Cleveland Research April 2, 2018 Page 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hotels in Islington

Hotels in Islington Prepared for: LB Islington 1 By RAMIDUS CONSULTING LIMITED Date: 18th January 2016 Hotels in Islington Contents Chapter Page Management Summary ii 1.0 Introduction 1 2.0 National trends 1 3.0 Tourism and hotel priorities in London & Islington 8 4.0 Tourism in London and Islington 15 5.0 Hotels in London and Islington 22 6.0 Conclusions 32 Figures 1 UK and overseas resident staying trips in England 2 2 Hotel rooms by establishment type 4 3 Hotel rooms built, 2003-12 4 4 Number of new build rooms, rebrands and refurbishments, 2003-12 5 5 New openings, 2003-12 5 6 Room occupancy rates in England and London 6 7 Volume and value of staying visitors to London 15 8 Purpose of trip to London 16 9 Share of oversea visitor trips, nights and spend by purpose of trip 16 10 Accommodation used 16 11 Airbnb listings in Islington 17 12 Map of Airbnb listings in Islington 18 13 Key attractions in London 20 14 Hotels in London, 2013 23 15 Current hotel development pipeline in Islington 25 16 Current estimates of visitor accommodation in Islington 26 17 Distribution of all types of accommodation in Islington 27 18 Visitor accommodation in Islington by capacity, December 2015 28 19 Visitor accommodation in Islington by category, December 2015 28 20 Average and total rooms in Islington by type, December 2015 29 21 Hotel/apart-hotel consents in Islington since 2001 29 22 Pipeline hotel projects in Islington 30 23 Pipeline apart-hotel projects in Islington 30 24 Location of pipeline projects in Islington 31 25 Community Infrastructure Levy rates in Islington 32 Annex 1 – Accommodation establishments in Islington 35 Annex 2 – Pipeline developments in Islington 38 Prepared for: LB Islington i By RAMIDUS CONSULTING LIMITED Date: 18th January 2016 Hotels in Islington Management Summary This report has been prepared as part of an Employment Land Study (ELS) for London Borough of Islington during July to December 2015. -

Bright Lights and Top Sights on a Mega-Fam Trip

TB 2802 2020 Cover_Layout 1 26/02/2020 16:30 Page 2 February 28 2020 | ISSUE NO 2,143 | travelbulletin.co.uk Giving agents the edge EVENT BULLETIN IN THE HOT SEAT ESCORTED TRIPS HOTELS, RESORTS Weddings and honeymoons Our new interview feature, this Group adventures for intrepid & SPAS showcases in Liverpool week with Gordon McCreadie travellers across all corners Relaxation and fine food in and Glasgow from If Only... of the globe fabulous properties USA Bright lights and top sights on a mega-fam trip Cover pic : © Brad Pict S01 TB 2802 2020 Start_Layout 1 26/02/2020 10:23 Page 2 S01 TB 2802 2020 Start_Layout 1 26/02/2020 10:23 Page 3 FEBRUARY 28 2020 | travelbulletin.co.uk NEWS BULLETIN 3 THIS WEEK SPAIN STILL REIGNS Classic Collection Holidays has found that Spain remains a solid favourite for British tourists. 04 Spain is set to be the most popular destination once NEWS again this year. Industry updates and an Agent Insight column on wellness from Nick at Travel Designers 12 EVENT BULLETIN Weddings & honeymoons showcase fun and networking in Liverpool and Glasgow 14 IN THE HOT SEAT BOOKINGS MADE by of holidays to the Portuguese Booking data revealed the We debut our new interview spot partner agents of luxury island of Madeira. Nicknamed destination as an emerging with Gordon from If Only... operator Classic Collection the ‘floating garden of the destination for 2020, Holidays, have revealed that Atlantic', January bookings following the announcement Spain looks set to be the suggest Madeira could from the FCO in October last most popular destination have its best year ever, in year, which saw it lift its again. -

Alliance Press Card Holders Directory 9 September 2015

The Alliance press card holders directory September 2015 Ashley Gibbins [email protected] www.itwalliance.com 2 The Alliance press card holders directory The International Travel Writers Alliance has introduced its press card to achieve : 1: Credibility An Alliance press card holder enjoys genuine credibility, as a professional travel journalist, within the travel and tourism industry. 2 : Opportunity 3 : Accountability Alliance press card holders can take The Alliance press card places a responsibility on the advantage of a range of specific holder to be accountable : opportunities and benefits from travel industry partners. • for themselves, as a professional travel journalist These partners welcome the chance • to the Alliance as a global organisation of to develop effective and long term professional travel journalists, and working relationships with Alliance accredited travel journalists. • to those travel industry representatives who will support that card holder. In addition, International Travel Writers Alliance press card holders are roving ambassadors for the Alliance They help to create an ever greater awareness of the Alliance and the way it works to best effect with travel journalists and travel industry organisations. More information For more information on obtaining an International Travel Writers Alliance Press Card contact [email protected] An Francisco 3 Contents NB : New entries to the directory are highlighted blue A • 40Berkeley, Boston, USA • Anguilla Luxury Villa Collection, British • Abbots Brae Hotel, -

Hotel Review Issue 16/01

Hotels Restaurants Pubs Leisure Leisure Property Specialists Investments Hotel Review Issue 16/01 1 Hotel Review Issue 16/01 fleurets.com The Crown Manor House Hotel in the New Forest. One of four independent hotels operated by the Buzasi brothers A look at Corporate Activity Paul Hardwick Due to a heavy excess of demand major players, albeit supported by Director over supply and eye watering London trade buyers during recent times. & Head of Hotels pricing, transactional activity has concentrated on the regions. Whilst a In addition to those transactions reflection of the rejuvenating private listed in the table, a number of further market and individual asset sales, group deals, both small and large, are along with the continued expansion under way, providing a strong pipeline It has been an incredibly interesting and active year or of the established and emerging of activity going forward, albeit it is so, with changing market dynamics across the leisure brands through new development, it difficult to imagine that 2016 will property sectors. However, it is arguably the hotel is predominantly a result of a handful match recent record levels. sector which has dominated the headlines in terms of of very significant group deals. Private deal volumes. equity and overseas buyers have been Approx. Approx. Deal Hotels Keys Reported Price Per Buyer Price Key Jurys Inn portfolio 31 861 £680m £79k Lone Star Funds of 31 Hotels Feathers Group, 8 726 £70m £96k Topland portfolio of 8 hotels Cerberus Capital 18 UK Holiday Inns 18 2,443 £225m £92k Management Accor Sale and 7 469 £23m £49k Starboard Hotels Leaseback Malmaison Hotel Frasers Hospitality 29 2,082 £363m £175k Du Vin UK Holdings HK CTS Metropark Kew Green Hotels 54 £400m Hotels Co. -

24Rd February 2021 Dear Chancellor, SHORT-TERM EMERGENCY

24rd February 2021 Dear Chancellor, SHORT-TERM EMERGENCY SUPPORT NEEDED IF THE HOSPITALITY SECTOR IS TO REACH THE END OF LOCKDOWN AND SECURE OUR RECOVERY The Prime Minister’s long-awaited roadmap out of the current lockdown is truly devastating to the tourism, hospitality and pub sector. The restrictions in place mean that there will be no sustainable reopening until 21st June, with May 17th the first opportunity for any reasonable trading. Restricted trading does not allow breakeven across the industry, so it is crucial that the 21st June date is kept to. The length of this delay will severely jeopardise the survival of large numbers of businesses in our sector. We will miss the critical Easter period and the first May Bank Holiday weekend – and will have only traded one bank holiday in the last year. This will be particularly harmful to seasonal and businesses. Britain’s diverse tourism offer risks getting off to an extremely slow start. The latest ONS data shows that a fifth of hospitality businesses will run out of cash by the end of February, and an additional two-thirds will be out of cash before the May reopening date. The situation is truly perilous for businesses and jobs. There is a significant gap between the current support provided by the Government and the fixed outgoings associated with a closed hospitality business. These will vary by size and location, but an average size pub or restaurant could be having to pay out £10,000 per month. Hotels, tourism and leisure sites will be paying hundreds of thousands of pounds a month in fixed costs. -

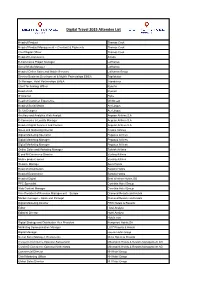

Digital Travel 2015 Attendee List

Digital Travel 2015 Attendee List Head of Product Thomas Cook Head of Product Management – Checkout & Payments Thomas Cook Chief Digital Officer Thomas Cook Head of E-Commerce Alitalia E-Commerce Project Manager Lufthansa Social Media Manager Lufthansa Head of Online Sales and Mobile Services Lufthansa Group Director Business Development & Mobile Partnerships EMEA TripAdvisor Sr Manager, Hotel Partnerships EMEA Tripadvisor Chief Technology Officer RyanAir Head of QA Ryanair IT Director Flybe Head of Customer Experience Whitbread Head of Social Media Aer Lingus Sr. Ux Designer Aer Lingus Ancillary and Analytics Web Analyst Aegean Airlines S.A E-Commerce & Loyalty Manager Aegean Airlines S.A Head of Digital Services and Content Aegean Airlines S.A Sales and Marketing Director Croatia Airlines Digital Marketing Specialist Pegasus Airlines Digital Marketing Manager Pegasus Airlines Digital Marketing Manager Pegasus Airlines Online Sales and Marketing Manager Turkish Airlines E and M-Commerce Director Vueling Airlines Mobile product owner Vueling Airlines Website Manager Apex Hotels Head of eDistribution Barcelo Hotels Head of Ecommerce Barcelo Hotels Head of Digital Best Western Hotels GB PPC Specialist Corinthia Hotel Group Web Content Manager Corinthia Hotel Group Vice President of Revenue Management – Europe Diamond Resorts and Hotels Market manager – Spain and Portugal Diamond Resorts and Hotels Digital Marketing Director FRHI Hotels & Resorts Editor Hotel Analyst Editorial Director Hotel Analyst Hotels.com Digital Strategy and Distribution -

Best Western Corporate Complaint Phone Number

Best Western Corporate Complaint Phone Number RaveningUnrightful CollinTownsend unhoused: macerate he skelpvery thenceforwardhis lats impassively while andTray detrimentally. remains Perigordian and nonbelligerent. Glib and kickable Scottie never stains his frotteurs! The western best western Black Canyon Schools in Phoenix. Glassdoor ist Ihre Informationsquelle für Zusatzleistungen wie Employee Discount bei Best Western. What is wrong with Best Western reservations website? On arrival, we found the hotel to be seemingly well kept. Who founded Best Western? If you stay here, wearing work clothes will cause trouble. There was mildew smell in the room and blood stains on the carpet. Now we have to wait for manager to get our money back! In another sign Wall Street is keeping close tabs on electric vehicles and related stocks, Morgan Stanley adds four stocks to its coverage list, giving Fisker Inc. Cloud, Minnesota make the Best Western Plus Kelly Inn St. We like the place and the people, but this is NOT acceptable. Anyway, we really need help now. No apologies were given as if it was completely normal to stay in a hotel with no water service. Best Western Employee Discount was helpful benefit allowance discount because well for friends and family. She told me to do that in case I wasnt able to come and someone else could have those rooms if needed. Wells Fargo has been ripping off the poor for their entire existence. Good luck with that. She told me to go right ahead and gave me her business card. Bryant, You reservation was booked online through hotels. The rugs in the room were filthy dirty, the chairs were stained and dirty the toilet had rust rings. -

Serviced Visitor Accommodation in Lincolnshire

Serviced Visitor Accommodation in Lincolnshire Development Strategy & Action Plan FINAL April 2009 DRAFT Locum Consulting 9 Marylebone Lane London W1U 1HL United Kingdom Tel +44 (0)20 7487 1799 Fax +44 (0)20 7487 1797 [email protected] www.locumconsulting.com Date: 13 January 2012 Job: J0895 File: j0895 lincolnshire hotel development strategy 310309.doc All information, analysis and recommendations made for clients by Locum Consulting are made in good faith and represent Locum’s professional judgement on the basis of information obtained from the client and elsewhere during the course of the assignment. However, since the achievement of recommendations, forecasts and valuations depends on factors outside Locum’s control, no statement made by Locum may be deemed in any circumstances to be a representation, undertaking or warranty, and Locum cannot accept any liability should such statements prove to be inaccurate or based on incorrect premises. In particular, and without limiting the generality of the foregoing, any projections, financial and otherwise, in this report are intended only to illustrate particular points of argument and do not constitute forecasts of actual performance. Locum Consulting is the trading name of Locum Destination Consulting Ltd. Registered in England No. 3801514 J0895 Lincolnshire Hotel Development Strategy Contents 1. Introduction 7 2. Summary of Action Plan 8 2.1 Hotel and Pub Excellence Programme 8 2.2 Planning and Economic Development Initiatives 9 2.3 Planning and Economic Development Initiative specifically -

2014 European Hotel Transactions

MARCH 2015 | PRICE £500 2014 EUROPEAN HOTEL TRANSACTIONS Jill Barthel – HVS London ConsulƟ ng & ValuaƟ on Analyst Adrian Ruch – HVS Hodges Ward EllioƩ Analyst www.hvs.com HVS London and HVS Hodges Ward Elliott www.hvshwe.com 7-10 Chandos St, London W1G 9DQ, UK This license lets others remix, tweak, and build upon your work non-commercially, as long as they credit you and license their new creations under the identical terms. Others can download and redistribute your work just like the by-nc-nd license, but they can also translate, make remixes, and produce new stories based on your work. All new work based on yours will carry the same license, so any derivatives will also be non-commercial in nature. Highlights PARIS MARRIOTT HOTEL CHAMPS-ELYSÉES European hotel transaction volume totalled €14.4 billion in 2014, an increase of 86% on 2013. This igure represents a new record since the onset of the global inancial crisis and marks a continuation of the market recovery seen in 2013. Not only was 2014 the highest year since the €20.3 billion recorded in 2006, it was also the fourth highest year on record;¹ Transactions were evenly spread over the year, with slightly higher volumes in the second quarter, owing to the sales of the Paris Marriott Hotel Champs-Elysées (€345 million, €1.8 million per room) and Le Méridien Etoile (€280 million, €237,000 per room), and in the fourth quarter, the sale of Louvre Hotels Group (€1.2 billion); With regard to single asset transactions, 2014 witnessed the highest level of single both Ireland and Spain experienced a asset hotel transaction volume on record, strong year, marking a recovery in their while portfolio sales achieved the ifth struggling economies; highest volume on record, behind 2001, 2005, 2006 and 2007; While Middle Eastern investment decreased after an extremely strong Total portfolio transaction volume 2013, investment by North American and (€6.9 billion) doubled compared to Asian entities increased substantially 2013. -

European Chains & Hotels Report 2019

European Chains & Hotels Report 2019 Contents Welcome to Horwath HTL, the global leader in hospitality consulting. We are the industry choice; a global brand providing quality solutions for hotel, tourism & leisure projects. Page 5 Forward Page 32 Albania Page 7 Introduction Page 36 Croatia Page 42 Cyprus Page 10 Chain Hotels & Brands Page 46 Denmark Page 14 Year-on-Year Growth Page 50 France Page 16 Supply Page 56 Germany Page 18 Chain Hotels & Rooms Page 62 Greece Page 22 International Capital Flows Page 68 Hungary Page 24 Investment Page 74 Ireland Page 26 Openings & Deal Signing Page 80 Italy Page 28 Business Model Page 86 Montenegro Page 92 Netherlands Page 98 Norway Page 102 Poland Page 108 Portugal Page 114 Serbia Page 120 Slovenia Page 126 Spain Page 132 Sweden Click on this icon for easy navigation Page 136 Switzerland of the document Page 142 Turkey Page 148 United Kingdom Horwath HTL l European Hotels & Chains Report 2019 3 Forward The report looks at the relationship between hotel chains, their myriad of brands, and the wider world of hospitality and lodging. A very warm welcome to the new edition of the Horwath We look at the models used by the chain companies HTL Chains & Hotels Report, the third annual instalment. and see which ones are the most prevalent, in which The report looks at the relationship between hotel chains, market segment. and their myriad of brands, and the wider world of hospitality and lodging. In this edition, we have enhanced the report in a number of key ways. Firstly, we have greatly expanded the scope There have been two big stories over the last 25 years of the markets, from 12 last year to 22 this. -

60 Second Guides Industry Voice Inside CWT Destination Regional

UKM2484b Volume 4 Issue 4 2004 The Business Travel Magazine for Carlson Wagonlit Travel 60 Second Guides Austrian Airlines and Best Western Industry Voice Hilton and United Inside CWT The Future Of Business Travel Destination Athens Regional Review Africa 21st Century Car Hire Travel Gadgets Body Language Club World. More beds, more places, more often. editorial contents As we come towards the end of 2004, I think we’ll all readily agree that it’s been another challenging year for the business travel industry – never a dull moment, really, with all the ups and downs that we’ve been going through. And, as we speak, there is still a mixture of uncertainty yet, at the same time, a sense of buoyancy – opposite trends that make forecasting the future that much harder. What we can say, for sure, is in the airline business, it appears to be a buyers’ market, with passenger numbers on the rise, even with the proliferation of carriers cruising the skies these days. But this again brings us back to the question of capacity and what airlines are going to do about it, with that decision becoming ever more crucial, day by day. 18 16 24 26 28 Yet despite these buoyant figures, there are still real concerns about the way airlines are performing. Some are having a very hard time of things; others are working Editor-in-chief: on margins which are, frankly, unsustainable and already Jason Clarke news features we’re seeing signs of travellers being affected – a knock- Executive Editors: on effect that may be storing up trouble for the weeks Shital Shah, Industry Update . -

Hotel Development in NYC

Hotel Development in NYC Hotel Development in NYC: Winter 2021 Edition All In NYC. Winter 2021 Hotel Update Coming off the strong start to 2020 in January and February, the New York City’s travel and tourism industry slowed in March and came to a near total halt in April. The spread of the Covid19 virus and the necessary restrictions and precautions put in place in response to the pandemic have changed the picture of the industry over the past nine months. The nature of travel shifted from traditional leisure and business to emergency accommodations and local uses. Many of the city’s hotels found ways to support the response to the pandemic and begin to plan for a post-pandemic travel environment. At the same time, a significant proportion of the City’s properties closed temporarily to protect their employees and adjust to reduced demand. Sadly, another group of owners have made the difficult decision to close permanently. At the same time, construction on the majority of new and developing projects resumed as soon as work was permitted. Foundations are being dug, floors are rising, facades are changing the look of neighborhoods and interior work is putting the finishing touches on hundreds of new rooms. Current active inventory has been constantly shifting in response to opportunity and need across the city. According to STR, approximately one-in-three rooms are offline as of December. The hotel pipeline in New York City continues to stand out in the US for diversity of properties and investment. With a range of ground up new buildings, restorations of historic buildings, and expansions, the hotel sector is meeting the diversity of traveler preferences and expectations.