Bluestar-Israel-Equity-Update-2014.10

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Elbit Medical Technologies Initiation of Coverage

Elbit Medical Technologies Initiation of coverage Two promising private assets Pharma & biotech 28 June 2018 Elbit Medical Technologies is an Israel-based healthcare investment company traded on the TASE. It is invested in two private companies: Price* NIS1.12 InSightec is a commercial-stage medical device company marketing a non- Market cap NIS259m invasive thermal tissue ablation therapy in three indications and Gamida *Priced as at 26 June 2018 Cell is a cell and immune therapy company developing a universal bone NIS3.64/US$ marrow transplant (BMT) product for haematological malignancies. Net debt ($m) at 31 December 2017 42.4 Although their recent offerings of NIS182m of convertible notes lengthen Shares in issue 231.4m the cash runway it raises the prospect of dilution in 2022. In addition, the Free float 10.8% parent company Elbit Imaging (~89% owned) has its own challenges. We value Elbit Medical at NIS407m or NIS1.76 per share. Code EMTC Primary exchange TASE Revenue PBT* EPS* DPS P/E Yield Secondary exchange N/A Year end ($m) ($m) ($) ($) (x) (%) 12/15 1.8 (1.1) 0.0 0.0 N/A N/A Share price performance 12/16 0.0 (3.7) 0.0 0.0 N/A N/A 12/17 0.0 (5.2) 0.0 0.0 N/A N/A Note: *PBT and EPS are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments. InSightec: A non-invasive operating room Elbit Medical currently holds a ~22% (~19% fully diluted) stake in InSightec, a commercial-stage medical device company. -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

Alphabetical Listing by Company Name

FOREIGN COMPANIES REGISTERED AND REPORTING WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION December 31, 2015 Alphabetical Listing by Company Name COMPANY COUNTRY MARKET 21 Vianet Group Inc. Cayman Islands Global Market 37 Capital Inc. Canada OTC 500.com Ltd. Cayman Islands NYSE 51Job, Inc. Cayman Islands Global Market 58.com Inc. Cayman Islands NYSE ABB Ltd. Switzerland NYSE Abbey National Treasury Services plc United Kingdom NYSE - Debt Abengoa S.A. Spain Global Market Abengoa Yield Ltd. United Kingdom Global Market Acasti Pharma Inc. Canada Capital Market Acorn International, Inc. Cayman Islands NYSE Actions Semiconductor Co. Ltd. Cayman Islands Global Market Adaptimmune Ltd. United Kingdom Global Market Adecoagro S.A. Luxembourg NYSE Adira Energy Ltd. Canada OTC Advanced Accelerator Applications SA France Global Market Advanced Semiconductor Engineering, Inc. Taiwan NYSE Advantage Oil & Gas Ltd. Canada NYSE Advantest Corp. Japan NYSE Aegean Marine Petroleum Network Inc. Marshall Islands NYSE AEGON N.V. Netherlands NYSE AerCap Holdings N.V. Netherlands NYSE Aeterna Zentaris Inc. Canada Capital Market Affimed N.V. Netherlands Global Market Agave Silver Corp. Canada OTC Agnico Eagle Mines Ltd. Canada NYSE Agria Corp. Cayman Islands NYSE Agrium Inc. Canada NYSE AirMedia Group Inc. Cayman Islands Global Market Aixtron SE Germany Global Market Alamos Gold Inc. Canada NYSE Alcatel-Lucent France NYSE Alcobra Ltd. Israel Global Market Alexandra Capital Corp. Canada OTC Alexco Resource Corp. Canada NYSE MKT Algae Dynamics Corp. Canada OTC Algonquin Power & Utilities Corp. Canada OTC Alianza Minerals Ltd. Canada OTC Alibaba Group Holding Ltd. Cayman Islands NYSE Allot Communications Ltd. Israel Global Market Almaden Minerals Ltd. -

Geographic Listing by Country of Incorporation

FOREIGN COMPANIES REGISTERED AND REPORTING WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION December 31, 2010 Geographic Listing by Country of Incorporation COMPANY COUNTRY MARKET Antigua Sinovac Biotech Ltd. Antigua Global Mkt Argentina Alto Palermo S.A. Argentina Global Mkt Banco Macro S.A. Argentina NYSE BBVA Banco Frances S.A. Argentina NYSE Cresud Sacif Argentina Global Mkt Empresa Distribuidora y Comercializadora Norte S.A. - Edenor Argentina NYSE Grupo Financiero Galicia S.A. Argentina Global Mkt IRSA Inversiones y Representacions, S.A. Argentina NYSE MetroGas S.A. Argentina OTC Nortel Inversora S.A. Argentina NYSE Pampa Energia SA Argentina NYSE Petrobras Argentina S.A. Argentina NYSE Telecom Argentina S.A. Argentina NYSE Transportadora de Gas del Sur S.A. Argentina NYSE YPF S.A. Argentina NYSE Australia Allied Gold Ltd. Australia OTC Alumina Ltd. Australia NYSE BHP Billiton Ltd. Australia NYSE Genetic Technologies Ltd. Australia Global Mkt Metal Storm Ltd. Australia OTC Novogen Ltd. Australia Global Mkt Orbital Corp Ltd. Australia OTC Prana Biotechnology Ltd. Australia Cap. Mkt Progen Pharmaceuticals Ltd. Australia OTC Rio Tinto Ltd. Australia OTC Samson Oil & Gas Ltd. Australia NYSE-Amex Sims Metal Management Ltd. Australia NYSE Westpac Banking Corp. Australia NYSE Bahamas Calpetro Tankers (Bahamas I) Ltd. Bahamas OTC - Debt Calpetro Tankers (Bahamas II) Ltd. Bahamas OTC - Debt Calpetro Tankers (Bahamas III) Ltd. Bahamas OTC - Debt Ultrapetrol (Bahamas) Ltd. Bahamas Global Mkt Belgium Anheuser-Busch Inbev SA/NV Belgium NYSE Etablissements Delhaize Freres & Cie - Le Lion Belgium NYSE Page 1 COMPANY COUNTRY MARKET Bermuda AllShips Ltd. Bermuda OTC Alpha and Omega Semiconductor Ltd. Bermuda Global Mkt Asia Pacific Wire & Cable Corp. -

2/26/2010 Root-Suffix Affected NASDAQ-Listed Symbols.Xlsx Current Symbol Security Name AMSWA American Software, Inc. Class A

2/26/2010 Root-Suffix Affected NASDAQ-Listed Symbols.xlsx Current Symbol Security Name AMSWA American Software, Inc. Class A Common Stock AMTCP Ameritrans Capital Corporation 9.375% Participating Preferred Stock APAGF Apco Oil and Gas International Inc. Ordinary Shares APCVZ Fresenius Kabi Pharmaceuticals Holding, Inc. Contingent Value Rights ARDNA Arden Group, Inc. Class A Common Stock ARTNA Artesian Resources Corporation Class A Common Stock ASCMA Ascent Media Corporation Series A Common Stock ASRVP AmeriServ Financial Inc. AmeriServ Financial Trust I - 8.45% Beneficial Unsecured Securities, Series A ASTIZ Ascent Solar Technologies, Inc. Class B Warrants ASURD Asure Software, Inc Common Stock AUTCU AutoChina International Limited Unit AUTCW AutoChina International Limited Warrant BANFP BancFirst Corporation - BFC Capital Trust II Cumulative Trust Preferred Securities BELFA Bel Fuse Inc. Class A Common Stock BELFB Bel Fuse Inc. Class B Common Stock BLDRR Builders FirstSource, Inc. transferable subscription rights BNHNA Benihana Inc. Class A Common Stock BPOPM Popular, Inc. Popular Capital Trust II - 6.125% Cumulative Monthly Income Trust Preferred Securities BPOPN Popular, Inc. 6.70% Cumulative Monthly Income Trust Preferred Securities BWINA Baldwin & Lyons, Inc. Class A Common Stock BWINB Baldwin & Lyons, Inc. Class B Common Stock CABLU China Cablecom Holdings, Ltd. Units (British Virgin Islands) CABLW China Cablecom Holdings, Ltd. Warrants 4/10/2010 (British Virgin Islands) CALPW Caliper Life Sciences Inc Warrant CBMXW CombiMatrix Corporation Warrants CCPCN Capital Crossing Preferred Corporation Series D Non-Cumulative Exchangeable Preferred Stock CENTA Central Garden & Pet Company Class A Common Stock Nonvoting CHINA CDC Corporation Class A Common Shares CHOPU China Gerui Advanced Materials Group Limited Units 1 Sh & 2 Wts (Virgin Islands British) CHOPW China Gerui Advanced Materials Group Limited Warrant 03/19/2011 (Virgin Islands British) CHSCP CHS Inc. -

Board Changes

9 July 2014 Plaza Centers N.V. (the “Company” or “Plaza”) Board Changes The directors of Plaza, a leading emerging markets property developer, today announces that, following its Annual General Meeting (“AGM”) held on 8 July 2014, the following Board appointments will take place with immediate effect: Mr. Ron Hadassi (executive director) (49) has a broad experience in leading real estate firms. Mr. Hadassi is currently the Chairman of Elbit Imaging Limited. In addition, Mr. Hadassi is a senior manager of Bronfman-Fisher Group, engaged in industry, real estate, finance and retail and holds various positions within the Bronfman-Fisher Group. Mr. Hadassi also currently holds directorships in the Bronfman-Fisher Group and in Nanette Real Estate Group N.V. Mr. Hadassi has a BA in Economics, Political Science from the Tel Aviv University, an LLB from the Tel Aviv University and an MBA from the Tel Aviv University. Mr. David Dekel (non-executive director) (49) is currently a non-executive director at Nanette Real Estate Group N.V., a residential developer operating in Central Europe. Mr. Dekel currently also holds directorships in Endeavour Enterprises N.V., Endeavour Holding B.V., Endeavour Investments SRL, Gilat Satellite Networks (Holland) B.V., Gilat to Home Latin America (Holland) B.V. and Circuitronix B.V. In the previous 5 years Mr. Dekel was a director of Blue Phoenix Solutions B.V. Mr. Dekel holds a BBA from the Delta University in Utrecht, the Netherlands and an MBA from the University of Teesside (the Hague extension) in The Hague, the Netherlands. Mr. Shlomi Kelsi (non-executive director) (42) is currently the managing director of all holding subsidiaries of Ampal- American Israel Corporation. -

CERAGON NETWORKS LTD. (Exact Name of Registrant As Specified in Its Charter)

As filed with the Securities and Exchange Commission on March 31, 2020 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________ to __________ OR ☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report __________ Commission file number 0-30862 CERAGON NETWORKS LTD. (Exact Name of Registrant as Specified in Its Charter) Israel (Jurisdiction of Incorporation or Organization) 24 Raoul Wallenberg Street, Tel Aviv 69719, Israel (Address of Principal Executive Offices) Zvi Maayan (+972) 3-543-1643 (tel.), (+972) 3-543-1600 (fax), 24 Raoul Wallenberg Street, Tel Aviv 6971920, Israel (Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol(s) Name of Each Exchange on Which Registered Ordinary Shares, Par Value NIS 0.01 CRNT Nasdaq Global Select Market Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report 80,662,805 Ordinary Shares, NIS 0.01 par value. -

Ticker Name Sector Subgroup Market Cap Price P/E Gryld ESLT ELBIT SYSTEMS LTD Aerospace/Defense Aerospace/Defense-Equip 1872732

Ticker Name Sector Subgroup Market Cap Price P/E GrYld ESLT ELBIT SYSTEMS LTD Aerospace/Defense Aerospace/Defense-Equip 1872732000 43.72 10.16 3.29 TATT TAT TECHNOLOGIES LTD Aerospace/Defense Aerospace/Defense-Equip 44163170 5.01 N/A N/A DELTY DELTA GALIL INDUSTRIES-ADR Apparel Apparel Manufacturers 132338700 5.65 N/A 6.01 CGEN COMPUGEN LTD Biotechnology Medical-Biomedical/Gene 142664900 4.16 N/A N/A PNTR POINTER TELOCATION LTD Commercial Services Commercial Services 19191250 4.01 11.46 N/A LAXAF LAXAI PHARMA LTD Commercial Services Research&Development 570408.8 0.01 N/A N/A BPHX BLUEPHOENIX SOLUTIONS LTD Computers Computer Services 15623440 0.63 N/A N/A JCDA JACADA LTD Computers Computer Services 9037805 2.25 N/A N/A TISA TOP IMAGE SYSTEMS LTD Computers Computers-Integrated Sys 17851280 2.00 18.18 N/A ELTK ELTEK LTD Electronics Circuit Boards 6940612 1.05 N/A N/A ELRNF ELRON ELECTRONIC INDS LTD Electronics Electronic Compo-Misc 122792500 4.14 N/A N/A RADA RADA ELECTRONIC INDS LTD Electronics Electronic Compo-Misc 19954930 2.25 12.50 N/A ORBK ORBOTECH LTD Electronics Electronic Measur Instr 444145500 10.31 7.26 N/A CAMT CAMTEK LTD Electronics Electronic Measur Instr 56486220 1.98 6.83 N/A ITRN ITURAN LOCATION AND CONTROL Electronics Electronic Secur Devices 258956200 12.35 N/A 8.10 MAGS MAGAL SECURITY SYS LTD Electronics Electronic Secur Devices 37967580 2.40 N/A N/A OTIV ON TRACK INNOVATIONS LTD Electronics Identification Sys/Dev 45468330 1.46 N/A N/A BSI ALON HOLDINGS BLUE SQ-ADR Food Food-Retail 342303500 5.19 N/A N/A WILC G. -

Small, Savvy, High-Tech Firms Preponderate Among Israeli Multinationals, Survey Finds

Small, savvy, high-tech firms preponderate among Israeli multinationals, survey finds EMBARGO: The contents of this report must not be quoted or summarized in the print, broadcast or electronic media before September 2nd, 2009, 10:00 a.m. Israel; 7 a.m. GMT and 3:00 a.m. United States EST. Release of the second ranking of Israeli outward investors Jerusalem and New York , September 2nd, 2009 The second annual survey of Israeli multinational enterprises (MNEs) is being released today. It was conducted by a joint team composed of the Manufacturers Association of Israel, Tel Aviv University, Hebrew University and the Vale Columbia Center on Sustainable International Investment (VCC), a joint undertaking of Columbia Law School and The Earth Institute at Columbia University in New York.1 The survey is part of a long-term, multi-country study of the rapid global expansion of multinational enterprises (MNEs) from emerging markets. The results released today cover the year 2007, although some information on 2008 is also provided. In 2007, Israel's top 20 MNEs – ranked by foreign assets – had over USD 12 billion in foreign assets (table 1), over USD 26 billion in foreign sales (including exports), and employed nearly 68,000 persons abroad. Foreign assets, sales and employment had increased by 33%, 8% and 24%, respectively, since 2006 (table 2). Four firms, Israel Chemicals, Amdocs, Teva and Ormat, together accounted for 60% of the total foreign assets of the top 20. An important clarification is in order. The report speaks of ‘the top 20’ for convenience. It is not in fact possible to be certain that the 20 companies listed in table 1 below are the largest Israeli investors abroad. -

London Session of the Russell Tribunal on Palestine 20Th to 22Nd November 2010 Expert's Presentations – INDEX

London session of the Russell Tribunal on Palestine 20th to 22nd November 2010 Expert's presentations – INDEX Day One - Saturday 20th of November The Legal Framework relevant to corporate conduct Richard Hermer QC Yasmine Gado Dr William Bourdon Implications of corporate activities in and around settlements Dr Dalit Baum Hugh Lanning Wael Natheef Adri Nieuwhof Ghaleb Mashni John Dorman Trade and labelling of settlement goods Salma Karmy Christophe Perrin Nancy Kricorian and Rae Abileah Phon Van Den Biesen Genevieve Coudrais Day two - Sunday 21st of November Financial services sector Merav Amir Mario Franssen Saskia Muller The security industry and the war industry John Hilary Maria Lahood Josh Ruebner Merav Amir / Dr Dalit Baum Shir Hever and Jamal Juma'a Paul Troop Chris Osmond Ben Hayes 1 REDRESS FOR PALESTINIAN VICTIMS OF HUMAN RIGHTS ABUSES IN THE COURTS OF ENGLAND & WALES1 Richard Hermer QC - Doughty Street Chambers, London This paper would not have been possible without the input of Andrew Sanger of the University of Cambridge who provided the Tribunal with the first draft of this document based upon his careful and erudite researches. Although all errors are mine, he should be considered as co-author. 1. INTRODUCTION The Tribunal have asked me to consider whether, and if so how, English law could provide remedies to victims of human rights abuses by reference to a number of specific examples. Whilst I remain happy to talk to these examples at the hearing, I hope I can be forgiven for thinking that it is likely to be of greater assistance to the Tribunal if I provide an overview of the basic components of English law in so far as they relate to redress and accountability for victims of human rights abuses. -

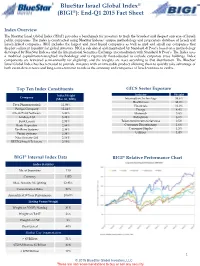

Bluestar Israel Global Index® (BIGI®): End-Q1 2015 Fact Sheet

BlueStar Israel Global Index® (BIGI®): End-Q1 2015 Fact Sheet Index Overview The BlueStar Israel Global Index (’BIGI’) provides a benchmark for investors to track the broadest and deepest universe of Israeli public companies. The index is constructed using BlueStar Indexes’ unique methodology and proprietary database of Israeli and Israeli-linked companies. BIGI includes the largest and most liquid companies as well as mid and small cap companies that display sufficient liquidity for global investors. BIGI is calculated and maintained by Standard & Poor’s based on a methodology developed by BlueStar Indexes and the International Securities Exchange in consultation with Standard & Poor’s. The Index uses a modified capitalization-weighted methodology and is rigorously float-adjusted to exclude corporate cross holdings. Index components are reviewed semi-annually for eligibility, and the weights are reset according to that distribution. The BlueStar Israel Global Index has been created to provide investors with an investable product allowing them to quickly take advantage of both event-driven news and long-term economic trends as the economy and companies of Israel continue to evolve. Top Ten Index Constituents GICS Sector Exposure Index Weight Industry Weight Company (Mar. 31, 2015) Information Technology 33.6% Health Care 32.0% Teva Pharmaceutical 12.93% Financials 16.0% Perrigo Company 12.44% Energy 4.4% Check Point Software 6.42% Materials 3.8% Amdocs Ltd 5.25% Industrials 3.2% Bank Leumi 2.95% Telecommunications Services 2.5% Bank Hapoalim 2.84% Consumer Discretionary 1.6% VeriFone Systems 2.36% Consumer Staples 1.5% Verint Systems 2.34% Utilities 1.4% Nice Systems Ltd 2.16% BEZEQ Israeli Telecom. -

Summarized English Version of the Original Document in Hebrew)

December 3, 2012 Members of the Board Strauss Group Ltd. Dear Sirs, Re: Compensation information for the CEO position (Summarized English version of the original document in Hebrew) 1. Per your request, please find enclosed comparative information regarding compensation levels for the CEO position in companies with similar characteristics to Strauss Group. 2. Prof. Moshe Zviran Ltd. is the leading provider of information and consulting services for top executives' compensation and benefits practices in Israel. The Company serves a wide variety organizations including Teva, Bezeq, Israel Chemicals, Machteshim, Bank Hapoalim, Bank Discount, Tnuva, Clal Insurance, Migdal, Menorah, Tzur-Shamir, AIG, Cellcom, Pelephone, Partner Communications, Hot, Azrieli, Shikun Binui, El-Al, Elbit Imaging, Nisko, Avgol, Space Communications, Nice Systems, Verint, Click Software, Ophir Optronics, Nova, Stratasys, Gilat Satellite, Gamida Cell, Eposnse, Evogene, VBL, Compugen, and many other companies. Methodology 3. To provide comparable information and ensure validity and accuracy of this analysis, we use rigorous methodologies to ensure that the surveyed position is carefully matched according to revenues scope and responsibilities. 4. The comparative data for the requested positions were extracted from our live, up-to-date, information database of senior management at over 350 companies. Our database is considered as the most comprehensive in Israel and has become the industry standard for negotiating remuneration levels for Israeli top executives. 5. The comparator group consists of 10 companies with revenues above 1 billion USD, including: Osem, Tnuva, El-Al, Hot, Machteshim, Cellcom, Partner, Pelephone, Shufersal, Shikun&Binui. Some of the companies are publicly-traded while others are privately-owned; some have global operations (such as Machteshim and Shikun&Binui) while others operate only in Israel.