Symbol Name SFET.TA Safe-T Group Ltd NNDM.TA Nano Dimension Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

HOUSTON REAL ESTATE MISSION to ISRAEL March 3-9, 2018

Program dated: May 24, 2017 HOUSTON REAL ESTATE MISSION TO ISRAEL March 3-9, 2018 D a y O n e : Saturday, March 3, 2018 DEPARTURE . Depart the U.S.A. Overnight: Flight D a y T w o : Sunday, March 4, 2018 TLV 24/7 . 12:00 p.m. Meet your tour educator in the hotel lobby. Enjoy lunch at Blue Sky, with it’s a wide selection of fish, vegetables, olive oil and artisan cheese, accompanied with local wines and overlooking the stunning views of the Mediterranean Sea. A Look into Our Journey: Tour orientation with the Mission Chair and the tour educator. The Booming Tel Aviv Real Estate Market: Take a tour of various locations around Tel Aviv with Ilan Pivko, a leading Israeli Architect and entrepreneur. Return to the hotel. Cocktails overlooking the Mediterranean Sea. Combining Business Abroad and Real Estate in Israel: Dinner at 2C with Danna Azrieli, the Acting Chairman of The Azrieli Group, at the Azrieli Towers. Overnight: Tel Aviv D a y T h r e e : Monday, March 5, 2018 FROM RED ROOFTOPS TO HIGH-RISERS . The Laws of Urban Development in Israel: Private breakfast at the hotel with Dr. Efrat Tolkowsky, CEO of the Gazit-Globe Real Estate Institute at IDC. Stroll down Rothschild Boulevard to view examples of the intriguing Bauhaus-style architecture from the 1930s; the local proliferation of the style won Tel Aviv recognition as a UNESCO World Heritage site and the nickname of ‘the White City'. Explore the commercial and residential developments with Dr. Micha Gross, the head of the Tel Aviv Bauhaus Center. -

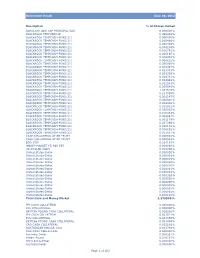

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Bluestar Israel Quarterly Update Q3 2013 Final.Pptx

BlueStar Israel Equity Update Third Quarter 2013 Q2 2013 in Review & Second Half 2013 Outlook What’s Inside Ø Global developed market equities pulled back slightly in Q2 2013 while U.S. stocks, as measured by the S&P 500 index, bucked the trend and posted a rise of 2.91%. Ø The BlueStar Israel Global Index was down by 95 bps in Q2 2013 while the MSCI Israel and TA-100 indexes were down 4.16% and 2.76%, respectively. 1. The BlueStar Ø Israeli consumer stocks, which are correlated with both domestic consumption as well as consumer spending in Israel’s export markets, lead Israeli Global Equities in Q2, while the Israel Global financial and energy stocks, which lead the Israeli Global Equity market’s rebound from the Index in Q1 2012 lows, consolidated. 2013 Ø The Israeli government decided on a 2013 and 2014 budget that will result in tax increases and spending cuts and the Shekel’s sharp appreciation versus the dollar and euro eased a bit. 2-5. About the Ø Mellanox Technologies announced it will delist its shares from the Tel Aviv Stock Exchange and the TASE’s bid to be included in MSCI’s European regional indexes was declined. Both BlueStar Israel events sparked concern about the future of the local exchange. Also, Israeli corporate Global Index pyramids come under attack by The Committee on Increasing Competitiveness in the Economy and the Business Concentration Law. (including Risk/ Ø The Energy sector is asserting itself as a major player in the Israeli economy, natural gas Return Data) reserve estimates and oil estimates are rising, and the government has decided upon an export strategy, clearing up uncertainty and removing some of the risk factors associated with investing in that sector. -

Elbit Medical Technologies Initiation of Coverage

Elbit Medical Technologies Initiation of coverage Two promising private assets Pharma & biotech 28 June 2018 Elbit Medical Technologies is an Israel-based healthcare investment company traded on the TASE. It is invested in two private companies: Price* NIS1.12 InSightec is a commercial-stage medical device company marketing a non- Market cap NIS259m invasive thermal tissue ablation therapy in three indications and Gamida *Priced as at 26 June 2018 Cell is a cell and immune therapy company developing a universal bone NIS3.64/US$ marrow transplant (BMT) product for haematological malignancies. Net debt ($m) at 31 December 2017 42.4 Although their recent offerings of NIS182m of convertible notes lengthen Shares in issue 231.4m the cash runway it raises the prospect of dilution in 2022. In addition, the Free float 10.8% parent company Elbit Imaging (~89% owned) has its own challenges. We value Elbit Medical at NIS407m or NIS1.76 per share. Code EMTC Primary exchange TASE Revenue PBT* EPS* DPS P/E Yield Secondary exchange N/A Year end ($m) ($m) ($) ($) (x) (%) 12/15 1.8 (1.1) 0.0 0.0 N/A N/A Share price performance 12/16 0.0 (3.7) 0.0 0.0 N/A N/A 12/17 0.0 (5.2) 0.0 0.0 N/A N/A Note: *PBT and EPS are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments. InSightec: A non-invasive operating room Elbit Medical currently holds a ~22% (~19% fully diluted) stake in InSightec, a commercial-stage medical device company. -

NASDAQ Stock Market

Nasdaq Stock Market Friday, December 28, 2018 Name Symbol Close 1st Constitution Bancorp FCCY 19.75 1st Source SRCE 40.25 2U TWOU 48.31 21st Century Fox Cl A FOXA 47.97 21st Century Fox Cl B FOX 47.62 21Vianet Group ADR VNET 8.63 51job ADR JOBS 61.7 111 ADR YI 6.05 360 Finance ADR QFIN 15.74 1347 Property Insurance Holdings PIH 4.05 1-800-FLOWERS.COM Cl A FLWS 11.92 AAON AAON 34.85 Abiomed ABMD 318.17 Acacia Communications ACIA 37.69 Acacia Research - Acacia ACTG 3 Technologies Acadia Healthcare ACHC 25.56 ACADIA Pharmaceuticals ACAD 15.65 Acceleron Pharma XLRN 44.13 Access National ANCX 21.31 Accuray ARAY 3.45 AcelRx Pharmaceuticals ACRX 2.34 Aceto ACET 0.82 Achaogen AKAO 1.31 Achillion Pharmaceuticals ACHN 1.48 AC Immune ACIU 9.78 ACI Worldwide ACIW 27.25 Aclaris Therapeutics ACRS 7.31 ACM Research Cl A ACMR 10.47 Acorda Therapeutics ACOR 14.98 Activision Blizzard ATVI 46.8 Adamas Pharmaceuticals ADMS 8.45 Adaptimmune Therapeutics ADR ADAP 5.15 Addus HomeCare ADUS 67.27 ADDvantage Technologies Group AEY 1.43 Adobe ADBE 223.13 Adtran ADTN 10.82 Aduro Biotech ADRO 2.65 Advanced Emissions Solutions ADES 10.07 Advanced Energy Industries AEIS 42.71 Advanced Micro Devices AMD 17.82 Advaxis ADXS 0.19 Adverum Biotechnologies ADVM 3.2 Aegion AEGN 16.24 Aeglea BioTherapeutics AGLE 7.67 Aemetis AMTX 0.57 Aerie Pharmaceuticals AERI 35.52 AeroVironment AVAV 67.57 Aevi Genomic Medicine GNMX 0.67 Affimed AFMD 3.11 Agile Therapeutics AGRX 0.61 Agilysys AGYS 14.59 Agios Pharmaceuticals AGIO 45.3 AGNC Investment AGNC 17.73 AgroFresh Solutions AGFS 3.85 -

Market Cap Close ADV

Market Cap Close ADV 1598 67th Pctl $745,214,477.91 $23.96 225,966.94 801 33rd Pctl $199,581,478.89 $10.09 53,054.83 2399 Listing_ Revised Ticker_Symbol Security_Name Exchange Effective_Date Mkt Cap Close ADV Stratum Stratum AAC AAC Holdings, Inc. N 20160906 M M M M-M-M M-M-M Altisource Asset Management AAMC Corp A 20160906 L M L L-M-L L-M-L AAN Aarons Inc N 20160906 H H H H-H-H H-H-H AAV Advantage Oil & Gas Ltd N 20160906 H L M H-L-M H-M-M AB Alliance Bernstein Holding L P N 20160906 H M M H-M-M H-M-M ABG Asbury Automotive Group Inc N 20160906 H H H H-H-H H-H-H ABM ABM Industries Inc. N 20160906 H H H H-H-H H-H-H AC Associated Capital Group, Inc. N 20160906 H H L H-H-L H-H-L ACCO ACCO Brand Corp. N 20160906 H L H H-L-H H-L-H ACU Acme United A 20160906 L M L L-M-L L-M-L ACY AeroCentury Corp A 20160906 L L L L-L-L L-L-L ADK Adcare Health System A 20160906 L L L L-L-L L-L-L ADPT Adeptus Health Inc. N 20160906 M H H M-H-H M-H-H AE Adams Res Energy Inc A 20160906 L H L L-H-L L-H-L American Equity Inv Life Hldg AEL Co N 20160906 H M H H-M-H H-M-H AF Astoria Financial Corporation N 20160906 H M H H-M-H H-M-H AGM Fed Agricul Mtg Clc Non Voting N 20160906 M H M M-H-M M-H-M AGM A Fed Agricultural Mtg Cla Voting N 20160906 L H L L-H-L L-H-L AGRO Adecoagro S A N 20160906 H L H H-L-H H-L-H AGX Argan Inc N 20160906 M H M M-H-M M-H-M AHC A H Belo Corp N 20160906 L L L L-L-L L-L-L ASPEN Insurance Holding AHL Limited N 20160906 H H H H-H-H H-H-H AHS AMN Healthcare Services Inc. -

Delek Group Economic Interest 14.44%

Flow of Natural Gas from Tamar Field Restarted Tel Aviv, September 27, 2017. Delek Group (TASE: DLEKG, US ADR: DGRLY) (“the Company”) announces that attached is an Immediate Report published by Delek Drilling Limited Partnership (“the Partnership”) concerning the restart of the flow of natural gas from the Tamar field. Further to what was stated in the Partnership’s Immediate Report dated September 23, 2017 concerning locating a crack in the exhaust pipe used on the Tamar platform to release natural gas and pressure both in normal and emergency times (“the Fault”) while Noble Energy Mediterranean Ltd (“the Operator”) was carrying out upgrade and improvement works on the Tamar platform, the Partnership announces that this morning the flow of natural gas was recommenced from the Tamar field after the Operator had completed the repair of the fault yesterday. It should be noted that the Operator is continuing to carry out the planned upgrade works. It should also be noted, according to the Partnership’s estimates, that the costs of repair of the Fault and its impact on the Partnership’s revenues from sales of natural gas are not material, as detailed in the Immediate Report of September 23, 2017. Partners in the Tamar Project and their percentage holdings: Noble Energy Mediterranean Ltd 32.50% Isramco Negev 2, Limited Partnership 28.75% Delek Drilling Limited Partnership 22.00% Tamar Petroleum Ltd 9.25% Dor Gas Exploration Limited Partnership 4.00% Everest Infrastructure Limited Partnership 3.50% Delek Group economic interest 14.44% This is a convenience translation of the original HEBREW immediate report issued to the Tel Aviv Stock Exchange by the Company on September 27, 2017. -

AFPM 2014 Annual Report

PROSPERITY FUELING AMERICAN FUEL & PETROCHEMICAL MANUFACTURERS 2014 ANNUAL REPORT AMERICAN ENERGY POLICY AT A CROSSROADS A MESSAGE FROM THE CHAIRMAN OF THE BOARD AND THE PRESIDENT OF AFPM Last year, the United States became the Today, American energy policy is at a For the refining and petrochemical world’s top producer of oil and natural gas, crossroads. The issues at stake and manufacturing industries, 2014 will prove a position that no one would have predicted the policy decisions to be made have to be a pivotal year. As a country, we face just five years ago. As a result, American never been more important. A surge crucial choices as we endeavor to maintain fuel and petrochemical manufacturers in regulations, coupled with a basic access to affordable, reliable and secure now have the opportunity and the ability to misunderstanding of the fossil fuel industry, energy sources. transform the nation’s economic outlook. hampers the ability to establish sound policies and regulations that will enable us Working on behalf of and in concert with Embracing the strong global demand to continue the progress we’ve made toward our members, AFPM will continue to: for high-quality, affordable refined renewed economic growth. petroleum and petrochemical products, • Advocate for a regulatory environment AFPM companies are putting economics Fossil fuels have been an essential part that is straightforward and effective. and infrastructure to work. Refiners are of our daily lives for so long that their true meeting America’s fuel needs, maintaining impact can easily be taken for granted. • Educate policymakers and the public a strategic inventory and becoming a key But make no mistake – they don’t just to ensure the benefits of fossil fuels are exporter. -

Delek Cover English 04.2006

ANNUAL REPORT 2005 Delek Group Ltd 7, Giborei Israel St., P.O.B 8464, Industrial Zone South, Netanya 42504, Israel Tel: 972 9 8638444, 972 9 8638555 Fax: 972 9 885495 www.delek-group.com Table of Contents: Chapter A Corporate Description Chapter B Director's Report on the Corporation Chapter C Financial Statements for December 31, 2004 Chapter D Additional Information on the Corporation Chapter E MATAV - CABLE SYSTEMS MEDIA LTD IMPORTANT This document is an unofficial translation from the Hebrew original of the 2005 annual report of Delek Group Ltd. that was submitted to the Tel-Aviv Stock Exchange and the Israeli Securities Authority on March 29, 2006. The Hebrew version submitted to the TASE and the Israeli Securities Authority shall be the sole binding version. Investors are urged to review the full Hebrew report. Part One – A Description of the General Development of the Company's Businesses 1. The Company's Activities and the Development of its Business ......................... 3 2. Sectors of Operation .................................................................................................. 6 3. Equity Investments in the Company and Transactions in its Shares................... 7 4. Dividend Distribution ................................................................................................. 8 5. Financial Information Regarding the Group's Sectors........................................... 9 6. The General Environment and Outside Influences................................................. 9 7. Oil Refining Sector -

Retirement Funds June 30, 2012 Description % of Shares Owned

Retirement Funds June 30, 2012 Description % of Shares Owned BARCLAYS LOW CAP PRINCIPAL CAS 0.000000% BLACKROCK FEDFUND(30) 0.440244% BLACKROCK TEMPCASH-FUND(21) 0.000000% BLACKROCK TEMPCASH-FUND(21) 0.000486% BLACKROCK TEMPCASH-FUND(21) 0.000485% BLACKROCK TEMPCASH-FUND(21) 0.008246% BLACKROCK TEMPCASH-FUND(21) 0.006791% BLACKROCK TEMPCASH-FUND(21) 0.005165% BLACKROCK TEMPCASH-FUND(21) 0.006043% BLACKROCK TEMPCASH-FUND(21) 0.004035% BLACKROCK TEMPCASH-FUND(21) 0.035990% BLACKROCK TEMPCASH-FUND(21) 0.020497% BLACKROCK TEMPCASH-FUND(21) 0.023343% BLACKROCK TEMPCASH-FUND(21) 0.008326% BLACKROCK TEMPCASH-FUND(21) 0.000781% BLACKROCK TEMPCASH-FUND(21) 0.004848% BLACKROCK TEMPCASH-FUND(21) 0.022593% BLACKROCK TEMPCASH-FUND(21) 0.000646% BLACKROCK TEMPCASH-FUND(21) 1.307615% BLACKROCK TEMPCASH-FUND(21) 0.214356% BLACKROCK TEMPCASH-FUND(21) 0.001147% BLACKROCK TEMPCASH-FUND(21) 0.024810% BLACKROCK TEMPCASH-FUND(21) 0.009406% BLACKROCK TEMPCASH-FUND(21) 0.018922% BLACKROCK TEMPCASH-FUND(21) 0.030062% BLACKROCK TEMPCASH-FUND(21) 0.010464% BLACKROCK TEMPCASH-FUND(21) 0.004697% BLACKROCK TEMPCASH-FUND(21) 0.001179% BLACKROCK TEMPCASH-FUND(21) 0.007266% BLACKROCK TEMPCASH-FUND(21) 0.000112% BLACKROCK TEMPCASH-FUND(21) 0.008062% BLACKROCK TEMPCASH-FUND(21) 0.011657% CASH COLLATERAL AT BR TRUST 0.000001% CASH COLLATERAL AT BR TRUST 0.000584% EOD STIF 0.024153% MONEY MARKET FD FOR EBT 0.000000% US DOLLAR CASH 0.008786% United States-Dollar 0.000000% United States-Dollar 0.000003% United States-Dollar 0.000019% United States-Dollar 0.000003% United States-Dollar -

Alphabetical Listing by Company Name

FOREIGN COMPANIES REGISTERED AND REPORTING WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION December 31, 2015 Alphabetical Listing by Company Name COMPANY COUNTRY MARKET 21 Vianet Group Inc. Cayman Islands Global Market 37 Capital Inc. Canada OTC 500.com Ltd. Cayman Islands NYSE 51Job, Inc. Cayman Islands Global Market 58.com Inc. Cayman Islands NYSE ABB Ltd. Switzerland NYSE Abbey National Treasury Services plc United Kingdom NYSE - Debt Abengoa S.A. Spain Global Market Abengoa Yield Ltd. United Kingdom Global Market Acasti Pharma Inc. Canada Capital Market Acorn International, Inc. Cayman Islands NYSE Actions Semiconductor Co. Ltd. Cayman Islands Global Market Adaptimmune Ltd. United Kingdom Global Market Adecoagro S.A. Luxembourg NYSE Adira Energy Ltd. Canada OTC Advanced Accelerator Applications SA France Global Market Advanced Semiconductor Engineering, Inc. Taiwan NYSE Advantage Oil & Gas Ltd. Canada NYSE Advantest Corp. Japan NYSE Aegean Marine Petroleum Network Inc. Marshall Islands NYSE AEGON N.V. Netherlands NYSE AerCap Holdings N.V. Netherlands NYSE Aeterna Zentaris Inc. Canada Capital Market Affimed N.V. Netherlands Global Market Agave Silver Corp. Canada OTC Agnico Eagle Mines Ltd. Canada NYSE Agria Corp. Cayman Islands NYSE Agrium Inc. Canada NYSE AirMedia Group Inc. Cayman Islands Global Market Aixtron SE Germany Global Market Alamos Gold Inc. Canada NYSE Alcatel-Lucent France NYSE Alcobra Ltd. Israel Global Market Alexandra Capital Corp. Canada OTC Alexco Resource Corp. Canada NYSE MKT Algae Dynamics Corp. Canada OTC Algonquin Power & Utilities Corp. Canada OTC Alianza Minerals Ltd. Canada OTC Alibaba Group Holding Ltd. Cayman Islands NYSE Allot Communications Ltd. Israel Global Market Almaden Minerals Ltd. -

And Cross-Lingual Paraphrased Text Reuse and Extrinsic Plagiarism Detection

Mono- and Cross-Lingual Paraphrased Text Reuse and Extrinsic Plagiarism Detection Muhammad Sharjeel School of Computing and Communications, Lancaster University Supervisors: Dr. Paul Rayson Dr. Rao Muhammad Adeel Nawab Lancaster University, COMSATS University Islamabad, Lancaster, United Kingdom Lahore Campus, Pakistan [email protected] [email protected] A dissertation submitted in fulfilment of the requirements for the degree of Doctor of Philosophy in Computer Science June 23, 2020 This thesis is dedicated to my mother, and my late father. Acknowledgements In the Name of Allah, the Most Gracious, the Most Merciful First and foremost, I thank the Almighty Allah (SWT), the ultimate source of all knowledge and wisdom in this world, for His countless blessings on me. Regarding my dissertation, I would like to express my sincere gratitude towards my thesis supervisors, Dr. Paul Rayson and Dr. Rao Muhammad Adeel Nawab. And I wish to “reuse” this sentence in so many ways, to show how grateful I am for their guidance, continuous motivation, and outstanding support that formed an endless “corpus” of wisdom that will be with me, always! I greatly admire Dr. Paul Rayson for being a kind, accessible, and an amiable supervisor. I am indebted to Dr. Rao Muhammad Adeel Nawab for mentoring my research for the past several years and helping me to develop a strong background in Natural Language Processing and Machine Learning. A thanks also goes to all the anonymous reviewers for their invaluable feedback that has led to significant improvements in my PhD study. A heartfelt thanks goes to my parents! Words cannot express my feelings, espe- cially towards my mother.