Making Connections Stronger

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fuel Forecourt Retail Market

Fuel Forecourt Retail Market Grow non-fuel Are you set to be the mobility offerings — both products and Capitalise on the value-added mobility mega services trends (EVs, AVs and MaaS)1 retailer of tomorrow? Continue to focus on fossil Innovative Our report on Fuel Forecourt Retail Market focusses In light of this, w e have imagined how forecourts w ill fuel in short run, concepts and on the future of forecourt retailing. In the follow ing look like in the future. We believe that the in-city but start to pivot strategic Continuously pages w e delve into how the trends today are petrol stations w hich have a location advantage, w ill tow ards partnerships contemporary evolve shaping forecourt retailing now and tomorrow . We become suited for convenience retailing; urban fuel business start by looking at the current state of the Global forecourts w ould become prominent transport Relentless focus on models Forecourt Retail Market, both in terms of geographic exchanges; and highw ay sites w ill cater to long customer size and the top players dominating this space. distance travellers. How ever the level and speed of Explore Enhance experience Innovation new such transformation w ill vary by economy, as operational Next, w e explore the trends that are re-shaping the for income evolutionary trends in fuel retailing observed in industry; these are centred around the increase in efficiency tomorrow streams developed markets are yet to fully shape-up in importance of the Retail proposition, Adjacent developing ones. Services and Mobility. As you go along, you w ill find examples of how leading organisations are investing Further, as the pace of disruption accelerates, fuel their time and resources, in technology and and forecourt retailers need to reimagine innovative concepts to become more future-ready. -

For the Fuel & Convenience Store Industry

FOOT TRAFFIC REPORT FOR THE FUEL & CONVENIENCE STORE INDUSTRY Q1 2017 A NEW ERA FOR THE CONVENIENCE STORE As the convenience store industry adapts to meet customer needs and grow market share, location intelligence is becoming increasingly critical to understanding consumer habits and behaviors. GasBuddy and Cuebiq teamed up in the first quarter of 2017 to issue the first foot traffic report for the fuel and convenience store industry. Highlights: GasBuddy and Cuebiq examined 23.5 million consumer trips to the pumps and convenience stores between January 1 and March 31. In Q1, more than half of GasBuddies visited locations within six miles of their homes or places of employment, giving retailers the opportunity to leverage their greatest resource—knowing their customer base—to localize and personalize their product selection. Weekdays between 11:00 a.m. and 1:00 p.m. were highly-trafficked hours in Q1. Convenience stores are poised to lure business away from QSRs and grocery stores now that customers can eat quality meals at the same place and time they choose to fill up their tanks. With filling a gas tank clocking in at an efficient 2-3 minutes, the 73% of GasBuddies who spent more than five minutes at locations in Q1 demonstrated that consumers are likely willing to spend some time in store before or after visiting the pumps. QUARTERLY FOOT TRAFFIC REPORT 1 GasBuddy examined nearly 23.5 million consumer trips to gas Indiana-based gas station and stations and c-stores in Q1 2017 convenience store chain Ricker’s enjoys a loyal GasBuddy customer Which fuel brands captured the base—the nearly 50-station brand highest ratio of footfall per station? captured more than 4x the industry average footfall per location in Q1. -

Fouad El-Nemr Has Been

Volume 28Volume • Number 1919 •• NumberNumber12 • DECEMBER 66 •• JUNEJUNE 201720082008 BusinessBusiness SolutionsSolutions forfor RetailRetail DecisionDecision MakersMakers ®® A HARBOR COMMUNICATIONS PUBLICATION A HARBOR COMMUNICATIONS PUBLICATION ® Recognizing this Year’s Industry Frontrunners Figuring Out the Future of Tobacco .....45 Dazzling Customers Across Dayparts ....48 C-Stores Power Through Storms ........52 Faces WS.indd 2 11/20/17 10:59 AM COVER STORY EGULARLY WHEN PUNDITS EVALU- every day for a cup of joe or a break- ATE athletes they often compile fast sandwich or to fill up their gas 2017 Rcareer statistics, crunching the tanks. And because many on this numbers to determine the best quar- year’s list belong to family-owned terback, most talented goalie, elite companies, these young professionals point guard or top outfielder. are that much more in tune to ensuring Numbers come into play in every- their customers are receiving the high- day business as well when evaluating est quality service, each and every day. staff. Often the best employees, man- Those who work in this business are agers, directors or executives who members of an evolving and diverse demonstrate intangibles such as cre- industry, which is not surprising given ativity, leadership, originality and the diversity of U.S. consumers who loyalty are harder to quantify. frequent today's c-stores. As the face of The individuals in the following the channel’s customer base becomes pages represent big corporations and even more diverse, companies willing small retail chains—but all demonstrate to embrace social media, technology the type of qualities that most employ- and even meal kits are becoming more ers seek. -

Newsletterwinter2014

NEWSLETTERWINTER2014 WELCOME NRC Realty & Capital Advisors, LLC is pleased to provide you with its first quarterly newsletter dealing with topics of interest to owners and operators in the convenience store and gasoline station industry. Given our industry experience and expertise, particularly as it relates to real estate and financial services, we believe that we are able to provide a wide array of information that should be of benefit to you and your business. In this inaugural issue, we begin a four-part series on Finally, we have enclosed an article entitled “NRC Achieves “Understanding the Value of Your Business.” The first article Banner Year in 2013” which highlights the notable in the series is “Why Should I Have My Company Valued?” transactions that NRC was involved in last year. Again, and is written by Evan Gladstone, Executive Managing looking at recent transactions and trends will provide a good Director and Ian Walker, Senior Vice President. “barometer” of things to look for in the future. This issue also contains a reprint of the “2013 C-Store We at NRC are excited about our quarterly newsletter and Industry Year in Review: An M&A and Capital Markets hope that you will find it of value. Should you have any Perspective” written by Dennis Ruben, Executive Managing questions about anything contained in this newsletter or any Director, which first appeared online on CSP Daily News other matter, please feel free to contact Evan Gladstone on January 8th through 10th as a three-part series. A at (312) 278-6801 or [email protected], Dennis review of that article should prove to be particularly useful Ruben at (480) 374-1421 or [email protected], or in understanding where the industry has been recently and Ian Walker at (312) 278-6830 or [email protected]. -

San Diego's Mid-Century Modern Marvels

SAVE OUR HERITAGE ORGANISATION PRESENTS SAN DIEGO’S MID-CENTURY MODERN MARVELS INTRODUCTION As we advance into the 2020s, 20th-century Modern architecture is having a renaissance. Not only is the style rising in popularity, but Mid-Century designs are reaching a level of maturity that qualifies many for historic designation and a higher level of recognition and importance. This self-guided driving tour will take you from North Park, Mission Valley, and Hillcrest to the coast with stops in Point Loma, Shelter Island, and La Jolla to see some of San Diego’s most marvelous Mid-Century Modern buildings. Built from the years 1949 to 1977, the movement’s end in the 1970s, these designs showcase the work of many of San Diego’s leading Modernist architects, including Lloyd Ruocco, Robert Mosher, and William Krisel. While this tour is limited to public buildings and represents only a dozen of the Mid-Century sites worthy of recognition and study, we hope it offers a taste of the diversity of Mid-Century Modern designs and their place in San Diego’s development. MAP Click below on this image to be redirected to an interactive Google Map that will help guide you to each of the 12 sites on the tour. 1. Rudford’s Restaurant, 1949 Photos by Sandé Lollis Photo by James Daigh 2900 El Cajon Boulevard A signature El Cajon Boulevard landmark, Rudford’s Restaurant has been in operation since 1949. The sleek modern design features oval porthole style windows and original neon signage. El Cajon Boulevard is historically significant as a commercial strip known for its neon, and Rudford’s is a key example of this mid-century neighborhood development. -

Convenience Stores, Gas Stations Found Bright

CONVENIENCE STORES, GAS STATIONS FOUND BRIGHT SPOTS IN PANDEMIC An Ipsos Point of View Circle K, 7-Eleven, Wawa and other stores added/ expanded their digital business models in 2020, addressing consumer concerns for health and safety, by seizing on the demand for curbside and in-store pickup. Will that continue if normal life returns? Here’s what the data shows. Key Objectives/Findings: • Convenience stores and gas stations faced similar problems—including lower foot traffic and health and safety concerns —to other retailers in 2020 but found opportunity in pickup and delivery. • Despite fuel prices falling and fewer people driving, these stores were able to take advantage of a boost in impulse trips and sales. • Third-party app usage for convenience stores and gas stations soared, helping offset the decline in fuel demand. • New Ipsos research shows how convenience stores and gas stations can adapt as consumer habits slowly return to ones common before the pandemic. 2 IPSOS | CONVENIENCE STORES, GAS STATIONS FOUND BRIGHT SPOTS IN PANDEMIC Over the past year, more buying shifted online amid the retail shakeout and the extraordinary circumstances presented by the pandemic—a trend that had major implications for convenience stores and gas stations. From Circle K to 7-Eleven and more, convenience store chains and gas stations adjusted to a very different world of fewer drivers, fewer fuel purchases and a huge demand for delivery of household items. As life slowly returns to normal, will those trends continue? Here’s what Ipsos has found from recent studies that can help conveni- ence store leaders and managers prepare for the future. -

Foot Traffic Report Q4 2017

FOOT TRAFFIC REPORT & DRIVING TRENDS for the fuel & convenience store industry 2017 YEAR IN REVIEW & 2018 FORECAST 2017 YEAR IN REVIEW & 2018 FORECAST GasBuddy and Cuebiq examined 121 million consumer trips to convenience and fuel retailers in 2017—with 35 million visits taking place between October 1 and December 31. This data provides insights into consumer behavior that will continue to be relevant throughout 2018. Highlights: Ricker’s Captures the Top Spot in 2017 The Indiana-based retailer edges out the competition for the highest ratio of footfall per station in 2017—nearly five times the industry average. Costco claims second place after capturing the top spot in Q4, and Meijer comes in a close third. Good Forecourt Lighting is Good for Business Throughout 2017, there was a strong correlation between overnight foot traffic and the quality of forecourt lighting. Stations near interstates with above-average outdoor lighting ratings on GasBuddy saw a 50% increase in foot traffic, during the hours of 9:00pm to 5:00am, when compared to those with below-average ratings. Visits were up in Q4 From Q3 to Q4 2017, visits to gas stations and convenience stores saw an uplift of 5.15%. Busiest Time of the Day An analysis of location data reveals that Friday at 12:00pm saw the highest average levels of foot traffic in 2017. Lunch hours were the busiest during the work week, and the morning commute was comparatively slower. GasBuddies Go Beyond the Pump McDonald’s narrowly edged out Subway to become GasBuddies' favorite quick-service restaurant of 2017, and Starbucks took the title over Dunkin' Donuts in the coffee shop category. -

Inside Jersey Store List by Store 1 of 16 7-ELEVEN 598 JOLINE AVE

Inside Jersey Store List by Store 130 DELI ROUTE 130 & DAVIDSON NORTH BERGEN 08865 1ST FOOD STOP 450 AMWELL ROAD HILLSBOROUGH 08844 6 ELEVEN 449 GRAND AVE RAHWAY 07065 7 DAYS FOOD STORE 392 NORTH AVE DUNELLEN 08812 7‐ELEVEN 1509 MAIN ST ASBURY PARK 07712 7‐ELEVEN 122 BLOOMFIELD AVENUE BLOOMFIELD 07003 7‐ELEVEN 856 RTE 70 BRICK 08724 7‐ELEVEN 2075 HWY 88 BRICK 08723 7‐ELEVEN 101 CHAMBRIDGE RD BRICK TOWN 08723 7‐ELEVEN 108 LAKESHORE WAY BRICKTOWN 08723 7‐ELEVEN 341 RT 46 BUDD LAKE 07828 7‐ELEVEN 434 RIDGEDALE AVE EAST HANOVER 07936 7‐ELEVEN 21 LINCOLN HIGHWAY EDISON 08837 7‐ELEVEN 50 SHANK RD FREEHOLD 07728 7‐ELEVEN 309 NORTH AVENUE GARWOOD 07027 7‐ELEVEN 42 RTE 517 HACKETTSTOWN 07840 7‐ELEVEN 100 GOFFLE RD. HAWTHORNE 07506 7‐ELEVEN 222 DUTCH NECK HIGHTSTOWN 08520 7‐ELEVEN 432 ROUTE 206 SOUTH HILLSBOROUGH 08844 7‐ELEVEN 527 FLORIDA GROVE ROAD HOPELAWN 08861 7‐ELEVEN 2510 RT.9 SOUTH HOWELL 07731 7‐ELEVEN 665 BENNETS RD JACKSON 08527 7‐ELEVEN 747 ROUTE 15 SOUTH LAKE HOPATCONG 07843 7‐ELEVEN 415 LAWRENCEVILLE RD LAWRENCEVILLE 08648 7‐ELEVEN 415 LAWRENCEVIL LAWRENCEVILLE 08648 7‐ELEVEN 218 POMPTON AVENUE LITTLE FALLS 07424 7‐ELEVEN 647 BRANCH AVE LITTLE SILVER 07739 7‐ELEVEN 554 OCEAN BVLD LONG BRANCH 07740 7‐ELEVEN 598 JOLINE AVE LONG BRANCH 07740 7‐ELEVEN 750 RUTHERFORD AVE LYNDHURST 07071 7‐ELEVEN 326 MORRISTOWN MATAWAN 07747 7‐ELEVEN 959 ROUTE 53 MORRIS PLAINS 07950 7‐ELEVEN 280 MAIN STREET NEW MILFORD 07646 7‐ELEVEN 692 LIVINGSTON NORTH BRUNSWICK 08902 7‐ELEVEN 47 MONMOUTH RD NR PK OAKHURST 07755 7‐ELEVEN 807 DEAL ROAD OCEAN TOWNSHIP 07712 7‐ELEVEN 269 CHANGEBRIDGE ROAD PINE BROOK 07058 7‐ELEVEN 701 OCEAN RD POINT PLEASANT 08742 7‐ELEVEN 2900 BRIDGE AVE POINT PLEASANT 08742 7‐ELEVEN 420 BROADWAY PT PLEASANT 08742 7‐ELEVEN WEST FRONT 7 MAPLE AVE RED BANK 07701 7‐ELEVEN 500 LOCUST ST. -

Storeno State Mall Name FBC Store Type YTD Sales # Units Sold

Dec-19 StoreNo State Mall Name FBC Store Type YTD Sales # Units Sold # Receipts Units/Receipt Avg $ Receipt 1 CA The Shops at Mission Viejo Sam Guagliardo In-Line 579,475.02 12,413 10,379 1.20 $55.83 2 FL Dadeland Mall Chris Canada Kiosk 330,047.29 8,743 6,763 1.29 $48.80 4 FL Coconut Point Chris Canada In-Line 271,663.12 6,748 4,911 1.37 $55.32 5 PA Ross Park Mall Chris Canada In-Line 566,328.52 19,179 12,353 1.55 $45.85 6 CA South Bay Galleria Sam Guagliardo In-Line 216,941.59 5,432 4,355 1.25 $49.81 7 CT Westfield Trumbull Chris Canada Kiosk 279,730.18 16,039 11,910 1.35 $23.49 8 CA Westfield Valencia Town Center Sam Guagliardo In-Line 1,236,192.29 12,843 9,950 1.29 $124.24 9 PA Millcreek Mall Chris Canada In-Line 413,278.37 11,326 8,633 1.31 $47.87 10 CA The Mall of Victor Valley Sam Guagliardo Kiosk 396,509.02 11,596 8,639 1.34 $45.90 11 CA Antelope Valley Mall Sam Guagliardo In-Line 437,148.76 10,733 8,811 1.22 $49.61 12 FL Altamonte Mall Chris Canada In-Line 302,632.40 7,629 6,833 1.12 $44.29 13 NM Cottonwood Mall David Holland In-Line 139,928.50 5,898 4,006 1.47 $34.93 14 NM Coronado Center David Holland Kiosk 443,210.18 19,211 13,753 1.40 $32.23 15 FL The Falls Chris Canada In-Line 258,320.20 5,906 4,499 1.31 $57.42 16 FL Edison Mall Chris Canada Kiosk 354,239.65 12,014 9,353 1.28 $37.87 17 FL Boynton Beach Mall Chris Canada In-Line 18 FL Melbourne Square Mall Chris Canada Kiosk 315,866.19 7,161 5,834 1.23 $54.14 19 TX Baybrook Mall David Holland In-Line 980,316.56 18,848 14,975 1.26 $65.46 20 TX Barton Creek Square Shopping -

Presentation of the Group PDF 603KB

2 Universal Registration Document 2020 / UNIBAIL-RODAMCO-WESTFIELD Presentation of the Group Presentation of the Group 1.1 KEY FACTS 3 1.2 HISTORY 4 1.3 STRATEGY AND BUSINESS MODEL 6 1.4 BUSINESS OVERVIEW 12 Business segments 12 Portfolio breakdown 13 Development pipeline 15 CHAPTER 1.5 PORTFOLIO 16 1.5.1 France: Shopping Centres 16 1.5.2 France: Convention & Exhibition 18 1.5.3 France: Offices 19 1.5.4 Central Europe: Shopping Centres 20 1.5.5 Central Europe: Offices 21 1.5.6 Spain: Shopping Centres 21 1.5.7 Spain: Offices 21 1.5.8 Nordics: Shopping Centres 22 1.5.9 Nordics: Offices 22 1.5.10 Austria: Shopping Centres 23 1.5.11 Austria: Offices 23 1.5.12 Germany: Shopping Centres 24 1.5.13 Germany: Offices 24 1.5.14 The Netherlands: Shopping Centres 25 1.5.15 The Netherlands: Offices 25 1.5.16 United States: Shopping Centres 26 1.5.17 United States: Offices 28 1.5.18 United Kingdom: Shopping Centres 29 1.5.19 United Kingdom: Offices 29 1.6 OVERVIEW OF VALUATION REPORTS PREPARED BY UNIBAIL-RODAMCO-WESTFIELD’S INDEPENDENT EXTERNAL APPRAISERS FOR EUROPEAN ASSETS 30 1.7 OVERVIEW OF VALUATION REPORTS PREPARED BY UNIBAIL-RODAMCO-WESTFIELD’S INDEPENDENT EXTERNAL APPRAISERS FOR AMERICAN ASSETS 32 1.8 STRUCTURE 34 1.9 SIMPLIFIED GROUP ORGANISATIONAL CHART 35 Universal Registration Document 2020 / UNIBAIL-RODAMCO-WESTFIELD 3 Presentation of the Group Key facts 1.1 KEY FACTS 1. 87 16 OFFICES & OTHERS SHOPPING CENTRES BUILDINGS(1) 10 80% CONVENTION & EXHIBITION COLLECTION RATE(3) VENUES(2) 247 ~3,100 COVID-19 ESG INITIATIVES EMPLOYEES €1,790 Mn €7.28 ADJUSTED RECURRING NET RENTAL INCOME EARNINGS PER SHARE €2.3 Bn €56.3 Bn DISPOSALS(4) GROSS MARKET VALUE €166.8 €4.4 Bn EPRA NET REINSTATEMENT PIPELINE VALUE PER SHARE (1) Only standalone offices > 10,000 sqm and offices affixed to a shopping centre > 15,000 sqm, including La Vaguada offices. -

Location Supply Loyalty Store Go

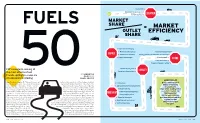

High traffic• Good ingress and egress • LOCATION GO Sizable acreage • • Sophisticated buying • Below-market prices Focus on foodservice • SUPPLY • Guaranteed volumes Strong product assortment and variety • • Supply advantages Friendly staff • STORE Clean restrooms • Traveler-friendly “extras”• CSP’s inaugural ranking of Rewards programs • LOYALTY the most effective fuel Social-media presence • BY SAMANTHA brands spotlights a new era OLLER AND of convenience retailing ANGEL ABCEDE HOW TO PLAY Gasoline is one tough sell. ¶ It is purely functional— market efficiency, which OPIS calculates by divid- Fuel variety Use a combination of not fun. It is a necessity—not a choice. It is noxious, ing a brand’s market share by its outlet share. The • buying and pricing toxic and highly flammable. And the typical higher a brand’s market efficiency, the higher its • Adequate number of dispensers buying experience? Being forced to watch your per-store fuel volumes. ¶ While major oil dom- strategies and Bright lighting money disappear gallon by gallon, cent by cent. inates in market share, the Fuels 50 ranking is • retail offers to attract fuel ¶ And despite a short-term goose from low pric- topped by many of the industry’s “new era” re- Well-maintained pumps customers to your site. es, gasoline demand is hardwired to be flat or tail heavyweights: Wawa, QuikTrip, Sheetz and FORECOURT • The brands that diminishing in the long term, thanks to tough RaceTrac. These are private brands that recog- • Competitive prices sell the most gasoline fuel-economy standards and demographic nize and maximize the critical link between the Room to maneuver per location generate the trends. -

Mission Valley

MISSION VALLEY GERMANY CentrO - Oberhausen Gera Arcaden - Gera Gropius Passagen - Berlin Höfe am Brühl - Leipzig Minto - Mönchengladbach Palais Vest - Recklinghausen Pasing Arcaden - Munich Paunsdorf Center - Leipzig OUR PORTFOLIO Ring-Center - Berlin Ruhr Park - Bochum Westfield Hamburg- Überseequartier - Hamburg THE NETHERLANDS Citymall Almere - Almere SWEDEN Westfield Mall of Greater Stockholm the Netherlands - Leidschendam Westfield Mall of Scandinavia Stadshart Amstelveen - Amstelveen Nacka Forum SEATTLE Stadshart Zoetermeer - Zoetermeer Solna Centrum Westfield Southcenter Täby Centrum POLAND SAN FRANCISCO AREA Warsaw Westfield Galleria at Roseville UNITED KINGDOM DENMARK Westfield Arkadia Westfield Oakridge CHICAGO London Copenhagen Centrum Ursynów Westfield San Francisco Centre Westfield Old Orchard Westfield Stratford City Fisketorvet Galeria Mokotów Westfield Valley Fair Chicago O’Hare International CONNECTICUT Croydon Galeria Wileńska Westfield Meriden Westfield London Złote Tarasy Westfield Trumbull Wrocław Wroclavia BELGIUM Brussels CZECH REPUBLIC Mall of Europe Prague SLOVAKIA Westfield Chodov NEW YORK AREA Bratislava Bubny Westfield Garden State Plaza Aupark Centrum Černý Most Metropole Zličín Westfield South Shore ITALY Westfield Sunrise Milan Westfield World Trade Center Westfield Milano JFK International AUSTRIA Newark Liberty International Vienna Donau Zentrum Shopping City Süd WASHINGTON D.C. AREA Westfield Annapolis Westfield Montgomery Westfield Wheaton SPAIN FRANCE UNITED STATES Benidorm - Benidorm Westfield Carré Sénart - Greater Paris