward vertical integration – in polyester, fibre intermediates, plastics, petrochemicals, petroleum refining and oil and gas exploration and production – to be fully integrated along the materials and energy value chain. The group’s activities span exploration and production of oil and gas, petroleum refining and marketing, petrochemicals (polyester, fibre intermediaries, plastics and chemicals), Textiles, retail and special economic zones. -

The Study of Reliance Jio

International Journal of Trade & Commerce-IIARTC January-June 2017, Volume 6, No. 1 pp. 173-180 ISSN-2277-5811 (Print), 2278-9065 (Online) © SGSR. (www.sgsrjournals.co.in) All rights reserved UGC Approved Journal in Social Science Category; Journal No. 48636 COSMOS (Germany) JIF: 4.242; ISRA JIF: 3.957; NAAS Rating 3.55; ISI JIF: 3.721 New Era in Telecommunication- The Study of Reliance Jio B. Kumar Faculty of Commerce & Business Administration, Meerut College, Meerut (U.P), India E-mail Id: [email protected] Abstract PAPER/ARTICLE INFO Being world’s second largest population of 1.2 billion, India is a young RECEIVED ON: 11/03/2017 nation with 63% of its population under the age of 35 years. It has a fast ACCEPTED ON: 16/05/2017 growing digital audience with 800 million mobile connections and over 200 million internet users. Reliance thoroughly believes in India’s Reference to this paper potential to lead the world with its capabilities in innovation. Towards should be made as follows: that end, Reliance envisages creation of a digital revolution in India. Reliance Jio aims to enable this transformation by creating not just a B. Kumar (2017), ―New Era cutting-edge voice and broadband network, but also a powerful eco-system in Telecommunication- The on which a range of rich digital services will be enabled – a unique green- Study of Reliance Jio‖, Int. J. field opportunity. of Trade and Commerce- The three-pronged focus on broadband networks, affordable smart phones IIARTC, Vol. 6, No. 1, pp. and the availability of rich content and applications has enabled Jio to 173-180 create an integrated business strategy from the very beginning, and today, Jio is capable of offering a unique combination of telecom, high speed data, digital commerce, media and payment services. -

Reliance Industries Companyname

COMPANY UPDATE RELIANCE INDUSTRIES Déjà vu: Downgrade in order India Equity Research| Oil, Gas and Services COMPANYNAME We turned very bullish on Reliance Industries (RIL) with our BRAVEHEART EDELWEISS 4D RATINGS ‘BUY’ in 2016; four years on and a 4x rally since, we believe the stock’s Absolute Rating HOLD primary triggers—deleveraging, asset monetisation and digital Rating Relative to Sector Outperform momentum—have played out. We also believe the pendulum has swung Risk Rating Relative to Sector Medium entirely: from extreme pessimism to exuberance, infallible expectations Sector Relative to Market Equalweight on execution and a peak analyst ‘Buy’ ratio (80%). That the valuation is pricing in overly high growth expectations when its WACC is rising and economic spread being negative suggest risks lie on the downside. This is MARKET DATA (R: RELI.BO, B: RIL IN) CMP : INR 2,146 not RIL’s first brush with euphoria: 1994 (India liberalisation), 2000 (Y2K) Target Price : INR 2,105 and 2008 (KG-D6/Refining). The current exuberance gives us a sense of déjà vu; downgrade to ‘HOLD’ with a target price of INR2,105. 52-week range (INR) : 2,163 / 867 Share in issue (mn) : 6,339.4 M cap (INR bn/USD mn) : 14,148 / 70,157 Ten-year Jio 35% CAGR, eh; high WACC; negative economic spread Avg. Daily Vol.BSE/NSE(‘000) : 11,335.2 Our two-stage reverse-DCF analysis shows the market is baking in high EPS growth, particularly for Jio Platforms (35% CAGR sustaining for ten years). We believe the SHARE HOLDING PATTERN (%) associated risk is high, and despite its strong past execution, even RIL is not infallible. -

Monoct152007 Letter to Madam/Sirs

November 29, 2020 BSE Limited National Stock Exchange of India Limited Phiroze Jeejeebhoy Towers Exchange Plaza Dalal Street Plot No. C/1, G Block Mumbai 400 001 Bandra-Kurla Complex, Bandra (East) Mumbai 400 051 Scrip Code: 500325 / 890147 Trading Symbol: RELIANCE / RELIANCEPP Dear Sirs, Sub: Compliance under Regulation 23(9) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 In terms of Regulation 23(9) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, we enclose disclosure of Related Party Transactions on a consolidated basis, in the format specified in the accounting standards for the half year ended September 30, 2020. Please take the same on record. Thanking you, Yours faithfully, For Reliance Industries Limited Savithri Parekh Joint Company Secretary and Compliance Officer Encl: a/a Copy to: The Luxembourg Stock Exchange Singapore Stock Exchange Societe de la Bourse de Luxembourg 2 Shenton Way, #19- 00 SGX 35A boulevard Joseph II Centre 1, B P 165, L-2011 Luxembourg Singapore 068804 Regd. Office: 3rd Floor, Maker Chambers IV, 222, Nariman Point, Mumbai- 400 021, India Phone #: +91-22-3555 5000, Telefax: +91-22-2204 2268. E-mail: [email protected], Website: www.ril.com CIN- L17110MH1973PLC019786 Related Party disclosure for Reliance Industries Limited on a consolidated basis for the half year ended September 30, 2020 (i) List of Related Parties with whom transactions have taken place and relationships Sr. No. Name of the Related Party Relationship 1 Actoserba Active Wholesale Private Limited ^ 2 Ashwani Commercials Private Limited 3 Atri Exports Private Limited 4 Big Tree Entertainment Private Limited 5 Carin Commercials Private Limited 6 CCN DEN Network Private Limited 7 Chander Commercials Private Limited 8 Creative Agrotech Private Limited 9 Sr. -

Related Party Disclosure for the Half

May 29, 2020 BSE Limited National Stock Exchange of India Limited Phiroze Jeejeebhoy Towers Exchange Plaza Dalal Street Plot No. C/1, G Block Mumbai 400 001 Bandra-Kurla Complex, Bandra (East) Mumbai 400 051 Scrip Code: 500325 Trading Symbol: RELIANCE Dear Sirs, Sub: Compliance under Regulation 23(9) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 In terms of Regulation 23(9) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, we enclose disclosure of Related Party Transactions on a consolidated basis, in the format specified in the accounting standards for the half year ended March 31, 2020. Please take the same on record. Thanking you, Yours faithfully, For Reliance Industries Limited Savithri Parekh Joint Company Secretary and Compliance Officer Encl: a/a Copy to: The Luxembourg Stock Singapore Stock Taipei Stock Exchange Exchange Exchange 15F, No.100, Sec. 2, Societe de la Bourse de 2 Shenton Way, #19- Roosevolt Road, Luxembourg 00 SGX Centre 1, Taipei, Taiwan, 10084 35A boulevard Joseph II Singapore 068804 B P 165, L-2011 Luxembourg Regd. Office: 3rd Floor, Maker Chambers IV, 222, Nariman Point, Mumbai- 400 021, India Phone #: +91-22-3555 5000, Telefax: +91-22-2204 2268. E-mail: [email protected], Website: www.ril.com CIN- L17110MH1973PLC019786 Related Party disclosure for Reliance Industries Limited on a consolidated basis for the half year ended March 31, 2020 (i) List of Related Parties and relationships Sr. No.Name of the Related Party Relationship 1 Ashwani Commercials Private Limited 2 Atri Exports Private Limited 3 Big Tree Entertainment DMCC 4 Big Tree Entertainment Lanka Private Limited 5 Big Tree Entertainment Private Limited 6 Big Tree Entertainment Singapore Pte. -

Results of Reliance

Profit & Loss account of Reliance Industries ------------------- in Rs. Cr. ------------------- Mar '07 Mar '08 Mar '09 Mar '10 Mar '11 12 mths 12 mths 12 mths 12 mths 12 mths Income Sales Turnover 118,353.71 139,269.46 146,328.07 200,399.79 258,651.15 Excise Duty 6,654.68 5,463.68 4,369.07 8,307.92 10,515.09 Net Sales 111,699.03 133,805.78 141,959.00 192,091.87 248,136.06 Other Income 236.89 6,595.66 1,264.03 3,088.05 3,358.61 Stock Adjustments 654.60 -1,867.16 427.56 3,947.89 3,243.05 Total Income 112,590.52 138,534.28 143,650.59 199,127.81 254,737.72 Expenditure Raw Materials 80,791.65 98,832.14 109,284.34 153,689.01 198,076.21 Power & Fuel Cost 2,261.69 2,052.84 3,355.98 2,706.71 2,255.07 Employee Cost 2,094.09 2,119.33 2,397.50 2,330.82 2,621.59 Other Manufacturing Expenses 1,112.17 715.19 1,162.98 2,153.67 2,915.44 Selling and Admin Expenses 5,478.10 5,549.40 4,736.60 5,756.44 7,207.83 Miscellaneous Expenses 321.23 412.66 562.42 651.96 500.52 Preoperative Exp Capitalised -111.21 -175.46 -3,265.65 -1,217.92 -30.26 Total Expenses 91,947.72 109,506.10 118,234.17 166,070.69 213,546.40 Mar '07 Mar '08 Mar '09 Mar '10 Mar '11 12 mths 12 mths 12 mths 12 mths 12 mths Operating Profit 20,405.91 22,432.52 24,152.39 29,969.07 37,832.71 PBDIT 20,642.80 29,028.18 25,416.42 33,057.12 41,191.32 Interest 1,298.90 1,162.90 1,774.47 1,999.95 2,328.30 PBDT 19,343.90 27,865.28 23,641.95 31,057.17 38,863.02 Depreciation 4,815.15 4,847.14 5,195.29 10,496.53 13,607.58 Other Written Off 0.00 0.00 0.00 0.00 0.00 Profit Before Tax 14,528.75 23,018.14 18,446.66 -

Company Information

Reliance Industries Limited 7 Company Information Board of Directors Board Committees Chairman & Managing Director Audit Committee Finance Committee Mukesh D. Ambani Yogendra P. Trivedi Mukesh D. Ambani (Chairman) (Chairman) Executive Directors Non Executive Directors S. Venkitaramanan3 Nikhil R. Meswani Mahesh P. Modi Hital R. Meswani Nikhil R. Meswani Ramniklal H. Ambani Mansingh L. Bhakta Dr. Raghunath A. Health, Safety Hital R. Meswani 1 Yogendra P. Trivedi Mashelkar &Environment Committee R Ravimohan1 Hardev Singh Kohli Dr. Dharam Vir Kapur Hital R. Meswani 1 PMS Prasad Mahesh P. Modi Corporate Governance Dr. Dharam Vir Kapur R Ravimohan2 S. Venkitaramanan3 and Stakeholders’ Hardev Singh Kohli Prof. Ashok Misra Interface Committee Remuneration Committee Prof. Dipak C. Jain Yogendra P. Trivedi Mansingh L. Bhakta Dr. Raghunath A. Mashelkar (Chairman) (Chairman) Mahesh P. Modi Yogendra P. Trivedi Company Secretary Vinod M. Ambani Dr. Dharam Vir Kapur S. Venkitaramanan3 Employees Stock Dr. Dharam Vir Kapur Solicitors & Advocates Kanga & Co. Compensation Committee Shareholders’/Investors’ Yogendra P. Trivedi Grievance Committee Auditors Chaturvedi & Shah, (Chairman) Mansingh L. Bhakta Deloitte, Haskins & Sells Mukesh D. Ambani (Chairman) Rajendra & Co. 1w.e.f. August 21, 2009 Mahesh P. Modi Yogendra P. Trivedi 2w.e.f. September 1, 2009 Prof. Dipak C. Jain Mukesh D. Ambani4 3up to July 24, 2009 Nikhil R. Meswani 4up to August 21, 2009 Hital R. Meswani Bankers ABN Amro Canara Bank HDFC Bank Limited Standard Chartered Bank Allahabad Bank Central Bank of India ICICI Bank Limited State Bank of Hyderabad Andhra Bank Citibank N.A IDBI Bank Limited State Bank of India Bank of America Corporation Bank Indian Bank State Bank of Patiala Bank of Baroda Deutsche Bank Indian Overseas Bank Syndicate Bank Bank of India The Hong Kong and Oriental Bank of UCO Bank Bank of Maharashtra Shanghai Banking Commerce Union Bank of India Calyon Bank Corporation Limited Punjab National Bank Vijaya Bank Major Manufacturing Divisions Dahej Jamnagar Nagothane Patalganga P. -

Reliance Industries

19 April 2019 4QFY19 Results Update | Sector: Oil & Gas Reliance Industries BSE SENSEX S&P CNX 39,140 11,753 CMP: INR1386 TP: INR1431(+3%) Neutral Bloomberg RIL IN Better petrochem offsets poor refining performance Equity Shares (m) 5,922 M.Cap.(INRb)/(USDb) 8765.9 / 126.1 Reliance Industries’ (RIL) standalone EBITDA declined 6% QoQ (+2% YoY) to INR137b 52-Week Range (INR) 1407 / 907 due to a sequential contraction in the refining margin and a fall in petrochem volume. 1, 6, 12 Rel. Per (%) 0/11/34 Despite the YoY increase in EBITDA, almost doubling of interest cost resulted in PBT 12M Avg Val (INR M) 10619 declining by 5% YoY (-5% QoQ). PAT stood at INR85.6b (our estimate: INR84.4b; -2% Free float (%) 53.8 YoY, -4% QoQ). A better-than-expected performance in the non-core segments resulted in consol. EBITDA of INR208b (our estimate: INR192b; +13% YoY, -2% QoQ). Financials & Valuations (INR b) Consol. PAT stood at INR104b (our estimate: INR98b; +10% YoY, flat QoQ). Y/E March 2019 2020E 2021E For the full year, standalone EBITDA stood at INR583b (+13% YoY) due to higher Net Sales 5,671 7,292 7,854 volume and margins in the petrochem segment, despite a weaker performance in the EBITDA 839 942 1,105 Net Profit 398 419 476 refining segment. Consol. FY19 EBITDA stood at INR839.2b (+31% YoY) due to a better EPS (INR) 67.2 70.7 80.3 contribution from the telecom and retail segments. Consol. PAT stood at INR398.4b EPS Gr. -

Reliance Industries

18 January 2019 3QFY19 Results Update | Sector: Oil & Gas Reliance Industries BSE SENSEX S&P CNX 36,374 10,905 CMP: INR1,134 TP: INR1,426 (+26%) Buy Bloomberg RIL IN Refinery margin boosted by crude optimization, secondary Equity Shares (m) 5,922 M.Cap.(INRb)/(USDb) 7186.4 / 101.2 units’ performance 52-Week Range (INR) 1329 / 872 Reliance Industries’ (RIL) 3QFY19 standalone EBITDA increased 12% YoY (-4% QoQ) to 1, 6, 12 Rel. Per (%) 0/1/19 INR145b, below our estimate of INR149b, due to a lower-than-expected petrochem 12M Avg Val (INR M) 9056 performance. GRM stood at USD8.8/bbl (our estimate: USD7.5/bbl) and throughput at Free float (%) 53.8 18.0mmt (our estimate: 17.5mmt). Standalone PAT grew 8% YoY (+1% QoQ) to Financials & Valuations (consol.) (INR b) INR89.3b (our estimate: INR87.4b). Consolidated EBITDA of INR213b (+21% YoY, +1% Y/E March 2019E 2020E 2021E QoQ) was ahead of our estimate, driven primarily by a better-than-expected retail Sales 5,572 6,537 6,767 performance. Consolidated PAT stood at INR103.8b (our estimate: INR95.4b; +10% EBITDA 779 932 1,039 YoY, +9% QoQ). NP 385 438 430 Higher-than-expected GRM: GRM stood at USD8.8/bbl, as against EPS (Rs) 65.0 74.0 72.6 USD11.6/bbl in 3QFY18 and USD9.5/bbl in 2QFY19; throughput was at EPS Growth (%) 6.6 13.9 -1.9 18.0mmt (our estimate: 17.5mmt; -1% YoY, +8% QoQ). Premium over BV/Share (Rs) 553 618 682 Singapore complex stood at USD4.5/bbl. -

Related Party Disclosure for the Half

May 27, 2021 BSE Limited National Stock Exchange of India Limited Phiroze Jeejeebhoy Towers Exchange Plaza Dalal Street Plot No. C/1, G Block Mumbai 400 001 Bandra-Kurla Complex, Bandra (East) Mumbai 400 051 Scrip Code: 500325 / 890147 Trading Symbol: RELIANCE / RELIANCEPP Dear Sirs, Sub: Compliance under Regulation 23(9) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 In terms of Regulation 23(9) of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, we enclose disclosure of Related Party Transactions on a consolidated basis, in the format specified in the accounting standards for the half year ended March 31, 2021. Please take the same on record. Thanking you, Yours faithfully, For Reliance Industries Limited Savithri Parekh Joint Company Secretary and Compliance Officer Encl: a/a Copy to: Luxembourg Stock Exchange Singapore Stock Exchange 35A Boulevard Joseph II, 2 Shenton Way, #19- 00 SGX L-1840, Luxembourg Centre 1, Singapore 068804 Regd. Office: 3rd Floor, Maker Chambers IV, 222, Nariman Point, Mumbai- 400 021, India Phone #: +91-22-3555 5000, Telefax: +91-22-2204 2268. E-mail: [email protected], Website: www.ril.com CIN- L17110MH1973PLC019786 Related Party disclosure for Reliance Industries Limited on a consolidated basis for the half year ended March 31, 2021 (i) List of Related Parties with whom transactions have taken place and relationships Sr. No. Name of the Related Party Relationship 1 Ashwani -

Starview E-Paper

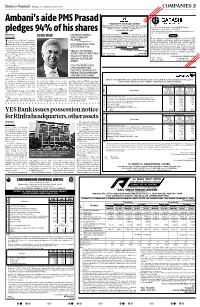

MUMBAI | THURSDAY, 30 JULY 2020 COMPANIES 3 . < Ambani’s aide PMS Prasad pledges 94% of his shares AMRITHA PILLAY PMS PRASAD OWNED A Mumbai, 29 July QUICK VIEW TOTAL OF 640,000 n a curious move, Reliance Industries’ RIL SHARES (RIL) executive director and Mukesh I Ambani’s trusted aide PMS Prasad HIS COMPENSATION STOOD (pictured) pledged 600,000 shares of the AT IN FY20 company last month, which is 93.75 per ~11.15 CR cent of the total shares he owns in RIL. Prasad owned a total of 640,000 RIL PRASAD’S LAST TRADING shares and his compensation stood at ACTIVITY, PRIOR TO THE PLEDGE ~11.15 crore in FY20. WAS IN SEPTEMBER 2017, Typically, professional corporate WHEN HE SOLD executives pledge shares when they need 136,666 to raise cash to exercise stock options in SHARES the company’s shares or invest the money elsewhere. HE IS CONSIDERED AS ONE Neither Prasad nor RIL responded to OF RIL’S SENIOR-MOST Business Standard’s queries on the rea- son for the pledge. EXECUTIVES, OFTEN CREDITED According to stock exchange filings, FOR THE JAMNAGAR REFINERY Alok Agarwal, chief financial officer COMPLEX ESTABLISHMENT (CFO), RIL, had pledged 1.44 million shares in September 2019 and revoked Extract of unaudited financial results of Dr. Reddy’s Laboratories Limited and its subsidiaries for the quarter the pledge on 940,000 shares even as the news for exiting 95 per cent of stock was trading at ~1055.9 per share. ended 30 June 2020 prepared in compliance with Indian Accounting Standards he pledged another 225,000 shares his stake in the bank, had also pledged RIL on Wednesday, closed at ~2095.85 a last month. -

Enhancing the Quality of Life. Starting up to a Digital Life

Annual Report 2015-16 Enhancing the quality of life. Starting up to a digital life. “Our dreams have to be bigger. Our ambitions higher. Our commitment deeper. And our efforts greater. This is my dream for Reliance and for India.” Padma Vibhushan Shri Dhirubhai H. Ambani Founder Chairman Reliance has started up a transformative force with a view to digitally empower and enrich Indians with a distinctly digital identity of their very own. Enhancing the quality of life. Starting up to a digital life. Reliance’s businesses and operations have a In its inherent role as a curator of development, deep and wide impact across Indian society. Reliance is nurturing India’s digital dream for Over the past five decades, Reliance has become a bright and brilliant future. Reliance started an integral part of people’s lives, present in a transformative force with a view to digitally their midst, in every moment, keeping them empower and enrich Indians with a distinctly connected, safe and better. digital identity of their very own. Reliance also continues to cater to its consumers’ diverse Since its inception, Reliance has partnered the needs through over 150 major products and nation to develop and grow into its full potential brands across energy and service sectors. and propel the India growth story forward. From the hydrocarbons sector to new-age consumer Reliance is proud to have been a catalyst in businesses, Reliance today has a firm foothold India’s transformation into an attractive economy across sectors, driving the economy forward. globally by directing its investments and focus in areas that will continue to define and shape the These pioneering efforts demonstrate Reliance’s new India.