PNE WIND AG Semi-Annual Financial Report and Report on the Second Quarter of 2014 Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wind Energy Market 2013 | Yearbook Service, Technology & Markets Content

23rd EDITION WIND ENERGY MARKET Yearbook Service, Technology & Markets 2013 Wind Turbines Over 70 data sheets of wind turbines on- and offshore Lease agreements Overview for creating a lease agreement Service Overview of service-suppliers Imprint Publisher: German Wind Energy Association (BWE), Berlin Thorsten Paulsen, Hildegard Thüring Advertisements: Editorial board: bigbenreklamebureau gmbh, Ferdinand Eggert, eco-media 28870 Fischerhude kommunikation (editor-in-chief), Tel.: +49 (0)4293 – 890 890 Andrea Bittelmeyer, Franz-Josef Tigges Mail: [email protected] Translation: Order adress: Kira Gee German Wind Energy Association (BWE) Neustädtische Kirchstraße 6 Layout: 10117 Berlin Mike Müller, muellerstudio.de Tel.: +49 (0)30 212341-210 Fax: +49 (0)30 212341-410 Picture desk: E-Mail: [email protected] ISBN: 978-3-942579148 rd Silke Reents www.wind-energie.de 23 Edition, March 2013 Jan Oelker Cover: WIND ENERGY MARKET Yearbook Service, Technology & Markets 2013 rd Cover: Jan Oelker Cover: 23 EDITION Content 11 | WIND ENERGY IN GERMANY 21 | GloBAL MARKet global market While China paused for breath, the US and European markets had exceptionally strong years. According to the Global Wind The German wind market saw steady growth once again last Stable growth in a turbulent EnergyA good Council year, (GWEC), but the global a difficult wind power outlookmarket grew by year, further strengthening the positive trend of the previous ten percent while the world’s cumulative installed capacity rose year. In 2012, 20 percent more wind capacity went online than by 19 percent. in 2011. 29 | TURBINE CONceptS 35 | CERTIFICATION 41 | LEASE AGREEMENTS Bigger, taller, Setting the right The market for certification is on the course move and demands are increasing. -

European Power List 2021

SPECIAL REPORT EUROPEAN POWER LIST 2021 THE PEOPLE AND TRENDS AT THE LEADING EDGE OF EUROPEAN WIND / TOP 100 PEOPLE IN EUROPEAN WIND / 5 TRENDS THAT SHAPED THE TOP 100 / JOIN US AT FINANCING WIND EUROPE 2021 Contents Welcome 3 How we did it 4 Our criteria 5 Our judges 6 What does the European Power List tell us about the market? 8 Our top 100 profiles 18 Q&A Interview: Nigel Slater 20 The European Power List 2021 in full 26 The European Power List 2021 is proudly sponsored by: SUPPORTING SPONSORS Copyright © Tamarindo Group / A Word About Wind / Energy Storage Report. This report or any part thereof should not be distributed or reproduced without the express permission of Tamarindo Group / A Word About Wind / Energy Storage Report. Please contact [email protected] for all enquiries including distribution, reproduction and membership. EUROPEAN POWER LIST 2021 Welcome It is ten years since we started ranking the top These leaders now face a major challenge. They people in European wind. will all play crucial roles in making sure that wind is key to the ‘green recovery’ from Covid-19. Since then, we have published seven top 100 lists This will not be easy. We see major obstacles to with a European focus. First, we did this in our the rollout of wind across Europe. annual Top 100 Power People. Now we do this regularly in the European Power List. Over the For example, last month WindEurope warned years we have featured a total of 337 of wind’s wind installations of 14.7GW in Europe in 2020 most influential people in these reports, and ten are not enough to meet long-term carbon from that first list still feature today. -

See Who Attended

Company Name First Name Last Name Job Title Country 24Sea Gert De Sitter Owner Belgium 2EN S.A. George Droukas Data analyst Greece 2EN S.A. Yannis Panourgias Managing Director Greece 3E Geert Palmers CEO Belgium 3E Baris Adiloglu Technical Manager Belgium 3E David Schillebeeckx Wind Analyst Belgium 3E Grégoire Leroy Product Manager Wind Resource Modelling Belgium 3E Rogelio Avendaño Reyes Regional Manager Belgium 3E Luc Dewilde Senior Business Developer Belgium 3E Luis Ferreira Wind Consultant Belgium 3E Grégory Ignace Senior Wind Consultant Belgium 3E Romain Willaime Sales Manager Belgium 3E Santiago Estrada Sales Team Manager Belgium 3E Thomas De Vylder Marketing & Communication Manager Belgium 4C Offshore Ltd. Tom Russell Press Coordinator United Kingdom 4C Offshore Ltd. Lauren Anderson United Kingdom 4Cast GmbH & Co. KG Horst Bidiak Senior Product Manager Germany 4Subsea Berit Scharff VP Offshore Wind Norway 8.2 Consulting AG Bruno Allain Président / CEO Germany 8.2 Consulting AG Antoine Ancelin Commercial employee Germany 8.2 Monitoring GmbH Bernd Hoering Managing Director Germany A Word About Wind Zoe Wicker Client Services Manager United Kingdom A Word About Wind Richard Heap Editor-in-Chief United Kingdom AAGES Antonio Esteban Garmendia Director - Business Development Spain ABB Sofia Sauvageot Global Account Executive France ABB Jesús Illana Account Manager Spain ABB Miguel Angel Sanchis Ferri Senior Product Manager Spain ABB Antoni Carrera Group Account Manager Spain ABB Luis andres Arismendi Gomez Segment Marketing Manager Spain -

Company Name First Name Last Name Job Title Country

Company Name First Name Last Name Job Title Country 1StopWind Ltd Arran Bell Operations Manager United Kingdom 1StopWind Ltd. Alan Mckerns United Kingdom 1StopWind Ltd. Bernadette McAulay Finance Manager United Kingdom 1StopWind Ltd. Joel Telling General Manager United Kingdom 23 Degrees Renewables Ltd Ed Woodrow Business Development United Kingdom 24SEA bvba Gert De Sitter Owner Belgium 3S Europe GmbH Matthias Lamp Vice President of Sales & Marketing Germany 3sun Denmark ApS Christian Christensen Operations Director Denmark 3sun Group Limited Jody Potter United Kingdom 3sun Group Limited Graham Hacon VP Business Development, Offshore Wind United Kingdom 3sun Group Limited Sherri Smith Company Secretary United Kingdom 3W Industri Service Simon Øland Project manager - sales Denmark 3W Industri Service Kenneth Pedersen IWI-S Denmark 4C Offshore Lauren Anderson United Kingdom 4C Offshore Richard Aukland Director United Kingdom 4C Offshore Rosie Haworth Market Researcher United Kingdom 4C Offshore Vincenzo Poidomani Principal Geotechnical Engineer United Kingdom 8.2 Bruno ALLAIN CEO France 8.2 Monitoring GmbH Bernd Höring Managing director Germany 920338402 Ellinor Meling Ceo Norway A&P Group Emma Harrick United Kingdom A.P. Møller Holding Simon Ibsen Investor Denmark A/S Dan-Bunkering Ltd. Jens Kirk Denmark A/S Dan-Bunkering Ltd. Michael Brunø-Sørensen Senior Bunker Trader Denmark A1wind Aps Martin Jensen Director / A1wind Aps Denmark AAF Ltd Steven Brett Europe MFAS Aftermarket Sales Manager United Kingdom AAG Allan Tarp Sales Manager Denmark -

CODE of GOOD PRACTICE for RENEWABLE ENERGY in ROMANIA 2021 Dear Reader

CODE OF GOOD PRACTICE FOR RENEWABLE ENERGY IN ROMANIA 2021 Dear Reader, Carlo Pignoloni CEO, Enel Romania President of the Board, RWEA You may wonder why the Romanian Wind Energy Association (RWEA) decided to issue a Code of Good Practice for the industry now, in 2021, more than 10 years since the first wind energy projects in the country were commissioned. Wind energy, with more than 3000 MW installed, has become one of the major energy sources in the country and last year accounted for almost 14% of the total energy produced in Romania. While this is a very important share, adding to the sizeable quota of renewable energy generation in Romania, it is quite safe to say that we are far from the country’s potential. RWEA members demonstrated that they came to invest in the country for the long term, supported economic growth and technological advance and are part of the backbone of the energy sector. But there is much more left to be done. At the time when I am writing these lines, several new renewable projects have been announced in Romania by different companies, and the pipeline is expected to grow significantly. This is a welcome development, as Romania’s generation fleet is ageing and needs to be replaced quickly and at optimal costs. The country, its economy and its people need access to affordable, reliable, sustainable and modern energy and one cannot overemphasize wind’s importance. This brings me to the purpose of this Code and its timing. In order to make this transition just, we need to think of all stakeholders and improve the quality of life of citizens-customers. -

NEX for Start of Q2 2019.Xlsx

Company Name Description Domicile Weight NEX Sector Currency Acuity Brands Inc LEDs, OLEDs, controls for indoor & outdoor lighting. UNITED STATES 1.71% EEF USD Albioma SA Biomass, sugarcane, hybrid combustion and cogeneration. FRANCE 0.32% RBB EUR Ameresco Inc Energy savings, performance contracts, also in renewables. UNITED STATES 0.49% EEF USD Atlantica Yield plc Yieldco, Contracted renewables assets, also transmission. SPAIN 1.21% RSR USD Audax Renovables SA Wind power, mainly, in Europe and Americas. SPAIN 0.41% RWD EUR Ballard Power Systems Inc Mid‐size fuel cells; R&D, PEM FCs as in transportation. CANADA 0.22% ECV CAD BCPG PCL Solar and other renewable energy. THAILAND 1.21% RSR THB Bloom Energy Corp Stationary fuel cells, distributed, but not‐renewable energy UNITED STATES 0.75% ECV USD Boralex Inc Renewables generation, develops, operates wind, hydro, solar. CANADA 1.45% RWD CAD BYD Co Ltd Batteries, potential use in EVs, rail, solar farms, forklights. CHINA 1.68% ENS HKD Canadian Solar Inc Solar, vertically integrated solar manufacturer, China. CANADA 1.21% RSR USD Canvest Environmental Protection Group Co Ltd Waste to Energy, China‐focused. HONG KONG 0.32% RBB HKD Caverion OYJ Energy efficiency, buildings, industrial infrastructure, Europe. FINLAND 0.49% EEF EUR China High Speed Transmission Equipment Group Co Ltd Wind power, turbine gear boxes & transmissions. HONG KONG 1.45% RWD HKD China Longyuan Power Group Corp Ltd Wind, also in solar, biomass, geothermal, tidal. CHINA 1.45% RWD HKD Clearway Energy Inc Contracted power generation, thermal, some renewables. UNITED STATES 1.45% RWD USD Contact Energy Ltd Electric Utility, offers power from geothermal and hydro. -

M&A Facts – Special Edition Windenergy Hamburg 2020

M&A Facts – Special Edition WindEnergy Hamburg 2020 Wind Energy Industry M&A-Highlights and Market Insights Data source: S&P Capital IQ, desktop research. Analysis by Proventis Partners. ►This brief study was drafted by Proventis Partners with the aim to provide a high-quality analysis of the wind energy industry with respect to company valuations as well as M&A activities. It includes analyses of respective peer group trading multiples and selected transactions. Wind energy is not a homogeneous industry; business models and profitability levels differ, and consequently so do valuations. This is reflected by our approach to divide the industry in four segments, reflecting individual stages of the wind energy value chain: 1) Wind Turbine Generator (“WTG”) Manufacturers, 2) Wind Turbine Component Suppliers, 3) Wind Park Developers 4) Wind Park Operation, Maintenance and Service Providers. ►Valuations of publicly-listed companies in the WTG manufacturing- and the supplier segment weakened during the first half of 2020, as the uncertainties surrounding the COVID-19 pandemic affected stock market valuations across the globe. Trading multiples of WTG manufacturers were effected stronger than other segments. However, renewable energy generation is one of the few sectors that are widely considered to emerge stronger from the crisis. Historical high valuation levels of >30x TEV/EBITDA for our European peer group of wind park developers seem to confirm this thesis. 1. Global Wind Turbine Generator Manufacturers Peer Group Note: TEV = Total Enterprise Value. LTM = Last Twelve Months. HY = Half-Year. Data source: S&P Capital IQ. In €m. Global WTG Manufacturers segment includes the leading publicly listed manufacturing companies. -

Ausstellerliste Husum Wind 14.–17. September 2021

AUSSTELLERLISTE HUSUM WIND 14.–17. SEPTEMBER 2021 4cast GmbH & Co. KG 8.2 Consulting AG ABO Wind AG ADDINOL Lube Oil GmbH Aero Enterprise GmbH AK Fehmarn GmbH & Co. KG AllCon Service & Dienstleistungs GmbH Alpiq Energie Deutschland GmbH Alterric GmbH Ametek GmbH AMMONIT Gesellschaft für Messtechnik mbH Ammonit Wind Tunnel GmbH AMUSYD ANE GmbH & Co. KG anemos Gesellschaft für Umweltmeteorologie Anker Foundations GmbH AQUATEC ARGE Kuranz GmbH AS Tech Industrie-und Spannhydraulik GmbH AUCOTEAM GmbH Ingenieurgesellschaft Avacon Netz GmbH Bachmann electronic GmbH BayWa r.e. renewable energy GmbH Beckhoff Automation GmbH & Co. KG BELFOR Deutschland GmbH Berdan Civata Somun Makina BGB Innovation BGZ Fondsverwaltung GmbH BiL eG Blacksafe GmbH Blanke Meier Evers Bonfiglioli Deutschland GmbH Bremer & Leguil GmbH Bundesverband WindEnergie e.V. BUREAU VERITAS BWTS GmbH BYTE MEE Softwareentwicklung GmbH BZEE Network GmbH Centrica Energy Trading GmbH CIwind GmbH cms@wind GmbH composite consult GmbH Connected Wind Services Deutschland GmbH CPC Germania GmbH & Co. KG Cresto Group AB CW Consult GmbH & Co. KG husumwind.com Stand 06/2021 Änderungen vorbehalten. AUSSTELLERLISTE HUSUM WIND 14.–17. SEPTEMBER 2021 Danish Wind Export Association Dark Sky GmbH DEKRA SE Deutsche Kreditbank AG Deutsche WindGuard GmbH Deutsche Windtechnik AG Deutsches Zentrum für Luft- und Raumfahrt e.V. Dirkshof DrehPunkt GmbH Dubai Cable Company (Pvt) Ltd DVV Media Group GmbH DZ BANK AG E.ON Energie Deutschland GmbH ee-Nord GmbH & Co. KG EFEN GmbH Eickhoff Antriebstechnik GmbH -

2020 Q4 ECO Quarterly Report

Q4 2020 Quarterly Report: WilderHill Clean Energy Index®, December 31, 2020 The Clean Energy Index® (ECO) began 4th Quarter 2020 around 125, and ended Q4 around 215, strongly up Q4. ECO Index® started Q1 2020 near 70, initially rising to 90. Then like much in Q1 it crashed on pandemic, saw a close in March under 50 – bouncing back Q2. Afterwards it gained a large +50% for 3rd Quarter. Momentum in this singular theme continued, for a Q4 gain around +70%, and remarkably some +207% year gain in the ECO Index®. Thus, even after falling hard due to Covid, this decarbonization & ESG story since March roared back 4-fold(!). A past say, 4 years since start of 2017, when the ECO Index® was 38, it’s notably up +460%. ECO passively covers an emerging risky theme so it at times ‘drops like a rock’, as in 2020. Big gains occur here, and bigger drops too. Yet, greater interest might be paid here ahead: solar is about to become the lowest-priced electricity, ever. Potentially that may create vast new demand from U.S., Europe, Asia. As infrastructure & good-jobs, equity & social justice – overlap with climate solutions, there may be striking moves ahead. Not just volatility in solar, perhaps too in wind power, batteries and innovative energy storage, electric vehicles, green hydrogen, fuel cells, and decarbonization of everything– unlike anything before. Last 5 years, this Benchmark ECO Index® live since 2004 and the 1st for climate solutions is up +300%. This over a time when perhaps any gains in energy stand out. -

Company Overview Valuation Data Source

Valuation Data Source company overview No. Company No. Company No. Company "Bank "Saint-Petersburg" Public 60 AbClon Inc. 117 Activision Blizzard, Inc. 1 Joint-Stock Company Abdullah Al-Othaim Markets 118 Actron Technology Corporation 61 2 1&1 Drillisch AG Company 119 Actuant Corporation 3 1-800-FLOWERS.COM, Inc. Abdulmohsen Al-Hokair Group for 120 Acuity Brands, Inc. 62 4 11 bit studios S.A. Tourism and Development Company 121 Acushnet Holdings Corp. 5 1st Constitution Bancorp 63 Abengoa, S.A. 122 Ad-Sol Nissin Corporation 6 1st Source Corporation 64 Abeona Therapeutics Inc. 123 Adairs Limited 7 21Vianet Group, Inc. 65 Abercrombie & Fitch Co. 124 ADAMA Ltd. 8 22nd Century Group, Inc. 66 Ability Enterprise Co., Ltd. 125 Adamas Pharmaceuticals, Inc. Ability Opto-Electronics Technology 126 Adamis Pharmaceuticals Corporation 9 2U, Inc. 67 Co.,Ltd. 127 Adani Enterprises Limited 10 3-D Matrix, Ltd. 68 Abiomed, Inc. 128 Adani Gas Limited 11 361 Degrees International Limited 69 ABIST Co.,Ltd. 129 Adani Green Energy Limited 12 3D Systems Corporation 70 ABL Bio Inc. Adani Ports and Special Economic 13 3i Group plc 130 71 Able C&C Co., Ltd. Zone Limited 14 3M Company 131 Adani Power Limited 72 ABM Industries Incorporated 15 3M India Limited 132 Adani Transmissions Limited 73 ABN AMRO Bank N.V. 16 3S KOREA Co., Ltd. 133 Adaptimmune Therapeutics plc 74 Aboitiz Equity Ventures, Inc. 17 3SBio Inc. 134 Adastria Co., Ltd. 75 Aboitiz Power Corporation 18 500.com Limited 135 ADATA Technology Co., Ltd. 76 Abraxas Petroleum Corporation 19 51 Credit Card Inc. -

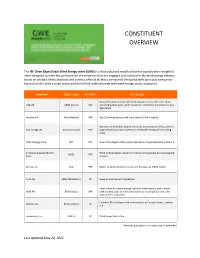

Constituent Overview

CONSTITUENT OVERVIEW The ISE Clean Edge Global Wind Energy Index (GWE) is a float-adjusted modified market capitalization-weighted index designed to track the performance of companies that are engaged and involved in the wind energy industry based on analysis of the products and services offered by those companies (including both pure play companies focused on the wind energy sector and diversified multinationals with wind energy sector exposure). COMPANY STOCK TICKER PP / NPP* AT A GLANCE Diversified with considerable wind exposure across the value chain, ABB Ltd. ABBN (Swiss) NPP including turbine parts, grid connectors, converters, transmission, and digitization Acciona S.A. ANA (Madrid) NPP Top 25 wind producer with more than 8.3 GW installed Operator of Australia's largest electricity generation portfolio, and the AGL Energy Ltd. AGL (Australian) NPP largest listed Australian investor in renewable energy (RE) including wind Alliant Energy Corp. LNT NPP One of the largest utility owner-operators of regulated wind in the U.S. American Superconductor Wind turbine design, electronic controls and systems, and engineering AMSC NPP Corp. services Arcosa, Inc. ACA NPP Maker of wind and transmission and distribution (T&D) towers Arise AB ARISE (Stockholm) PP Swedish onshore wind developer Swiss-based European energy operator (hydroelectric and nuclear) BKW AG BKW (Swiss) NPP with growing sales of wind and services to municipalities and other Swiss and EU customers Canadian RE developer with wind projects in Canada, France, and the Boralex, Inc. BLX (Toronto) PP U.K. Broadwind, Inc. BWEN PP Wind tower fabrication *Denotes pure play vs. non pure play or diversified Last updated May 28, 2021 China Datang Corp. -

PNE WIND AG Financial Report on the First Three Months and on the First Quarter of 2011 at a Glance

PNE WIND AG Financial report on the first three months and on the first quarter of 2011 At a glance PNE WIND AG Group figures All figures in TEUR 01.01. - 31.03. 2011 01.01. - 31.03. 2010 01.01. - 31.03. 2009 Total aggregate output 12,328 28,614 88,916 Revenues 11,011 16,396 88,804 Operating profit (EBIT) 2,482 10,228 7,233 Result from ordinary activities (EBT) 1,770 9,348 5,300 Result 1,715 9,321 5,115 Equity as at March 31 83,276 79,776 59,793 Equity ratio as at March 31, in % 42.18 43.61 36.02 Balance sheet total as at March 31 197,414 182,924 166,503 Earnings per share (undiluted), in EUR 0.04 0.21 0.12 Average number of shares, in EUR million 45.8 44.5 41.3 Key data (as at March 31, 2011) Securities identification code AOJBPG ISIN DE000A0JBPG2 Number of shares 45,775,826 Market capitalisation EUR 117.6 million Market segment Prime Standard Indices HDax, Mid-Cap-Market-Index, CDAX Technology, ÖkoDAX Designated sponsors Commerzbank, VEM Aktienbank, Close Brothers Seydler Bank Reuters PNEGn Bloomberg PNE3 Table of contents 2 Preface 4 Stock market news of PNE WIND AG 6 Condensed interim group management report 22 Consolidated statement of comprehensive income 27 Condensed notes 31 Imprint Preface Stock market news of Condensed interim Consolidated interim Condensed notes PNE WIND AG group management report financial statement Preface Dear shareholders The events in Japan, with the catastrophic The internationalisation of our business accident at the Fukushima nuclear power plant model also made encouraging progress in have led to a drastic rethink of energy policy the first quarter.