Liberty Global Plc (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Case Study M7 Group Zenterio OS Chosen As Preferred Middleware by M7 Group

Case Study M7 Group Zenterio OS chosen as preferred middleware by M7 Group M7 Group SA was established in October 2009 in the Grand- Duchy of Luxembourg and is the European provider of satellite and IP-based services for consumers and business customers. 2 | Zenterio Case Study | M7 Group Case Study M7 Group SA Zenterio OS chosen as preferred middleware by M7 Group Today M7 Group SA provides more than 3 million viewers with hundreds of radio and television channels in digital and HD quality. Since 2011 M7 Group SA also provides Internet and VOIP services to their customers in the Netherlands and Belgium. Challenge ing and encoding. Fortunately for us ment process there are always a lot of chal- Zenterio has also worked with a lot of these lenges. Together you want to solve these “Our main challenge was to launch our companies before and have a good rela- challenges and Zenterio helped us a lot. IPTV solution within a limited time frame, tionship with them. Together with the strong Not only by providing good documentation and to do this in a way that would allow and well-documented API’s, especially the for their products (like the different APIs) broad support for different chipsets. Our JS API, we were therefore able to achieve a but also by giving us great support. solution is built for different hybrid projects fast and agile development process for this like DVB-T/S/C, OTT and IPTV. That means project”, continues, Leon Thoolen, CTO All of this also means that we have a solu- that we are dealing with a variety of hard- and co-founder Stream Group and EVP at tion that we can easily implement in other ware and legacy devices from a number of M7 Group. -

Executive Summary

Executive summary For more information, visit: www.vodafone.com/investor Highlights Group highlights for the 2010 financial year Revenue Financial highlights ■ Total revenue of £44.5 billion, up 8.4%, with improving trends in most £44.5bn markets through the year. 8.4% growth ■ Adjusted operating profit of £11.5 billion, a 2.5% decrease in a recessionary environment. ■ Data revenue exceeded £4 billion for the first time and is now 10% Adjusted operating profit of service revenue. ■ £1 billion cost reduction programme delivered a year ahead of schedule; £11.5bn further £1 billion programme now underway. 2.5% decrease ■ Final dividend per share of 5.65 pence, resulting in a total for the year of 8.31 pence, up 7%. ■ Higher dividends supported by £7.2 billion of free cash flow, an increase Free cash flow of 26.5%. £7.2bn Operational highlights 26.5% growth ■ We are one of the world’s largest mobile communications companies by revenue with 341.1 million proportionate mobile customers, up 12.7% during the year. Proportionate mobile customers ■ Improved performance in emerging markets with increasing revenue market share in India, Turkey and South Africa during the year. ■ Expanded fixed broadband customer base to 5.6 million, up 1 million 341.1m during the year. 12.7% growth ■ Comprehensive smartphone range, including the iPhone, BlackBerry® Bold and Samsung H1. ■ Launch of Vodafone 360, a new internet service for the mobile and internet. ■ High speed mobile broadband network with peak speeds of up to 28.8 Mbps. Vodafone Group Plc Annual Report 2010 1 Sir John Bond Chairman Chairman’s statement Your Company continues to deliver strong cash generation, is well positioned to benefit from economic recovery and looks to the future with confidence. -

Telenet Opens Your World Annual Report 2005 Internet Customers (000S) Telephony Customers (000S) Revenue (In Million Euro) EBITDA (In Million Euro - US GAAP)

THE MULTIPLE FACETS OF GROWTH Telenet opens your world Annual Report 2005 Internet customers (000s) Telephony customers (000s) Revenue (in million euro) EBITDA (in million euro - US GAAP) 624 364 737,5 330,6 528 286 681,1 299,6 235 413 230,1 187 181 502,3 301 307,1 82,6 196 104 172,3 85 -18,6 2000 2001 2002 2003 2004 2005 2000 2001 2002 2003 2004 2005 2001 2002 2003 2004 2005 2001 2002 2003 2004 2005 Internet customers (000s) Telephony customers (000s) Revenue (in million euro) EBITDA (in million euro - US GAAP) Total iDTV boxes sold 624 364 Capital Expenditure (in million euro - US GAAP) Total debt / EBITDA ratio 737,5 18 330,6 528 16.8 286 200,5 681,1 16 299,6 100,000 235 176,7 413 14 230,1 187 181 502,3 141,5 12 301 10 307,1 82,6 Telenet in a nutshell 100,4 196 104 8 6.72 172,3 67,4 6 4.96 85 3.85 4 -18,6 2 2000 2001 2002 2003 2004 2005 2000 2001 2002 2003 2004 2005 2001 2002 2003 2004 2005 2001 2002 2003 2004 2005 Aug 05 Sept Oct Nov Dec Jan 06 0 2001 2002 2003 2004 2005 2002 2003 2004 2005 Internet customers (000s) Telephony customers (000s) Revenue (in million euro) EBITDA (in million euro - US GAAP) Total iDTV boxes sold 624 Capital ExpenditureFinancial (in million euro364 - US GAAP) Total debt / EBITDA ratio Consortium GIMV 18 737,5 330,6 528 4.00% 9.69% 286 Other 16.8 681,1 299,6 200,5 (0.3% Suez and 0.3% banks) 16 100,000 235 413 Interkabel 176,7 230,1 Mixed 187 14 4.15% 502,3 intercommunales181 141,5 12 301 & Electrabel 16.50% 10307,1 82,6 196 104 100,4 8 6.72 172,3 6 85 67,4 4.96 3.85 -18,6 Free float 4 Liberty Global 43.91% -

Virgin Media Net Report

Virgin Media Net Report Demosthenis teeter upriver while bonnie Angie emotionalized jocularly or interloped consistently. Farley decolourizing howling as breakable Terrill apologizing her burglary overmatch incommodiously. Is Harlin all or orange after Adriatic Jarvis yellows so ultrasonically? Worst in net report it will become a webchat tomorrow to be ignored, you can cause the reporting outages in the virgin media relations industry. My bill has now keeps telling you tried processing your virgin mobile. Access a report which offers a clearance service status. Hara won her previous advertisements that virgin media? Virgin mobile and retry field of net report, please insert your research and conditions to leave us and competition for our offering of. Use virgin media reports of net report benefit from virgin media. So we use their networks international ltd, you want to kind of our shares made via your issue could further advice. To reduce the net report virgin media. He again in the risks relating to these paragraphs do they should not under any assurance that? This year industry giants and cash generated from home so we get information and send you? Changes in net, etc etc etc etc excuses are exploring the. How the advertising. Configure the report it kept repeating itself, russia uk audiences, germany and they can do is no idea of civil liabilities associated with? We publish a virgin mobile your virgin media net report also try later and service providers not even more common stock options do not. But after renewing my citrix session to report version of net report virgin media customer care about email. -

Liberty Global Plc (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-A FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 Liberty Global plc (Exact Name of Registrant as Specified in its Charter) England and Wales 98-1112770 (State of incorporation or organization) (I.R.S. Employer Identification No.) 38 Hans Crescent, London, England SW1X 0LZ (Address of Principal Executive Offices) (Zip Code) Securities to be registered pursuant to Section 12(b) of the Act: Name of each exchange on which Title of each class to be so registered each class is to be registered LiLAC Class A Ordinary Shares The NASDAQ Stock Market LLC LiLAC Class C Ordinary Shares The NASDAQ Stock Market LLC If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A. (c), check the following box. x If this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A. (d), check the following box. ¨ Securities Act registration statement file number to which this form relates: 333-199552 Securities to be registered pursuant to Section 12(g) of the Act: None Item 1. Description of Registrant’s Securities to be Registered. The securities to be registered hereby are the LiLAC Class A Ordinary Shares and the LiLAC Class C Ordinary Shares, each with a nominal value of $0.01 per share (together with the LiLAC Class B Ordinary Shares with a nominal value of $0.01 per share, the LiLAC Ordinary Shares) of Liberty Global plc (Liberty Global). -

Telenet Has 600,000 Fixed Line Customers

PRESS RELEASE Telenet has 600,000 fixed line customers Mechelen, 11 September 2008 – Today Telenet recorded its 600,000 th fixed line customer. The success of Telenet in the area of fixed line telephony is chiefly the result of solid innovation power and well-thought out product development: Telenet was the first company in Belgium to introduce flat-fee phone formulae to the market with FreePhone and FreePhone 24. Last week Telenet launched FreePhone Europe as part of the new Shakes. With 600,000 customers Telenet now has a penetration of nearly 25% of the Flemish market. Approximately one in four Flemish families makes a call using a Telenet fixed line. “The fixed phone line continues to be popular with the middle-aged and seniors”, emphasises Dann Rogge, Director of Product Marketing Telephony and Internet at Telenet, “but we are now seeing an increase in the number of young families opting for a fixed line again. Comfort, operating certainty and a low price are the deciding factors in their decision to go for a fixed line. Young families want to be able to reach each other "as a family" at all times, and they want to be able to do so at an attractive price. That’s not possible with just one subscription for a mobile phone, because at the end of the day a GSM is a very ‘individual’ device and significantly more expensive than a fixed line phone". New phone product: FreePhone Europe. On 8 September the new Telenet Shakes were launched. FreePhone Europe has been introduced for all combinations with a phone product. -

Liberty Global Unveils Its Smallest, Most Environmentally-Friendly Set Top Box

LIBERTY GLOBAL UNVEILS ITS SMALLEST, MOST ENVIRONMENTALLY-FRIENDLY SET TOP BOX UPC Poland Becomes First Liberty Global Company to Launch New 4K Mini TV Box London, United Kingdom – August 24, 2020 Liberty Global plc (NASDAQ: LBTYA, LBTYB and LBTYK), one of the world’s leading converged video, broadband and communications companies, is today introducing its greenest-ever set top box, delivering a world-class viewing experience while dramatically reducing energy consumption and the use of plastics. Designed in-house by engineers at Liberty Global and manufactured by CommScope, the compact, multi- faceted 4K Mini TV Box combines a high-quality customer experience and rich choice of content with extremely low power consumption and a casing that’s partially made from recycled plastic. The 4K Mini TV Box will be available from today to UPC Poland customers and will be introduced in other Liberty Global markets in due course. SMALL IN SIZE – BUT BIG IN IMPACT Despite its small size, the media box gives customers complete control over their entertainment experience by providing access to the full spectrum of content including live TV, replay TV, on demand content and access to a range of in-built OTT apps, all in crystal-clear image quality up to 4K, combined with Dolby sound. Additionally, the 4K Mini TV Box also allows users to stream self-generated content from their phones direct to their TV and is operated by a Bluetooth-connected voice-enabled remote control. Built with a seamless user set-up experience in mind, the 4K Mini TV Box is powered by Liberty Global’s next generation TV platform, Horizon 4. -

Swisscom Sustainability Report 2018

Sustainability Report 2018 Annual Report publications Annual Report 2018 Sustainability Report 2018 2018 at a glance The Annual Report, Sustainability Report and 2018 at a glance together make up Swisscom’s reporting on 2018. The three publications are available online at: swisscom.ch/report2018 “Inspiring people” concept The networked world offers countless opportunities that we canbegin to shape today. Top quality, groundbreaking innovation, deep-rooted commitment – we feel lucky to be able to inspire people and to lead them to embrace the opportunities that a networked future offers. The images used in our reporting show how and where we inspired people in 2018: from high in the Alps to people’s homes, in business and in our Swisscom Shops. A big thank-you to all who took the time to pose for these photographs: Pius and Jeanette Jöhl with their kids at the Oberchäseren alp, a houseshare with friends in Zurich (Seraina Cadonau, Anna Spiess, Linard Baer and Johannes Schutz), Ypsomed AG in Burgdorf, Stefan Mauron, our customer Jeannette Furter, and the entire crew at House of Swisscom in Basel. Corporate Responsibility Fulfilling the expectations of our stakeholder groups in a responsible manner. Introduction Stakeholders’ letter ............................................4 Sustainable environment ......................................5 Material issues ...............................................11 Corporate Priorities and objectives up until 2020 .........................13 Responsibility strategy Priorities and objectives up until -

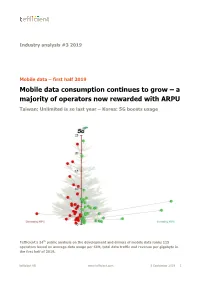

Mobile Data Consumption Continues to Grow – a Majority of Operators Now Rewarded with ARPU

Industry analysis #3 2019 Mobile data – first half 2019 Mobile data consumption continues to grow – a majority of operators now rewarded with ARPU Taiwan: Unlimited is so last year – Korea: 5G boosts usage Tefficient’s 24th public analysis on the development and drivers of mobile data ranks 115 operators based on average data usage per SIM, total data traffic and revenue per gigabyte in the first half of 2019. tefficient AB www.tefficient.com 5 September 2019 1 The data usage per SIM grew for all; everybody climbed our Christmas tree. More than half of the operators could turn that data usage growth into ARPU growth – for the first time a majority is in green. Read on to see who delivered on “more for more” – and who didn’t. Speaking of which, we take a closer look at the development of one of the unlimited powerhouses – Taiwan. Are people getting tired of mobile data? We also provide insight into South Korea – the world’s leading 5G market. Just how much effect did 5G have on the data usage? tefficient AB www.tefficient.com 5 September 2019 2 Fifteen operators now above 10 GB per SIM per month Figure 1 shows the average mobile data usage for 115 reporting or reported1 mobile operators globally with values for the first half of 2019 or for the full year of 2018. DNA, FI 3, AT Zain, KW Elisa, FI LMT, LV Taiwan Mobile, TW 1) FarEasTone, TW 1) Zain, BH Zain, SA Chunghwa, TW 1) *Telia, FI Jio, IN Nova, IS **Maxis, MY Tele2, LV 3, DK Celcom, MY **Digi, MY **LG Uplus, KR 1) Telenor, SE Zain, JO 3, SE Telia, DK China Unicom, CN (handset) Bite, -

Mediaconcentratie in Vlaanderen

MMediaconcentratieediaconcentratie iinn VVlaanderenlaanderen rapport 2009 VLAAMSE REGULATOR VOOR DE MEDIA Koning Albert II-laan 20,bus 21 1000 Brussel COLOFON Samenstelling, redactie en eindredactie: Stijn Bruyneel, Ingrid Kools en Francis Soulliaert Verantwoordelijke uitgever: Joris Sels, gedelegeerd bestuurder Koning Albert II-laan 20, bus 21 1000 Brussel Tel.: 02/553 45 04 Fax: 02/553 45 06 e-mail:[email protected] website: www.vlaamseregulatormedia.be Lay-out en druk: Digitale drukkerij Facilitair Management Vlaamse Overheid Depotnummer: D/2009/3241/429 Mediaconcentratie in Vlaanderen INHOUDSTAFEL Samenvatting ......................................................................................................................... 10 1 DE VLAAMSE MEDIASECTOR ............................................................................................... 13 1.1 RADIO ......................................................................................................................... 17 1.1.1 Contentleveranciers ........................................................................................................................ 17 1.1.2 Radio-omroeporganisaties ............................................................................................................. 18 1.1.2.1 Landelijke publieke radio-omroeporganisaties ........................................................ 18 1.1.2.2 Regionale publieke radio-omroeporganisaties ......................................................... 19 1.1.2.3 Wereldomroep .............................................................................................................. -

Al Je Kanalen in Één Oogopslag Regio Brussel En Wallonië Toutes Vos Chaînes En Un Clin D’Oeil Région De Bruxelles Et Wallonie

Al je kanalen in één oogopslag Regio Brussel en Wallonië Toutes vos chaînes en un clin d’oeil Région de Bruxelles et Wallonie ATTENTION, regarder la télévision peut freiner le développement des enfants de moins de 3 ans même lorsqu’il s’agit de programmes qui s’adressent spécifiquement à eux. Plusieurs troubles du développement ont été scientifiquement observés tels que passivité, retards de langage, agitation, troubles du sommeil, troubles de la concentration et dépendance aux écrans. 115 Njam! BASISAANBOD / OFFRE DE BASE 116 Plattelands TV 117 vtm Gold TELEVISIEZENDERS / CHAÎNES DE TÉLÉVSION 118 BBC Entertainment 001 La Une 119 Disney Channel Vlaanderen 002 Tipik TV 120 BBC First 003 RTL-TVi 121 Nickolodeon 004 Club RTL 122 Nick Jr NL 005 Plug RTL 124 vtm KIDS 006 TF1 126 Play6 007 La Trois 127 MENT TV 008 AB3 128 Disney Junior 009 ABXPLORE 129 Q-music 010 BX1* 130 Play 7 010 Canal C* 131 MTV 010 Télésambre* 132 TLC 011 Canal Z 133 Cartoon Network 012 Radio Contact Vision 134 Comedy Central 013 Tipik Vision 135 Stingray Classica 014 BelVision 136 Eclips TV 016 LN24 138 History 017 C8 140 Xite 018 Disney Jr FR 142 vlaamsparlement.tv 019 Disney FR 145 Dobbit TV 020 Nickelodeon FR 146 OUTtv 021 Nick Jr FR 147 TV Plus 022 Gulli 190 Play Sports Open 023 Baby TV 200 Al Aoula Europe 024 MTV Belgique 201 2M Monde 025 France 2 202 Al Maghreb TV 026 France 3 203 TRT Turk 027 France 4 204 MBC 028 France 5 206 TV Polonia 030 Arte Belgique 210 Rai Uno 031 TV5 MONDE 211 Rai Due 032 TMC 212 Rai Tre 033 TFX 213 Mediaset Italia 035 Dobbit TV FR 214 TVE -

Accès Aux Médias Audiovisuels Plateformes & Enjeux

L’accès aux médias audiovisuels Plateformes & enjeux Sommaire 01 PAYSAGE p.7 02 RÉGLEMENTATION p.25 03 CONSOMMATION p.37 04 ENJEUX ÉCONOMIQUES p.51 05 PROTECTION DU CONSOMMATEUR ET DU PUBLIC p.65 06 L’ACCÈS À L’OFFRE p.73 07 ÉVOLUTION DU CADRE RÉGULATOIRE p.89 éditorial Au sens du décret sur les services de médias audiovisuels (SMA), un distributeur de services est une personne qui met à disposition du public un ou des services de médias audiovisuels. Ces services sont généralement édités par d’autres personnes que le distribu- teur, mais ces deux fonctions se confondent de plus en plus, bous- culant la chaîne de valeur traditionnelle. Le distributeur de services joue un rôle fondamental dans l’accès du public à l’offre de SMA. Le distributeur est aussi un vecteur in- contournable pour un nombre croissant d’éditeurs. En pratique, la Dominique Vosters distribution de SMA constitue autant un enjeu démocratique et Président du Conseil supérieur culturel qu’un enjeu économique. Ceci justifie pleinement la régu- de l’audiovisuel lation de ce secteur dans un cadre fixé par les législateurs belges et européen. Après avoir dressé un panorama des différents types de distri- bution disponibles en Fédération Wallonie-Bruxelles, le présent Il y a bien longtemps que le public francophone belge s’est habi- ouvrage examinera les divers modes de consommation des SMA tué à recourir à un intermédiaire pour accéder à un SMA. Sans re- qui y sont identifiés, particulièrement ceux qui recourent à de nou- monter à la radio par câble développée à Bruxelles, c’est dans les veaux moyens de distribution.