Mizuho Securities USA LLC Consolidated Statement of Financial Condition

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Office of the State Treasurer Summary of Responses to Request For

Office of the State Treasurer Summary of Responses to Request for Disclosure July 1, 2017 through June 30, 2018 INVESTMENT PAID 3RD COMPANY NAME DIVISION SERVICES PAYMENT ARRANGEMENTS COMMENTS PARTY FEES? PROVIDER? Aberdeen Asset Management Inc. PFM Yes No ACA Financial Guaranty Corporation DEBT Yes No Acacia Financial Group, Inc. DEBT Yes No Academy Securities DEBT Yes No Acadian Asset Management, Inc. PFM Yes No AIG Financial Products Corp. DEBT Yes No Alliance Bernstein ("AB") PFM Yes No Altaris Constellation Partners IV, L.P. PFM Yes No Altaris Health Partners II, L.P. PFM Yes No Altaris Capital Partners, LLC was paid management fees Management fees are permissible third party payments. (See C.G.S. § Altaris Health Partners III, L.P. PFM Yes Yes totaling $180,961 pursuant to the Limited Partnership 3-13l (b)(2). Agreement. Altaris Capital Partners, LLC was paid management fees Management fees are permissible third party payments. (See C.G.S. § Altaris Health Partners IV, L.P. PFM Yes Yes totaling $86,119 pursuant to the Limited Partnership 3-13l (b)(2). Agreement. Ambac Assurance Corporation DEBT Yes No American Realty Advisors PFM Yes No AMTEC Corp. DEBT No No Anderson, Kill & Olick PFM Yes No Aon Hewitt Investment Consulting, Inc. PFM Yes No Apollo Capital Management VIII, LLC PFM Yes No Apollo Capital Management IX, LLC PFM Yes No Appomattox Advisers, Inc. PFM Yes No (Thomas Welles Fund I, LLC ) AQR Capital Management, LLC PFM Yes No Arclight Energy Partners Fund V, L.P. PFM Yes No TransPacific Group LLC was paid $2,100,000 in connection Placement agent fees are permissible third party payments. -

1074500000 Freddie Mac Barclays Capital Wells Fargo Securities, LLC Deutsche Bank Mizuho Securities USA LLC Oppenheimer

PRICING SUPPLEMENT DATED March 27, 2020 (to the Offering Circular Dated February 13, 2020) $1,074,500,000 Freddie Mac Variable Rate Medium-Term Notes Due January 3, 2022 Issue Date: April 3, 2020 Maturity Date: January 3, 2022 Subject to Redemption: No Interest Rate: See “Description of the Medium-Term Notes” herein Principal Payment: At maturity CUSIP Number: 3134GVJE9 You should read this Pricing Supplement together with Freddie Mac’s Global Debt Facility Offering Circular, dated February 13, 2020 (the “Offering Circular”), and all documents that are incorporated by reference in the Offering Circular, which contain important detailed information about the Medium-Term Notes and Freddie Mac. See “Additional Information” in the Offering Circular. Capitalized terms used in this Pricing Supplement have the meanings we gave them in the Offering Circular, unless we specify otherwise. The Medium-Term Notes may not be suitable investments for you. You should not purchase the Medium-Term Notes unless you understand and are able to bear the yield, market, liquidity and other possible risks associated with the Medium-Term Notes. You should read and evaluate the discussion of risk factors (especially those risk factors that may be particularly relevant to this security) that appears in the Offering Circular under “Risk Factors” before purchasing any of the Medium-Term Notes. The Medium-Term Notes, including any interest or return of discount on the Medium-Term Notes, are not guaranteed by and are not debts or obligations of the United States or any federal agency or instrumentality other than Freddie Mac. Price to Public (1)(2) Underwriting Discount (2) Proceeds to Freddie Mac (1)(3) Per Medium-Term Note 100% .035% 99.965% Total $1,074,500,000 $376,075 $1,074,123,925 1. -

Changes of Directors and Executive Officers

March 22, 2021 Mizuho Financial Group, Inc. Changes of Directors and Executive Officers Mizuho Financial Group, Inc. hereby announces changes of Member of the Board of Directors and Executive Officers (including changes in their areas of responsibility, etc.) of the following entities within the Group : Mizuho Financial Group, Inc. (MHFG) Mizuho Bank, Ltd. (MHBK) Mizuho Trust & Banking Co., Ltd. (MHTB) Mizuho Securities Co., Ltd. (MHSC) Mizuho Research & Technologies, Ltd. (MHRT) 1 Contents Mizuho Financial Group, Inc. (MHFG) .......................................................................................................... 3 1. Changes of Member of the Board of Directors ..................................................................................... 3 2. Changes of Executive Officers .............................................................................................................. 3 3. Directors and Executive Officers as of April 1, 2021 .......................................................................... 5 Mizuho Bank, Ltd. (MHBK) ............................................................................................................................ 8 1. Changes of Directors and Executive Officers ...................................................................................... 8 2. Directors and Executive Officers as of April 1, 2021 ......................................................................... 12 Mizuho Trust & Banking Co., Ltd. (MHTB) ............................................................................................... -

Corporate Venturing Report 2019

Corporate Venturing 2019 Report SUMMIT@RSM All Rights Reserved. Copyright © 2019. Created by Joshua Eckblad, Academic Researcher at TiSEM in The Netherlands. 2 TABLE OF CONTENTS LEAD AUTHORS 03 Forewords Joshua G. Eckblad 06 All Investors In External Startups [email protected] 21 Corporate VC Investors https://www.corporateventuringresearch.org/ 38 Accelerator Investors CentER PhD Candidate, Department of Management 43 2018 Global Startup Fundraising Survey (Our Results) Tilburg School of Economics and Management (TiSEM) Tilburg University, The Netherlands 56 2019 Global Startup Fundraising Survey (Please Distribute) Dr. Tobias Gutmann [email protected] https://www.corporateventuringresearch.org/ LEGAL DISCLAIMER Post-Doctoral Researcher Dr. Ing. h.c. F. Porsche AG Chair of Strategic Management and Digital Entrepreneurship The information contained herein is for the prospects of specific companies. While HHL Leipzig Graduate School of Management, Germany general guidance on matters of interest, and every attempt has been made to ensure that intended for the personal use of the reader the information contained in this report has only. The analyses and conclusions are been obtained and arranged with due care, Christian Lindener based on publicly available information, Wayra is not responsible for any Pitchbook, CBInsights and information inaccuracies, errors or omissions contained [email protected] provided in the course of recent surveys in or relating to, this information. No Managing Director with a sample of startups and corporate information herein may be replicated Wayra Germany firms. without prior consent by Wayra. Wayra Germany GmbH (“Wayra”) accepts no Wayra Germany GmbH liability for any actions taken as response Kaufingerstraße 15 hereto. -

Filed Pursuant to Rule 424(B)(2) Registration No

Table of Contents Filed pursuant to Rule 424(b)(2) Registration No. 333-136268 CALCULATION OF REGISTRATION FEE Proposed maximum Proposed Amount of offering maximum registration Title of each class of Amount to be price aggregate fee securities to be registered registered per unit offering price (1)(2) 6.30% Debentures, Series 2007 A $525,000,000 99.443% $522,075,750 $16,027.73 (1) Calculated in accordance with Rule 457(r) under the Securities Act of 1933. (2) This “Calculation of Registration Fee” table shall be deemed to update the “Calculation of Registration Fee” table in Consolidated Edison Company of New York, Inc.’s Registration Statement on Form S-3ASR (No. 333-136268). Table of Contents Filed pursuant to Rule 424(b)(2) Registration No. 333-136268 PROSPECTUS SUPPLEMENT (To Prospectus dated August 3, 2006) $525,000,000 Consolidated Edison Company of New York, Inc. 6.30% Debentures, Series 2007 A due 2037 This is a public offering by Consolidated Edison Company of New York, Inc. of $525,000,000 of Series 2007 A Debentures due August 15, 2037. Interest on the Debentures is payable on February 15, 2008 and thereafter semi-annually on February 15 and August 15 in each year. We may redeem some or all of the Debentures at any time as described in this prospectus supplement. The Debentures will be unsecured obligations and rank equally with our other unsecured debt securities that are not subordinated obligations. The Debentures will be issued only in registered form in denominations of $1,000 or an integral multiple thereof. -

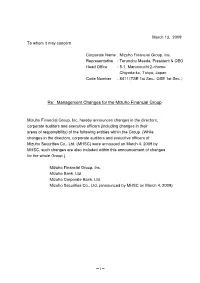

Re: Management Changes for the Mizuho Financial Group

March 13, 2009 To whom it may concern Corporate Name : Mizuho Financial Group, Inc. Representative : Terunobu Maeda, President & CEO Head Office : 5-1, Marunouchi 2-chome Chiyoda-ku, Tokyo, Japan Code Number : 8411(TSE 1st Sec., OSE 1st Sec.) Re: Management Changes for the Mizuho Financial Group Mizuho Financial Group, Inc. hereby announces changes in the directors, corporate auditors and executive officers (including changes in their areas of responsibility) of the following entities within the Group. (While changes in the directors, corporate auditors and executive officers of Mizuho Securities Co., Ltd. (MHSC) were annouced on March 4, 2009 by MHSC, such changes are also included within this announcement of changes for the whole Group.) Mizuho Financial Group, Inc. Mizuho Bank, Ltd. Mizuho Corporate Bank, Ltd. Mizuho Securities Co., Ltd. (announced by MHSC on March 4, 2009) -1- 【Mizuho Financial Group, Inc. (MHFG)】 Name New Position (effective as of April 1, 2009) Current Position Mr. Shin Executive Officer General Manager of Kuranaka General Manager of Human Resources Human Resources Mr. Hiroshi Executive Officer General Manager for Corporate Planning Iwamoto Mizuho Research Institute, Ltd. Mizuho Research Institute, Ltd. Managing Executive Officer Chief Economist Mr. Masakane Executive Officer General Manager of Koike General Manager of Financial Planning Financial Planning Mr. Masanori Retired Executive Officer Murakami General Manager of Corporate Communications -2- 【Executive Officer Appointees】 Name Shin Kuranaka Date of Birth Oct. 5, 1957 Education Mar. 1981 Graduated from Faculty of Economics, Kyoto University Business Experience Apr. 1981 Joined The Industrial Bank of Japan, Limited Joint General Manager of Human Resources Division of Mizuho Corporate Bank, Ltd. -

A Special Thanks to Our Sponsors: Titanium Level

PRELIMINARY AGENDA CLO SUMMIT – DANA POINT, CA – November 28‐30, 2018 A SPECIAL THANKS TO OUR SPONSORS: TITANIUM LEVEL PLATINUM LEVEL PRELIMINARY AGENDA GOLD LEVEL SILVER LEVEL PRELIMINARY AGENDA BRONZE LEVEL PRELIMINARY AGENDA EXHIBITOR LEVEL WIFI SPONSOR HANDBAG SPONSOR WEDNESDAY, NOVEMBER 28, 2018 11:00AM Exhibit Set‐Up / Registration Desk Opens All confirmed pre‐registered delegates must approach the Registration Desk to check in and pick up conference badges. Business Cards are required to retrieve badges. 1:25PM Co‐Chair Welcoming Remarks Paul Burke, Managing Director, Head of Agency & Trust Sales ‐ North America, Citibank, N.A. Lynda Lazzari, Managing Director, Deloitte & Touche LLP Jonathan Polansky, Managing Director‐Structured Finance Surveillance, Moody's Investors Service; Navneet Agarwal, Managing Director‐Structured Finance Americas, Moody's Investors Service 1:30PM Investing in CLOs for Family Offices & Pension Funds Moderator: Aidan Canny, Managing Director, Global Head of Financial Institutions & Investment Managers, BNY Mellon Panelists: PRELIMINARY AGENDA Pim van Schie, Senior Portfolio Manager, Neuberger Berman Investment Advisers Steven Park, Principal, Executive Director, Alexandria Capital, LLC Joelle Berlat, Managing Director, Deloitte Tax LLP Christopher Desmond, Associate, Dechert LLP Peter Martenson, Partner, Eaton Partners PCS 2:15PM How Technology is Streamlining the Loan Trading Process Managing Credit portfolios can be a time consuming, manual process Multiple systems with poor integration means a high -

Southwestern Electric Power Company Mizuho Securities UBS Investment Bank Citigroup Scotiabank

Prospectus Supplement (To Prospectus dated May 19, 2014) $400,000,000 Southwestern Electric Power Company 3.90% Senior Notes, Series J, due 2045 Interest on the Senior Notes is payable semi-annually on April 1 and October 1 of each year, beginning on October 1, 2015. The Senior Notes will mature on April 1, 2045. We may redeem the Senior Notes either in whole or in part at our option at any time, and from time to time, at the applicable redemption prices described on page S-4 of this prospectus supplement. The Senior Notes do not have the benefit of a sinking fund. The Senior Notes are unsecured and rank equally with all of our other unsecured and unsubordinated indebtedness from time to time outstanding and will be effectively subordinated to all of our secured debt, to the extent of the assets securing such debt. We will issue the Senior Notes only in registered form in minimum denominations of $1,000 and integral multiples in excess thereof. Per Note Total Public offering price(1) . 99.108% $396,432,000 Underwriting discount . 0.875% $3,500,000 Proceeds, before expenses, to Southwestern Electric Power Company(1) 98.233% $392,932,000 (1) Plus accrued interest, if any, from March 26, 2015. INVESTING IN THESE NOTES INVOLVES RISKS. SEE THE SECTION ENTITLED “RISK FACTORS” ON PAGE S-3 OF THIS PROSPECTUS SUPPLEMENT FOR MORE INFORMATION. Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Senior Notes or determined that this prospectus supplement or the accompanying prospectus is accurate or complete. -

Mizuho Financial Group, Inc. (Translation of Registrant’S Name Into English)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 6-K REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934 For the month of July 2019 Commission File Number 001-33098 Mizuho Financial Group, Inc. (Translation of registrant’s name into English) 5-5, Otemachi 1-chome Chiyoda-ku, Tokyo 100-8176 Japan (Address of principal executive office) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐ Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ☐ No ☒ If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):82- . SIGNATURES Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. Date: July 30, 2019 Mizuho Financial Group, Inc. By: /s/ Makoto Umemiya Name: Makoto Umemiya Title: Managing Executive Officer / Group CFO The following is the English translation of excerpt regarding the Basel Pillar 3 disclosures and the relevant information from our Japanese language disclosure material published in July 2019. -

ADC Agree Realty Corporation's Fourth Quarter 2020 Earnings

EDITED TRANSCRIPT Agree Realty Corporation’s Fourth Quarter 2020 Earnings Conference Call Friday, February 19, 2021; 9:00AM ET Edited transcript as provided by MultiVu, PR Newswire’s multimedia and broadcast services division. NYSE: ADC Q4 2020 Agree Realty Corporation Earnings Conference Call February 19, 2021 9:00AM CORPORATE PARTICIPANTS Joey Agree | Agree Realty Corporation | President & CEO Clay Thelen | Agree Realty Corporation | CFO CONFERENCE CALL PARTICIPANTS Linda Tsai | Jefferies Group, LLC Nate Crossett | Berenberg Capital Markets Haendel St. Juste | Mizuho Securities USA Katy McConnell | Citigroup Wes Golladay | Robert W. Baird & Co. Todd Stender | Wells Fargo Securities, Inc. Michael Bilerman | Citigroup PRESENTATION Operator Operator: Good morning, and welcome to the Agree Realty Fourth-Quarter 2020 Earnings Conference Call. [Operator Instructions] Please note this event is being recorded. I would now like to turn the conference over to Clay Thelen, Chief Financial Officer. Please go ahead, Clay. Clay Thelen | Agree Realty Corporation | CFO Thank you. Good morning, everyone, and thank you for joining us for Agree Realty's Fourth-Quarter and Full-Year 2020 Earnings Call. Joey, of course, will be joining me this morning to discuss our record results for the past year. Please note that during this call, we will make certain statements that may be considered forward-looking under federal securities law. Our actual results may differ significantly from the matters discussed in any forward-looking statements for a number of reasons, including uncertainty related to the scope, severity and duration of the COVID-19 pandemic; the actions taken to contain the pandemic or mitigate its impact; and the direct and indirect economic effects of the pandemic and containment measures on us and on our tenants. -

Mizuho Capital Markets LLC Consolidated Statement Of

Mizuho Capital Markets LLC Consolidated Statement of Financial Condition March 31, 2021 With Report of Independent Auditors Mizuho Capital Markets LLC Consolidated Statement of Financial Condition March 31, 2021 Contents Report of Independent Auditors ... ..................................................................................................1 Consolidated Statement of Financial Condition .........................................................................2 Notes to Consolidated Statement of Financial Condition ..........................................................3 Ernst & Young LLP Tel: +1 212-773-0000 5 Times Square Fax: +1-212-773-6350 New York, NY 10036-6530 ey.com Report of Independent Auditors The Board of Directors of Mizuho Securities USA LLC, Swap Dealer Governing Body, and Member of Mizuho Capital Markets LLC We have audited the accompanying consolidated statement of financial condition of Mizuho Capital Markets LLC as of March 31, 2021, and the related notes (the “financial statement”). Management’s Responsibility for the Financial Statement Management is responsible for the preparation and fair presentation of this financial statement in conformity with U.S. generally accepted accounting principles; this includes the design, implementation and maintenance of internal control relevant to the preparation and fair presentation of the financial statement that is free of material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on the financial statement based on our audit. We conducted our audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statement is free of material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statement. -

Federal Farm Credit Banks Funding Corporation

TERM SHEET Federal Farm Credit Banks Consolidated Systemwide Bonds This Term Sheet relates to the Bonds described below and should be read in conjunction with the Federal Farm Credit Banks Consolidated Systemwide Bonds and Discount Notes Offering Circular dated December 8, 2014, as amended and supplemented (the "Offering Circular"). The Floating Rate Bonds described herein (the "Bonds") were sold to Citigroup Global Markets Inc., First Tennessee Bank N.A., INTL FCStone Financial Inc. - BD Rates Division, Jefferies LLC, Loop Capital Markets LLC, Mizuho Securities USA LLC, Morgan Stanley & Co. LLC, TD Securities (USA) LLC and Wells Fargo Securities, LLC (the "Dealers"), as principals, for resale to investors at the Issue Price. Terms set forth below unless otherwise defined have the meaning ascribed to them in the Offering Circular. Principal Amount: $205,000,000 Denomination: $1,000 and integral multiples of $1,000 in excess thereof Issue Price: 100.000% Issue Date & Settlement Date: March 12, 2018 Maturity Date: March 12, 2021 Reference Rate: LIBOR Designated Maturity: 1-month Interest Rate: LIBOR, plus the Spread, subject to the Maximum Interest Rate and the Minimum Interest Rate Spread: Plus 0.010% Maximum Interest Rate: Not Applicable Minimum Interest Rate: 0.000% Reset Periods: Each 1-month period beginning on the Issue Date and thereafter on each Interest Payment Date prior to the Maturity Date Reset Dates: The first day of each LIBOR Reset Period Determination Dates: The day which is two London Banking Days prior to each Reset Date Day Count Basis: Actual/360 Citigroup Global Markets Inc. First Tennessee Bank N.A.