Shareholder Circular and Notice of the 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

COVID-19 Proxy Governance Update

COVID-19 Proxy Governance Update 2020 AGM mid-season review FROM EQUINITI 01 Looking back and planning ahead It is incredible to note that it has been over 12 weeks since the official announcement on 23 March of the UK Government’s Stay at Home Measures, and nearly seven months since the severity of the pandemic became apparent in China. Over the said period, PLC boards, company secretaries and investor relations officers have kept their corporate calendars going thanks to rapid adoption of modified regulatory guidelines and inventive modes of engagement with investors. With annual general meetings being an obvious highlight in the corporate calendar, we take stock of the progress made so far over the 2020 AGM season, as well as using what we learned to plan ahead. Now that we are over the first ‘hump’ with the busy period of May AGMs out of the way, we are readying for the second ‘peak’ of June and July AGMs, and then an ‘easing’ until the second ‘mini’ season in the early autumn. As such, in this update, we look at: • 2020 AGM season statistics…so far • Proxy adviser engagement and ISS recommendations review • High-level assumptions for Q3 and Q4 • Relevant updates from the regulators, industry bodies and proxy advisers • Communications in the COVID-19 world – special commentary by leading financial PR firm,Camarco • How has COVID-19 impacted activism – special commentary by international law firm,White & Case 02 2020 AGM Season Statistics…so far Scope of data To assess progress and forecast what is to come, we look at the key statistics for the UK AGM season 2020 thus far. -

Taylor Woodrow Plc Report and Accounts 2006 Our Aim Is to Be the Homebuilder of Choice

Taylor Woodrow plc Report and Accounts 2006 Our aim is to be the homebuilder of choice. Our primary business is the development of sustainable communities of high-quality homes in selected markets in the UK, North America, Spain and Gibraltar. We seek to add shareholder value through the achievement of profitable growth and effective capital management. Contents 01 Group Financial Highlights 54 Consolidated Cash Flow 02 Chairman’s Statement Statement 05 Chief Executive’s Review 55 Notes to the Consolidated 28 Board of Directors Financial Statements 30 Report of the Directors 79 Independent Auditors’ Report 33 Corporate Governance Statement 80 Accounting Policies 37 Directors’ Remuneration Report 81 Company Balance Sheet 46 Directors’ Responsibilities 82 Notes to the Company Financial Statement Statements 47 Independent Auditors’ Report 87 Particulars of Principal Subsidiary 48 Accounting Policies Undertakings 51 Consolidated Income Statement 88 Five Year Review 52 Consolidated Statement of 90 Shareholder Facilities Recognised Income and Expense 92 Principal Taylor Woodrow Offices 53 Consolidated Balance Sheet Group Financial Highlights • Group revenues £3.68bn (2005: £3.56bn) • Housing profit from operations* £469m (2005: £456m) • Profit before tax £406m (2005: £411m) • Basic earnings per share 50.5 pence (2005: 50.6 pence) • Full year dividend 14.75 pence (2005: 13.4 pence) • Net gearing 18.6 per cent (2005: 23.7 per cent) • Equity shareholders’ funds per share 364.7 pence (2005: 338.4 pence) Profit before tax £m 2006 405.6 2005 411.0 2004 403.9 Full year dividend pence (Represents interim dividends declared and paid and final dividend for the year as declared by the Board) 2006 14.75 2005 13.4 2004 11.1 Equity shareholders’ funds per share pence 2006 364.7 2005 338.4 2004 303.8 * Profit from operations is before joint ventures’ interest and tax (see Note 3, page 56). -

Disclaimer Strictly Not to Be Forwarded to Any

DISCLAIMER STRICTLY NOT TO BE FORWARDED TO ANY OTHER PERSONS IMPORTANT: You must read the following disclaimer before reading, accessing or making any other use of the attached document relating to SEGRO plc (the “Company”) dated 10 March 2017. In accessing the attached document, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. You acknowledge that this electronic transmission and the delivery of the attached document is confidential and intended for you only and you agree you will not forward, reproduce, copy, download or publish this electronic transmission or the attached document (electronically or otherwise) to any other person. The attached document has been prepared solely in connection with the proposed rights issue and offering of nil paid rights, fully paid rights and new ordinary shares (the “Securities”) of the Company (the “Transaction”). The Prospectus has been published in connection with the admission of the Securities to the Official List of the UK Financial Conduct Authority (the ‘‘Financial Conduct Authority’’) and to trading on the London Stock Exchange plc’s main market for listed securities (together, ‘‘Admission’’). The Prospectus has been approved by the Financial Conduct Authority as a prospectus prepared in accordance with the Prospectus Rules made under section 73A of the Financial Services and Markets Act 2000, as amended. NOTHING IN THIS ELECTRONIC TRANSMISSION AND THE ATTACHED DOCUMENT CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE IT IS UNLAWFUL TO DO SO. -

City Investment Watch

UK Commercial – January 2021 MARKET IN City Investment MINUTES Savills Research Watch December records highest monthly volume of 2020 bringing the annual total to £4.48Bn. December is historically the busiest month of the year as and retail complex totals approximately 192,700 sq. ft. The investors look to close deals prior to year-end. Any concerns total rent passing is approximately £7.3 million per annum the typical flurry of activity would be impacted by the with approximately 40% of the income expiring in 2021. omnipresent political and economic disruption, principally December saw £1.18Bn focused around lengthy Brexit trade negotiations and the No new assets were marketed in December given the transact over 16 deals ever-evolving Covid-19 pandemic, were allayed swiftly. disruption associated with the November Lockdown and the The largest deal of the year exchanged early in the month Christmas / New Year break. Accordingly, with the rise in contributing to a monthly volume of £1.18Bn, a significant investment turnover there has been an expected fall in the increase on November (£404M) and the 2020 monthly average volume of stock under offer, which currently stands at £1.50Bn of £301.60M, but 31% below December 2019 (£1.69Bn). across 14 transactions. A comparatively strong December contributed to a total Q4 Unsurprisingly given the disruption across both investment volume of £2.14Bn, 34% down on Q4 2019 and 39% down on and occupational markets, investors were principally the Q4 10-year average. Total 2020 transactional volume seeking Core (54% of annual transactional volume over reached £4.48Bn, which is approximately 42.5% down on that 13 transactions) and Core Plus (29% over 29 transactions) achieved in 2019 (£8.18Bn) and 53% below the 10-year average. -

Building Excellence

Barratt Developments PLC Building excellence Annual Report and Accounts 2017 Annual Report and Accounts 2017 Inside this report 1 45 113 175 Strategic Report Governance Financial Statements Other Information 1 Key highlights 46 The Board 114 Independent Auditor’s Report 175 KPI definitions and why we measure 2 A snapshot of our business 48 Corporate governance report 119 Consolidated Income Statement 176 Glossary 4 Our performance and financial highlights 60 Nomination Committee report 119 Statement of Comprehensive Income 177 Other Information 6 How we create and preserve value 65 Audit Committee report 120 Statement of Changes in 8 Chairman’s statement 74 Safety, Health and Environment Shareholders’ Equity – Group 10 Key aspects of our market Committee report 121 Statement of Changes in 76 Remuneration report Shareholders’ Equity – Company 12 Chief Executive’s statement Notice regarding limitations on Directors’ liability under 106 Other statutory disclosures 122 Balance Sheets English law 17 Our Strategic priorities Under the Companies Act 2006, a safe harbour limits the 112 Statement of Directors’ 123 Cash Flow Statements liability of Directors in respect of statements in, and omissions from, the Strategic Report contained on pages 1 to 44 and the Our principles Responsibilities 124 Notes to the Financial Statements Directors’ Report contained on pages 45 to 112. Under English Law the Directors would be liable to the Company (but not to 34 Keeping people safe any third party) if the Strategic Report and/or the Directors’ Report contains errors as a result of recklessness or knowing 35 Being a trusted partner misstatement or dishonest concealment of a material fact, 36 Building strong but would not otherwise be liable. -

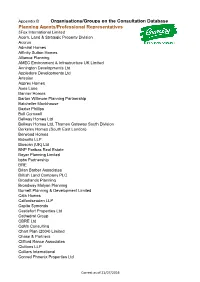

Organisations/Groups on the Consultation Database Planning

Appendix B Organisations/Groups on the Consultation Database Planning Agents/Professional Representatives 3Fox International Limited Acorn, Land & Strategic Property Division Acorus Admiral Homes Affinity Sutton Homes Alliance Planning AMEC Environment & Infrastructure UK Limited Annington Developments Ltd Appledore Developments Ltd Artesian Asprey Homes Axes Lane Banner Homes Barton Willmore Planning Partnership Batcheller Monkhouse Baxter Phillips Bell Cornwell Bellway Homes Ltd Bellway Homes Ltd, Thames Gateway South Division Berkeley Homes (South East London) Berwood Homes Bidwells LLP Bioscan (UK) Ltd BNP Paribas Real Estate Boyer Planning Limited bptw Partnership BRE Brian Barber Associates British Land Company PLC Broadlands Planning Broadway Malyan Planning Burnett Planning & Development Limited Cala Homes Calfordseaden LLP Capita Symonds Castlefort Properties Ltd Cathedral Group CBRE Ltd CgMs Consulting Chart Plan (2004) Limited Chase & Partners Clifford Rance Associates Cluttons LLP Colliers International Conrad Phoenix Properties Ltd Correct as of 21/07/2016 Conrad Ritblat Erdman Co-Operative Group Ltd., Countryside Strategic Projects plc Cranbrook Home Extensions Crest Nicholson Eastern Crest Strategic Projectsl Ltd Croudace D & M Planning Daniel Watney LLP Deloitte Real Estate DHA Planning Direct Build Services Limited DLA Town Planning Ltd dp9 DPDS Consulting Group Drivers Jonas Deloitte Dron & Wright DTZ Edwards Covell Architecture & Planning Fairclough Homes Fairview Estates (Housing) Ltd Firstplan FirstPlus Planning Limited -

Investor Presentation

Investor Presentation HY 2020 Our Investment Case 1 2 3 4 Our distinctive The scale and A well-positioned Our operational business model & quality of our development expertise & clear strategy portfolio pipeline customer insight Increasing our focus 22.5m sq ft of Development pipeline Expertise in on mixed use places high quality assets aligned to strategy managing and leasing our assets based on our customer insight Growing London Underpinned by our Provides visibility campuses and resilient balance sheet on future earnings Residential and refining and financial strength Drives incremental Retail value for stakeholders 1 British Land at a glance 1FA, Broadgate £15.4bn Assets under management £11.7bn Of which we own £521m Annualised rent 22.5m sq ft Floor space 97% Occupancy Canada Water Plymouth As at September 2019 2 A diverse, high quality portfolio £11.7bn (BL share) Multi-let Retail (26%) London Campuses (45%) 72% London & South East Solus Retail (5%) Standalone offices (10%) Retail – London & SE (10%) Residential & Canada Water (4%) 3 Our unique London campuses £8.6bn Assets under management £6.4bn Of which we own 78% £205m Annualised rent 6.6m sq ft Floor space 97% Occupancy As at September 2019 4 Canada Water 53 acre mixed use opportunity in Central London 5 Why mixed use? Occupiers Employees want space which is… want space which is… Attractive to skilled Flexible Affordable Well connected Located in vibrant Well connected Safe and promotes Sustainable and employees neighbourhoods wellbeing eco friendly Tech Close to Aligned to -

Consultation Statement Submission Version

Consultation Statement (Submission) November 2019 2 Consultation Statement (Submission) November 2019 Table of contents 1 Introduction ............................................................................................................................... 4 2 Regulation 19 consultation process ........................................................................................... 6 2.1 Notification ................................................................................................................................ 6 Website .................................................................................................................................... 6 Emails ...................................................................................................................................... 6 Social media ............................................................................................................................ 6 Hard copies ............................................................................................................................. 7 2.2 Coverage .................................................................................................................................. 7 Media coverage ....................................................................................................................... 7 Scrutiny Committee ................................................................................................................ 8 Petitions.................................................................................................................................. -

Retail Is Not Dead and Regionally Dominant Shopping Centres Offer an Attractive Value Play

REAL ASSETS Research & Strategy For professional clients only January 2019 Retail is not dead and regionally dominant shopping centres offer anattractive value play Executive summary: ■ The consumer has taken control of the retail relationship which is putting pressure on retailers’ margins, as they face increased competition and a need to invest in a full reconfiguration of their supply chain to offer an “Omni-channel” distribution model ■ This pressure on retailers’ margins is likely to limit rental value growth Justin Curlow prospects over the short-term, as traditional bricks and mortar retailers’ Global Head of Research & Strategy space consolidations leave more voids than online pure play retailers establishing a physical presence absorb ■ In our view, regionally dominant shopping centres and second-tier tourist- oriented city high streets represent an attractive “value play” for investors, as we feel the entire sector is being tainted by the same doomsday brush despite the fact that the operational performance of these schemes remains strong ■ The sector is not without risks, as highlighted by the continued raft of Vanessa Moleiro retailer failures and bankruptcies which could be exacerbated if an economic Research Analyst downturn materialised over the short term. In addition, for those schemes that remain viable and in demand, the retailer-landlord relationship has to respond to a shorter retail life cycle and increased ambiguity across ultimate sales channels ■ Ultimately, we do not think the developed world will stop consuming -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

Constituents & Weights

2 FTSE Russell Publications 19 August 2021 FTSE 100 Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) 3i Group 0.59 UNITED GlaxoSmithKline 3.7 UNITED RELX 1.88 UNITED KINGDOM KINGDOM KINGDOM Admiral Group 0.35 UNITED Glencore 1.97 UNITED Rentokil Initial 0.49 UNITED KINGDOM KINGDOM KINGDOM Anglo American 1.86 UNITED Halma 0.54 UNITED Rightmove 0.29 UNITED KINGDOM KINGDOM KINGDOM Antofagasta 0.26 UNITED Hargreaves Lansdown 0.32 UNITED Rio Tinto 3.41 UNITED KINGDOM KINGDOM KINGDOM Ashtead Group 1.26 UNITED Hikma Pharmaceuticals 0.22 UNITED Rolls-Royce Holdings 0.39 UNITED KINGDOM KINGDOM KINGDOM Associated British Foods 0.41 UNITED HSBC Hldgs 4.5 UNITED Royal Dutch Shell A 3.13 UNITED KINGDOM KINGDOM KINGDOM AstraZeneca 6.02 UNITED Imperial Brands 0.77 UNITED Royal Dutch Shell B 2.74 UNITED KINGDOM KINGDOM KINGDOM Auto Trader Group 0.32 UNITED Informa 0.4 UNITED Royal Mail 0.28 UNITED KINGDOM KINGDOM KINGDOM Avast 0.14 UNITED InterContinental Hotels Group 0.46 UNITED Sage Group 0.39 UNITED KINGDOM KINGDOM KINGDOM Aveva Group 0.23 UNITED Intermediate Capital Group 0.31 UNITED Sainsbury (J) 0.24 UNITED KINGDOM KINGDOM KINGDOM Aviva 0.84 UNITED International Consolidated Airlines 0.34 UNITED Schroders 0.21 UNITED KINGDOM Group KINGDOM KINGDOM B&M European Value Retail 0.27 UNITED Intertek Group 0.47 UNITED Scottish Mortgage Inv Tst 1 UNITED KINGDOM KINGDOM KINGDOM BAE Systems 0.89 UNITED ITV 0.25 UNITED Segro 0.69 UNITED KINGDOM -

Press Release

PRESS RELEASE 19 February 2021 RESULTS FOR THE YEAR ENDED 31 DECEMBER 2020 Strong financial results - business well positioned to deliver continued earnings and dividend growth. Commenting on the results, David Sleath, Chief Executive, said: “SEGRO delivered another strong set of financial results in 2020, with record lettings driven by our customer focus and the increasing demand for prime industrial properties from a wide occupier base. “The pandemic has reinforced the importance of efficient and resilient distribution networks to facilitate the provision of a wide variety of goods and services, leading to increased demand for warehouse space. 2020 saw a record level of investment for SEGRO as we seek to capitalise on these favourable trends, giving us confidence in our ability to drive further growth in rental income, earnings and dividends over the coming years. “We have also reviewed, challenged and refreshed our approach to sustainability. Today we are re-launching our Responsible SEGRO framework, with three long-term priorities that outline our commitment to society and position us to truly deliver on our Purpose of ‘creating the space that enables extraordinary things to happen’.” HIGHLIGHTSA: • Adjusted pre-tax profit of £296.5 million up 10.8 per cent compared with the prior year (2019: £267.5 million). Adjusted EPS is 25.4 pence (2019: 24.4 pence). • Adjusted NAV per share is up 16.3 per cent to 814 pence (2019: 700 pence) mainly due to a 10.3 per cent increase in the valuation of the portfolio driven by asset management, our development activity and yield compression. • A record leasing and asset management performance with £77.9 million of new headline rent in 2020, including £41.1 million of new pre-let agreements.