APA Format 6Th Edition Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Entire Dissertation Noviachen Aug2021.Pages

Documentary as Alternative Practice: Situating Contemporary Female Filmmakers in Sinophone Cinemas by Novia Shih-Shan Chen M.F.A., Ohio University, 2008 B.F.A., National Taiwan University, 2003 Thesis Submitted in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy in the Department of Gender, Sexuality, and Women’s Studies Faculty of Arts and Social Sciences © Novia Shih-Shan Chen 2021 SIMON FRASER UNIVERSITY SUMMER 2021 Copyright in this work rests with the author. Please ensure that any reproduction or re-use is done in accordance with the relevant national copyright legislation. Declaration of Committee Name: Novia Shih-Shan Chen Degree: Doctor of Philosophy Thesis title: Documentary as Alternative Practice: Situating Contemporary Female Filmmakers in Sinophone Cinemas Committee: Chair: Jen Marchbank Professor, Department of Gender, Sexuality and Women’s Studies Helen Hok-Sze Leung Supervisor Professor, Department of Gender, Sexuality and Women’s Studies Zoë Druick Committee Member Professor, School of Communication Lara Campbell Committee Member Professor, Department of Gender, Sexuality and Women’s Studies Christine Kim Examiner Associate Professor, Department of English The University of British Columbia Gina Marchetti External Examiner Professor, Department of Comparative Literature The University of Hong Kong ii Abstract Women’s documentary filmmaking in Sinophone cinemas has been marginalized in the film industry and understudied in film studies scholarship. The convergence of neoliberalism, institutionalization of pan-Chinese documentary films and the historical marginalization of women’s filmmaking in Taiwan, Hong Kong, and the People’s Republic of China (PRC), respectively, have further perpetuated the marginalization of documentary films by local female filmmakers. -

2019 Annual Report

FINANCIAL HIGHLIGHTS 2019 2018 Change Earnings & Dividends# Per Share Earnings per Share # Performance nd Dividends per Share Celebrating its 52 3.5 Loss per share HK$(0.67 ) HK$(0.45 ) 48% 3 Dividends per share year of operation, Television 2.5 - Interim HK$0.30 HK$0.30 2 - Final HK$0.20 HK$0.70 HK$0.50 HK$1.00 Broadcasts Limited is the 1.5 HK$ 1 HK$’mil HK$’mil leading terrestrial TV broadcaster 0.5 Revenue from external customers - Hong Kong TV broadcasting 2,190 2,923 -25% Since0 2016, TVB has headquartered in Hong Kong. TVB - myTV SUPER 442 402 10% -0.5 - Big Big Channel business 129 87 47% been-1 transformed from - Programme a licensing and 2015 2016 2017 2018 2019 is also one of the largest distribution 740 870 -15% YEAR # excluding special dividend - Overseas pay TV and traditional media to a TVB Anywhere 144 140 3% commercial Chinese programme - Other activities 4 55 -92% major digital player, 3,649 4,477 2019 Revenue from External Customers by producers in the world with an Operating Segment Segment profit/(loss)* % relating to 2018 are shown in brackets operating over-the-top - Hong Kong TV broadcasting (304 ) 194 N/A annual production output of over - myTV SUPER 40 16 154% Hong Kong TV broadcastingservices - Big Big Channel business 44 (19 ) N/A 60% (65%) myTV SUPER - Programme licensing and 22,000 hours of dramas and distribution 412 414 -1% Programmeand TVB Anywhere - Overseas, pay TV and licensing and TVB Anywhere (10 ) (16 ) -37% variety programmes, in addition distribution - Other activities (4 ) (17 ) -74% 20%social (19%) media platform - CorporateBig support# (152 ) (150 ) 1% to documentaries and news Other activities 26 422 -94% 1% (2%) Big Channel and e-commerceTotal expensesΔ 3,698 4,062 -9% reports, and an archive library of Overseas pay TV myTV SUPER Big Big andplatform TVB Anywhere 12% (9%) Big ChannelBig Shop Loss attributable. -

Announcement of 2020 Annual Results

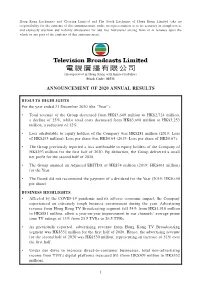

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (Incorporated in Hong Kong with limited liability) Stock Code: 00511 ANNOUNCEMENT OF 2020 ANNUAL RESULTS RESULTS HIGHLIGHTS For the year ended 31 December 2020 (the “Year”): • Total revenue of the Group decreased from HK$3,649 million to HK$2,724 million, a decline of 25%, whilst total costs decreased from HK$3,698 million to HK$3,253 million, a reduction of 12%. • Loss attributable to equity holders of the Company was HK$281 million (2019: Loss of HK$295 million). Loss per share was HK$0.64 (2019: Loss per share of HK$0.67). • The Group previously reported a loss attributable to equity holders of the Company of HK$293 million for the first half of 2020. By deduction, the Group delivered a small net profit for the second half of 2020. • The Group attained an Adjusted EBITDA of HK$74 million (2019: HK$461 million) for the Year. • The Board did not recommend the payment of a dividend for the Year (2019: HK$0.50 per share). BUSINESS HIGHLIGHTS • Affected by the COVID-19 pandemic and its adverse economic impact, the Company experienced an extremely tough business environment during the year. Advertising revenue from Hong Kong TV Broadcasting segment fell 54% from HK$1,910 million to HK$881 million, albeit a year-on-year improvement in our channels’ average prime time TV ratings of 13% from 23.5 TVRs to 26.5 TVRs. -

2018 Annual Report

FINANCIAL HIGHLIGHTS 2018 2017 Change Revenue and Prot Attributable to Equity Holders of the Company Performance Revenue (Continuing operations) (Loss)/earnings per share HK$(0.45) HK$0.56 N/A Prot Attributable to Equity Holders of the Company Adjusted earnings per share§ HK$0.69 HK$0.56 24% 6,000 Dividends per share 5,000 - 2017 first interim dividend – HK$0.60 - 2018 interim dividend/ 2017 second interim dividend HK$0.30 HK$0.30 4,000 - Final dividend HK$0.70 HK$0.30 HK$1.00 HK$1.20 3,000 HK$’ million HK$’ - 2017 special dividend – HK$0.70 2,000 HK$’mil HK$’mil 1,000 Revenue from external customers - Hong Kong TV broadcasting 2,923 2,818 4% 0 - myTV SUPER 402 280 43% 2014 2015 2016 2017 2018 § - Big Big Channel business 87 44 98% YEAR - Programme licensing and distribution 870 955 -9% - Overseas pay TV and TVB Anywhere 140 151 -7% Earnings & Dividends# Per Share - Other activities 55 88 -38% Earnings per Share 4,477 4,336 3% Dividends# per Share 3.5 HK$’mil HK$’mil Segment profit/(loss)* 3 - Hong Kong TV broadcasting 173 165 5% 2.5 - myTV SUPER 16 (85) N/A - Big Big Channel business (19) (11) 78% 2 - Programme licensing and HK$ 1.5 distribution 414 504 -18% - Overseas pay TV and TVB Anywhere (16) (53) -71% 1 - Other activities (17) 6 N/A # 0.5 - Corporate support (129) (152) -16% 422 374 13% 0 2014 2015 2016 2017 2018 § ∆ YEAR Total expenses 4,062 3,946 3% # excluding special dividend (Loss)/profit attributable to equity holders (199) 243 N/A Adjusted profit attributable to equity holders§ 301 243 24% 2018 Revenue from External Customers -

Review of Operations

REVIEW OF OPERATIONS HONG KONG TV BROADCASTING The milk powder category remained at the top position in the ad spend table, even though there Hong Kong TV broadcasting business continued to be was a 14% year-on-year drop on sales. This is a key our core business, accounting for approximately 65% of advertising category as visiting Mainland China’s the Group’s revenue in 2017. tourists continue to spend on consumer products. The loan and mortgage category, largely due to more TV ADVERTISING aggressive activities by finance companies, recorded strong growth of more than 30% and secured the After a prolonged cyclical downturn, the Hong Kong second position. Other performing categories included economy experienced a mild recovery in 2017 as retail banking and local properties, both of which reported sales index which suffered from year-on-year declines encouraging increases of 36% and 64% respectively. in the last 24 months finally exhibited a 3.0% growth in Revenue from government/quasi government category March 2017. The retail sales index reported an overall recorded a more than 60% growth which was boosted growth of 2.2% in 2017. by income related to events celebrating the 20th The advertising market, however, has yet to recover, as anniversary of the establishment of the Hong Kong total advertising spending in Hong Kong was estimated SAR on 1 July 2017. However, revenue from skin care to have fallen by 4% year-on-year in 2017. Throughout continued to drop in 2017 recording a fall of 9% year- the year, most of the advertisers were very cautious in on-year, and similarly, the spending from dental care spending the budgeted dollars, as the choice of media dropped 35%, compared with last year. -

Journal of Visual Culture 12(3): the Archives Issue

VCU12310.1177/1470412913502031Journal of Visual CultureAbbas and Abou-Rahme 5020312013 journal of visual culture The Archival Multitude Basel Abbas and Ruanne Abou-Rahme (in conversation with Tom Holert) Abstract Previously ascribed the position of meta-archivist in a culture marked by remembrance and retro-vision, the contemporary artist has been relocated arguably by today’s radical distribution of archival activity in and by the practices and technologies of social media. This conversation with Basel Abbas and Ruanne Abou-Rahme, two young audiovisual practitioners from Palestine, reveals some of the reasons behind this reconfiguration of the archival in its relation to the arts. Reflecting upon the emergence of an ‘archival multitude’ in North Africa and the Middle East during the past few years, Abbas and Abou-Rahme discuss the necessity of actively assessing the networked archives of the digital realm, thereby entailing significant shifts of their own artistic methodology. Keywords Arab Spring • the archival • contemporary art • Palestine • social media Contemporary art practices have been marked significantly by the impact of an ever-expanding notion of the archival that tends to favour and prioritize modes of operation such as collecting, curating, compiling, editing, ethnographizing, etc. Most of these practices engage in revisionary, often imaginative, sometimes utopian projects. Interrogating existing archives, investigating their infrastructural tasks and (in)accessibility, proposing alternate usages or constructing new (counter-) archives range among the strategies deployed regularly in exhibitions and performances. Hence, the re-contextualizing, re-arranging, re-organizing, re-enacting, re-evaluating or journal of visual culture [http://vcu.sagepub.com] SAGE Publications (Los Angeles, London, New Delhi, Singapore and Washington DC) Copyright © The Author(s), 2013. -

2020 Annual Report

C127090 FINANCIAL HIGHLIGHTS 2020 Revenue from External Customers by 2020 2019 Change Operating Segment % relating to 2019 are shown in brackets Performance Loss per share HK$(0.64 ) HK$(0.67 ) -5% Hong Kong TV broadcasting 49% (60%) Dividends per share - Interim - HK$0.30 Programme - Final - HK$0.20 licensing and - HK$0.50 distribution 26% (20%) HK$’mil HK$’mil Other activities Revenue from external customers 1% (1%) - Hong Kong TV broadcasting 1,323 2,190 -40% - myTV SUPER 412 442 -7% Overseas pay TV myTV SUPER Big Big Channel - Big Big Channel and and TVB Anywhere 15% (12%) and e-Commerce e-Commerce business 107 129 -16% 5% (3%) business - Programme licensing and 4% (4%) distribution 718 740 -3% - Overseas pay TV and TVB Anywhere 159 144 11% - Other activities 5 4 NM 2020 Revenue by Geographical Locations 2,724 3,649 -25% % relating to 2019 are shown in brackets Hong Kong Segment profit/(loss)* 56% (72%) - Hong Kong TV broadcasting (593 ) (304 ) 95% - myTV SUPER 11 40 -71% - Big Big Channel and e-Commerce business 53 44 20% Mainland China - Programme licensing and 29% (15%) distribution 346 412 -16% - Overseas pay TV and Malaysia and TVB Anywhere 8 (10 ) N/A Singapore - Other activities (3 ) (4 ) NM 7% (7%) - Corporate support§ (173 ) (152 ) 14% USA and Other (351 ) 26 N/A Canada territories 4% (3%) 4% (3%) Total expensesΔ 3,253 3,698 -12% Loss attributable to equity holders (281 ) (295 ) -5% Earnings and Dividends§ Per Share Earnings per Share 31 December 31 December Dividends§ per Share 2020 2019 HK$’mil HK$’mil 1.5 Total assets 9,832 -

Announcement of 2020 Interim Results

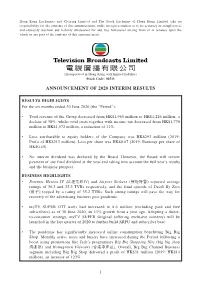

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (Incorporated in Hong Kong with limited liability) Stock Code: 00511 ANNOUNCEMENT OF 2020 INTERIM RESULTS RESULTS HIGHLIGHTS For the six months ended 30 June 2020 (the “Period”): • Total revenue of the Group decreased from HK$1,965 million to HK$1,226 million, a decline of 38%, whilst total costs together with income tax decreased from HK$1,770 million to HK$1,572 million, a reduction of 11%. • Loss attributable to equity holders of the Company was HK$293 million (2019: Profit of HK$213 million). Loss per share was HK$0.67 (2019: Earnings per share of HK$0.49). • No interim dividend was declared by the Board. However, the Board will review payment of any final dividend at the year-end taking into account the full year’s results and the business prospect. BUSINESS HIGHLIGHTS • Forensic Heroes IV (法證先鋒IV) and Airport Strikers (機場特警) reported average ratings of 36.3 and 33.2 TVRs respectively, and the final episode of Death By Zero (殺手) topped by a rating of 35.2 TVRs. Such strong ratings will pave the way for recovery of the advertising business post pandemic. • myTV SUPER OTT users had increased to 8.6 million (including paid and free subscribers) as of 30 June 2020, an 11% growth from a year ago.