Section 408(B)(2) Erisa Disclosures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TEACHERS' RETIREMENT SYSTEM of the STATE of ILLINOIS 2815 West Washington Street I P.O

Teachers’ Retirement System of the State of Illinois Compliance Examination For the Year Ended June 30, 2020 Performed as Special Assistant Auditors for the Auditor General, State of Illinois Teachers’ Retirement System of the State of Illinois Compliance Examination For the Year Ended June 30, 2020 Table of Contents Schedule Page(s) System Officials 1 Management Assertion Letter 2 Compliance Report Summary 3 Independent Accountant’s Report on State Compliance, on Internal Control over Compliance, and on Supplementary Information for State Compliance Purposes 4 Independent Auditors’ Report on Internal Control over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards 8 Schedule of Findings Current Findings – State Compliance 10 Supplementary Information for State Compliance Purposes Fiscal Schedules and Analysis Schedule of Appropriations, Expenditures and Lapsed Balances 1 13 Comparative Schedules of Net Appropriations, Expenditures and Lapsed Balances 2 15 Comparative Schedule of Revenues and Expenses 3 17 Schedule of Administrative Expenses 4 18 Schedule of Changes in Property and Equipment 5 19 Schedule of Investment Portfolio 6 20 Schedule of Investment Manager and Custodian Fees 7 21 Analysis of Operations (Unaudited) Analysis of Operations (Functions and Planning) 30 Progress in Funding the System 34 Analysis of Significant Variations in Revenues and Expenses 36 Analysis of Significant Variations in Administrative Expenses 37 Analysis -

Jefferies Financial Group Inc. 2019 Investor Meeting

Jefferies Financial Group Inc. 2019 Investor Meeting Wednesday, October 16, 2019 Presentations and Q&A Note on Forward Looking Statements Certain statements contained herein may constitute "forward-looking statements," within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and/or the Private Securities Litigation Reform Act of 1995, regarding Jefferies Financial Group Inc., Jefferies Group LLC, Spectrum Brands Holdings, Inc. and Global Brokerage, Inc., and their respective subsidiaries. These forward-looking statements reflect the respective issuer’s current views relating to, among other things, future revenues, earnings, operations, and other financial results, and may include statements of future performance, plans, and objectives. Forward-looking statements may also include statements pertaining to an issuer’s strategies for the future development of its business and products. These forward- looking statements are not historical facts and are based on the respective issuer’s management expectations, estimates, projections, beliefs and certain other assumptions, many of which, by their nature, are inherently uncertain and beyond management’s control. It is possible that the actual results may differ, possibly materially, from the anticipated results indicated in these forward-looking statements. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict including, without limitation, the cautionary statements and risks set forth in the respective issuer’s Annual and Quarterly Reports and other reports or documents filed with, or furnished to, the SEC from time to time, which are accessible on the SEC website at sec.gov. -

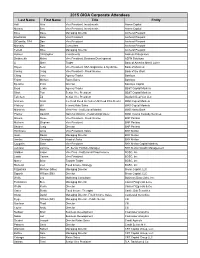

2015 GIOA Corporate Attendees

2015 GIOA Corporate Attendees Last Name First Name Title Entity Hall Wes Vice President, Investments Alamo Capital Mullally Ben Vice President, Investments Alamo Capital Bove Dave Managing Director Amherst Pierpont Brudzinski Beau Vice President Amherst Pierpont DiCamillo, CFA Dan Vice President Amherst Pierpont Markaity Dan Consultant Amherst Pierpont Teifeld Mike Managing Director Amherst Pierpont Holmen Christopher Investments Andress Enterprises Deshmukh Nisha Vice President, Business Development ASPN Solutions Li Shen Trader Bank of America Merrill Lynch Hayes Sean Vice President, SSA Origination & Syndicate Bank of Montreal Conley Craig Vice President - Fixed Income Bank of the West Ching Jerry Agency Trader Barclays Fisher Michael Rates Sales Barclays Bjursten Peter Director Barclays Capital Boyd Lewis Agency Trader BB&T Capital Markets Short Tom Senior Vice President BB&T Capital Markets Tollefsen Ed Senior Vice President Blaylock Beal Van LLC Graham Scott Co-Head Fixed Inc Sales US/Head Prim Dealer BMO Capital Markets Pilsbury Bill Interest Rate Sales BMO Capital Markets Mitrovich Mark Vice Pres - Institutional Market BMO Harris Bank Preiner David B. National Director - Relationship Devel BMO Trust & Custody Services Gavula Steve Vice President - Fixed Income BNP Paribas Mulhern Stephen Vice President BNP Paribas Shubert Craig Director BNP Paribas Hennessy Anna Vice President, Sales BNY Mellon Isaac David Managing Director BNY Mellon Jacobs Christopher Head of Sales BNY Mellon Coughlin Sean Vice President BNY Mellon Capital Markets Jemison Johnnie VP, Senior Portfolio Manager BNY Mellon Wealth Management Glidden Jason Vice Pres - Institutional Fixed Income BOSC, Inc Lewis Camee Vice President BOSC, Inc Maher Brian Taxable Trader BOSC, Inc Rietveld Joel Fixed Income Strategy BOSC, Inc Fitzpatrick Michael (Mike) Managing Director Brean Capital, LLC Sapoch William (Bill) Director Brean Capital, LLC Wells Les Marketing Consultant Business Data Links, Inc. -

Office of the State Treasurer Summary of Responses to Request For

Office of the State Treasurer Summary of Responses to Request for Disclosure July 1, 2017 through June 30, 2018 INVESTMENT PAID 3RD COMPANY NAME DIVISION SERVICES PAYMENT ARRANGEMENTS COMMENTS PARTY FEES? PROVIDER? Aberdeen Asset Management Inc. PFM Yes No ACA Financial Guaranty Corporation DEBT Yes No Acacia Financial Group, Inc. DEBT Yes No Academy Securities DEBT Yes No Acadian Asset Management, Inc. PFM Yes No AIG Financial Products Corp. DEBT Yes No Alliance Bernstein ("AB") PFM Yes No Altaris Constellation Partners IV, L.P. PFM Yes No Altaris Health Partners II, L.P. PFM Yes No Altaris Capital Partners, LLC was paid management fees Management fees are permissible third party payments. (See C.G.S. § Altaris Health Partners III, L.P. PFM Yes Yes totaling $180,961 pursuant to the Limited Partnership 3-13l (b)(2). Agreement. Altaris Capital Partners, LLC was paid management fees Management fees are permissible third party payments. (See C.G.S. § Altaris Health Partners IV, L.P. PFM Yes Yes totaling $86,119 pursuant to the Limited Partnership 3-13l (b)(2). Agreement. Ambac Assurance Corporation DEBT Yes No American Realty Advisors PFM Yes No AMTEC Corp. DEBT No No Anderson, Kill & Olick PFM Yes No Aon Hewitt Investment Consulting, Inc. PFM Yes No Apollo Capital Management VIII, LLC PFM Yes No Apollo Capital Management IX, LLC PFM Yes No Appomattox Advisers, Inc. PFM Yes No (Thomas Welles Fund I, LLC ) AQR Capital Management, LLC PFM Yes No Arclight Energy Partners Fund V, L.P. PFM Yes No TransPacific Group LLC was paid $2,100,000 in connection Placement agent fees are permissible third party payments. -

LAZARD GROUP LLC (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2008 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to 333-126751 (Commission File Number) LAZARD GROUP LLC (Exact name of registrant as specified in its charter) Delaware 51-0278097 (State or Other Jurisdiction of Incorporation (I.R.S. Employer Identification No.) or Organization) 30 Rockefeller Plaza New York, NY 10020 (Address of principal executive offices) Registrant’s telephone number: (212) 632-6000 Securities Registered Pursuant to Section 12(b) of the Act: None Securities Registered Pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. -

Underwriter and Commercial Paper Dealer Pool Term: April 2021 ‐ March 2026

Debt Management Department Qualification No. 10089751‐21‐W RFSQ Investment Banking Services ‐ Underwriter and Commercial Paper Dealer Pool Term: April 2021 ‐ March 2026 Firms currently in the pool as of April 22, 2021: Senior Manager Academy Securities, Inc. Piper Sandler & Co. BofA Securities, Inc Raymond James & Associates, Inc. Cabrera Capital Markets LLC RBC Capital Markets, LLC Citigroup Global Markets Inc. Samuel A. Ramirez & Co., Inc. D.A. Davidson & Co. Siebert Williams Shank & Co., LLC Goldman Sachs & Co. LLC Stern Brothers & Co. Jefferies LLC Stifel, Nicolaus & Company, JP Morgan Securities LLC Incorporated Loop Capital Markets UBS Financial Services Inc. Morgan Stanley & Co. LLC Wells Fargo Securities Co‐Manager 280 Securities Mischler Financial Group, Inc. Academy Securities, Inc. Morgan Stanley & Co. LLC Alamo Capital Multi‐Bank Securities, INC. American Veterans Group, PBC Piper Sandler & Co. BofA Securities, Inc Samuel A. Ramirez & Co., Inc. Blaylock Van, LLC Raymond James & Associates, Inc. Cabrera Capital Markets LLC RBC Capital Markets, LLC Citigroup Global Markets Inc. Rice Securities, LLC D.A. Davidson & Co. Siebert Williams Shank & Co., LLC Drexel Hamilton, LLC Stern Brothers & Co. Goldman Sachs & Co. LLC Stifel, Nicolaus & Company, Jefferies LLC Incorporated JP Morgan Securities LLC UBS Financial Services Inc. Loop Capital Markets Wells Fargo Securities Commercial Paper Dealer BofA Securities, Inc Piper Sandler & Co. Goldman Sachs & Co. LLC RBC Capital Markets, LLC Jefferies LLC Siebert Williams Shank & Co., LLC JP Morgan Securities LLC UBS Financial Services Inc. Morgan Stanley & Co. LLC Wells Fargo Securities For questions regarding the City’s Investment Banking Services ‐ Underwriter and Commercial Paper Dealer Pool, please contact Taif Tozy at (619) 533‐4517 or [email protected] Updated 4/22/2021 . -

1074500000 Freddie Mac Barclays Capital Wells Fargo Securities, LLC Deutsche Bank Mizuho Securities USA LLC Oppenheimer

PRICING SUPPLEMENT DATED March 27, 2020 (to the Offering Circular Dated February 13, 2020) $1,074,500,000 Freddie Mac Variable Rate Medium-Term Notes Due January 3, 2022 Issue Date: April 3, 2020 Maturity Date: January 3, 2022 Subject to Redemption: No Interest Rate: See “Description of the Medium-Term Notes” herein Principal Payment: At maturity CUSIP Number: 3134GVJE9 You should read this Pricing Supplement together with Freddie Mac’s Global Debt Facility Offering Circular, dated February 13, 2020 (the “Offering Circular”), and all documents that are incorporated by reference in the Offering Circular, which contain important detailed information about the Medium-Term Notes and Freddie Mac. See “Additional Information” in the Offering Circular. Capitalized terms used in this Pricing Supplement have the meanings we gave them in the Offering Circular, unless we specify otherwise. The Medium-Term Notes may not be suitable investments for you. You should not purchase the Medium-Term Notes unless you understand and are able to bear the yield, market, liquidity and other possible risks associated with the Medium-Term Notes. You should read and evaluate the discussion of risk factors (especially those risk factors that may be particularly relevant to this security) that appears in the Offering Circular under “Risk Factors” before purchasing any of the Medium-Term Notes. The Medium-Term Notes, including any interest or return of discount on the Medium-Term Notes, are not guaranteed by and are not debts or obligations of the United States or any federal agency or instrumentality other than Freddie Mac. Price to Public (1)(2) Underwriting Discount (2) Proceeds to Freddie Mac (1)(3) Per Medium-Term Note 100% .035% 99.965% Total $1,074,500,000 $376,075 $1,074,123,925 1. -

EMS Counterparty Spreadsheet Master

1 ECHO MONITORING SOLUTIONS COUNTERPARTY RATINGS REPORT Updated as of October 24, 2012 S&P Moody's Fitch DBRS Counterparty LT Local Sr. Unsecured Sr. Unsecured Sr. Unsecured ABN AMRO Bank N.V. A+ A2 A+ Agfirst Farm Credit Bank AA- AIG Financial Products Corp A- WR Aig-fp Matched Funding A- Baa1 Allied Irish Banks PLC BB Ba3 BBB BBBL AMBAC Assurance Corporation NR WR NR American International Group Inc. (AIG) A- Baa1 BBB American National Bank and Trust Co. of Chicago (see JP Morgan Chase Bank) Assured Guaranty Ltd. (U.S.) A- Assured Guaranty Municipal Corp. AA- Aa3 *- NR Australia and New Zealand Banking Group Limited AA- Aa2 AA- AA Banco Bilbao Vizcaya Argentaria, S.A. BBB- Baa3 *- BBB+ A Banco de Chile A+ NR NR Banco Santander SA (Spain) BBB (P)Baa2 *- BBB+ A Banco Santander Chile A Aa3 *- A+ Bank of America Corporation A- Baa2 A A Bank of America, NA AA3AAH Bank of New York Mellon Trust Co NA/The AA- AA Bank of North Dakota/The AA- A1 Bank of Scotland PLC (London) A A2 A AAL Bank of the West/San Francisco CA A Bank Millennium SA BBpi Bank of Montreal A+ Aa2 AA- AA Bank of New York Mellon/The (U.S.) AA- Aa1 AA- AA Bank of Nova Scotia (Canada) AA- Aa1 AA- AA Bank of Tokyo-Mitsubish UFJ Ltd A+ Aa3 A- A Bank One( See JP Morgan Chase Bank) Bankers Trust Company (see Deutsche Bank AG) Banknorth, NA (See TD Bank NA) Barclays Bank PLC A+ A2 A AA BASF SE A+ A1 A+ Bayerische Hypo- und Vereinsbank AG (See UniCredit Bank AG) Bayerische Landesbank (parent) NR Baa1 A+ Bear Stearns Capital Markets Inc (See JP Morgan Chase Bank) NR NR NR Bear Stearns Companies, Inc. -

Filed Pursuant to Rule 424(B)(2) Registration No

Table of Contents Filed pursuant to Rule 424(b)(2) Registration No. 333-136268 CALCULATION OF REGISTRATION FEE Proposed maximum Proposed Amount of offering maximum registration Title of each class of Amount to be price aggregate fee securities to be registered registered per unit offering price (1)(2) 6.30% Debentures, Series 2007 A $525,000,000 99.443% $522,075,750 $16,027.73 (1) Calculated in accordance with Rule 457(r) under the Securities Act of 1933. (2) This “Calculation of Registration Fee” table shall be deemed to update the “Calculation of Registration Fee” table in Consolidated Edison Company of New York, Inc.’s Registration Statement on Form S-3ASR (No. 333-136268). Table of Contents Filed pursuant to Rule 424(b)(2) Registration No. 333-136268 PROSPECTUS SUPPLEMENT (To Prospectus dated August 3, 2006) $525,000,000 Consolidated Edison Company of New York, Inc. 6.30% Debentures, Series 2007 A due 2037 This is a public offering by Consolidated Edison Company of New York, Inc. of $525,000,000 of Series 2007 A Debentures due August 15, 2037. Interest on the Debentures is payable on February 15, 2008 and thereafter semi-annually on February 15 and August 15 in each year. We may redeem some or all of the Debentures at any time as described in this prospectus supplement. The Debentures will be unsecured obligations and rank equally with our other unsecured debt securities that are not subordinated obligations. The Debentures will be issued only in registered form in denominations of $1,000 or an integral multiple thereof. -

2020 Annual Report

CAPABILITIES INVESTMENT BANKING MARKETS RESEARCH INVESTMENT MANAGEMENT LOCATIONS U.S. INTERNATIONAL ATLANTA BELFAST BOSTON BERLIN CHICAGO FRANKFURT CLEVELAND GRAZ DALLAS HONG KONG REPORT 2020 ANNUAL DETROIT LEIPZIG HOUSTON LONDON INDIANAPOLIS LUXEMBOURG LOS ANGELES MALTA MINNEAPOLIS MUNICH NEW YORK ZURICH ORLANDO SAN FRANCISCO STAMFORD WASHINGTON, DC ANNUAL REPORT ©2021 COWEN, INC. ALL RIGHTS RESERVED. COWEN.COM COWEN INC. COWEN COWENRESEARCH 2020COWEN.COM COWEN INC. COWEN COWENRESEARCH LETTER FROM THE CHAIR & CEO 2020 was a challenging year, to put it mildly. But in the face of adversity and disruption, the Cowen team rose to the occasion, helping our clients outperform and delivering the best operating and financial results on record.2020 was the first year we cracked the $1 billion mark in revenues, generating over $1.5 billion. We also recorded our highest ever economic operating income with over $330 million. These impressive milestones did not happen overnight — they were years in the making. The direct result of careful strategic planning and targeted investment. But above all else, they are a testament to the hard work and dedication of the Cowen team. A GROWING PLATFORM — 2020 REVENUE MIX* DEAR SHAREHOLDERS, PARTNERS, COLLEAGUES AND FRIENDS: INVESTMENT BANKINGMuch47% has been written about 2020 and its BROKERAGE painful42% experiences – the disruption and divisions, challenges and chaos. It is the year MANAGEMENT FEE 4% that will forever be the watershed for the rest INCENTIVE INCOME 5% $1.6B of our lives. A year when people around the INVESTMENT INCOME 2% world—individually and collectively—experienced OTHER 0% something that was previously unthinkable—all at the same time. -

$2,290,000,000* State of California General Obligation Bonds

SQUIRE DRAFT 9/11/14 PRELIMINARY OFFICIAL STATEMENT DATED SEPTEMBER 11, 2014 NEW ISSUE – BOOK ENTRY ONLY Ratings: Moody’s: Aa3 S&P: A Fitch: A (See “RATINGS” herein) In the opinion of Bond Counsel to the State of California (the “State”), interest on the Bonds is excluded from gross income for federal income tax purposes under Section 103 of the Internal Revenue Code of 1986, as amended (the “Code”), and interest on the Bonds is exempt from State personal income taxes. See “TAX MATTERS” herein. $2,290,000,000* STATE OF CALIFORNIA GENERAL OBLIGATION BONDS $940,000,000* $200,000,000 * n or qualification or filing under the under or filing qualification or n VARIOUS PURPOSE VARIOUS PURPOSE GENERAL OBLIGATION BONDS GENERAL OBLIGATION BONDS (GREEN BONDS) $950,000,000* $200,000,000 * VARIOUS PURPOSE VARIOUS PURPOSE GENERAL OBLIGATION REFUNDING BONDS GENERAL OBLIGATION BONDS (MANDATORY PUT BONDS) ll this Preliminary Official Statement constitute an offer to sell or the offer sell to an constitute Statement Official Preliminary this ll Dated: Date of Delivery Bonds Due: As shown under “SUMMARY OF THE OFFERING” The State of California is issuing $940,000,000* Various Purpose General Obligation Bonds (the “Construction Bonds”), $200,000,000* Various Purpose General Obligation Bonds (Green Bonds) (the “Green Bonds”) and $950,000,000* Various Purpose General Obligation Refunding Bonds (the “Refunding Bonds”), all bearing interest at fixed rates (collectively, the “Fixed Rate Bonds”), and $200,000,000*Various Purpose General Obligation Bonds (Mandatory Put Bonds), comprised of __________series designated as Series ___ and Series ___ Bonds (each a “Series of Mandatory Put Bonds”), each bearing interest at a fixed rate to the applicable Mandatory Tender Date as further described herein (the “Mandatory Put Bonds” and together with the Fixed Rate Bonds, the “Bonds”). -

Jefferies 4Th Annual ASIA EXPERT Summit Agenda & Biographies

THE GLOBAL INVESTMENT BANKING FIRM Jefferies 4th Annual ASIA EXPERT Summit Island Shangri-La, Hong Kong February 4 – 5, 2015 (Wednesday & Thursday) Agenda & Biographies Subject to change Equities | Fixed Income | Commodities | Investment Banking | Wealth & Asset Management As of Feb 5, 2015 Jefferies 4th Annual ASIA EXPERT Summit Island Shangri-La, Hong Kong, Level 39 The Atrium February 4 – 5, 2015 (Wednesday & Thursday) Wednesday, February 4, 2015 Thursday, February 5, 2015 9:00am China Unconventional Oilfield Services Update – Impact of Oil Price Drop and Future How Internet is Changing the Financial Services Industry in Asia Forecasts Alister Musgrave, MD of Moneyhero.com.hk Robert Liou, China Country Manager, PacWest Consulting Partners James Lloyd, Head of Strategy & Corporate Development, Advanced Merchant Payments (AMP) 10:00am Who Wins As China’s Cement Demand Slows? (Mandarin) Panel Debate: The Sword of Damocles: Tech IP Wars in China Zuoyi Liu, Founder of Cement Geography Panelists: IPR and Competition Partners from Bird and Bird • Hank Leung, Managing Associate, Bird & Bird • Zhaofeng Zhao, Partner, Bird & Bird • Moderator: Conor O’Mara, Asian Tech Specialist Sales 11:00am China Insurance Industry Development and Pension Fund Reform (Mandarin) How Mobile Internet is Revolutionizing The Retail Industry Jinlong Guo, Director of Insurance Division, Institute of Finance and Banking, Chinese Jason Chiu, Chief Executive Officer of Cherrypicks Academy of Social Sciences 12:30pm Keynote Presentation & Panel: Shanghai HK Stock Connect: