Stranded Assets and the Fossil Fuel Divestment Campaign: What Does Divestment Mean for the Valuation of Fossil Fuel Assets?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Climate Coalition

Log in Page Discussion Read View source View history Search SourceWatch HELP CMD SHINE A LIGHT ON What Is CMD? CORRUPTION! Donate Here ALEC Exposed Outsourcing America Thanks to a $50,000 challenge grant, your gift will be matched 1- Exposed Koch Exposed to-1, so every dollar you give today will go twice as far! FrackSwarm CoalSwarm NFIB Exposed GIVE TODAY! Fix the Debt State Policy Network Recent Changes Global Climate Coalition Random page The Global Climate Coalition (GCC) was one of the most outspoken How To and confrontational industry groups in the United States battling Learn more from the Sign Up to Edit Center for Media and reductions in greenhouse gas emissions. Prior to its disbanding in early Democracy's research Contact Us 2002, it collaborated extensively with a network that included industry on climate change. Help Write History Research Corporations trade associations, "property rights" groups affiliated with the anti- Edit an Article environmental Wise Use movement, and fringe groups such as Correct Errors This article is Sovereignty International, which believes that global warming is a plot to part of the Search Effectively enslave the world under a United Nations-led "world government." Center for Media Find FAQs & Democracy's Explore Our Index Contents spotlight on front groups and Blow the Whistle 1 Personnel corporate spin. Find the Home Page 2 History Other Info 3 Excerpts from the GCC web site 4 Funding About SourceWatch About PRWatch 5 Internal Documents Search Categories 6 Case Studies Random Article 7 Contact Information 8 Other SourceWatch Related Resources Other Policies 9 External links Ground Rules Disclaimers Copyright Info Personnel Ads Glenn Kelly, Executive Director Gail McDonald, President William O'Keefe, Chairman, an executive for the American Petroleum Institute Tools Frank Maisano, Media Contact, is a member of the Potomac Communications Group, whose other clients What links here include Con Edison, the Edison Electric Institute, the Nuclear Energy Institute, the U.S. -

Media Locks in the New Narrative

7. Influences on a changed story and the new normal: media locks in the new narrative It was the biggest, most powerful spin campaign in Australian media history—the strategy was to delay action on greenhouse gas emissions until ‘coal was ready’—with geo-sequestration (burying carbon gases) and tax support. Alan Tate, ABC environment reporter 1990s On 23 September 2013 the Australian Broadcasting Corporation (ABC) program Media Watch explored a textbook example of why too many Australians and their politicians continue to stumble through a fog of confusion and doubt in regard to climate change. The case under the microscope typified irresponsible journalism. Media Watch host Paul Barry, with trademark irony, announced: ‘Yes it’s official at last … those stupid scientists on the Intergovernmental Panel on Climate Change [IPCC] got it wrong’, in their latest assessment report. He quoted 2GB breakfast jock Chris Smith from a week earlier saying the IPCC had ‘fessed up’ that its computers had drastically overestimated rising temperatures. ‘That’s a relief,’ said Barry, and how do we know this? ‘Because Chris Smith read it on the front page of last Monday’s Australian newspaper. When it comes to rubbishing the dangers of man-made global warming the shock jocks certainly know who they can trust.’ But wait. The Australian’s story by Environment Editor Graham Lloyd—‘We got it wrong on warming says IPCC’ was not original either. According to Media Watch, Lloyd appeared to have based his story on a News Limited sister publication from the United Kingdom. Said Barry: ‘He’d read all about it in the previous day’s Mail on Sunday,’ which had a story headlined ‘The great green con’. -

Capital Markets: Talking Points the Rise of Non-Bank Infrastructure Project Finance 3 Contents

www.pwc.com/capitalprojectsandinfrastructure Capital Markets: Talking Points The Rise of Non-Bank Infrastructure Project Finance 3 Contents Executive Summary 1 Introduction 2 Some Banks Have Steadily Reduced Exposure to the Market 3 The Rise of Infrastructure Project Bonds and Non-bank Lending 4 Four Prerequisites 6 Market Segmentation 10 Green 11 Amber/Green 17 Amber 18 Red 20 Conclusion 22 Contacts 23 4 Executive Summary governments and project sponsors about how best to access the capital markets for infrastructure projects. This paper seeks to provide some clarity to the project bond concept. Firstly we have identified four critical preconditions that we think must exist for a project bond In recent years we’ve all seen market to take root: significant changes to the financing available capital outside of the of large-scale infrastructure projects 1 banking system; around the globe. The traditional route of long-term bank debt is still 2 sufficient governance and available in some markets. But transparency in financial reporting; with stiffer banking regulation, 3 Balanced tax and commercial it is questionable whether it can policies; and keep up should the project pipeline 4 project specific mechanisms to significantly expand. In many support credit quality. regions, institutional project debt may fill this need. Delineating this list allows governments to see where policy reform is required We believe that capital markets and how they should prioritise their involvement in financing infrastructure efforts if they wish to create a stronger projects outside of North America has now environment for infrastructure project reached a tipping point and will steadily bonds. -

Divestment May Burst the Carbon Bubble If Investors' Beliefs Tip To

Divestment may burst the carbon bubble if investors’ beliefs tip to anticipating strong future climate policy Birte Ewers,1;2;∗ Jonathan F. Donges,1;3;∗;# Jobst Heitzig1, Sonja Peterson4 1Potsdam Institute for Climate Impact Research, Member of the Leibniz Association, P.O. Box 60 12 03, 14412 Potsdam, Germany 2Department of Economics, University of Kiel, Olshausenstraße 40, 24098 Kiel, Germany 3Stockholm Resilience Centre, Stockholm University, Kraftriket¨ 2B, 114 19 Stockholm, Sweden 4Kiel Institute for the World Economy, Kiellinie 66, 24105 Kiel, Germany ∗The first two authors share the lead authorship. #To whom correspondence should be addressed; E-mail: [email protected] February 21, 2019 To achieve the ambitious aims of the Paris climate agreement, the majority of fossil-fuel reserves needs to remain underground. As current national govern- ment commitments to mitigate greenhouse gas emissions are insufficient by far, actors such as institutional and private investors and the social movement on divestment from fossil fuels could play an important role in putting pressure on national governments on the road to decarbonization. Using a stochastic arXiv:1902.07481v1 [q-fin.GN] 20 Feb 2019 agent-based model of co-evolving financial market and investors’ beliefs about future climate policy on an adaptive social network, here we find that the dy- namics of divestment from fossil fuels shows potential for social tipping away from a fossil-fuel based economy. Our results further suggest that socially responsible investors have leverage: a small share of 10–20 % of such moral investors is sufficient to initiate the burst of the carbon bubble, consistent with 1 the Pareto Principle. -

IPO Or Divestiture: Making Informed Decisions

IPO or divestiture: Making informed decisions By Yael Woodward Amaral, Partner, Accounting Advisory, KPMG in Canada To divest or go public. It is a simple proposition with complex considerations. No doubt, pursuing an initial public offering (IPO) is a viable option for private equity (PE) funds looking to raise cash from a portfolio asset they are not ready to part ways with, but like any major portfolio decision, it pays to go in with eyes wide open. Taking the IPO journey has its merits. Current market “ Going public is not a panacea for conditions are making it more difficult for funds to operate on a debt leverage model approach at the same levels of return. difficult times. As anyone who has As such, going public may be a mechanism to extract capital ventured down the IPO path can from the asset while maintaining ownership. attest, it only means trading one set of challenges for another.” The true cost of going public Even still, going public is not a panacea for difficult times. Economy of scale As anyone who has ventured down the IPO path can attest, It is one thing to say your organization wants to be public it only means trading one set of challenges for another. and another to be ready for the costs, compliance, and Whether raising a million dollars or a billion, going public public scrutiny that entails. The massive shift in the reporting means becoming beholden to new rules, processes, public environment alone can be a significant challenge for the shareholders and regulators. This can be unfamiliar territory under-prepared, as it demands significant financial reporting for funds that are used to working in a more autonomous capabilities, controls, IT infrastructure, human resource environment and selling acquisitions when the numbers deem considerations and governance that simply cannot be it best. -

Project Finance in Theory and Practice

Project Finance in Theory and Practice This page intentionally left blank Project Finance in Theory and Practice Designing, Structuring, and Financing Private and Public Projects Stefano Gatti AMSTERDAM • BOSTON • HEIDELBERG • LONDON NEW YORK • OXFORD • PARIS • SAN DIEGO SAN FRANCISCO • SINGAPORE • SYDNEY • TOKYO Academic Press is an imprint of Elsevier Academic Press is an imprint of Elsevier 30 Corporate Drive, Suite 400, Burlington, MA 01803, USA 525 B Street, Suite 1900, San Diego, California 92101-4495, USA 84 Theobald’s Road, London WCIX 8RR, UK This book is printed on acid-free paper. Copyright ß 2008, Elsevier Inc. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopy, recording, or any information storage and retrieval system, without permission in writing from the publisher. Permissions may be sought directly from Elsevier’s Science & Technology Rights Department in Oxford, UK: phone: (+44) 1865 843830, fax: (+44) 1865 853333, E-mail: [email protected]. You may also complete your request on-line via the Elsevier homepage (http://elsevier.com), by selecting ‘‘Support & Contact’’ then ‘‘Copyright and Permission’’ and then ‘‘Obtaining Permissions.’’ Library of Congress Cataloging-in-Publication Data Application Submitted British Library Cataloguing-in-Publication Data A catalogue record for this book is available from the British Library. ISBN 13: 978-0-12-373699-4 For information on all Academic Press publications visit -

Mexican CEL Ruling Roils Market by Carlos Campuzano and Alejandro Aguirre, in Mexico City, and Raquel Bierzwinsky, in New York

December 2019 Mexican CEL Ruling Roils Market by Carlos Campuzano and Alejandro Aguirre, in Mexico City, and Raquel Bierzwinsky, in New York More than 20 requests for injunctions have been filed by generators, industry associations and other interested parties in Mexico to challenge a government ruling that modifies who is entitled to receive clean energy certificates or “CELs” for generating renewable energy. CELs were created as part of the 2014 energy reforms to give electricity generators an incentive to use clean energy sources to produce electricity. For each megawatt hour of clean energy generated, a generator is entitled to one CEL. Suppliers of electricity to retail customers, including CFE Basic Supply — a subsidiary of CFE, the national utility — are legally required to supply a certain percentage of their electricity from clean energy sources. They comply by buying CELs. The annual requirement for 2018 was 5%. For 2019, 2020, 2021 and 2022, it increases to 5.8%, 7.4%, 10.9% and 13.9%, respectively. The administration and verification of CELs is managed by the Energy Regulatory Commission via an electronic system that records the CELs acquired or generated by each registered participant, their transfer to other participants, and the final cancellation upon use to comply with statutory obligations. By statute, only generators producing energy from clean energy sources whose power plants started operations after August 11, 2014 are entitled to receive CELs. However, the Ministry of Energy issued in late October a ruling that entitles all clean energy IN THIS ISSUE power plants owned by CFE to receive CELs for the energy produced, / continued page 2 1 Mexican CEL Ruling Roils Market 3 Financing EV Charging Infrastructure 8 US Offshore Wind: Current A TAX EQUITY PARTNERSHIP between a regulated utility and a tax equity Financing Conditions investor received a partial blessing from the IRS. -

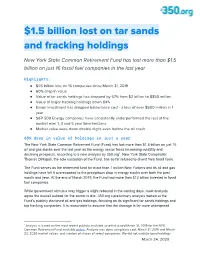

$1.5 Billion Lost on Tar Sands and Fracking Holdings

$1.5 billion lost on tar sands and fracking holdings New York State Common Retirement Fund has lost more than $1.5 billion on just 16 fossil fuel companies in the last year Highlights: ● $1.5 billion loss on 16 companies since March 31, 2019 ● 60% drop in value ● Value of tar sands holdings has dropped by 57% from $2 billion to $850 million ● Value of major fracking holdings down 84% ● Exxon investment has dropped below base cost - a loss of over $500 million in 1 year ● S&P 500 Energy companies have consistently underperformed the rest of the market over 1, 3 and 5 year time horizons ● Market value were down double digits even before the oil crash 60% drop in value of holdings in just a year The New York State Common Retirement Fund (Fund) has lost more than $1.5 billion on just 16 oil and gas stocks over the last year as the energy sector faces increasing volatility and declining prospects, according to a new analysis by 350.org1. New York State Comptroller Thomas DiNapoli, the sole custodian of the Fund, has so far refused to divest from fossil fuels. The Fund serves as the retirement fund for more than 1 million New Yorkers and its oil and gas holdings have left it overexposed to the precipitous drop in energy stocks over both the past month and year. At the end of March 2019, the Fund had more than $13 billion invested in fossil fuel companies. While government stimulus may trigger a slight rebound in the coming days, most analysts agree the overall outlook for the sector is dim. -

Legal Regulation of Aircraft Engine Emissions in the Age of Climate Change

Legal Regulation of Aircraft Engine Emissions in the Age of Climate Change by Jin Liu A thesis submitted to University College London for the degree of Doctor of Philosophy June 2011 Faculty of Laws UCL 1 I, Jin Liu confirm that the work presented in this thesis is my own. Where information has been derived from other sources, I confirm that this has been indicated in the thesis. _____________________________________ Jin Liu 2 Abstract Although the contribution of international civil aviation to climate change seems small (with a global share of just 3.5 percent of emissions of CO 2), the projected growth in air traffic means that it is highly significant. There is thus an urgent need to explore legal regulations for limiting and/or reducing the adverse impacts of aircraft emissions on the environment. This thesis examines the progress which has been made on international aviation emissions abatement and provides an analysis of the reasons for delay. It concludes that the contribution of aviation to climate change is a multi-scalar problem and as such neither conventional top-down international legal regimes, nor any single regulatory instrument can solve it. The research question for this thesis is how to break the deadlock of conventional legal approaches and overcome the barriers to international aviation greenhouse gas emissions abatement. New governance theory provides the theory within which the future of aviation emissions regulation has been explored. Drawing on the scholarly literature on new governance, this thesis argues for a multi-scalar regulatory architecture which simultaneously engages multi-level governance, and a multi-party and multi-instrument approach to the problem. -

Global Corporate Divestment Study

2014 | ey.com/transactions EY | Assurance | Tax | Transactions | Advisory About EY GlobalEY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our Corporateclients and for our communities. EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information Divestmentabout our organization, please visit ey.com. Study About EY’s Transaction Advisory Services How you manage your capital agenda today will define Strategicyour competitive position tomorrow. divestments We work with clients to create social and economic value by helping them make better, more informed decisions about strategically managing capital and transactions in fast-changing drivemarkets. Whether value you’re preserving, optimizing, raising or investing capital, EY’s Transaction Advisory Services combine a unique set of skills, insight and experience to deliver focused advice. We help you drive competitive advantage and increased returns through improved decisions across all aspects of your capital agenda. © 2014 EYGM Limited. All Rights Reserved. EYG no. DE0493 ED 0115 This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. -

Fair Play? What Are the Odds on Sustainable Gambling?

greenfutures No.83 January 2012 Fair play? What are the odds on sustainable gambling? Meet Paul Polman, the man who wants to reinvent consumption It’s 2032: print some energy and drink the sea Jeremy Rifkin: imagine the internet, only for energy About Us greenfutures Green Futures is the leading international partners the opportunity to place themselves Published by magazine on environmental solutions at the heart of the debate. They enjoy and sustainable futures. It was founded privileged access to the expertise of the by Jonathon Porritt in 1996 to showcase Green Futures team and Forum for the examples of practical and desirable change, Future as a whole, as well as targeted free Editor in Chief MARTIN WRIGHT and is published by Forum for the Future. subscriptions and advertising opportunities. Our readership includes key decision- Managing Editor makers and opinion-formers in business, If you’d like to join us as a partner, please ANNA SIMPSON government, education and non-profit contact Katie Shaw: 020 7324 3660; Editorial and Marketing Coordinator organisations. [email protected] KATIE SHAW We work with a select group of partners who demonstrate a strong commitment Read Green Futures online: Design THE URBAN ANT LTD to sustainable development. In return www.greenfutures.org.uk “Hope and optimism – in spite of present difficulties.” for a contribution towards the cost of This old African saying, made famous by Namibian artist John Muafangejo, seems Founder producing Green Futures, we offer our @GreenFutures pretty apt just now. Even those of us who resolutely see the glass as half full only have JONATHON PORRITT to glance at the news to wonder if, after all, we’re pretty much down to the dregs. -

Pump up the Volume

PUMP UP THE VOLUME BRIngIng down costs and IncReasIng JoBs In the offshoRe wInd sectoR report Clare McNeil, Mark Rowney and Will Straw July 2013 © IPPR 2013 Institute for Public Policy Research AbOUT THE AUTHOrs Clare McNeil is a senior research fellow at IPPR. Mark rowney is a research fellow at IPPR. Will Straw is associate director for climate change, energy and transport at IPPR. AcknOwLEdgMEnTs the authors would like to thank Richard howard and adrian fox of the crown estate, Paul Reynolds from gL garrad hassan, Bruce Valpy from BVg associates, and aram w ood at statkraft for comments on an earlier draft of the report. we are also grateful to our IPPR colleagues graeme cooke, tony dolphin, Rick Muir, nick Pearce and Reg Platt for their comments. all of the views contained in this report are those of the authors and any errors remain ours alone. we owe a debt of gratitude to people at many organisations with whom we spoke over the course of the research. this includes alstom, the carbon trust, climate change capital, the committee on climate change, the crown estate, the danish wind Industry association, the danish embassy in London, dong energy, the energy technologies Institute, the german offshore wind energy foundation, greenpeace, Mainstream Renewable Power, Rwe, siemens UK, tata steel, the tUc, Vestas, and gL garrad hassan. thanks also to a number of civil servants across the government who engaged with us over the course of the project. thanks finally to sian ferguson at ashden trust and to gordon edge, nick Medic, Maf smith and Jennifer webber at RenewableUK for their kind sponsorship of this project and guidance throughout.