Employment and Property Land Study TECHNICAL PAPER

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dumfries & Galloway Local Authority Pack 2017-18

DUMFRIES & GALLOWAY LOCAL AUTHORITY PACK 2017-18 Contents Cabinet Secretary’s Introduction 02 What is CashBack for Communities? 04 CashBack for Communities Phase 4 Partners 06 Case Studies 08 Impact Evaluation 14 CashBack Phase 4 Introduction 16 Local Authority Breakdown 17 Cabinet Secretary’s Introduction It is only right that cash seized from criminals is invested directly to improve lives, increasing opportunities for Scotland’s future – our young people. 02 “I am keen to ensure that these opportunities continue to be provided in disadvantaged communities across Scotland.” I am rightly proud of the Scottish Government’s unique CashBack for I have seen first-hand the positive impact that CashBack funded activities can Communities programme – a programme that makes crime pay by seizing have on young people and I am keen to ensure that these opportunities continue criminals’ cash and investing it in the young people of Scotland through sports, to be provided in disadvantaged communities across Scotland. youth work, employability and cultural diversionary activities. Crime brings misery to individuals and communities. It is only right that CashBack impacts on criminals and their illegal gains, reinvesting bad money cash seized from criminals is invested directly to improve lives, increasing for good purposes to build better, safer, healthier communities, improving opportunities for Scotland’s future – our young people. facilities, running projects that in many cases would otherwise simply not have existed, and giving our young people something positive, purposeful and This local authority pack provides a flavour of the CashBack for Communities constructive to do. programme, the activities and opportunities it funds in your area and the real difference it makes to young lives. -

Christmas 2017 Final.Pdf

www.stjosephscollege.co.uk A Message from the Head Teacher The term is drawing to a close and Christmas is coming! As I Thursday 4th January: School reopens 8.50 a.m. write we look forward to the PFA Carol Service, End of Term Monday 8th January: S4/S5/S6 Prelims begin Services and of course the holiday. As you will see from this Tuesday 9th January: Parent Council Meeng 7 p.m. newsleer it has been another acon packed term which Friday 19th January: S4/S5/S6 Prelims end included our very successful and enjoyable Christmas Ceilidhs th Saturday 20 January: Ski trip departs and Market. This week our school band will entertain those Saturday 27th January: Ski trip returns vising the new Dumfries and Galloway Royal Infirmary and Sunday 28th January: Catholic Educaon Week begins members of the Charies Commiee will take the th opportunity to present £1500 to the hospital as a Tuesday 30 January: 100th Anniversary of Catholic Educa‐ on Act Mass in St. Margaret’s Cathedral, Ayr 11.30 a.m. consequence of the Christmas Market. A huge well done and nd thanks are due to all who gave of their me, resources and Friday 2 February: S4 Reports to Parents th energy at this busy me of year. Tuesday 6 February: S4 Parents’ Evening th On the staffing front our best wishes and thanks go to Miss J Monday 12 February: Holiday th th O’Donnell who has moved to a Social Subjects teaching post Tuesday 13 – Wednesday 14 February: Staff INSET closer to home and also to Miss M J Wilson who will take up Wednesday 14th February: Ash Wednesday a new post in Home Economics early in the new year. -

Dumfries and Galloway Nhs Board

DUMFRIES AND GALLOWAY NHS BOARD PUBLIC MEETING A meeting of the Dumfries and Galloway NHS Board will be held at 10am on Monday 5th August 2019 in the Lecture Theatre, Education Centre, Dumfries and Galloway Royal Infirmary, Cargenbridge, Dumfries, DG2 8RX. AGENDA Time No Agenda Item Who Attached / Verbal 10.00am 62 Apologies L Geddes Verbal 10.00am 63 Declarations of Interest N Morris Verbal 10.05am 64 Previous Minutes N Morris Attached 10.10am 65 Matters Arising and Review of Actions List N Morris Attached QUALITY & SAFETY ASSURANCE 10.15am 66 Healthcare Associated Infection Report E Docherty Attached 10.25am 67 Patient Services Feedback Report E Docherty Attached 10.35am 68 Improving Safety & Reducing Harm – E Docherty Attached Community Health & Social Care Report 10.45am 69 Working Well Annual Report C Cooksey Attached 10.55am 70 The Sturrock Report C Cooksey Attached 11.35am 71 Risk Management Annual Report E Docherty Attached 11.45am 72 Volunteering Annual Report E Docherty Attached PERFORMANCE ASSURANCE 11.50am 73 Summary Performance Report J Ace Attached 12.05am 74 Integration Joint Board Update Report K Lewis Verbal 12.10pm 75 Integration Annual Performance Report V Freeman Verbal 12.20pm 76 Workforce Sustainability Programme C Cooksey Attached Board LUNCH BREAK NOT PROTECTIVELY MARKED Page 1 of 2 Time No Agenda Item Who Attached / Verbal FINANCE & INFRASTRUCTURE 1.00pm 77 Financial Performance Update K Lewis Attached PUBLIC HEALTH & STRATEGIC PLANNING 1.20pm 78 Regional Delivery Plan J Ace Verbal 1.30pm 79 Maggies Centre Update -

Scottish Birds

ISSN 0036-9144 SCOTTISH BIRDS THE JOURNAL OF THE SCOTTISH ORNITHOLOGISTS' CLUB Volume 9 No. 4 WINTER 1976 Price 7Sp SCOTTISH BIRD REPORT 1975 1977 SPECIAL INTEREST TOURS by PER'EGRINE HOLIDAYS Director s: Raymond Hodgkins, MA. (Oxon)MTAI. Patricia Hodgkins, MTAI a nd Neville Wykes, (Acct.) All Tours by scheduled Air and Inclusive. Most with guest lecturers and a tour manager. *Provisional SPRING IN VENICE . Mar 19-26 . Art & Leisure £139 SPRING IN ATHENS ... Mar 22-31 . Museums & Leisure £125 SPRING IN ARGOLlS ... Mar 22-31 . Sites & Flowers £152 PELOPONNESE . .. Apr 1-15 ... Birds & Flowers £340 CRETE . Apr 1·15 .. Birds & Flowers £330 MACEDONIA . Apr 28-May 5 . .. Birds with Peter Conder £210 ANDALUSIA .. May 2·14 . Birds & Flowers £220* PELOPONNESE & CRETE ... May 24-Jun 7 . .. Sites & Flowers £345 CRETE (8 days) . , . May 24, 31, June 7 ... Leisure £132 NORTHERN GREECE ... Jun 8·22 ... Mountain Flowers £340 RWANDA & ZAIRE . Jul 15·Aug 3 ... Gorillas with John £898 Gooders. AMAZON & GALAPAGOS . .. Aug 4-24 ... Dr David Bellamy £1064 BIRDS OVER THE BOSPHORUS ... Sep 22-29 ... Eagles with £195 Dr Chris Perrins. KASHMIR & KULU . .. Oct 14-29 ... Birds & Flowers £680* AUTUMN IN ARGOLlS ... Oct 12·21 ... Birds & Sites £153* AUTUMN IN CRETE ... Nov 1-8 ... Birds & Leisure £154* Brochures by return. Registration without obligation. PEREGRINE HOLIDAYS at TOWN AND GOWN TRAVEL, 40/41 SOUTH PARADE, AGENTS SUMMERTOWN, OXFORD, OX2 7JP. Phone Oxford (0865) 511341-2-3 Fully Bonded Atol No. 275B RARE BIRDS IN BRITAIN AND IRELAND by J. T. R. SHARROCKand E. M. SHARROCK This new, much fuller, companion work to Dr Sharrock's Scarce Migrant Birds in Britain and Ireland (£3.80) provides a textual and visual analysis for over 221 species of rare birds seen in these islands. -

I General Area of South Quee

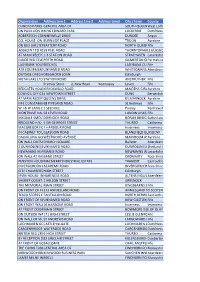

Organisation Address Line 1 Address Line 2 Address Line3 City / town County DUNDAS PARKS GOLFGENERAL CLUB- AREA IN CLUBHOUSE OF AT MAIN RECEPTION SOUTH QUEENSFERRYWest Lothian ON PAVILLION WALL,KING 100M EDWARD FROM PARK 3G PITCH LOCKERBIE Dumfriesshire ROBERTSON CONSTRUCTION-NINEWELLS DRIVE NINEWELLS HOSPITAL*** DUNDEE Angus CCL HOUSE- ON WALLBURNSIDE BETWEEN PLACE AG PETERS & MACKAY BROS GARAGE TROON Ayrshire ON BUS SHELTERBATTERY BESIDE THE ROAD ALBERT HOTEL NORTH QUEENSFERRYFife INVERKEITHIN ADJACENT TO #5959 PEEL PEEL ROAD ROAD . NORTH OF ENT TO TRAIN STATION THORNTONHALL GLASGOW AT MAIN RECEPTION1-3 STATION ROAD STRATHAVEN Lanarkshire INSIDE RED TELEPHONEPERTH ROADBOX GILMERTON CRIEFFPerthshire LADYBANK YOUTHBEECHES CLUB- ON OUTSIDE WALL LADYBANK CUPARFife ATR EQUIPMENTUNNAMED SOLUTIONS ROAD (TAMALA)- IN WORKSHOP OFFICE WHITECAIRNS ABERDEENAberdeenshire OUTSIDE DREGHORNDREGHORN LOAN HALL LOAN Edinburgh METAFLAKE LTD UNITSTATION 2- ON ROAD WALL AT ENTRANCE GATE ANSTRUTHER Fife Premier Store 2, New Road Kennoway Leven Fife REDGATES HOLIDAYKIRKOSWALD PARK- TO LHSROAD OF RECEPTION DOOR MAIDENS GIRVANAyrshire COUNCIL OFFICES-4 NEWTOWN ON EXT WALL STREET BETWEEN TWO ENTRANCE DOORS DUNS Berwickshire AT MAIN RECEPTIONQUEENS OF AYRSHIRE DRIVE ATHLETICS ARENA KILMARNOCK Ayrshire FIFE CONSTABULARY68 PIPELAND ST ANDREWS ROAD POLICE STATION- AT RECEPTION St Andrews Fife W J & W LANG LTD-1 SEEDHILL IN 1ST AID ROOM Paisley Renfrewshire MONTRAVE HALL-58 TO LEVEN RHS OFROAD BUILDING LUNDIN LINKS LEVENFife MIGDALE SMOLTDORNOCH LTD- ON WALL ROAD AT -

Active Travel Dumfries Hospital Leaflet

QUARRY ROAD SCHOOL ROAD ROAD SCHOOL The smarter way to travel travel to way smarter The Dumfries Town 115 X74/74 CATHERINEFIELD ROAD Bus Routes 0256-17 Centre Inset 236 2 KNOWEHEADLocharbriggs RD September 2017 Primary Railway AUCHENCRIEFF RD School Holywood www.co-wheels.org.uk Station 236 1 246246 01387 Tel: Holywood L O A one. owning of hassle and costs the Primary Dumfries V STATION RD. E 336211 07788 Mob: School RS 81 River Nith Academy WALK without cars Co-wheels access can you so member a Locharbriggs Email: [email protected] Email: 3 Become work. and live people where near parked A76 A701 EDINBURGH RD ACADEMY STREET 504 cars with club car hour’ the by ‘pay a is Co-wheels 246 LOREBURNE STREET on: Davies Rhian Officer Travel Active our contact Or 1 Telephone: 01387 860805 or through Facebook through or 860805 01387 Telephone: MOSSDALE activetraveldumfries.wordpress.com HERRIES ANNAN RD. Lochthorn 1QB DG1 Library Heathhall visit: please walks, Ae Village, Parkgate, Village, Ae 3 504 Primary Café, and Shop Bike Ae Burns guided and sessions maintenance bike as such events AVE School WHITE SANDS C ST. MARY’S STREET BUCCLEUCH STREET F Statue don’t you when not transport to the new hospital, including active travel travel active including hospital, new the to transport 1 379/79/385 Dumfries to nearby shops Cycle HOODS LOANING Heathhall GT. KING ST. T. S LEAFIELD ROAD public and cycling walking, on information more For H and it want you when car A LIS NG B www.solwaycycles.co.uk Website: E Cinema DGOne X74/74 2 . -

Nithsdale Active Schools & Community Sport January – March

Nithsdale Active Schools & Community Sport January – March 2017 Update SUMMARY Welcome Back – We hope you enjoyed your Easter break and are looking forward to a sporty summer term. January to March was a very busy term and our Active Schools & Community Sport team Contents Include: - would like to share a few of our achievements over this period. January - March update SUPER 5’S CROSS COUNTRY Super 5’s has proved to be a very popular after school activity, seeing over 100 pupils sign Super 5’s XC up to the running league. The league results were as follows: Nithsdale Badminton P7 Boys P7 Girls 1st Euan Brown Georgetown 1st Skye Rae Heathhall Regional Badminton 2nd Alex Scott Dunscore 2nd Abbie Gray Georgetown 3rd Freddie Duncan Closeburn 3rd Sara Thomson Georgetown Girls Football Festival P6 Boys P6 Girls 1st Niall Rogerson Heathhall 1st Leah Brown St Andrew’s Mabie Mile Fun Run 2nd Archie Scott Sanquhar 2nd N/A N/A 3rd Leon Robertson Heathhall 3rd= N/A N/A Bikeability Training P5 Boys P5 Girls 1st Billy Gray Georgetown 1st Clara Conchar Georgetown Cross country Champs 2nd= Jacob Holden Laurieknowe 2nd Eve Crombie Noblehill 2nd= Cameron Edgar Georgetown 3rd Rachel Eden Troqueer Jigs & Reels 3rd Samuel Wojciak Troqueer Breakfast / Lunch clubs This year we saw a huge number of pupils attending 5 out of 5 races which saw them all achieving the gold certificate. Photo of last race at Maxwelltown High School and overall Fit Families winners Niall Rogerson & Skye Rae Active Girls Week Easter Holiday Fun Facebook: https://www.facebook.com/pages/Nithsdale-Active-Schools-and-Community-Sport Email: [email protected] Tel: 01387 260399 NITHSDALE BADMINTON COMPETITION Following cluster heats, 40 pupils took part in the Nithsdale Badminton Competition to determine the pupils who would progress to the regional final. -

Rethinking Scotland's Neolithic: Combining Circumstance with Context

Proc Soc Antiq Scot, 136 (2006), 7–46 BROPHY: RETHINKING SCOTLAND’S NEOLITHIC | 7 Rethinking Scotland’s Neolithic: combining circumstance with context Kenneth Brophy* ABSTRACT In 1985, a seminal review of Scottish Neolithic studies from an outside perspective written by Ian Kinnes was published in these Proceedings. Kinnes’s paper offered a discussion of the state of knowledge of Scotland’s Neolithic at that time, reviewing 40 years of excavations results. He was also critical of, as he saw it, the parochial and derivative nature of Neolithic studies in Scotland. In this paper, written 20 years after Kinnes’s significant contribution, the response to this charge will be discussed. A review of major developments in Neolithic studies since 1985 has also been undertaken, the results of which are included here. The impact of developer-funded archaeology and aerial photography in particular has generated substantial new data not available to Kinnes; these data have been generated within a new theoretical climate in Neolithic studies, and this too will be addressed. Reviews of evidence for settlement and monuments are presented as case studies to exemplify progress made since 1985. There is no reason, other than that of modern external source. Similar criticisms have more political expediency, why the ‘Scottish Neolithic’ recently been made by Barclay (2001a; 2004a; should exist as an entity. This poses the basic 2004b), who contended that only in the 1970s problem: parochial definition without parochial did prehistorians in Scotland move beyond thought (Kinnes 1985, 16). the pervasive image of Scotland as a largely Just over 20 years ago, Ian Kinnes wrote highland landscape in the Neolithic. -

The Quaternary Geology of the Solway

The Quaternary Geology of the Solway Geology and Landscape (Scotland) Programme Research Report RR/11/04 HOW TO NAVIGATE THIS DOCUMENT Bookmarks The main elements of the table of contents are book- marked enabling direct links to be followed to the principal section headings and sub- headings, figures, plates and tables irrespective of which part of the document the user is viewing. In addition, the report contains links: from the principal section and subsection headings back to the contents page, from each reference to a figure, plate or table directly to the corresponding figure, plate or table, from each page number back to the contents page. RETURN TO CONTENTS PAGE BRITISH GEOLOGICAL SURVEY The National Grid and other Ordnance Survey data are used with the permission of the GEOLOGY AND LANDSCAPE (SCOTLAND) PROGRAMME Controller of Her Majesty’s Stationery Office. RESEARCH REPORT RR/11/04 Licence No: 100017897/2011. Keywords Quaternary, Solway. National Grid Reference SW corner 290000, 550000 Centre point 515000, 570000 The Quaternary Geology NE corner 340000, 590000. Map of the Solway Sheet Solway East and Solway West, 1:50 000 scale, Special Quaternary sheets. A A McMillan, J W Merritt, C A Auton, and N R Golledge Front cover Ice-wedge casts in glaciofluvial sand and gravel sheet deposits of the Kilblane Sand and Gravel Contributors Formation at Halleaths Gravel D C Entwisle, B Humphreys, C J Jordan, B É Ó Dochartaigh, E R Phillips, Pit [NY 0868 8344], Lochmaben. Photo A A McMillan (P774196). and C L Vye Bibliographical reference MCMILLAN, A A, MERRITT, J W, AUTON, C A, and GOLLEDGE, N R. -

Abbey Ward 5 Profile Abbey Ward 5 Profile

Abbey Ward 5 Profile Abbey Ward 5 Profile Local Government Boundary Commission for Scotland Fifth Review of Electoral Arrangements Final Recommendations Dumfries and Galloway Council area Ward 5 (Abbey) ward boundary 0 0 3 Mi2l2e.5mmiillees Crown Copyright and database right 0 2.5 km 2016. All rights reserved. Ordnance ± Survey licence no. 100022179 Key statistics - Settlements Kippford is a small village along the Solway coast. Kippford can only be accessed by car from Some key details about the main towns and Barnbarroch, passing by Craigieknowes Golf Course villages in the Abbey Ward are given below. and two campsites. Dalbeattie is identified as a District Centre in the Rockcliffe is a small, coastal village with a view of Stewartry Housing Market Area. Rough Island, Hestan Island, the Solway Firth and Its population in 2011 was 4,227. It benefits from sometimes the Lake District. close proximity to one of the internationally Kirkbean is a small village near the Solway Firth It renowned Seven Stanes mountain biking routes is home to a primary school which serves the local and has a range of shops, facilities and businesses area and is partnered with New Abbey primary serving the wider area. To the east, the town is school. enclosed by forestry incorporating important walking and cycling routes. The north of the town includes the cemetery and other areas of open Council and Partners Facilities space forming part of the wider green network as Primary Schools well as the main entry to the town from Dumfries. The southern approach to the town is in close Dalbeattie Primary School 281 proximity to the East Stewartry Coast National Troqueer Primary School 263 Scenic Area. -

Licence Holder Premises Name Address 1 Address 2 Address 3

Licence Holder Premises Name Address 1 Address 2 Address 3 Address 4 Address 5 Sale of Alcohol Pamela Stevenson Corsewall Lighthouse Hotel Corsewall Point Kirkcolm Stranraer DG9 0QD On and Off Sales Stuart Martin Wales Partnership S.M. Wales & Family Store 2 Kerrsland Road Stranraer DG9 7SE Off Sales Scott and Karen Sheppard (Partnership) Arkhouse Inn 17-19 Church Street Stranraer DG9 7JG On and Off Sales Tesco Stores Limited Tesco Metro Charlotte Street Stranraer DG9 7EF Off Sales Iain Alexander William Gillespie John Gillespie & Sons Ltd 20 Main Street Portpatrick Stranraer DG9 8JL Off Sales Jillian Patricia Bell Costcutters 65 St. John Street Whithorn Newton Stewart DG8 8PF Off Sales Derrick William Robert Jobb Ellangowan Hotel St. John Street Creetown Newton Stewart DG8 7JF On and Off Sales Sharon McWhirter Dunn L&S Store 109 Fairhurst Road Stranraer DG9 7QA Off Sales The Firm of the Waterfront The Waterfront Hotel 7 North Crescent Portpatrick Stranraer DG9 8SX On Sales Bar 12 Limited Bar 12 12A Hanover Square Stranraer DG9 7AF On and Off Sales Paul Willoughby Kenmuir Arms Hotel 31 Main Street New Luce Newton Stewart DG8 0AJ On and Off Sales Jane Jones & Alex Muir t/a Firm of Kirkinner Inn The Kirkinner Inn 5 Main Street Kirkinner Newton Stewart DG8 9AN On and Off Sales Alexander Moir Sutherland The Thistle Inn 47 Dalrymple Street Stranraer DG9 7EY On and Off Sales Andrew Wilson Firth Hillcrest House Maidland Place Wigtown Newton Stewart DG8 9EU On Sales Beatrice Walkington Brambles Bistro and Coffee Shop 43 Main Street Glenluce Newton -

Transactions Dumfriesshire and Galloway Natural

TRANSACTIONS of the DUMFRIESSHIRE AND GALLOWAY NATURAL HISTORY and ANTIQUARIAN SOCIETY FOUNDED 20 NOVEMBER 1862 THIRD SERIES VOLUME 91 XCI Editors: DAVID F. DEVEREUX JAMES FOSTER ISSN 0141-1292 2017 DUMFRIES Published by the Council of the Society Office-Bearers 2016–2017 and Fellows of the Society President Dr Jeremy Brock Vice Presidents Mrs P.G. Williams, Mr R. Copland, Mr D. Dutton and Mr M. Cook Fellows of the Society Mr A.D. Anderson, Mr J.H.D. Gair, Dr J.B. Wilson, Mr K.H. Dobie, Mrs E. Toolis, Dr D.F. Devereux, Mrs M. Williams, Dr F. Toolis, Mr L. Murray and Mr L.J. Masters Hon. Secretary Mr J.L. Williams, Merkland, Kirkmahoe, Dumfries DG1 1SY Hon. Membership Secretary Mr S. McCulloch, 28 Main Street, New Abbey, Dumfries DG2 8BY Hon. Treasurer Mrs A. Weighill Hon. Librarian Mr R. Coleman, 2 Loreburn Park, Dumfries DG1 1LS Hon. Institutional Subscriptions Secretary Mrs A. Weighill Hon. Editors Mrs E. Kennedy, Nether Carruchan, Troqueer, Dumfries DG2 8LY Dr J. Foster (Webmaster), 21 Maxwell Street, Dumfries DG2 7AP Hon. Syllabus Conveners Miss S. Ratchford, Tadorna, Hollands Farm Road, Caerlaverock, Dumfries DG1 4RS Mrs A. Clarke, 4 Redhall Road, Templand, Lockerbie DG11 1TF Hon. Curators Mrs J. Turner and Miss S. Ratchford Hon. Outings Organisers Mr D. Dutton Ordinary Members Dr Jeanette Brock, Mr D. Scott and Mr J. McKinnell CONTENTS A Case of Mistaken Identity? Monenna and Ninian in Galloway and the Central Belt by Oisin Plumb .................................................................. 9 Angles and Britons around Trusty’s Hill: some onomastic considerations by Alan James ....................................................................................................