Iiflwealth Hurun Indiarichlist2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

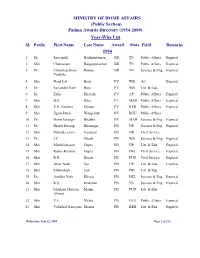

(Public Section) Padma Awards Directory (1954-2009) Year-Wise List Sl

MINISTRY OF HOME AFFAIRS (Public Section) Padma Awards Directory (1954-2009) Year-Wise List Sl. Prefix First Name Last Name Award State Field Remarks 1954 1 Dr. Sarvapalli Radhakrishnan BR TN Public Affairs Expired 2 Shri Chakravarti Rajagopalachari BR TN Public Affairs Expired 3 Dr. Chandrasekhara Raman BR TN Science & Eng. Expired Venkata 4 Shri Nand Lal Bose PV WB Art Expired 5 Dr. Satyendra Nath Bose PV WB Litt. & Edu. 6 Dr. Zakir Hussain PV AP Public Affairs Expired 7 Shri B.G. Kher PV MAH Public Affairs Expired 8 Shri V.K. Krishna Menon PV KER Public Affairs Expired 9 Shri Jigme Dorji Wangchuk PV BHU Public Affairs 10 Dr. Homi Jehangir Bhabha PB MAH Science & Eng. Expired 11 Dr. Shanti Swarup Bhatnagar PB UP Science & Eng. Expired 12 Shri Mahadeva Iyer Ganapati PB OR Civil Service 13 Dr. J.C. Ghosh PB WB Science & Eng. Expired 14 Shri Maithilisharan Gupta PB UP Litt. & Edu. Expired 15 Shri Radha Krishan Gupta PB DEL Civil Service Expired 16 Shri R.R. Handa PB PUN Civil Service Expired 17 Shri Amar Nath Jha PB UP Litt. & Edu. Expired 18 Shri Malihabadi Josh PB DEL Litt. & Edu. 19 Dr. Ajudhia Nath Khosla PB DEL Science & Eng. Expired 20 Shri K.S. Krishnan PB TN Science & Eng. Expired 21 Shri Moulana Hussain Madni PB PUN Litt. & Edu. Ahmed 22 Shri V.L. Mehta PB GUJ Public Affairs Expired 23 Shri Vallathol Narayana Menon PB KER Litt. & Edu. Expired Wednesday, July 22, 2009 Page 1 of 133 Sl. Prefix First Name Last Name Award State Field Remarks 24 Dr. -

In This Issue... Plus

Volume 18 No. 2 February 2009 12 in this issue... 6 Vibrant Gujarat 8 India Inc. at Davos 12 15th Partnership Summit 22 3rd Sustainability Summit 8 31 Defence Industry Seminar plus... n India Rubber Expo 2009 n The Power of Cause & Effect n India’s Tryst with Corporate Governance 22 n India & the World n Regional Round Up n And all our regular features We welcome your feedback and suggestions. Do write to us at 31 [email protected] Edited, printed and published by Director General, CII on behalf of Confederation of Indian Industry from The Mantosh Sondhi Centre, 23, Institutional Area, Lodi Road, New Delhi-110003 Tel: 91-11-24629994-7 Fax: 91-11-24626149 Email: [email protected] Website: www.cii.in Printed at Aegean Offset Printers F-17 Mayapuri Industrial Area, Phase II, New Delhi-110064 Registration No. 34541/79 JOURNAL OF THE Confederation OF INDIAN INDUSTRY 2 | February 2009 Communiqué Padma Vibhushan award winner Ashok S Ganguly Member, Prime Minister’s Council on Trade & Industry, Member India USA CEO Council, Member, Investment Commission, and Member, National Knowledge Commission Padma Bhushan award winners Shekhar Gupta A M Naik Sam Pitroda C K Prahalad Editor-in-Chief, Indian Chairman and Chairman, National Paul and Ruth McCracken Express Newspapers Managing Director, Knowledge Commission Distinguished University (Mumbai) Ltd. Larsen & Toubro Professor of Strategy Padma Shri award winner R K Krishnakumar Director, Tata Sons, Chairman, Tata Coffee & Asian Coffee, and Vice-Chairman, Tata Tea & Indian Hotels Communiqué February 2009 | 5 newsmaker event 4th Biennial Global Narendra Modi, Chief Minister, Gujarat, Mukesh Ambani, Chairman, Investors’ Summit 2009 Reliance Industries, Ratan Tata, Chairman, Tata Group, K V Kamath, President, CII, and Raila Amolo Odinga, Prime Minister, Kenya ibrant Gujarat, the 4th biennial Global Investors’ and Mr Ajit Gulabchand, Chairman & Managing Director, Summit 2009 brought together business leaders, Hindustan Construction Company Ltd, among several investors, corporations, thought leaders, policy other dignitaries. -

India Emerging As an Economic Superpower

IOSR Journal Of Humanities And Social Science (IOSR-JHSS) Volume 20, Issue 5, Ver. IV (May. 2015), PP 45-50 e-ISSN: 2279-0837, p-ISSN: 2279-0845. www.iosrjournals.org India Emerging as an Economic Superpower Himani Assistant Professor In Economics D.A.V. College For Girls, Yamuna Nagar Abstract: With nearly 1.1 billion inhabitants, India is the second largest country on earth in population, and seventh largest in geographical area, over 1.1 million square miles. This is almost 1,000 people for every square mile of area nationwide—much denser than even China. Since achieving independence from British rule in 1947, it has seen its share of conflict, struggle and setbacks. Although India still faces many challenges, it is now poised to reach a higher position on the world scene than at any previous time. The Indian economy has grown an average of around 6% annually over the past decade and 8% per year over the past three years— among the fastest rates in the world. It boasts an emerging middle class and increasing gross domestic product, exports, employment and foreign investment. This is complemented by a roaring stock market (index value up by a third in 2005 and by 200% since 2001), low external debt and large foreign exchange reserves. Recent visits from leaders and officials from the United States, France, Germany and Russia have spotlighted India‟s rise. These wealthier nations see India as a trading partner with enormous potential. Now the question is „Will India Become a Superpower?‟ This paper is an attempt to show that “Whether India is really becoming an economic super power or is it a myth?” I. -

Barclays Hurun India Rich List 2018

Rank Name Wealth INR crore Company Name Industry Residence 1 Mukesh Ambani 371,000 Reliance Industries Diversified Mumbai 2 SP Hinduja & family 159,000 Hinduja Diversified London 3 LN Mittal & family 114,500 ArcelorMittal Metals & Mining London 4 Azim Premji 96,100 Wipro Software & Services Bengaluru 5 Dilip Shanghvi 89,700 Sun Pharmaceutical Industries Pharmaceuticals Mumbai 6 Uday Kotak 78,600 Kotak Mahindra Bank Financial Services Mumbai 7 Cyrus S Poonawalla 73,000 Serum Institute of India Pharmaceuticals Pune 8 Gautam Adani & family 71,200 Adani Enterprises Diversified Ahmedabad 9 Cyrus Pallonji Mistry 69,400 Shapoorji Pallonji Investments Mumbai 9 Shapoor Pallonji Mistry 69,400 Shapoorji Pallonji Investments Monaco 11 Acharya Balkrishna 57,000 Patanjali Ayurved FMCG Haridwar 12 Nusli Wadia & family 56,100 Britannia Industries FMCG Mumbai 13 Rahul Bajaj & family 55,300 Bajaj Auto Automobile & Auto Components Pune 14 Sri Prakash Lohia 46,700 Indorama Chemicals & Petrochemicals London 15 Kumar Mangalam Birla 46,300 Aditya Birla Diversified Mumbai 15 Radhakishan Damani 46,300 Avenue Supermarts Retailing Mumbai 17 Adi Godrej 44,600 Godrej Consumer Durables Mumbai 17 Jamshyd Godrej 44,600 Godrej Consumer Durables Mumbai 17 Nadir Godrej 44,600 Godrej Consumer Durables Mumbai 17 Rishad Naoroji 44,600 Godrej Consumer Durables Mumbai 17 Smita V Crishna 44,600 Godrej Consumer Durables Mumbai 22 Benu Gopal Bangur & family 41,100 Shree Cement Cement & Cement Products Kolkata 23 Yusuff Ali MA 39,200 Lulu Retailing Abu Dhabi 24 Ajay Piramal 38,900 -

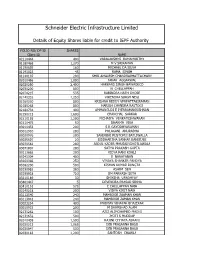

Schneider Electric Infrastructure Limited

SCHNEIDER ELECTRIC INFRASTRUCTURE LIMITED DIVIDEND FOR THE YEAR ENDED 31/03/2012 (BANK A/C NO.00032220004122 WITH HDFC) LIST OF UNPAID DIVIDEND WARRANTS AS ON 31/03/2017 FOLIO WNO CHQ AMOUNT NAME IN30014210488906 25994 20 800.00 GEORGE SEQUEIRA IN30023910648758 28793 21 40.00 PHILIP GEEVARGHESE THONDUPARAMPILE 01010144 12 22 18.00 UMA SHANKER AGARWAL 01010179 15 23 18.00 MOHD MATAHAR ALI 01010199 19 24 28.00 KADAICHEIRTTU PALANIAPPA AMIRTHA LINGAM 01010205 22 25 66.00 C T MEENAKSHI AMMAL 01010206 23 26 296.00 S SEETHAI AMMAL 01010207 24 27 794.00 V ANANTHALAKSHMI AMMAL 01010322 27 28 28.00 NATWARLAL MOHANLAL ASHRA 01010463 36 30 48.00 PREM CHAND AGRAWAL 01020114 65 32 36.00 ADITYA BARAN BANDOPADHYAY 01020119 66 33 18.00 DEBY SANKAR BANERJEE 01020721 122 36 130.00 SUDHIR BHATTACHARJEE 01020857 132 37 18.00 BONA BANERJEE 01020863 136 38 18.00 SONDHA RANI BAL 01030076 183 39 18.00 C JAGADEESH CHANDRA 01040168 254 41 70.00 RAM CHARAN DAS 01040223 261 42 358.00 ARUNKANT GIRDHARDAS DAWDA 01040396 275 44 48.00 PREM NATH DHANDA 01040397 276 45 24.00 PREM NATH DHANDA 01040419 279 46 48.00 SHIV DAYAL DHINGRA 01040493 286 47 28.00 KRISHAN LAL DUA 01040639 296 49 114.00 SUBHADRAN DEVI 01040811 306 50 48.00 SHANTI DEVI 01040889 311 51 48.00 BISHNUPRIYA DAS 01040893 315 52 18.00 SAROGINI DAS 01040901 321 53 48.00 SWAPAN CHANDRA DAS 01040912 322 54 30.00 SUBHADRAN DEVI 01070068 370 56 28.00 AMALENDU GANGULY 01070177 376 57 18.00 SUPROVAT GHOSH 01070301 395 58 18.00 C GUMMANNAIAH 01070310 396 59 134.00 PAHLAD RAI GUPTA 01070564 418 60 2.00 AMITA GHOSE -

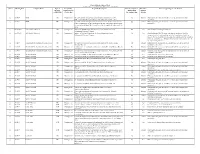

Proposal by Management Or Shareholder Proposal's Description

Kotak Mahindra Mutual Fund Details of votes cast during the Financial year 2019-20 Quarter Meeting Date Company Name Type of Proposal by Proposal's description Investee company’s Vote (For/ Reason supporting the vote decision meetings Management or Management Against/ (AGM/EGM) Shareholder Recommendation Abstain) Q1 03/04/19 WPIL PB Management Special Resolution for approval of Continuation of appointment of Mr. For Abstain Within applicable guidelines, however can not opine on individual V.N.Agarwal Non-Executive Director with effect from April 01, 2019 capabilities. Q1 03/04/19 WPIL PB Management Special Resolution for approval of continuation of term of office under current For Abstain Within applicable guidelines, however can not opine on individual tenure of appointment of Mr. Samarendra Nath Roy, Independent Director up to capabilities. the conclusion of Sixty Fifth Annual General Meeting with effect from April 01, 2019. Q1 05/03/2019 APL Apollo Tubes Ltd PB Management Issuance of 400,000 Equity Shares on Preferential Basis to an Entity For For Normal course of funding for business. Belonging to Promoter Category Q1 05/03/2019 APL Apollo Tubes Ltd PB Management Issuance of 5,00,000 Warrants on Preferential Basis to an Entity For For Capital infusion of Rs 172 crores is to augment funding needs of the Belonging to Promoter Category company in order to meet working capital and completion of existing projects. Price of Rs 1800 for fresh equity shares and Rs 2000 for warrants is above current market price. Dilution of non-promoter shareholders interest by ~3% is not significant. -

Seil Web Data

Schneider Electric Infrastructure Limited Details of Equity Shares liable for credit to IEPF Authority FOLIO NO/ DP ID SHARES Client ID NAME 02210444 400 VARALAKSHMI RAMAMURTHY 01180468 1,270 M V SRIRAMAN 01190655 160 MICHAEL DA SILVA 01191023 45 RAMA SINGH 01240107 200 SHRI AMALESH CHANDRABHATTACHARY 02010466 1,000 JANAK AGGARWAL 02020260 2,400 HARBANS SINGH BAWADECD 02030200 800 N CHELLAPPAH 02070215 535 RABINDRA NATH GHOSE 02140332 1,250 VIRENDRA SINGH NEGI 02160220 800 KRISHNA REDDY VPRPATTABIRAMAN 02180268 800 HARISH CHANDRA RASTOGI 02180734 400 AMMANGUDI E IYERRAMAKRISHNAN 02190213 1,600 CHANCHAL SARKAR 02210155 1,200 PICHAIYA VENKATESHWARAN 02210475 50 DHARMA VIRA 03011433 200 S R GAYODHYARAMAN 03012910 280 POLAGANI ANURADHA 03020976 200 SAKERBAI RUSTOMJI BATLIWALLA 03025597 20 SIDDHARTHA SANKAR BANERJEE 03070582 280 ABDUL KADER MHUSAINGHOTLAWALA 03071807 280 SATYA PRAKASH GUPTA 03113662 200 VIDYA RANI KOHLI 03141304 400 S NARAYANAN 03160366 250 VINAYA SHANKER PANDYA 03182230 500 KISHAN KUMAR RUNGTA 03190982 360 ASHIM SEN 03199918 720 OM PARKASH SETH 03210189 30 SHIKSHA UPADHYAY 03401447 5 DEVENDRA PRASAD SINHA 03410151 575 C CHELLAPPAN NAIR 03140218 200 VIDYA KIRIT NAIK 03113540 240 MAHBOOB ZAAMAN KHAN 03113041 240 MAHBOOB ZAMAN KHAN 03023254 400 MADHAV VINAYAK BHAJEKAR 03010915 200 M SHAMSHAD ALAM 02131282 100 AZIZ ALIMOHAMED MADNI 02131632 500 JYOTI S MUDDUP 02010438 1,500 RAJINI CHHAYA ASRANI 02020213 1,065 DEB PRASANNA BASU 02020947 530 DEB PRASANNA BASU 02030183 1,200 SANTOSH CHAWLA 01220965 45 GUDALUR VARADACHARI PARTHASARATHY -

Godrej in E Very Home and Workplace. Enriching Qualit Y of Life E Veryday

Godrej & Boyce Mfg. Co. Ltd. ( G&B ), the flagship Company of the Godrej Group, has played a key VISION role in India's economic history by driving excellence in design and manufacturing, and delivering Godrej in every home and workplace. sustainable value for its stakeholders and communities. MISSION With revenues of over INR 11,500 crore ( FY-2021 ) and over 14,000 committed employees, G&B's Enriching quality of life everyday, everywhere. diverse presence across 10 industries - from complex engineering solutions to consumer goods like appliances, furniture and security solutions - positively impacts the lives of one-third of India's population every day. Through international subsidiaries and joint ventures, the VALUES Company's products have also established a strong global footprint across 5 continents. Integrity Trust As a values-driven company known for its integrity and a strong social conscience, it has built a compassionate corporate culture designed to empower individuals, teams and communities G&B Care for the Environment operates in. For this, G&B has been consistently recognised as one of India's most respected To Serve companies. Our focus on customers for over a century has helped us constantly innovate; design Respect products and solutions with clarity of purpose that are manufactured in a quality-driven and technology-led environment and distributed through a national and international network of KEY METRICS partners. Established 1897 Strong sustainable practices that help protect the environment are also enshrined in our Good & Turnover INR 11,500 crore Green policy that remains at the core of G&B's business operations. -

Press Release-Swiss Ambassadors Award 2014-December 03

Embassy of Switzerland in India Press release Mumbai 04 December 2014 Mr. Azim Premji receives the Swiss Ambassador’s Award 2014 for inspirational and socially responsible leadership Swiss Ambassador’s Award recognizes individuals who have contributed to the promotion of Indo-Swiss bilateral relations or have stood out for their exceptional role in the society and industry. Mr. Azim Premji, Chairman, Wipro Ltd. was honoured with the ‘Swiss Ambassador’s Award for inspirational and socially responsible leadership’ on December 03, 2014 at an event organised in Mumbai. Swiss Ambassador Dr. Linus von Castelmur, referring to Mr. Azim Premji as one of the beacons of India’s corporate world emphasized that the Wipro chairman has maintained values such as tolerance, honesty, modesty, ethical and social responsible behavior while reaching entrepreneurial heights. Delivering the laudatory speech, Mr. Jamshyd Godrej, Chairman & Managing Director, Godrej & Boyce Mfg. Co. Ltd. said, “Azim has always had a frugal lifestyle. Some of the greatest persons in business over the last fifty years are those who were driven by the passion of development in a totally selfless way. Azim stands tall among them, shunning personal recognition. This deep commitment to the development of India led him to be a leader in philanthropy so that he could use his considerable wealth to do good for those many millions of Indians who lacked opportunity in education.” Mr. Azim Premji, Chairman, Wipro Ltd in his acceptance speech said, “It’s an honor to receive the Swiss Ambassador’s award. I feel strongly that corporations have their own responsibility to society and individuals have their own responsibility. -

Annual Report 2013-14

ICRIER Indian Council for Research on International Economic Relations Annual Report 2013-2014 Bhoomi Poojan at the site of ICRIER’s New Green Building, February 14, 2014 Table of Contents Foreword by the Chairperson 06 Board of Governors 08 Management Committees 09 Founder Members and Life Members 10 Director’s Report 11 Abbreviations 14 ICRIER’s Research Activities 18 Public Lectures and Discussions 48 Conferences and Workshops 51 Seminars 63 International Networking 77 Book/Report Releases 78 Publications 83 Books 83 Reports 84 Wadhwani Chair Reports 85 Working Papers 86 Wadhwani Chair: Issue Briefs and India-US Insight Series 87 Acknowledgements 88 ICRIER Team 89 Faculty Activities 92 Audited Annual Accounts 108 ICRIER Donors 115 About ICRIER 116 Annual Report 2013-2014 Foreword by the Chairperson has made its report public with recommendations to the world’s governments and business and finance leaders on actions that will lead to more climate-resilient patterns of economic growth and development. Two years ago, ICRIER launched a major programme on urbanisation under my guidance in an honorary capacity. Funded by the Ministry of Urban Development, Government of India, this programme has focused on research in a number of critical themes of urbanisation and provided key policy inputs. A parallel programme of capacity building on urbanisation has received strong Isher Judge Ahluwalia support from the state governments. Additionally, the Chairperson, ICRIER “Conversations on Urbanisation” series, a joint initiative by ICRIER and India Habitat Centre, was launched to ICRIER has continued its impressive task of knowledge provide a platform to discuss pressing urban challenges creation and dissemination in the changing economic and with a wider audience. -

(East), Mumbai - 400 051

Date: August 11, 2021 To, To, BSE Limited National Stock Exchange of India Limited P. J. Towers, Dalal Street, Fort, Exchange Plaza, Bandra Kurla Complex, Mumbai – 400 001 Bandra (East), Mumbai - 400 051 Ref.: BSE Scrip Code No. “540743” Ref.: “GODREJAGRO” Sub.: Outcome of the 30th (Thirtieth) Annual General Meeting Dear Sir/Madam, With reference to our letter dated July 16, 2021 in respect of the Notice of the 30th (Thirtieth) Annual General Meeting (“AGM”) of Godrej Agrovet Limited scheduled on Tuesday, August 10, 2021 at 4.00 p.m. (IST) through Video Conference (“VC”) / Other Audio Visual Means (“OAVM”), we would like to inform that the AGM was duly held and business was transacted thereat as per the Notice of the AGM dated May 7, 2021 and in terms of the General Circular dated May 5, 2020 read with General Circulars dated April 8, 2020, April 13, 2020 and January 13, 2021 issued by the Ministry of Corporate Affairs (“MCA”) and in compliance with the provisions of the Companies Act, 2013 (“the Act”) and the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“SEBI Listing Regulations”). In this connection, please find enclosed, the following disclosures pursuant to the SEBI Listing Regulations and the Act:- 1. Summary of proceedings of the AGM pursuant to Regulation 30 read with Part A of Schedule III of the SEBI Listing Regulations – Enclosed as Annexure-1; 2. Results of Voting pursuant to Regulation 44(3) of the SEBI Listing Regulations – Enclosed as Annexure-2; 3. Report of Scrutinizer dated August 10, 2021 pursuant to Section 108 of the Companies Act, 2013 read with the Companies (Management and Administration) Rules, 2014 – Enclosed as Annexure-3; 4. -

Annual Report 2019-20

59th ANNUAL REPORT 2019-20 AHMEDABAD | GANDHINAGAR | BENGALURU 211 59th ANNUAL REPORT 2019-20 AHMEDABAD | GANDHINAGAR | BENGALURU CONTENTS 1.0 Introduction ..................................................................................................................................1 1.1. NID’s Evolving Mandate........................................................................................................3 1.2. Noteworthy Achievements and Major Events of the Year .....................................................5 1.3. Distinguished Visitors ...........................................................................................................10 2.0 Governing Council Members .......................................................................................................13 3.0 Council’s Standing Committee .....................................................................................................15 4.0 The Senate ....................................................................................................................................16 5.0 Faculty Forum ...............................................................................................................................20 6.0 Design Education at NID ..............................................................................................................21 6.1. Learning to Learn, Learning to Know, and Learning to Do ....................................................21 6.2. Professional Education Programmes .....................................................................................22