Cost of Doing Business in the Philippines

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2018–2019 Information Pack Mathematical Literacy Reading

ISA International Schools’ Assessment ISAInternational Schools’ Assessment 2018–2019 Information Pack Mathematical Literacy Reading Writing Scientific Literacy Australian Council for Educational Research What is the ISA? The ISA is a set of tests used by international schools and schools with an international focus to monitor student performance over time and confirm that their internal assessments are aligned with international expectations of performance. Designed and developed by the Australian Council for Educational Research (ACER), the ISA reading, mathematical literacy and scientific literacy assessments are based on the Programme for International Student Assessment (PISA). PISA is developed under the auspices of the Organisation for Economic Cooperation and Development (OECD). Note that the ISA is not part of PISA and is not endorsed by the OECD. What is ACER? ACER is one of the world's leading educational research centres, committed to creating and promoting research-based knowledge, products and services that can be used to improve learning across the life span. ACER has built a strong reputation as a reliable provider of support and expertise to education policy makers and professional practitioners since it was established in 1930. The development of the ISA is linked to ACER’s work on PISA: ACER led a consortium of research and educational institutions as the major contractor to deliver the PISA project on behalf of the OECD from 2000 to 2012. What is PISA? PISA is a triennial international survey which aims to evaluate education systems worldwide by testing the skills and knowledge of nationally representative samples of 15-year-old students in key subjects: reading literacy, mathematical literacy and scientific literacy in order to inform national stakeholders about how well their education systems are preparing young people for life after compulsory education. -

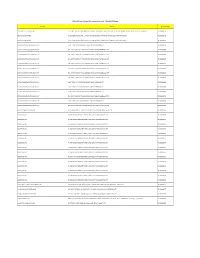

DOLE-NCR for Release AEP Transactions As of 7-16-2020 12.05Pm

DOLE-NCR For Release AEP Transactions as of 7-16-2020 12.05pm Company Address Transaction No. 3M SERVICE CENTER APAC, INC. 17TH, 18TH, 19TH FLOORS, BONIFACIO STOPOVER CORPORATE CENTER, 31ST STREET COR., 2ND AVENUE, BONIFACIO GLOBAL CITY, TAGUIG CITY TNCR20000756 3O BPO INCORPORATED 2/F LCS BLDG SOUTH SUPER HIGHWAY, SAN ANDRES COR DIAMANTE ST, 087 BGY 803, SANTA ANA, MANILA TNCR20000178 3O BPO INCORPORATED 2/F LCS BLDG SOUTH SUPER HIGHWAY, SAN ANDRES COR DIAMANTE ST, 087 BGY 803, SANTA ANA, MANILA TNCR20000283 8 STONE BUSINESS OUTSOURCING OPC 5-10/F TOWER 1, PITX KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000536 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000554 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000569 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000607 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000617 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000632 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000633 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000638 8 STONE BUSINESS OUTSOURCING OPC 5-10/F TOWER 1, PITX KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000680 8 STONE BUSINESS OUTSOURCING OPC 5-10/F TOWER 1, PITX KENNEDY -

Event Results

Brent International School Manila HY-TEK's MEET MANAGER 7.0 - 3:41 PM 9/14/2019 Page 1 42nd Brent Invitational Swim Meet - 9/14/2019 Results Event 1 Girls 8 & Under 25 SC Meter Freestyle Name Age Team Seed Time Finals Time Points 1 Leighton, Ella 8 Brent International School 18.31 18.44 7 2 Rivadelo, Bella 8 NordAngliaIntlSchoolMnl 22.98 18.59 5 3 Flegler, Lilika 8 Manila Japanese School 19.37 19.46 4 *4 Hoddinott, Senna 7 International School Manila 20.36 19.81 2 . 50 *4 Prashasnth, Draya 8 NordAngliaIntlSchoolMnl NT 19.81 2 . 50 6 Bate, Chiara Marie 8 International School Manila 19.83 20.17 1 7 Ratkai, Szoia 6 International School Manila 21.04 20.53 8 Akimoto, Wakana 7 Manila Japanese School 22.21 21.02 9 Georgiou, Angelica 7 International School Manila 21.41 21.13 10 Georgiou, Joanita 7 International School Manila 22.04 21.39 11 Nguyen, Quyen 7 International School Manila 21.63 21.45 *12 Ando, Shiori 7 Manila Japanese School 33.00 22.12 *12 Green, Emma 8 International School Manila 32.74 22.12 14 Martel, Anika 7 British School Manila 23.45 22.28 15 Endo, Hanna 7 International School Manila 21.44 22.49 16 Long, Caylin 7 British School Manila 27.70 22.70 17 Elliot Lopez, Tara 8 British School Manila 26.08 23.47 18 Wee, Mariana 6 British School Manila 32.58 24.36 19 Barber, Sienna 8 International School Manila 23.64 24.49 20 Quiñonero Lozano, Lucia 7 International School Manila 25.39 24.53 21 Power, Zara 7 British School Manila 24.99 24.72 22 Gane, Raynaya 7 British School Manila 26.57 24.79 23 Hayashi, Fumiko 7 International School Manila -

Masterlist of Private Schools Sy 2011-2012

Legend: P - Preschool E - Elementary S - Secondary MASTERLIST OF PRIVATE SCHOOLS SY 2011-2012 MANILA A D D R E S S LEVEL SCHOOL NAME SCHOOL HEAD POSITION TELEPHONE NO. No. / Street Barangay Municipality / City PES 1 4th Watch Maranatha Christian Academy 1700 Ibarra St., cor. Makiling St., Sampaloc 492 Manila Dr. Leticia S. Ferriol Directress 732-40-98 PES 2 Adamson University 900 San Marcelino St., Ermita 660 Manila Dr. Luvimi L. Casihan, Ph.D Principal 524-20-11 loc. 108 ES 3 Aguinaldo International School 1113-1117 San Marcelino St., cor. Gonzales St., Ermita Manila Dr. Jose Paulo A. Campus Administrator 521-27-10 loc 5414 PE 4 Aim Christian Learning Center 507 F.T. Dalupan St., Sampaloc Manila Mr. Frederick M. Dechavez Administrator 736-73-29 P 5 Angels Are We Learning Center 499 Altura St., Sta. Mesa Manila Ms. Eva Aquino Dizon Directress 715-87-38 / 780-34-08 P 6 Angels Home Learning Center 2790 Juan Luna St., Gagalangin, Tondo Manila Ms. Judith M. Gonzales Administrator 255-29-30 / 256-23-10 PE 7 Angels of Hope Academy, Inc. (Angels of Hope School of Knowledge) 2339 E. Rodriguez cor. Nava Sts, Balut, Tondo Manila Mr. Jose Pablo Principal PES 8 Arellano University (Juan Sumulong campus) 2600 Legarda St., Sampaloc 410 Manila Mrs. Victoria D. Triviño Principal 734-73-71 loc. 216 PE 9 Asuncion Learning Center 1018 Asuncion St., Tondo 1 Manila Mr. Herminio C. Sy Administrator 247-28-59 PE 10 Bethel Lutheran School 2308 Almeda St., Tondo 224 Manila Ms. Thelma I. Quilala Principal 254-14-86 / 255-92-62 P 11 Blaze Montessori 2310 Crisolita Street, San Andres Manila Ms. -

INFORMATION SHEET for INTERNAL TRAINING PURPOSES ONLY Come to Where Contemporary Lifestyles M Eet

INFORMATION SHEET FOR INTERNAL TRAINING PURPOSES ONLY COMe To WHERE CONTEMPORARY LIFESTYLEs M EET FOR INTERNAL TRAINING PURPOSES ONLY VERSION 1.0 AS OF MARCH 2015 A MASTER PLAN OF CONVERGENCE The core of Bonifacio Global City’s new center of gravity, Park Triangle, presents Alveo Land’s Park Triangle Residences. This sole condominium development in this dynamic destination, located at the corner of 32nd Street and 11th Avenue, offers unmatched proximity to premier schools, offices, and leisure scenes. A landmark tower among the few communities to rise above the area’s corporate row, it is also the only property in BGC with direct access to an Ayala mall. PARK TRIANGLE RESIDENCES ARTIST’S PERSPECTIVE FOR INTERNAL TRAINING PURPOSES ONLY FOR INTERNAL TRAINING PURPOSES ONLY VERSION 1.0 AS OF MARCH 2015 VERSION 1.0 AS OF MARCH 2015 BONIFACIO GLOBAL CITY An Ayala Land growth center with unmatched accessibility— perfect for a city where life comes together. Breakthrough ideas connecting, practices rooted in sustainability, a city that works. Infrastructure, city management, and green processes collaborating for an unparalleled living and working experience. At BGC’s new center of gravity, Park Triangle pulls you closer to a galaxy of urban conveniences orbiting your pivotal destination. BGC SkYLINE FOR INTERNAL TRAINING PURPOSES ONLY FOR INTERNAL TRAINING PURPOSES ONLY VERSION 1.0 AS OF MARCH 2015 VERSION 1.0 AS OF MARCH 2015 KALAYAAN AVENUE TO MAKATI/ORTIGAS MANILA JAPANESE SCHOOL 8TH AVE THE BRITISH SCHOOL MANILA ST. LUKE’S 34TH ST MEDICAL 38TH ST CENTER S&R MC HOME DEPOT TURF BGC ENERGY CENTER INTERNATIONAL CROSSROADS SCHOOL MANILA RIZAL DRIVE 5TH AVE 32ND ST SHANGRI-LA UP PROFESSIONAL AT THE FORT 7TH AVE SCHOOLS TRACK 30TH THE MINDMUSEUM EVERY ONE BONIFACIO NATION 9TH AVE TRESTON HIGH STREET BONIFACIO INTERNATIONAL HIGH STREET COLLEGE 30TH ST CARLOS P. -

School Membership Pack

SCHOOL MEMBERSHIP PACK 1. Introduction Letter p. 2 2. Membership Application Form p. 4 3. Pre-Membership Visit Survey Form p. 8 4. Candidate School Staff List Form p. 11 5. Pre-Membership Visit Report p. 12 6. Application Procedure Flowchart p. 29 7. FOBISIA Constitution p. 30 8. FOBISIA By-Laws p. 41 9. Pre-Membership Visit Document Checklist p. 60 10. Schedule of School Membership Fees p. 61 11. School Membership FAQs p. 62 FOBISIA Chair | Mr. Anthony Rowlands | [email protected] FOBISIA CEO | Mr. John Gwyn Jones | [email protected] Dear Applicant, RE INVITATION TO APPLY FOR FOBISIA MEMBERSHIP FOR YOUR SCHOOL Thank you for your interest in becoming a FOBISIA Member School. Membership is open to schools located in Asia that provide a British-type curriculum for a significant majority of students. To qualify as members, schools must satisfy the membership criteria as set out in FOBISIA’s Constitution and By-laws, and successfully complete the application process as set out in Regulation 6 of the Constitution. The governing body of a school must approve the application. To apply for membership of FOBISIA, please prepare a Letter of Intent, which is an official letter from the Head of School (max. one A4-page) providing some context for the application, e.g. history of the school, current status, reasons for wanting to join FOBISIA. Please also complete the following forms and email them, along with your Letter of Intent, to FOBISIA (To: [email protected] ): • Initial Application Form (F1) • Pre-Membership Visit Survey Form (F2) • Staff List Form (F3) Please ensure you retain a copy of these documents as they may be required for reference in a subsequent stage of the application process, should a Pre-Membership Visit be recommended by FOBISIA’s Membership Committee. -

Working at the Asian Development Bank Presentation Outline About

Working at Presentation Outline the Asian Development Bank • About ADB • ADB’s Long Term Strategic Framework (Strategy 2020) Masayuki Tamagawa • Human Recourse Issues Director General Budget, Personnel, Management Systems Department • Working at ADB & Living in Manila 2008 ADB Members About ADB • Multilateral Development Bank founded in 1966 • One of the International Financial Institutions (IFIs), such as World Bank, IMF, etc. • 67 members (48 in the region, 41 borrowing members) • Japan and the United States, coequally ADB’s largest shareholders(15.571%) • Regional voting power 65.040% Regional Member Countries (Borrowing) Regional Member Countries (Non-Borrowing) Nonregional Member Countries ADB’s Vision ADB’s Mission An Asia and Pacific region free of poverty To help our developing member countries reduce poverty, and improve living conditions and quality of life Asia & Pacific – Growth and Poverty 12.0 More than Staff 10.0 65% of the population 8.0 living on • 2,443 employees, 6.0 less than from 55 of its 67 members GDP Growh Rate (%) 2$/day is • 852 Professional Staff (101 in field Office) 4.0 from Asia • 1,591 Local Staff (479 in field Office) 2.0 and Pacific, 0.0 totaling 1.7 2000 2001 2002 2003 2004 2005 2006 2007 Billion. China India Viet Nam United States Japan Organization Board of Governors Operational Structure •Evaluation Board of Directors •Compliance Review Knowledge Management •Regional & Sustainable Development President Operations 1 •Economics and Research •South Asia •Regional Economic Integration Managing Vice President -

Assessing the Efficacy of Covid-19 Policies in the Philippines

www.kosmospublishers.com [email protected] DOI: 10.37722/APHCTM.2021202 Assessing the Efficacy of Covid-19 Policies in the Philippines Lim Chris* British School Manila, Philippines Received Date: August 10, 2021; Accepted Date: August 19, 2021; Published Date: August 25, 2021; *Corresponding author: Lim Chris, British School Manila, Philippines. Email: [email protected] Abstract Introduction This research assessed the efficacy of the Philippine Following the first wave of COVID-19 cases in the government’s COVID-19 policies by calculating the regional Philippines beginning mid-March, the government’s response and national effective reproduction number (Rt) after the consisted heavily of enhanced community quarantines, closure implementation of government policies. Rt was obtained of schools nationwide, and travel restrictions. These through using a model with a Bayesian framework, which is approaches have often been questioned by experts and the an approach that creates probabilistic models based on general public [1]. existing evidence. The model, known as “EpiEstim”, provides estimates through analyzing the daily incidence of cases The main criticism against the Philippine government’s within predefined time periods. The effects of stringency on COVID-19 response has been its draconian and prolonged nationwide transmissibility were determined by analyzing the nature, deemed one of the harshest approaches to COVID-19 bi-variate relationship between the Government Stringency in Southeast Asia, if not, the world [2]. As a result of severely Index (OxCGRT) with the estimated nationwide Rt values, restricting the country’s economic activity, the economy of the between February 6, 2020 and March 3, 2021. This study is Philippines has experienced a significant recession, with the relevant because the Philippine government’s response to GDP having contracted by 9.6% year-on-year. -

Uptown Ritz Residence Location Map Uptown Ritz Residence the Elites 88 Developments Nearby Uptown Ritz Residence the Elites 88

UPTOWN RITZ RESIDENCE LOCATION MAP UPTOWN RITZ RESIDENCE THE ELITES 88 DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 BUILDING FEATURES DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 ST. LUKE’S MEDICAL CENTER – GLOBAL CITY BACK DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 UNIFIED PHILIPPINE STOCK EXCHANGE TOWER BACK DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 OFFICES OF MAJOR MULTI-NATIONAL COMPANIES BACK DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 BRITISH SCHOOL - MANILA MANILA JAPANESE SCHOOL INTERNATIONAL SCHOOL - MANILA UNIVERSITY OF THE PHILS. BACK DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 SM-AURA / RADISSON HOTEL BACK DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 ASCOTT BONIFACIO GLOBAL CITY BACK DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 SHANGRI-LA at the FORT BACK DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 GRAND HYATT HOTEL-MANILA BACK DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 BURGOS CIRCLE at FORBES TOWN CENTER BACK DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 THE FORT STRIP BACK DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 SHOPS IN SERENDRA & METRO MARKET! MARKET! BACK DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 S&R MEMBERSHIP SHOPPING BACK DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 UPTOWN PLACE BACK DEVELOPMENTS NEARBY UPTOWN RITZ RESIDENCE THE ELITES 88 ONE BONIFACIO HIGH STREET BONIFACIO HIGH STREET-CENTRAL BONIFACIO HIGH STREET BACK DEVELOPMENTS NEARBY UPTOWN RITZ -

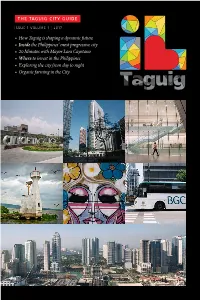

How Taguig Is Shaping a Dynamic Future • Inside

THE TAGUIG CITY GUIDE ISSUE 1 VOLUME 1 | 2017 • How Taguig is shaping a dynamic future • Inside the Philippines’ most progressive city • 20 Minutes with Mayor Lani Cayetano • Where to invest in the Philippines • Exploring the city from day to night • Organic farming in the City Mandaluyong P ASIG RIVER EDSA C5 ROAD PASIG RIVER Pasig Uptown Makati D Bonifacio EDSA 32nd Street PASIG RIVER Fort Bonifacio A Metro Market Market 5th AvenueSM Aura Pateros Premier C Manila Mckinley American West Cemetery and Memorial Lawton Avenue H Vista Mall Taguig City Hall G Heritage Park SOUTH LUZON EXPRESSWAY Acacia Estates C6 ROAD Libingan ng mga Bayani E C5 ROAD B F Characterized by a strong government, a diverse population and robust industries, Taguig is a highly urbanized Arca city that is evolving into a dynamic and sustainable community by supporting and driving economic growth, South NINOY AQUINO focusing on the development of its people, and integrating environmental thinking into its plans. INTERNATIONAL PNR FTI AIRPORT Taguig C6 ROAD Laguna Lake M.L.Quezon Avenue Parañaque Taguig lies at the western shore of PNR Bicutan Laguna Lake, at the southeastern portion of Metro Manila. Napindan River (a tributary of Pasig River), forms the common border of Taguig and Pasay City, while Taguig River Muntinlupa (also a Pasig River tributary) cuts through the northern half of the city. The city’s topography has given it a rather unique characteristic, where water features, farmlands, urbanized centers and commercial districts are all within a 20-minute drive from each other. A Bonifacio Global City Land Area: 45.38 sq.km. -

Free Download

A Journal for Planning and Building in a Global Context 4 / 2011 – 2012 TRIALOG 111 4/2011-2012 1 Editorial Nowadays privatisation is often seen as a panacea private investments and through Public Private Title page: for the problems of urban modernisation and Partnerships, Banashree Banerjee looks at impor- Free interpretation of the layout of the structure of development. Whether because of dissatisfaction tant lessons learned. The schemes and initiatives the Latinos neighbourhood with public services or because of shifts in politics analysed reveal the underlying policies and prac- of the private town Bumi or the economy, many cities turn to the private tices that continue to have a direct influence on Serpong Damai (Jakarta). (Gotsch, Grewe, Stahmer) sector to aid in their development, and many private creating an exclusive city. initiatives take the reins when the government weak. In particular in the developing world, the context of The cooperation with PPPs in urban development political instability, environmental risk, and socio- has become an important strategy for many govern- economic divide creates distinct spaces for the ments. Staying in India, Kiran Sandhu provides an privatisation of services and public goods by new overview of the country's attempt to modernise its actors from the corporate sector and distinct civil malfunctioning infrastructure through PPPs. Her society groups. The situation also produces a fertile article reveals the enabling environment the Indian ground for partnerships between governments and government has created, and also includes a look at the private sector, so-called "Private Public PPP trends in infrastructure development as well as Partnerships" or PPPs. -

Cost of Doing Business in the Philippines

COST OF DOING BUSINESS START-UP COSTS I. REGISTRATION FEES PHILIPPINE SECURITIES AND EXCHANGE COMMISSION (SEC) Registration of Corporations & Partnerships Main Fees to be Paid (In Pesos) Stock Corporations 1/5 of 1% of the Authorized Capital Stock or the subscription price of the subscribed Filing Fee capital stock whichever is higher but not less than P1,000.00 plus LRF* By-laws P500.00 plus LRF* Non-Stock Corporations Filing Fee of Articles of Incorporation P500.00 plus LRF* By-laws P500.00 plus LRF* Partnership 1/5 of 1% of the partnership's capital Articles of Partnership but not less than P1,000.00 plus LRF* *Legal Research Fee equivalent to 1% of Filing Fee but not less than P10.00 Source: http://www.sec.gov.ph/ DEPARTMENT OF TRADE AND INDUSTRY (DTI) Business Name Registration Main Fees to be Paid (Bureau of Trade Regulation and consumer Protection -- (In Pesos) BTRCP) A. Filipino National Single Proprietorship Business Name Registration Certificate (based on territorial jurisdiction) : Barangay P200.00 City/Municipality 500.00 Regional 1,000.00 National P2,000.00 Documentary stamp P15.00 B. Foreign National Business Name Registration Certificate P300.00 Certificate of Authority to Engage in Business (Filing Fee) P500.00 Registration Fee P5,000.00 Documentary stamp P15.00 Source: http://www.dti.gov.ph/ BOARD OF INVESTMENTS (BOI) Filing / Application Feesa Regular Fees Classification Project Cost MSE Fees (Php) (Php) New / Expansion Micro Not exceeding Php3 million Waived 1,500 Small Exceeding Php3 million but not over Php4 million