Core 1..76 Committee (PRISM::Advent3b2 10.50)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wireless Competition in Canada: an Assessment

Volume 6•Issue 27•September 2013 WIRELESS COMPETITION IN CANADA: AN ASSESSMENT Jeffrey Church † Professor, Department of Economics and Director, Digital Economy Program, The School of Public Policy, University of Calgary Andrew Wilkins † Research Associate, Digital Economy Program, The School of Public Policy, University of Calgary SUMMARY If there’s one thing Canadians agree on, it’s that Canada’s wireless industry can and should be more competitive. The federal government is on side with the policy objective of having four carriers in every region and has responded with policies that provide commercial advantages to entrants. But, the rub is that there has not been a study that actually assesses the state of competition in wireless services in Canada, until now. Those in favour of policies that will promote and sustain entry point to Canada’s high average revenue per user and low wireless penetration rate (mobile connections per capita) as evidence that there is insufficient competition. The difficulty is that the facts are not consistent with this simplistic analysis. Measurements of wireless penetration are skewed toward countries that maintain the Calling Party Pays Protocol and favour pay-as-you-go plans, both of which encourage inflated user counts. Canada’s participation per capita on monthly plans and minutes of voice per capita are not outliers. Moreover, in terms of smartphone adoption and smartphone data usage, Canada is a global leader, contributing to high average revenue per user. Consistent with being world leaders in the rollout of high speed wireless networks, Canada lead its peer group in capital expenditures per subscriber in 2012: the competition of importance to Canadians is not just over price, but also over the quality of wireless networks. -

This Information Is Provided for Information Purposes Only. Neither

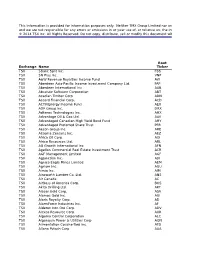

This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies represents, warrants or guarantees the accuracy or completeness of the information contained in this document and we are not responsible for any errors or omissions in or your use of, or reliance on, the information provided. © 2014 TSX Inc. All Rights Reserved. Do not copy, distribute, sell or modify this document without TSX Inc.'s prior written consent. Root Exchange Name Ticker TSX 5Banc Split Inc. FBS TSX 5N Plus Inc. VNP TSX A&W Revenue Royalties Income Fund AW TSX Aberdeen Asia-Pacific Income Investment Company Ltd. FAP TSX Aberdeen International Inc. AAB TSX Absolute Software Corporation ABT TSX Acadian Timber Corp ADN TSX Accord Financial Corp. ACD TSX ACTIVEnergy Income Fund AEU TSX ADF Group Inc. DRX TSX Adherex Technologies Inc. AHX TSX Advantage Oil & Gas Ltd. AAV TSX Advantaged Canadian High Yield Bond Fund AHY TSX Advantaged Preferred Share Trust PFR TSX Aecon Group Inc. ARE TSX AEterna Zentaris Inc. AEZ TSX Africa Oil Corp. AOI TSX Africo Resources Ltd. ARL TSX AG Growth International Inc AFN TSX Agellan Commercial Real Estate Investment Trust ACR TSX AGF Management Limited AGF TSX AgJunction Inc. AJX TSX Agnico Eagle Mines Limited AEM TSX Agrium Inc. AGU TSX Aimia Inc. AIM TSX Ainsworth Lumber Co. Ltd. ANS TSX Air Canada AC TSX AirBoss of America Corp. BOS TSX Akita Drilling Ltd. AKT TSX Alacer Gold Corp. ASR TSX Alamos Gold Inc. AGI TSX Alaris Royalty Corp. AD TSX AlarmForce Industries Inc. AF TSX Alderon Iron Ore Corp. -

Arzinbooks-Karbordi94.Pdf

ﺑﺴﻤﻪ ﺗﻌﺎﻟﻲ ﻗﺎﺑﻞ ﺗﻮﺟﻪ اﻋﻀﺎء ﻫﻴﺌﺖ ﻋﻠﻤﻲ داﻧﺸﮕﺎه ﻫﺎ، ﻛﺘﺎﺑﺨﺎﻧﻪ ﻫﺎ، ﻣﺮاﻛﺰ ﺗﺤﻘﻴﻘﺎﺗﻲ و ﭘﮋوﻫﺸﻲ و ﺳﺎﻳﺮ ﻋﻼﻗﻪ ﻣﻨﺪان ﺑﻪ ﻛﺘﺐ ﻻﺗﻴﻦ داﻧﺶ ارزﻳﻦ ﺟﻬﺎن در ﺳﻴﺰدﻫﻤﻴﻦ ﻧﻤﺎﻳﺸﮕﺎه ﺑﻴﻦ اﻟﻤﻠﻠﻲ ﻛﺘﺐ ﻛﺎر ﺑﺮدي داﻧﺸﮕﺎﻫﻲ ﺑﺎ ﻋﺮﺿﻪ ﺣﺪود 3000 ﻋﻨﻮان از ﺟﺪﻳﺪﺗﺮﻳﻦ ﻛﺘﺐ ﻣﻨﺘﺸﺮ ،ه ،ه ﻋﻤﺪﺗﺎ 2014 و 2015 از ﻣﻌﺘﺒﺮﺗﺮﻳﻦ ﻧﺎﺷﺮان ﺟﻬﺎن در زﻣﻴﻨﻪ ﻫﺎي ﻋﻠﻮم اﻧﺴﺎﻧﻲ ، ﻓﻨﻲ و ﻣﻬﻨﺪﺳﻲ ، ﻫﻨﺮ و ﻣﻌﻤﺎري ، ﻋﻠﻮم ﭘﺎﻳﻪ ، ﭘﺰﺷﻜﻲ و داروﺳﺎزي ﺣﻀﻮر ﻓﻌﺎل دارد . ﻛﺘﺎب ﻫﺎي ﻧﺎﺷﺮان ﻣﻌﺘﺒﺮ زﻳﺮ ﺗﻮﺳﻂ داﻧﺶ ارزﻳﻦ ﺟﻬﺎن در ﺳﻴﺰدﻫﻤﻴﻦ ﻧﻤﺎﻳﺸﮕﺎه ﺑﻴﻦ اﻟﻤﻠﻠﻲ ﻛﺘﺐ ﻛﺎرﺑﺮدي ﻋﺮﺿﻪ ﻣﻲ ﮔﺮدد: IGI Global / Pharmaceutical Press / Guilford Press / SAGE / Hart Publishing / Royal Society of Chemistry (RSC) Berghahn Publishing / Hurst Publishers / Jessica Kingsley Publishers / Pluto Press / I.B.Tauris / SAQI Cambridge Scholars Publishing / Oxford University press / American Society of Health-System Pharmacists ﺟﻬﺖ درﻳﺎﻓﺖ ﻓﺎﻳﻞ اﻛﺴﻞ ﻛﺘﺐ ﻧﻤﺎﻳﺸﮕﺎه ﻣﻲ ﺗﻮاﻧﻴﺪ ﺑﻪ ﺳﺎﻳﺖ ﺷﺮﻛﺖ ﻣﺮاﺟﻌﻪ ﻧﻤﻮده ﺎﻳ ﺗﻤﺎس ﺣﺎﺻﻞ ﻓﺮﻣﺎﺋﻴﺪ. ﻛﺘﺎب ﻫﺎ ﺑﺎ ﺗﺨﻔﻴﻒ 15 ﺗﺎ 35 % ﺑﺪو ن ﭽﻫﻴ ﮕﻮﻧﻪ ﻣﺤﺪودﻳﺖ ﺧﺮﻳﺪ ﻋﺮﺿﻪ ﻣﻴﺸﻮد . در ﺻﻮرﺗﻲ ﻛﻪ اﻣﻜﺎن ﺣﻀﻮر ﻣﺴﺘﻘﻴﻢ ﺗﻮﺳﻂ ﻣﺘﻘﺎ ﺿﻴﺎن ﻣﻴﺴﺮ ﻧﺒﺎﺷﺪ ، ﻣﺸﺘﺮﻳﺎن ﻣ ﻲ ﺗﻮاﻧﻨﺪ ﻟﻴﺴﺖ ﻛﺘﺎﺑﻬﺎي ﻣﻮرد ﻧﻴﺎز ﺧﻮد را ﺑﻪ آدرس اﻳﻤﻴﻞ ﻳﺎ ﻓﺎﻛﺲ اﻳﻦ ﺷﺮﻛﺖ ارﺳﺎل ﻛﻨﻨﺪ ﺗﺎ در ﺧﺼﻮص ارﺳﺎل ﻛﺘﺎﺑﻬﺎ اﻗﺪام ﻣﻘﺘﻀﻲ ﺻﻮرت ﮔﻴﺮد . در ﺻﻮرت اﺗﻤﺎم ﻣ ﻮﺟﻮدي ﻛﺘﺐ در ﺧﻮاﺳﺘﻲ ، ﻛﺘﺎب ﻫﺎي ﻣﻮرد ﻧﻴﺎز ﺑﻪ ﺻﻮرت ﺛﺒﺖ ﺳﻔﺎرش ﻗﺎﺑﻞ ﺗﻬﻴﻪ ﻣﻲ ﺑﺎﺷﺪ و داﻧﺶ ارزﻳﻦ ﺟﻬﺎن ﻛﺘﺎﺑﻬﺎي ﺛﺒﺖ ﺳﻔﺎرش ﺷﺪه را ﺣﺪ اﻛﺜﺮ ﺗﺎ ﻣﺪت زﻣﺎن 2 ﻣﺎه ﭘﺲ از اﺗﻤﺎ م ﻧﻤﺎﻳﺸﮕﺎه در اﺧﺘﻴﺎر ﻣﺘﻘﺎﺿﻴﺎن ﻗﺮار ﺧﻮاﻫﺪ داد.ﻫﻤﭽﻨﻴﻦ اﻳﻦ ﺷﺮﻛﺖ اﻣﻜﺎن ﺛﺒﺖ ﺳﻔﺎرش و ﺗﺎ ﻣﻴﻦ ﻛﻠﻴ ﻪ ﻛﺘﺎﺑﻬﺎي ﻣﻮرد ﻧﻴﺎز ﺷﻤﺎ را در ﻃﻮل ﺳﺎل دارد. -

2001 Annual Report

Part of your life. COMMITTED TO THE PEOPLE OF SASKATCHEWAN > 2001 ANNUAL REPORT View this annual report online at www.sasktel.com/about_sasktel/financial_reports/2001_annualreport/ For more information about SaskTel, our initiatives and operations, or to obtain additional copies of the 2001 SaskTel Annual Report, please contact SaskTel Corporate Affairs at 1-877-337-2445 or visit our website at www.sasktel.com. www.sasktel.com > LETTER OF TRANSMITTAL Regina, Saskatchewan March 31, 2002 To Her Honour The Honourable Lynda Haverstock Lieutenant Governor of the Province of Saskatchewan Dear Lieutenant Governor: I have the honour to submit herewith the annual report of SaskTel for the year ending December 31, 2001, including the financial statements, duly certified by auditors for the corporation, and in the form approved by the Treasury Board, all in accordance with The Saskatchewan Telecommunications > CONTENTS Holding Corporation Act. Financial Highlights . .01 Respectfully submitted, Letter from the President . .02 Year in Review . .04 Honourable Maynard Sonntag Minister Responsible for Crown Investments Corporation (CIC) E-Business . .09 SaskTel International . .12 Corporate Social Responsibility . .14 Management’s Discussion and Analysis . .17 Five Year Record of Service . .35 Consolidated Financial Statements . .37 Board of Directors . .50 Corporate Directory . .51 Corporate Governance . .52 > FINANCIAL HIGHLIGHTS Net Income Operating Revenues Cumulative percentage SaskTel has lowered average Operating Expenses ($ millions) ($ millions) per minute long distance charges since 1990 ($ millions) 125 1000 0% 1000 100 750 20% 750 75 40% 500 500 50 60% 250 250 25 80% 0 0 100% 0 1997 1998 1999 2000 2001 1997 1998 1999 2000 2001 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 1997 1998 1999 2000 2001 • NET INCOME was $101.5 million in 2001 and • INCREASED FOCUS on growth and diversification • During the year, SaskTel ACQUIRED RSL COM cash from operating activities was $268.8 million. -

2001 APRIL 15, 2002 2001 T ABLE of CONTENTS Annual Information Form for the Year Ended December 31, 2001 April 15, 2002

BCE INC. ANNUAL INFORMATION FORM FOR THE YEAR ENDED DECEMBER 31, 2001 APRIL 15, 2002 2001 T ABLE OF CONTENTS Annual Information Form for the year ended December 31, 2001 April 15, 2002 Documents Incorporated by Reference . .2 BCE Emergis . .25 Trade-marks . .2 General . .25 Note to Reader . .3 Recent Developments . .26 Item 1 • Corporate Structure of BCE . .3 Competition . .26 Item 2 • General Development of BCE . .3 BCE Ventures . .27 Overview . .3 BCI . .27 Recent Developments . .4 Telesat . .28 Significant Developments . .4 CGI . .29 Item 3 • Businesses of BCE . .5 Others . .29 Bell Canada Segment . .5 Employees . .29 General . .5 Legal Proceedings . .30 Subsidiaries and Associated Companies . .7 Certain Contracts . .31 Regulation . .10 Forward-Looking Statements . .32 Competition . .15 Risk Factors . .32 Capital Expenditures . .18 Item 4 • Selected Financial Information (Consolidated) . .39 Environment . .18 Item 5 • Management’s Discussion and Analysis . .39 Bell Globemedia . .18 Item 6 • Market for the Securities of BCE Inc. .39 General . .18 Item 7 • Directors and Officers of BCE Inc. .39 CTV . .19 Item 8 • Additional Information . .40 Bell Globemedia Publishing . .19 Schedule – Corporate Structure . .41 Bell Globemedia Interactive . .19 Regulation . .20 Competition . .20 Teleglobe . .21 General . .21 Global Network – GlobeSystem . .22 Regulation . .23 Competition . .25 NOTES: (1) Unless the context indicates otherwise, “BCE” refers to BCE Inc. and its subsidiaries and associated companies. (2) All dollar figures are in Canadian dollars, unless otherwise indicated. 2001 BCE Annual Information Form 1 Documents incorporated by reference Part of Annual Information Form in which Documents incorporated by reference 1. Portions of the BCE Inc. 2001 Annual Report Items 2, 5 and 6 2. -

Broadcasting Decision CRTC 2004-349

Broadcasting Decision CRTC 2004-349 Ottawa, 16 August 2004 Craig Wireless International Inc. Brandon, Foxwarren, McCreary, Dauphin, Elie, Winnipeg, Interlake (Fraserwood), Lac du Bonnet and Falcon Lake, Manitoba Application 2003-0432-9 Public Hearing in the National Capital Region 20 October 2003 Craig – MDS licence renewal The Commission renews the broadcasting licence for the Class 1 multipoint distribution system broadcasting distribution undertaking serving various urban and rural communities in Manitoba. The licence term will be seven years, from 1 September 2004 to 31 August 2011 The application 1. At the 20 October 2003 hearing in the National Capital Region, the Commission considered an application by Craig Wireless International Inc. (Craig) for renewal of the Class 1 broadcasting distribution undertaking (BDU) licence it holds for the operation of a multipoint distribution system (MDS) undertaking serving Winnipeg and eight other Manitoba communities. SkyCable Inc., which was originally licensed to provide MDS service to these Manitoba communities in Decision CRTC 95-910, 20 December 1995, was renamed Craig Wireless International Inc. in 2000. 2. Also considered at the 20 October 2003 hearing were renewal applications by two other MDS licensees, namely LOOK Communications Inc. (LOOK) and Image Wireless Communications Inc. (Image). LOOK holds two regional Class 1 BDU licences, one to provide MDS service to Toronto and 26 other communities in southern Ontario, and the other to serve the communities of Montréal and Québec and surrounding areas, the Saguenay/Lac St-Jean region, and Eastern Ontario and Western Quebec (including the National Capital Region). Image holds thirteen Class 3 BDU licences, one to serve Lloydminster, Alberta, and the remainder for separate MDS undertakings serving Regina, Saskatoon and ten other communities in Saskatchewan. -

Comments of Craig Wireless Systems Ltd

Craig Wireless Systems Ltd. 6th Floor, 177 Lombard Avenue Winnipeg, MB R3B 0W5 t: 204.925.9125 f: 204.488.2710 July 17, 2009 BY EMAIL Ms. Heather Hall Manager, Emerging Networks Radiocommunications and Broadcasting Regulatory Branch Industry Canada 300 Slater Street Ottawa, Ontario K1A 0C8 Dear Ms. Hall: Re: Canada Gazette, Part I, March 14, 2009, Notice No. DGRB-005-09: Reply Comments of Craig Wireless Systems Ltd. on Consultation on Transition to Broadband Radio Service (BRS) in the Band 2500-2690 MHz In accordance with the procedures set out in the above-referenced Gazette Notice, please find attached the reply comments of Craig Wireless Ltd. on the Department’s Consultation on Consultation on Transition to Broadband Radio Service (BRS) in the Band 2500-2690 MHz. If you have any questions regarding the attached reply comments, please do not hesitate to contact the undersigned. Yours very truly, [original signed by J. Drew Craig] ________________________________ J. Drew Craig Craig Wireless Systems Ltd. Encl. Canada Gazette, Part I, March 14, 2009, Notice DGRB-005-09 REPLY COMMENTS OF CRAIG WIRELESS SYSTEMS LTD. ON CONSULTATION ON TRANSITION TO BROADBAND RADIO SERVICE (BRS) IN THE BAND 2500 - 2690 MHz I. INTRODUCTION Craig Wireless Ltd. (“CWS”) is pleased to submit these reply comments in response to Industry Canada’s Consultation on Transition to Broadband Radio Service (BRS) in the Band 2500-2690, DGRB-005-09 (the “Consultation Paper”) published in the Canada Gazette on March 14, 2009. CWS is in receipt of comments from the following interested parties in this proceeding: ABC Communications (ABC), Bell Canada, Inukshuk Wireless Partnership and Rogers Communications Inc. -

Market Definition Issues for Audio and Audio- Visual Distribution Products and Services in a Digital Environment

Market Definition Issues for Audio and Audio- Visual Distribution Products and Services in a Digital Environment A Report Prepared for the Canadian Radio-television and Telecommunications Commission Lilla Csorgo and Ian Munro February 15, 2011 About the Authors Lilla Csorgo is a Vice President in the Toronto office of Charles River Associates, a leading global consulting firm that offers economic, financial, and business management expertise to major law firms, industries, accounting firms, and governments around the world. Prior to rejoining CRA in 2010, Dr. Csorgo was special economic advisor to the Commissioner of the Canadian Competition Bureau. Before that, Dr. Csorgo was the Economist Member of the Canadian Competition Tribunal where she adjudicated the civil provisions of the Canadian Competition Act. Ian Munro is an independent consultant based in Halifax. Economic, policy, and regulatory analysis in the communications sector comprise one of Mr. Munro‟s areas of specialization. Mr. Munro‟s career has included time with the federal government (Industry Canada‟s spectrum management program), in consulting (Charles River Associates), and at a policy think-tank (the Atlantic Institute for Market Studies). Disclaimer The views expressed in this report are those of the authors. The views do not necessarily reflect the views of other Charles River Associates Inc. (“CRA”) staff or any other person connected with CRA. The CRTC was not involved in formulating any of our recommendations and did not participate in our consideration of the issues. i Table of Contents Executive Summary……………………………………………………………………….1 1. Introduction ................................................................................................................. 2 2. An Overview of the Broadcasting Regulatory Framework ......................................... 4 3. A Primer on Market Definition: A Summary ............................................................. -

USCIS - H-1B Approved Petitioners Fis…

5/4/2010 USCIS - H-1B Approved Petitioners Fis… H-1B Approved Petitioners Fiscal Year 2009 The file below is a list of petitioners who received an approval in fiscal year 2009 (October 1, 2008 through September 30, 2009) of Form I-129, Petition for a Nonimmigrant Worker, requesting initial H- 1B status for the beneficiary, regardless of when the petition was filed with USCIS. Please note that approximately 3,000 initial H- 1B petitions are not accounted for on this list due to missing petitioner tax ID numbers. Related Files H-1B Approved Petitioners FY 2009 (1KB CSV) Last updated:01/22/2010 AILA InfoNet Doc. No. 10042060. (Posted 04/20/10) uscis.gov/…/menuitem.5af9bb95919f3… 1/1 5/4/2010 http://www.uscis.gov/USCIS/Resource… NUMBER OF H-1B PETITIONS APPROVED BY USCIS IN FY 2009 FOR INITIAL BENEFICIARIES, EMPLOYER,INITIAL BENEFICIARIES WIPRO LIMITED,"1,964" MICROSOFT CORP,"1,318" INTEL CORP,723 IBM INDIA PRIVATE LIMITED,695 PATNI AMERICAS INC,609 LARSEN & TOUBRO INFOTECH LIMITED,602 ERNST & YOUNG LLP,481 INFOSYS TECHNOLOGIES LIMITED,440 UST GLOBAL INC,344 DELOITTE CONSULTING LLP,328 QUALCOMM INCORPORATED,320 CISCO SYSTEMS INC,308 ACCENTURE TECHNOLOGY SOLUTIONS,287 KPMG LLP,287 ORACLE USA INC,272 POLARIS SOFTWARE LAB INDIA LTD,254 RITE AID CORPORATION,240 GOLDMAN SACHS & CO,236 DELOITTE & TOUCHE LLP,235 COGNIZANT TECH SOLUTIONS US CORP,233 MPHASIS CORPORATION,229 SATYAM COMPUTER SERVICES LIMITED,219 BLOOMBERG,217 MOTOROLA INC,213 GOOGLE INC,211 BALTIMORE CITY PUBLIC SCH SYSTEM,187 UNIVERSITY OF MARYLAND,185 UNIV OF MICHIGAN,183 YAHOO INC,183 -

Craig Wireless Mcs Application September 1999

CRAIG WIRELESS MCS APPLICATION SEPTEMBER 1999 Craig Wireless - MCS Application September, 1999 Table Of Contents Page Executive Summary .......................................................................................................i 1.0 Introduction ............................................................................................................1 2.0 Application Objectives............................................................................................2 3.0 The Applicant: Craig Wireless..............................................................................4 3.1 Our History ........................................................................................................ 4 3.2 Our Technical Track Record .............................................................................. 5 3.3 Our Marketing and Sales Experience.................................................................. 6 3.4 Our Operational and Management Expertise....................................................... 7 3.5 Biographical Profiles......................................................................................... 8 LEARNING PLAN (bound separately) Craig Wireless - MCS Application September, 1999 Page i Executive Summary Craig Broadcast Systems Inc. is pleased to file this application with Industry Canada on behalf of Craig Wireless a company to be incorporated, for a licence to operate a Multipoint Communications System (MCS) in the 2500-2596 MHz band in the province of British Columbia (B.C.). In this application -

Supplement to the Management Proxy Circular

SUPPLEMENT TO THE MANAGEMENT PROXY CIRCULAR dated April 11, 2017 with respect to the ANNUAL GENERAL MEETING OF SHAREHOLDERS OF YELLOW PAGES LIMITED to be held on MAY 10, 2017, at 11:00 a.m. (Eastern Time) SUPPLEMENT TO THE MANAGEMENT PROXY CIRCULAR This supplement dated April 11, 2017 (the “Supplement”) to the management proxy circular of Yellow Pages Limited (the “Corporation”) dated March 22, 2017 (the “Proxy Circular”) is being furnished to shareholders of the Corporation in connection with the annual general meeting (the “Meeting”) of holders of common shares (“Shareholders”) of the Corporation, which will be held in Suite 6.300 of the offices of the Corporation located at Le Nordelec, 1751 Richardson Street, Montreal, Québec on Wednesday, May 10, 2017, at 11:00 a.m. (Eastern Time), for the purposes set out in the Notice of Meeting as amended hereby. On April 10, 2017, the Corporation announced that two additional nominees have been added to the slate of management’s director nominees standing for election at the Meeting. The board of directors of the Corporation (the “Board”) intends to support, in addition to the election of the incumbent Directors who are seeking re-election, the election of Messrs. David A. Eckert and Stephen K. Smith as Directors of the Corporation. This Supplement amends and supplements the Proxy Circular. In particular, the sections of the Proxy Circular entitled “Number and Election of Directors” and “Nominees” (found at pages 7 to 12 of the Proxy Circular) are amended and restated in their entirety, and replaced by, the information provided in the sections of this Supplement entitled “Number and Election of Directors” and “Nominees”. -

Comments Submitted by Inukshuk Wireless Partnership

160 Elgin Street, Floor 19 1100 Boulevard Rene 333 Bloor St. East Ottawa, ON Levesque West Toronto, ON K2P 2C4 Suite 1220 M4W 1G9 Montreal, PQ H3B 4N4 July 17, 2009 Director, Spectrum Management Operations Radiocommunications and Broadcasting Regulatory Branch Industry Canada 300 Slater Street Ottawa ON K1A 0C8 Sent via email: [email protected] Re: Canada Gazette, Part I, March 14, 2009, Gazette Notice No. DGRB-005-09, Consultation on the Transition to Broadband Radio Service (BRS) in the Band 2500-2690 MHz Rogers Communications Inc. (Rogers), on behalf of Rogers, Bell Canada and Inukshuk Wireless Partnership, appreciates the opportunity to provide reply comments on the above-noted consultation. The documents are being sent in Adobe Acrobat Professional Version 8.0. Operating System: Microsoft Windows XP. Yours very truly, Barry Chapman Don Falle Kenneth G. Engelhart Vice President - General Manager Senior Vice President - Regulatory Affairs Inukshuk Wireless Partnership Regulatory Bell Canada Rogers Communications Inc. Attach. Reply Comments of Bell Canada, Inukshuk Wireless Partnership & Rogers Communications Inc. Canada Gazette Notice No. DGRB-005-09 Consultation on Transition to Broadband Radio Service (BRS) in the Band 2500-2690 MHz Published in the Canada Gazette, Part I March 14, 2009 July 17, 2009 Inukshuk Wireless Partnership Page 2 Canada Gazette Notice No. DGRB-005-09 Executive Summary 1. Bell Canada, Inukshuk Wireless Partnership, and Rogers Communications Inc. (collectively “Inukshuk”) are pleased to provide the following reply to the comments of other interested parties in response to the consultation paper titled Consultation on Transition to Broadband Radio Service (BRS) in the Band 2500-2690 MHz – DGRB-005-09 (“the Consultation Paper”).