Sheffield Haworth Intelligence Report 2018 Wealth Management Review Market Commentary, Analysis and Key Executive Moves

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Brewin Dolphin Select Managers Fund

MI Brewin Dolphin Select Managers Fund Annual Report 28 February 2019 MI Brewin Dolphin Select Managers Fund Contents Page Directory* . 1 Statement of the Authorised Corporate Director’s Responsibilities . 2 Certification of the Annual Report by the Authorised Corporate Director . 2 Statement of the Depositary’s Responsibilities . 3 Independent Auditor’s Report to the Shareholders . 4 MI Select Managers Bond Fund Investment Objective and Policy* . 6 Investment Adviser's Report* . 6 Portfolio Statement* . 8 Comparative Table* . 24 Statement of Total Return . 26 Statement of Change in Net Assets Attributable to Shareholders . 26 Balance Sheet . 27 Notes to the Financial Statements . 28 Distribution Table . 40 MI Select Managers North American Equity Fund Investment Objective and Policy* . 41 Investment Adviser's Report* . 41 Portfolio Statement* . 43 Comparative Tables* . 49 Statement of Total Return . 51 Statement of Change in Net Assets Attributable to Shareholders . 51 Balance Sheet . 52 Notes to the Financial Statements . 53 Distribution Tables . 60 MI Select Managers UK Equity Fund Investment Objective and Policy* . 61 Investment Adviser's Report* . 61 Portfolio Statement* . 63 Comparative Tables* . 72 Statement of Total Return . 74 Statement of Change in Net Assets Attributable to Shareholders . 74 Balance Sheet . 75 Notes to the Financial Statements . 76 Distribution Tables . 83 MI Select Managers UK Equity Income Fund Investment Objective and Policy* . 84 Investment Adviser's Report* . 84 Portfolio Statement* . 86 Comparative Tables* . 92 Statement of Total Return . 94 Statement of Change in Net Assets Attributable to Shareholders . 94 Balance Sheet . 95 Notes to the Financial Statements . 96 Distribution Tables . 103 General Information* . 104 *These collectively comprise the Authorised Corporate Director’s Report. -

The Charles Schwab Corporation (Exact Name of Registrant As Specified in Its Charter)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): May 22, 2019 The Charles Schwab Corporation (Exact name of registrant as specified in its charter) Commission File Number: 1-9700 Delaware 94-3025021 (State or other jurisdiction (I.R.S. Employer of incorporation) Identification No.) 211 Main Street, San Francisco, CA 94105 (Address of principal executive offices, including zip code) (415) 667-7000 (Registrant’s telephone number, including area code) N/A (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock – $.01 par value per share SCHW New York Stock Exchange Depositary Shares, each representing a 1/40th ownership interest in a share of 6.00% Non-Cumulative Preferred Stock, Series C SCHW PrC New York Stock Exchange Depositary Shares, each representing a 1/40th ownership interest in a share of 5.95% Non-Cumulative Preferred Stock, Series D SCHW PrD New York Stock Exchange Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). -

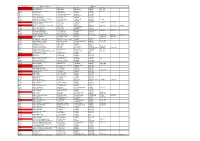

Banks List (May 2011)

LIST OF BANKS AS COMPILED BY THE FSA ON 31 MAY 2011 This list of banks is intended to be used solely as a guide. The FSA does not warrant, nor accept any responsibility for the accuracy or completeness of the list or for any loss which may arise from reliance by any person on information in the list. (Amendments to the List of Banks since 30 April 2011 can be found on page 6) Banks incorporated in the United Kingdom Abbey National Treasury Services plc DB UK Bank Limited ABC International Bank plc Dunbar Bank plc Access Bank UK Limited, The Duncan Lawrie Ltd Adam & Company plc Ahli United Bank (UK) plc EFG Private Bank Ltd Airdrie Savings Bank Egg Banking plc Aldermore Bank Plc European Islamic Investment Bank Plc Alliance & Leicester plc Europe Arab Bank Plc Alliance Trust Savings Ltd Allied Bank Philippines (UK) plc FBN Bank (UK) Ltd Allied Irish Bank (GB)/First Trust Bank - (AIB Group (UK) plc) FCE Bank plc Alpha Bank London Ltd FIBI Bank (UK) plc AMC Bank Ltd Anglo-Romanian Bank Ltd Gatehouse Bank plc Ansbacher & Co Ltd Ghana International Bank plc ANZ Bank (Europe) Ltd Goldman Sachs International Bank Arbuthnot Latham & Co, Ltd Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Ltd Banc of America Securities Ltd Bank Leumi (UK) plc Habib Allied International Bank plc Bank Mandiri (Europe) Ltd Habibsons Bank Ltd Bank of Beirut (UK) Ltd Hampshire Trust plc Bank of Ceylon (UK) Ltd Harrods Bank Ltd Bank of China (UK) Limited Havin Bank Ltd Bank of Ireland (UK) Plc HFC Bank Ltd Bank of London and The Middle East plc HSBC Bank -

Annual Review 2018 About Us Our Purpose Is to Help Britain Prosper

Lloyds Banking Group Annual Review 2018 About us Our purpose is to Help Britain Prosper. We are the largest UK retail financial services provider with around 26 million customers and a presence in nearly every community. We are transforming the business into The Group’s main business activities are retail and commercial banking, general a digitised, simple, low risk, financial insurance and long-term savings, provided under well recognised brands including Lloyds Bank, Halifax, Bank of Scotland and services provider whilst creating a Scottish Widows. Our shares are quoted on the London responsible business that focuses on and New York stock exchanges and we are one of the largest companies in the customers’ needs. This is key to our FTSE 100 index. long-term success and to fulfilling Reporting Just as we operate in an integrated way, our aim to become the best bank for we aim to report in an integrated way. customers, colleagues and shareholders. We have taken further steps towards this goal this year. As well as reporting our Business model on financial results, we also report on our pages 10 to 11 approach to operating responsibly and take into account relevant economic, political, social, regulatory and environmental factors. This Annual Review contains forward looking statements with respect to certain of the Group’s plans and its current goals and expectations relating to its future financial condition, performance, results, strategic initiatives and objectives. For further details, reference should be made to the forward looking statements on page 45. This icon appears throughout Inside this year’s Annual Review this report highlighting how we are Helping Britain Prosper. -

Reference Banks / Finance Address

Reference Banks / Finance Address B/F2 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F262 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F57 Abbey National Treasury Services Abbey House Baker Street LONDON NW1 6XL B/F168 ABN Amro Bank 199 Bishopsgate LONDON EC2M 3TY B/F331 ABSA Bank Ltd 52/54 Gracechurch Street LONDON EC3V 0EH B/F175 Adam & Company Plc 22 Charlotte Square EDINBURGH EH2 4DF B/F313 Adam & Company Plc 42 Pall Mall LONDON SW1Y 5JG B/F263 Afghan National Credit & Finance Ltd New Roman House 10 East Road LONDON N1 6AD B/F180 African Continental Bank Plc 24/28 Moorgate LONDON EC2R 6DJ B/F289 Agricultural Mortgage Corporation (AMC) AMC House Chantry Street ANDOVER Hampshire SP10 1DE B/F147 AIB Capital Markets Plc 12 Old Jewry LONDON EC2 B/F290 Alliance & Leicester Commercial Lending Girobank Bootle Centre Bridal Road BOOTLE Merseyside GIR 0AA B/F67 Alliance & Leicester Plc Carlton Park NARBOROUGH LE9 5XX B/F264 Alliance & Leicester plc 49 Park Lane LONDON W1Y 4EQ B/F110 Alliance Trust Savings Ltd PO Box 164 Meadow House 64 Reform Street DUNDEE DD1 9YP B/F32 Allied Bank of Pakistan Ltd 62-63 Mark Lane LONDON EC3R 7NE B/F134 Allied Bank Philippines (UK) plc 114 Rochester Row LONDON SW1P B/F291 Allied Irish Bank Plc Commercial Banking Bankcentre Belmont Road UXBRIDGE Middlesex UB8 1SA B/F8 Amber Homeloans Ltd 1 Providence Place SKIPTON North Yorks BD23 2HL B/F59 AMC Bank Ltd AMC House Chantry Street ANDOVER SP10 1DD B/F345 American Express Bank Ltd 60 Buckingham Palace Road LONDON SW1 W B/F84 Anglo Irish -

Brookfield Asset Management 2017 Year End Conference Call & Webcast Thursday, February 15, 2018 – 11:00 AM ET

Brookfield Asset Management 2017 Year End Conference Call & Webcast Thursday, February 15, 2018 – 11:00 AM ET CORPORATE PARTICIPANTS Suzanne Fleming Managing Partner, Branding & Communications Brian Lawson Chief Financial Officer Bruce Flatt Chief Executive Officer CONFERENCE CALL PARTICIPANTS Cherilyn Radbourne TD Securities Ann Dai KBW Mario Saric Scotiabank Andrew Kuske Credit Suisse PRESENTATION Operator Thank you for standing by. This is the conference operator. Welcome to the Brookfield Asset Management 2017 Year End Conference Call and Webcast. As a reminder, all participants are in listen-only mode and the conference is being recorded. After the presentation, there will be an opportunity to ask questions. To join the question queue, you may press star then one on your telephone keypad. Should you need assistance during the conference call you may signal an operator by pressing star and zero. I would like to turn the conference call over to Suzanne Fleming, Managing Partner, Branding and Communications. Please go ahead, Ms. Fleming. Suzanne Fleming, Managing Partner, Branding & Communications Thank you, operator, and good morning. Welcome to Brookfield’s 2017 year-end conference call. On the call today are Bruce Flatt, our Chief Executive Officer, and Brian Lawson, our Chief Financial Officer. Brian will start off by discussing the highlights of our financial and operating results for the quarter and the year and Bruce will then give a business update. After our formal comments we’ll turn the call over to the operator and take your questions. In order to accommodate all those who would like to ask questions, we ask that you refrain from asking multiple questions at one time in order to provide an opportunity for others in the queue. -

Giving Private Banking a Stroke of Elegance

PRIVATE BANKER May 2015 Issue 320 www.privatebankerinternational.com On track for digital wellness • Interview: Arbuthnot Latham's James Fleming • PBI London Awards: Preview • Interview: Lombard Odier's Dominic Tremlett • Country survey: France PBI 320.indd 1 22/05/2015 20:11:30 Join thousands of financial services Intelligent Environments, the international professionals who have joined The provider of digital solutions in association with Retail Banker International, Digital Banking Club to understand Cards International, Electronic and discuss the future of mobile and Payments International, Private Banker online financial services International and Motor Finance Membership benefits 10% discount on Delegate passes for Motor Finance and Private Banking UK conferences Annual Subscription to Retail Banker International, Cards International, Electronic Payments International, Motor Finance and Private Banker International publications (new subscribers only) World Market Intelligence Ltd’s archive of over 250 Retail Banking, Private Banking and Cards and Payments research reports (for new report purchasers only) Annual subscription to Retail Banking Intelligence Centre and Wealth Insight Intelligence database (new subscribers only) World Market Intelligence Ltd’s bespoke research and consultancy services For further information please email: [email protected] Join The Club! www.thedigitalbankingclub.com Or For further information please email: [email protected] PBI 320.indd 2 22/05/2015 20:11:30 TDBC-Advert-Dec-2014.indd 1 19/01/2015 09:03:48 Private Banker International EDITOR’S LETTER ANALYSIS CONTENTS London state of mind NEWS Join thousands of financial services Intelligent Environments, the international 2: NEWS BRIEFS hese are exciting times for wealth exposure. provider of digital solutions in association management in the UK. -

Research Institute

June 2021 Research Institute Global wealth report 2021 Thought leadership from Credit Suisse and the world’s foremost experts Introduction Now in its twelfth year, I am proud to present to you the 2021 edition of the Credit Suisse Global Wealth Report. This report delivers a comprehensive analysis on available global household wealth, underpinned by unique insights from leading academics in the field, Anthony Shorrocks and James Davies. This year’s edition digs deeper into the impact of the COVID-19 pandemic and the response of policymakers on global wealth and its distribution. Mindful of the important wealth differences that have built over the last year, our report also offers perspectives and, indeed, encouraging prospects, for wealth accumulation throughout the global wealth pyramid as we look to a world beyond the pandemic. I hope you find the insights of this edition of the Global Wealth Report to be of particular value in what remain unprecedented times. António Horta-Osório Chairman of the Board of Directors Credit Suisse Group AG 2 02 Editorial 05 Global wealth levels 2020 17 Global wealth distribution 2020 27 Wealth outlook for 2020–25 35 Country experiences 36 Canada and the United States 38 China and India 40 France and the United Kingdom 42 Germany, Austria and Switzerland 44 Denmark, Finland, Norway and Sweden 46 Japan, Korea, Singapore and Taiwan (Chinese Taipei) 48 Australia and New Zealand 50 Nigeria and South Africa 52 Brazil, Chile and Mexico 54 Greece, Italy and Spain 56 About the authors 57 General disclaimer / important -

Meet Our Speakers

MEET OUR SPEAKERS DEBRA ABRAMOVITZ Morgan Stanley Debra Abramovitz is an Executive Director of Morgan Stanley and serves as Chief Operating Officer of Morgan Stanley Expansion Capital. Debra oversees all financial, administrative, investor relations and operational activities for Morgan Stanley Expansion Capital, and its predecessor Morgan Stanley Venture Partners funds. Debra also serves as COO of Morgan Stanley Credit Partners. Debra joined Morgan Stanley’s Finance Department in 1983 and joined Morgan Stanley Private Equity in 1988, with responsibility for monitoring portfolio companies. Previously, Debra was with Ernst & Young. Debra is a graduate of American University in Paris and the Columbia Business School. JOHN ALLAN-SMITH Barclays Americas John Allan-Smith leads the US Funds team for Corporate Banking at Barclays and is responsible for coordinating the delivery of products and services from our global businesses; ranging from debt, FX solutions, cash management and trade finance, to working capital lending and liquidity structures. John joined Barclays in 2014 and has 20 years of experience in the funds sector. Prior to joining Barclays, John worked at The Royal Bank of Scotland (RBS) in London, Stockholm and New York, spending 10 years in the RBS Leveraged Finance team. Subsequently, John had responsibility for the portfolios and banking sector of the Non-Core division of RBS in the Americas. John holds an ACA qualification from the Institute of Chartered Accountants of England and Wales and is a qualified accountant. He also has a BSc (Hons) in Chemistry from The University of Nottingham. ROBERT ANDREWS Ashurst LLP Robert is a partner in the banking group at Ashurst and is one of the most experienced funds finance specialists in Europe. -

Bank of England List of Banks- October 2020

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 1st October 2020 (Amendments to the List of Banks since 31st August 2020 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The Distribution Finance Capital Limited Ahli United Bank (UK) PLC AIB Group (UK) Plc EFG Private Bank Limited Al Rayan Bank PLC Europe Arab Bank plc Aldermore Bank Plc Alliance Trust Savings Limited (Applied to Cancel) FBN Bank (UK) Ltd Allica Bank Ltd FCE Bank Plc Alpha Bank London Limited FCMB Bank (UK) Limited Arbuthnot Latham & Co Limited Atom Bank PLC Gatehouse Bank Plc Axis Bank UK Limited Ghana International Bank Plc GH Bank Limited Bank and Clients PLC Goldman Sachs International Bank Bank Leumi (UK) plc Guaranty Trust Bank (UK) Limited Bank Mandiri (Europe) Limited Gulf International Bank (UK) Limited Bank Of Baroda (UK) Limited Bank of Beirut (UK) Ltd Habib Bank Zurich Plc Bank of Ceylon (UK) Ltd Hampden & Co Plc Bank of China (UK) Ltd Hampshire Trust Bank Plc Bank of Ireland (UK) Plc Handelsbanken PLC Bank of London and The Middle East plc Havin Bank Ltd Bank of New York Mellon (International) Limited, The HBL Bank UK Limited Bank of Scotland plc HSBC Bank Plc Bank of the Philippine Islands (Europe) PLC HSBC Private Bank (UK) Limited Bank Saderat Plc HSBC Trust Company (UK) Ltd Bank Sepah International Plc HSBC UK Bank Plc Barclays Bank Plc Barclays Bank UK PLC ICBC (London) plc BFC Bank Limited ICBC Standard Bank Plc Bira Bank Limited ICICI Bank UK Plc BMCE Bank International plc Investec Bank PLC British Arab Commercial Bank Plc Itau BBA International PLC Brown Shipley & Co Limited JN Bank UK Ltd C Hoare & Co J.P. -

List of British Entities That Are No Longer Authorised to Provide Services in Spain As from 1 January 2021

LIST OF BRITISH ENTITIES THAT ARE NO LONGER AUTHORISED TO PROVIDE SERVICES IN SPAIN AS FROM 1 JANUARY 2021 Below is the list of entities and collective investment schemes that are no longer authorised to provide services in Spain as from 1 January 20211 grouped into five categories: Collective Investment Schemes domiciled in the United Kingdom and marketed in Spain Collective Investment Schemes domiciled in the European Union, managed by UK management companies, and marketed in Spain Entities operating from the United Kingdom under the freedom to provide services regime UK entities operating through a branch in Spain UK entities operating through an agent in Spain ---------------------- The list of entities shown below is for information purposes only and includes a non- exhaustive list of entities that are no longer authorised to provide services in accordance with this document. To ascertain whether or not an entity is authorised, consult the "Registration files” section of the CNMV website. 1 Article 13(3) of Spanish Royal Decree-Law 38/2020: "The authorisation or registration initially granted by the competent UK authority to the entities referred to in subparagraph 1 will remain valid on a provisional basis, until 30 June 2021, in order to carry on the necessary activities for an orderly termination or transfer of the contracts, concluded prior to 1 January 2021, to entities duly authorised to provide financial services in Spain, under the contractual terms and conditions envisaged”. List of entities and collective investment -

We Understand the Value of Global Connections. Do You?

We understand the value of global connections. Do you? China Student and graduate careers 2014-2015 We’re inspired by the way the world is changing Across the world, economic growth is bringing new prosperity. Businesses are pioneering new trade routes and new centres of wealth and influence are emerging. We’re inspired by these changes and the opportunities they bring for our business, our employees and our customers. The best and brightest people are also excited by this progress. These are the people we are looking to connect with, because these people will help shape the future of HSBC. We have a proud history built on our values, which are reflected in everything we do. Our values are: to be open to different ideas and cultures, dependable in having the courage to make decisions based on doing the right thing without compromising our global standards and the integrity on which HSBC is built, and to be connected to our customers, communities, regulators and each other. It’s these values that define who we are. Achieve your potential at HSBC. www.hsbc.com/careers A world of knowledge and experience As one of the largest banking and financial services This ensures we are well positioned for long-term organisations in the world, with offices across more than sustainable growth and to make a positive contribution to 75 countries and territories, our long-term success has the environment and communities in which we operate. been built on the value of local knowledge and being where the growth is. See where your future could take you at HSBC.